Global Homeware Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global homeware market in the consumer lifestyle and household goods sector has evolved from being restricted to simple, locally made essentials to comprising a wide-ranging area ruled by designing, providing convenience, and the customer's personal expression. That whole colorful saga dates back to the times when households used to depend on handmade pottery, wooden cutlery, and woven baskets for storage. These products were not part of any industry; rather, they were the basic necessities that had been molded by the availability of local resources and by the continuing traditions and cultures around the world. The Industrial Revolution, which saw the birth of the factory system as the means of mass-producing goods, was the turning point in the trends that had been followed in the homeware sector thus far. It not only led to the production of affordable pots and pans, fabrics and furniture for the whole family, but it also made these products available to consumers through the introduction of distribution networks.

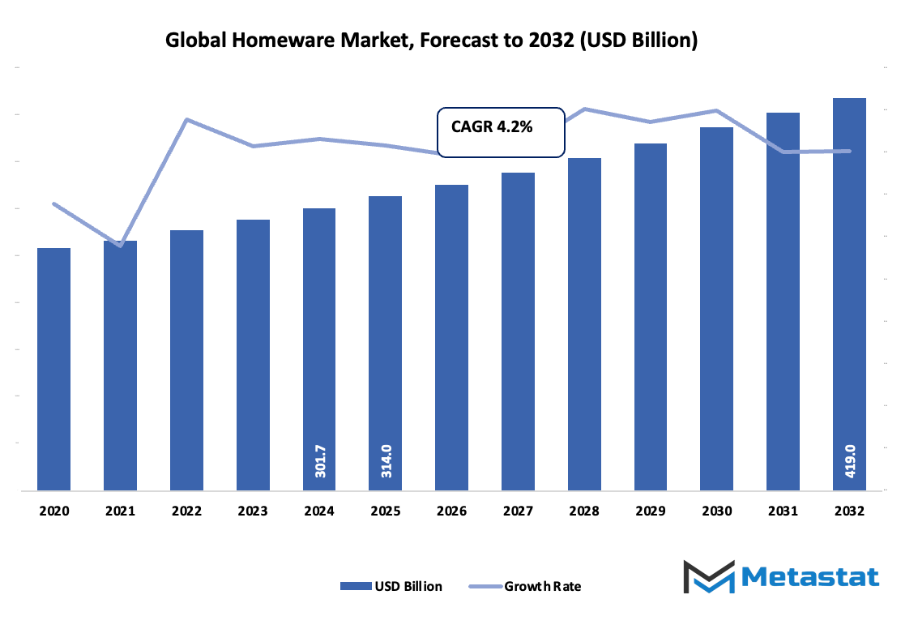

- The global homeware market is expected to be worth around USD 314 billion by the year 2025, with a compound annual growth rate (CAGR) of about 4.2% from 2025 to 2032, and the market's value might go over USD 419 billion.

- Home decoration represents approximately 12.9% of the market share, emphasizing innovation through intensive research and opening new applications

- Some of the main forces that are propelling growth are: Increased consumer attention to home décor and lifestyle improvement, rapid urbanization, and growth of the residential sector.

- Green and eco-friendly homeware products seem to be the most promising area.

- A strong impression: The coming decade will see the market growing rapidly in terms of value, thereby marking the opening of new avenues for growth.

The energy of the market was replenished in the 1950s and 1960s. The end of the Second World War saw the creation of more income and the development of cities, making families use consumer goods that represented comfort and security to furnish their homes. Products from Nordic furniture and mid-century modern design were looked at by the public as items that helped shape one's mood and identity rather than just as household goods. The retail chains and department stores of the time then made shopping a centralized activity, and the homeware companies started to build their brand loyalty among consumers.

In the late '90s and early 2000s the process of globalization led to the expansion of material sources and the widening of material range. People going to the shops no longer had to be exclusive those who were used to buying ceramics from Asia or textiles from Europe—their availability was offered to the masses. The digital technology was the catalyst for the next big move. E-commerce thus allowed small artists to connect with buyers worldwide, while big stores were showing their complete collections online, giving personalized suggestions and analyzing buying patterns according to data.

