Global Immunochemistry Analyzers Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

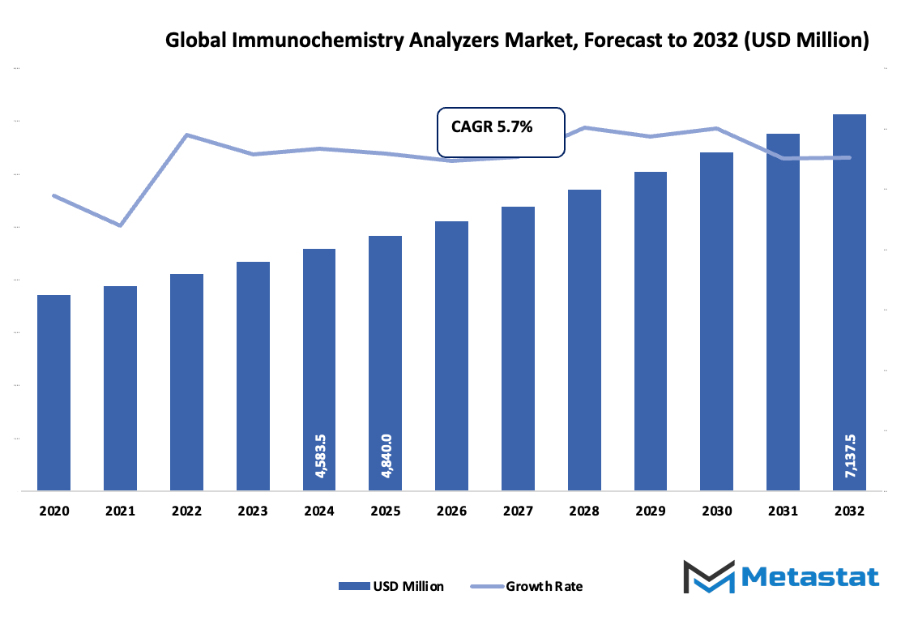

- The global immunochemistry analyzers market is expected to be around 4,840 million USD in 2025, with a compound annual growth rate (CAGR) of about 5.7% until 2032 and a possible market value of more than 7,137.5 million USD.

- In 2024, the share of benchtop analyzers in the market will be at 19.8%, promoting the development of new ideas and the use of analyzers in different fields through the support of research.

- The major growth drivers are: rising needs and preferences for early handling of diseases and biomarker identification, further automation of laboratories, and the merger of diagnostic services.

- The market for point-of-care and decentralized testing is gaining momentum due to the ongoing trend of immunochemistry analyzers getting smaller and smarter. This is one of the major opportunities.

- The projection is that the market value will experience an exponential increase in the coming ten years, which indicates that the market will be very attractive from the investment point of view.

Market Background & Overview

The global immunochemistry analyzers market has evolved into a separate sector that has been profoundly influenced by scientific advances, laboratory requirements, and changing expectations in health care systems. The concept of this market started taking shape in the last years of the twentieth century when manual immunoassay procedures began to be replaced by clinical labs. The first-type analyzers were slow, had a narrow menu of tests, and the performance depended a lot on the operator's proficiency, but nonetheless, they hinted at the beginning of a transition to automated testing that was to eventually change the diagnostic workflows completely.

The 1990s marked a major breakthrough when automated immunoassay systems started using highly sensitive detection methods and did not need that much stabilization of the reagents. This made it possible for the hospitals to do hormone tests, infectious disease panels, and therapeutic drug monitoring with much more constancy than before. A decade later, tiny benchtop machines suitable for mid-volume testing were already being launched by the manufacturers, thus the door to the regional laboratories and physician offices had been opened, although they had not had access to modern assay technology before. The ever-increasing focus on the management of chronic diseases forced the developers to create instruments that could later handle higher throughput and provide faster turnaround.

A quality program adoption by laboratories to be on the same page with the U.S. Food and Drug Administration and the European Medicines Agency represented another pivotal moment. As a result of the higher regulatory expectations, the labs had to improve their methods of tracing and calibrating, as well as to set and follow common standards for the quality of their performance. These actions helped to build confidence in automated immunochemistry testing over time so that the deployment of the instruments covered both the public and private health care areas.

