MARKET OVERVIEW

The global outsourcing market is the massive operation of business services where organizations, for whatever reason, offload some functions or jobs to third party service providers. This has been a consequence of the desire to maximize their resources, enhance operational efficiency, and access specialized knowledge without having to add more employees in-house. The Global Outsourcing industry comprises information technology, customer care, finance, and health care. This is also an aspect where companies would look for a means of automating their operations but maintaining their core competencies. Firms are able to outsource such duties as software development, salary management, or supply chain management logistics to third-party providers that possess the infrastructure and are capable of performing such tasks.

This model also streamlines the complexity of operations with the added layer of flexibility for services to move with the peaks and lows of fluctuating business requirements. Businesses seek providers from different parts of the world to leverage differential time zones, cost centers, and skill pools across regions. This market thus facilitates cross-border collaboration and innovation globally. The global outsourcing market would be aligned with evolving technologies and the ever-evolving expectations of the customers. Thus, innovation in automation, artificial intelligence, and data analytics will redefine the traditional paradigms of outsourcing.

The outsourced services would enhance accuracy, quicker turnaround, and improved decision-making ability for the client organizations with these technology integrations. There will also be a trend towards greater outcome-driven outsourcing contracts, i.e., the service providers are remunerated according to results that can be measured and not according to preagreed tasks that they are required to complete. This makes the market more results-driven. The Global Outsourcing industry is globally dispersed, and at some time in the past, nations such as India and the Philippines dominated the industry based on cost and availability of skilled manpower, but presently other regions are beginning to become legitimate outsourcing centers. Latin America, Eastern Europe, and some regions of Africa stand to receive global companies on the basis of competitive pricing, multilingual skill sets, and proximity to major markets. It is probable that this new generation of outsourcing destinations will diversify, bring new dynamics to the marketplace, and provide an opportunity for current providers and newcomers.

Among the trends that will define the future of the global outsourcing market is the increasing focus on cybersecurity and compliance. With more companies outsourcing high-risk operations, the need for tight data protection measures and compliance with global regulations will heighten. Service providers will have to heavily invest in secure systems and certifications to ensure their clients' trust and efficiency in operations. In addition, sustainability and responsible business will become vital elements in the global outsourcing market. Firms will more closely examine the environmental and societal footprint of their outsourcing vendors. Therefore, partnerships will align more with corporate objectives for corporate responsibility. In this way, it will dictate new vendor selection criteria and enable more sustainable behavior across the sector. Though predicated on the principles of cost effectiveness and skill sharing, the global outsourcing market will evolve as companies learn to deal with the growing complexity and interconnectedness of the world.

It is set to evolve and flourish in a world of emerging technologies, an expansion geographically, and shifting expectations from clients. Since this market is an integral component of global business operation, the industry is going to continue as a corner stone of businesses' strategic decision-making across the world.

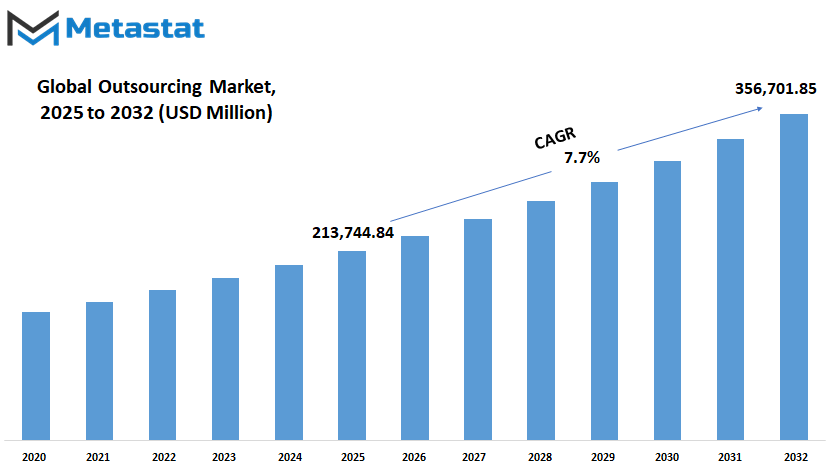

Global outsourcing market is estimated to reach $356,701.85 Million by 2032; growing at a CAGR of 7.7% from 2025 to 2032.

