MARKET OVERVIEW

The global maritime market stretch far beyond traditional shipping and commerce, involving a sophisticated web of technological innovation, regulatory systems, and new challenges. While goods transportation remains an underlying function, the business continues to evolve with geopolitics, the environment, and technological advancements that redefine its course.

Maritime operations are founded on a dynamic network of ports, vessels, offshore platforms, and computerized logistics networks. As automation is an integral part of daily functions, artificial intelligence and blockchain will transform the tracking, security, and delivery of freight. More reliance on data-driven analysis will determine decision-making, with risk management and efficiency more precise than ever before.

Cybersecurity attacks will also become a more serious issue, with international players implementing stronger protective strategies to protect vital information and infrastructure. Environmental problems will, however, continue to influence Global Maritime intitiatives, coupled with more stringent emission regulations that will push companies toward cleaner fuels and eco-friendly ship design.

Sustainability will require investments that will be crazy amounts of money directed to cleaner methods of propulsion, such as hydrogen fuel cells and ammonia-powered engines, among others, to reduce this industry's carbon footprint. There will also be ocean protection and waste management programs, with interest in balancing economic pressures and environmental issues.

Geopolitical rivalries and trade policy will determine the future course of maritime commerce. Nations will thus reassess supply chains and strategic alliances to define routes of trade. Border disputes, changing tariffs, and economic sanctions by which access to state-of-the-art shipping lanes is reshaped will determine future maritime trade routes, not to mention the increasing waves of new technology that unveil a lot of displacement and global disruption. The volatility of international politics will necessitate flexibility for companies within the industry, adding to the requirement for diversified strategies and contingency planning.

Aside from commercial transport, the sector will have more activity in deep-sea mining and offshore energy production. Pressure for rare minerals that are vital to contemporary technology will fuel exploration into previously unexplored oceanic regions, sparking concerns over environmental repercussions and regulatory authority. Floating solar power projects and offshore wind farms will also grow, utilizing sea space for clean energy applications that make the world economy greener.

The function of workforce development in the Global Maritime industry will change dramatically as automation and digitization reshape conventional job functions. Skilled workers will continue to be vital, but training programs will have to adapt to provide workers with proficiency in robotics, AI-based systems, and digital navigation technology. Maritime schools and industry leaders will probably work together to close knowledge gaps, making professionals ready for the challenges of a more technologically driven world.

Since shipping commercial continues to provide enormous international commerce, so there is continuous accommodation of new trends and challenges due to changing dynamics of the industry. At the core of all this is legal regulatory and technological drivers as well as the forces of preservation and political realities. The global maritime market stands at a juncture, which means the change and adaptability. Those who will picture the futuristic view and custom themselves to the different ways will make that picture for the future of this industry.

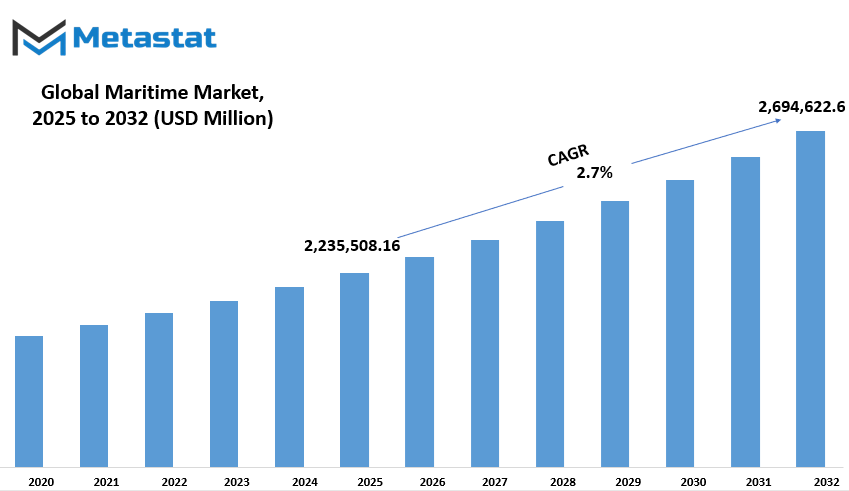

Global maritime market is estimated to reach $2,694,622.67 Million by 2032; growing at a CAGR of 2.7% from 2025 to 2032.