Technological progress continues to reshape the market’s direction. Over the past decade, instruments have integrated chemiluminescent detection, touchscreen interfaces, advanced onboard quality checks, and connectivity features designed to streamline data transfer into laboratory information systems. Reports from industry associations note that large hospital networks process millions of immunoassay tests annually, with some high-volume labs running more than 20,000 samples per day during peak seasons. Government health agencies have also documented rising utilization of diagnostic immunoassays tied to aging populations, vaccination programs, and monitoring of metabolic and cardiovascular conditions. These trends will guide future product design as laboratories favour systems that support stable reagent packs, longer walk-away times, and reduced maintenance.

Today, the industry stands at a point where automation, accuracy, and digital integration will influence how new instruments are built. As healthcare providers continue to prioritize dependable testing capacity, the market will move toward platforms that strengthen efficiency while supporting an expanding menu of clinical needs.

Market Segmentation Analysis

The global immunochemistry analyzers market is mainly classified based on Product Type, Technology, Application, End User.

By Product Type is further segmented into:

- Benchtop Analyzers: Benchtop Analyzers support steady analytical activity for the global immunochemistry analyzers market by offering reliable processing capacity inside laboratory settings. Consistent performance, durable construction, and strong output capability encourage steady adoption. Laboratories value organized layouts, dependable functions, and smooth sample handling that support routine clinical evaluations requiring accurate and timely immunochemical assessment.

- Portable Analyzers: Portable Analyzers allow flexible placement and movement across medical environments. Compact structure, easy handling, and quick setup encourage frequent use during time-sensitive evaluations. Field operations, small facilities, and urgent care environments depend on rapid testing support that strengthens responsive immunochemical assessments without interrupting workflow in varied clinical surroundings.

- Modular Systems: Modular Systems provide scalable setups that support expanding laboratory needs. Adjustable components, coordinated configurations, and adaptable capacity encourage laboratories to match instrument layout with available resources. Growth-focused environments rely on flexible structure that allows additional modules, improved throughput, and smooth integration with analytical routines requiring enhanced immunochemical support.

- Fully Automated Platforms: Fully Automated Platforms support continuous processing with steady accuracy and minimal manual involvement. Consistent workflows, controlled procedures, and dependable sample movement encourage strong demand in high-volume laboratories. Automated architecture reduces handling errors and strengthens uniform assessment across extensive immunochemical workloads requiring dependable output during demanding clinical operations.

- Semi-Automated Systems: Semi-Automated Systems offer balanced operation combining guided manual steps with supportive mechanical functions. Laboratories requiring cost-effective options depend on structured workflows that enhance precision without full automation. Controlled handling, clear procedures, and stable performance allow consistent immunochemical analysis across facilities managing moderate testing volumes with limited operational resources.

- Others: Other specialized configurations support unique laboratory needs by offering tailored features outside standard categories. Distinct layouts, focused functions, and adjustable performance support specific analytical demands. Facilities with narrow testing priorities rely on structured systems that strengthen efficiency during targeted immunochemical evaluation across defined diagnostic requirements.

By Technology the market is divided into:

- Chemiluminescence Immunoassay: Chemiluminescence Immunoassay provides strong analytical sensitivity supported by measurable light emission during antigen-antibody interaction. Laboratories value clear signal detection, dependable accuracy, and fast processing. High demand arises from efficient workflows that support various clinical assessments requiring reliable outcomes during routine and advanced immunochemical testing across many diagnostic environments.

- Enzyme-Linked Immunosorbent Assay: Enzyme-Linked Immunosorbent Assay supports broad clinical testing through enzyme-generated color changes that indicate analyte presence. Steady performance, familiar procedures, and adaptable formats encourage widespread use in many laboratory settings. Structured steps and clear visual readouts support dependable immunochemical evaluation during research and diagnostic operations requiring consistent accuracy.

- Radioimmunoassay: Radioimmunoassay offers sensitive detection supported by radioactive markers that measure antigen-antibody reactions. Laboratories focused on high-precision outcomes rely on controlled handling, regulated processes, and stable measurement capability. Strong analytical depth supports demanding immunochemical applications requiring accurate quantification across research and clinical facilities with specialized infrastructure.

