Global Natural Health Products Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global natural health products market has expanded from a niche area of herbal remedies to a well-acknowledged industry that connects traditional wellness with modern science. The seed of this movement can be planted in the 1970s when the customers in the USA and some parts of Europe started to doubt the long-term effects of synthetic drugs and preservatives. At that time, the early health shops were supplying herbal teas, vitamins, and plant-derived supplements, with the major portion of the supply being from local farms or small producers. The market during that time was mostly unregulated and was built on trust as well as word-of-mouth reputation.

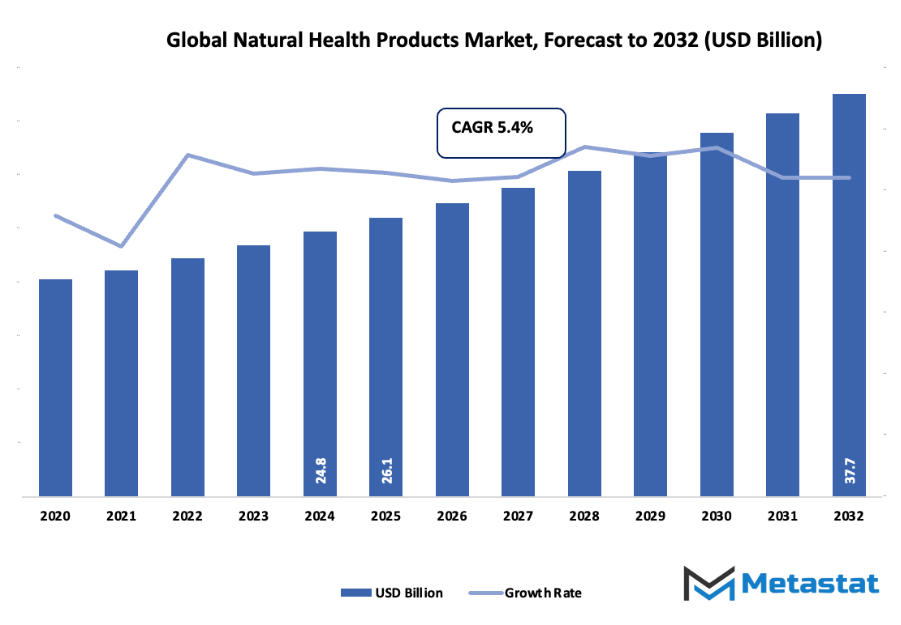

- Global natural health products market valued at approximately USD 26.1 million in 2025, growing at a CAGR of around 5.4% through 2032, with potential to exceed USD 37.7 million.

- Vitamins & Minerals account for nearly 29.2% market share, driving innovation and expanding applications through intense research.

- Key trends driving growth: Growing consumer preference for preventive healthcare and wellness, Rising awareness about the benefits of herbal and organic supplements

- Opportunities include: Expansion of personalized and targeted natural health formulations

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

By the end of the 1990s, the concept of preventive healthcare was getting so much recognition that it even started to change people's shopping habits. Treating illnesses was not the only reason for people's purchases; they were also looking to keep their bodies and minds healthy and full of life. The perception of natural health products changed completely and the market, which had been growing silently, got international attention with pharmaceutical and food firms courting the natural products industry. The implementation of quality tests and standardized labeling made the consumer to feel more confident about the products he/she is dealing with. Gradually, the internet came into the picture and it took the shadows off the natural therapies by being the cheater who exposed and enlightened the audience that needed such qualities as authenticity and transparency.

In the new millennium, major countries in Asia-Pacific, North America, and Europe started regulating the free-for-all market in dietary supplements and herbal formulations as the first step. The certification systems like organic labeling, Good Manufacturing Practices (GMP), and safety testing became mandatory requirements to gain a foothold in the market. The situation was both a challenge and an opportunity because the companies had to spend on research and compliance and at the same time, they had to win the trust of the consumers. On the other hand, traditional medicine systems from India and China began to be of interest worldwide again, and their influence was seen in the formulations and the choice of the ingredients.

