MARKET OVERVIEW

The North America Agave Spirits market is expected to become a vibrant sequence of the beverage industry, demonstrating increasing interest in the consumer-side for craft and artisanal products. The growing recognition among more consumers of agave spirits-tequila and mezcal- will expose huge visibility to innovation and diversification for this market. This will be indicated by changes in consumer preference, and sustainable orientation with which uniqueness of flavor is needed.

Premium and super-premium products will be in greater demand in the North America Agave Spirits market. Indeed, consumers are becoming increasingly discerning, leading to more interest in high-quality spirits and exhibiting the unique characteristics of agave. It is this trend which will influence brands to invest in premium production practices and emphasize elements connected to heritage, sourcing, and production. Targeted small-batch production in distilleries also focus on spirits with flair flavor profiles using traditional methods that would appeal to that consumer who views authenticity as key.

North America Agave Spirits Market will increasingly adopt the craft cocktail culture. Mixologists will experiment increasingly with agave spirits, integrating them into innovative cocktail recipes that increase visibility for the spirits in bars and restaurants, putting consumers to test various agave-based cocktails. Since creativity will be a more important bar focus, bars will be most likely to feature agave spirits on menus as popular beverages.

Variety will also increase in the North America Agave Spirits market. Tequila and mezcal will continue to be the leaders of this sector, but new players will provide the flavour and unique twist on those bases that appeal to a much larger audience. These will allow consumers to experience new things and thus open up the market beyond traditional options. This is most likely to occur through brands leveraging the interests of health-conscious consumers with low-calorie or organic agave spirits to attract healthy drinkers.

Sustainability will be a vital factor in the North America Agave Spirits market in the years to come. Consumers are increasingly in search of brands that go further to ascertain and integrate the concept of sustainability in the production process. The distilleries will gradually shift towards more ecological approaches, from source responsibly to agave plants to utilizing energy-efficient measures. Brands that set standards for sustainability and transparency in production will likely woo consumers towards such value systems as they will differentiate themselves in the fray of competition.

Education and awareness of agave spirits in the market also are expected to increase. Awareness and education among consumers will result in better knowledge about differences between tequila, mezcal, and others, leading to appreciation for such products. This is going to spur a culture of exploration, where consumers will appreciate trying various agave spirit options. Therefore, workshops and tastings for agave spirits likely will attract enthusiasts to the product for better engagement and loyalty.

The North America Agave Spirits market will thus be at its great ease while transforming due to the changing consumer preferences, rather rising appreciation of quality, artisanal products. Premium offerings and sustainability, then, innovative cocktail culture are going to shape the market landscape. These adaptations on the part of the brands would create a vibrant and diversified stock of agave spirits that caters to consumer discrimination. The North America Agave Spirits market will decidedly turn out to be one of the key players in the broader beverage industry in the future.

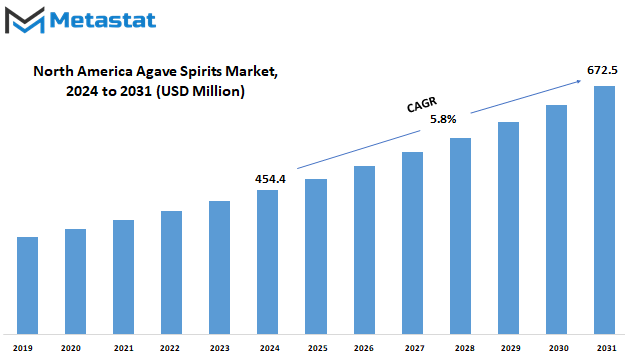

North America Agave Spirits market is estimated to reach $672.5 Million by 2031; growing at a CAGR of 5.8% from 2024 to 2031.

GROWTH FACTORS

The North America Agave Spirits market is expected to grow rapidly in the years ahead. Such a positive growth trend comes about because of multiple driving factors influencing consumer preferences and marketplace dynamics. The highest impetus driving the growth is generated from the rise in popularity of agave spirits among young consumers, that is, millennials and Generation Z. These segments appreciate craft beverages, offering unique flavors and experiences. This means that the demand for agave spirits, especially tequila and mezcal, is likely to shoot up sharply as thirst for products that are at once distinctive yet reflecting craftsmanship and quality will soon increase.