- Fluorescence Immunoassay: Fluorescence Immunoassay uses fluorescent labeling to deliver measurable signals during analyte detection. Laboratories benefit from strong sensitivity, clear visualization, and efficient performance across multiple testing categories. Stable output supports immunochemical analysis requiring reliable detection strength for varied diagnostic and monitoring activities in structured laboratory environments.

- Electrochemiluminescence: Electrochemiluminescence supports precise analyte measurement through electrically stimulated light emission. Laboratories value strong signal clarity, low background interference, and dependable reproducibility. Robust analytical characteristics assist facilities requiring well-controlled immunochemical assessment during routine and specialized diagnostic workloads requiring steady accuracy.

- Others: Other technologies support unique analytical needs by offering distinct detection methods suited for specific testing demands. Laboratories with focused requirements adopt specialized processes that maintain accuracy, clarity, and stable measurement. Flexible adaptation strengthens immunochemical evaluation across environments managing uncommon or advanced diagnostic procedures.

By Application the market is further divided into:

- Therapeutic Drug Monitoring: Therapeutic Drug Monitoring supports accurate measurement of medication levels for safe and effective treatment oversight. Laboratories rely on dependable assays, clear quantification, and consistent performance. Structured monitoring ensures treatment alignment with medical goals by supporting immunochemical analysis crucial for medication management across various clinical situations.

- Oncology: Oncology applications require detailed biomarker assessment supporting cancer detection and treatment planning. Laboratories depend on strong assay accuracy, reliable reproducibility, and steady output that aids clinical decision-making. Immune-based testing supports timely evaluation of disease progression and treatment response during structured cancer management workflows.

- Cardiology: Cardiology testing benefits from immunochemical tools that measure cardiac markers essential for diagnosing cardiovascular events. Laboratories appreciate fast processing, stable accuracy, and dependable detection during critical evaluations. Analytical support strengthens assessment of cardiac conditions requiring timely identification within emergency and routine cardiac care environments.

- Allergy Testing: Allergy Testing relies on accurate detection of allergen-specific antibodies for proper identification of sensitivity patterns. Laboratories use consistent assays, steady output, and controlled workflows to deliver clear results. Structured immunochemical evaluation supports clinicians in understanding allergic responses across broad patient populations.

- AIDS: AIDS-related applications require sensitive immunochemical tools for monitoring infection status and related biomarkers. Laboratories depend on accurate detection, stable performance, and clear measurement during ongoing evaluation of disease progression. Reliable assays support critical assessments within HIV management programs focused on continuous patient monitoring.

- Endocrinology: Endocrinology relies on immunochemical analysis to measure hormone levels essential for diagnosing endocrine disorders. Laboratories require dependable accuracy, structured procedures, and efficient processing. Clear hormonal profiling supports medical teams in understanding glandular function and identifying imbalances across varied clinical cases.

- Infectious Disease Testing: Infectious Disease Testing depends on immunochemical techniques for detecting pathogens and associated antibodies. Laboratories value fast turnaround, stable reliability, and strong analytical clarity. Structured testing supports outbreak control, treatment planning, and general diagnostic workflows across community and hospital settings.

- Autoimmune Disease: Autoimmune Disease assessment requires immunochemical detection of autoantibodies contributing to inflammatory disorders. Laboratories rely on steady precision, organized processes, and robust detection capability. Clear biomarker measurement supports clinical understanding of immune system malfunction across various autoimmune conditions requiring detailed evaluation.

- Others: Other applications support unique diagnostic needs across specialized medical fields. Laboratories adopt focused immunochemical assessments designed for targeted biomarker detection, helping refine clinical understanding and treatment planning. Controlled workflows support accurate evaluation within environments managing uncommon or highly specific diagnostic requirements.

By End User the global immunochemistry analyzers market is divided as:

- Hospital Laboratories: Hospital Laboratories depend on immunochemical systems for routine diagnostics, emergency evaluations, and specialized testing. Strong reliability, consistent throughput, and organized workflows support large patient volumes. Integrated laboratory networks rely on coordinated processes that maintain timely and accurate diagnostic support across hospital-based clinical services.

