Global Household Cleaning Products Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

Initially, the demand for household cleaning products only in domestic felt needs, but later it was one of the most powerful and dynamic industries that influenced modern living habits. The cleaning market's story started in the late 1800s, when soaps and very basic disinfectants were made either by people in their homes or by small local producers. As the process of industrialization got going in the cities, urban households with increasingly congested lives wanted more effective means to maintain health as hygiene was becoming more and more important. The coming of the brand name detergents in the early 1900s was a significant turning point that made cleaning a commercial and cultural habit. Procter & Gamble, and Unilever, among others, started to increase their production output, introducing powders and liquids that would soon be considered indispensable parts of every household around the globe.

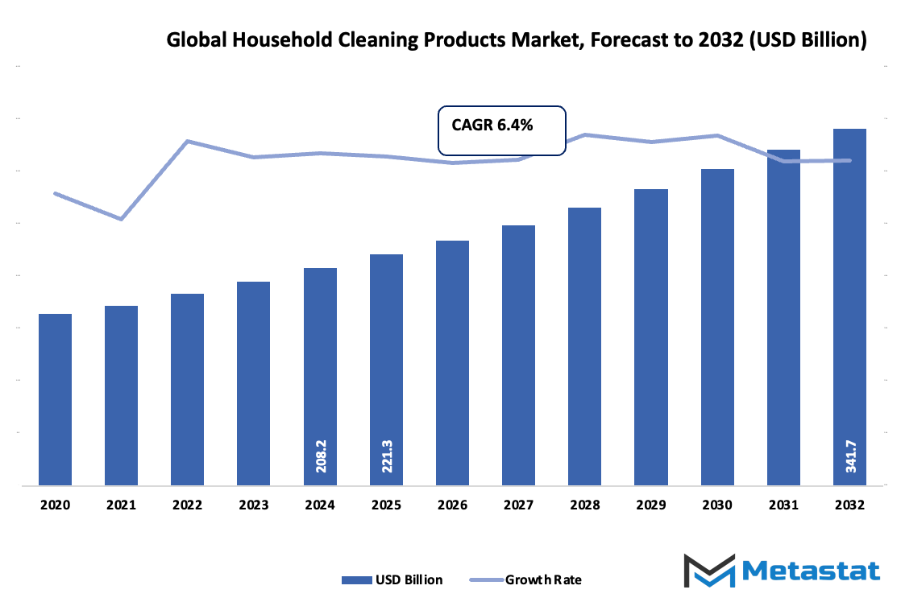

- The global household cleaning products market size is projected to reach around USD 221.3 billion by 2025, with a CAGR of about 6.4% during the period of 2032, and possibly growing more than USD 341.7 billion.

- Glass cleaner has almost one fifth (20.2%) of the market share, and is the main driving force of innovation and application expanding the whole industry with extensive research.

- Bigger and bolder trends that are responsible for growth are: The Public's Higher Consciousness regarding Hygiene and Sanitation, The Surge in Popularity of Eco-Friendly and Natural Cleaning Supplies

- Sales through online and e-commerce channels are rising and thus presenting great opportunities for the market.

- The market will experience phenomenal value growth over the next ten years, which will also be able to reveal considerable areas of growth.

The post-world war II era saw a dramatic change in the industry, where synthetic chemicals and packaged consumer goods took over the definition of convenience. Cleanliness was already associated with upper class due to the new advertising that started in the 1960s and 1970s. Consequently, this pressure gave birth to products that were dedicated to the specific areas of kitchens, bathrooms, fabric, and flooring. So, with women gradually being employed, their need for one's product to come in forms such as sprays, wipes, and concentrated liquids was very high and thus they got more acceptance.

The cleaning products market for the world started a switch in the 1990s that was driven by the growing environmental awareness and lifestyle changes. Hardly any consumer was using the chemical-heavy cleaners anymore, which led to the panning of the biodegradable and non-toxic products out. Different regions of the world set the bar higher on the standards for labeling, safety, and ingredient disclosure, which in fact gave rise to the practice of being open in manufacturing.

