MARKET OVERVIEW

The oil and gas industry as a whole is fundamentally critical as a small cornerstone for the regulation, control, and efficient flow of liquids and gases during extraction, processing, storage, and distribution. These valves play a vital role in maintaining safety, operational reliability, and compliance with industry standards while engineered to meet the demands of the energy sector. This market is expected to adapt, innovate, and expand as the industry continues to evolve to meet shifting demands and technological advancements.

The Global Oil And Gas Valves market serves a broad range of applications, from upstream exploration and production activities to midstream transportation and downstream refining processes. These valves come in various types, including ball, gate, globe, butterfly, and check valves, each engineered for specific functionalities and operational requirements. The right valve type is very important because it affects efficiency, safety, and environmental performance across different operational scenarios. It depends much on those parts to support pipelines, process plants, as well as storing sites, primarily where high pressures, extreme temperature levels, as well as erosive materials apply.

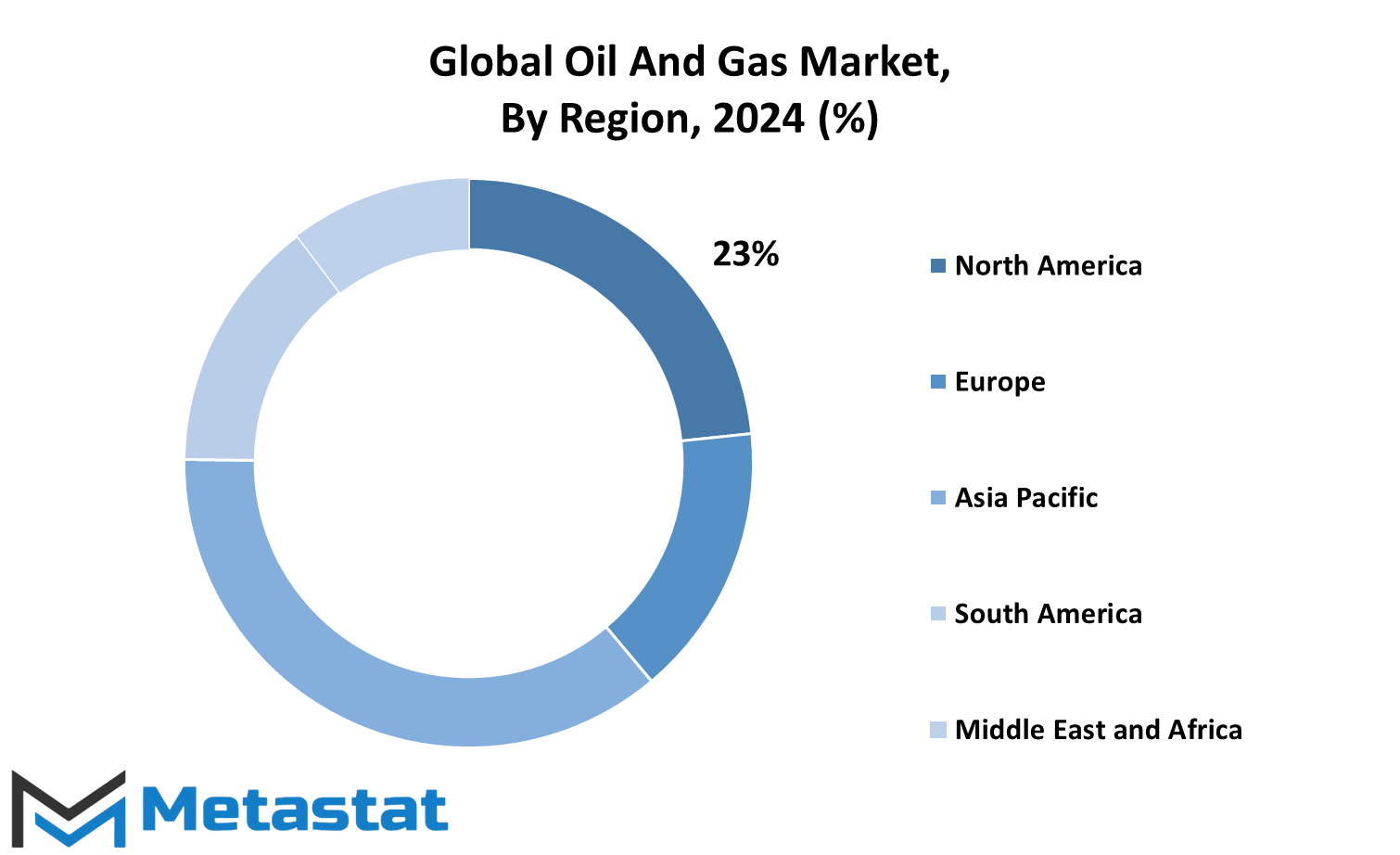

The Global Oil And Gas Valves market is comprehensive because it includes almost all types of participants, that is, manufacturer, supplier, distributors, as well as a customer. This market covers regions with substantial oil and gas reserves and activity, such as North America, the Middle East, Asia-Pacific, Europe, and Latin America. Geographical distribution in this industry is determined by regional production capacities, infrastructure development, and the demand for energy resources. Thus, the market behaves dynamically in response to geopolitical developments, regulatory changes, and technological advancements.