- Diagnostic Centers: Diagnostic Centers use immunochemical instruments for diverse testing panels serving outpatient populations. Efficient workflows, accessible layouts, and stable performance support high sample turnover. Coordinated operations strengthen service quality for facilities focused on structured diagnostic delivery across community healthcare environments.

- Research Laboratories: Research Laboratories rely on immunochemical tools for experimental studies involving biomarker measurement and molecular evaluation. Controlled procedures, dependable accuracy, and flexible methods support scientific exploration. Detailed analytical capability advances research across various fields requiring precise immunochemical assessment.

- Pharmaceutical Companies: Pharmaceutical Companies use immunochemical analyzers during drug development, safety evaluation, and clinical testing phases. Strong analytical precision, reproducible results, and consistent performance support regulatory and research requirements. Structured workflows encourage reliable data generation across laboratory operations focused on therapeutic innovation.

- Blood Banks: Blood Banks employ immunochemical systems to screen donated samples and support transfusion safety. Reliable detection, clear measurement, and efficient throughput help maintain high-quality screening protocols. Stable workflows ensure consistent evaluation of infectious markers across blood collection environments.

- Academic Institutions: Academic Institutions adopt immunochemical analyzers for teaching, training, and research activities. Stable functionality, accessible operation, and reproducible results support education and scientific development. Student laboratories and research units rely on dependable analytical tools for structured learning and investigative projects

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$4840 Million |

|

Market Size by 2032 |

$7137.5 Million |

|

Growth Rate from 2025 to 2032 |

5.7% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

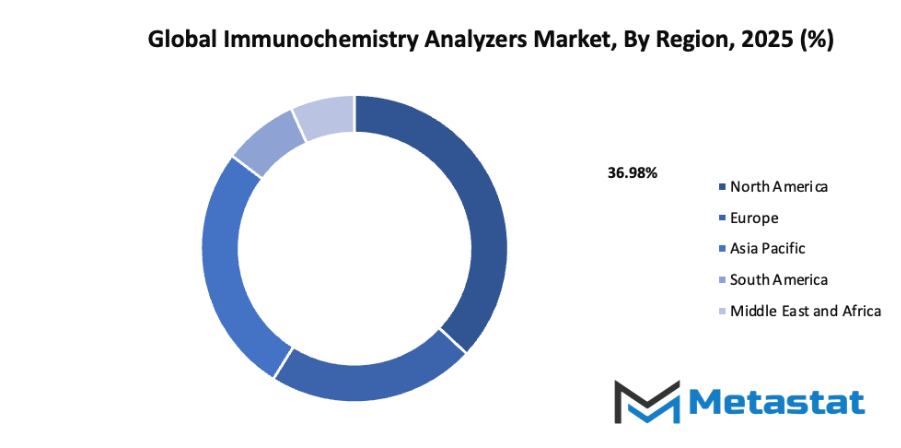

- Based on geography, the global immunochemistry analyzers market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Market Dynamics

Growth Drivers:

Expanding demand for early disease detection and biomarker profiling:

Growing focus on medical conditions at initial stages boosts interest in tests able to identify small biological changes. Early identification supports better treatment planning, raising the need for systems that offer dependable biomarker checks. Wider healthcare access also supports stronger use of these analyzers across various testing centers.

Increasing laboratory automation and consolidation of diagnostic services:

More diagnostic networks seek faster output and steady accuracy through automated systems that handle larger workloads. Centralized facilities benefit from consistent processing, reduced manual handling, and better use of staff time. This shift strengthens adoption of advanced analyzers able to support high-volume testing without slowing routine operations.

Restraints & Challenges:

High equipment and reagent costs limiting penetration in low-income countries:

Large capital spending creates barriers for many facilities, especially where budgets remain tight. Ongoing reagent expenses add further pressure, slowing expansion in regions needing affordable diagnostic options. Limited financial support reduces access to upgraded systems, restricting broader use and slowing improvements in testing capacity.

Stringent regulatory requirements and lengthy validation processes:

Approval pathways demand detailed evidence to confirm system reliability, creating long waiting periods before broad use. Extensive documentation, multiple test phases, and strict compliance rules extend development timelines. These steps protect public health but slow introduction of new devices, delaying wider adoption across testing environments.