The digital age is said to have contributed a lot to the cleaning industry with its total transformation. The process of how products are delivered to the homes has been modified, due to the existence of e-commerce channels, social media and direct-to-consumer brands. We can say that the future supply chains will be impacted by robotics in production and smart packaging becoming more common. It was during the pandemic that we all recognized the importance of cleanliness in both emotional and practical terms; thus, the demand for it was increased in both developed and emerging markets.

Looking ahead, the global household cleaning products market will continue to adapt to shifting cultural values and technological innovation. From simple bars of soap to sensor-driven cleaning solutions, its journey reflects more than economic growth, it mirrors humanity’s enduring pursuit of health, comfort, and order within the spaces we call home.

Market Segments

The global household cleaning products market is mainly classified based on Product Type, Application, Distribution Channel.

By Product Type is further segmented into:

- Glass Cleaner: Glass cleaners are crucial in keeping homes and offices surfaces clear and smear-free. The concern about hygiene and the aesthetic appeal is an important reason for the rise of these products in the market. Besides, manufacturers are presenting the users with streak-free formulas and pleasant smells as their main selling points. The aspect of multi-purpose glass cleaners that can also be used on mirrors and screens has also caught the attention of the consumers. The continuous increase in the market share of these products has been made possible by their easy availability across various retail formats.

- Surface Cleaners: Among the global household cleaning products market, Surface cleaners are still one of the biggest areas. This category of products clears off dirt, stains, and germs from different surfaces thus making the living space hygienic. The disinfectant-based surface cleaners are the ones most people are choosing these days and the health concerns worldwide is one of the main reasons behind this sales increase. Besides, manufacturers are making use of natural and biodegradable components to win over the eco-conscious buyers. The product's adoption rate has been boosted more by the convenience of spray bottles and ready-to-use wipes.

- Dishwashing Products: Dishwashing products are the main household agents to eliminate widely and effectively utensils and kitchen tools cleaning. The demand for the products keeps growing along with the household cooking and food preparation activities. Both formats, liquids, and solids, are equally preferred because of their efficiency and user-friendliness. Moreover, skin-friendly formulations and mild fragrances have become the customers’ favourites. The introduction of concentrated and refillable products is contributing to growing eco-friendliness while also enabling market growth.

- Others: Other cleaning products, including air fresheners, toilet cleaners, and multipurpose cleaning solutions, contribute significantly to the market. The growing need for complete home hygiene maintenance has led to steady demand in this segment. Continuous product innovation and marketing strategies have expanded customer reach. The introduction of specialized products for specific cleaning purposes also enhances overall market performance.

By Application the market is divided into:

- Bathroom Cleaners: The demand for bathroom cleaners is on the rise and they are a direct result of the increased awareness of cleanliness and sanitation among the public. These products provide a solution for tough stains, limescale, and bacteria and thereby create a healthy environment. Their ability to keep bathrooms free of unpleasant odors has made them even more popular among consumers. Regularly introducing new fragrances and packaging keeps the product line fresh and so more people will buy them. The new high-end bathroom cleaning brands have further stimulated the growth of this segment.

- Kitchen Cleaners: Kitchen cleaners still occupy an important position in the global household cleaning products market being the main ones used to ensure hygiene in the areas where food is prepared. The use of these products will help to create a cooking space that is safe by eliminating grease, stains, and bacteria. The trend of cooking more at home has been a factor in the increased use of the product. The manufacturers of the products are also making multi-purpose kitchen cleaners that have very good antibacterial properties. Consumers are also shifting towards natural ingredients which is influencing their buying choices.

- Floor Cleaners: In the residential and commercial sectors, floor cleaners are the go-to products for cleaning and keeping surfaces shiny. The market for these products is still growing as cleanliness standards continue to rise. Consumers are looking for products that are easy to use, quick-drying, and safe for all types of floors. Manufacturers are concentrating on making floor cleaners not only with good scents but also with disinfectant qualities. The concentrated formulas not only have better cost-effectiveness but also better environmental performance.

