MARKET OVERVIEW

The Global Luxury and Organic Honey market remains a segment that has really attracted much attention from its consumers and businesses. So, this market will indeed continue to evolve as higher-quality, ethically made food items become more of a demand. As more and more consumers become health-conscious and conscious of the impact of their purchasing decisions on the environment, demand for organic and luxury honey varieties is expected to increase significantly. Luxury honey is a premium product coming from specific bee species or rare floral sources, often cultivated in exclusive and limited quantities.

Organic honey, however, comes from sustainable farming methods and avoids the use of pesticides and chemicals. Thus, organic honey is always a pure and intact product. Both these types of honeys are considered to be premium, artisanal honeys. Thus, in most markets, it would be sought after. As these products are believed to have quality, being unique, and because they were made with such attention, these products usually come with a higher price. The Global Luxury and Organic Honey market will cater to an increasingly growing demographic seeking premium, health-conscious alternative sweeteners beyond mass market production.

This shift by consumers is based on greater awareness and consciousness of healthy benefits in organic products. Organic honey is known for being antimicrobial and antioxidant-rich, making it popular amongst people looking for natural cures or a more healthy addition to their diet. Luxury honey also appeals consumers seeking exclusivity because many types of honey, especially Manuka, are relatively rare and hold high values for their therapeutic use. Apart from being used as a sweetener, honey is bound to find wider usage in skincare, wellness, and gourmet food products.

The luxury honey will find application in premium skincare lines with the use of natural honey to create luxurious all-natural skincare formulations. In addition, the wellness sector will benefit from a rising interest in organic honey in health-focused products, including energy bars, teas, and supplements. This multi-dimensional appeal will help expand the market across different sectors and ensure that it continues to grow. The market will also attract more interest from e-commerce platforms that will offer consumers access to a wider range of luxury and organic honey options.

Online marketplaces will become key players, enabling small, boutique producers to reach global customers who value exclusivity and premium quality. Consumers will use the internet more and more to find new varieties of honey, learn about the sourcing processes, and realize the benefits of luxury honey. This will help spread luxury and organic honey market geographically, connecting niche producers with a broader and more diverse consumer base. Overall, the Global Luxury and Organic Honey market will grow as consumers value quality, health, and sustainability in the products they buy.

The distinctiveness of luxury honey and the health benefits of organic honey will drive market growth, and both sectors will likely see increased consumer interest. This sets a bright future for the luxury and organic honey market because more people are on a quest for authentic, premium alternatives to conventional food products.

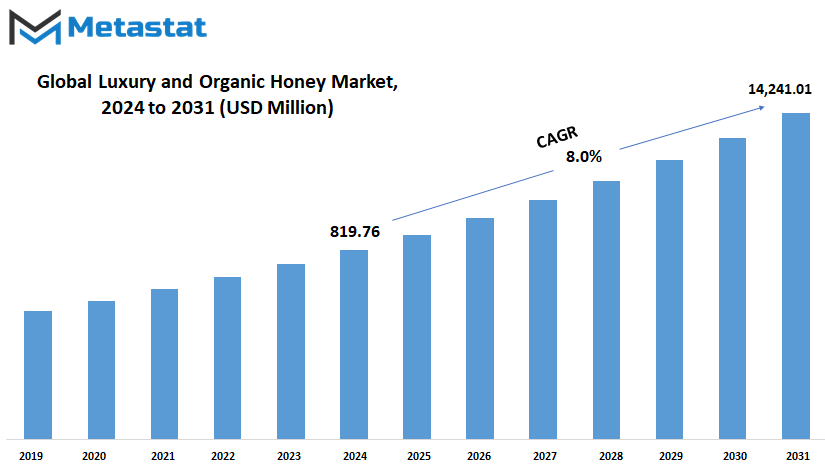

Global Luxury and Organic Honey market is estimated to reach $1,405.48 Million by 2031; growing at a CAGR of 8.0% from 2024 to 2031.

GROWTH FACTORS

The Global Luxury and Organic Honey market is an interesting culmination of consumer preferences, trends toward sustainability, and health consciousness. In the recent past, there has indeed been a shift in consumers' attitudes toward sweetener choice, moving steadily away from artificial sweeteners and embracing more natural alternatives. At the forefront of these alternative options is organic honey-a product that has gained so much attention because it ties in with the growing focus on sustainable and health-conscious products. This shift is driven by a demand for natural ingredients that are healthier but also possess distinct features and better taste, thereby becoming the darling of conscious consumers.

