MARKET OVERVIEW

The Mexico Factory Automation and Industrial Control Systems (ICS) market, a dynamic sector at the intersection of technology and industry, embodies a transformative force reshaping the manufacturing landscape in the region. This thriving market, characterized by its continual evolution, serves as a catalyst for enhanced operational efficiency and advanced control mechanisms within manufacturing facilities across Mexico.

The Mexico Factory Automation and ICS market lies an industry that has seamlessly integrated cutting-edge technologies into the manufacturing processes. Leveraging automation solutions, these systems orchestrate a symphony of precision and reliability, steering the manufacturing sector towards unprecedented levels of productivity. Robotics, programmable logic controllers, and smart sensors stand as the cornerstones of this innovative landscape, infusing manufacturing floors with a new era of efficiency.

This industry’s significance reverberates across diverse sectors, from automotive to electronics, as manufacturers seek to optimize their production lines. The Mexico Factory Automation and ICS market are instrumental in streamlining processes, minimizing downtime, and elevating product quality. As a result, companies within the region are not merely adopting technological advancements; they are actively embracing a paradigm shift towards a future where human machine collaboration is the norm.

The intricacies of the Mexico Factory Automation and ICS market unfold in its role as an enabler of enhanced safety and control in industrial environments. These systems operate as vigilant guardians, ensuring that manufacturing processes adhere to stringent standards and regulations. The real-time monitoring capabilities of ICS contribute to risk mitigation, creating an environment where safety and precision are not compromised.

Amidst this transformative journey, Mexico’s industrial landscape witnesses the synergy between human expertise and technological prowess. Skilled professionals play a pivotal role in configuring, maintaining, and optimizing the intricate network of automation and control systems. As the demand for expertise in this domain grows, educational institutions and training programs are evolving to equip the workforce with the skills necessary to navigate the complexities of the modern manufacturing environment.

Furthermore, the Mexico Factory Automation and ICS market serve as a testament to the nation’s commitment to sustainable and environmentally conscious manufacturing practices. Through efficient resource utilization and waste reduction, these systems contribute to a greener industrial footprint, aligning with global initiatives for a more sustainable future.

The Mexico Factory Automation and ICS market are not merely about technological advancements; they embody a transformative journey shaping the very fabric of manufacturing in the region. From the integration of robotics to fostering a skilled workforce, this industry stands as a beacon of progress, propelling Mexico’s manufacturing sector into a future defined by efficiency, precision, and sustainability.

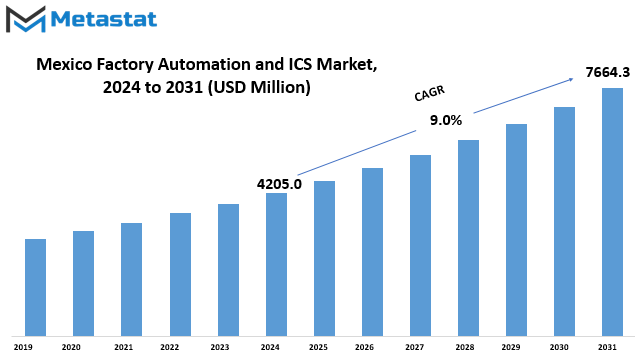

Mexico Factory Automation and ICS market is estimated to reach $7664.3 Million by 2031; growing at a CAGR of 9.0% from 2024 to 2031.

GROWTH FACTORS

The Mexico Factory Automation and Industrial Control System (ICS) market are experiencing notable growth, driven by several key factors. These factors play a crucial role in shaping the market landscape and influencing its trajectory. On the flip side, certain challenges pose potential obstacles to this growth. Additionally, specific opportunities emerge on the horizon, promising lucrative prospects for the market in the years to come.

The market's expansion is the growth factors that propel its upward trajectory. One such pivotal factor is the increasing demand for automation in manufacturing processes. As industries strive for efficiency and productivity enhancements, the adoption of factory automation and ICS becomes imperative. This rising demand is further fueled by the pursuit of cost-effectiveness and improved operational efficiency.