As the industry continues to move forward, changes in the Global Oil And Gas Valves market will be catalyzed by changing energy demands, the impetus for sustainability, and digital technology innovation. Smart valves, which come with sensors and automation, will become the new standards for operational efficiency and predictive maintenance. This technology will help support the goals of the industry regarding reduced downtime, better asset management, and a more environmentally responsible approach. Besides, new researches in the area of material science are likely to yield valves with excellent wear and corrosion resistance for better operation lifetimes and minimum maintenance.

Market is going to depict growth in emphasis toward safety and compliance. Tight emission control and protection of environment as well as work safety requirements would mean valves must be much advanced in designs meeting all those requirements. Furthermore, increased emphasis on renewable sources of energy and alternate fuels would create specific market demands, therefore also creating avenues for valve-specific applications.

The Global Oil And Gas Valves market is a critical part of the energy sector with its scope and importance to continue growing in reaction to the growing needs of this industry. As technology evolves and environmental conditions change, it will continue playing a vital role in ensuring that the oil and gas value chain is operated efficiently, safely, and sustainably. Its ability to adapt to emerging trends will determine its relevance and success in the years to come.

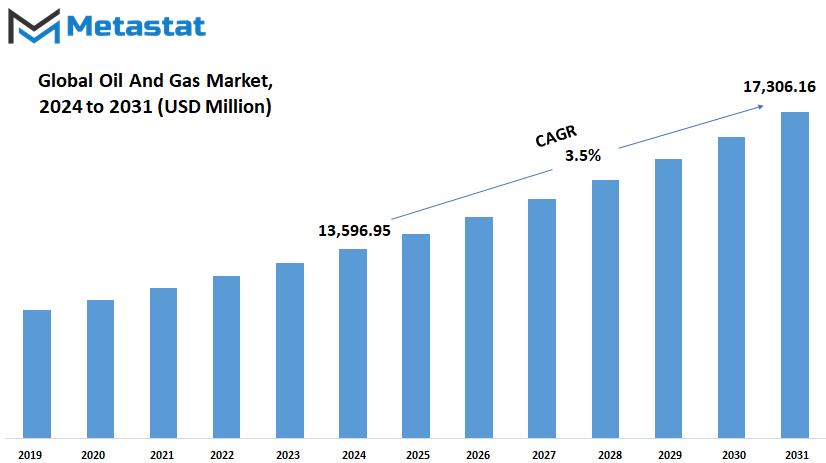

Global Oil And Gas Valves market is estimated to reach $17,306.16 Million by 2031; growing at a CAGR of 3.5% from 2024 to 2031.

GROWTH FACTORS

The global oil and gas valves market is experiencing tremendous transformations due to a number of dynamic factors that are shaping the market for oil and gas valves. One of the key drivers is the rising global energy demand as nations seek to secure reliable and sustainable energy sources for their growing populations and industries. As the world continues to consume more energy, there is a growing emphasis on improving the safety and efficiency of oil and gas infrastructure, which includes the critical role that valves play in regulating the flow of resources through pipelines, processing plants, and other operational systems.