A rapidly growing factor facilitating the North America Agave Spirits market is enhanced health awareness among consumers. Consumers opt for spirits that are perceived to be relatively healthy. Organic and additive-free agave spirits are gaining popularity as they align with customer wellness objectives. Enhanced demand for healthier drinking options is expected to further strengthen the growth prospects of the agave spirits segment in North America.

In addition, cocktail culture will drive the market growth further. Agave spirits are becoming essential ingredients in many cocktail recipes as bars and restaurants innovate drink offerings. This not only enhances their visibility but also encourages consumers to try agave-based cocktails at home, increasing sales.

However, the North America Agave Spirits market would face teething challenges that would be in the way of growth. There may be a risk to the supply chain, and there may be uncertainties around agave prices. With time, if the demand picks up, then supply for quality agave may become scarce, which would keep the prices high for the producer, that is translated into consumers paying more as well. There may also be regulatory challenges about the production and labeling of the agave spirits, which may prove to be a challenge for companies wanting entry or expansion within the market.

Despite these challenges, there are still sound opportunities for the North America Agave Spirits market over the next few years. Premiumization, whereby consumers are now willing to pay more for quality, presents the opportunity for some brands to create unique, higher-end agave spirits. Of course, production processes being sustainable and environmental will attract the environmentally conscious, presenting another way forward.

Though numerous challenges may be facing North America Agave Spirits, the rise in consumer interest, health consciousness, and increasing cocktail culture will continue to propel further growth within the industry. Successful brands responding to trends but less so to their challenges will seek opportunities for success in this dynamic market.

