MARKET OVERVIEW

The Global Octene Copolymer Linear Low Density Polyethylene market is one of the more specialized niches in the vast polymer and plastic industry, discussing the production, application, and distribution of a particular type of polyethylene. The market, in this case, is characterized by its emphasis on a polymer blend that uses octene as a comonomer, thus providing specific mechanical and chemical properties to the resultant material. Octene copolymerized LLDPE is known for its balance between flexibility, strength, and processability, thus a material of choice for various advanced applications.

The Global Octene Copolymer Linear Low Density Polyethylene market finds its significance in industries that demand superior performance and durability from materials. Octene as a comonomer increases the impact resistance, elongation at break, and puncture strength of LLDPE. These are properties not seen in most other polyethylenes. The product finds applications in the packaging, agriculture, construction, and automotive sectors where these improved properties give way to direct performance benefits. These advantages enable octene copolymer LLDPE, for example, to provide increased film toughness, better sealing properties, and high clarity-a standpoint critical for modern packaging solutions-in the packaging industry.

This industry, focused around this particular market, operates to a very advanced degree of specificity with highly technological polymerization of material. Their product manufacturing will take control the octene ratio and ethylene ratios in achieving conditions under the most optimal basis of polymerization. Due to this advanced process, it helps them produce something as needed from an end-user like strong agricultural film, heavy industry liner, to even consumer packages.

Another defining trait of the Global Octene Copolymer Linear Low Density Polyethylene market is its innovation-oriented approach. Research and development activities play a significant role, as firms continually work on fine-tuning the production processes, enhancing material performance, and identifying new application opportunities. Material scientists, engineers, and industry participants are expected to drive the new-generation LLDPE products that will take the performance of their predecessors to a new level.