Moreover, the integration of advanced technologies serves as a catalyst for market growth. The incorporation of innovative solutions, such as Internet of Things (IoT) and Artificial Intelligence (AI), enhances the capabilities of factory automation and ICS. These technological advancements not only streamline operations but also open new possibilities for businesses in terms of real-time monitoring, predictive maintenance, and data-driven decision-making.

On the downside, challenges lurk that could potentially hamper the market's growth trajectory. One such concern is the issue of cybersecurity. As factory automation and ICS systems become more interconnected and digitized, the vulnerability to cyber threats increases. The need for robust cybersecurity measures becomes paramount to safeguard critical infrastructure and sensitive data. Failure to address this challenge adequately could undermine the trust in these systems, hindering their widespread adoption.

Additionally, economic uncertainties and fluctuations pose another potential obstacle. The market's growth is intricately tied to economic stability and investment confidence. Factors such as fluctuating currency values, trade tensions, and global economic downturns can impact the pace of adoption of factory automation and ICS technologies. Navigating these uncertainties requires a nuanced approach and strategic planning from market players.

Amidst these challenges, there exist promising opportunities that can drive the Mexico Factory Automation and ICS market forward. One such avenue is the increasing emphasis on sustainability and environmental consciousness. As businesses align with eco-friendly practices, there is a growing demand for automation solutions that contribute to resource optimization and reduced environmental impact. Market players can capitalize on this trend by developing and offering solutions that align with the sustainability goals of industries.

Furthermore, the ongoing trend of digital transformation in various sectors presents a ripe opportunity for the market. Industries across Mexico are embracing digitalization to stay competitive and relevant. This paradigm shift opens avenues for the integration of factory automation and ICS solutions, positioning them as integral components of the broader digital transformation journey.

The Mexico Factory Automation and ICS market's growth are fueled by the increasing demand for automation, technological advancements, and opportunities arising from sustainability and digital transformation trends. While cybersecurity and economic uncertainties present challenges, strategic measures can mitigate these risks. Overall, the market is poised for significant development, with the potential to reshape the industrial landscape in Mexico in the years ahead.

MARKET SEGMENTATION

By Product

The Mexico Factory Automation and Industrial Control Systems (ICS) market present a diverse landscape with various components contributing to its overall functionality. When we break down this market, it is helpful to focus on its different products, specifically Field Devices and Industrial Control Systems.

Field Devices play a crucial role in the Mexico Factory Automation landscape. These devices are the on-the-ground components responsible for collecting and transmitting data. They serve as the eyes and ears of the system, capturing information from the physical environment. Examples of Field Devices include sensors, actuators, and other monitoring instruments. These components are integral for ensuring that the system receives real-time data to inform decision-making processes.

On the other hand, Industrial Control Systems (ICS) form another essential aspect of the market. ICS refers to the integrated technologies used to control and automate industrial processes. This includes various systems such as Distributed Control Systems (DCS) and Programmable Logic Controllers (PLC). These systems play a pivotal role in managing and optimizing industrial operations, providing a centralized control mechanism.

Examining the market by product segmentation sheds light on the distinctive functions and contributions of Field Devices and ICS. Field Devices primarily focus on data collection and transmission, while ICS takes charge of the overall control and automation processes within industrial settings. Both these components work in tandem to enhance efficiency, productivity, and ecision-making within manufacturing environments.

In addition to product segmentation, it is crucial to understand the broader implications of the Mexico Factory Automation and ICS market. The integration of advanced technologies in industrial settings brings forth significant benefits. Enhanced efficiency, reduced manual intervention, and improved precision are among the advantages gained through the adoption of automation and ICS solutions.

Moreover, the increasing demand for smart manufacturing solutions further amplifies the importance of the Mexico Factory Automation and ICS market. Businesses are recognizing the need to embrace digital transformation to stay competitive in today's dynamic market. Automation not only streamlines processes but also opens avenues for innovation, paving the way for a more resilient and adaptable industrial landscape.

