MARKET OVERVIEW

The global pharmaceutical cleaning validation market will continue to set industry standards by pushing new ground in compliance, product safety, and operational integrity. With pharmaceutical manufacturing growing more complex and regulations tightening globally, cleaning validation will no longer be a procedural necessity. it will be a strategic operation that dictates how businesses design processes, select equipment, and implement automation.

Down the line, the global pharmaceutical cleaning validation market will come much further than the conventional chemical residue checking. In the not-too-distant future, it will involve advanced digital equipment and predictive validation models to predict threats several months ahead of product changeovers occurring. Traditional validation procedures, that depend so heavily upon manual documentation and visual checking, will come more and more to be substituted by real-time data collection, inline monitors, and cloud-computer-based compliance monitoring systems. These developments will not only ease the audit burden but also build stronger systems of assurance that reduce cross-contamination and product recalls.

New regulatory landscapes in countries like India, China, and Brazil will demand harmonized processes. This shift will demand more pressure on drug manufacturers to implement global validation approaches that will be able to endure scrutiny throughout the numerous agencies, such as the FDA, EMA, and WHO. Consequently, multinational pharmaceutical companies will revise their standard operating procedures to align with these evolving mandates. Consequently, the global pharmaceutical cleaning validation market will begin reflecting a more harmonized trend, moving towards systems that are scalable, repeatable, and internationally interpretable.

Technology integration will also redefine what is required of cleaning validation. Self-cleaning equipment and AI-powered monitoring equipment will not only capture performance but will analyze trend data to predict failures. Pharmaceutical facilities will no longer wait for deviations to occur; instead, they will employ intelligent validation tools that predict them. The market will see more utilization of simulation software in the development of validation protocols, using past data to model cleaning cycles that take less time, fewer resources, and maintain maximum efficacy.

Pressure for high-potency drugs and personalized medicine will challenge facility design to evolve. Flexible, multi-product manufacturing plants will place a greater burden on cleaning regimes. This will necessitate the global pharmaceutical cleaning validation market to make a transition toward modular, speed-to-market solutions without compromising on regulatory compliance. Cleaning policies will shift from static, rigidly recorded procedures to dynamic, feedback-driven processes that are continuously optimized by operational analytics.

Workforce development and training will be another area that will go through transformation. With newer validation systems being highly technical, skill requirements will shift. Operators and quality assurance groups will need technical skills in digital equipment and data analysis, along with regulation expertise. The industry will therefore influence education courses and on-ground training modules, inviting a new generation of pharmaceutical professionals with expertise in cross-functional validation technologies.

In the years to come, the global pharmaceutical cleaning validation market will not only enable compliance. It will be a force for innovation, affecting upstream and downstream activities alike. Harmonizing technological advancements with regulatory foresight, this market will create cleaner, safer, and more responsive pharmaceutical environments that never fall short of healthcare providers' and patients' expectations worldwide.

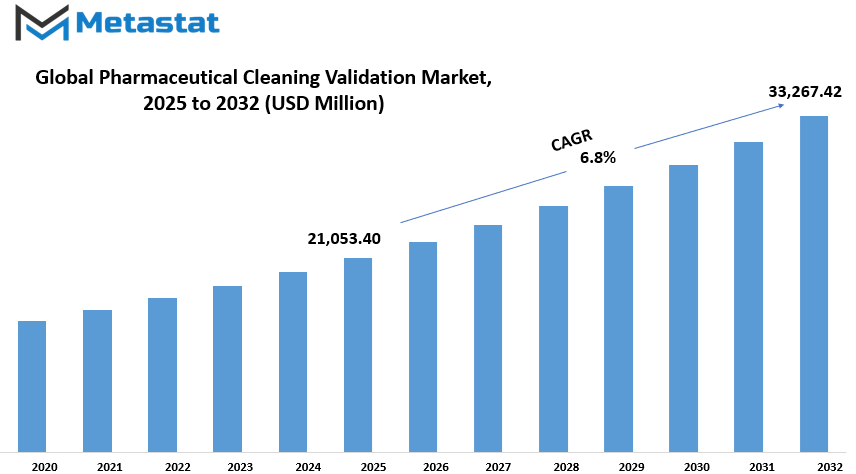

Global pharmaceutical cleaning validation market is estimated to reach $33,267.42 Million by 2032; growing at a CAGR of 6.8% from 2025 to 2032.