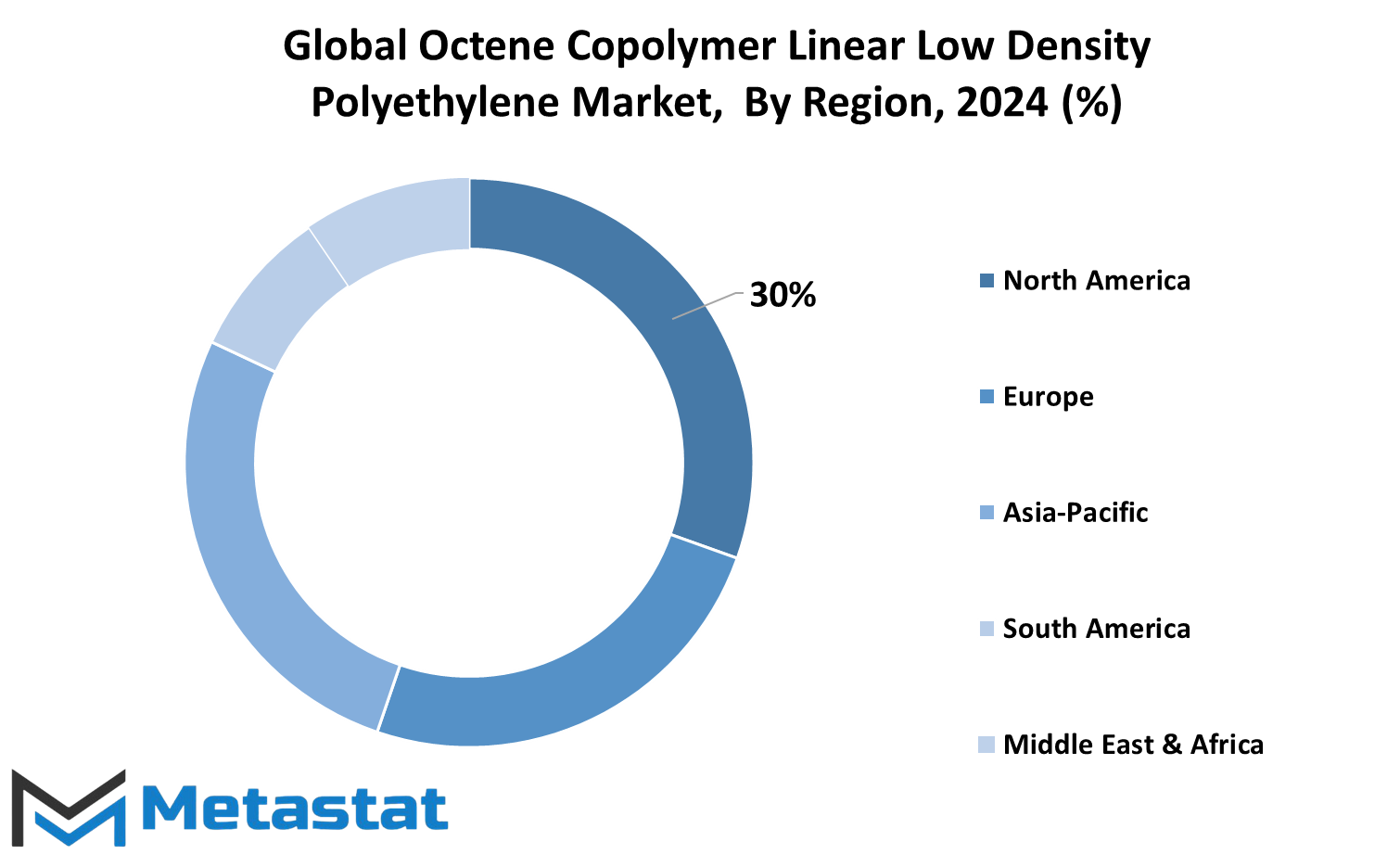

From a geographic perspective, the market covers many regions, which are characterized by production facilities, distribution networks, and end-user industries creating a complex supply chain. Supply and demand in these regions dictate market dynamics in terms of pricing, availability, and technological adoption. In addition, regulatory differences between countries influence the production and application of these polymers, and manufacturers must adapt to these differences in their operations.

With all these factors into consideration, it is evident that the Global Octene Copolymer Linear Low Density Polyethylene market will change accordingly with technological growth, changes in consumer preferences, and emerging needs of industries. In the next few years, a significant focus for industries will be on sustainability-orientated forms of LLDPE, i.e., recycling and eco-friendliness, and more efficient and environmentally responsive production processes as manufacturers look towards achieving global objectives on the environmental front.

This market encompasses the interplay between material science, industrial application, and global trade. Its distinctive characteristics and the continued demand for performance-enhanced polymers ensure that it remains an area of interest and innovation within the broader polymer industry.

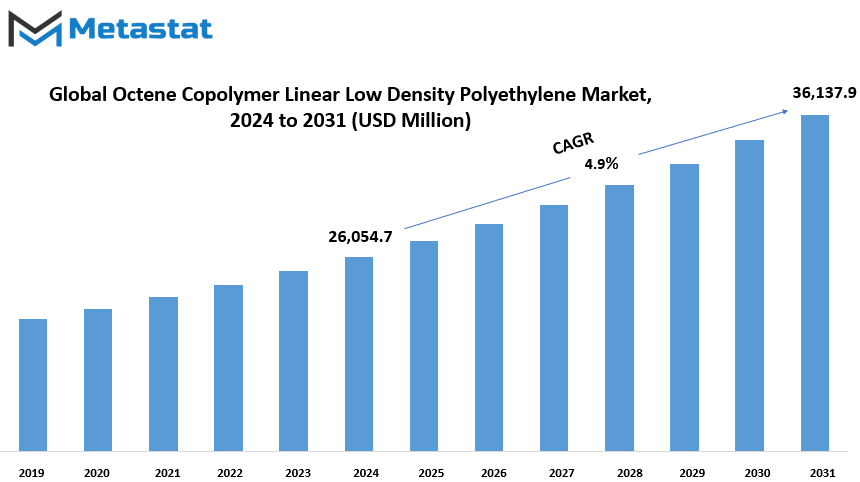

Global Octene Copolymer Linear Low Density Polyethylene market is estimated to reach $36,137.9 Million by 2031; growing at a CAGR of 4.9% from 2024 to 2031.

GROWTH FACTORS

With diverse applications and unique properties, the Global Octene Copolymer Linear Low-Density Polyethylene market is expanding. Increased demand from the food and beverage industries has been a strong driver for such growth in high-strength packaging solutions. The material's durability and adaptability ensure products do not spoil in their storage or on their transportation stages and do not have a tendency to degrade during the supply chain processes. Another application area is in the agricultural sector, where LLDPE is used in films and greenhouse applications. It offers protection, retains moisture, and controls temperature, which makes it an essential part of modern agriculture.

The market has several challenges that might slow its growth. One of the most important challenges is the fluctuation in raw material prices, which affects the cost of production. Fluctuation leads to uncertainty for manufacturers and can make LLDPE products less affordable. Furthermore, environmental issues associated with plastic waste and the necessity of enhanced recycling practices create a major challenge. As the government introduces more stringent regulations and the public becomes increasingly conscious of plastic pollution, the industry needs to work on these challenges to maintain its growth path.