Technological advancements in valve design are another crucial force driving the global oil and gas valves market. Manufacturers are increasingly investing in innovations that improve the performance and reliability of valves. This includes better materials that resist corrosion and wear in harsh environments, as well as more sophisticated valve technologies that can withstand high-pressure and high-temperature conditions. Such developments help to address the evolving challenges of the oil and gas industry, ensuring that infrastructure operates smoothly and with greater safety. With technology advancing, the designs are expected to be even more advanced with better functionality and longer lifespans for oil and gas valves.

Despite the promising growth of the market, there are challenges. The maintenance cost of valves is very high, especially for those used in extreme environments such as offshore drilling. The complexity and often harsh conditions of these operations increase the wear and tear on equipment, requiring frequent repairs and replacements. This increases the overall operational costs, which can be a barrier to market expansion, especially for smaller operators.

The volatile price of crude oil continues to be one challenge. Changes in oil prices might cause uncertainties within investment and development of infrastructure as it may cause businesses to refrain from investing in a large project without knowing its viability in the long run. This level of instability is likely to drag the introduction pace of new valve systems in the market.

On the bright side, the use of smart valves and automation technologies will bring much promise to the future. Digital tools will continue to gain prominence for more enhanced monitoring and control of oil and gas processes. Smart valves are said to deliver real-time performance data, and through these valves, the operator will have closer monitoring of the pipeline conditions and other systems. It has the effect of improving safety, reducing the likelihood of accidents, and enhancing general operational efficiency.

As these technologies mature and become more affordable, they will be likely to cause significant growth in the global oil and gas valves market, hence its future in the years ahead. In summary, there are challenges with the global oil and gas valves market, but increasing demand for energy, plus technological innovations that could lead to automation, portend a more positive future. Companies that adapt to these issues and new technologies will play a large role in dictating the direction of the future.

MARKET SEGMENTATION

By Product Type

The Global Oil and Gas Valves market is growing rapidly due to increased demand for energy resources and increasing infrastructural developments for oil and gas facilities around the globe. The product type of valves makes a crucial distinction in this market, categorized under different applications and usage within the oil and gas industry. The market for different types of valves is expected to be valued at impressive figures as of 2024, as these components are gaining increasing importance in the energy sector.

The product type, gate valves, will remain the market leader with a projected value of USD 4,270.69 million in 2024. Gate valves are essential for regulating the flow of oil and gas in pipelines, ensuring smooth operation and minimal leakage. Demand from this industry segment would increase since a gate valve helps increase efficiency by saving operational downtimes. There is a rising need for such dependable and hardy equipment across both upstream and downstream sectors within the oil and gas industry.

The next most valued are globe valves that should register a value of USD 2,139.93 million in 2024. Globe valves are mainly used for the regulation of flow in pipelining and have far greater accuracy than other valve types. As more advanced systems are being developed in quest for better fluid flow control, globe valves shall continue to be in vogue, mainly in critical applications, where such devices must deliver absolute accuracy along with control.

Ball valves is another major product type in the Global Oil and Gas Valves market, valued at USD 3,981.30 million in 2024. Their simplicity and effectiveness make them popular in shut-off and flow control applications. As industries look for low-maintenance, efficient, and cost-effective solutions to control the flow of gas and oil in pipelines and storage systems, use of ball valves is expected to increase.

Butterfly valves will also see substantial demand at USD 1,401.23 million. Due to their compact design and rapid opening and closing functions, they are highly sought after for applications where space and response time are of prime importance. Butterfly valves will remain attractive for new projects as well as for retrofitting existing systems because the industry will be constantly driving towards more efficient designs.

Check valves with an estimated value of USD 596.10 million for the year 2024, and pressure relief valves (PRVs) projected to reach USD 571.97 million, have become essential tools for safety and protection in the oil and gas industry. Backflow is halted by check valves, while the pressure relief valve prevents systems from reaching dangerous levels of pressure. With safety in mind, it will be hard for companies not to rely on these valves during their growth.