GROWTH FACTORS

The global pharmaceutical cleaning validation market is attracting growing attention for a number of significant reasons. One such reason is the growing pressure from regulatory bodies to be compliant with Good Manufacturing Practices (GMP). Pharmaceutical manufacturers need to follow high standards of cleanliness and hygiene while manufacturing. Regulatory bodies globally have tightened up their audits and regulations, making manufacturers pay greater attention to cleaning validation. It is not only about audit pass but also ensuring the quality and safety of drugs. Since the need for medicines is increasing, there is more need to prevent contamination at each manufacturing stage. People depend on medicine to get better or stay healthy, and one error in manufacturing can cause detrimental effects. That's why there is more focus on quality checks and contamination control.

But it is not simple to put in place efficient cleaning validation systems. It requires enormous financial investment, technical know-how, and experienced staff. To most firms, especially those in the developing world, this is an issue. The equipment and systems needed are expensive, and getting the right cleaning validation protocol in place is time-consuming, expensive, and needs specialized knowledge. Small firms or new entrants may struggle to achieve these. In certain areas, there is a shortage of professionals well-versed in the procedures involved, hence hindering the pace of adopting proper cleaning practices.

Regardless of these challenges, there are notable indications of market growth. One of the promising ones is the innovation in automated cleaning validation technologies. The systems aim at simplifying the process, accelerating it, and increasing its accuracy. Through reduced manual labor, they assist pharmaceutical companies to ensure compliance requirements at a more manageable pace. Through automation, also, they lower the chances of human error that is so important in something like drug production. Another development, albeit a controversial one, has been the movement of pharmaceutical manufacture to developing economies. With increased manufacturing plants established in these developing nations, greater cleaning validation demands are made possible with them as well. Domestic firms desire to achieve international standards, and that compels them to invest in good validation systems.

Overall, the pharmaceutical cleaning validation market is growing due to greater regulatory emphasis and greater focus on safety. Although lack of knowledge and high expenditure are barriers, new technology and more production in developing countries provide great opportunities for growth.

MARKET SEGMENTATION

By Product

The global pharmaceutical cleaning validation market is increasing day by day with the growing need for cleaner manufacturing of pharmaceuticals and increased quality checks within the pharmaceutical industry. Cleaning validation lies at the center of maintaining that residues of manufacturing should not reach final products, which could compromise patient safety or the efficacy of the drug. This activity ensures the drug-making equipment is clean and devoid of contamination before they can be reused. It entails consistent examination, checking, and keeping records that confirm cleanness as well as conforming to guidelines. This growth is influenced by one of the major catalysts of the development of this market.

The more and more medicines released onto the market, particularly in bulk quantities, the more pressing the need becomes for good-quality cleaning procedures that will stop cross-contamination. This is particularly important in medicines companies that are producing multiple drugs within the same plants. Government agencies like the FDA and EMA have created strict cleaning validation regulations, therefore it is now an integral part of medicine making. These demands are compelling drug firms to invest more in good cleaning systems and validation services.

The cleaning validation market is also influenced by technological advancements. Most of the companies are presently equipped with latest cleaning systems, automation, and software that facilitate monitoring, recording, and validating cleaning activities more efficiently and precisely. This lessens the scope of human mistakes and makes it uncomplicated to follow strict regulatory guidelines. Thus, demand for such products is likely to increase in the future.

On the product side, the market is diversified further in the following ways: Small Molecule Drug, Peptides, Proteins, and Cleaning Detergent. The Small Molecule Drug segment is the market leader with a value of $11,521.84 million. While the drugs are simpler to manufacture, the products have some cleaning procedures attached to them because they are difficult products in formulation, along with having possibilities of contamination risk. The protein and peptide forms as sensitive bio products, also require cleanliness, very high accuracy. Cleaning Detergents are also an essential component of the process, employed to remove residues and for equipment cleanliness.

On a global level, the global pharmaceutical cleaning validation industry will keep developing as the demand for safe and compliant drug production continues to grow. Under strict regulatory pressure and increased product awareness for safety, this industry is most likely going to remain fundamental to the pharmaceutical sector's future.