However, the opportunities are unfolding with the improvement in recycling technologies and sustainable practices. Innovative techniques for recycling LLDPE to be used in eco-friendly products are changing the perception of the material. Not only does it reduce the footprint of LLDPE on the environment, but it also becomes more attractive for environmentally conscious industries and consumers. Companies that make investments in the sustainable production processes and circular economy principles will get a competitive edge in the market.

The future of the Global Octene Copolymer LLDPE market seems bright with ongoing innovations and a thrust toward sustainability driving it forward. Industries are continually seeking materials that can balance performance with environmental responsibility, and LLDPE is poised to fill these gaps. Manufacturers, regulators, and other stakeholders will together overcome the challenges of raw material price volatility and environmental issues. It can be said that, driven by sustainable practices and technological advancements, the market has a possibility of thriving for a more sustainable future.

MARKET SEGMENTATION

By Type

In recent years, the global market for Octene Copolymer Linear Low-Density Polyethylene has seen rapid growth. The type of polymer is generally versatile and finds extensive application in a number of industries such as packaging to automobile manufacturing. LLDPE is produced through the polymerization of ethylene with octene, known for its strength, flexibility, and durability. The market for Octene Copolymer LLDPE is strongly segmented according to the percentage content of octene, and the segments are what would determine the type of properties and hence applicability.

Octene Copolymer LLDPE is divided into three primary categories depending on the content of octene: High Octene Content LLDPE, Low Octene Content LLDPE, and Medium Octene Content LLDPE. The varying amount of octene content during its production primarily affects the various physical properties of the polymer like flexibility and strength, as well as processing characteristics.

High octene content LLDPE provides excellent flexibility and stretchability, which is important for flexible packaging films or stretch films applications where high elongation materials are needed. With an increase in octene content, the polymer gets softer and more elastic, allowing it to better bend and stretch without breaking into pieces when manufactured.

Low Octene Content LLDPE has a higher density and is stiffer than high octene LLDPE. It is used in applications where durability and strength are not as crucial as flexibility, such as items like containers, bottles, and other packaging products that have to rely on more rigid structures for the safety and stability during transportation and handling.

Medium Octene Content LLDPE has properties of flexibility, as well as strengths. This makes the polymer generally selected for such applications that must balance both in their use and are found typically in agricultural films, automotive parts, or simply packaging materials. The balanced features of this plastic make it widely versatile and adapted to a diverse industrial use.

Its market keeps growing because its benefits are highly recognized by diverse industries. Where companies are aiming to improve a product's properties- mainly performance, affordability, and environment-friendliness, Octene Copolymer LLDPE can be used on a wide spectrum of applications in the future.

By Form

The Global Octene Copolymer Linear Low Density Polyethylene (LLDPE) market is segmented according to the different forms it takes in various applications. These forms include film, sheet, molding, and coating. Each of these forms plays a significant role in the industrial and commercial use of LLDPE, catering to a wide array of sectors from packaging to construction.

The film form of LLDPE is primarily used in packaging, especially in applications where flexibility and lightness are required. It is particularly used for products that require high strength and durability, such as food packaging, stretch wraps, and agricultural films. Its capability to provide moisture resistance and its flexibility make it perfect for such applications.

LLDPE in sheet is used in some construction, signs, and many specialized applications for a flat material that is also rigid. Sheeting of LLDPE provides chemical resistance as well as being durable and processible. As such, these sheets find a place in applications where materials should be able to withstand exposure to harsh environments, or where easy fabrication is preferred.

LLDPE is molded into various shapes for containers, toys, and other molded goods. Its low density makes it suitable for molding, providing strength and flexibility in the products that it creates. The flexibility and durability of molded LLDPE products make them versatile and highly used in various industries, such as packaging and consumer goods.

Last but not the least, LLDPE is also used in coating applications. Through its variety of applications, the polymer becomes a form of protection for products by being resistant to moisture, chemicals, and abrasion. Coating with LLDPE prolongs the life of such products, hence useful in the construction and automotive industries as well as for electronics.

Each of these forms of LLDPE is crucial to different industries due to its properties, such as flexibility, strength, and resistance to environmental factors. The widespread use of these forms, from packaging materials to protective coatings, shows the importance of LLDPE in both everyday consumer products and industrial goods. These applications will continue to grow as industries seek more durable, versatile, and cost-effective materials.

By Application

The Global Octene Copolymer Linear Low-Density Polyethylene (LLDPE) market is rapidly growing. This versatile material has various applications in numerous industries that range from packaging, automotive, and construction to consumer goods, healthcare, agriculture, and industrial applications. All these sectors utilize the distinctive properties of octene copolymer LLDPE, including its strength, flexibility, and durability.