A key motivator for the market is the growing demand for premium and high-quality products that resonate with indulgence and wellness. Organic honey is perceived as a luxury product and meets this duality of aspiration. With its potential health benefits, including antioxidant and antimicrobial properties, organic honey has found a solid footing among individuals seeking holistic well-being. Its appeal is further amplified by the value placed on ethical sourcing and eco-friendly practices, which resonate deeply with environmentally aware consumers.

Despite these encouraging factors, the market faces challenges that cannot be overlooked. High production costs are often associated with organic certification processes and the specialized care required in honey production. Such products are often in short supply, which often translates to high prices, thereby discouraging a larger market from buying such products. Moreover, adulteration and counterfeit products pose a threat to the integrity of the market, thereby damaging consumer confidence and creating a major barrier to growth.

However, there is much room for innovation in the Global Luxury and Organic Honey market, especially in luxury gifting and premium wellness. There is a lot of room for creative packaging and branding approaches that can transform organic honey from a pantry staple to an exclusive lifestyle product. Tapping into this potential will allow producers to reach a broader audience, including those looking for unique and thoughtful gift options.

Looking ahead, the Global Luxury and Organic Honey market will continue to evolve, molded by consumer preferences for authenticity, quality, and sustainability. Strategic investments in production transparency and marketing can help overcome current challenges, so organic honey not only maintains its esteemed status but also opens new paths in the global marketplace.

MARKET SEGMENTATION

By Type

The international markets have lately witnessed a niche yet upsurging segment in terms of food and wellness-related needs. This unique combination takes the richness of high-end products and blends it with the natural purity of varieties of organic honey. Herein, quality, authenticity, and sustainability are the keywords. Such products cater to those particular and discarding crowds who are keen on spending money on health and premium options. The increased demand for such honey comes from the rising awareness of the benefits of natural food and the attraction towards luxury offers that promise unbeatable taste and health benefits.

There is a variety of luxury and organic honey available in the global market. Different choices are catered to because of this. This includes known varieties like Manuka honey, which has medicinal properties, and Clover honey, known for its mild sweetness. Acacia honey, with its pale color and floral flavor, is preferred for those who like less complex profiles. Multifloral honey, collected from multiple blossoms, has an excellent richness that is pleasing to adventurous palates. Specialty infused honey, which combines flavors like lavender, truffle, or vanilla, brings out how this product can bridge the gap between gourmet indulgence and natural food. Such variety underscores how diverse consumer preferences can shape the future of this market, creating opportunities for innovation and exclusivity.

Luxury honey is distinct in its presentation and sometimes sourced from rare environments; therefore, it brings luxury to the consumer. Organic honey ensures that the production is in strict environmental and ethical standards, which appeals further to a sustainability-conscious generation. The blend of these two aspects luxury and organic integrity promises a product that satisfies both the desire for indulgence and the need for responsibly sourced goods.

In the future, the market of global luxury and organic honey will probably grow in response to health, wellness, and ethical consumerism trends. Sustainable beekeeping practices, along with biodiversity preservation efforts, will be key components in the support of such premium honeys. Brands with a focus on transparency and quality will become increasingly prominent as consumers demand more from the products they choose.

The convergence of luxury and organic honey thus affords not only an culinary experience but also a rapport with nature and mindful consumption; it represents a future with indulgence and sustainability simultaneously harmonized, appealed by the generation that values its worthiness and responsibility both simultaneously.

By Application

The concept of luxury has taken on new dimensions in today's world, extending beyond traditional markers of wealth and status to embrace a growing preference for products that align with values of sustainability, health, and authenticity. Organic honey has emerged as a prime example of this shift, because of its rich nutritional profile and environmental benefits. This has, therefore, integrated very harmoniously into the lifestyles of those who enjoy indulgence while at the same time focusing on conscious living. The appeal of organic honey lies in its purity but also due to its versatility. While consumers are becoming more keen to knowing their food and personal care origins, organic honey comes to the fore in many applications in terms of need. In the food and beverages sector, it is lauded for its natural sweetness and health benefits, providing a welcome alternative to refined sugars. From gourmet recipes to artisanal drinks, organic honey adds flavor while introducing an element of sophistication.

The nutraceutical industry is also realizing organic honey as a good business opportunity. Its antioxidant and antibacterial properties make it the perfect ingredient in health supplements and functional foods for a rapidly growing population that's focusing on preventive healthcare. So, in personal care and cosmetics, they use organic honey for its moisturizing and healing properties from face masks to shampoos as people demand a natural yet effective skincare product.

The medicinal use of organic honey further underlines the value of this substance. Historically known for healing purposes, organic honey is slowly being integrated into treatments for wounds, sore throats, and digestive issues. Its application not only highlights effectiveness but also aligns with the greater push toward natural remedies over synthetic alternatives.

