MARKET OVERVIEW

The One-Off Event Insurance Market represents a unique facet within the broader insurance landscape, catering to the specific and ever-changing needs of one-time gatherings and occasions. This sector has gained substantial importance in recent years, primarily due to the increasing frequency and diversity of events that fall outside the realm of conventional insurance policies. As the nature of events continues to evolve, so does the pivotal role of one-off event insurance.

This market thrives on the dynamism and adaptability it offers to event organizers, ensuring that their gatherings, ranging from small-scale community festivals to large-scale corporate functions, are adequately safeguarded. One-off event insurance caters to the intricacies of each event, offering customized coverage that takes into account the unique aspects of the occasion.

One of the fundamental distinctions of this market is its ability to provide coverage for a wide array of potential risks associated with events. Whether it's a concert, a charity run, a trade show, or a wedding, organizers often face a multitude of uncertainties that could disrupt or jeopardize their meticulously planned gatherings. Such uncertainties may include adverse weather conditions, accidents, property damage, or even unforeseen cancellations. The One-Off Event Insurance Market steps in to mitigate these risks, offering policies that are carefully tailored to address these specific concerns.

One of the primary factors that event organizers consider when obtaining one-off event insurance is the size and scope of the gathering. For smaller, local events, the coverage may be relatively straightforward, focusing on liability protection and essential safeguards. In contrast, large-scale events, such as international conventions or major sporting occasions, necessitate more comprehensive policies that encompass a broader range of contingencies. These may include not only liability coverage but also coverage for property damage, cancellation due to unforeseen circumstances, and even coverage for acts of terrorism.

The versatility of one-off event insurance extends beyond the diversity of events themselves. It also extends to the flexibility of coverage periods. Organizers can choose policies that provide coverage for a single day, a weekend, or even an entire week, depending on the duration of their event. This flexibility allows for cost-effective solutions that cater to the specific needs of each event, preventing organizers from paying for extended coverage when it is unnecessary.

In essence, one-off event insurance provides a safeguard for those who wish to celebrate or host an event without shouldering the full financial burden of unfortunate incidents. It offers a tailored safety net, specific to the nature and scale of the event, ensuring that unforeseen circumstances do not result in a significant financial setback.

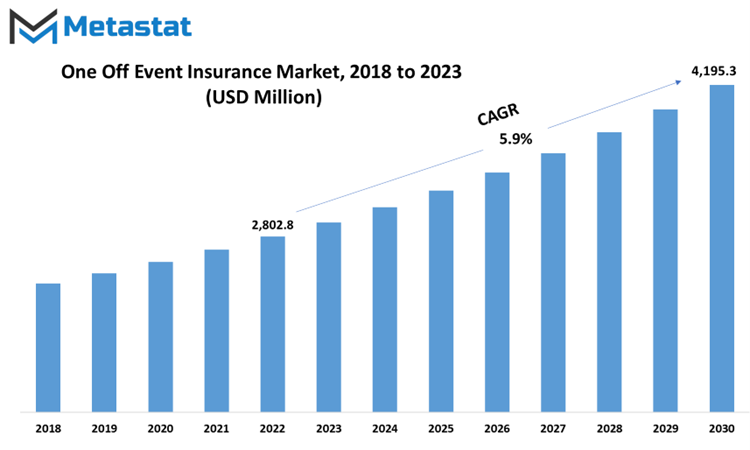

Global One-Off Event Insurance market is estimated to reach $4,195.3 Million by 2030; growing at a CAGR of 5.9% from 2023 to 2030.

GROWTH FACTORS

The One-Off Event Insurance Market is witnessing a surge in demand, driven by the growing appetite for unique and experiential events. Event organizers are recognizing the need for tailored insurance coverage to safeguard their investments and mitigate potential risks. This shift in attitude is a pivotal driver of the market's growth.

The increasing awareness among event organizers about the potential risks associated with events is another key factor propelling the market forward. Organizers are beginning to understand that unforeseen circumstances can disrupt their plans and result in financial losses. Therefore, the need for comprehensive insurance solutions has become evident.

However, it's essential to acknowledge the challenges faced by event organizers in the insurance market. High premium costs can be a deterrent for many, especially for smaller or independent event planners with tight budgets. Additionally, the complex underwriting processes can create barriers for those seeking coverage. These issues need to be addressed to ensure that insurance remains accessible and viable for all event organizers.