All said and done, the Global Oil And Gas Valves market would continue to gain pace in the years ahead and every type of valve would indeed contribute towards augmenting efficiency, safety, and operational reliability within the oil and gas industry. The values of 2024 have shown some promise as an indicator of continued demand for such components and there is, indeed, hope ahead for the industry.

By Body Material

Global Oil And Gas Valves is an important segment in the global energy industry, handling the control and regulation of fluid flow within pipelines, various types of storage systems, and other key infrastructure. It involves a broad range of valves, from different designs intended to control the flow of oil, gas, among others, within these settings. As we look forward, it becomes clear that design and material choices will influence their performance and reliability. Two of the common materials associated with the production of these valves are cast bodies and forged bodies.

Cast material valves are usually cast by pouring molten metal into a mold. This method allows for the creation of complex shapes and sizes that may not be achievable with other methods. Cast valves are known for their cost-effectiveness and suitability for large-volume production, making them an attractive option for many applications in the oil and gas industry. As the demand for cost-effective solutions in infrastructure grows, cast valves will play a significant role in the Global Oil And Gas Valves market. Durability and the ability to handle large volumes of liquids and gases constitute the main reason for their continued use in pipeline systems and other infrastructure.

Forged valves, on the other hand, are made by giving shape to metal under high pressure. This process gives the material higher strength. So, the forged valves are more robust and resistant than their cast counterparts. The main benefit of forged valves is that they offer better resistance to high pressure and temperature variation. The increasing trend in deep reserves of oil and gas industry and operations under harsher environments will also give more importance to forged valves. These valves are essential in applications where strength and performance must be high, such as offshore platforms and high-pressure pipelines. With technology changing every day, the need for forged valves is likely to grow with time due to their resistance to harsh conditions.

With time, cast and forged valves in the Global Oil and Gas Valves market will find their application in any project depending on the specific requirements of the project. Factors such as environmental conditions, pressure, and temperature will be influential. But one thing is sure: each of the two valve types has its merits. With this, these materials will stay at the heart of the effort to advance safety, efficiency, and reliability in the flow systems that make the oil and gas industry operate efficiently.

By Size

Global Oil and Gas Valves markets have developed drastically in recent times and have been mainly fueled by an enhanced demand for better systems regulating oil and gas at both upstream and downstream processes. Industry would continue to be on an upwards trajectory with a focus on improving technology and pursuit of energy efficiency. This market is expected to evolve with the ever-changing demands of the oil and gas sector as the world continues to focus on sustainability. In the future, the Global Oil and Gas Valves market will be further specialized in terms of valve sizes.

As the market is segmented by size, ranging from 0.25 to 8 inches, 8 to 20 inches, and over 20 inches, highly efficient solutions tailored for application-specific will emerge in the market. For most applications, smaller valve sizes, between 0.25 and 8 inches, are called into use for precise control in smaller pipelines and systems. These valves are very important in industries where the control of flow is accurate, such as in natural gas transportation and the chemical industry. The demand for these valves will only increase with the growing need for more efficient pipeline management. The valves in the range of 8 to 20 inches will probably experience a rally as they can maintain higher pressures and greater volumes and thus have more applications where big oil and gas pipelines are concerned. More significantly, oversized valves bigger than 20 inches will be crucial for infrastructure, where oil and gas bulk volumes are dealt with.

These valves will continue to be the heart of major transmission systems, allowing energy resources to be safely and efficiently transferred over long distances. They will play a significant role in the oil and gas sector's expansion as the global demand for energy grows, with the new emerging economies contributing to the energy needs of these nations. This revolutionizes the Global Oil and Gas Valves market because in the near future, innovative technologies like smart valves will take control of things in real time with automated controlling capabilities. So, automation along with digitalization would bring high levels of efficiency and safety with economic cost-effectiveness. This further accelerates market growth as reduced human intervention reduces failure rates at work.

The Global Oil and Gas Valves market will continue to grow, owing to the necessity for excellent performance and efficiency under even more stringent and demanding conditions. As the industry develops, specific valves, especially in different sizes, will be a must-have in keeping the oil and gas infrastructure at optimal functionality and safety. These developments will not only address the current challenges but also lay the foundation for a more sustainable and technologically advanced future in the oil and gas industry.