The global natural health products market is very modern now; it is about the combination of technology and nature. Digital health solutions, individual diet services, and eco-friendly materials are some of the factors that will continue to propel this market. The consumers' inclination for tracing of the products' origins, mindful and planet-friendly packaging will lead to production being considered ethical as a matter of course.

Market Segments

The global natural health products market is mainly classified based on Product Type, Distribution Channel, End User.

By Product Type is further segmented into:

- Vitamins & Minerals: The demand for vitamins and minerals is on the rise as consumers are becoming more conscious about their daily nutritional intake. These supplements are taken to support the whole-body functions, enhance immunity, and shut down the risk of deficiencies occurring due to inadequate diets. The easy access and a large variety of products are making them one of the major contributors to the global market for Natural Health Products.

- Herbal Remedies: The Herbal remedies are becoming more and more popular due to their natural composition and fewer side effects when compared to synthetic medicines. They are made from plants and herbs and can be employed to cure all sorts of illnesses and even to enhance the body's immunity and general well-being. The increasing consumer interest in traditional treatment methods is one factor that keeps them at the forefront of the global natural health products market.

- Homeopathic Medicines: The homeopathic medicines continue to take a steady place in the market as more people believe in the power of natural healing and less chemical usage. Such treatment focuses on curing the underlying cause of the problem rather than masking the symptoms. The growing number of consumers looking for gentle and holistic treatment methods is one of the key factors contributing to the market.

- Traditional Medicines: The traditional medicines which are based on cultural and ancient practices continue to attract users who are looking for natural healing approaches. They are responsible for maintaining the body's balance and improving its functions through plant-based formulations. The cultural health tradition is one of the driving factors behind the worldwide expansion of the Natural Health Products market as it creates trust among the consumers.

- Probiotics: Probiotics have become one of the most popular ways to maintain digestive health and enhance the body's natural defenses. These tiny living organisms that provide health benefits are incorporated in several dietary supplements and food items helping the intestines to be healthy and the body to absorb more nutrients. The growing understanding of the function of the gut microbiota in human health has been a factor that has led to an increase in demand in the market.

- Other: This category consists of products like essential oils, amino acids, and other natural supplements that have different health benefits. They are the products that provide solutions for stress reduction, sleep enhancement, and skin care. The growing number of products and the consumers' desire to try new natural alternatives are the key factors to the rise in this segment's share in the global natural health products market.

By Distribution Channel the market is divided into:

- Pharmacies & Drug Stores: Pharmacies and drug stores are key players in product distribution and therefore, the health products purchasing consumers trust. They attract consumers with their professionalism and quality assurance provided at their clinics. This channel is still a very important one for the global natural health products market as it continues to distribute products widely.

- Supermarkets & Hypermarkets: Supermarkets and hypermarkets are the retail type where consumers mainly go to buy the whole range of natural health products with the least possible time spent. Their competitive pricing strategies and promotional activities are the key drivers of their customer attraction. The products’ easy access and high visibility are pointing towards the market expansion through such a channel.

- Online Stores: Online stores are the most preferred place nowadays for purchasing health products mainly because of convenience and wide product range. Digital access enables to do side by side checking of brands, prices, and reviews. The increase in e-commerce alongside better delivery services is facilitating the movement of sales across the market through this channel.

- Health & Wellness Stores: Health and wellness stores are the ones that sell natural and organic products only and their main target is the consumers with specific dietary and lifestyle requirements. They enhance consumer trust by providing personal service and expert advice. The continuing expansion of such stores is a major factor contributing to the overall market growth in the market.

- Direct Sales: Direct sales involve personal interaction between sellers and consumers, creating trust and personalized product recommendations. This approach encourages customer loyalty and repeat purchases. The direct selling model continues to strengthen its role in expanding reach within the global natural health products market.