GROWTH FACTORS

The global outsourcing market is heading towards astounding growth. It is defined by a number of factors that guarantee to redefine its path in the years to come. The growing adoption of cashless payment mechanisms, especially for public transport, has emerged as a key driver of this growth. Humans nowadays care more for convenience and speed than anything else, and cashless payment mechanisms straightaway address such needs by offering smooth, fast transactions that save them time while traveling. The shift goes with an intensifying worldwide trend towards the digitalization of all sorts of activities, as mundane as these may become, which are now increasingly conducted via technology-based solutions. Another contributing factor in the expansion of this market is the global urbanization and expansion of public transportation network trends.

As cities expand, they require robust transportation systems with the capacity to carry huge numbers of passengers efficiently. Public transportation networks are increasingly adopting advanced technologies, such as smart cards and e-payment systems, to further improve service delivery and ensure passenger satisfaction. These changes indicate the evolving nature of the expectations of commuters who would like to be transported efficiently and conveniently. Such developments not only enhance the efficiency of the operations but also enhance users' confidence by being sensitive to their needs. Development of the global outsourcing market, however, is not challenge-free. It requires large-scale investment in infrastructure to introduce smart card systems.

The expense and time it takes to establish the required technological infrastructure and integrate it with other systems may act as a deterrent for certain organizations and governments. Security and privacy regarding information are also another impending concern. Electronic payment systems are susceptible to cyber attacks, and individual and financial data need to be made secure to preserve user trust. The future is more promising notwithstanding these challenges. The smart cards that combine digital wallets and mobile apps will provide us with a sense of what the future might hold. The innovations will enable users to travel with no hiccups by unifying various transport modes into a single entity.

Loyalty programs, exclusive offers, and real-time updates of information for enhanced customer experience can be included as well. The market growth will be amplified by bringing more users towards these developments. The global outsourcing market is set to expand with the advancements in technology and urban needs at a juncture. By overcoming its challenges and leveraging new opportunities, this market has the ability to transform not only transportation but the relationship people have with technology on an everyday level.

MARKET SEGMENTATION

By Service Type

This market includes a wide variety of services that allow organizations to concentrate on core activities while specialized tasks are taken care of by outside specialists. Types of service include application development and maintenance, infrastructure management, quality assurance and testing, cloud services, data analytics, business intelligence, and numerous others. They can be categorized based on each organizational need with specific advantages in enhancing the business processes. Outsourcing application development and maintenance is necessary today since software-driven processes govern today's industries. A company engages in outsourcing services of developing, renewing, and maintaining software applications so that they remain up to date and updated.

Similarly, infrastructure management helps a long way in maintaining the IT environment secure and strong. A company will be able to obtain current tools and experience required for improved systems' performance and security, as compared to spending resources on in-house IT equipment and personnel. This is the same reason they are able to provide appropriate high-standard quality assurance and testing procedures in products and services shortly before entering the marketplace. Outsourcing provides the business with the facility to achieve higher rates of product delivery and less defects, depending on specialized testing methods designed in collaboration with third-party firms.

Third-party sourcing of cloud computing has further been increased. Companies will increasingly employ cloud platforms nowadays as a method of offering a storage house, processing services, and customer interaction. The possibility to outsource these services renders scalability simpler, and moving to new technologies also allows for more adaptability in an evolving setup. Business intelligence and data analytics are now a standard feature of the decision-making process.

Data analytics yields insights that become the foundation for strategic movements, and to outsource data analytics will provide an organization with access to robust tools and expertise it would otherwise have to develop in-house. This service would enable companies to gain insights into trends and fine-tune performance and, therefore, forecast future business situations.