The growth of this market is also propelled by the rising emphasis on sustainability. With the global focus on environmental conservation, industries are leveraging automation and ICS to optimize resource utilization and minimize waste. This aligns with the broader societal goals of achieving a more sustainable and eco-friendly approach to industrial practices.

The Mexico Factory Automation and ICS market, segmented by products into Field Devices and Industrial Control Systems, plays a pivotal role in shaping the country's industrial landscape. The synergy between these components contributes to increased efficiency, improved decision-making, and a drive towards sustainable and smart manufacturing practices. As industries continue to evolve, the adoption of automation technologies is poised to remain a key driver for progress in the Mexican industrial sector.

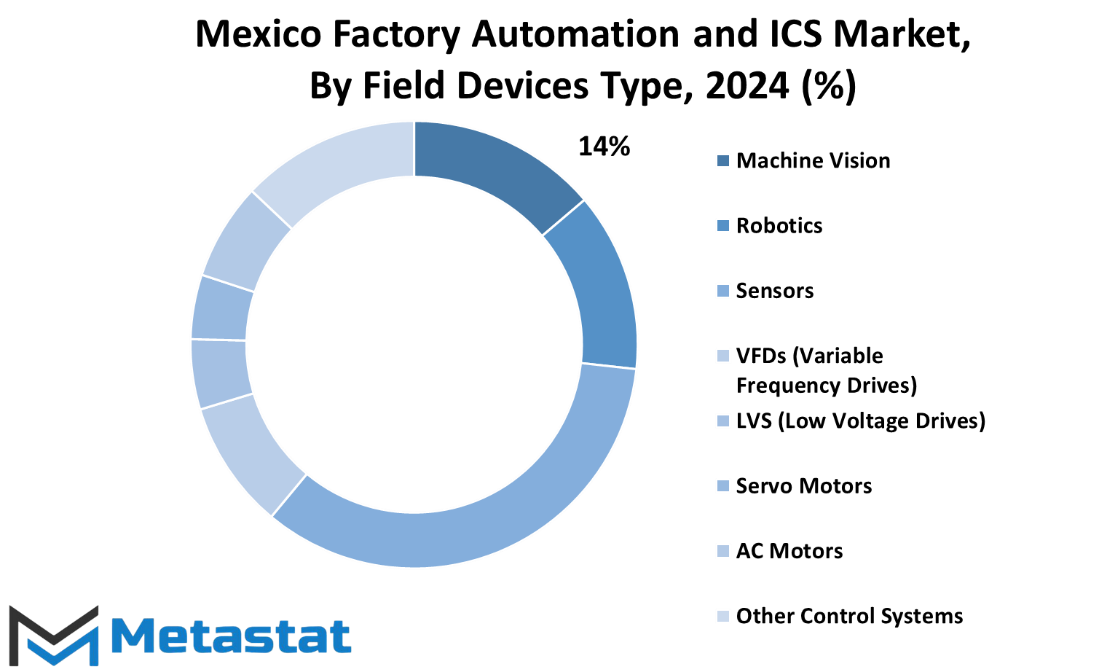

By Field Devices Type

The Mexico Factory Automation and ICS market is categorized based on various field devices. These devices play a crucial role in enhancing the efficiency and productivity of manufacturing processes. Among the field devices, the market is segmented into Machine Vision, Robotics, Sensors, Variable Frequency Drives (VFDs), Low Voltage Drives (LVS), Servo Motors, AC Motors, and Other Field Devices.

Machine Vision, a key component in the realm of automation, enables machines to interpret and respond to visual information, mimicking human vision capabilities. Robotics, another significant player, involves the use of automated machines to perform tasks traditionally carried out by humans. Sensors, an integral part of automation systems, gather data from the environment and enable machines to make informed decisions.