Another challenge is the limited availability of insurance options for high-risk events or unconventional venues. Events that push the boundaries, such as extreme sports competitions or gatherings in non-traditional locations, may find it difficult to secure suitable coverage. This limited availability can hamper the growth potential of the market, as it fails to meet the diverse needs of event organizers.

To overcome these challenges and foster market growth, advancements in technology play a crucial role. Online platforms and automated underwriting systems have the potential to streamline the insurance buying process for event organizers. These innovations can make it easier to understand coverage options, obtain quotes, and purchase insurance, thereby increasing accessibility.

Looking ahead, the One-Off Event Insurance Market holds promising opportunities. As technology continues to evolve, the market can leverage these advancements to offer more accessible and affordable coverage options. This not only benefits event organizers but also ensures the continued growth of the market in the coming years.

MARKET SEGMENTATION

By Types

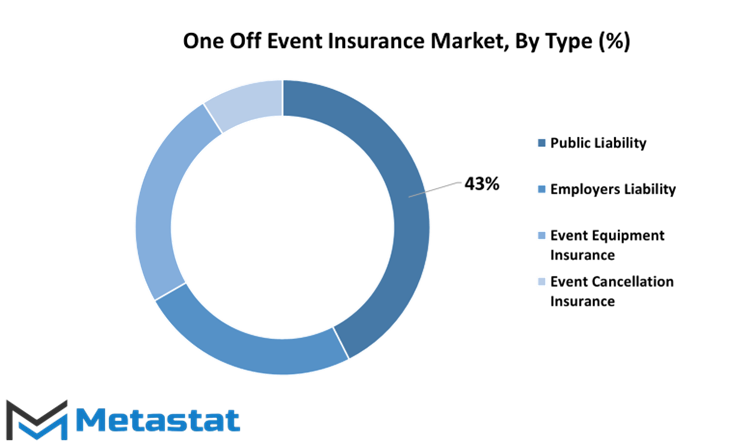

The market for one-off event insurance is multifaceted, with several types catering to specific needs. Types in this market encompass Public Liability, Employers Liability, Event Equipment Insurance, and Event Cancellation Insurance. These categories play a crucial role in addressing various aspects of risk management for events.

Public Liability insurance is designed to protect event organizers from claims made by attendees or the public for injuries or damages sustained during the event. It provides financial coverage and legal protection in cases where the event organizer is found liable for such incidents.

Employers' Liability insurance, on the other hand, focuses on the well-being of the event staff. It safeguards event organizers against claims from employees who may experience injuries or illnesses while working at the event. This type of insurance is particularly important, as event organizers have a duty of care toward their staff.

Event Equipment Insurance is centered on the valuable equipment and assets used in events. It covers losses or damage to equipment, including sound systems, lighting, staging, and other event-specific gear. Event organizers often invest substantially in such equipment, and this insurance mitigates the financial risk associated with equipment damage or loss.

Event Cancellation Insurance is a crucial aspect of risk management. It safeguards event organizers from financial losses incurred due to the cancellation, postponement, or abandonment of the event for reasons beyond their control. Such reasons may include extreme weather conditions, natural disasters, or unexpected issues with key personnel.

The One-Off Event Insurance market offers a range of insurance types, each tailored to address specific facets of risk associated with organizing and hosting events. These categories, namely Public Liability, Employers Liability, Event Equipment Insurance, and Event Cancellation Insurance, collectively contribute to comprehensive risk management, ensuring that event organizers can focus on creating memorable experiences while safeguarding against unexpected financial burdens.

By Application

In the world of insurance, there's a niche that often goes unnoticed – the one-off event insurance market. It serves a specific purpose, addressing the insurance needs of events that don't fit the standard, ongoing coverage. This market is more than just a single entity; it caters to a range of applications, each with its unique insurance requirements.

In this sector, the application is the key driver. It categorizes the insurance needs of different events, and one common way to classify them is by their purpose. These applications encompass various types of events and understanding them is vital for both insurance providers and event organizers. Large music events, festivals, and concerts often require unique insurance coverage. These gatherings, where thousands or even millions of people congregate, pose specific risks, ranging from weather-related cancellations to accidents and injuries within the venue. Event organizers need insurance policies that protect them from these potential liabilities.

Games category includes a wide array of events, from sporting tournaments to gaming conventions. In the world of sports, the risks are apparent – injuries to athletes, damage to equipment, or even the cancellation of the event due to unforeseen circumstances. For gaming conventions, protecting valuable electronic equipment and ensuring the event can go on as planned is essential.