To this, add customer services, administrative services, and add more depth to the market for outsourcing. As technology advances, the market for outsourcing will certainly evolve and expand itself into more interconnected and innovative endeavors. Automation, artificial intelligence, and more advanced digital platforms are likely to have a larger role, making service more efficient and less manual.

This change would lead to a more strategic partnership strategy where firms and outsourcing vendors work together to create innovation and synergistic growth. The global outsourcing market will be utilized more extensively and embraced by an increasing number of consumers, not just big companies but also small and medium businesses in order to remain competitive in an increasingly digital and globalized economy. This expansion will produce a future where companies can readily adjust, innovate, and flourish in the evolving global economy with the productive application of expert external services.

By Organization Size

The global outsourcing market is gradually making inroads as companies always look for cheaper ways and specialized expertise for accomplishing their operations. Beyond this, by looking at how the market share by organization size is distributed among large companies and SMEs, the situation is quite clear on the role these actors are playing in driving the trend forward.

A large enterprise usually has abundant resources but also grave issues of complexity in operational processes. It allows them to outsource specific functions, ranging from customer support to IT services, to external experts. Not only does it lower their overhead, but it also makes them better because these businesses can stay focused on their main activity.

The magnitude in which big businesses operate implies that these companies are likely to have a stake in outsourcing relationships and tend to make long-term deals with well-established service providers.

Their requirement for high availability and scalability provides huge opportunities for outsourcing companies to create new products and build business lines. Small and medium-sized businesses, with much fewer resources at their command, are also turning more and more to the path of outsourcing as a means of competing in this growing more connected international marketplace. These SMEs often have challenges accessing in-house competence for key activities within, for instance, functions such as technology, marketing, or regulatory compliance. They get access to specialized skills and tools through outsourcing, which is not always required to keep their workforce for non-core operations. It is not only cost-saving but also a strategic benefit, as with this, SMEs can respond easily to market dynamics with greater agility. In the future, technology will be a key driver of the change in the global outsourcing market.

Artificial intelligence, automation, and cloud computing are already changing the way outsourcing providers innovate and do business, enabling them to make their offerings smarter, faster, and more connected. Large enterprise and SMEs are likely to benefit from these innovations but may have different priorities. Large companies will likely emphasize scalability, data-driven decision-making. SMEs are likely to prioritize cost-effective solutions and flexible solutions. The function of the global outsourcing marketplace in defining business strategies for companies across the globe cannot be overemphasized whatsoever. Meeting the individual needs of organizations of all sizes, this market bodes well for consistent growth. As companies more and more need external know-how to contend with constantly changing situations, outsourcing will always be an indispensable resource that contributes to enhanced efficiency as well as success.

By Location

The global outsourcing market remains a critical component of any strategy or methodology employed by contemporary organizations in the process of improving operations, costs, and productivity. Global Outsourcing is the outsourcing of some business processes or functions to service providers, enabling organizations to concentrate on their core functions, leveraging expertise from specialized providers who possess the right capabilities and assets. With changing industries and technological advancements, outsourcing is still a strong tool for companies seeking to be competitive and responsive. A significant method through which the market is segmented is based on location, with outsourcing services split into onshore and offshore.

Onshore outsourcing involves contracting out services in the same country or region, thereby having fewer linguistic and cultural hurdles while facilitating proximity and ease of interaction.

Offshoring, on the other hand, is when services are procured from service providers in foreign nations where they tend to be inexpensive and accessible from a worldwide pool of expertise.

Both alternatives have their advantages, and businesses tend to prefer either one based on their immediate needs and future horizons. The global outsourcing market's future appears bright with emergent technology dictating service delivery and management processes. Technology like automation, artificial intelligence, and cloud computing must redefine conventional outsourcing to provide more efficient, quicker operations. Indeed, businesses can use AI-powered tools in mundane activities, while outsourcing such more difficult or creative ventures to professionals globally.

