Market Overview

The global Olive Oil market size was valued at USD 26.1 billion in 2025. The market is projected to grow from USD 27.5 billion in 2026 to USD 39.5 billion by 2033, exhibiting a CAGR of 5.3% during the forecast period.

The global olive oil market is continuing to grow steadily, driven by rising consumer emphasis on health, clean-label products, and Mediterranean eating habits. Olive oil is primarily derived from the olive fruit and is widely used in cooking, cosmetics, pharmaceuticals, and nutraceuticals. Over the past 10 years, the rising incidence of lifestyle-related diseases has boosted demand for natural fats rich in monounsaturated fatty acids, making olive oil a favoured choice over traditional edible oils.

The global olive oil market is growing steadily, driven by increased health consciousness, rising consumption of premium foods, and diversification into the cosmetics and nutraceutical sectors. Olive oil production around the world for the year 2023 was 2.76 million tonnes, which indicates a considerable recovery from the previous harvest season. The European Union remains the leading producer, accounting for around two-thirds of global supply, with Spain as the largest contributor. Annual per-capita consumption is highest in Mediterranean nations, where it can exceed 12 kg per individual, while non-traditional markets like the United States, India, Japan, and China are experiencing double-digit growth in olive oil imports.

Prices have fluctuated significantly in recent years, with extra virgin olive oil hitting record levels due to supply shortages. As production becomes more stable, prices are anticipated to ease, making retail options more affordable. The demand for extra virgin varieties is particularly robust, representing the premium segment and continuing to gain popularity due to their antioxidant properties and clean-label appeal.

Global Olive Oil Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

- Global Olive Oil market valued at USD 26.1 billion in 2025, growing at a CAGR of around 5.3% through 2033, with potential to exceed USD 39.5 billion.

- The Europe Olive Oil market holds 50.72% in 2025 with a robust position in future.

- Refined segment account for a market share of 35.5% in 2025, driving innovation and expanding applications through intense research.

- Key trends driving growth: Rising consumer demand for heart-healthy, antioxidant-rich oils promoting overall wellness and Growing use of olive oil in cosmetics, skincare, and nutraceuticals due to its natural moisturizing and anti-aging properties.

- Opportunities include increasing global demand for premium, organic, cold-pressed, and specialty olive oils in food and personal care segments.

- Key insight: Rising health awareness and premiumization are driving steady growth in global olive-oil consumption despite past production fluctuations.

Market Dynamics

Growth Drivers:

Increasing consumer demand for heart-healthy, antioxidant-rich oils promoting overall wellness.

Consumers are becoming more aware of the health benefits of olive oil, such as its ability to lower cholesterol and promote heart health, which is driving increased demand. With its high content of monounsaturated fats and natural antioxidants, olive oil is favoured over other cooking oils. This trend towards health consciousness is driving steady global demand.

Growing use of olive oil in cosmetics, skincare, and nutraceuticals due to its natural moisturizing and anti-aging properties.

Olive oil's inherent moisturizing, anti-inflammatory, and anti-aging characteristics have broadened its applications beyond cooking. Brands in personal care and nutraceuticals are adopting olive oil across the products such as creams, supplements, and wellness items, thereby boosting demand of olive oil during forecast period.

Restraints & Challenges:

Price volatility driven by climate sensitivity, crop diseases, and fluctuating olive harvests.

The price of olive oil can be unpredictable due to its vulnerability to climate factors and crop diseases. Olive oil output heavily relies on weather conditions, as droughts, heatwaves, and pest infestations can significantly diminish crop yields. These issues lead to supply variability, which can cause price instability that impacts consumer access and market growth of Olive Oil market.

Limited producing regions leading to supply constraints and higher dependency on imports.

Production is primarily confined to Mediterranean countries, resulting in supply limitations. Non-producing areas rely heavily on imports, making them susceptible to supply chain interruptions and hampering the ability to increase production in response to rising demand quickly.

