Global Liver Disease Therapeutics Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

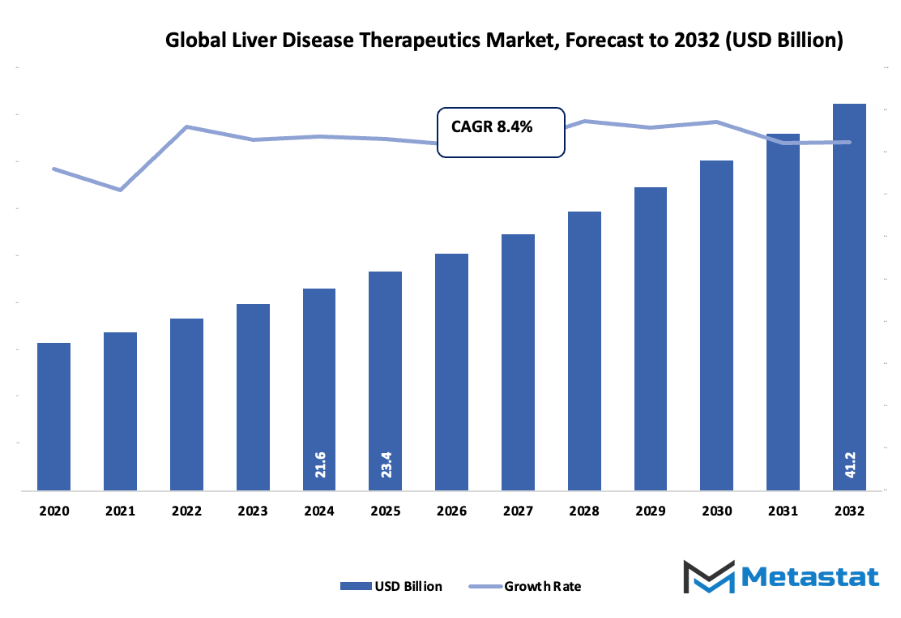

- The global liver disease therapeutics market valued at approximately USD 23.4 billion in 2025, growing at a CAGR of around 8.4% through 2032, with potential to exceed USD 41.2 billion.

- Oral account for a market share of 64.7% in 2024, driving innovation and expanding applications through intense research.

- Key trends driving growth: Rising incidence of non-alcoholic fatty liver disease (NAFLD) and viral hepatitis globally., Increasing R&D and approvals of novel therapies including antivirals and lipid-modulating agents.

- Opportunities include: Growing potential for personalized medicine and gene-based therapies in liver diseases.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

Market Background & Overview

The global liver disease therapeutics market and its industry were formed a long time ago, even before modern drug development introduced structured treatment pathways. Among the 20th-century advances mid-century proved to be the period when the public health authorities started monitoring liver diseases closely because of the increasing awareness of hepatitis infections. Pharmaceutical companies began focusing on medicines that would eventually create the basis for the treatment landscape of the future as national research institutes in the U.S., Europe, and Asia documented the viral hepatitis and alcohol liver injury burden.

The late 1980s were marked by scientific discoveries in molecular biology and the discovery of hepatitis C that acted as a turning point. Regulators motivated research directed to specific targets, and this backing led to a number of drug classes entering clinical trials. The market continued to undergo transformation during the 1990s and early 2000s as antiviral programs were expanded, liver transplants became more successful, and government monitoring systems started issuing comprehensive epidemiological reports. The World Health Organization assured that over 1.5 billion new hepatitis C cases were being detected every year in the early 2000s, which not only enhanced the global demand for effective treatment options but also influenced the trend of investments as the drug manufacturers became aware of the huge unmet need that would arise.

The current configuration of the industry is the result of these changes. The expectation for treatments has shifted as patients and physicians want therapies that will not only stop the progression of the liver damage but also perhaps even reverse it. The pharmaceutical companies have been moving towards precision-based methods because of the documentation provided by national liver organizations and clinical registries that chronic non-alcoholic fatty liver disease cases are increasing in the countries with changing lifestyles. Alongside, regulatory bodies have begun to impose stricter safety regulations, particularly after several older drug classes were banned because of toxicity concerns. This, in turn, has prompted companies to look for cleaner and more selective mechanisms.

The global liver disease therapeutics market will still be drawing heavily on scientific discovery, awareness, and policy decision-making as its main driving forces. Governments will be supporting expanded screening programs, wider vaccination coverage, and research collaborations thus constantly transforming the market. What was initially a very restricted action taken to counter the viral threats will eventually evolve into a large and diverse pharma sector characterized by incessant innovation, as the constantly increasing demand for safe and effective treatments will continue to drive its growth.