For use in flexible or rigid packaging applications in the packaging industry, octene copolymer LLDPE is used to create products, such as plastic wraps, bags, and containers, because it can withstand an external force on its structure but maintains structural strength. Flexible packaging is the most popular, considering the ease in using it as well as to preserve the product. On the other hand, rigid applications of packaging materials depend on strength and the forming of protective structures around goods; therefore, this makes LLDPE suitable for a wide variety of products that range from food packaging to consumer electronics.

In the automotive industry, LLDPE is used to make parts that require high impact and stress resistance, such as bumpers and other parts that are exposed to extreme conditions. The material is favored for its toughness and ability to reduce weight in vehicles without losing strength. This contributes to both improved fuel efficiency and the safety of vehicles, making LLDPE a key material in the automotive industry.

Octene copolymer LLDPE is generally used in building construction for piping, sheet materials, and even insulation. Being resistant to both environmental stress-cracking and highly durable at many temperatures, its use in various building applications provides excellent material property. In the agricultural sector, LLDPE is used extensively in films as well as in mulches so that crop productivity can be significantly enhanced by making water retention superior and crops hardy against intense weather conditions.

Healthcare is another industry in which octene copolymer LLDPE is playing a significant role. It is applied in the manufacture of medical devices and equipment because of its suitability for products requiring sterility, reliability, and ease of use, such as surgical gloves, syringes, and packaging for medical supplies.

The final application of octene copolymer LLDPE is in other industrial applications, where its unique properties make it suitable for a wide variety of products. Its use is increasing as more industries discover the advantages of using this material. The market for LLDPE will continue to grow steadily as demand increases in these diverse areas.

By End-Use Industry

The global market of Octene Copolymer LLDPE can be classified into a few major end-use industries which further grow the demand. They include food and beverage, pharmaceuticals, building and construction, automobiles, agriculture, and consumer goods. The respective industries are categorized under such demands that call for its varied use across industries.

Octene Copolymer LLDPE finds applications in the packing of packaged food and beverages as it is an excellent sealant with moisture barrier resistance, thus suitable to preserve packaged foods. The oxygen and other contamination barrier provided by the material helps to preserve the foodstuff and beverages during transportation and storage. It's the only choice for those looking to offer a longer shelf life and few chances of spoilage.

The Pharmaceutical also uses Octene Copolymer LLDPE for packaging most of its drugs, especially to those that face extreme environmental factor exposure. Material strength and a non-reactive nature make LLDPE materials ideal for applications in pharmaceutical applications, such as packaging drugs, medical devices and equipment. Therefore, the items are preserved while maintaining their stability by protecting these products from moisture and light, then air, crucial factors in this case to pharmaceutical products' high quality and active performance.

In the Building and Construction sector, Octene Copolymer LLDPE finds its place in various applications, such as in the production of pipes and insulation materials. The material’s flexibility and strength make it an excellent choice for use in both residential and commercial construction. It is also resistant to chemicals and weathering, which ensures its longevity and reliability in construction environments.

The use of Octene Copolymer LLDPE in the production of various automobile parts, fuel tanks, bumpers, and interior parts in automobiles, means that the component can be utilized at high temperatures and is extremely light in weight. This facilitates better fuel efficiency and a total vehicle weight reduction, while its resistance to wear leads to long-lasting functionality of automotive components.

This film copolymer of LLDPE is utilized in agriculture in making films which protects crops by safeguarding against rough weather and insects. Octene Copolymer LLDPE is one such material whose flexibility and non-degradative ability against ultraviolet light render it an ideal application in increasing crop yield, crop protection from any adverse stage during its development process.

The Octene Copolymer LLDPE used in its production of various products entails household items, toy, and packaging amongst others. This versatility and cost-effectiveness offer a way for manufacturers to make items durable, safe, and appealing to consumers, hence crucial for everyday goods production. Each of these industries will continue to rely on Octene Copolymer LLDPE to meet their specific requirements, driving its market growth and development.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$26,054.7 million |

|

Market Size by 2031 |

$36,137.9 Million |

|

Growth Rate from 2024 to 2031 |

4.9% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

Geographical segmentation of the world market for Octene Copolymer Linear Low Density Polyethylene encompasses North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. In North America, it includes the United States, Canada, and Mexico. Europe is segmented as the UK, Germany, France, Italy, and other European countries not specifically mentioned.