Variable Frequency Drives (VFDs) and Low Voltage Drives (LVS) contribute to energy efficiency by regulating the speed of electric motors, adapting to the varying demands of industrial processes. Servo Motors, known for their precision and control, find applications in tasks requiring accurate positioning and movement. AC Motors, a staple in industrial setups, convert electrical energy into mechanical motion, driving various machinery.

In addition to this, the market encompasses Other Field Devices, representing a diverse range of tools and equipment essential for factory automation. This comprehensive classification reflects the diverse technological landscape of the Mexico Factory Automation and ICS market, catering to the specific needs of different industries.

The significance of Machine Vision lies in its ability to enhance quality control and inspection processes. By imparting machines with visual acuity, manufacturers can identify defects and ensure products meet stringent quality standards. Robotics, on the other hand, revolutionizes production lines by automating repetitive and labor-intensive tasks, ultimately increasing efficiency and reducing costs.

Sensors, acting as the eyes and ears of automation systems, enable real-time data collection. This data, in turn, empowers machines to respond promptly to changes in the production environment, optimizing overall performance. VFDs and LVS, by regulating motor speed, contribute to energy savings and extend the lifespan of equipment, aligning with the growing emphasis on sustainability in industrial practices.

Servo Motors play a pivotal role in precision applications, such as robotics and CNC machining, ensuring accurate and controlled movements. AC Motors, with their versatility and reliability, power a wide range of machinery, making them indispensable in factory setups. The inclusion of Other Field Devices acknowledges the constant innovation and evolution in automation technologies, as new tools emerge to address specific industrial challenges.

The segmentation of the Mexico Factory Automation and ICS market based on field devices highlights the diverse array of technologies contributing to the advancement of manufacturing processes. From the visual acuity of Machine Vision to the precision of Servo Motors, each field device plays a unique role in shaping the landscape of industrial automation, ultimately driving efficiency, productivity, and quality in the Mexican manufacturing sector.

By ICS Type

In the Mexico’s Factory Automation and Industrial Control Systems (ICS) market, various types of ICS play a pivotal role in enhancing operational efficiency and streamlining processes within manufacturing facilities. This essay aims to shed light on the diverse categories of ICS, with a focus on Supervisory Control and Data Acquisition (SCADA), Distributed Control Systems (DCS), Programmable Logic Controllers (PLC), Manufacturing Execution System (MES), Product Lifecycle Management (PLM), Enterprise Resource Planning (ERP), Human Machine Interface (HMI), and Other Control Systems.

SCADA stands as a fundamental component within the ICS spectrum. It acts as the eyes and ears of industrial processes, providing real-time monitoring and control capabilities. Through SCADA, operators can visualize and manage various aspects of production, ensuring a seamless flow of operations. This technology contributes significantly to the overall efficiency of manufacturing units by enabling remote supervision and prompt decision-making.

Moving forward, Distributed Control Systems (DCS) form another integral segment of ICS. Unlike centralized systems, DCS distributes control functions across multiple nodes, fostering a more decentralized and responsive approach. This ensures that manufacturing processes can adapt swiftly to changes and maintain optimal performance levels. DCS thus emerges as a key player in promoting flexibility and resilience within industrial operations.

Programmable Logic Controllers (PLC) represent a cornerstone in the automation landscape. These compact and versatile devices facilitate the control of various manufacturing processes by executing programmable logic. PLCs are renowned for their reliability and versatility, making them indispensable in achieving precision and consistency in production.

Manufacturing Execution System (MES) steps into the limelight by orchestrating and optimizing manufacturing operations on the shop floor. MES integrates data from various sources, providing a comprehensive overview of production activities. This holistic approach ensures that decision-makers have access to accurate and real-time information, allowing for informed strategies to enhance overall productivity.

Product Lifecycle Management (PLM) serves as a strategic tool for managing the entire lifecycle of a product, from its inception to disposal. By integrating data and processes, PLM streamlines collaboration among different departments involved in product development, ensuring efficiency and reducing time-to-market.