Apart from practicality, organic honey has the place in gifting and premium occasions. Its appeal to nature and healthful qualities make it a perfect gift for people who want to show consideration and sophistication. Luxury packaging adds to it, turning a simple commodity into an expression of high elegance.

In the future, integration with all these diverse applications is sure to be more deep as awareness grows. Organic honey becomes a part of luxury global markets embracing products that bring more quality and sustainability in terms of being a product which is not a short-lived trend but a long-term symbol of conscious indulgence, catering to a future where ethical consumption and luxury will go side by side seamlessly.

By End User

The idea of blending global luxury and organic honey is an interesting move in consumer preferences, depicting an increasing concern for quality, sustainability, and wellness. Organic honey, which earlier was a household staple, has evolved to become the epitome of indulgence and conscious living, appealing to a wide spectrum of end users. This development resonates with the changing aspirations of consumers who seek authenticity and sophistication in the products that they select.

Organic honey is the epitome of health and luxury for the individual consumer. It appeals to people looking to upgrade their wellness routine with nutrient-dense, chemical-free alternatives. Premium packaging and branding are usually part of luxury honey products, making them desirable additions to modern lifestyles. Such consumers look for honey not just as a sweetener but as a statement piece for conscious living.

Hotels, restaurants, and cafes, also known as HoReCa, are increasingly adopting organic honey to elevate their offerings. These outlets increasingly add honey from organic farms to their menus, with which they create unique dishes and beverages that appeal to the health-conscious tastes of customers. Organic honey adds a luxurious feel to their menu, making the dining experience even more special. In an era where customer loyalty is based on delivering memorable moments, the use of premium ingredients such as these suggests a commitment to quality and differentiation.

Specialty stores and health and wellness centers continue to be important channels that expand the reach of organic honey. These outlets cater to a discerning clientele interested in products that align with their values and lifestyles. Specialty stores often make much of the unique stories behind organic honey brands: their ethical sourcing practices and environmental impact. Meanwhile, health and wellness centers position honey as a natural remedy and speak to its benefits regarding immunity and energy as part of holistic care.

The future of global luxury and organic honey holds much room for innovation. As sustainability becomes increasingly important, the producers will continue to adopt newer techniques in a way that ensures not to compromise the quality with the environment-friendly practices. More advanced traceability, tracing from the honeycomb to the jar, will only strengthen the relationship between the consumers and the producers. It will bring more people and the products together, hence making luxury as an experience with authenticity and care. Organic honey best embodies this interplay between sophistication and simplicity as luxury works to harmonize with nature and cater to diverse end-users while supporting a more healthful, thoughtful way of living.

By Sales Channel

The demand for global luxury and organic honey is increasing, since consumer preferences are turning to premium and healthier options. This honey, due to its pure sourcing and superior quality, appeals to those interested in natural products and willing to invest in an experience at a higher level. Its rise is not just attributed to health benefits but to the growing appreciation of sustainable food production practices. As more and more people look to balance consumption with environmental responsibility, conscious indulgence in the form of organic honey has been found.

The market for global luxury and organic honey is segmented through a myriad of sales channels that cater to the needs of varied consumers. Online retailers are increasingly popular because they save time. The advent of digital platforms has allowed customers to reach a vast array of premium organic honey from across the world, all from the comfort of their homes. This increased accessibility has widened the reach of niche brands and beekeepers to connect with global audiences. On the other hand, supermarkets and hypermarkets continue to hold their ground, offering consumers the chance to personally inspect and choose their preferred products. The tangible nature of shopping in these stores remains appealing, especially for those who place value on the experience of seeing and selecting their purchases directly.

Specialty stores and health-focused outlets are also carvings out significant space in this market. Such establishments cater to a clientele that seeks assurance of quality and exclusivity. Customers go to such stores for handpicked products of organic and luxury brands, like honey, that they believe are of very high quality. Direct sales from a beekeeper to the customer are a different type of sale in which customers tend to value authenticity and traceability. Directly purchasing from producers builds trust and supports small-scale beekeepers, which further solidifies the ethical aspect of the purchase.

The future of global luxury and organic honey is, therefore, tied to the evolving consumer expectations and technological developments. With the increasing awareness of health and sustainability, the demand for transparent and ethical sourcing will increase. Innovations in packaging and marketing are most likely to shape how this honey is presented to the world, emphasizing its premium qualities while ensuring environmental considerations. Also, digital platforms are more likely to be an enabler where people will look for information that allows for interactivity to learn more about their selected honey and what their honey entails. Such tendencies will keep the niche status of luxury and organic honey while in the near future redefining the boundaries of the premium food classes.