The size of the Asia-Pacific market for Octene Copolymer Linear Low Density Polyethylene was estimated to be 5,758.4 million USD in the year 2020. It is expected to rise up to approximately 8,286.3 million USD by the end of the year 2027 with a CAGR of 5.6% from the years 2021 to 2027. Major markets in the region include India, China, Japan, South Korea, and other markets in the Asia-Pacific region not included in the above list.

South America includes Brazil, Argentina, and all other countries in South America that are not mentioned by name. Middle East & Africa includes the GCC countries, Egypt, South Africa, and all other countries in the Middle East & Africa that are not mentioned by name.

These regional breakups help one understand the details of where the biggest markets for Octene Copolymer Linear Low Density Polyethylene are located and how those markets are going to grow over the next several years. Asia-Pacific's growth is particularly continuing as the demand for this product is growing within countries with developing industrial sectors and an increasing demand for packaging materials, agricultural products, and more. Other regions that will grow will be North America and Europe although at slower speeds than in the Asia-Pacific area.

The relatively smaller South American and Middle East & African areas also represent the potential for increased growth, going forward, since it is the source of new opportunities in high-margin polyethylene goods. Understanding these regional dynamics will enable businesses and investors to make more informed decisions about their operations and investments in the Octene Copolymer Linear Low Density Polyethylene market. With steady development and opportunities for expansion in the years ahead, the market is expected to continue growing in key regions.

COMPETITIVE PLAYERS

Global market for Octene Copolymer Linear Low Density Polyethylene (LLDPE) is growing considerably, as this polymer is highly in demand from various industries, such as packaging, automotive, and construction. This polymer has flexibility, durability, and resistance to environmental factors. Several major players dominate the market, expanding and developing through innovation and strategic partnerships.

ExxonMobil Chemical is one of the leading manufacturers in the global market for Octene Copolymer LLDPE. The company is emphasizing product performance improvement in its polyethylene products in order to give response to increasing demands by the packaging industry. It creates innovative technologies and has a wider global reach that maintains a strong competitive advantage for the company.

LyondellBasell Industries is another of the major players in this space. It has positioned itself as a key contributor to the development of new and improved polyethylene products, established on high-quality polymers. Ongoing research and development enable it to stay ahead of market trends and answer evolving industries' demands.

Another big player in the LLDPE market is Dow Chemical Company. This company has established a reputation for innovation and introduced a range of polyethylene products designed to meet the requirements of packaging, automotive, and other applications. They have focused on sustainability, and this has enabled them to fulfill the increasing demand for environmentally friendly products.

As another Saudi Arabian multinational, SABIC has also made meaningful contributions to the market of the Octene Copolymer LLDPE. Primarily recognized through its cutting-edge polymer technologies, SABIC provides high performance polyethylene solutions used in a lot of sectors. The company continues to deliver innovative products to their customers through its commitment to the field of research and development.

Some other key players in the market are INEOS Group, TotalEnergies, Braskem, Chevron Phillips Chemical Company, Mitsui Chemicals, LG Chem, Borealis AG, Formosa Plastics Corporation, Reliance Industries Limited, and Nova Chemicals. They are involved in manufacturing and marketing the Octene Copolymer LLDPE worldwide. With significant investments in technology, sustainability, and production capacity, these companies are better equipped to keep up with the surging demand for this all-around polymer.

The growth of the Octene Copolymer LLDPE market is expected to continue as industries seek more efficient and sustainable solutions. The competition among these key players will drive further innovation, ensuring that the market remains dynamic and responsive to global needs.

Octene Copolymer Linear Low Density Polyethylene Market Key Segments:

By Type of Octene Copolymer

- High Octene Content LLDPE

- Low Octene Content LLDPE

- Medium Octene Content LLDPE

By Form

- Film

- Sheet

- Molding

- Coating

By Application

- Packaging (Flexible and Rigid Packaging)

- Automotive

- Construction (Pipes, Sheets, and Insulation)

- Consumer Goods

- Healthcare (Medical Devices and Equipment)

- Agriculture (Films and Mulches)

- Others (Industrial Applications, etc.)

By End-Use Industry

- Food and Beverage

- Pharmaceuticals

- Building and Construction

- Automotive

- Agriculture

- Consumer Goods

Key Global Octene Copolymer Linear Low Density Polyethylene Industry Players

- ExxonMobil Chemical

- LyondellBasell Industries

- Dow Chemical Company

- SABIC

- INEOS Group

- TotalEnergies

- Braskem

- Chevron Phillips Chemical Company

- Mitsui Chemicals

- LG Chem

- Borealis AG

- Formosa Plastics Corporation

- Reliance Industries Limited

- Nova Chemicals

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252