MARKET OVERVIEW

The India Pressure Cooker market has witnessed a fascinating trajectory, deeply embedded in the culinary culture of the country. This essential kitchen appliance has transcended its functional utility to become an emblematic fixture in Indian households. From the bustling streets of Delhi to the serene villages of Kerala, the pressure cooker stands as a symbol of efficiency and convenience.

In the diverse tapestry of Indian cuisine, where flavors dance with complexity, the pressure cooker emerges as a stalwart companion. Its significance goes beyond the mundane act of cooking; it represents a seamless fusion of tradition and modernity. The rhythmic hiss of steam escaping the pressure cooker has become a reassuring melody, echoing across the kitchens of millions.

The Indian market for pressure cookers is not a mere aggregation of products but a reflection of the diverse preferences and culinary practices that span the length and breadth of the nation. From the compact kitchens of urban apartments to the sprawling setups in rural households, pressure cookers have found their place, adapting to the unique needs of each setting.

This market is not just about metal vessel and rubber gaskets; it’s a testament to innovation. As the demands of the modern consumer evolve, pressure cookers have metamorphosed into sophisticated appliances equipped with advanced features. Digital controls, safety mechanisms, and energy-efficient designs are seamlessly integrated into these culinary workhorses, ensuring they keep pace with the dynamic lifestyle of today’s Indian consumer.

Moreover, the market has seen a surge in eco-conscious designs, with manufacturers increasingly focusing on sustainability. Materials are carefully chosen, and production processes are streamlined to minimize environmental impact. This reflects a growing awareness among both manufacturers and consumers about the need for responsible and sustainable practices.

The India Pressure Cooker market is not just about meeting functional needs; it is a vibrant ecosystem where tradition meets innovation, where utility meets aesthetics. From the aromatic biryanis of Lucknow to the spicy curries of Chennai, pressure cookers have become an integral part of the gastronomic narrative, shaping the way India cooks and savors its diverse culinary delights. In the heart of this market, lies not just an appliance, but a cultural artifact that binds generations, bridging the gap between tradition and modernity in the Indian kitchen.

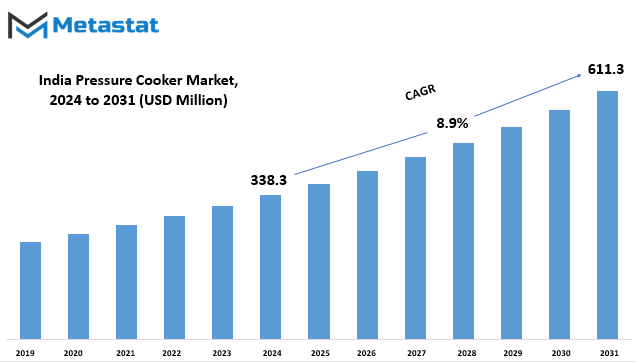

India Pressure Cooker market is estimated to reach $611.3 Million by 2031; growing at a CAGR of 8.9% from 2024 to 2031.

GROWTH FACTORS

The India Pressure Cooker market experiences various growth factors that significantly contribute to its development. These factors play a crucial role in shaping the market landscape and determining its trajectory. On the flip side, there are certain challenges that pose potential obstacles to the market's growth. Despite these hurdles, there are promising opportunities that await the market in the upcoming years.

To delve into the growth factors, it's essential to highlight the elements that propel the India Pressure Cooker market forward. One of the prominent driving forces is the increasing demand for efficient and time-saving cooking solutions. As more individuals seek convenient ways to prepare meals in today's fast-paced lifestyle, pressure cookers have become a go-to kitchen appliance. The ability to cook food swiftly while retaining its nutritional value positions pressure cookers as an indispensable tool in modern kitchens.

Furthermore, the market benefits from technological advancements in pressure cooker design and functionality. Manufacturers continually innovate to enhance user experience, incorporating features that make cooking more convenient and enjoyable. This innovation not only attracts existing users but also expands the market by enticing new consumers who value efficiency and modernity in their kitchen appliances.

While growth factors contribute positively to the market's advancement, it's crucial to acknowledge the challenges that may impede this progress. Factors like economic fluctuations and raw material price volatility can pose significant obstacles to the market's stability and growth. Economic uncertainties may impact consumer purchasing power, affecting their willingness to invest in non-essential items like pressure cookers. Likewise, fluctuations in raw material prices can lead to increased production costs, subsequently affecting product pricing and consumer affordability.