MARKET SEGMENTATION

By Type

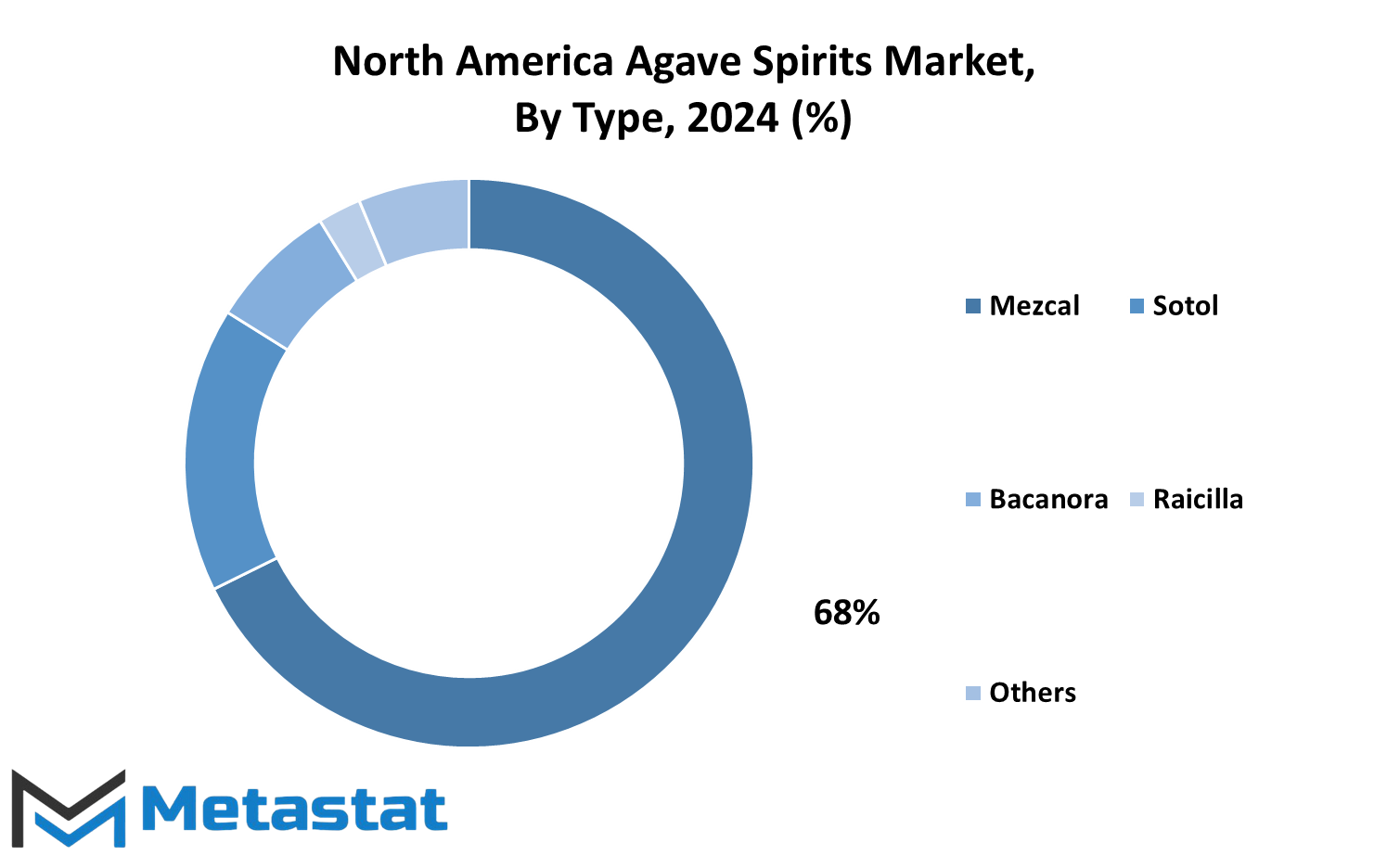

The North America Agave Spirits market is growing rapidly and changing consumer preferences towards craft beverages and increased interest in the spirits. Its demand is very high, and therefore, there must be knowledge about the five sub-categories of these spirits, which are- mezcal, sotol, bacanora, raicilla, and others. The characteristics and flavors vary with each kind, attracting different consumers.

Mezcal is often labelled as the best-selling style of agave spirit. It has a characteristically smoky flavor and is predominantly made in Mexico but has spread to North America. Customers are continuing to flock back towards mezcal partly because of long-held production techniques like traditional distillation and using many different species of agave. This respect for artisanality and authenticity is sure to drive further growth in the North America Agave Spirits market.

Perhaps the most important spirit gaining recognition is a different variety of agave spirit, sotol. Consumers are in search of lesser-known spirits. Produced from a species of desert plant called Dasylirion, sotol has earthy, herbal flavors that are different from those of most mezcal. Since it tastes and is produced differently, the curious customers will be drawn to try some of the world’s lesser-known spirits.

Bacanora is an agave spirit and hails from the Mexican state of Sonora. Like mezcal, it shares the traditional way of production, but this will still attract consumers in pursuit of authenticity and good quality. The North America Agave Spirits market will again enjoy renewed interest in the bacanora as other consumer tastes seek to discover new flavors and change palates.

Another emerging player in this market is raicilla, often called “wild mezcal.” This originates in the western region of Mexico and boasts a fruity and floral profile that puts it decidedly in a different category from its competitors. North American consumers are drinking much more adventurously these days; with such diversified interest, raicilla’s unique profiles will likely attract adventurous consumers who want to try something different.

The Others in the North America Agave Spirits market consist of other artisanal agave spirits, not included in the above categories. This category invites innovation in the creation of new flavors and taste variants, so it has a definite outlook toward presenting consumers with many options.

Overall, there is scope for growth in the North America Agave Spirits market since consumers are increasing their curiosity toward diversified types of agave spirits. With mezcal taking the lead and others like sotol, bacanora, and raicilla following the lead with increased traction, things set to change, bringing diverse drinking range wanting new experiences. As this trend continues, agave spirits will likely remain an interesting feature of the beverage landscape in North America.

By Price Point

The North America Agave Spirits market is growing and transforming at a very significant pace due to various factors that include changing consumer preferences, increased awareness of health and wellness, and growth of craft beverages. The segmentation offered in the report by price point provides useful information about consumers’ shopping behavior and their purchasing habits. As customers are becoming choosier, they are demanding more than quality products; they require products that match their lifestyles and individualism. The same trend will play a positive influence for the future.

