MARKET OVERVIEW

In the technological advancements, the Global Materials and Chemical Processing Software market has transformative power of software solutions within the materials and chemical processing industries. This market encapsulates a diverse array of software applications specifically tailored to optimize and enhance the intricate processes involved in materials and chemical manufacturing.

The Global Materials and Chemical Processing Software market addresses the multifaceted challenges faced by industries engaged in the production and processing of materials and chemicals. These challenges span from managing complex supply chains and ensuring regulatory compliance to enhancing overall operational efficiency. The software solutions offered in this market play a pivotal role in streamlining these processes, providing a technological backbone that facilitates seamless coordination and decision-making.

The significance of these software solutions becomes evident when considering the intricate nature of materials and chemical processing. From raw material acquisition to the final product, every stage involves a cascade of interconnected steps that demand precision and efficiency. Global Materials and Chemical Processing Software not only digitizes these processes but also introduces automation and predictive analytics, ushering in a new era of intelligent manufacturing.

The importance of the Global Materials and Chemical Processing Software market lies in its ability to empower industries with tools that transcend traditional methods. These software solutions enable real-time monitoring, data-driven insights, and adaptive decision-making, thereby fostering a more agile and responsive manufacturing environment. The impact is far-reaching, influencing not only the operational aspects of production but also contributing to sustainability goals through optimized resource utilization and waste reduction.

Moreover, as industries worldwide are embracing digital transformation, the Global Materials and Chemical Processing Software market becomes a catalyst for innovation. It catalyzes the development of smart factories and interconnected supply chains, laying the foundation for the next phase of industrial evolution. The integration of artificial intelligence and machine learning further enhances the capabilities of these software solutions, enabling predictive maintenance, quality control, and adaptive production strategies.

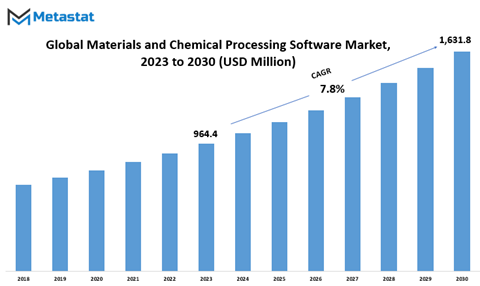

Global Materials and Chemical Processing Software market is estimated to reach $1,631.8 Million by 2030; growing at a CAGR of 7.8% from 2023 to 2030.

GROWTH FACTORS

The Global Materials and Chemical Processing Software market is driven by factors such as rising process automation, stringent regulatory requirements, and growth of smart manufacturing. However, high implementation costs pose a challenge. At the same time, increasing adoption of AI and cloud technologies is likely to provide lucrative opportunities.

Key growth drivers include the need for optimizing complex industrial processes while ensuring quality compliance. Software tools enable modeling, simulation, predictive analytics, and digital twin capabilities to maximize yield, efficiency, and safety. Stringent regulatory requirements in industries like pharmaceuticals and chemicals also boost demand. Integration of IOT, industry 4.0, and shift towards smart factory ecosystems further propel adoption.

However, high costs of implementation, integration, training and maintenance constrain uptake, especially among smaller companies. The lack of technical expertise and reluctance to migrate from legacy systems also hinders market growth to some extent. Resistance to change operational processes poses a challenge too.

Looking ahead, AI-driven cognitive modeling, cloud-based solutions, predictive maintenance, and advanced automation present new opportunities. Increasing R&D spending and strategic partnerships between software vendors and industrial companies will support development of next-gen solutions. Adoption of digital twin paradigm across materials and chemical processes also bodes well for market growth.

While cost and integration challenges persist, maturing technologies like AI, IIoT and cloud promise to accelerate Materials and Chemical Processing Software adoption across essential manufacturing verticals. Automation and optimization needs will continue to underpin market growth.

MARKET SEGMENTATION

By Type

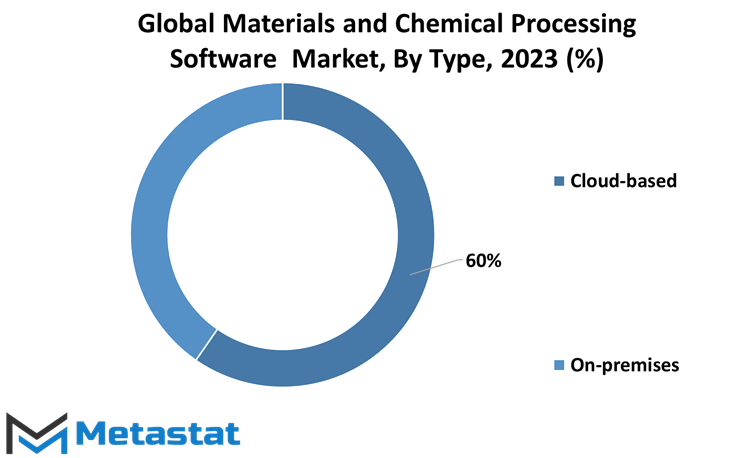

The Global Materials and Chemical Processing Software market is segmented into two key types are Cloud-based and On-premises solutions. Cloud-based materials and chemical processing software accounted for around 59% market share in 2021, valued at 496 USD Million. The growth in Cloud-based solutions is driven by benefits like lower upfront costs, flexibility, easy scalability, and remote access. SaaS models are gaining traction as they enable hassle-free upgrades and maintenance. Vendors like ProSim and AspenTech offer Cloud-ready solutions.