GROWTH FACTORS

The global maritime market has been growing steadily owing to the advancement of international trade along with an increasing demand for commercial shipping. With trade being an economic lifeline across oceans, the need for shipping services is stronger today than ever before. To support the increasing demand, countries are investing heavily in port infrastructure and shipping fleets, therefore aiding general market activity. Likewise, aggressive and huge investments are being made into maritime security and naval defense by both governments and private companies to protect trade routes and assure safe navigation. This will lead to global maritime market growth by making trade more secure and lowering the risks posed by piracy, territorial disputes, and various other menaces.

However, with these gains come attendant challenges that may prove to be a hindrance. Environmental laws have increased operational costs, forcing companies to adopt greener fuels, cut emissions, and abide by sustainability mandate. Such laws may prove worthwhile in reducing the environmental threat posed by the maritime activities. Still, at the same time, it adds unnecessary financial burden on the shoulders of shipping companies, thereby reducing profitability. Further, Global supply chain disruptions and geopolitical tensions also continue to be threats to maritime trade. Spawned by trade restrictions, conflicts, and sudden downturns in the economy, all these contribute to creating uncertainty for market players in terms of delays and fluctuations in shipping demand.

Advances in autonomous and environmentally friendly shipping open new avenues for innovations. It is expected that autonomous shipping will enhance efficiency by reducing human errors and optimizing fuel consumption. Concurrently, the green pathway thus advances toward electric and hydrogen vessels to achieve lowered carbon footprints and sustainability. These will lead to increased efficiency in the operations of the seas.

The maritime sector, they expect, will continue its evolution toward the future and balance economic growth with care for the environment. Supply chain disruptions and regulatory pressures that impose challenges should continue. Nevertheless, whether this sector thrives on in the long run will depend very much on its own ability to embrace technological advancement. Supported by ongoing global trade, the demand for shipping services will remain very high, thus securing the position of the maritime sector in fostering international trade. The future is envisaged as one filled with efficiency, sustainability, and adaptability: a fact grounded on present investments geared toward security and innovation.

MARKET SEGMENTATION

By Vessel Type

Given the ability to transport goods and people from one nation to another, the global maritime market is extremely important to international trade. It weighs heavily on the economy, which, in turn, is served by various types of vessels, each with different functions. Cargo vessels command the largest maritime market share, worth $534,845.33 million. These vessels are used for transporting goods over long distances, thereby enabling industries to procure the materials required for production. The other segment, container vessels, enables easy logistics by carrying standardized containers for efficient loading and unloading.

The tankers are another major category of vessels that carry liquids, crude oil, chemicals, and liquefied natural gas. The design of these vessels allows for the safe and efficient transportation of such valuable resources that sustain industries dependent on energy and raw materials. Bulk carriers converse with yet another category of ships that carry huge volumes of unpacked bulk goods like coal, grains, and ores. These vessels are built to load huge weights, which obviously make them a major player in international trade.

Examples of passenger ships are cruise lines or ferry lines transporting people to and from destinations. The cruise industry expanded and matured over the years, hence creating newer travel opportunities on a global scale and contributing to various tourism economies. Ferries connect the islands with the mainland and provide people with quick and convenient travel from one location to another. An additional application of passenger vessels is found within the fishing industry, in which these vessels furnish fish and other marine products to markets all over the world. In many areas, fishing ensures food security; hence fishing vessels are needed.

Naval vessels form a distinct category for purposes of defense and security. Countries use these ships to protect their territorial waters, search and rescue, and maritime safety. Some of these vessels are aircraft carriers, destroyers, and submarines, with each having a certain role in national security. Offshore vessels further the oil and gas exploration and renewable energy projects such as offshore wind farms, the former bringing personnel and equipment for deep water operations.

This industry continues developing the technology that connects to it while responding to the changing nature of the challenges and opportunities that have characterized its existence. Cutting-edge innovations in ship designing, fuel efficiency, and automation usher in a bright new dawn for this facility. Environmental concerns become sharper, and existing measures are taken toward a cleaner and sustainable energy future. At the same time, an evolution is underway regarding the rules for safety, efficiency, and low emissions.

The global maritime market remains an essential force in trade, security, and transportation. As demand for shipping continue to rise, the industry will keep evolving by becoming more efficient and sustainable in the support of worldwide economic growth.

