Global Iron and Steel Slag Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global iron and steel slag market will transcend its traditional realm as it enters a new era in which by-products will no longer be viewed as second-class outputs but as assets for various uses. Previously dealt with in a limited capacity, slag will come into the spotlight as industries find new uses for incorporating slag into business that goes far beyond construction and highway construction. Upcoming innovations will showcase how this material can contribute to environmental solutions, ranging from conditioning soils to lowering carbon footprints in production processes. In the process, it will spread its influence into industries where sustainability is becoming increasingly not an option but a necessary requirement.

While global eyes remain focused on efficiency and optimizing resources, the global iron and steel slag market will have opportunities to explore renewable energy, agriculture, and water treatment. The versatility of slag will provide researchers and industries with the option to experiment with using it in new ways to minimize waste and maximize eco-friendly production. Such guidance will bring about a situation in which slag is no longer solely associated with heavy industry application but also ventures into areas that have a direct impact on daily life.

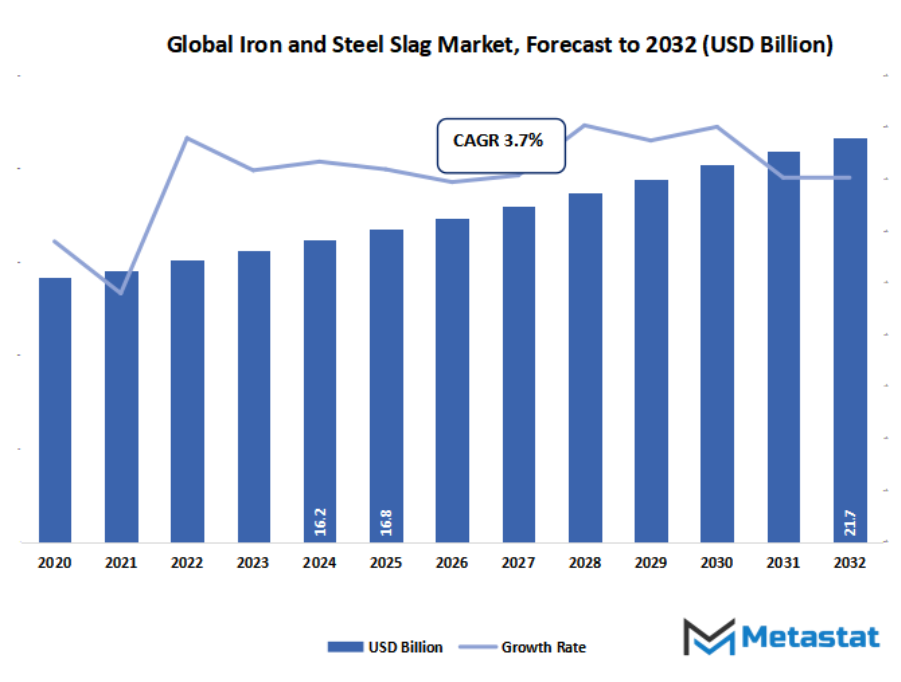

- global iron and steel slag market valued at approximately USD 16.8 billion in 2025, growing at a CAGR of around 3.7% through 2032, with potential to exceed USD 21.7 billion.

- Blast Furnace Slag account for nearly 53.7% market share, driving innovation and expanding applications through intense research.

- Key trends driving growth: Growing demand for sustainable construction materials and infrastructure development., Increasing production of steel globally, leading to higher slag availability.

- Opportunities include: Development of advanced processing technologies to convert slag into high-value products like synthetic aggregates and cementitious materials.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

The global iron and steel slag market had its basis in the course of the early levels of industrialization, whilst waste cloth from steelmaking began to attract attention for creation uses. From being dealt with as a byproduct with constrained value, it step by step turned into a inventive cloth, supported via experiments and growing commercial adoption.

An important milestone came when slag started being utilized in cement and street production, including energy and sturdiness to infrastructure. Over time, studies proved its environmental blessings via decreasing reliance on herbal aggregates. Recognition via authorities and standardization efforts marked defining moments, setting the direction for large commercial recognition global.

Consumer needs have shifted regularly closer to sustainable and fee-efficient constructing materials. Construction industries started out favouring slag for its durability and strength-saving capacity. The market adjusted to these expectations through expanding packages, turning patron options right into a motive force on the way to continue shaping destiny demand in infrastructure growth.

Advancements in processing technology progressed slag’s first-class and increased its uses throughout cement, fertilizers, and avenue engineering. These improvements decreased waste and greater performance. The market will maintain to advantage from technology, as future trends are predicted to open new commercial avenues and create large-scale packages.