Social media has been and will continue to be a significant influencer in the global homeware market by telling consumers to opt for generations that match their personalities and lifestyle choices. Awareness of the environment is affecting the choice of materials, and the firms will most likely be introducing recycled fibers, natural dyes, and energy-efficient production methods. Governments are slowly but surely tightening legislation on both packaging waste and sustainability reporting, thus pressurizing companies to adopt a more open way of doing business.

Buyers today, however, are not just looking for things that go with their interior; they want their reflections to be in the products they buy. The transformation of a very basic utility into a love of design and emotions connected to everyday life will, nonetheless, be continuously regulated by culture, technology, and personal narratives.

Market Segments

The global homeware market is mainly classified based on Product Type, Price Range, Distribution Channel, End User.

By Product Type is further segmented into:

- Home Decoration: The home decoration items provide the basis for a warm and intimate atmosphere indoors. The wall art, vases, mirrors, and indoor plants create a seamless color transition within a room. Every single piece of decoration adds design, texture, and style. Besides, the perfect combination of materials and colors helps to create a living space that, on the one hand, displays its personality and, on the other hand, is visually harmonious.

- Furniture: The furniture is the source of comfort, space for keeping things, and the structure of daily activities. Living rooms and bedrooms are arranged around sofas, tables, beds, and storage units. Also, very strong materials, safe designs, and very high building quality lead to better prices. Usually, consumers select items based on their spatial weight, comfort level, and aesthetic appeal.

- Kitchenware: Kitchenware is the mainstay of cooking and food preparation in every household. The cooks' main tools are pots, pans, knives, cutting boards, and containers. Moreover, there are special kitchen utensils that are designed to save time and reduce effort. On the other hand, long-lasting materials are employed to ensure that kitchen utensils not only last long but also function consistently over time. For daily cooking and preparation, many households prefer easy-to-clean and reliable kitchenware that can take a lot of use.

- Home Appliances: Home appliances make our life easier by helping with cooking, cleaning, and climate control. Refrigerators, washing machines, air coolers, and cooking units provide consistent performance and the reduction of manual labour. The power-saving features not only reduce electricity consumption but also lower the cost of the long-term investment. Soft and user-friendly controls along with safe features make it possible to use in a home or a small living area regularly.

- Soft Furnishings: Soft furnishings are made of cushions, bed linens, curtains, and rugs. The fabric selected adds comfort, colour, and warmth. Colours and textures reinforce the visual interest and soften the hard outlines of the furniture. The seasonal changes bring in fresh looks at very little cost. Simple washing and long-lasting durability provide continuous value.

- Lighting: The effect of lighting is felt in terms of comfort, focus, and mood. Brightness and colour tone can be set by table lamps, floor lamps, and ceiling lights. Different levels of illumination can be adjusted for the activities of reading, cooking, or resting. The use of modern energy-saving bulbs has contributed to minimizing power consumption. A well-planned lighting scheme not only highlights the furniture and decoration but also makes each room feel more open and inviting.

- Bathroom Accessories: Among the bathroom accessories are soap holders, shelves, towel racks, and storage baskets. The smart positioning of the items keeps them at hand and at the same time obscures them from view. The use of water-resistant materials ensures that the items will last for a long time. The use of neutral colours or polished metal finishes will go with most bathroom styles and will keep the area clean, organized, and pleasant for the users.

- Others: Other homeware items might be storage boxes, seasonal decor items, indoor fragrance products, or small organizers. These items are intended for keeping the order and providing comfort. A neat house can promote calmness and focus. The use of multi-functional pieces can help small areas remain organized thus reducing the stress that is caused during daily routines.

By Price Range the market is divided into:

- Economy: Economy products are represented by goods that attract customers who want to perform basic functions at the lowest prices possible. The affordability of such products is made possible through the use of simple materials and uncomplicated designs. The standardization of colours and the use of basic packaging have contributed to both waste and cost reduction. These products are designed and manufactured to provide a constant level of functioning over a long period of time which fits perfectly with the needs of customers looking mainly for the cheapest prices.

- Mid-range: Mid-range products are priced fairly yet they come with better materials, design, and durability. The price of the mid-range products is justified by their good quality and practical style that together support long use without heavy spending. Buyers usually want a compromise between the aspects of looking good, being strong, and being comfortable. Many customers think mid-range products provide the best value and performance ratio.