By Validation Test

The global pharmaceutical cleaning validation market is driven by the growing need to maintain strict cleanliness and safety standards within manufacturing facilities. Cleaning validation is an important process that checks if any equipment utilized in drug product manufacturing is cleaned and validated to prevent cross-contamination. With growing demand for drugs and vaccines, so does the importance of efficient cleaning validation operations. Companies must show that their cleaning activities are reproducible and repeatable in order to meet regulatory standards. This has created greater interest in the cleaning validation as a component of the overall quality assurance system.

Based on validation test, the market is divided into Non-specific Tests and Product-specific Analytical Tests. Non-specific tests check for residues that may be left behind on surfaces without checking for any specific ingredient. These are useful for catching overall contamination and are quicker and cheaper. They don't give specific information, though, about what kind of residue there is. Product-specific Analytical Tests are more targeted. They're designed to detect and measure specific ingredients or active pharmaceutical ingredients that may be on equipment. These tests are more accurate and are especially crucial when working with high-potency drugs or when even a trace amount of residue left behind can be hazardous.

Both of these tests play an important role based on the type of products being manufactured. Non-specific tests can be applied to routine cleaning checks, while product-specific tests are normally used when there is a higher risk factor or when it is a requirement of regulations. Speed, expense, and accuracy will normally decide how frequently and what type of test a company will employ.

The more strict the regulations and product categories become, the more product-specific tests will be applied as the standard. Several drug companies are making considerable investments in advanced test equipment and automation to make the process more efficient. The shift here is not so much about regulation compliance; it's also about providing patients with safe products each time. The market will further grow as companies become increasingly aware of the value of strong cleaning validation systems. With or without the use of general or specific test protocols, cleanliness of the production lines will always be the priority for the pharmaceutical industry.

By Non-specific Tests

The global pharmaceutical cleaning validation industry plays a crucial role in ensuring safety, quality, and regulatory compliance within the pharmaceutical industry. Because drugs are produced in bulk, there is always a risk of contamination from batch to batch if equipment is not properly cleaned. To prevent this, manufacturers perform cleaning validation procedures to test and verify that their cleaning eliminates any residual active ingredients, chemicals, or microbial contaminants. Of these methods, non-specific tests are used most frequently because they can detect ordinary traces of materials without detecting a particular kind of residue.

In non-specific tests, the market is further segmented into Total Carbon Analysis (TC), Total Organic Carbon Testing (TOC), Non-purgeable Organic Carbon (NPOC), Conductivity, etc. All of these processes help manufacturers to ascertain that there is no residual to be wished for on their equipment once cleaned. Total Carbon Analysis (TC) is an analysis of total carbon in a sample and gives a general idea of contamination. Total Organic Carbon Testing (TOC) is interested in the organic portion of the carbon present and is useful in the identification of residues of organic compounds. Non-purgeable Organic Carbon (NPOC) is a type of TOC in which volatile compounds are purged out by filtration and only the stable organic carbon is quantitated. Conductivity, however, quantitates the capacity of a solution to conduct an electric current, which can reflect the presence of ionic substances remaining from cleaning agents or drug components.

These generic tests are adopted since they are simple, precise, and cost-effective. They also save time since they do not involve a single test per residue type. In a high-speed pharmaceutical manufacturing facility, this enables companies to sustain production levels without compromising safety. As regulations by agencies like the FDA and EMA become more stringent, the demand for correct cleaning validation methods keeps increasing.

The market for such non-specific tests is expanding as companies look for better ways of confirming their cleaning procedures as effective and efficient. More pharmaceutical firms are investing in advanced testing equipment that provides greater ease in monitoring cleanliness in real-time. This will propel the global pharmaceutical cleaning validation market growth in the future. Non-specific tests, with their versatility and reliability, will continue to be a key part of this progress.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$21,053.40 million |