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$819.76 million |

|

Market Size by 2031 |

$1,405.48 Million |

|

Growth Rate from 2024 to 2031 |

8.0% |

|

Base Year |

2022 |

|

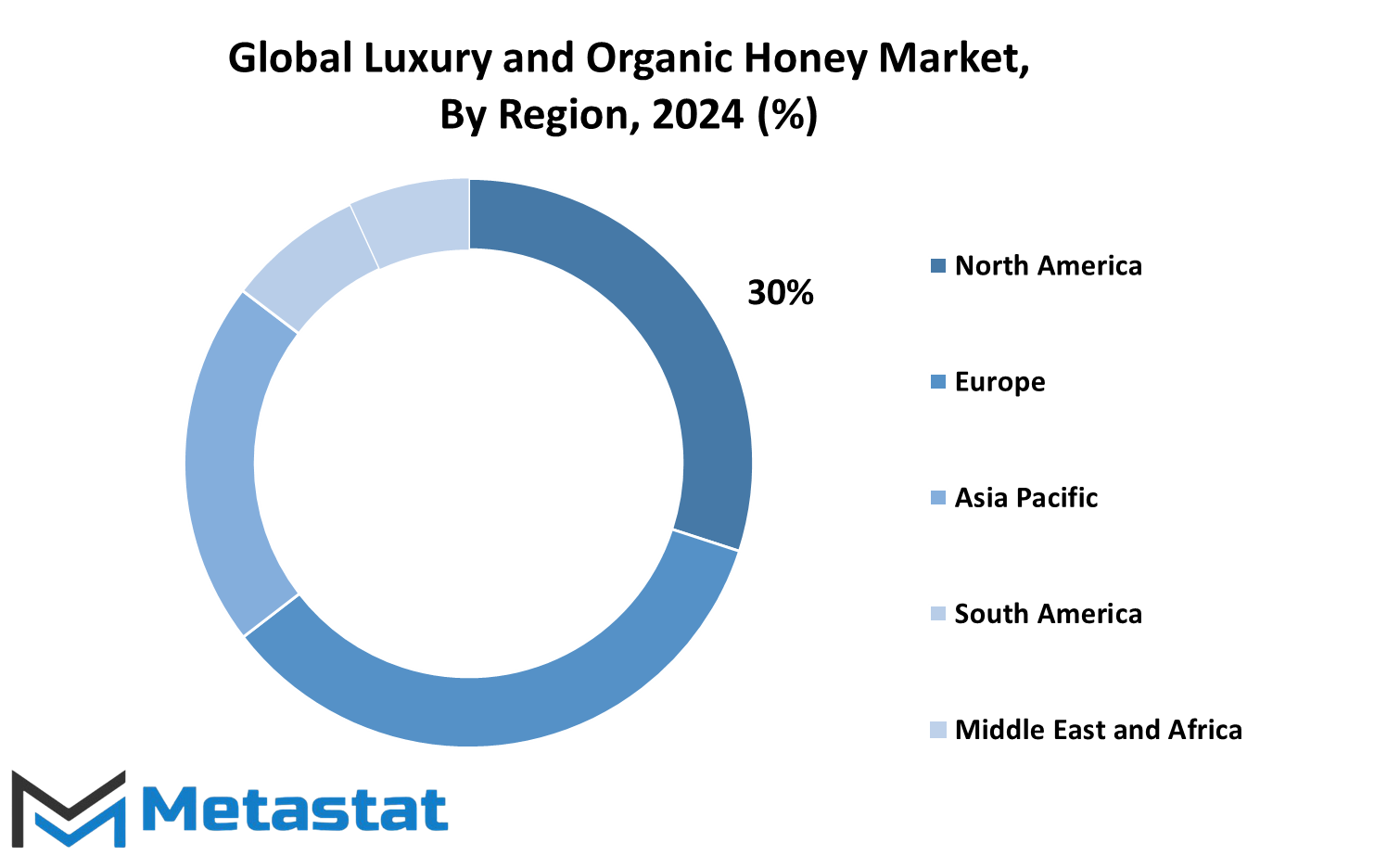

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global market for luxury and organic honey represents an interesting combination of tradition and innovation, offering a product that meets the needs of modern lifestyles and timeless appreciation for natural, high-quality goods. Organic honey, therefore, has attracted many, with a focus on health and wellness, as an all-natural alternative to refined sugars and artificial sweeteners. It's very expensive and appealing because of the quality of care put into the production, which is so pure and has taste unlike anything else. Its duality, where it can offer health benefits but indulge, has made luxury and organic honey a luxury in its own right and in high demand in various parts of the world.