- Other: Other cleaning applications include furniture polishes, appliance cleaners, and air purifying sprays. These products play a supportive role in maintaining overall household hygiene. The steady rise in demand reflects changing consumer lifestyles and preferences for organized living spaces. Innovation in scent combinations and eco-friendly packaging continues to attract attention. The introduction of smart cleaning solutions has also helped in expanding the product variety.

By Distribution Channel the market is further divided into:

- Supermarkets/Hypermarkets: Supermarkets and hypermarkets hold a major share in the global household cleaning products market due to the wide range of product availability. Consumers prefer these outlets because of the convenience of comparing brands and prices. Promotional offers and bulk discounts attract regular shoppers. The presence of product demonstrations also boosts sales. Continuous store expansion in urban areas ensures easy product access to a large customer base.

- Convenience Stores: Convenience stores contribute significantly to market distribution as they offer quick and easy access to daily cleaning essentials. These stores are preferred for emergency purchases and small pack sizes. Strategic placement in residential neighbourhoods adds to their importance. The personalized service and extended operating hours enhance their value for consumers. This channel is particularly strong in developing regions where larger retail formats are limited.

- Online Retail Stores: Online retail stores have become a fast-growing distribution channel in the global household cleaning products market. The increasing preference for online shopping, supported by digital payment options, has driven this growth. Online platforms offer a wider selection and the convenience of home delivery. Customer reviews and detailed product descriptions influence purchasing decisions. The growing popularity of subscription services for essential items also supports this segment.

- Others: Other distribution channels include direct selling, local markets, and specialty stores that focus on specific cleaning needs. These channels maintain relevance by catering to niche demands and offering personalized solutions. In many regions, traditional retail formats still play a vital role in product accessibility. Localized marketing and community-based selling approaches help maintain strong customer relationships. Continued diversification of distribution options supports steady market growth.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$221.3 Billion |

|

Market Size by 2032 |

$341.7 Billion |

|

Growth Rate from 2025 to 2032 |

6.4% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

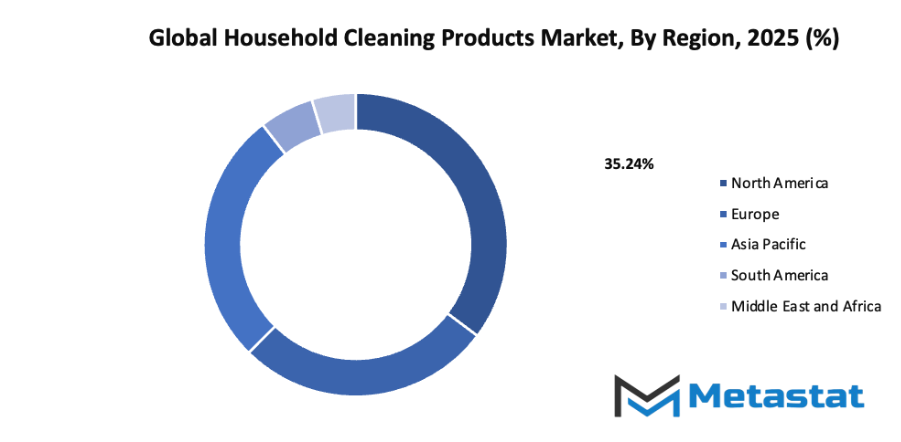

By Region:

- Based on geography, the global household cleaning products market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

Increased Awareness of Hygiene and Sanitation:

Awareness about hygiene and sanitation has increased due to health concerns and the spread of infectious diseases. Governments and organizations have promoted regular cleaning as an essential practice for health protection. The global household cleaning products market has gained traction as consumers are more cautious about maintaining a germ-free environment, supporting steady market growth.

Growing Demand for Eco-Friendly and Natural Cleaning Products:

Consumers are now seeking safe and sustainable cleaning products that contain fewer chemicals. The global household cleaning products market is seeing a rise in demand for biodegradable and plant-based solutions. Manufacturers are focusing on creating environmentally responsible products to reduce harm to both users and nature, strengthening trust and long-term demand.