Opportunities:

Growing miniaturization of immunochemistry analyzers for point-of-care and decentralised testing:

Smaller devices support rapid checks closer to patients, reducing travel needs and speeding treatment decisions. Portable formats improve convenience for community clinics, emergency units, and remote regions. Lower space requirements also help facilities with limited infrastructure, encouraging broader uptake of compact systems designed for quick, dependable results.

Competitive Landscape & Strategic Insights

The global immunochemistry analyzers market reflects steady growth supported by strong participation from both long-established organizations and rapidly rising regional manufacturers. Market activity shows continuous investment, wider test availability, and broader adoption across varied healthcare settings. Demand for reliable diagnostic solutions encourages each participant to refine product design, improve accuracy, and strengthen support services. Constant innovation from major producers encourages higher expectations across laboratories, hospitals, and diagnostic centers, leading to a wider focus on efficiency and dependable performance.

Major contributors include Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, Beckman Coulter Inc., Ortho Clinical Diagnostics, bioMérieux SA, DiaSorin S.p.A., Tosoh Corporation, Snibe Diagnostic, Mindray Medical International Limited, Autobio Diagnostics Co. Ltd., Randox Laboratories Ltd., Shenzhen New Industries Biomedical Engineering Co. Ltd., Sysmex Corporation, and Luminex Corporation. Strong portfolios from these organizations help expand testing capacity while also supporting quality improvement across numerous regions. Advanced platforms offered by leading organizations encourage broader acceptance of automated systems, while regional companies support affordability and localized service.

Market momentum also grows through rising awareness of early disease detection, steady expansion of healthcare infrastructure, and a greater focus on timely diagnostic support. Automated analyzers help laboratories handle increasing sample volumes without sacrificing performance, encouraging wider placement in both public and private facilities. Expanding distribution channels and accessible service networks give many regions improved access to dependable diagnostic tools, supporting better healthcare outcomes.

Collaborative efforts between producers, distributors, and healthcare providers encourage broader testing coverage across under-served areas. Regional contributors often tailor instruments to local requirements, helping strengthen overall industry resilience. Continuous upgrades in assay technology, software integration, and instrument precision create favourable conditions for future progress.

Ongoing needs for accurate laboratory results ensure consistent interest in updated analyzer systems. Strong participation from global leaders and growing contributions from regional companies establish a balanced competitive environment that supports steady advancement across the market.

Forecast & Future Outlook

- Short-Term (1-2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3-5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6-10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 4840 million in 2025 to over USD 7137.5 million by 2032. Immunochemistry Analyzers will maintain dominance but face growing competition from emerging formats.

Report Coverage

This research report categorizes the global immunochemistry analyzers market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global immunochemistry analyzers market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global immunochemistry analyzers market.

Immunochemistry Analyzers Market Key Segments:

By Product Type

- Benchtop Analyzers

- Portable Analyzers

- Modular Systems

- Fully Automated Platforms

- Semi-Automated Systems

- Others

By Technology

- Chemiluminescence Immunoassay

- Enzyme-Linked Immunosorbent Assay

- Radioimmunoassay

- Fluorescence Immunoassay

- Electrochemiluminescence

- Others

By Application

- Therapeutic Drug Monitoring

- Oncology

- Cardiology

- Allergy Testing

- AIDS

- Endocrinology

- Infectious Disease Testing

- Autoimmune Disease

- Others

By End User

- Hospital Laboratories

- Diagnostic Centers

- Research Laboratories

- Pharmaceutical Companies

- Blood Banks

- Academic Institutions

Key Global Immunochemistry Analyzers Industry Players

- Roche Diagnostics

- Abbott Laboratories

- Siemens Healthineers

- Beckman Coulter Inc.

- Ortho Clinical Diagnostics

- bioMérieux SA

- DiaSorin S.p.A.

- Tosoh Corporation

- Snibe Diagnostic

- Mindray Medical International Limited

- Autobio Diagnostics Co. Ltd.

- Randox Laboratories Ltd.

- Shenzhen New Industries Biomedical Engineering Co. Ltd.

- Sysmex Corporation

- Luminex Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383