Regulations encouraging recycling and sustainable practices inspired how industries considered slag. By framing policies around waste discount and circular economic system fashions, governments reinforced slag’s function as a resource. The global iron and steel slag market will maintain aligning with those standards, making sure compliance while supporting environmental priorities across extraordinary regions.

Market Segments

The global iron and steel slag market is mainly classified based on Type, Application.

By Type is further segmented into:

- Blast Furnace Slag - Blast furnace slag will continue to pick up momentum as industries pursue environmentally friendly alternatives in construction and cement manufacturing. The future will witness sophisticated processing techniques that improve endurance, minimize energy requirements, and restrict waste. The global iron and steel slag market will be dependent on blast furnace slag for environmentally friendly infrastructure development.

- Steelmaking Slag - Steelmaking slag will retain its value as recycling and resource efficiency gain international significance. Breakthroughs will make it possible for this slag to be processed into high-performance products beneficial to multiple industries. The market will grow more and more into converting steelmaking slag into solutions that minimize reliance on conventional raw materials.

- Other - Other types of slag will form new opportunities in which the science finds specialty uses. Possibilities in the future will involve smelting techniques that convert underutilized slag into feedstock for green technology. The global iron and steel slag market will become diversified as such alternative slags yield other economic and environmental benefits.

By Application the market is divided into:

- Building/Construction - Construction will be the future trend where slag will play a critical role in the production of sustainable concrete and cement. It will be necessary to boost strength while conserving the environment. The global iron and steel slag market will merge with construction techniques that promote greener, more long-lasting infrastructure globally.

- Railways - Railway construction will increasingly use slag as track ballast and foundation reinforcement. Its durability will underpin high-speed rail construction on growing networks. The market will gain as governments invest in new transportation, and materials based on slag will become a preferred option for long-term railway stability.

- Fertilizers - The use of slag in fertilizers will increase as agriculture will require environmentally friendly soil enrichment. New technologies will release nutrients that will enhance crop yields while preserving sustainability. The market will become closer to agriculture by transforming by-products into means for future food security.

- Metallurgical - Metallurgical uses will remain vital, where slag supports refining processes and recovery of valuable materials. With growing focus on efficiency, advanced systems will maximize slag’s role in metallurgical innovation. The market will advance toward reducing waste while optimizing metal production in upcoming decades.

- Other - Other uses will open up as technology continues to seek new purposes for slag in emerging industries. Energy storage, road construction, and restoring the environment will become long-term opportunities. The global iron and steel slag market will branch out into non-conventional areas, demonstrating its flexibility in a dynamic industrial future.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$16.8 Billion |

|

Market Size by 2032 |

$21.7 Billion |

|

Growth Rate from 2025 to 2032 |

3.7% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

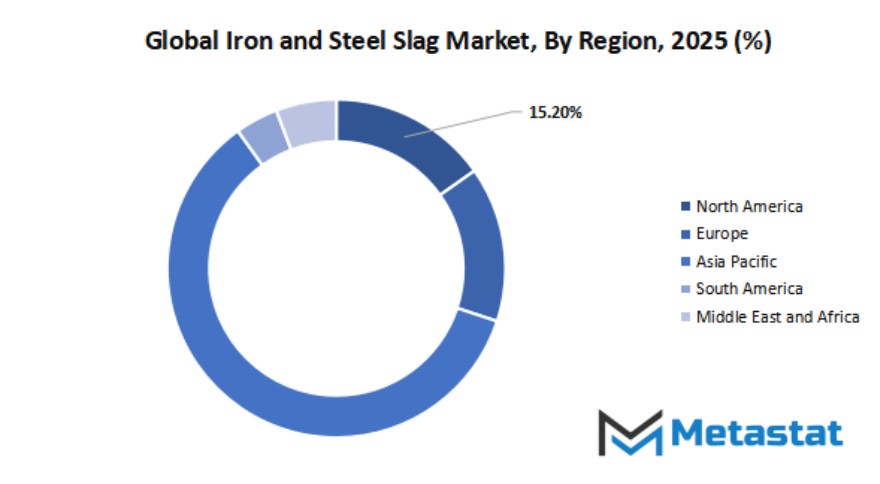

- Based on geography, the global iron and steel slag market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

Growing demand for sustainable construction materials and infrastructure development. - The global iron and steel slag market will see growth as construction sectors across the globe seek green alternatives to conventional raw materials. Slag will find increased use on roads, cement manufacturing, and mega infrastructure projects as it minimizes carbon footprints. Governments in the future will enact policies that promote sustainable construction.