Challenges and Opportunities

Regulatory Compliance and Safety Standards:

Strict regulations govern the formulation and labeling of cleaning products to ensure safety. The global household cleaning products market must adhere to chemical usage rules and environmental standards set by authorities. Compliance helps maintain consumer trust, but meeting such regulations increases production costs and requires constant updates to manufacturing processes.

Price Volatility of Raw Materials:

Fluctuating prices of raw materials such as surfactants, packaging materials, and natural ingredients impact the overall cost of production. The global household cleaning products market faces challenges in maintaining stable prices for end consumers. Managing sourcing strategies and improving supply chain efficiency help reduce financial risks for manufacturers.

Opportunities

Rising Demand for Online Sales and E-commerce Platforms:

Digital transformation has reshaped the way cleaning products are purchased. The global household cleaning products market is gaining from the growth of e-commerce, allowing customers to compare, review, and buy products conveniently. Brands that strengthen their online presence through promotions and quick delivery services are likely to gain a larger market share.

Competitive Landscape & Strategic Insights

The competitive landscape of the global household cleaning products market reflects a diverse mix of established global corporations and fast-growing regional brands. Leading companies such as Procter & Gamble, Unilever, Reckitt Benckiser Group, The Clorox Company, SC Johnson, Henkel AG & Co. KGaA (Dac), Colgate-Palmolive Company, Church & Dwight Co., Inc., Kimberly-Clark Corporation, and Lysol continue to shape market direction through strong brand recognition, wide product portfolios, and consistent innovation. These organizations invest heavily in research and development to meet consumer demand for effective, safe, and environmentally responsible cleaning solutions.

Smaller brands such as Method Products, PBC, Seventh Generation, Inc., Amway Corporation, Ecover, Fabuloso, Mrs. Meyer’s Clean Day, Simple Green, Astonish, Goodmaid Chemicals Corporation, Dr. Bronner’s, Pinalen, OxiClean, Biokleen, and ECOS are gaining ground through unique product positioning and eco-friendly approaches. Many of these regional or niche players have captured consumer attention by offering biodegradable, plant-based, or low-toxicity alternatives, aligning with the growing awareness of sustainable living. These strategies have helped smaller companies build loyal customer bases and compete with industry giants that dominate retail shelves worldwide.

The market competition continues to intensify as consumers show increasing preference for natural ingredients, transparent labeling, and ethical production. Global leaders are responding by reformulating traditional products, expanding into green product lines, and acquiring smaller sustainable brands. Price competition also remains strong, pushing companies to enhance efficiency across production and distribution channels. Strategic collaborations, marketing campaigns, and digital engagement are now critical factors in maintaining customer trust and brand visibility.

Market size is forecast to rise from USD 221.3 billion in 2025 to over USD 341.7 billion by 2032. Household Cleaning Products will maintain dominance but face growing competition from emerging formats.

Overall, the industry reflects a dynamic mix of innovation, sustainability, and strong brand competition. The balance between trusted global names and rising eco-conscious companies continues to define the direction of the global household cleaning products market, where adaptability and consumer understanding will determine long-term success.

Report Coverage

This research report categorizes the global household cleaning products market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global household cleaning products market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global household cleaning products market.

Household Cleaning Products Market Key Segments:

By Product Type

- Glass Cleaner

- Surface Cleaners

- Dishwashing Products

- Others

By Application

- Bathroom Cleaners

- Kitchen Cleaners

- Floor Cleaners

- Other

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail Stores

- Others

Key Global Household Cleaning Products Industry Players

- Procter & Gamble

- Unilever

- Reckitt Benckiser Group

- The Clorox Company

- SC Johnson

- Henkel AG & Co. KGaA (Dac)

- Colgate-Palmolive Company

- Church & Dwight Co., Inc.

- Kimberly-Clark Corporation

- Lysol

- Method Products, PBC

- Seventh Generation, Inc.

- Amway Corporation

- Ecover

- Fabuloso

- Kao Group

- Mrs. Meyer’s Clean Day

- Simple Green

- Astonish

- Goodmaid Chemicals Corporation

- Dr. Bronner’s

- Pinalen

- OxiClean

- Biokleen

- ECOS

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252