- Premium: Premium products boast quality materials, design, and sophisticated features. Longer service life and debonair style are the reasons why higher satisfaction is supported. A lot of premium buyers appreciate craftsmanship, meticulous detail, and generous warranties. A premium choice conveys a preference for the long-term comfort of living with a design quality that is indeed very good.

By Distribution Channel the market is further divided into:

- Specialty stores: Specialty stores have a focus on a very specific and curated product selection. Very knowledgeable and professional staff direct and guide the customers to the most suitable options. Well-organized and arranged display of products are very helpful for the comparison of materials and styles amongst the visitors. In addition, a focused product range encourages and supports the customers to make decisions with confidence. It is very common for the shoppers to experience and enjoy a hands-on review of texture, color, and build quality.

- Hypermarkets & Supermarkets: The large retail chains provide very wide variety, steady stock, and frequent discounts. Daily essentials and homeware can be bought together by the shoppers making it a very convenient one-stop buying. The quick access to many different styles has been encouraging fast decisions. Very wide space and organized aisles make browsing very easy.

- Online Stores: Online stores are a very big advantage for the buyers since they can compare prices, materials, and reviews without traveling. Clear product images and detailed descriptions help the customers to make informed choices. Fast delivery and flexible return options add up to the customer's convenience. Many buyers do enjoy shopping at late hours and having access to a large variety of brands from different places.

- Others: The other channels consist of home improvement outlets, pop-up fairs, and direct brand showrooms. These channels not infrequently curate already limited seasonal collections or exclusive designs for the customers. The limited-run events foster the discovery and the buyers are not only able to follow the trends but also explore the new styles which are not available in the common stores.

By End User the global homeware market is divided as:

- Residential: Residential demand centers on comfort, appearance, safety, and value for private living spaces. Buyers choose products that match daily routines such as cooking, resting, or socializing. A thoughtful setup strengthens comfort, order, and personal expression at home. Many shoppers follow trends before selecting colours or materials for long use.

- Commercial: Commercial spaces such as offices, hotels, and rental apartments focus on durability and efficient maintenance. Strong build quality supports frequent use and lowers replacement frequency. Coordinated style contributes to a professional appearance. Many commercial buyers focus on value, strength, and long-term reliability within the global Homeware market.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$314 Billion |

|

Market Size by 2032 |

$419 Billion |

|

Growth Rate from 2025 to 2032 |

4.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

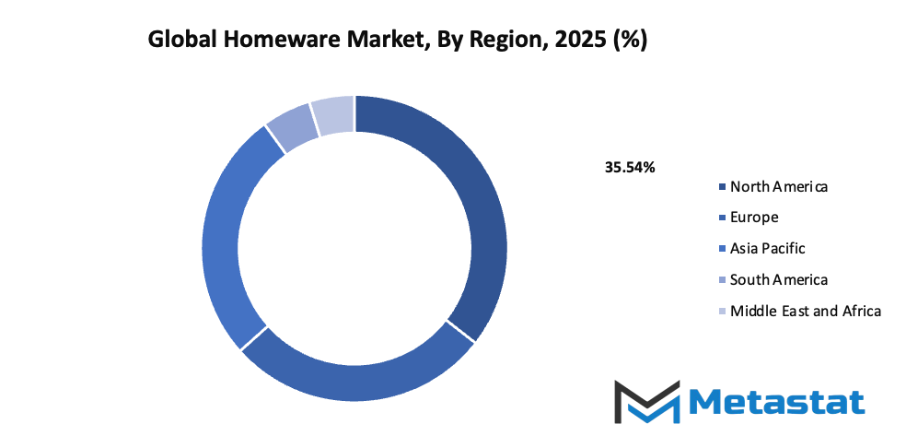

By Region:

- Based on geography, the global homeware market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Growing consumer focus on home décor and lifestyle enhancement:

Rising interest in stylish, comfortable living spaces encourages steady buying activity. The global Homeware market gains support from higher spending on decorative items, practical storage solutions, and coordinated themes. Social media exposure encourages stronger appeal toward attractive designs and refined finishing. - Rising urbanization and increase in residential construction activities:

Expanding city populations create strong demand for functional household goods. New housing projects raise purchasing for cookware, furniture, lighting, and storage. Modern apartments often require compact, space-saving designs, encouraging steady sales volume and frequent product updates based on style, durability, and comfort.

