MARKET OVERVIEW

The Global Microwave Devices market is going to shape up to play a more crucial role in the future of different industries, which will be steered by its growing applications in the sectors: telecommunications, defense, health care, and consumer electronics. With the continuous growth of technology, microwave devices will become an integral part of innovations in communications, medical treatments, and everyday consumer products. The need for even more efficient and high-performance devices will give an impetus to the further evolution of this market.

Microwave devices will benefit further applications in the telecommunications sector, which in turn will lead to further development of 5G networks and beyond. These devices provide for high-frequency communication that supports fast data transmission rates. As the world moves into the next generation of wireless technology, it will be up to the Global Microwave Devices market to make sure these systems work effectively, powering everything from smart cities to autonomous vehicles. These devices will play a crucial role in allowing infrastructure for these developments and will therefore be crucial to the future of connectivity.

The demand for microwave devices will increase in the defense industry as countries invest in the latest technologies in communication, radar, and electronic warfare. Microwave devices are already used widely in defense applications, and their importance is only going to increase with changing security concerns and military needs. The future will behold microwave technology advanced toward next-generation radar and real-time data communication in military actions. The fast-changing nature of the geopolitically unstable world necessitates more security, speed, and reliability from communication systems that will further improve microwave devices into the very nucleus of strategic defense technologies.

Medical diagnostics and treatment will see growing applications for microwave devices. Microwave imaging and ablation are just the latest revolutionary medical technologies being advanced that could make the practice of doctors much faster with results provided and without unnecessary, more cumbersome procedures. Thus, the advancement in microwave device applications is central to future practice because of growing trends toward precision medicine in this sector and greater success for many treatment processes. Continuous innovations from these technologies should lead to making new devices less in size and more powerful. They should therefore be easily handled by both the patients and even the healthcare service providers.

In the consumer electronics field, microwave influence will still be felt, especially on the evolvement of home appliances and entertainment systems. Microwave ovens begin with the first instances and work up to sensors in intelligent homes through radar-based sensors in microwave devices, which will drive innovations that make life easier and more efficient for the consumer. With growing interest in smart homes and automation, microwave devices will be part of the integration of technology into daily life, making it easier and more intuitive for users and their systems to become more connected. These innovations will help the consumer electronics market, as companies try to include the latest microwave technologies in their products.

The Global Microwave Devices market will continue to evolve with continuous developments in material science, miniaturization, and processing power. Industries adapting to new challenges and technological demands will find the microwave device increasingly at the center of future technologies' development. Steady growth is expected in this market as more applications are realized and microwave devices are integrated into existing systems that open up previously unimaginable possibilities.

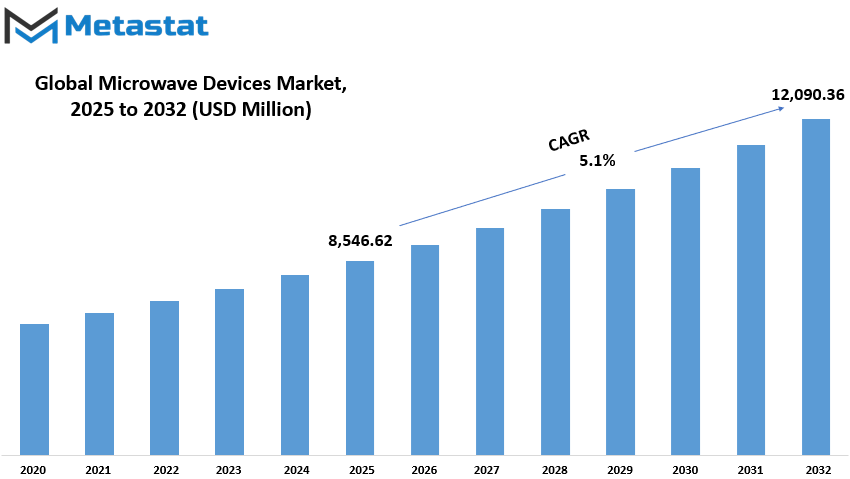

Global Microwave Devices market is estimated to reach $12,090.36 Million by 2032; growing at a CAGR of 5.1% from 2025 to 2032.