Despite these challenges, the market remains resilient, with potential opportunities waiting on the horizon. One such opportunity lies in the increasing awareness of sustainable and eco-friendly consumer choices. As environmental consciousness grows, there is a rising demand for kitchen appliances that align with eco-friendly practices. Manufacturers embracing sustainable production processes and materials can tap into this evolving consumer preference, presenting a lucrative avenue for market growth.

MARKET SEGMENTATION

By Material

The Indian Pressure Cooker market is a dynamic landscape, shaped by various factors that influence consumer choices and market trends. One key aspect that defines the market is the choice of materials used in manufacturing these kitchen essentials.

In 2022, the market witnessed a significant presence of Stainless-Steel pressure cookers. Valued at 200 USD Million, this segment showed a robust demand. Stainless Steel, known for its durability and resistance to corrosion, appealed to consumers seeking a long-lasting and reliable cooking companion.

However, Aluminum pressure cookers also had a notable presence, accounting for 84.9 USD Million in the same year. The Aluminum segment attracted consumers with its lightweight nature and efficient heat conductivity. While not as durable as stainless steel, aluminum pressure cookers found favor among those looking for a more affordable and manageable option.

The diversification of materials in the Pressure Cooker market reflects the varied preferences and needs of consumers. Stainless Steel caters to those prioritizing durability, willing to invest in a product that stands the test of time. In contrast, Aluminum appeals to a different demographic, offering a lighter and cost-effective alternative without compromising on functionality.

Consumer choice, therefore, plays a pivotal role in shaping the trajectory of the Pressure Cooker market. As individuals weigh the importance of durability, cost, and performance, manufacturers respond by providing options that align with these diverse preferences. This interplay between consumer demand and market offerings underscores the dynamic nature of the Indian Pressure Cooker market, where the choice of material becomes a crucial factor influencing the purchasing decisions of households across the country.