Enterprise Resource Planning (ERP) acts as the backbone of organizational processes, seamlessly integrating various business functions. In the context of factory automation, ERP systems optimize resource utilization, enhance communication, and contribute to overall operational excellence. The cohesive nature of ERP fosters a unified approach to managing resources, finances, and production.

Human Machine Interface (HMI) bridges the gap between operators and machines, providing an intuitive platform for interaction. With user-friendly interfaces, HMI systems empower operators to monitor and control manufacturing processes effectively. This ensures a smooth and efficient workflow, reducing the likelihood of errors and improving overall system reliability.

Beyond these mainstays, the category of Other Control Systems encapsulates a diverse range of technologies tailored to specific industrial needs. These systems may include advanced sensors, actuators, or specialized control mechanisms designed to address unique challenges in the manufacturing landscape.

Mexico’s Factory Automation and ICS market showcase a rich tapestry of technologies that collectively contribute to the evolution of industrial processes. From SCADA and DCS to PLC, MES, PLM, ERP, HMI, and other specialized control systems, each plays a distinct role in fostering efficiency, adaptability, and precision within manufacturing environments. As industries continue to embrace these technologies, the future holds the promise of even more refined and interconnected systems, driving continuous advancements in the field of factory automation.

By End-user Industry

In Mexico, the Factory Automation and Industrial Control Systems (ICS) market plays a pivotal role in various industries, contributing to streamlined operations and increased efficiency. This market’s impact is evident across diverse sectors, including Automotive, Chemical and Petrochemical, Utility, Pharmaceutical, Food and Beverage, Oil and Gas, Electronics, Mining, Water, and other end-user industries.

The Automotive industry in Mexico has witnessed a significant transformation, with Factory Automation and ICS enhancing production processes. These technologies facilitate precision and speed, leading to improved manufacturing outputs and product quality. The seamless integration of automation in the automotive sector has become a cornerstone for achieving operational excellence.

Similarly, the Chemical and Petrochemical industry benefits from Factory Automation and ICS, optimizing complex processes and ensuring the safety of operations. Automation not only streamlines production but also minimizes human intervention in hazardous environments, contributing to a safer working environment.

In the Utility sector, the application of Factory Automation and ICS brings about operational efficiency in managing utilities such as power and water. The real-time monitoring and control capabilities provided by these systems enable utilities to respond promptly to fluctuations in demand, ensuring a reliable and uninterrupted supply of essential services.

In the Pharmaceutical industry, stringent regulations and the need for precision in manufacturing processes make Factory Automation and ICS indispensable. These technologies help maintain quality standards, reduce errors, and enhance overall productivity in pharmaceutical manufacturing.

The Food and Beverage industry benefits from Factory Automation and ICS by ensuring consistency in production processes, quality control, and adherence to hygiene standards. Automation aids in meeting the ever-growing demand for diverse food products while maintaining high standards of safety and quality.

The Oil and Gas sector relies heavily on Factory Automation and ICS to optimize exploration, extraction, and refining processes. These technologies contribute to operational efficiency, cost reduction, and enhanced safety in a sector known for its complexity and challenges.

In the Electronics industry, where precision and speed are paramount, Factory Automation and ICS play a crucial role in manufacturing electronic components. The seamless coordination of various processes ensures the production of high-quality electronics within specified timelines.

The Mining industry benefits from these technologies by improving operational efficiency, ensuring worker safety, and optimizing resource utilization. Automation in mining processes enhances productivity while minimizing environmental impact, aligning with sustainable practices.

Water management, another vital aspect, sees improvements through Factory Automation and ICS. Efficient monitoring and control of water treatment processes contribute to the sustainable use of water resources and environmental conservation.

Beyond these specific industries, Factory Automation and ICS find applications in various other end-user industries. The versatility of these technologies allows for adaptation to diverse operational requirements, making them a valuable asset across the industrial landscape in Mexico.