Exhibitions represent another application within the one-off event insurance market. These can be trading shows, art exhibitions, or any gathering meant to showcase products or art pieces. Such events come with their own set of potential problems, including damage to exhibited items, accidents in the exhibition space, or even low visitor turnout.

There's the category of Others which includes Business events. These events are often organized by companies and can vary from product launches to shareholder meetings. Here, insurance needs might revolve around safeguarding company assets, covering potential losses due to event cancellation, or even ensuring the safety of attendees.

Furthermore, the Contingency application is a critical part of this category. It involves planning for unforeseen circumstances that could disrupt an event. It's like an insurance safety net, ensuring that if something unexpected occurs, the event can continue, or the organizer won't face substantial financial losses. This might involve protecting against adverse weather, technical failures, or even the non-appearance of a key speaker or performer.

Each of these applications requires tailored insurance solutions. What works for a concert might not work for an art exhibition, and what safeguards against risks in a business event might not apply to a gaming tournament. Therefore, insurance providers in the one-off event insurance market need to be versatile, understanding the specific risks associated with each application and crafting policies that address them comprehensively.

For event organizers, grasping the nuances of event insurance by application is equally crucial. It ensures that they invest in the right coverage, providing them with peace of mind when planning and executing their events. Whether it's a high-energy music festival, a competitive gaming event, an elegant art exhibition, or a critical business conference, the one-off event insurance market plays a pivotal role in safeguarding the success and financial stability of these diverse gatherings.

REGIONAL ANALYSIS

In terms of geography, the One-Off Event Insurance market spans across North America, Europe, and Asia-Pacific. These regions play a significant role in shaping the landscape of this market. They possess distinct characteristics and factors that influence the dynamics of One-Off Event Insurance. North America, as a key player, exhibits a mature and well-established insurance market. The region boasts a high level of awareness and adoption of insurance products, including those catering to one-off events. The presence of a robust regulatory framework and a culture of risk management contribute to the growth of the One-Off Event Insurance market in North America.

The global One-Off Event Insurance market is not a monolithic entity, but a tapestry woven from the diverse threads of North America, Europe, and Asia-Pacific. Each region brings its unique characteristics and challenges to the table, influencing the demand, adoption, and evolution of One-Off Event Insurance in their respective domains.

COMPETITIVE PLAYERS

One-off event insurance caters to a diverse array of occasions, addressing the needs and potential risks associated with each event. It's a dynamic segment within the insurance sector, adapting to the ever-changing demands of event organizers and participants.

Key players operating in the one-off event insurance industry include prominent names like Aon plc, AXA SA, and several others. These companies offer a range of insurance products tailored to the distinct requirements of one-time events. Their expertise lies in comprehending the intricate details of each event and crafting insurance packages that provide financial protection and peace of mind.

Aon plc, a global insurance giant, has a notable presence in the one-off event insurance market. They leverage their extensive experience and resources to offer customized insurance solutions for a wide spectrum of events. Aon's services encompass risk assessment, policy design, and claims processing, ensuring that event organizers have comprehensive coverage and support.

AXA SA, another major player in the insurance industry, is also a key participant in the one-off event insurance sector. AXA's approach is centered on delivering flexible and adaptable insurance options. They understand that no two events are identical, and their insurance solutions reflect this understanding.

The presence of these key players underscores the significance of one-off event insurance. Event organizers and hosts, aware of the unique risks and uncertainties tied to their activities, turn to these companies for specialized coverage. It's an industry that operates in tandem with the evolving landscape of events and continues to provide essential protection for a wide array of gatherings and functions. In essence, one-off event insurance is not a static concept but a responsive and vital aspect of the insurance sector.

One Off Event Insurance Market Key Segments:

By Types

- Public Liability

- Employers Liability

- Event Equipment Insurance

- Event Cancellation Insurance

By Application

- Concert

- Games

- Exhibition

- Others (Business, Contigency)

Key Global One Off Event Insurance Industry Players

- Aon plc

- AXA SA

- Banner Group

- Bateman Insurance

- Beazley Group

- Joseph G Brady Insurance Ltd.

- Commercial Express Quotes Ltd.

- Ecclesiastical Insurance Office plc

- Emerald Life Limited

- Brokersure Ltd.

- Event Insurance Services

- David J Miller Insurance Brokers Ltd.

- EventInsure

- Government Employees Insurance Company (GEICO)

- Graham Sykes Insurance

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252