Hence, this combination of technological prowess and human skill is meant to make outsourcing more holistic and efficient. As businesses grow more conscious of sustainability and morality, service providers will tend to shift services towards these principles. Thus, the businesses will be concentrated on collaborating with providers that share their values for responsible environmental and social measures. The geopolitical developments and realignment of economic power will also alter outsourcing tendencies as businesses reorient their strategies to accommodate stability and strength in this volatile world. While this distinction between onshore and offshore outsourcing is of high importance today, technology might soon make it possible for humans to communicate and collaborate across space without the constraint of distance.

Virtual and augmented reality platforms might create work experiences so immersive that they render the distance in space moot. This would further expand the global outsourcing market as companies attempt to evolve to emerging demands and seek novel means of leveraging outside expertise. The emerging possibilities and challenges of this global economy can then be addressed by an organization that prudently balances onshore and offshore alternatives.

By Industry

The global outsourcing market is expanding globally as industries look for effective solutions to deal with resources, cut costs, and concentrate on core operations. The market has become more and more crucial in determining how businesses function. BFSI, healthcare, telecommunication, retail, and other sectors are availing themselves of the assistance of outsourcing to make their operations process-efficient and enhance performance. With technological innovations and shifting consumer trends imposing pressure on industries, outsourcing the future is transforming shape by the minute. The BFSI sectors mostly gain by outsourcing processes to the shelf through services like support and after sales, information handling and regulatory monitoring; they remain engaged in improving efficiency by remaining competitive with such uncertain backdrops. Likewise, healthcare organizations look for outsourcing for the processes like medical billing, patient records, and telehealth services. By this way, they can pay more attention to the patient care with maintaining the operational efficiency.

Telecommunication firms pursue outsourcing in an effort to enhance customer care and better manage infrastructure to ensure connectivity continuity. Retail is a competitive and fast-paced industry, and it also derives benefit from outsourcing. Inventory, e-commerce solutions, and customer service can be outsourced to skilled players. By streamlining this process, they can concentrate on enhancing products and customer experience. It also benefits other industries as it lessens their administrative burdens and allows them to pursue strategic growth initiatives.

The future of the global outsourcing market is likely to be closely aligned with developments in artificial intelligence, automation, and cloud-based technology. These technologies will redefine the manner in which industries outsource by making it more precise, lowering turnaround times, and slashing costs further.

For example, analytics and chatbots powered by artificial intelligence will rule customer care, while automation will handle repetitive work with more efficiency. Cloud technology will continue to simplify borderless collaboration and render it seamless, further simplifying the crossing of conventional barriers to outsourcing. Additionally, the increasing demand for sustainability and ethical business will propel the manner in which outsourcing providers are run. The sector will seek those who endorse their values of keeping responsible practices intact. The outsourcing companies that adopt such principles and future technologies are likely to thrive in the coming years.

The global outsourcing market is evolving with the needs of the industries. The acceptance of technology and emphasis on sustainability will make it a primary component of the business world, and it will mold industries and propel advancement in years to come.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$213,744.84 million |