Challenges and Opportunities

- Fluctuating raw material and manufacturing costs:

Frequent price shifts for metals, glass, ceramics, and packaging materials increase production uncertainty. Factories must adjust schedules, sourcing plans, and inventory levels to manage higher expenses. Volatile energy charges and salary adjustments further press suppliers, reducing profit stability and slowing expansion of new ranges. - Intense market competition with availability of low-cost alternatives:

Numerous suppliers offer similar household items, making price comparison extremely common. Discount options limit premium pricing and shorten product life cycles. Frequent promotions, seasonal sales, and online marketplaces encourage rapid switching, demanding continuous improvement in design quality, durability, and overall value appeal.

Opportunities

- Increasing demand for sustainable and eco-friendly homeware products:

Growing awareness of environmental impact encourages selection of recycled materials, natural fibers, and long-lasting goods. Retail outlets highlight energy-saving lighting, reusable kitchen items, and minimal-waste packaging. Clear labeling and ethical sourcing improve confidence and support responsible purchasing, helping reduce waste across households.

Competitive Landscape & Strategic Insights

The global Homeware market features a wide range of established multinational corporations and ambitious regional businesses. Strong brand history and advanced production methods give international leaders a major advantage, while regional companies bring fresh ideas and lower production costs. Together, these forces create steady movement in product design, material quality, and customer expectations.

Large companies such as Steeelcase, Herman Miller Inc., Haworth Inc., HNI Corporation, GE Appliances, Philips Koninklijke N.V., F.I.L.A. Group, Le Creuset, Groupe SEB, Conair Corporation, LocknLock Co., Meyer Corporation, Lifetime Brands, Inc., Hamilton Beach Brands Holding Company, Tupperware., TTK Prestige Ltd., Denby Pottery, HF Coors Co. Inc., and ARC INTERNATIONAL SA hold strong positions in the global Homeware market. Many of these corporations operate through advanced manufacturing networks and wide distribution systems. Broad access to suppliers and retailers supports constant product availability across major regions. A strong focus on research and product testing encourages continuous improvement in durability, safety, and overall design.

Regional competitors focus on unique local styles and faster responses to shifting demand. Quick decision-making and direct relationships with local retailers allow faster launches of seasonal or culturally tailored goods. Flexible production systems allow regional businesses to experiment with new materials and develop specialty product lines. Lower production expenses also allow competitive pricing, giving customers cost-friendly alternatives without major sacrifice in quality.

Customer purchasing behaviour strongly influences decision-making within the Homeware market. A growing interest in simple designs and practical functions encourages brands to focus on durable materials and long-lasting products. Many customers now look for items that reduce waste and support energy-efficient living. As a result, leading companies invest in recyclable materials and safe production standards.

Market size is forecast to rise from USD 314 billion in 2025 to over USD 419 billion by 2032. Homeware will maintain dominance but face growing competition from emerging formats.

International corporations bring strong global presence, while regional businesses deliver agility and creativity. Combined strength from both levels encourages steady improvement across design, manufacturing, and distribution. Constant effort to balance quality, affordability, and style will continue shaping competition across the global Homeware market.

Report Coverage

This research report categorizes the global Homeware market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global Homeware market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global Homeware market.

Homeware Market Key Segments:

By Product Type

- Home Decoration

- Furniture

- Kitchenware

- Home Appliances

- Soft Furnishings

- Lighting

- Bathroom Accessories

- Others

By Price Range

- Economy

- Mid-range

- Premium

By Distribution Channel

- Specialty stores

- Hypermarkets & Supermarkets

- Online Stores

- Others

By End User

- Residential

- Commercial

Key Global Homeware Industry Players

- Steeelcase

- Herman Miller Inc.

- Haworth Inc.

- HNI Corporation

- GE Appliances

- Philips Koninklijke N.V.

- F.I.L.A. Group

- Le Creuset

- Groupe SEB

- Conair Corporation

- LocknLock Co.

- Meyer Corporation

- Lifetime Brands, Inc.

- Hamilton Beach Brands Holding Company

- Tupperware.

- TTK Prestige Ltd.

- Denby Pottery

- HF Coors Co. Inc.

- ARC INTERNATIONAL SA

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252