By Technology Type

Significant technological changes transform the global maritime market and affect much of what is possible within the industry. Industry advancement is increasingly making shipping a more efficient, sustainable, and safer venture. One of the major advancements is the autonomous ship, which can operate with minimal human intervention. In fact, such vessels navigate, detect an obstacle, and make real-time decisions using advanced sensors and artificial intelligence combined with automation. While fully autonomous ships are still in their infancy, partial automation is already reported to enable improved operations and reduce the need for large crews, thus reducing costs.

Perhaps the most important is digitization and IoT with regard to the new trends in shipping. Modern vessels are likely to come equipped with smart technologies that allow them to continuously monitor their performance, the condition of the cargo they carry, and consumption of fuel. This connectivity enables ship operators to optimize routes, preventing wastage in fuel, and enhance safety using preemptive mechanical failure detection. Here again, digitalization is making operational aspects more efficient while at the same time lowering operational risks.

Sustainability is a great concern for the maritime sector; thereby, green and sustainable maritime technologies have been developed. Given that the industry considers emission reduction through the use of alternative fuels such as LNG, hydrogen, and biofuels, energy-efficient ship designs and hybrid propulsion systems help to reduce the environmental burden of maritime transport. Administrative bodies worldwide have brought forth stricter emissions standards encouraging the shipping companies to invest in cleaner and efficient solutions.

In other words, the maritime safety technologies are evolving in nature whereby there is preventing accidents and reinforce the security of sea activities. Advanced radar systems, automated distress signals, and real-time tracking are enabling vessels to navigate successfully in bad conditions when avoiding collisions. Also, cybersecurity measures are beefed up safeguarding ships against anticipated cyber threats in their operational activities. The industry is therefore heading toward safer seas for both cargos and crew members.

Yet another one n Today modern maritime technology involves vessel navigation and communication systems that enable the ship to communicate with ports, other vessels, and satellite networks. Precision navigation is achieved by high tech features like advanced GPS tracking, automated route planning, and electronic chart displays. Such features increase overall efficiency and lower human errors related to navigation. Communication systems also are necessary in emergency response cases, ensuring that assistance can come as fast as possible when emergencies arise.

Technologically, the global maritime market transforms. Automation to digitalization, sustainability, and safety improvement all build up the future of global shipping. And as such technology keeps advancing, the industry will become more efficient, greener, and secure in the coming years.

By Application

The maritime industries are engaged primarily in some activities to help improve vessels' performance efficiency, distance traveled, and environmental impact, among other areas. At some point, international trade and transport definitely impacted the world economy as they connected countries and ensured goods and people or resources could cross oceans. Growth of the industry is facilitated by the increase in demand for maritime services while also innovating by integrating new technology into the industry to increase efficiency and safety considerations.

The application is typically used to classify different aspects of the maritime market segment. Commercial shipping- This mode of shipping is the backbone of global trade; it makes sure that goods actually do reach their destinations. Businesses depend on this type of shipping. Cargo ships, container vessels and bulk carriers are just a few means of cargo transport available. There is a strong focus on national security for both the defense and naval sectors, maintaining fleets of warships and submarines to safeguard territorial waters and deter any threatening activity.

Heavy dependency on the maritime support has made it an integral part of the industry in offshore oil and gas operations, from exploration to drilling and direct resource transportation. The marine tourism and cruise industry offers a different opportunity for travelers in experiencing life on the sea, thus contributing to the economy of coastal regions.

Fisheries support people's lives across the globe as they provide seafood to meet increasing demands while incorporating methods that promote sustainability in order to conserve marine ecosystems. Study through research and exploration advances the science by investigating life in oceans, charting underwater terrains, and understanding climate patterns.

The industry like any other is affected by changes in fuel prices, regulatory compliance, infrastructural development, and implications of costs. As emissions and marine pollution gain notoriety, the transition to cleaner and greener energy sources and technologies becomes imperative. Digitalization has redefined how maritime operations are conducted: decisions are made with greater confidence, powered by automation and data analytics. Prototypes like smart shipping, autonomous vessels, and enhanced operational processes are best-in-class in navigation, thereby reducing human error and increasing total operational efficiency.