Market Segmentation Analysis

The global liver disease therapeutics market is mainly classified based on Route of Administration, Drug Class, Disease Type, Treatment Type.

By Route of Administration is further segmented into:

- Oral:

Oral administration in the global liver disease therapeutics market will support treatment access through easy dosing and steady absorption. This route will help encourage early care, support long-term therapy plans, and offer practical use for several drug classes. Growing focus on convenience will continue to guide development within this segment. - Injectable:

Injectable administration in the global liver disease therapeutics market will deliver faster action, controlled dosage, and direct delivery for advanced conditions. This approach will support therapies that require higher precision or rapid effect, offering strong value for biologics and complex treatments. Steady demand will reflect expanding adoption across hospitals and specialized care settings.

By Drug Class the market is divided into:

- Small-molecule Orals:

Small-molecule orals in the global liver disease therapeutics market will offer adaptable use, simpler production, and broad availability across regions. Consistent growth will be supported by affordability, stable dosing options, and compatibility with chronic disease care. Continued research will strengthen the role of this class in long-term treatment plans. - Biologics & Monoclonal Antibodies:

Biologics and monoclonal antibodies in the global liver disease therapeutics market will continue to gain attention for targeted action and strong therapeutic potential. Rising use will respond to complex disease patterns and growing demand for advanced care. This class will support improved outcomes, especially for conditions requiring highly specific intervention. - RNA-based Therapeutics:

RNA-based therapeutics in the global liver disease therapeutics market will build momentum through mechanisms that address disease at a molecular level. This segment will benefit from expanding research and rising confidence in precision-focused approaches. Continued innovation will shape new treatment possibilities and broaden access to tailored therapy options. - Cell & Gene Therapy:

Cell and gene therapy in the global liver disease therapeutics market will support major advances through regenerative effects and long-term correction of underlying factors. Adoption will expand as technology becomes more refined and availability improves. This segment will guide the shift toward treatments designed to restore healthier liver function.

By Disease Type the market is further divided into:

- Viral Hepatitis (A-E):

Viral hepatitis (A-E) in the global liver disease therapeutics market will continue to drive demand due to persistent global cases and strong need for updated therapies. Treatment strategies will focus on reducing transmission, improving response rates, and expanding access to antiviral options across diverse healthcare systems. - Alcohol-Related Liver Disease (ARLD):

Alcohol-related liver disease in the global liver disease therapeutics market will require expanding therapeutic support as rising cases influence healthcare needs. Treatment efforts will emphasize early detection, supportive medications, and broader management options. Growth in this segment will reflect greater awareness and improved clinical focus on prevention and care. - Metabolic Dysfunction-Associated Steatotic Liver Disease (MASLD) / MASH:

MASLD/MASH in the global liver disease therapeutics market will gain significant attention as lifestyle-linked cases increase worldwide. Therapeutic approaches will aim to slow progression, manage inflammation, and support healthy liver function. Expanding research will drive new solutions to address this growing metabolic disease burden. - Autoimmune Liver Diseases:

Autoimmune liver diseases in the global liver disease therapeutics market will require treatments that control immune response and protect liver tissue. Continued advancement will support improved stability and long-term management. Growing recognition of these conditions will guide development of therapies suited for varied clinical needs. - Genetic & Pediatric Disorders:

Genetic and pediatric disorders in the global liver disease therapeutics market will need solutions designed for early-onset conditions and long-term care. Progress will stem from better understanding of inherited factors and improved diagnostic access. Treatment development will focus on safer options suitable for younger individuals and rare disease profiles. - Other Disease Types:

Other disease types in the global liver disease therapeutics market will include fewer common conditions that still require consistent therapeutic attention. Development will emphasize flexible treatment options and improved support for complex cases. This segment will remain important as healthcare systems aim to address diverse liver-related challenges.