|

Market Size by 2032 |

$356,701.85 Million |

|

Growth Rate from 2025 to 2032 |

7.7% |

|

Base Year |

2025 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

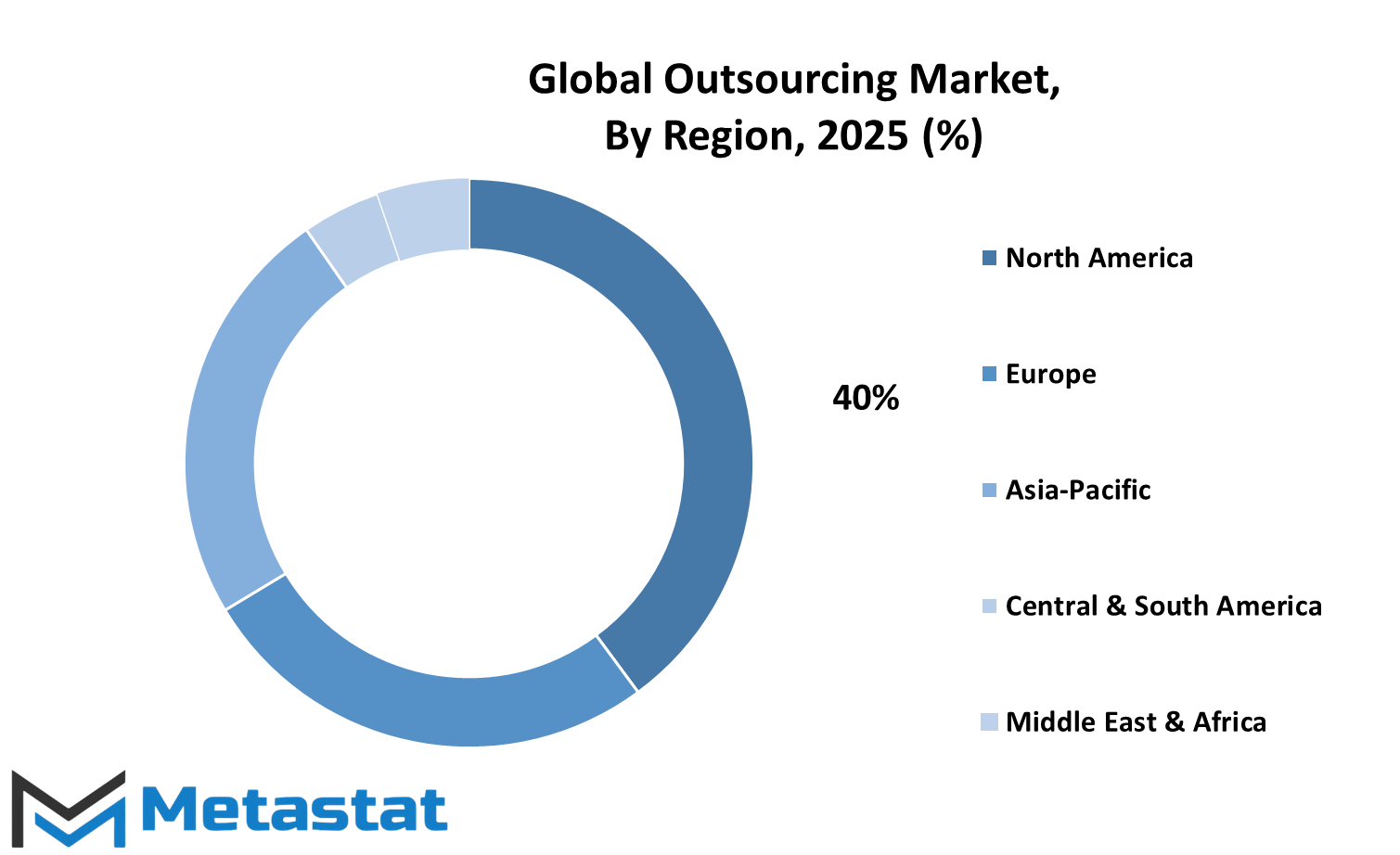

REGIONAL ANALYSIS

This global outsourcing market grows larger as companies worldwide seek to reduce expenses and simplify operations. In a quest to increase efficiency, focus on core competencies, and keep up in an increasingly globalizing world, companies seek access to resources on every continent. The global outsourcing market is one that works across multiple geographies with the strengths of each region being attractive to business requirements that vary by place.

Geographically, the international market for outsourcing is divided into the major regions: Europe, Asia-Pacific, South America, North America, and the Middle East & Africa. North America has three major players, the United States, Canada, and Mexico. Technological advancements in the United States with great demand for specialized services have it as a leader in North America. Complementary assistance of expert workforces in Canada and economical solutions in Mexico account for its cooperation and innovation in the various industries. Different parts of the region are covered under different European nations - the United Kingdom, Germany, France, and Italy. The legal and financial outsourced services continue to reside within the United Kingdom; the strengths of technology and engineering lie in Germany and France; Italy through creativity industry and specialized niche strength also provide this segment. Therefore, these diversified European strength segments infuse power and expand the region as a leader in outsourced services.