Opportunities:

Rising global demand for premium, organic olive oils

There is growing interest in premium and organic olive oils, with consumers seeking cold-pressed, extra-virgin, and certified organic options for their higher quality, taste, and perceived health benefits. This trend presents opportunities for niche products and enhanced offerings.

Expansion in food and personal care segments

The multifunctional nature of olive oil enables expansion into the gourmet food market, specialty culinary items, and personal care products. Innovative product introductions in these areas will enhance market reach and yield better profit margins.

Market Segmentation Analysis

The global Olive Oil market is mainly classified based on Type, Packaging, Application, and Distribution Channel.

By Type the market is further segmented into:

- Refined

Refined olive oil undergoes processing to remove impurities, resulting in a milder taste and a higher smoke point. It is commonly utilized for cooking and frying when a strong flavor is not required, providing an economical and stable option.

- Virgin

Virgin olive oil is produced from mechanically pressed olives without any chemical processing, preserving more nutrients and a moderate taste. It is ideal for daily cooking and light sautéing, striking a balance between quality and price.

- Extra Virgin

Extra virgin olive oil represents the highest standard, obtained by cold-pressing fresh olives with very low acidity. It is valued for its intense flavor, high antioxidant content, and health benefits, and is often used in salads, dressings, and high-end culinary applications.

- Others

This category encompasses specialty blends, flavored oils, and lampante oils that are not suitable for direct ingestion. It serves niche purposes in gourmet cuisine, industrial uses, or further refining processes.

By Packaging the market is divided into:

- Bottles

Bottled olive oil segment leads in retail sales, providing portion control, brand visibility, and flavor preservation amount the customers. Glass bottles are favored for premium oils, while plastic bottles offer a more budget-friendly option and perception.

- Pouches

Flexible pouches offer convenience, lightweight packaging, and lower shipping expenses. Their popularity is growing among small households and for single-use servings.

- Cans

Canned olive oils are commonly found in bulk purchases and commercial kitchens, ensuring resilience, protection from light, and extended shelf life.

By Application the market is further divided into:

- Food & Beverage

Olive oil is extensively used in cooking, baking, dressings, and gourmet dishes, reflecting both health trends and culinary practices.

- Personal Care and Cosmetics

It is utilized in skincare, haircare, and anti-aging products for its moisturizing and antioxidant benefits, driving demand in the beauty and wellness markets.

- Pharmaceuticals

Olive oil acts as a carrier for nutraceuticals, supplements, and certain medicinal formulations due to its health-promoting properties.

- Others

The Others segment covers industrial applications, such lubricants, Animal Nutrition or specialty products where olive oil contributes functional value.

By Distribution Channel the global Olive Oil market is divided as:

- Supermarkets & Hypermarkets

Supermarkets & Hypermarkets venues provide a broad selection and convenience for retail shoppers, often featuring promotional offers and private-label products.

- Convenience Stores

Convenience Stores offers smaller quantities and easy accessibility make these stores ideal for quick purchases or urban consumers looking for convenient options.

- Online

E-commerce facilitates direct sales to consumers, enhances exposure for premium products, and supports home delivery, experiencing rapid growth with increasing digital engagement.

- Others

The Others category includes specialty stores, gourmet boutiques, and institutional sales channels, addressing niche markets or bulk purchasing needs.