By Treatment Type the global liver disease therapeutics market is divided as:

- Anti-viral Drugs:

Anti-viral drugs in the global liver disease therapeutics market will maintain strong demand as efforts continue to reduce viral impact and improve recovery. Advancements will focus on boosting response rates and enhancing safety. Sustained development will support wider access across different healthcare settings. - Immunosuppressants:

Immunosuppressants in the global liver disease therapeutics market will help control immune-driven damage and support treatment of autoimmune conditions. Growth will reflect the need for reliable, long-term management options. Continued refinement will aim to reduce side effects and strengthen overall treatment effectiveness. - Targeted Therapy & Small Molecules:

Targeted therapy and small molecules in the global liver disease therapeutics market will guide precise treatment approaches that limit unwanted effects. These options will support better control of specific disease pathways and expand access to modern care. Growing clinical interest will push continued adoption. - Chemotherapy Drugs:

Chemotherapy drugs in the global liver disease therapeutics market will remain relevant for malignancy-related liver conditions requiring strong intervention. Development will work toward improving patient tolerance and refining treatment outcomes. This segment will support care where aggressive therapeutic action is necessary. - Antifibrotic/Antisteatotic Agents:

Antifibrotic and antisteatotic agents in the global liver disease therapeutics market will focus on slowing structural damage and supporting healthier liver tissue. Rising demand will reflect growing cases linked to metabolic conditions. Continued research will guide progress toward treatments that help preserve long-term liver function. - Vaccines:

Vaccines in the global liver disease therapeutics market will play a central role in preventing viral infections and reducing global disease burden. Expanding programs will help protect wider populations and lower future healthcare strain. Ongoing development will support stronger immunity and broader distribution. - Immunoglobulins:

Immunoglobulins in the global liver disease therapeutics market will support treatment needs that require immediate immune assistance or targeted immune modulation. Use will expand as clinical reliance grows for managing complex or acute cases. Improved access will reinforce the value of this therapeutic category across diverse patient groups.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$23.4 Billion |

|

Market Size by 2032 |

$41.2 Billion |

|

Growth Rate from 2025 to 2032 |

8.4% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

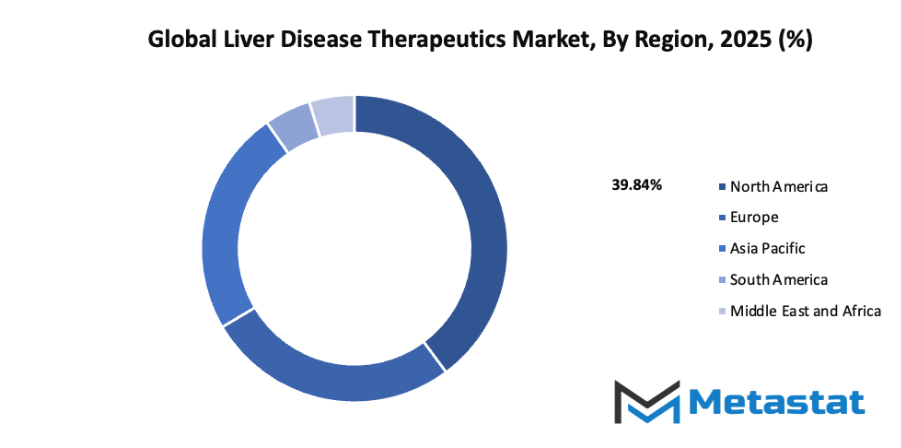

By Region:

- Based on geography, the global liver disease therapeutics market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Market Dynamics

Growth Drivers:

Rising incidence of non-alcoholic fatty liver disease (NAFLD) and viral hepatitis globally:

Higher NAFLD cases and widespread viral hepatitis are creating stronger demand for effective therapies across various care settings. Growing patient numbers push healthcare systems to focus on early intervention and better treatment access, supporting steady expansion of the global liver disease therapeutics market while encouraging continuous improvement in available care options.

Increasing R&D and approvals of novel therapies including antivirals and lipid-modulating agents:

Active research efforts and steady regulatory approvals are helping introduce safer and more targeted liver treatments. Development of antiviral options and lipid-modulating drugs supports improved clinical outcomes and encourages investment from multiple industry participants, strengthening progress linked to the global liver disease therapeutics market and expanding advanced therapy availability.

Restraints & Challenges:

High treatment costs and long development timelines for new liver disease drugs:

Extensive clinical testing requirements and complex regulatory pathways make new drug development slow and costly. Rising expenses limit access for many patients and reduce adoption in resource-limited regions, placing pressure on healthcare budgets and slowing broader progress connected to the global liver disease therapeutics market.

Limited awareness and diagnosis of early liver disease in developing regions:

Early-stage liver damage often goes unnoticed in underserved locations due to limited screening programs and low public understanding. Lack of timely diagnosis delays treatment and reduces overall effectiveness of available therapies, creating barriers to improved outcomes and slowing steady growth of the global liver disease therapeutics market.

