MARKET OVERVIEW

The Global Litigation Funding Investment market embodies the strategic alliance between investors and litigants, forging a unique financial ecosystem where capital infusion becomes a catalyst for legal pursuits. Unlike conventional financial markets, this niche market operates on a premise where investors deploy funds to support legal cases in exchange for a share of the eventual settlement or judgment.

The genesis of this market can be traced back to a fundamental shift in the perception of legal disputes as investable assets. Traditionally, legal battles were seen as adversarial endeavors with costs perceived as liabilities. However, the emergence of the Global Litigation Funding Investment market has turned this paradigm on its head, transforming legal challenges into lucrative investment opportunities.

One of the key drivers propelling the growth of this market is the escalating costs associated with legal proceedings. As legal complexities burgeon and disputes become more protracted, litigants increasingly find themselves facing formidable financial burdens. In this milieu, litigation funding presents a lifeline, enabling parties to navigate the intricate maze of legal processes without succumbing to financial strain.

Furthermore, the global nature of this market underscores its significance on a broad scale. As legal disputes transcend borders, the Global Litigation Funding Investment market has become a pivotal player in fostering cross-border collaboration. Investors, irrespective of their geographical location, now have the means to participate in legal cases worldwide, fostering a more interconnected and globalized legal finance landscape.

The dynamics of the Global Litigation Funding Investment market also reflect a nuanced understanding of risk and reward. Investors, armed with a thorough assessment of legal merits, evaluate cases as potential investment opportunities. This not only introduces an element of financial acumen into legal proceedings but also incentivizes a more rigorous scrutiny of the merits of each case, contributing to the overall efficiency and transparency of the legal system.

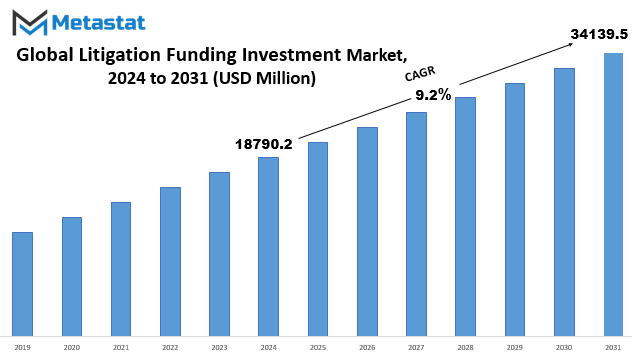

Global Litigation Funding Investment market is estimated to reach $34139.5 Million by 2031; growing at a CAGR of 9.2% from 2024 to 2031.

GROWTH FACTORS

In litigation funding investment, several factors contribute to its growth and sustained development. One pivotal aspect is the increasing awareness and acceptance of litigation funding as a viable financial strategy. As more individuals and businesses recognize its benefits, the demand for such funding solutions rises, propelling market growth.

Economic conditions also play a crucial role in shaping the landscape of litigation funding investments. During periods of economic uncertainty or downturns, individuals and businesses may face financial constraints, leading them to explore alternative means of funding their legal endeavors. Litigation funding emerges as a practical option, offering financial support without the immediate burden of upfront costs.

Furthermore, the evolving legal landscape contributes to the expansion of the litigation funding market. Changes in regulations and legal frameworks can impact the accessibility and acceptance of litigation funding, influencing its prevalence in different jurisdictions. A legal environment that fosters and supports litigation funding activities creates a conducive atmosphere for market growth.

The role of institutional investors cannot be understated in the growth of the litigation funding investment market. As institutional investors increasingly recognize the potential returns and risk mitigation offered by litigation funding, they actively participate in this market. Their involvement brings a level of credibility and stability, attracting more participants and further fueling market expansion.

Technology also plays a pivotal role in the growth of the litigation funding investment market. The digitization of legal processes and the availability of data analytics tools enable investors to make more informed decisions. This increased transparency and efficiency contributes to the overall attractiveness of litigation funding as an investment avenue.

The growth of the litigation funding investment market is multifaceted, driven by factors such as increasing awareness, economic conditions, legal developments, institutional investor participation, and technological advancements. As these elements continue to shape the landscape, the litigation funding market is poised for sustained expansion in the foreseeable future.

MARKET SEGMENTATION

By Type

The Litigation Funding Investment Market is a multifaceted landscape, with various segments shaping its dynamics. One of the pivotal elements contributing to its complexity is the diverse range of types within this market.