On the basis of pricing, North America Agave Spirits market has been divided into the five following categories: Economy, Standard, Premium, Super Premium, and Ultra Premium. The Economy segment refers to products sold at less than $35. These are, as a rule of thumb, products intended for price-sensitive consumers, who cannot afford to spend more on higher-priced spirits, but want to start drinking agave spirits or are comfortable when they get to enjoy the drink as a more relaxed experience. However, due to greater acceptance of agave spirits, they may be drawn to the better-quality offerings that fall within the Standard category and sell between $35 and $50. This category would typically contain products that emphasize the traditional production of the brands; here, the consumer is not too keen on knowing more about the heritage and the craftsmanship of the spirit.

The Premium category, where prices are between $50 and $75, obviously indicates that consumers would pay for a drinking experience. The products are normally characterized by distinct flavors, artisanal production, and generally better-quality ingredients. Super Premium range, $75-$100: The tier is aimed at enthusiasts who adore the subtlety of agave spirits or need the best quality. Ultra Premium segment: more than $100, is for a niche customer who is prepared to pay for exclusivity, rareness of ingredients, or limited editions. This is the premium segment of North America Agave Spirits, which addresses the niche appeal of collectors and connoisseurs.

North America Agave Spirits market prospects in the future will be experienced with the growth of all segments of pricing. Even more and more consumers in the world learn about the diversity of agave spirits and the greater quality of those spirits, they tend to choose more premium products. Consumer preference will then shape the new market with new and innovative offerings meeting the tastes of a diversified audience. Finally, appreciation for agave spirits is on the rise, with the opportunity for brands to provide authentic and memorable drinking experiences for consumers.

By Distribution Channel

North America Agave Spirits Market a Prime Opportunity for Rising Growth Change in consumer palate and increase in demand for premium beverages. Agave spirits, which include tequila, are seen with higher growth rates as the different flavors contribute towards unique taste and cultural tradition within their communities. Consumers will increasingly become more adventurous with their drinks, leading them to become educated about the diverse qualities of agave-based spirits. Additionally, there is a strong interest in authenticity and craftsmanship in what the products are, again in harmony with the traditions that back up these spirits.

One of the main factors that define the future of the North America Agave Spirits market will be the kind of distribution channels by which these products come to consumers. This market is further subdivided into two primary modes of distribution; Ready-to-Drink and Ready-to-Pour products. Both of these segments are attractive in their own ways, with a scope for development in future years.

The Read—to-Drink segment is particularly promising as consumers increasingly seek convenience without sacrificing quality. Pre-packaged cocktails and mixed drinks made with agave spirits offer a quick and easy option for those looking to enjoy their favorite beverage at home or on the go. This option is especially appealing to younger generations, who are often looking for high-quality, on-the-go options that fit into their fast-paced lifestyles. As technology continues developing, it is quite likely that the packaging and preservation of these Ready-to-Drink agave products will improve, not only to enhance flavor but appeal in general.

On the other hand, the Ready-to-Pour segment will be targeted toward a customer who wants more control over making their drinks but likes the convenience of having a pre-mixed solution. The opportunity would be found in settings where people like to share a discussion of agave spirits at home with friends and yet still prefer the ritual of preparing their own drinks. As consumers become increasingly positive toward social gatherings and home entertaining, the demand for Ready-to-Pour products will increase.

Looking forward, it would be wise to project that the evolving North America Agave Spirits market will continue to grow through those channels as consumer preferences continue to shift. After all, with rising interest in premium, crafted drinks and the benefit of Ready-to-Drink and Ready-to-Pour, the market is poised for continued success into the future. Over time, as companies continue to refine their products and enhance customer experiences, the agave spirits market in North America will continue growing.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$454.4 million |

|

Market Size by 2031 |

$672.5 Million |

|

Growth Rate from 2024 to 2031 |

5.8% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The North America Agave Spirits market has been growing rapidly due to the rise in consumer demand for new and premium alcoholic beverages. More people will experience other drinks, and hence, there is an upward movement of agave spirits like tequila and mezcal across the region. Growth is mainly seen across the North American regions because the demand is stronger in those regions. North America can be delineated into key countries, primarily the U.S., Canada, and Mexico, all of whom are to contribute to this future market.

Premium and super-premium agave spirits are in higher demand in the U.S. Upscale demand exists for craft cocktails and high-end beverages, pushing distillers to be more refined and unique in their portfolios. The trend to quality over quantity is going to be prevalent among American drinkers, and the North America Agave Spirits market will have more premium products in the coming years. Moreover, the U.S. market appetite for innovation will drive the entrails of various agave-based products that are devised based on changing consumer preferences.