By End User the market is further divided into:

- Children: The market for children's natural health products is expanding thanks to people's increasing awareness of safe and mild dietary supplements. The products aim mainly at supporting immunity, promoting bone health, and aiding growth. Parents favour natural products that contain the least amount of additives, which in turn generates demand from this age group in the global natural health products market.

- Adults: The adult group is the largest segment of the market due to their hectic lifestyle and health concerns. There is a high demand for products that cater to energy, immunity, and stress management. The increasing focus on preventive health and fitness is one of the main factors that promote adult consumption in the market.

- Elderly: The elderly are dependent on natural health products to keep their vitality and to cope with age-related health problems. There is a large market for products assisting joint health, digestive health, and immunity. The worldwide demographic trend of an increasing older population guarantees that this segment will always be an important player in the global natural health products market.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$26.1 Million |

|

Market Size by 2032 |

$37.7 Million |

|

Growth Rate from 2025 to 2032 |

5.4% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

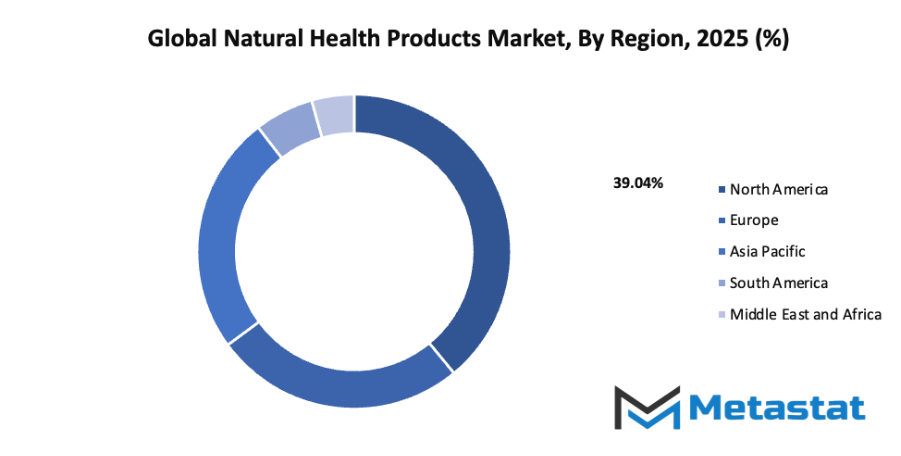

By Region:

- Based on geography, the global natural health products market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Growing consumer preference for preventive healthcare and wellness: The global natural health products market is benefiting from the shift toward preventive healthcare. Many consumers are now investing in supplements and natural remedies to avoid illnesses rather than treating them after they occur. This preference for wellness-focused products is helping natural health brands gain trust and long-term customer loyalty.

- Rising awareness about the benefits of herbal and organic supplements: The market is supported by rising awareness of the advantages of herbal and organic supplements. Educational campaigns, digital health platforms, and social media have increased understanding of natural ingredients. Consumers now associate such products with better safety, fewer side effects, and long-term health improvement.

Challenges and Opportunities

- Strict regulatory requirements and compliance challenges: The global natural health products market is affected by complex regulatory requirements. Manufacturers must follow strict rules to prove product safety and authenticity. Different countries have varying standards, which can delay product launches and increase costs. Meeting these compliance needs remains a significant hurdle for producers and exporters.

- Limited scientific evidence for efficacy of certain natural products: The market struggles with limited scientific proof for some natural remedies. Lack of consistent clinical studies creates uncertainty among consumers and health professionals. Strengthening scientific research and testing can help validate product effectiveness and build stronger confidence in natural health brands.

Opportunities

- Expansion of personalized and targeted natural health formulations: The global natural health products market is witnessing growth through personalized formulations. Consumers now prefer products designed to match individual health needs and lifestyle patterns. Advances in data analysis and biotechnology will support the creation of tailored natural supplements, leading to better results and stronger customer satisfaction.