By Type

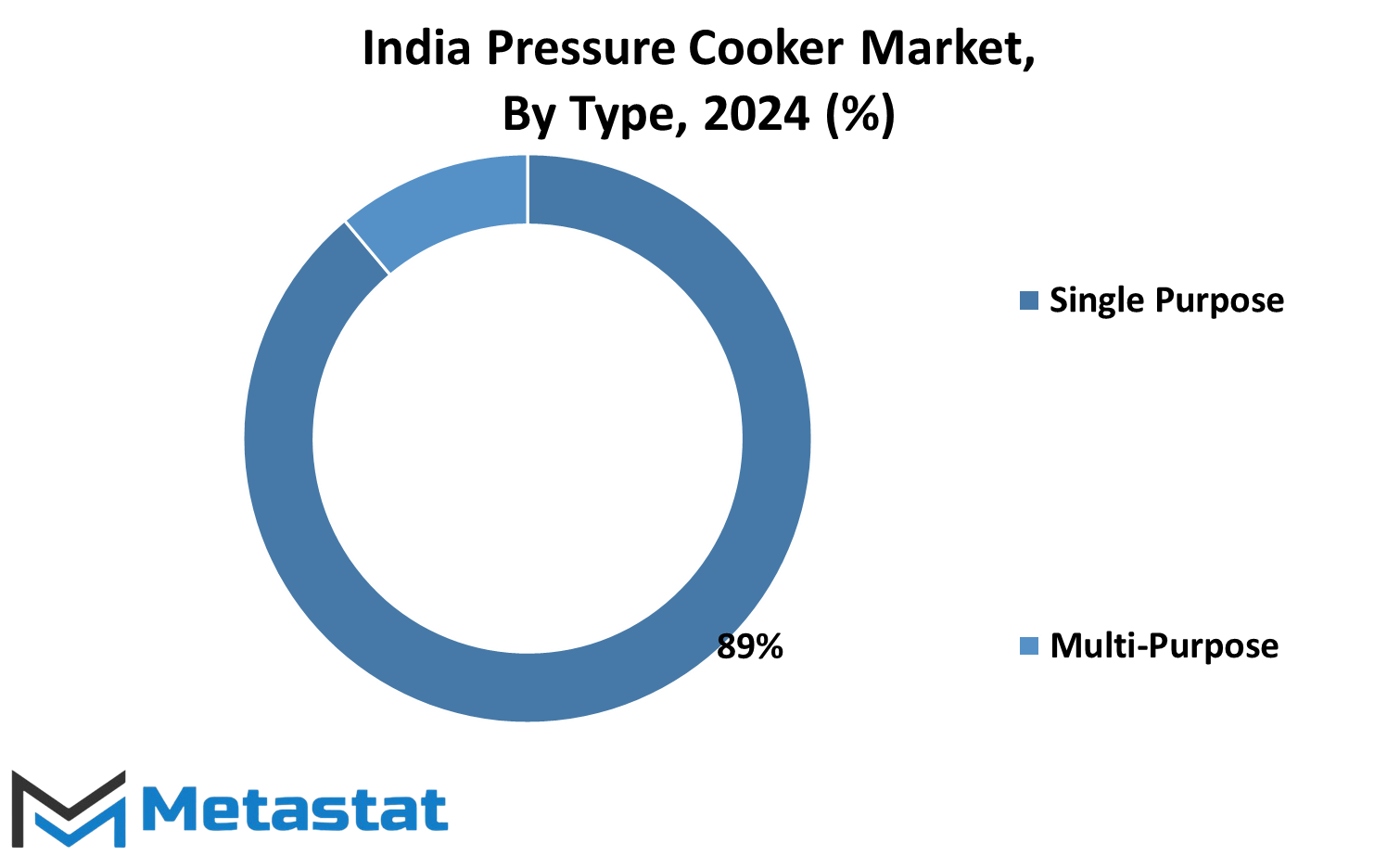

The Indian Pressure Cooker market can be broadly categorized into two types: Single Purpose and Multi-Purpose. This classification provides a convenient way to understand the diverse range of pressure cookers available in the market. By segmenting them into these two categories, consumers can make more informed choices based on their specific needs and preferences.

The Single Purpose pressure cookers are designed for specific cooking tasks, emphasizing simplicity and efficiency. These cookers cater to individuals who prefer a straightforward approach in their kitchen, focusing on a particular cooking function without the need for additional features. For those who value specialized performance, these single-purpose pressure cookers offer a targeted solution.

However, the multi-Purpose pressure cookers are crafted to accommodate various cooking requirements. These versatile appliances come equipped with a range of features, allowing users to explore diverse cooking techniques within a single appliance. The emphasis here is on flexibility and adaptability, providing a comprehensive solution for individuals who enjoy experimenting with different recipes and cooking styles.

The market's division into Single Purpose and Multi-Purpose categories not only simplifies the decision-making process for consumers but also reflects the industry's responsiveness to diverse consumer needs. This segmentation acknowledges the varying preferences in the market, offering a tailored approach to those who seek efficiency and simplicity as well as those who value versatility and experimentation.

The Indian Pressure Cooker market's classification into Single Purpose and Multi-Purpose types serves as a practical guide for consumers navigating the plethora of options available. This straightforward categorization allows individuals to align their purchase decisions with their specific cooking requirements, ensuring a more satisfying and tailored culinary experience.

By Capacity

In the India Pressure Cooker market, an insightful breakdown by capacity unveils distinct segments, each with its unique market value. The 1-2 Liters category, a compact but significant space, held a value of 87.7 USD Million in the year 2022. This segment caters to the needs of individuals and small families, offering a practical solution for daily cooking requirements.

Moving up the capacity spectrum, the 2-5 Liters segment emerged as a substantial player, boasting a market value of 132.6 USD Million in 2022. This range caters to a broader consumer base, accommodating larger households and those who prefer to cook in larger batches. The versatility of the 2-5 Liters category positions it as a popular choice in the market.

In the middle ground, the 5-8 Liters segment carved its space with a market value of 49.2 USD Million in 2022. This capacity range strikes a balance between accommodating moderate to large quantities of food, making it suitable for diverse cooking needs. The 5-8 Liters segment reflects the market's responsiveness to varying consumer demands.