Geographically, the market is split across several key regions. The leading consumer awareness as well as demand for these sustainable products in North America includes the United States, Canada, and Mexico. In Europe, that includes the UK, Germany, France, Italy, or even more countries, appreciation of premium as well as organic honey has increased significantly for being artisanal. The European market has a rich tradition of gourmet foods and, therefore, is an obvious place for such luxury products.

The Asia-Pacific region, which includes India, China, Japan, South Korea, and their neighbors, brings a cultural appreciation for honey's health properties and medicinal uses. Here, luxury honey is often combined with traditional remedies, which serves as a bridge between ancient practices and modern branding. Meanwhile, in South America, with countries like Brazil and Argentina, there exist a lot of biodiversity aspects that allow for the production of unique honey varieties. This creates a natural advantage that contributes to the increase of the region in its presence in the global market.

In the Middle East and Africa, GCC countries, Egypt, and South Africa, there are some historic and cultural connotations attached to honey. Added to this, modern demand for high-end products has further fueled the trend. Wealthier demographics and health-conscious living have increased demand for luxury and organic honey in the region.

Looking forward, the global market will continue to grow due to the fact that more and more consumers will require sustainability, quality, and authenticity. Innovative branding, coupled with the increasing availability of regional specialties, is likely to expand the demand for luxury and organic honey. This market will not only succeed but also change the manner in which people perceive the value of natural, artisanal products in a world that is fast-paced and modern.

COMPETITIVE PLAYERS

The market for global luxury and organic honey is slowly gaining importance as consumers around the world become increasingly concerned with the quality and origin of their food products. This niche segment, which emphasizes premium quality, sustainable sourcing, and health benefits, is gaining attention not only from discerning buyers but also from companies looking to position themselves as leaders in the industry. The competitive landscape is very diversified with Manuka Health, New Zealand Honey Co., Comvita, and many others dominating the market through innovation, branding, and ethical practices.

Luxury and organic honey can combine exclusivity with wellness for the modern consumer. With the change in health trends, demand for natural sweeteners with added benefits has grown significantly. It also stands out nowadays as a far healthier than refined sugar product and serves as an icon of decadence when bottled up with style. For example, honey producers like Comvita and Wedderspoon Organic have excelled in conveying the distinctness of honey, whether this is via its monofloral origin or due to other high levels of bioactive compounds. All these differenciating elements go far beyond their appeal to healthy nutcrackers-it also fosters a sensation of reliability.

The competitive players in the market realize that winning is all about differentiation. Savannah Bee Company and Steens Honey have taken a stance on building relations with their audience by stressing transparency in sourcing and production. Capilano Honey and Hilltop Honey are spending money on sustainability because it is a practice that will benefit the planet and improve the reputation of the brand. This trend toward sustainability fits with values for youth generations, the largest influencer in purchases made towards sustainability.

As we look ahead, the worldwide luxury and organic honey will continue its innovation. Highly advanced techniques in bee-keeping, improvements in traceability, and a better awareness of customer preferences will come to further shape the future of this industry. Expect companies such as Bee Wild Honey and Rowse Honey to incorporate technological advancements not only in ensuring consistency in quality but also in presenting an appeal that is undoubtedly artisanal to valued consumers.

In this changing market, the dominant players have ample opportunity to redefine luxury. They must integrate tradition and modernity. Their efforts into innovation and sustainability will create the way for the growth phase. Luxury and organic honey shall continue to signify health and refinement for ages to come.

Luxury and Organic Honey Market Key Segments:

By Type

- Luxury Honey

- Organic Honey

- Manuka Honey

- Clover Honey

- Acacia Honey

- Multifloral Honey

- Specialty Infused Honey

By Application

- Food and Beverages

- Nutraceuticals

- Personal Care and Cosmetics

- Medicinal Use

- Gifting and Premium Occasions

By End User

- Individual Consumers

- Hotels, Restaurants, and Cafes (HoReCa)

- Specialty Stores

- Health and Wellness Centers

By Sales Channel

- Online Retailers

- Supermarkets and Hypermarkets

- Specialty Stores

- Direct Sales (Beekeepers to Consumers)

- Health and Organic Food Stores

Key Global Luxury and Organic Honey Industry Players

- Manuka Health

- New Zealand Honey Co.

- Comvita

- Capilano Honey

- Wedderspoon Organic

- Langnese Honey

- Rowse Honey

- Bee Wild Honey

- Hilltop Honey

- Savannah Bee Company

- Steens Honey

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383