Increasing production of steel globally, leading to higher slag availability. - Increasing steel production in industrialized countries and emerging economies will proportionally boost the availability of slag. As steel continues to be the foundation of urbanization, automotive, and manufacturing industry, the market will have a continuous supply of raw material. This will guarantee a constant supply and aid downstream uses.

Challenges and Opportunities

Environmental concerns related to slag disposal and heavy metal content. - The market will continue to experience environmental pressure from the dangers of inappropriate slag disposal. Fears of heavy metal leaching into water and soil will promote stronger regulations. This will be challenging but also compel industries to have safer, more environmentally friendly methods of disposal and reuse.

Variability in slag quality affecting its suitability for specific applications. - The global iron and steel slag market will be impacted by unpredictable slag composition that lessens dependability in end-user industries. Property variations make it inappropriate for some high-performance uses. Subsequent research and standardization programs will be focused on reducing such variations to global quality standards.

Opportunities

Development of advanced processing technologies to convert slag into high-value products like synthetic aggregates and cementitious materials. - Technological advancement will redefine the global iron and steel slag market by freeing up more valuable applications. Sophisticated processing strategies will make it feasible to transform slag into synthetic aggregates, extra cementitious materials, and environmentally friendly production merchandise. This change will no longer handiest lower wastage however will also provide moneymaking possibilities for industries which might be sustainability orientated.

Competitive Landscape & Strategic Insights

The global iron and steel slag market is stimulated through a mixture of well-mounted international corporations and emerging nearby gamers, setting up a various and dynamic competitive environment. Slag, being a by-product of the steel manufacturing procedure, has been historically applied during construction, agriculture, and different industrial makes use of. Its adaptability and increasing use throughout industries has made it a incredibly useful material, and this has drawn both mounted industry leaders and more recent entrants looking to make their mark. With industries globally nevertheless seeking out low priced and environmentally pleasant resources of deliver, the demand for iron and metallic slag will continue to be monstrous.

Multinational giants command the lion's share of the marketplace primarily based on production volumes, excessive generation, and international networks. Firms like ArcelorMittal, POSCO, Nippon Steel Corporation, Tata Steel, and China Baowu Steel Group also are valuable to organising enterprise requirements and preserving constant deliver chains. These corporations have a record of manufacturing steel for many years, and their capacity makes them well-proper to system and market slag on a worldwide scale. Their potential for innovation in reusing and recycling slag also will increase their position inside the enterprise, wherein they can satisfy increasing expectations of sustainable operations.

Besides those international leaders, there are corporations at the local stage supplying substantial contributions to the marketplace. Companies such as Steel Authority of India Limited, JSW Steel, and JFE Steel Corporation are building their presence by way of filling home and regional demand, as well as in addition achieving into global markets. Their processes generally tend to rely upon synthesis between nearby knowledge and aggressive pricing, Likewise, firms like United States Steel Corporation, Thyssenkrupp AG, and Voestalpine AG are based in their own regions and thus contribute to global supply while having specialized knowledge.

The mixture of global giants and local competitors guarantees that the global iron and steel slag market will keep expanding in a harmonized manner. The bigger companies introduce stability and innovation, while the smaller and local companies introduce flexibility and flexibility into the market. This equilibrium not only fortifies the general framework of the industry but also promotes healthy competition that accrues to customers in various industries. Since both groups are heavily investing in expansion, research, and ecologically friendly practices, the market will continue to change in directions that favour industry requirements and meet the world's demand for sustainability.

Market size is forecast to rise from USD 16.8 billion in 2025 to over USD 21.7 billion by 2032. Iron and Steel Slag will maintain dominance but face growing competition from emerging formats.

The global iron and steel slag market may also be geographically extended, with rising economies finding new and innovative methods to utilize slag for infrastructure at the same time as excessive-earnings nations look for eco-friendlier substances to preserve tempo with stringent legal guidelines. This convergence of call for will an increasing number of reshape the notion of slag from its status as a by-product to that of a vital contributor to sustainable improvement efforts. More than its boundaries set by means of traditional uses, the market can be a beacon of the way redefining assets can release possibilities formerly assumed beyond its reach.

Report Coverage

This research report categorizes the global iron and steel slag market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global iron and steel slag market.

Iron and Steel Slag Market Key Segments:

By Type

- Blast Furnace Slag

- Steelmaking Slag

- Other

By Application

- Building/Construction

- Railways

- Fertilizers

- Metallurgical

- Other

Key Global Iron and Steel Slag Industry Players

- ArcelorMittal

- POSCO

- Nippon Steel Corporation

- Tata Steel

- China Baowu Steel Group

- JFE Steel Corporation

- Steel Authority of India Limited

- JSW Steel

- United States Steel Corporation

- Thyssenkrupp AG

- Voestalpine AG

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252