Commercial Litigation stands out as a significant player, boasting a valuation of 8250.2 USD Million in the year 2022. This segment, marked by legal disputes involving businesses, reflects the intricate web of financial stakes and legal nuances inherent in the corporate world.

Another noteworthy player in the Litigation Funding Investment Market is the Bankruptcy Claim segment, which held a value of 3405.3 USD Million in 2022. This facet of litigation funding revolves around financial claims arising from bankruptcy proceedings, offering investors a unique avenue to navigate the legal intricacies surrounding financial insolvency.

The International Arbitration segment, valued at 2683.6 USD Million in 2022, introduces a global dimension to the market. It encompasses funding for legal disputes that transcend national borders, showcasing the market’s adaptability to the challenges posed by the international legal landscape.

Personal Injury, with a valuation of 1622.5 USD Million in 2022, represents another key domain within the Litigation Funding Investment Market. This segment focuses on providing financial support to individuals seeking legal recourse for personal injuries, offering a crucial lifeline in navigating the complexities of personal injury litigation.

The Litigation Funding Investment Market, characterized by its diverse segments such as Commercial Litigation, Bankruptcy Claim, International Arbitration, and Personal Injury, exemplifies the multifaceted nature of the legal and financial domains it encompasses. Each segment, with its unique set of challenges and opportunities, contributes to the overall tapestry of the market, reflecting the dynamic interplay between legal proceedings and financial investments.

By Enterprise Size

In the Litigation Funding Investment Market, the segmentation by enterprise size plays a pivotal role in understanding the market dynamics. The market is broadly classified into Micro, Small, and Medium Enterprises (MSMEs) and Large Enterprises.

In 2022, the MSMEs segment held a significant value of 5834.9 USD Million. This highlights the substantial contribution of smaller and medium-sized enterprises to the litigation funding investment market. These enterprises, though smaller in scale, play a crucial role in shaping the market landscape.

On the other hand, the Large Enterprises segment boasted a valuation of 10126.6 USD Million in the same year. This substantial figure emphasizes the substantial financial involvement of larger enterprises in the litigation funding sector. Large enterprises, with their expansive resources and capabilities, contribute significantly to the overall market size and influence its trajectory.

The distinct values associated with each enterprise size segment underscore the diverse nature of participants in the litigation funding investment market. From the smaller players, bringing agility and innovation, to the larger entities, contributing financial might and stability, the market encapsulates a spectrum of businesses. This segmentation provides a nuanced understanding of how enterprises of different sizes contribute to and navigate the complexities of the litigation funding investment landscape.

In this market segmentation, it becomes evident that the dynamics are not solely influenced by the sheer size of enterprises but also by the strategies, adaptability, and resilience displayed by each category. The interplay between MSMEs and Large Enterprises creates a dynamic ecosystem, where each participant, irrespective of size, plays a vital role in shaping the overall narrative of the Litigation Funding Investment Market.

The Litigation Funding Investment Market, categorized by enterprise size, showcases the intricate interplay between Micro, Small, and Medium Enterprises (MSMEs) and Large Enterprises. The market’s landscape is shaped by the distinctive values associated with each segment, highlighting the diverse contributions of businesses of varying sizes. This segmentation approach provides a comprehensive perspective, allowing stakeholders to discern the varied dynamics and appreciate the multifaceted nature of the litigation funding investment domain.