GROWTH FACTORS

The main growth drivers for the global microwave devices market are increasing demand for high-speed wireless communications and increasing usage of microwave devices in the medical and healthcare industries. In other words, these are the two major growth factors that are propelling the expansion of the market forward. More and more connection of the world leads to a rise in the requirement for faster and more efficient communication networks. Microwave devices are important in the development of new high-speed data transfer capabilities that would form the foundation for future communication systems.

Microwave devices are finding applications in the medical and healthcare sector in a lot of ways. They are becoming more common in diagnostic and therapeutic technologies, such as imaging systems, cancer treatment, and other medical procedures. This development is responsible for the growth in the market since healthcare providers continue to seek better technologies that enhance patient care and treatment results. The microwave devices' capability of providing non-invasive solutions for medical procedures has especially made them more valuable in the healthcare industry.

Despite these positive growth factors, several challenges may hinder the market’s progress. High development and manufacturing costs are a significant concern. Designing and producing advanced microwave devices requires substantial investment in research and technology, making it expensive for many companies to bring new products to market. Additionally, regulatory challenges and issues with spectrum allocation may further slow the growth of the market. Additional complexity can arise for designers and developers due to strict regulations concerning microwave technology and the scarce availability of spectrum for communication applications.

However, the future of the microwave devices market is promising with advances in 5G and the Internet of Things. It is likely that these emerging technologies will offer significant opportunities to the market in the coming years. With the increased adoption of 5G, demand for devices with high microwave frequency will soar since they offer a higher degree of speed, data volume support, and even higher speeds. It will also fuel demand for the growth of the Internet of Things devices, whose dependency on rapid communication systems contributes to the higher demand for microwave devices.

The Global microwave devices market to grow in coming years as a result of high demand for communication systems that can transmit data at faster speeds and due to increasing health care application of microwave devices. Although, it faces high price and regulatory hurdles that can dampen the growth prospects. Opportunities in future for the companies with 5G and IoT emerging technologies.

MARKET SEGMENTATION

By Device Type

The Global Microwave Devices market is quite dynamic and can be broadly divided into two primary categories, which are Passive Microwave Devices and Active Microwave Devices. This categorization signifies the differences between the applications where these devices find their utility. These applications vary from telecommunication to satellite communication and even to radar systems. Each segment, however, possesses certain characteristics that identify its role in the overall market.

This is expected to grow to $3,688.84 million by the end. This will translate to a big share of the market, because without passive devices, microwave systems are not properly complete. The power and frequency controls of the microwave signals without amplification or signal generation rely heavily on the usage of passive devices. These are mostly filters, couplers, and attenuators that do not depend on any form of power from an external source to work.

They find applications in several industries where signals need to be manipulated without bringing in additional energy into the system. The increasing demand for high-performance communication networks and the developments in wireless technology are driving the growth of this market.

On the other hand, Active Microwave Devices, unlike passive ones, function due to an external power source. These amplify or produce microwave signals with devices including amplifiers, oscillators, and mixers. They are vital for maintaining signal strength and quality in a wide range of applications. The increasing advancement of technology is also expected to raise the demand for active microwave devices, especially since they are necessary for high-speed communication, radar systems, and even medical equipment. Their role in improving microwave systems makes them indispensable in today's technological revolution.

Passive and Active Microwave Devices are complementary within the microwave devices market. Whereas passive devices relate to signal controlling and directing functions, active devices are concerned with signal generation and amplification functions. The combination of these two types of devices is critical to the development of efficient and reliable microwave systems that can meet the growing demands of industries around the world.

As the market continues to expand, both segments are expected to play a significant role in driving innovation and improving the performance of microwave technologies. The ongoing evolution of communication networks and the development of new technologies will probably sustain the demand for these essential devices.

By Frequency

A more detailed classification includes the bands categorizing the frequency of microwave devices, which finds application in multiple specific areas- L Band, X Band, S Band, C Band, Ku Band, Ka Band among others. With the frequency operation of microwave device, it establishes its suitability level for different businesses and applications that require such utilities. Each distinct band has qualities that make certain tasks more perfect. The knowledge of these bands and their usage will provide worthwhile insight into the microwave devices market.

The L Band has lower frequency range values, often found in communication and radar applications. As its frequency range is low, it can even pass through most obstacles like the weather. Such a band is often used in aviation and for satellite communications.