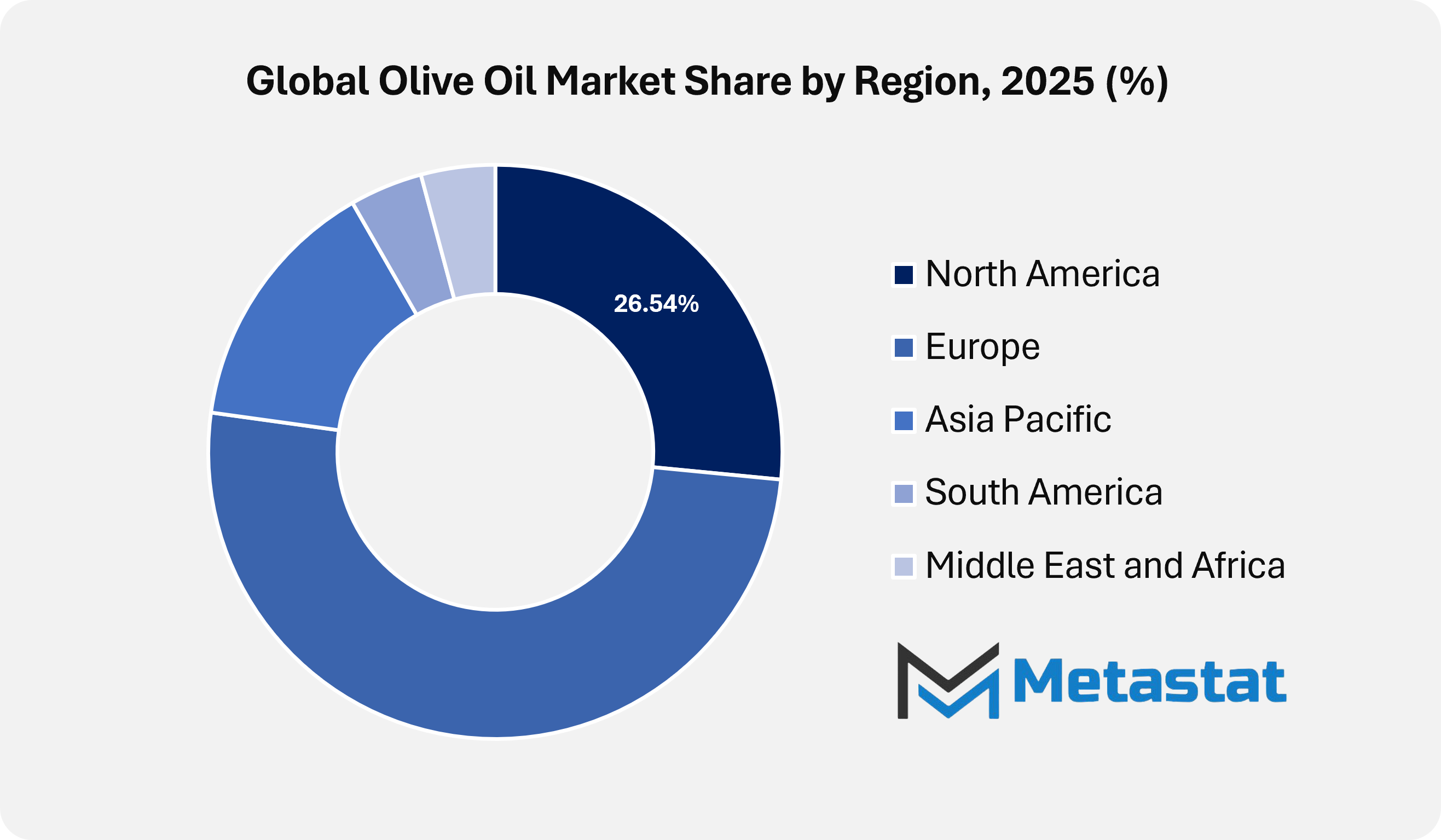

By Region:

Based on geography, the global Olive Oil market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

Europe Olive Oil Market is set to expand at a CAGR of 5.3% within the forecast period, reaching a market size (TAM) of USD 19.8 billion by the end of 2033.

Consumers in Europe are becoming more aware of the health benefits of olive oil, such as lowering cholesterol and promoting heart health. This awareness drives consistent demand for olive oil as a key ingredient in cooking and salads. Nations that embrace the Mediterranean diet, such as Italy, Spain, and Greece, continue to focus on using natural, nutritious oils. The shift towards healthier living, including functional and clean-label foods, further boosts olive oil consumption across age demographics within Europe region.