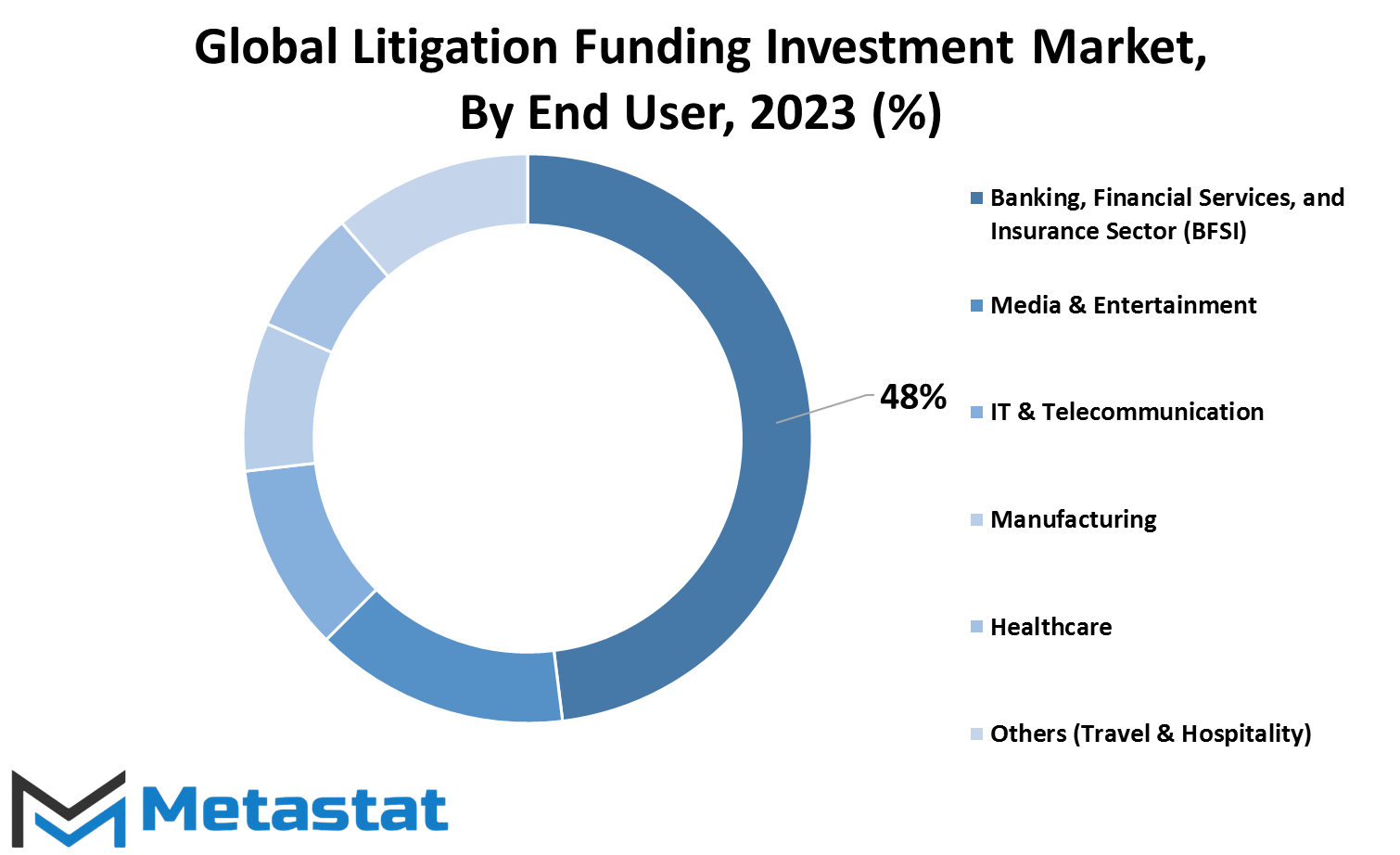

By End User

The Litigation Funding Investment Market is a dynamic landscape with various sectors contributing to its growth. One of the key divisions within this market is based on end-users, catering to the unique needs of different industries.

The Banking, Financial Services, and Insurance Sector (BFSI) stand as prominent players in the Litigation Funding Investment Market. These institutions recognize the importance of financial support when it comes to legal matters. Whether it’s resolving disputes or navigating complex legal issues, the BFSI sector finds value in litigation funding to ensure smooth financial operations.

Media & Entertainment is another significant end-user in this market. In an industry driven by creativity and innovation, legal challenges are not uncommon. Litigation funding provides a financial cushion for media and entertainment companies, allowing them to focus on producing quality content without being hindered by legal hurdles.

The IT & Telecommunication sector, being a cornerstone of the modern business landscape, also benefits from litigation funding. As technology advances, legal complexities often arise. Litigation funding offers a strategic approach for companies in this sector to manage legal challenges while sustaining their technological innovations.

Manufacturing, a sector deeply rooted in production and supply chains, is not exempt from legal disputes. Litigation funding becomes a valuable resource for manufacturers, helping them navigate legal obstacles and maintain operational efficiency.

In the Healthcare industry, where regulatory compliance is paramount, litigation funding plays a crucial role. It enables healthcare organizations to address legal issues promptly, ensuring the continued delivery of quality healthcare services.

The category of others encompasses diverse industries, including Travel & Hospitality. In an industry reliant on positive customer experiences, litigation funding supports companies dealing with legal issues, allowing them to focus on providing exceptional services to travelers.

The Litigation Funding Investment Market caters to a spectrum of industries, acknowledging the unique challenges each sector faces. From BFSI to Media & Entertainment, IT & Telecommunication, Manufacturing, Healthcare, and beyond, litigation funding serves as a strategic financial tool, empowering businesses to overcome legal hurdles and thrive in their respective domains.