Opportunities:

Growing potential for personalized medicine and gene-based therapies in liver diseases:

Advances in genetic testing and tailored treatment design are opening new paths for more accurate and effective liver care. Personalized strategies and gene-oriented solutions hold promise for treating conditions once considered difficult to manage, offering long-term prospects for innovation within the global liver disease therapeutics market and improving treatment precision.

Competitive Landscape & Strategic Insights

The global liver disease therapeutics market reflects strong activity from long-established corporations and newer regional groups seeking wider recognition. Competition continues to grow as research groups and manufacturers expand treatment options and improve product lines. Abbott Laboratories, AbbVie Inc, Astellas Pharma Inc, Alnylam Pharmaceuticals Inc, Bristol-Myers Squibb Co, F Hoffmann-La Roche Ltd, Gilead Sciences Inc, GlaxoSmithKline plc, Merck & Co Inc, Novartis AG, Pfizer Inc, Sanofi SA, Takeda Pharmaceutical Co, Endo International plc, Provectus Biopharmaceuticals Inc, Intercept Pharmaceuticals Inc, Madrigal Pharmaceuticals Inc, Eiger BioPharmaceuticals Inc, Ionis Pharmaceuticals Inc, and Aligos Therapeutics Inc continue to influence market direction through ongoing studies, new approvals, and broader distribution strategies.

Many organizations focus on building treatments that offer steady improvement in patient outcomes while keeping safety standards at the center of development. Strong financial backing supports larger corporations, allowing faster movement from early testing to full commercial release. Smaller groups rely on targeted studies and partnerships to secure space in a field often shaped by large-scale operations. Steady investment encourages broader pipelines, giving hospitals and treatment centers access to a wider set of options.

Competition encourages each participant to strengthen research programs, improve production efficiency, and adjust pricing to meet hospital and clinic needs. Regulatory changes, patent timelines, and supply chain planning also influence long-term progress. Organizations with strong manufacturing systems and reliable distribution networks often gain steady acceptance in new regions. Meanwhile, groups focused on specialized treatments work to demonstrate clear medical value within specific liver conditions, helping build recognition in a crowded market.

Overall growth continues as more health systems seek dependable and affordable treatment paths. With strong scientific interest, growing patient awareness, and consistent investment from both established and emerging contributors, the market maintains forward momentum and encourages continued development across multiple treatment categories.

Forecast & Future Outlook

- Short-Term (1-2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3-5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6-10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 23.4 billion in 2025 to over USD 41.2 billion by 2032. Liver Disease Therapeutics will maintain dominance but face growing competition from emerging formats.

Report Coverage

This research report categorizes the Liver Disease Therapeutics market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Liver Disease Therapeutics market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Liver Disease Therapeutics market.

Liver Disease Therapeutics Market Key Segments:

By Route of Administration

- Oral

- Injectable

By Drug Class

- Small-molecule Orals

- Biologics & Monoclonal Antibodies

- RNA-based Therapeutics

- Cell & Gene Therapy

By Disease Type

- Viral Hepatitis (A-E)

- Alcohol-Related Liver Disease (ARLD)

- Metabolic Dysfunction-Associated Steatotic Liver Disease (MASLD) / MASH

- Autoimmune Liver Diseases

- Genetic & Pediatric Disorders

- Other Disease Types

By Treatment Type

- Anti-viral Drugs

- Immunosuppressants

- Targeted Therapy & Small Molecules

- Chemotherapy Drugs

- Antifibrotic/Antisteatotic Agents

- Vaccines

- Immunoglobulins

Key Global Liver Disease Therapeutics Industry Players

- Abbott Laboratories

- AbbVie Inc

- Astellas Pharma Inc

- Alnylam Pharmaceuticals Inc

- Bristol-Myers Squibb Co

- F Hoffmann-La Roche Ltd

- Gilead Sciences Inc

- GlaxoSmithKline plc

- Merck & Co Inc

- Novartis AG

- Pfizer Inc

- Sanofi SA

- Takeda Pharmaceutical CoEndo International plc

- Provectus Biopharmaceuticals Inc

- Intercept Pharmaceuticals Inc

- Madrigal Pharmaceuticals Inc

- Eiger BioPharmaceuticals Inc

- Ionis Pharmaceuticals Inc

- Aligos Therapeutics Inc

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383