The growing inclination towards premium, extra virgin, and cold-pressed olive oils due to their enhanced flavour, antioxidant properties, and authenticity is propelling the growth in Europe region. The culinary practices in Europe heavily favour high-quality olive oil for both domestic cooking and professional kitchens. The rise of gourmet cuisine, food tourism, and the growth of artisanal products have heightened demand for specialty and organic options. These factors emphasis on quality over quantity promotes higher-priced segments and inspires innovation among producers.

Increasingly health-conscious consumers in North America is propelling the market growth. The increasingly embracing Mediterranean diets and healthier oils due to heightened awareness of cardiovascular and overall health benefits is the key driver for the expansion of Olive Oil market within US and Canada. This trend provides olive oil producers with an opportunity to broaden their reach through education, health-oriented marketing, and by promoting extra virgin and cold-pressed oils as higher-end, heart-healthy options compared to standard cooking oils.

The growth of online grocery services and specialty food retailers in North America enables olive oil brands to reach a wider audience, including urban and health-conscious consumers. Subscription services, gourmet product packages, and direct-to-consumer online sales create opportunities for smaller or niche brands to showcase premium and organic options. This increase in digital and specialty retail opportunities enables producers to diversify their distribution methods and improve brand recognition. Hence, expansion of e-Commerce and Specialty Retail is also propelling the market growth in North America.

Olive oil consumption is increasing rapidly, driven by growing awareness of health issues, higher disposable incomes, and the popularity of Mediterranean diets among urban populations within Asia Pacific region. Countries like China, India, and Japan are becoming significant import markets, with demand primarily focused on premium and extra virgin olive oils for culinary and wellness applications.

In the Middle East and Africa, olive oil demand is slowly increasing due to urban development, an expanding restaurant and foodservice industry, and a rising preference for healthier cooking oils. At the same time, the region has limited olive oil production. Consumers are increasingly willing to try premium and branded oils, creating opportunities for both imports and value-added products.

South America is experiencing consistent growth, especially in Brazil and Argentina, where culinary trends and rising disposable incomes are driving the acceptance of olive oil. Although local production is limited, it is still relied on heavily, leading to a heavy reliance on imports.

Competitive Landscape & Strategic Insights

The olive oil industry is highly competitive and fragmented, featuring both large multinational corporations and smaller regional or niche producers. Major companies such as Deoleo S.A., Sovena Group, Borges International Group, Salov S.p.A., Colavita S.p.A., Pompeian, Gallo, and Minerva lead the global market through extensive distribution channels, robust brand portfolios, and tactical acquisitions. For instance, Deoleo operates across more than 70 countries and oversees several well-known brands, utilizing its scale to achieve cost efficiency and capture market presence. Sovena Group sets itself apart through vertical integration, overseeing the entire process from cultivation to processing, bottling, and distribution, enabling it to manage costs, ensure supply stability, and maintain consistent quality. Also, Salov and Colavita highlight their heritage and authenticity, which resonate with consumers' perceptions of Italian quality, particularly in the extra virgin and cold-pressed oil sectors. Borges International Group and Dcoop offer a combination of worldwide reach and diverse product lines that encompass olive oil, nuts, and various Mediterranean foods, helping them mitigate market volatility across any one category.

From a strategic standpoint, the market is increasingly moving towards premium offerings, specialty items, and value-added products. Consumers are increasingly preferring extra virgin, organic, single-origin, and flavored olive oils, prompting both multinational and local producers to innovate and launch differentiated stock-keeping units (SKUs). Sustainability and traceability are becoming vital competitive advantages, as health-conscious and environmentally minded consumers seek assurance of origin, eco-friendly production, and ethical sourcing practices. Smaller regional or artisanal brands, like Terra Creta, Gaea, Coosur, Ybarra, and Mueloliva, continue to succeed in niche markets by focusing on single origin, Protected Designation of Origin (PDO)/Protected Geographical Indication (PGI) certifications, and gourmet appeal.