The Mexico Factory Automation and ICS market play a crucial role in enhancing operational efficiency and productivity across different industries. The impact of automation extends beyond specific sectors, contributing to a technologically advanced and interconnected industrial landscape in Mexico.

COMPETITIVE PLAYERS

The Mexico Factory Automation and Industrial Control Systems (ICS) market is marked by significant players such as Rockwell Automation Inc and Honeywell International Inc. These companies play a crucial role in shaping the dynamics of the Factory Automation and ICS industry in the region.

Rockwell Automation Inc stands as a prominent player in this market, contributing to the advancement of factory automation. Their involvement spans various aspects of industrial control systems, reflecting their commitment to enhancing efficiency and productivity in manufacturing processes. Through their innovative solutions, Rockwell Automation Inc has made a substantial impact on how factories operate and manage their production systems.

Similarly, Honeywell International Inc is another key player that has left an indelible mark on the Mexico Factory Automation and ICS market. The company's expertise lies in developing and implementing industrial control systems that cater to the specific needs of diverse industries. Honeywell International Inc is known for its comprehensive approach, offering solutions that address the complexities of modern manufacturing environments.

The presence of these key players underscores the significance of automation and industrial control systems in the Mexican industrial landscape. The adoption of advanced technologies by these companies reflects the broader trend of modernizing manufacturing processes. As these players continue to innovate, the ripple effect extends to the overall growth and development of the Mexico Factory Automation and ICS market.

Beyond the key players, it's crucial to understand the broader context of factory automation and industrial control systems in Mexico. These technologies are not merely buzzwords; they represent a fundamental shift in how industries operate. The integration of automation and control systems is driven by the need for enhanced efficiency, reduced downtime, and improved overall performance.

In Mexico, where industries are continually seeking ways to optimize their operations, factory automation becomes a pivotal tool. The automation of production processes allows for precision and consistency, minimizing errors and improving the overall quality of manufactured goods. This, in turn, has a direct impact on competitiveness and market positioning for companies operating in various sectors.

Industrial control systems play a complementary role in this scenario. They provide the necessary infrastructure to monitor and regulate industrial processes, ensuring seamless operations. Integrating these systems enhances efficiency and contributes to a safer working environment, reducing the risk of accidents and errors.

The Mexico Factory Automation and ICS market, driven by key players like Rockwell Automation Inc and Honeywell International Inc, is a testament to the transformative power of technology in the industrial sector. As these companies continue to innovate and refine their offerings, the ripple effect is felt across diverse industries in the region. The journey towards a more automated and controlled manufacturing landscape in Mexico is not just a trend; it's a strategic move towards a future where efficiency and precision are paramount.

Factory Automation and ICS Market Key Segments:

By Product

- Field Devices

- Industrial Control Systems (ICS)

By Field Devices Type

- Machine Vision

- Robotics

- Sensors

- VFDs (Variable Frequency Drives)

- LVS (Low Voltage Drives)

- Servo Motors

- AC Motors

- Other Field Devices

By ICS Type

- Supervisory Control and Data Acquisition (SCADA)

- Distributed Control Systems (DCS)

- Programmable Logic Controllers (PLC)

- Manufacturing Execution System (MES)

- Product Lifecycle Management (PLM)

- Enterprise Resource Planning (ERP)

- Human Machine Interface (HMI)

- Other Control Systems

By End-user Industry

- Automotive

- Chemical and Petrochemical

- Utility

- Pharmaceutical

- Food and Beverage

- Oil and Gas

- Electronics

- Mining

- Water

- Other End-user Industries

Key Mexico Factory Automation and ICS Industry Players

- Rockwell Automation Inc

- Honeywell International Inc

- ABB Ltd

- Emerson Electric Company

- Omron Corporation

- Mitsubishi Electric Corporation

- Siemens AG

- Robert Bosch GmbH

- Texas Instruments Inc

- Yokogawa Electric Corporation

- Schneider Electric SE

- Yaskawa Electric Corporation

- Keyence Corporation

- FANUC America Corporation

- Kuka AG

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252