The X band provides higher frequencies, which is useful for providing a more precise function - and is often used in applications such as military radar systems and satellite communications. This band can be used in weather radar systems and most of the military technologies because it offers accurate high-resolution data that these systems require.

Another very significant frequency band of weather radar and satellite communication usage is the S Band. Higher than the L Band, S Band can see higher resolutions thus making it so much applicable when it comes to storm tracking, meteorological observation of storms and phenomena, and monitoring. In this regard, there are extensive deployments of the air traffic control system.

The C Band is the most commonly used in communication satellites. It has a balance between the range and resolution of data. Its ability to carry large amounts of data with minimal interference makes it highly desirable for telecommunications, television broadcasting, and wireless communications.

The Ku Band is used in direct-to-home satellite communications. Due to its higher frequency, the Ku Band is capable of carrying more data at a faster speed, which has become a modern requirement for broadband internet and high-definition television, among others.

The Ka Band offers even higher frequencies that can support higher data transfer rates. This is applicable in high-speed data transmission applications, including high-definition satellite television, broadband internet, and military communication systems.

Lastly, the "others" category contains some less commonly used but equally significant frequency bands, tailored to special applications. Often these are used for emerging needs in specialized areas such as scientific research and industrial operations.

The global microwave devices market is divided by frequency into distinct bands, each with its unique applications. From the long-range communication capabilities of the L Band to the high-speed data transmission enabled by the Ka Band, these frequency bands play an essential role in various industries. Understanding the differences between them is key to selecting the right microwave devices for specific needs.

By End-User

The Global Microwave Devices market is important in the world due to its applications, and the variety it caters to, supports multiple industries. It can be broadly segmented into four major categories, that are: Space & Communication, Military & Defense, Healthcare, and Other sectors. All of these end-user groups have their role in pushing up the demand for microwave devices and shaping the market's growth and development.

In the Space & Communication sector, microwave devices are essential for satellite communications, radar systems, and broadcasting. The need for reliable and efficient communication technologies in space exploration and satellite operations ensures a continuous demand for microwave devices. As the demand for global connectivity increases, the need for high-performance microwave equipment in space-related applications will likely grow.

Military & Defense is another key sector driving the microwave devices market. All military organizations across the world are dependent on the microwave technology for radar, surveillance systems, secure networks for communication, and electronic warfare. The microwave devices aid in the provision of critical information and ensure national security. Greater global security issues and defense technology upgrades will help increase the microwave devices market demand in this area.

In Healthcare, the microwave devices find application in diverse areas such as medical imaging, treatment, and diagnostics. Microwave ablation systems applied in cancer treatments and diagnostic appliances that do not require invasive medical procedures have started to gain grounds in the health sector. Advanced healthcare technologies, therefore, lead to an ever-increasing requirement for specialized microwave equipment to supplement these innovations.

The "Others" category includes many industries that apply microwave devices also. These sectors include automotive, consumer electronics, and industrial applications, among others. Each of the industries applies microwave technology for distinct purposes, for example, for sensor systems and heating applications and more. This will open the door to newer opportunities for microwave devices as technologies advance.

It means the Global Microwave Devices market will be influenced by various end-user sectors' demands and needs. Continued growth in the areas of Space & Communication, Military & Defense, Healthcare, and others will lead to a growth curve in the microwave technology that is developed and used. Each one of these areas is in its growth, and so does the microwave devices market with respect to new technology advancement and usage.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$8,546.62 million |