REGIONAL ANALYSIS

The global Litigation Funding Investment market is categorized geographically into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. This division helps in analyzing and understanding the market dynamics in different regions across the world.

North America represents a significant portion of the Litigation Funding Investment market, boasting a well-established legal framework and a robust financial ecosystem. The region's prominence is further emphasized by its advanced technological infrastructure and a mature legal services sector.

In Europe, the Litigation Funding Investment market showcases a diverse landscape. Various countries with distinct legal systems contribute to the overall dynamics of the market. The region benefits from a rich history of legal precedence, influencing the market trends and investment strategies.

Asia-Pacific emerges as a dynamic player in the Litigation Funding Investment market. The diverse legal frameworks and evolving regulatory environments in countries like China and India create both challenges and opportunities for investors. The region's economic growth and increasing legal awareness contribute to the market's expansion.

South America, with its unique legal landscape, is becoming a notable player in the Litigation Funding Investment market. The region's developing economies and ongoing legal reforms present an evolving scenario for investors, adding an element of dynamism to the market.

The Middle East & Africa exhibit their own distinct characteristics in the Litigation Funding Investment market. The legal landscape is shaped by a combination of traditional legal systems and modern influences. This diversity adds a layer of complexity and opportunity for those looking to invest in the region.

The global Litigation Funding Investment market's geographical segmentation provides a comprehensive view of its dynamics. Each region brings its own set of opportunities and challenges, making it imperative for investors to understand the nuances of the legal and financial landscapes to make informed decisions.

COMPETITIVE PLAYERS

In the Litigation Funding Investment market, various key players play a pivotal role in shaping the industry's competitive landscape. These players contribute significantly to the evolution and growth of the market, providing funding solutions that support legal actions.

Among the prominent entities in this arena are Parabellum Capital LLC, Brickell Key Asset Management Limited, Burford Capital LLC, Woodsford Group Ltd., Apex Litigation Finance Ltd, Omni Bridgeway, Vannin Capital, Augusta Ventures, Longford Capital Management LP, Calunius Capital LLP., and Harbour Litigation Funding Ltd. Each of these firms brings its unique strengths and strategies to the table, contributing to the overall dynamism of the litigation funding space.

Parabellum Capital LLC, for instance, is known for its innovative approach and strategic investments, while Brickell Key Asset Management Limited boasts a track record of effective asset management in the litigation funding domain. Burford Capital LLC is recognized for its comprehensive legal finance solutions, and Woodsford Group Ltd. brings a wealth of experience in assessing and supporting legal claims.

Apex Litigation Finance Ltd is another significant player, offering financial support tailored to the needs of litigants. Omni Bridgeway, with its global presence, plays a crucial role in expanding the reach and impact of litigation funding. Vannin Capital, Augusta Ventures, and Longford Capital Management LP each contribute to the market's competitiveness through their specialized expertise and commitment to supporting legal endeavors.

Calunius Capital LLP. and Harbour Litigation Funding Ltd. round out the list of influential players, each adding its unique perspective and resources to the litigation funding landscape. These firms collectively contribute to the vibrancy and competitiveness of the market, facilitating access to justice and ensuring that meritorious legal claims receive the necessary financial backing.

The Litigation Funding Investment market is shaped and driven by a diverse set of key players. Their unique strengths, strategies, and contributions collectively define the competitive dynamics of this evolving industry, creating a space where financial support aligns with legal endeavors, fostering a robust and dynamic environment for litigants and investors alike.

Litigation Funding Investment Market Key Segments:

By Type

- Commercial Litigation

- Bankruptcy Claim

- International Arbitration

- Personal Injury

By Enterprise Size

- Micro, Small, and Medium Enterprises (MSMEs)

- Large enterprises

By End User

- Banking, Financial Services, and Insurance Sector (BFSI)

- Media & Entertainment

- IT & Telecommunication

- Manufacturing

- Healthcare

- Others (Travel & Hospitality)

Key Global Litigation Funding Investment Industry Players

- Parabellum Capital LLC

- Brickell Key Asset Management Limited

- Burford Capital LLC

- Woodsford Group Ltd.

- Apex Litigation Finance Ltd

- Omni Bridgeway

- Vannin Capital

- Augusta Ventures

- Longford Capital Management LP

- Calunius Capital LLP.

- Harbour Litigation Funding Ltd

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383