The agave spirit market is also growing in Canada, but on a slightly slower scale than in the United States. However, there's encouraging growth happening in the Canadian market as consumers gain exposure and appreciation for agave spirits. As awareness of the variety and richness of agave spirits grows, Canadian consumers should fuel significant growth in the next several years. More agave spirits brands will be entering the Canadian market, increasing the prospect for larger and smaller producers alike.

Mexico-the country of origin for agave spirits-remains a vital component of the global supply base. The country's large, local market for agave spirits is coupled with its role as the primary exporter to North America. This entails that supply will keep pace with an ever-increasing demand. For many years to come, Mexico's centuries-old tradition and experience in agave spirits production will place it as a pivotal country in the North America Agave Spirits market.

Overall, the future for the North America Agave Spirits market looks rosy with great demand prospects; this is primarily expected to be in the United States and Canada. This growth is in response to shifting consumer behavior and increased availability of variety products, which will shape the prospects of this market through years ahead.

COMPETITIVE PLAYERS

The North America Agave Spirits market experienced tremendous growth over the past few years, with a view to the establishment of several major players in this industry by striving for more expansion within the competitive sector. This is because agave spirits, particularly mezcal and tequila, are very popular, thus entailing a competitive landscape in terms of efforts both from long-established brands and newcomers to gain a share in the market. Some of the leaders in this surge are companies such as Casa Cortés, Banhez Mezcal, and Bozal Mezcal who are constantly upgrading their products to reach a mass appeal.

Future Competition Set to Grow Higher: The North America Agave Spirits market is expected to rise further regarding its competition since more players are emerging who are recognized for innovativeness in production techniques, marketing strategies, and dispersion methods. Bruxo Mezcal and Mezcal Derrumbes, in order to be different from the rest, now would have to create differences for their products to stand out in this market. Companies like El Silencio Holdings Inc. and Ilegal Mezcal, who believe that tastes of its consumers have changed, care more about artisanal, sustainable, green or locally produced goods, and therefore should now focus on explaining the production process, support transparency and highlight whatever uniqueness their offer has.

Since demand is still on the rise, major players like Mezcal Amarás, Mezcal Creyente, and Diageo PLC (Mezcal Unión) will be spending the necessary to build networks of distribution all over North America. This may include major distributor partnerships, alliances with bars and restaurants, and direct sales to consumers through online retail sales sites. In this competitive market, brands like Mezcal Vago and Mezcales de Leyenda will have to hold on to the distinctiveness of the brand while adapting to emerging consumer preferences.

Growth interest in sustainability and ethical sourcing will be a further driver on the future direction of North America Agave Spirits. Consumers demand to know about the origin of their goods and be able to trace the products back to their origin: nowadays, Montelobos Mezcal, Pernod Ricard (Del Maguey), and Real Minero will have to prove it. The commitment to sustainability aspects will thus be reflected either in environment-friendly manufacturing or linkage with local populations involved in agave farming.

North America Agave Spirits has much potential with the entry of major players like Mezcal Sombra, Wahaka Mezcal, and Mezcal Koch. Here companies can take their lead in leveraging innovation and sustainability by better consumer preferences for the market going forward.

North AmericaAgave Spirits Market Key Segments:

By Type

- Mezcal

- Sotol

- Bacanora

- Raicilla

- Others

By Price Point

- Economy >$35

- Standard $35-50

- Premium $50-$75

- Super Premium $75 - $100

- Ultra Premium $+100

By Distribution Channel

- Ready-to-Drink

- Ready-to-Pour

Key North America Agave Spirits Industry Players

- Casa Cortés

- Banhez Mezcal

- Bozal Mezcal

- Bruxo Mezcal

- Mezcal Derrumbes

- El Silencio Holdings Inc.

- Ilegal Mezcal

- Mezcal Amarás

- Mezcal Creyente

- Diageo PLC (Mezcal Unión)

- Mezcal Vago

- Mezcales de Leyenda

- Montelobos Mezcal

- Pernod Ricard (Del Maguey)

- Real Minero

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252