Stepping into the realm of larger capacities, the Above 8 Liters segment, though comparatively smaller, held a value of 15.4 USD Million in 2022. This category is tailored for those with substantial cooking requirements, such as catering services or larger gatherings. While it may not command the largest market share, the Above 8 Liters segment plays a niche role in meeting specific user needs.

The capacity-based segmentation of the India Pressure Cooker market provides a nuanced understanding of consumer preferences. From compact and efficient solutions for individuals to larger capacities catering to diverse cooking demands, the market's offerings align with the varied needs of consumers. This segmentation not only reflects the diversity in product preferences but also highlights the industry's adaptability to the dynamic demands of the consumer base.

By Application

The Indian Pressure Cooker market exhibits a notable segmentation based on its diverse applications. Two prominent categories that define this market are the Household and Commercial segments. Each of these segments holds a distinct value, reflecting their significance in the overall market landscape.

Starting with the Household segment, it was appraised at 248.2 USD Million in the year 2022. This segment encapsulates the pressure cookers used in domestic settings, emphasizing their prevalence and importance in everyday households across the country. The substantial valuation underscores the widespread adoption of pressure cookers as indispensable kitchen appliances for individual consumers and families alike.

On the other hand, the Commercial segment carries its own weight in the market, boasting a valuation of 36.8 USD Million in the same year. This category encompasses pressure cookers utilized in commercial establishments such as restaurants, catering services, and other food-related businesses. The distinct value assigned to the Commercial segment highlights the demand for durable and efficient pressure cookers in professional kitchens, where large-scale cooking is a routine necessity.

The segmentation of the Indian Pressure Cooker market into these two key categories provides a nuanced understanding of its dynamics. It reflects not only the consumer-driven demand for reliable and versatile cooking solutions at home but also the robust requirements of the commercial sector. As households seek efficient kitchen appliances for daily use, businesses in the food industry require specialized equipment to meet their high-volume cooking needs.

COMPETITIVE PLAYERS

The Pressure Cooker market in India boasts a competitive landscape with several key players vying for market share. Leading the pack is Hawkins Cookers Limited, a renowned player in the industry known for its quality products. TTK Prestige Limited is another notable contender, making a significant impact with its range of pressure cookers. Butterfly Gandhimathi Appliances Limited and Bajaj Electricals Limited also contribute to the competitive dynamic, offering diverse options to consumers.

Stovekraft Limited, a player with a strong market presence, competes actively in this space. Vinod Cookware and Wonderchef Home Appliances Pvt. Ltd. further enrich the market with their offerings, providing consumers with a variety of choices. Elgi Ultra PVT LTD and Sunflame Enterprises Private Limited also play pivotal roles in the competitive landscape, each bringing their unique strengths to the table.

Preethi Kitchen Appliances Pvt. Ltd., Jaipan Industries Limited, and United Metalik Private Limited are additional contenders, contributing to the overall vibrancy of the Pressure Cooker market. The Bergner Group, Stahl Kitchens, and Hamilton Housewares Pvt. Ltd. add further diversity, each carving a niche with its distinctive product offerings.

As these competitive players navigate the Indian Pressure Cooker market, the industry experiences a healthy level of rivalry. Each company strives to differentiate itself, whether through product innovation, quality enhancements, or strategic marketing initiatives. The collective efforts of these key players contribute to the growth and dynamism of the Pressure Cooker market in India, providing consumers with a wide array of choices to meet their diverse cooking needs.

India Pressure Cooker Market Key Segments:

By Material

- Stainless Steel

- Aluminum

By Type

- Single Purpose

- Multi-Purpose

By Capacity

- 1-2 Liters

- 2-5 Liters

- 5-8 Liters

- Above 8 Liters

By Application

- Household

- Commercial

Key India Pressure Cooker Industry Players

- Hawkins Cookers Limited

- TTK Prestige Limited

- Butterfly Gandhimathi Appliances Limited

- Bajaj Electricals Limited

- Stovekraft Limited

- Vinod Cookware

- Wonderchef Home Appliances Pvt. Ltd.

- Elgi Ultra PVT LTD

- Sunflame Enterprises Private Limited

- Preethi Kitchen Appliances Pvt. Ltd.

- Jaipan Industries Limited

- United Metalik Private Limited

- Bergner Group

- Stahl Kitchens

- Hamilton Housewares Pvt. Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252