|

Market Size by 2032 |

$33,267.42 Million |

|

Growth Rate from 2025 to 2032 |

6.8% |

|

Base Year |

2024 |

|

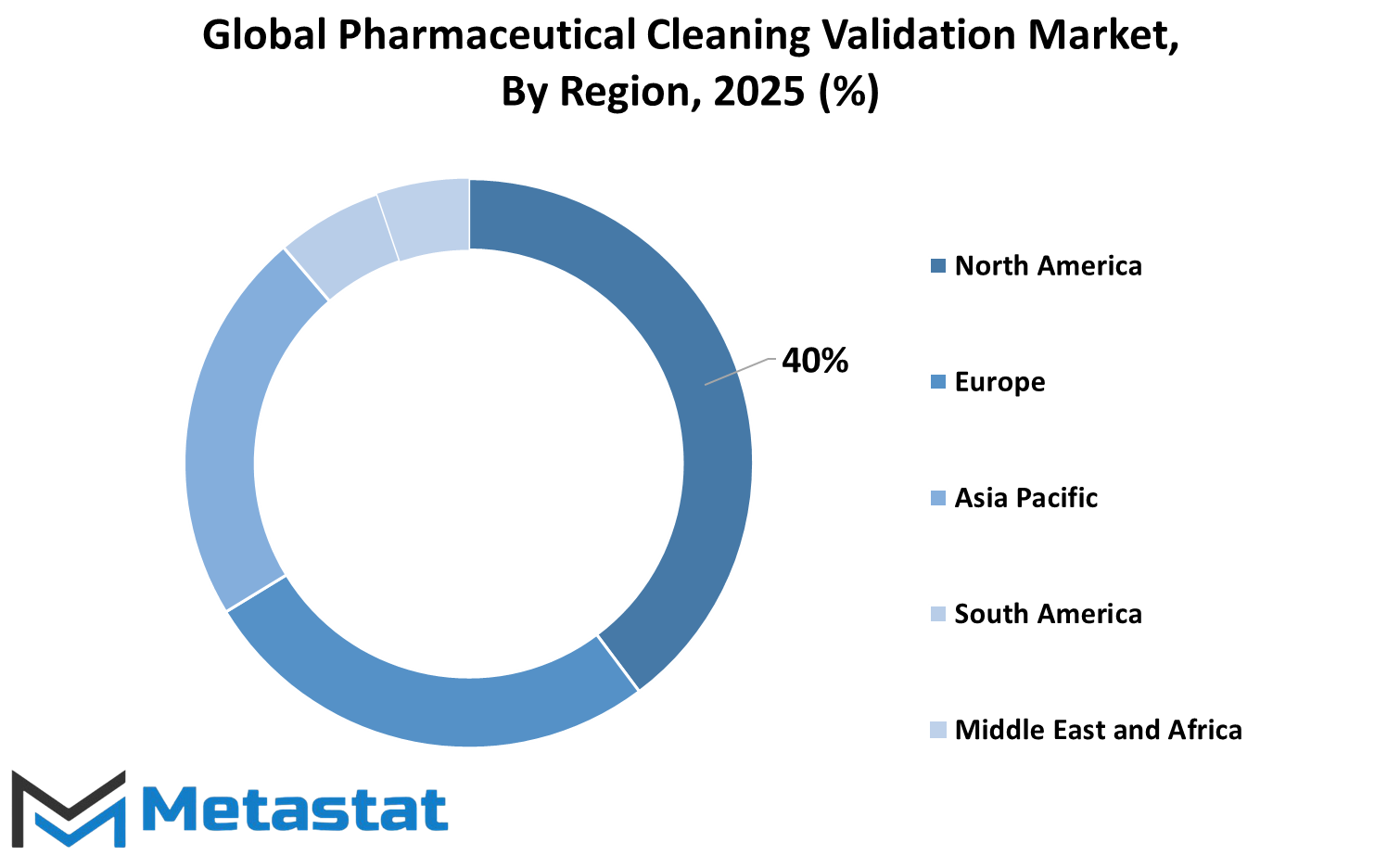

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global pharmaceutical cleaning validation market is analyzed in various prominent regions, such as North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Each of these regions contributes uniquely to the market based on various factors such as healthcare regulations, industrialization, and investment in pharmaceutical production. North America takes a crucial place in the market because it has a robust pharmaceutical industry, advanced technologies, and stringent regulation norms. In this region, the United States dominates with the highest share, backed by continuous investments in healthcare infrastructure and efforts to ensure rigorous hygiene practices. Canada and Mexico also make their contributions to the growth of the region, but on a smaller scale than that of the U.S.

Europe is another significant market and consists of nations like the UK, Germany, France, and Italy. These nations boast established pharmaceutical markets and a considerable history of control by the regulating authorities, providing the push toward cleaning validation demand. Germany and the UK are usually at the forefront when it comes to innovating and leading in terms of production. The remainder of Europe, although smaller compared to its counterparts, is still a strong presence in the overall market base due to developing awareness and practices of quality controls.