Investments in shipbuilding and port development and in maritime logistics continue to shape the vision of the future for this industry. Public-private partnerships will do particularly well in developing sustainable solutions that provide for an exceptional balance between economic growth and environmental responsibility. The focus is increasingly bringing safety, security, and technology into developing a movement to ensure the maritime sector is an important project for global connectivity and economic stability.

Continuous monitoring and adaptation are needed as the industry continues to progress along the line of evolving global maritime market needs and regulatory and technological advancement. Collaboration of stakeholders across a wide spectrum would ensure that maritime operations are sustainable and continue to operate efficiently in the long term. The maritime industry will evolve, meet the demands of an ever-changing world, and recast its value proposition through innovation combined with a commitment to environmental responsibility.

By End-Users

The global maritime market is considered the backbone of global trade and transportation. The market serves various industries by making possible the movement of goods and people across various regions. This huge market is further divided into several end-user segments from which the industry derives its overall growth and efficiency. Shipping companies are one of the end-user segments that facilitate this sector by providing movement services for both cargo and passenger sea transport. These companies manage fleets and transportation schedules and set safety standards for the general public. Depending on the nature of the cargo, the types of vessels usually operated by shipping companies include container ships, bulk carriers, and oil tankers.

Maritime sector contribution extends to government and defense agencies, which are also part of the global maritime market. These concentrate on securing national waters, enforcing laws, and having naval power. Many of them provide investment to the maritime side to safeguard national interests against illegal activities, as well as promote trade activities. Maritime activities of a defense nature include patrolling, surveillance, and search and rescue missions, all of which tend to stabilize ocean-centric territories.

Freight forwarders help companies with managing their shipping using the logistics and documentation functions and coordinating modes of transport. They serve as the middlemen to get the cargo on its way toward a destination while skipping the hurdles of customs and international law on shipping. Route planning and cost management skills make these professionals critical to the industry.

Port operators manage the infrastructure and daily activities of ports worldwide. Manage the loading and unloading, facilitate the processing of goods, and facilitate trade by having an efficient port. Ports serve as major hubs for global trade; hence, their performance will directly impact supply chain efficiency. Technology investments have also played a great role in automation to improve port operations in terms of delay and increased overall productivity.

Shipbuilding and maintenance companies construct new vessels and look after the existing ones. It designs, engineers, and assembles ships for a sound industrystandard. Maintenance services ensure that the vessels are in good condition and thus result in fewer mechanical failures and longer operational life periods.

They bridge various modes of transport into efficient trade routes for facilitating maritime transport. These companies coordinate the shipment of goods from the manufacturer to the end consumer. Their activities are vital to the link between the world market and a steady supply.

Marine tourism is a fast-emerging segment in the maritime industry. Cruises and water sports are among the attractions for people who want to experience something different on their holidays. This will not only add to the economy of the coastal area but also offer new employment opportunities in the areas.

Every end-user segment is vital in sustaining the thriving international trade and transportation within the global maritime market, and these individual efforts come together to smoothen the maritime activities in direct support of economic growth and global connectivity.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$2,235,508.16 million |