By Application

The global Oil and Gas Valves market is a part of the energy industry, playing a critical role in the safe and efficient operation of oil and gas pipelines, refineries, and production facilities. The growth and development in oil and gas exploration, transportation, and refining are responsible for the drive in the valve market. This market will continue to grow in the next few years as energy demands continue to rise all over the world. Oil and gas valves can be broken down into three main segments: upstream, midstream, and downstream. These segments serve different purposes in the industry.

The upstream sector is the function of the activities that pertain to oil and gas exploration and production. This means finding raw oil and natural gas in deep earth reservoirs. Valves play a vital role in upstream operations as they control the flow of fluids, pressures, and the overall safety aspects during extraction. Given the increasing global demand for oil and gas, especially in the developing world, the upstream part of the market will continue to expand. With technological advances and increased exploration in previously untapped areas, the need for advanced valves to manage the complexities of extraction will rise. This means more efficient and durable valve solutions.

In the midstream sector, which covers the transportation and storage of oil and gas, valves are fundamental to controlling the flow of products through pipelines. This segment of the market will grow substantially with new pipeline projects initiated to transport oil and gas from extraction points to refineries and distribution centers. There is a high potential for valves in such pipelines, especially when infrastructure continues to grow and old systems call for replacement. With more interest in environmental conservation and sustainability, valves which cut down leakages and minimize energy consumption shall gain much recognition in the midstream industry.

Downstream refers to refining crude oil to several products that are used; gasoline, diesel, and other petrochemicals. This kind of sector will require various types of valves as they take control of certain operations in a refinery and ensure chemical handling and processes. As refined product demands rise across the world, so will the demand for efficient valve technologies for high-pressure and extreme environment operations. Not to mention, the push for clean and sustainable energy sources has and will continue to emphasize valves that can help minimize emissions and improve energy efficiency in the refining process.

As the demand for oil and gas grows globally, the demand for sophisticated valves will be increased in all sectors of the industry. All three segments-upstream, midstream, and downstream-have specialized valves that satisfy specific needs, including pressure management, flow control, and safe transportation and processing of energy resources. The future of the global Oil and Gas Valves market is bright because of the constant innovations that are going to keep supporting the expanding energy industry.

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$13,596.95 million |

|

Market Size by 2031 |

$17,306.16 Million |

|

Growth Rate from 2024 to 2031 |

3.5% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The Oil and Gas Valves market worldwide has undergone much change over time, and its trend is also likely to evolve further as all the regions adapt to the shift in energy needs and technological revolutions. The geographies are subdivided into segments that have diverse characteristics and offer opportunities. Close analysis of those regions shows that the local nature of their systems has a crucial influence on the larger oil and gas industry as well as valve market's prospect.

North America, covering the U.S., Canada, and Mexico, is a prime market for global Oil and Gas Valves. The U.S. is an important market in this region since it is among the largest producers of oil and natural gas; its demand for energy infrastructure also continues to rise. North America leads the market given that technology for innovation, as presented by automation, smart valves and more, ensures its dominance with future growth rates likely to emanate from this region alone. Canada is another country greatly involved in making this market more active, mostly through expansion initiatives aimed at bolstering their energy-related sectors, the oil sands-related projects, offshore explorations of Canada, etc.

In Europe, the UK, Germany, France, and Italy are some of the major countries in the region's oil and gas industry. Demand for valves in Europe is driven by the need for efficient, sustainable energy production and distribution. Shift towards renewable energy sources and modernization of existing infrastructure will determine the demand for advanced valve technologies. European regulations concerning the environment's sustainability will also increase calls for more energy-efficient valves as part of fulfilling emission reduction expectations. Growth for the entire Europe market will essentially depend on whether the region adopts these new requirements as a standard part of business practices.

Asia-Pacific is growing faster in the world oil and gas valve market. China, India, Japan, and South Korea are also focusing on energy security and infrastructure development. With the rise in energy consumption, there will be a need for more robust and reliable valves. Offshore and onshore oil and gas exploration will expand in this region, which will drive valve demand. With the region focusing more on smart technologies, Asia-Pacific may be the leader in the integration of automated and smart valves into energy systems.