In the Asia-Pacific region, India, China, Japan, and South Korea are making good strides. India and China are particularly emerging as prime locations for the manufacture of pharmaceuticals based on cost-effective production and increasing numbers of domestic and international manufacturers establishing facilities. Japan and South Korea contribute to the market through emphasis on high-quality healthcare services and advanced production methods. The rest of the Asia-Pacific region is slowly catching up as the word gets out on cleaning standards and regulatory measures.

South America consists of Brazil, Argentina, and other contiguous nations. Brazil is unique as a result of its increasing pharmaceutical market coupled with government initiatives towards enhancing healthcare systems. Argentina is also developing but at a slower pace. The rest of South America is gradually contributing to the market based on initiatives to adopt international standards of production.

The Middle East & Africa consists of GCC Countries, Egypt, South Africa, and others. This region is growing steadily, with nations such as the UAE and Saudi Arabia investing in pharmaceutical production and healthcare. Egypt and South Africa are the leaders in Africa with increased demand for improved pharmaceutical practices. The rest of the region is anticipated to increase as awareness and infrastructure enhance. Generally, all regions contribute differently, determining the future of the global pharmaceutical cleaning validation market.

COMPETITIVE PLAYERS

The global pharmaceutical cleaning validation market is essential in ensuring drug manufacturing plants are kept in top condition with respect to cleanliness and safety. Cleaning validation serves to ensure that equipment utilized in the production of pharmaceutical products is thoroughly cleaned to avoid cross-contamination. The process is important for patient safety, product quality, and regulatory compliance. With the rise in the pharmaceutical industry, the need for improved cleaning validation processes also rises. Organizations worldwide are making investments in improved technologies and services to make their cleaning validation processes more efficient.

The major players in the Pharmaceutical Cleaning Validation market are always making efforts to provide improvements. These are Luchideon, Ecolab Inc., STERIS Corporation, Hach, Elements Material Technology, Shimadzu Corporation, ProPharma Group, Waters Corporation, Intertek Group, Merck kGaA, QbD Group, Alconox Inc., Mérieux NutriSciences Corporation, and Cormica. These organizations offer products and services that assist in cleaning validation efforts, including analytical testing, validation protocols, monitoring tools, and consultancy. Each of these companies has something to contribute, allowing drug companies to comply with stringent regulatory expectations while enhancing their internal quality procedures.

Regulatory agencies like the FDA and EMA need pharmaceutical companies to validate cleaning processes. They have to demonstrate that cleaning operations remove consistently residues of the earlier product, cleaning chemicals, as well as any possible contaminants. Lacking validation, companies face regulatory action, product recalls, or even patient harm. Therefore, cleaning validation is not a mere ritual but an integral part of pharmaceutical manufacturing.

Technology has a significant contribution in the improvement of cleaning validation techniques. Through enhanced testing equipment and automated systems, businesses are able to measure residues more precisely and minimize the duration of verifying a clean status. This not only accelerates production but also minimizes the possibility of human mistake. Businesses like Waters Corporation and Shimadzu Corporation are recognized for creating sophisticated equipment that facilitates these outcomes.

Overall, the Pharmaceutical Cleaning Validation market plays a critical role in sustaining safety and compliance during the drug production process. The participation of key companies and the adoption of improved technologies make this process efficient and dependable. With consistent innovation and stringent regulatory requirements, the market will keep expanding as companies aim at achieving high-quality standards.

Pharmaceutical Cleaning Validation Market Key Segments:

By Product

- Small Molecule Drug

- Peptides

- Proteins

- Cleaning Detergent

By Validation Test

- Non-specific Tests

- Product-specific Analytical Tests

By Non-specific Tests

- Total Carbon Analysis (TC)

- Total Organic Carbon Testing (TOC)

- Non-purgeable Organic Carbon (NPOC)

- Conductivity

- Others

Key Global Pharmaceutical Cleaning Validation Industry Players

- Luchideon

- Ecolab Inc.

- STERIS Corporation

- Hach

- Elements Material technology

- Shimadzu Corporation

- ProPharma Group

- Waters Corporation

- Intertek Group

- Merck kGaA

- QbD Group

- Alconox Inc.

- Mérieux NutriSciences Corporation

- Cormica

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252