|

Market Size by 2032 |

$12,090.36 Million |

|

Growth Rate from 2024 to 2031 |

5.1% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

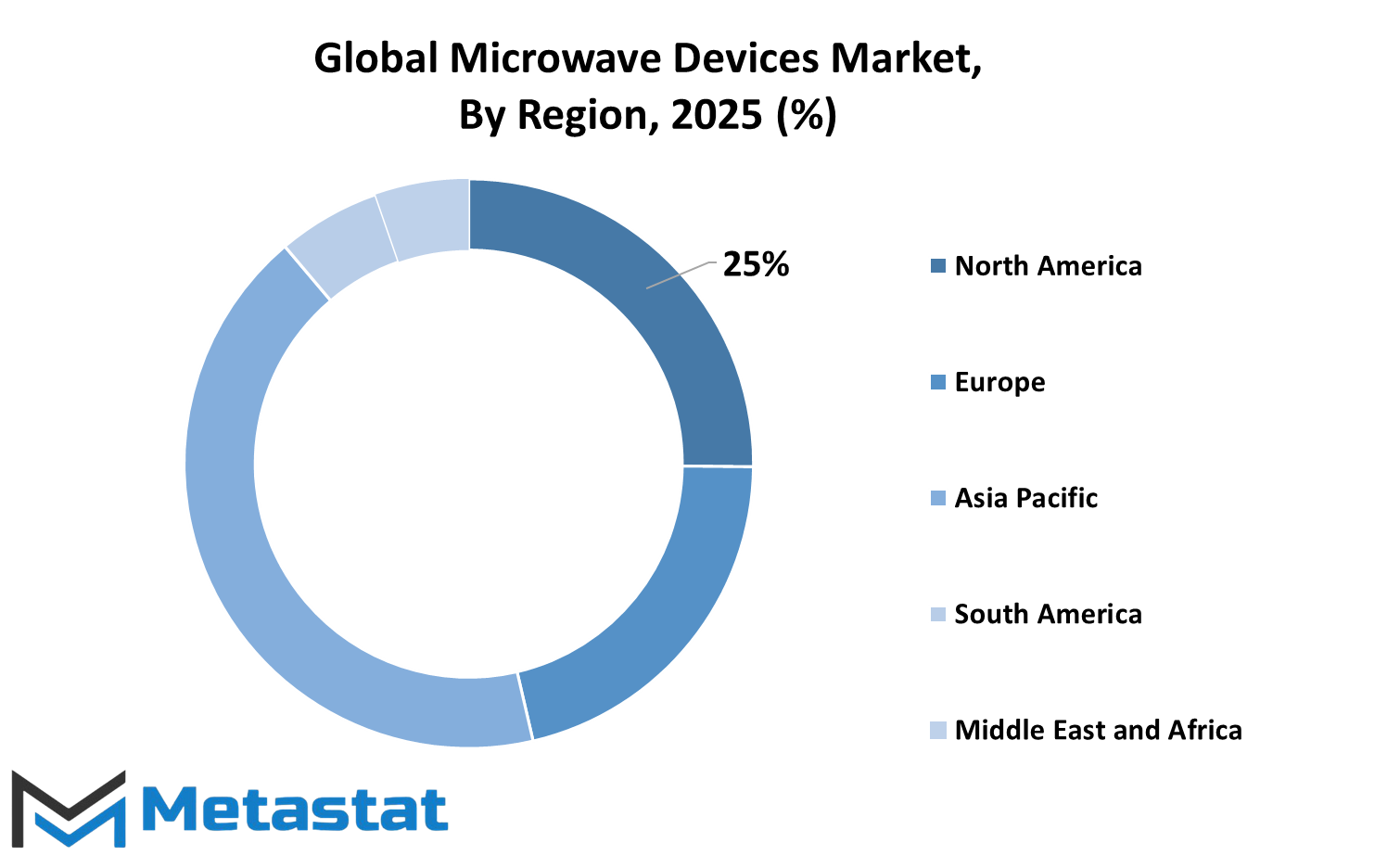

REGIONAL ANALYSIS

The global Microwave Devices market is divided by geography into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Further, each region is sub-divided into further subregions for more detailed segmentation of the market.

The market in North America has further segmentation into the U.S., Canada, and Mexico. The U.S. holds a significant market share with prosperous demand across industries driven by technological advancements. Although the share of both Canada and Mexico is relatively small, these countries are observing growth in the adoption of microwave devices, primarily in communication systems and industrial applications.

Europe is another major marketplace for microwave devices. This incorporates major countries that include the United Kingdom, Germany, France, Italy, among others that would be categorized as a part of Rest of Europe. The UK, along with Germany, will majorly fuel high growth in the region. Telcom infrastructure progress and defense will drive this activity. The microwave devices market also encompasses France and Italy. Increasing demand for microwave devices is observed in the industrial and consumer electronics sectors. The rest of Europe refers to other unspecified countries involved in the development of the market.