South America, particularly Brazil and Argentina, has emerged as a very important region in the global energy landscape. Investment is being made in Brazil's deepwater oil reserves and Argentina's vast shale gas resources, which will increase demand for high-quality valves. The region is expected to continue efforts to develop its energy infrastructure, opening up new opportunities for valve manufacturers.

In the Middle East and Africa region, the large countries such as Saudi Arabia, the UAE, Egypt, and South Africa are seen to be very relevant in the overall oil and gas market. High reserves of both oil and gas make this area a significant site for valve demand; however, these countries face huge challenges such as changes in oil price and infrastructure update. However, continued diversification of economies and investment in sustainable energy will spur significant growth in the market in the long term.

This will bring a more connected and dynamic global industry with different energy priorities and infrastructure goals driving each region forward. With this development in energy markets, demand for advanced valves is sure to continue rising as it moves towards increased automation, efficiency, and sustainability.

COMPETITIVE PLAYERS

The Global Oil and Gas Valves market has registered tremendous growth over the past years and is forecasted to rise further. Increasing competition has brought several key players to the front, which in turn have resulted in innovations and improvements in valve technology to satisfy the growing needs of the oil and gas industry. Some of the big names are Emerson Electric Co., Schlumberger Limited, Alfa Laval Corporate AB, Flowserve Corporation, Crane Co., Danfoss A/S, Dwyer Instruments Ltd., CIRCOR International Inc., Parker Hannifin Corporation, Weir Group Plc., Metso Corporation, Baker Hughes Company, and National Oilwell Varco, Inc. Each of these companies is strategically working to strengthen its position in the market through new product development, technological advancements, and expansion into global markets.

As the world moves toward more sustainable energy solutions, the need for efficient and durable valves in the oil and gas sector will only grow. Key players in the Global Oil and Gas Valves market look toward the future by introducing innovative technologies, including smart valves, automated control systems, and predictive maintenance tools. These new-age technologies will prove to be highly crucial for boosting operational efficiency, cutting down on costs, and enhancing safety standards. Furthermore, with growing environmental concerns, there is a rising need for valves that can control complex systems, withstand high-pressure environments, and have minimal leakage.

Another significant trend is the increasing demand for valves that can operate in extreme temperatures and corrosive environments. The oil and gas industry often operates in harsh conditions, such as offshore drilling sites or deep-water exploration, where traditional valve solutions may not be sufficient. This is where companies like Flowserve Corporation and Metso Corporation are looking to introduce more advanced materials and designs that will meet these demands.

Mergers, acquisitions, and partnerships are also influencing the competitive landscape of the Global Oil and Gas Valves market. Companies are forming alliances with one another to enhance their product portfolios and gain more market share. For example, the Parker Hannifin Corporation merger with other industry leaders has availed the company opportunities to increase its technological capabilities, thereby increasing its range of solutions to meet the diverse needs of the oil and gas industry.

The future for the Global Oil and Gas Valves market, in short, seems bright. Key players are adopting technological innovation, and emphasis on sustainability will help them thrive further. A competitive environment would always be dynamic, and the role of such companies in forming the future oil and gas landscape is crucial. Through constant innovation and strategic collaboration, they will be ready to meet the evolving needs of the industry for years to come.

Oil And Gas Valves Market Key Segments:

By Product Type

- Gates

- Globes

- Balls

- Butterflies

- Checks

- PRVs

- Others

By Body Material

- Cast

- Forged

By Size

- 0.25 to 8 inches

- 8 to 20 inches

- Above 20 inches

By Application

- Upstream

- Midstream

- Downstream

Key Global Oil and Gas Valves Industry Players

- Emerson Electric Co.

- Schlumberger Limited

- Alfa Laval Corporate AB

- Flowserve Corporation

- Crane Co.

- Danfoss A/S

- Dwyer Instruments Ltd.

- CIRCOR International Inc.

- Parker Hannifin Corporation

- Weir Group Plc.

- Metso Corporation

- Baker Hughes Company

- National Oilwell Varco, Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252