On-premises software held around 41% market share, valued at 339.1 USD Million in 2021. On-premises deployment is preferred by organizations concerned about data security, lack of high-speed internet connectivity, or highly proprietary processes. This model also allows customization to legacy IT systems. Implementation costs are, however, higher.

Regionally, North America and Europe exhibit higher adoption of Cloud-based materials and chemical software compared to APAC, owing to reliable infrastructure. Highly regulated industries also prefer on-site solutions for control, especially biopharma. Overall, the global shift towards Cloud is likely to accelerate as connectivity and cyber security improves across regions.

While on-premises dominates currently, ease of use and lower costs are expected to drive materially higher Cloud adoption in the Global Materials and Chemical Processing Software market through the decade. However, critical applications will continue leveraging on-premises solutions.

By Application

The Global Materials and Chemical Processing Software market caters to Large Enterprises and SMEs. Large Enterprises accounted for around 65% of the market share in 2021, valued at 541.9 USD Million. Materials and chemical processing software adoption is high among large multinational companies in chemicals, oil & gas, pharmaceuticals, metals & mining, and related domains. Extensive value chain scale and complexities drive the need for specialized process modeling, simulation, and optimization software.

SMEs represented 35% of the market share, valued at 293.2 USD Million in 2021. Small and mid-sized companies involved in specialty chemicals, additives, coatings, and polymers leverage such software for shorter time-to-market and quality control. Rising focus of SMEs on operational efficiency, product development, and regulatory compliance is driving adoption.

By region, Large Enterprises dominate in North America and Europe. High R&D budgets allow large companies to invest in advanced solutions for process improvements. In Asia Pacific, SME adoption is rising rapidly owing to favorable government initiatives and expanding manufacturing sector.

While Large Enterprises currently leads in Materials and Chemical Processing Software adoption globally, SME participation is increasing as solution accessibility improves through cloud delivery models. Vendors are also targeting unmet needs of small companies through tailored offerings.

REGIONAL ANALYSIS

The global Materials and Chemical Processing Software market exhibits varied trends across major geographical regions based on factors like manufacturing footprint, technology adoption, regulation, and end-use demand. This market consists of software solutions used for materials simulation, chemical process modeling, quality control, and production management.

North America holds a dominant share of the Materials and Chemical Processing Software market presently. The widespread presence of pharmaceutical, specialty chemical, and advanced manufacturing industries drives adoption in the region. Stringent regulatory requirements also necessitate robust software solutions for process control and quality assurance. High technology maturity fosters integration of advanced features like AI and IoT.

Europe accounts for the second largest share of this market. Strict industry regulations, increasing focus on sustainability, and growth in sectors like automotive, cosmetics, and processed foods are key regional drivers. Germany, France, the UK, and Italy are major markets. Established vendors as well as startups are competing in this space.

The Asia Pacific shows high growth potential due to rapid industrialization in China, India and Southeast Asia. Government initiatives supporting smart manufacturing and rising process automation investments will expand the market. However, lower technology maturity vis-à-vis North America hinders adoption of advanced software capabilities currently.

In summary, while North America and Europe are dominant presently, the Materials and Chemical Processing Software market exhibits geographic nuances based on manufacturing maturity, regulation, and technology adoption rates. Developing regions are also projected to drive future growth. Leading vendors are tailoring solutions to meet specific regional demands.

COMPETITIVE PLAYERS

The Global Materials and Chemical Processing Software market is served by many established software vendors as well as emerging players. Key companies operating in this industry include ProSim and AspenTech among others. ProSim is a leading developer of process simulation software used across chemicals, petrochemicals, polymers, metals, and other industries. Its flagship ProSimPlus platform enables modeling of physical and chemical processes to optimize plant operations. Key capabilities include steady state and dynamics simulation, thermodynamics calculations, and predictive analytics. ProSim serves major oil & gas, pharmaceutical, and specialty chemical companies worldwide.

AspenTech provides critical software solutions for chemicals, polymer, and life sciences industries. Its aspenONE Engineering portfolio helps optimize chemicals and polymer engineering processes. Key products include Aspen Plus for accurate property predictions, Aspen Capital Cost Estimator for cost analysis, and Aspen Polymers for plastics process modeling. AspenTech leverages cloud, AI, and big data to drive next-gen process optimization.

Other players like MathWorks, ANSYS, OSIsoft, and Hexagon PPM offer software tools for first principles and data-driven modeling, quality control, production management, and smart manufacturing across materials and chemical processes.

Domain expertise in process engineering and close customer partnerships give leading vendors like ProSim and AspenTech a strong competitive edge in the Materials and Chemical Processing Software market. Continued technology innovation focused on automation, optimization, and sustainability will be crucial to serve evolving customer needs in this industry.

Materials and Chemical Processing Software Market Key Segments:

By Type

- Cloud-based

- On-premises

By Application

- Large Enterprises

- SMEs

Key Global Materials and Chemical Processing Software Industry Players

- ProSim

- AspenTech

- Chemstations

- Siemens

- Ansys

- AVEVA

- PSE

- WinSim

- Schlumberger Limited

- Aurel Systems Inc.

- EPCON

- CORYS

- METSIM International, LLC

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383