Asia-Pacific is one of the biggest and fastest-growing regions in the microwave devices market, including India, China, Japan, South Korea, and the rest of Asia-Pacific. China is one of the major market contributors due to its large manufacturing sector and requirement for microwave devices in the telecom and defense sectors. Japan and South Korea also are important markets, with increased electronics and automobile industries. It grows further with microwave demand in the rest of Asia Pacific, consisting of emerging markets of Southeast Asia that are catching onto microwave technology as their infrastructures progress.

In South America, the market is Brazil, Argentina, and the Rest of South America. Brazil is the largest market in this region, with increasing demand for microwave devices in the communication, healthcare, and automotive sectors. Argentina follows closely, with growing adoption in the telecommunications sector. The Rest of South America includes countries such as Chile and Colombia, which are also experiencing an increase in demand for microwave devices.

Middle East & Africa can be divided into the GCC countries, Egypt, South Africa, and the Rest of the Middle East & Africa. The market is dominated by large investments by Saudi Arabia and UAE in infrastructural and defense expenditure. Other contributors like Egypt and South Africa also reveal growth momentum mainly due to upsurge demand of technology for both communication and industrial applications. The Rest of the Middle East & Africa comprises countries with emerging markets where microwave technology is gaining momentum.

COMPETITIVE PLAYERS

The increasing demand in high-performance technology applications in fields such as the telecommunication and defense industries is what fuels microwave devices. Industry players are some of the major well-entrenched corporations that have shown considerable innovation on microwave components from design to their manufacture. Of these companies is Analog Devices, Inc., L3Harris Technologies, Inc., Cobham PLC, and Qorvo, Inc. among others that drive innovations in and within this industry.

Analog Devices, Inc. is an analog, mixed-signal, and digital signal processing leader that has a significant role in the development of microwave devices that are critical to wireless communication and radar systems. L3Harris Technologies, Inc. is a leader in advanced technologies for aerospace, defense, and commercial applications, providing microwave solutions that support mission-critical operations. Cobham PLC, known for its focus on aerospace and defense sectors, is another prominent player that contributes to the development of microwave technologies, particularly in satellite communications and radar systems.

Qorvo, Inc. is a significant force in the market, particularly in the design and manufacturing of semiconductor solutions, including those used in microwave devices for mobile and broadband communications. Teledyne Technologies Incorporated is another leading manufacturer of high-performance electronic devices. These products include microwave components for use in applications ranging from instrumentation and defense electronics. Innovation of microwave devices for telecommunication, military, and space exploration also comes from MACOM Technology Solutions Holdings, Inc. and Microsemi Corporation.

Other key vendors in the microwave devices market include Keysight Technologies and Anritsu Corporation. These firms develop advanced test and measurement solutions for microwave technologies, which are the backbone for microwave device development and testing, to ensure that these devices perform within performance and reliability specifications. Other companies further contributing to microwave solutions include Thales Group, Richardson Electronics, Ltd, and Radiall SA, in fields such as communications and defense applications.

Toshiba Corporation and Cytec Corporation are also a big part of the market, producing quality microwave components for various industries. Texas Instruments Incorporated and Skyworks Solutions, Inc. have also been the pioneers in the field of semiconductor innovations, whose products are in use in various wireless communication and radar systems. Finally, Communications & Power Industries LLC (CPI) offers microwave and RF solutions for the telecom, military, and commercial fields, thereby forming the last on the list of significant players in this dynamic and highly competitive market. These firms shape the microwave devices market as the technology keeps changing and responds to the variety of needs modern industries have.

Microwave Devices Market Key Segments:

By Device Type

- Passive Microwave Devices

- Active Microwave Devices

By Frequency

- L Band

- X Band

- S Band

- C Band

- Ku Band

- Ka Band

- Others

By End-User

- Space & Communication

- Military & Defense

- Healthcare

- Others

Key Global Microwave Devices Industry Players

- Analog Devices, Inc.

- L3Harris Technologies, Inc.

- Cobham PLC

- Qorvo, Inc.

- Teledyne Technologies Incorporated

- MACOM Technology Solutions Holdings, Inc.

- Microsemi Corporation

- Keysight Technologies

- Anritsu Corporation

- Thales Group

- Richardson Electronics, Ltd

- Radiall SA

- Toshiba Corporation

- Cytec Corporation

- Texas Instruments Incorporated

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383