Distribution strategies also influence the competitive landscape for the key players. E-commerce and specialty gourmet retailers are experiencing rapid growth, offering smaller brands the chance to connect directly with urban and international consumers. Major players are leveraging their scale to expand global distribution while simultaneously investing in premium product lines to remain relevant in the lucrative segment. Ultimately, leadership in the market is increasingly defined by a blend of scale, brand heritage, quality control, innovation in premium and specialty goods, and the capacity to cater to rising consumer demands for transparency and sustainability.

Forecast & Future Outlook

Market size is forecast to rise from USD 26.1 billion in 2025 to over USD 39.5 billion by 2033.

The olive oil market's future is likely to be influenced by rising health awareness, a preference for premium products, and the growth of culinary and wellness uses. Consumers are expected to demand more extra virgin, organic, and single-origin oils for their health benefits and antioxidant properties, while interest in cosmetics, nutraceuticals, and functional foods will also increase. E-commerce and specialty retail will enhance accessibility and allow brands to gain a stronger foothold. Sustainable farming practices, traceability, and provenance certification will become essential competitive differentiators.

Olive Oil Market Key Segments:

By Type:

- Refined

- Virgin

- Extra Virgin

- Others (Specialty Blends, Flavored Oils, and Lampante Oils, etc)

By Packaging:

- Bottles

- Pouches

- Cans

By Application:

- Food & Beverage

- Personal Care and Cosmetics

- Pharmaceuticals

- Others (Lubricants, Animal Nutrition, etc)

Key Market Players:

- Gong Cha

- Chatime

- CoCo Fresh Tea & Juice

- Kung Fu Tea

- Sharetea

- The Alley

- Tiger Sugar

- Heytea

- Mixue Ice Cream & Tea

- Xing Fu Tang

- YiFang Taiwan Fruit Tea

- Chi Cha San Chen

- Boba Guys

- Happy Lemon

- Quickly

- Royaltea

- OneZo

- Tealive

- Presotea

- Comebuy Tea

- KOI Thé

- Wushiland Boba

- Teaspoon

- Chun Shui Tang

- TP Tea

- Ten Ren's Tea Time

- Moge Tee

- Mr. Wish

- Truedan

- Jayporeolives

- LiHO TEA

By Distribution Channel:

- Supermarkets & Hypermarkets

- Convenience Stores

- Online

- Others (Specialty Stores, Gourmet Boutiques, etc)

Report Coverage

This research report categorizes the Olive Oil market based on key segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Olive Oil market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market.

The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Olive Oil market.

|

Report Attributes |

Details |

|

Study Period |

2021-2033 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2033 |

|

Historical Period |

2021-2025 |

|

Growth Rate |

CAGR 5.3% from 2026 to 2033 |

|

Revenue Unit |

USD billion |

|

Sales Volume Unit |

Kilotons |

|

Segmentation |

By Type, Packaging, Application, Distribution Channel, and Region |

|

By Type |

|

|

By Packaging |

|

|

By Application |

|

|

By Distribution Channel |

|

|

By Region |

North America (By Type, Packaging, Application, Distribution Channel, and Country) |

|

|

|

Europe (By Type, Packaging, Application, Distribution Channel, and Country) |

|

|

|

|

Asia Pacific (By Type, Packaging, Application, Distribution Channel, and Country) |

|

|

|

|

South America (By Type, Packaging, Application, Distribution Channel, and Country) |

|

|

|

|

Middle East and Africa (By Type, Packaging, Application, Distribution Channel, and Country) |

|

|

WHAT REPORT PROVIDES

- Olive Oil Price Forecast

- Olive Oil Historic Price

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

REALTED REPORTS

- North America Extra Virgin Olive Oil Market

- North America Olive Market

- Saudi Arabia Olive Oil Market

US: +1-(714)-364-8383

US: +1-(714)-364-8383