Asia-Pacific is among the world giants in outsourcing that involves India, China, Japan, and South Korea, among others. India is the IT and software services giant through its labor force and flexibility. China specializes in more manufacturing and supply chain management. The remaining part in technology and innovation is courtesy of Japan and South Korea. The overall cost-effectiveness and this dynamic talent pool render the Asia-Pacific region the most desirable global business location. In South America, Brazil and Argentina dominate with robust IT services and customer support locations serving businesses in languages and time zones. The region is promising due to its flexibility and expanding technological infrastructure.

These regions are the Middle East and Africa, with the more established nations of the GCC, Egypt, and South Africa. They have been investing in technology as well as qualified labor that would serve as a foundation to work from in the future.

As companies turn more towards international solutions, the global outsourcing market will also change and adapt with improving technology and changing business concerns. Regional inputs hint at a future of cooperation where firms across the globe collaborate together to gain mutual success without borders.

COMPETITIVE PLAYERS

The global outsourcing market remains a vibrant and competitive environment in which companies across various industries depend on outsourcing services for effectiveness, cost savings, and exposure to particular expertise. Over time, the demand for outsourcing will keep growing higher, with companies wanting to be as competitive as they can in addressing emerging challenges. The market will remain the most significant in terms of driving the future for business, with most vendors providing a wide array of services that range from IT to software development, customer support, and supply chain management. The largest names of technology and consulting are the leaders of the outsourcing sector, and among them include some of the best companies.

Accenture, IBM, Tata Consultancy Services (TCS), Infosys, Wipro, and HCL Technologies lead the charge in providing end-to-end outsourcing services. These firms have, over the years, been making investments in technology, innovating, and enhancing skills. The speed at which they remain in the lead in digital evolution and automaton will surely see them remain at the top for a number of years to come. For example, the limits of cloud computing and artificial intelligence are extended by Accenture and IBM to ensure efficiency is achieved with less cost. In the future, additional competition continues in the global outsourcing market and influences the high-end services by companies like DXC Technology, Cognizant, and Capgemini. These firms have extended their portfolios to encompass innovative technologies, such as machine learning, data analysis, and blockchain.

This transformation will translate to more services becoming outsourced to businesses that want leverage with new tools and expertise for growth. Other firms that can potentially benefit from this surge in demand include Fujitsu and Atos. The emerging but smaller players such as CGI Group, Tech Mahindra, and NTT Data also have a significant role to play in the future competitive landscape. These companies introduce a unique set of abilities to the game, with cloud services know-how, cybersecurity, and analytics at an sophisticated level, which are anticipated to provide low-cost outsourcing solutions.

The future development of the global outsourcing market will be based on new trends in technology, business models, and consumer attitudes. Outsourcing will remain a key factor for firms that want to grow and survive in the future. Firms in the outsourcing industry need to be responsive to new issues, but stick to the quality and innovation of their offerings.

Outsourcing Market Key Segments:

By Service Type

- Application Development and Maintenance

- Infrastructure Management

- Quality Assurance and Testing

- Cloud Services

- Data Analytics and Business Intelligence

- Other

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Location

- Onshore

- Offshore

By Industry

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Telecommunications

- Retail

- Other

Key Global Outsourcing Industry Players

- Accenture

- IBM

- Tata Consultancy Services (TCS)

- Infosys

- Wipro

- HCL Technologies

- Cognizant

- Capgemini

- DXC Technology

- Fujitsu

- Atos

- CGI Group

- Tech Mahindra

- NTT Data

- SAIC

- SAP

- Kyndryl

- EPAM Systems

- Mindtree

- Syntel

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252