|

Market Size by 2032 |

$2,694,622.67 Million |

|

Growth Rate from 2024 to 2031 |

2.7% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

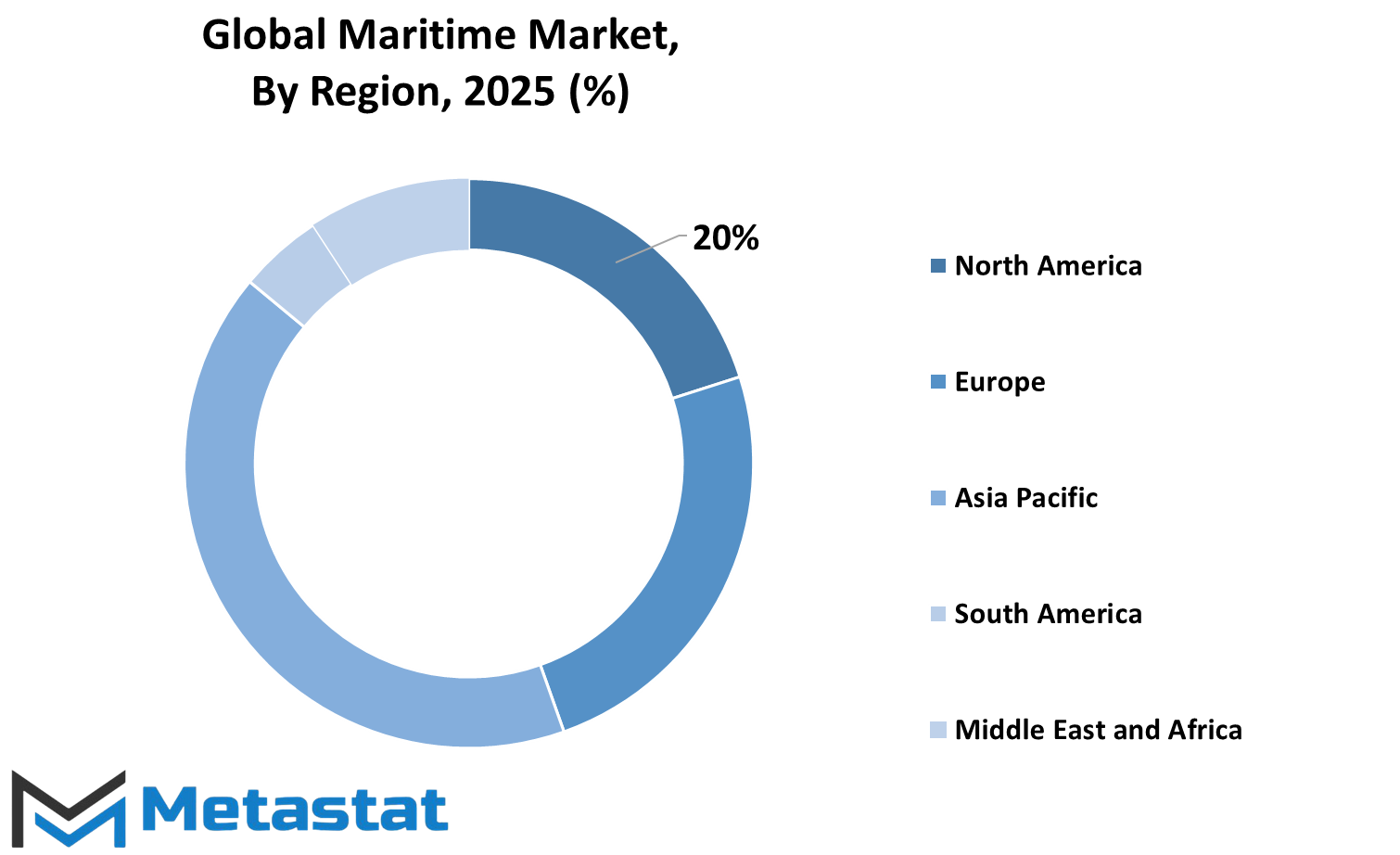

REGIONAL ANALYSIS

It was a matter of so much time for the global maritime market in general in between international trades and economies, and other activities that it has to collaborate with the whole world in transporting goods and resources. Some of these factors have been technological advancement, environmental regulations, as well as economic conditions. The demand for transportation in the future will only increase, and so new challenges and opportunities from the evolving industry will keep the demand dynamic.

Geographically, the maritime market has been categorized into key regional markets. It houses North America-the U.S., Canada, and Mexico. Each of them is involved in the industry with its ports, shipping companies, and trade networks. Europe consists of the UK, Germany, France, and Italy, along with the rest of Europe. The continent has ports and shipping industries that greatly assist in global commerce.

The Asia-Pacific region: India, China, Japan, South Korea, and the rest of Asia-Pacific have experienced outstanding growth mainly due to increasing manufacturing and export activities. This would be South America, including Brazil, Argentina, and the rest of South America, for all model-understanding and innovative maritime trade for its agricultural and industrial exports. The Middle East & Africa region-ed into grouping such as GCC countries, Egypt, South Africa, and the rest of the Middle East & Africa-bears a strong influence in energy exports and strategic shipping routes.

Automation, digitization, and the use of alternative fuels are some of the technological advancements shaping the industry. Several companies are investing in smart shipping solutions for greater operational efficiency as well as environmental impact reduction. There are also stringent emission regulations aimed at promoting best practices in the segment, thus influencing the global maritime market in greener technologies. Economic global trade policies, inflation, and disruption of supply chains are factors that can affect demand for shipping and operational costs.