Competitive Landscape & Strategic Insights

The global natural health products market continues to grow as more people seek natural ways to improve their well-being and maintain a healthy lifestyle. This increasing awareness about the benefits of herbal and organic supplements has encouraged many consumers to shift from synthetic alternatives to products made from natural ingredients. The growing focus on preventive healthcare has also played a major role in shaping the direction of this market, as individuals are more conscious of the long-term effects of their dietary and lifestyle choices. Governments and healthcare organizations across several countries are supporting natural product use, promoting it as a safer and more sustainable option.

The industry is a mix of both international industry leaders and emerging regional competitors. Important competitors include Amway, Herbalife Nutrition Ltd., Nature’s Bounty Co., GNC Holdings Inc., NOW Foods, Church & Dwight Co., Inc., Standard Process Inc., Nutraceutical Corporation, Gaia Herbs, Nature’s Way Products, LLC, The Himalaya Drug Company, Blackmores Limited, Natural Factors Nutritional Products Ltd., Solgar Inc., Garden of Life, New Chapter, Inc., Thorne Research, Inc., and Integria Healthcare in global natural health products market. Each of these companies continues to play a key role in shaping product innovation, distribution networks, and marketing strategies that influence consumer preferences.

Growing consumer demand for plant-based and organic options has encouraged companies to invest in research and development. This has led to new formulations that meet specific health needs such as digestive health, immune support, stress management, and energy enhancement. The focus on transparency has also become more significant, with brands emphasizing clean labeling, sustainable sourcing, and environmentally friendly packaging. These practices not only strengthen customer trust but also position brands as responsible players in a market that values ethical and sustainable choices.

E-commerce platforms have made these products more accessible to global customers, helping smaller regional producers compete with established brands. Online channels allow direct consumer engagement and feedback, helping manufacturers understand market needs better. This digital transformation has reduced barriers for new entrants and encouraged healthy competition among major and local brands. As a result, the overall quality and diversity of available natural health products have improved significantly.

Despite strong growth, the market still faces challenges related to product authenticity, regulatory standards, and consumer education. Different countries have varying regulations for natural supplements, which can create inconsistencies in product quality. To address these issues, leading manufacturers are adopting higher safety standards and more transparent communication about ingredient sources and benefits. Educating consumers about proper usage and expected results is also

Market size is forecast to rise from USD 26.1 million in 2025 to over USD 37.7 million by 2032. Natural Health Products will maintain dominance but face growing competition from emerging formats.

crucial for building long-term trust and ensuring satisfaction.

Looking ahead, steady market growth is expected as health awareness continues to rise worldwide. Increased investment in research, marketing, and sustainability efforts will further strengthen consumer confidence. Collaboration between manufacturers, healthcare professionals, and regulatory bodies will also help improve product safety and accessibility. With continued innovation and a focus on consumer well-being, the market is set to remain one of the most dynamic and trusted sectors within the broader wellness economy.

Report Coverage

This research report categorizes the global natural health products market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global natural health products market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global natural health products market.

Natural Health Products Market Key Segments:

By Product Type

- Vitamins & Minerals

- Herbal Remedies

- Homeopathic Medicines

- Traditional Medicines

- Probiotics

- Other

By Distribution Channel

- Pharmacies & Drug Stores

- Supermarkets & Hypermarkets

- Online Stores

- Health & Wellness Stores

- Direct Sales

By End User

- Children

- Adults

- Elderly

Key Global Natural Health Products Industry Players

- Amway

- Herbalife Nutrition Ltd.

- Nature’s Bounty Co.

- GNC Holdings Inc.

- NOW Foods

- Church & Dwight Co., Inc.

- Standard Process Inc.

- Nutraceutical Corporation

- Gaia Herbs

- Nature’s Way Products, LLC

- The Himalaya Drug Company

- Blackmores Limited

- Natural Factors Nutritional Products Ltd.

- Solgar Inc.

- Garden of Life

- New Chapter, Inc.

- Thorne Research, Inc.

- Integria Healthcare

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252