In the wake of increasing awareness regarding environmental issues, the maritime industry is sailing towards clean energy and efficient vessels. The technology shift has given rise to innovations in fuel, such as those using LNG and hybrid propulsion systems. Ports have been added to the different eco-friendly initiatives like on-shore power and waste-management systems for a healthier environment.

The global maritime market trade is still very much a part of the economy. The companies that partake in the business therefore try to embrace all technological and regulatory changes to serve their own quest for competitiveness and efficiency toward sustainability. The continuous progress in science and technology and global collective actions in making this industry more resilient- and environmentally responsible will likely shape the future of the global maritime market.

COMPETITIVE PLAYERS

The global maritime market holds a significant place in the facilitative activities of global trade. This industry invests much of its own shipbuilding, marine technology, and shipping services in transporting goods from country to country at times over the vast distance in sea. The industry, which really counts on the global maritime market side, includes names like Maersk Line, Mediterranean Shipping Company (MSC), CMA CGM Group, COSCO Shipping Corporation, Evergreen Marine Corporation, and Hapag-Lloyd, among others, in the often-tightest block of container shipping and integrated international logistics. It is worth noting, however, that value because these companies own vast fleets and are continually investing in newer technologies designed to enhance efficiency and reduce the environmental impact of operations.

Aside from shipping, shipbuilding forms a substantial part of maritime industry activities. It boasts key players such as MOL (Mitsui O.S.K. Lines), Japan Marine United Corporation, Hyundai Heavy Industries and Hanwha Ocean whose structures include those of cargo ships, oil tankers and passenger vessels. With advancements in design and engineering, modern ships have lesser fuel consumption and are environmentally friendly, responding to global demands for emissions and sustainable development.

The advancement also relies on significant contributions made by technology firms, actively engaging in industries such as propulsion systems, automation, and navigation solutions by conglomerates such as Wärtsilä Corporation, Rolls-Royce Holdings, Kongsberg Gruppen, and ABB Marine & Ports. Innovations in vessel design or manufacturing hence enhance ship performance, safety, and efficiencies in energy consumption. DNV GL is one of the major key class societies that provides the international regulatory frameworks and safety standards of compliance internationally.

Several challenges including fluctuating fuel prices, changing regulations, and geopolitical developments affect trade routes and previous some shipping companies invest in new alternative fuels, digitalization, and automation just to catch up with the competition. Moreover, with the strict regulation of clean energies, the transition to liquefied natural gas (LNG) and hybrid propulsion is also in the shift for cleaner energy resources.

Nevertheless, the maritime sector is undeniably one of the key sectors for a country's overall development. Ever-changing customer demands will force the companies to reposition market efficiencies and continue their sustainable growth. Given the constant evolving advances in technology and collaboration across the industry, maritime trade's future looks bright.

Maritime Market Key Segments:

By Vessel Type

- Cargo Ships

- Container Ships

- Tankers

- Bulk Carriers

- Passenger Ships

- Fishing Vessels

- Naval Vessels

- Offshore Vessels

By Technology Type

- Autonomous Ships

- Digitalization & IoT in Shipping

- Green & Sustainable Maritime Technologies

- Maritime Safety Technologies

- Vessel Navigation & Communication Systems

By Application

- Commercial Shipping

- Defense & Naval

- Offshore Oil & Gas

- Marine Tourism & Cruise

- Fisheries

- Research & Exploration

By End-Users

- Shipping Companies

- Government & Defense

- Freight Forwarders

- Port Operators

- Shipbuilding & Maintenance Companies

- Logistics & Supply Chain Companies

- Marine Tourism

Key Global Maritime Industry Players

- Maersk Line

- Mediterranean Shipping Company (MSC)

- CMA CGM Group

- COSCO Shipping Corporation

- Evergreen Marine Corporation

- Hapag-Lloyd

- MOL (Mitsui O.S.K. Lines)

- Japan Marine United Corporation

- Hyundai Heavy Industries

- Hanwha Ocean

- Wärtsilä Corporation

- Rolls-Royce Holdings

- Kongsberg Gruppen

- DNV GL

- ABB Marine & Ports

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252