Global Home Textile Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global home textile market began to exist when the demand for domestic furnishings that were not just a utility increased with rising post-war prosperity and expanding middle classes in Europe and North America. Linen, towels, and curtains were among the first items that were produced in large quantities and were mostly alike. The same happened when production was spreading worldwide, particularly through Asia's textile hubs, the industry was maturing and was able to provide great design, quality and variety.

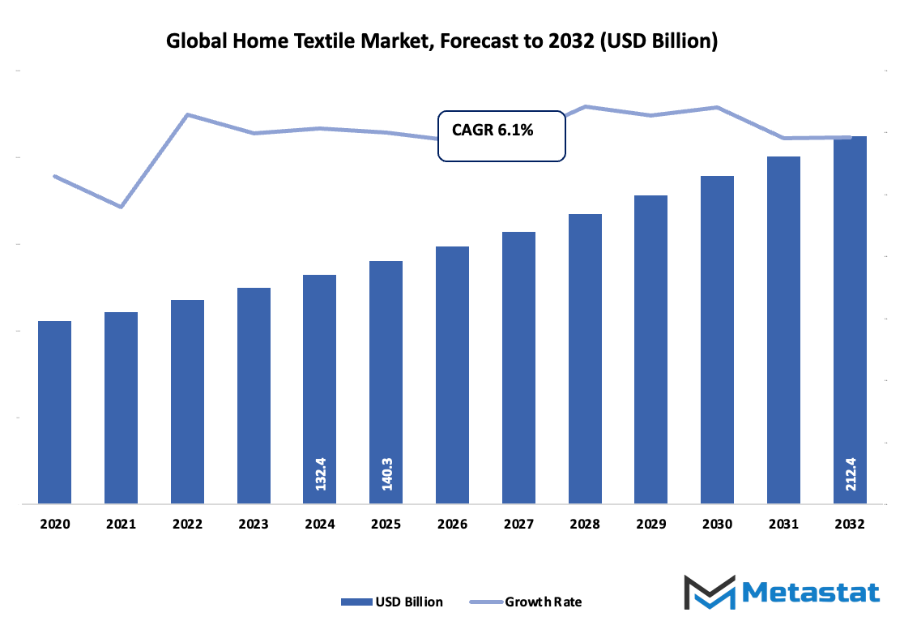

- The global home textile market is expected to be around USD 140.3 Billion by the end of 2025 and is going to grow at a CAGR of around 6.1% through 2032. It has the possibility of surpassing USD 212.4 Billion.

- Bedroom Linen takes the largest share of about 37.6% in the market and continues to innovate and expand its uses through vigorous research.

- The main reason for the growth in the market is: The consumers’ rising interest in home décor and interior design.

- Among the opportunities are: The growing use of fabric materials that are sustainable and eco-friendly.

- Main takeaway from this trend is that the market is going to be of a great worth in the coming decade, hence the potential for growth will be huge.

In the following decades, production gradually moved to places where it was cheaper while brand owners started to highlight design and performance: e.g. hypoallergenic finishes, high thread counts, flame-retardant bathroom textiles, more sophisticated carpets. The turn of the century brought not only digital printing, but also new synthetic blends and global retail chains that made it easier to reach consumers faster. This was the time when by the 2010s the market became a place where the consumers' expectations of texture, sustainability, functionality and beauty would be the factor to change the meaning of home textile products.

In a nutshell, the global home textile market comprises products like bedding, bath, kitchen, curtains, upholstery, and floor coverings, catering to both residential and commercial usage. The data that is available indicates that the size of the market was about USD 124.72 billion in 2023.

The consumers' demand for products with better performance, e.g., stain resistance, easy-care and allergy-friendly features, etc., has become as significant as the aesthetic finish. Furthermore, regulatory pressure and buyer expectations for transparency and environmental impact have set new standards: textile research associations that were originated decades ago are now even connecting with sustainability programs. All these trends fuse into the globally networked supply-chain that is operative now: manufacturers in Asia slipping the multi-national brands, European design houses playing with the colors and patterns, and online retail channels giving the access to the entire range of products.

The global home textile market has made a remarkable journey from the simple functional fabrics to being a design-led and performance-driven industry, and it will keep progressing as the consumer preferences, materials technology, and regulatory environments develop in unison.

Market Segments

The global home textile market is mainly classified based on Product Type, Material, Distribution Channel, End User.

By Product Type is further segmented into:

- Bedroom Linen:

Bedroom linen within the global home textile market reflects steady demand, with focus on comfort, durability, and design. Growing interest in coordinated bedding sets, soft fabrics, and easy-care materials supports wider acceptance across households and hospitality spaces. Strong emphasis on colour variety and fabric quality continues to shape overall market direction. - Bathroom Linen:

Bathroom linen shows ongoing growth as consumers seek high-absorption towels, bathmats, and washcloths that offer both comfort and long-lasting use. Rising awareness of hygiene, softer textures, and appealing designs encourages consistent purchases. Expanded choices in weight, weave, and quick-dry features strengthen market preference for premium yet practical bathroom essentials. - Carpets and Floor Coverings:

Carpets and floor coverings maintain significant value, supported by rising interest in stylish, low-maintenance options for homes and workplaces. Demand leans toward stain-resistant materials, modern patterns, and affordable alternatives to traditional flooring. Enhanced durability and wider availability of custom sizes guide market expansion across various residential and commercial settings. - Kitchen Linen:

Kitchen linen continues to attract attention due to higher demand for easy-wash, durable fabrics that support everyday cooking needs. Towels, aprons, napkins, and table covers with heat resistance and improved absorbency remain key choices. Growing interest in coordinated kitchen décor also influences product selection and increases market potential. - Curtains and Drapes:

Curtains and drapes remain essential for privacy, light control, and aesthetic appeal. Expanded fabric options, noise-reduction features, and thermal insulation strengthen market demand. Custom designs and colour options further enhance consumer attraction, making this segment a consistent contributor to overall market growth across homes and commercial interiors.

By Material the market is divided into:

- Polyester:

Polyester enjoys strong acceptance due to affordability, easy maintenance, and reliable durability. Wrinkle resistance and colour retention support wide usage across multiple textile categories. Increased availability of blended fabrics adds value, giving consumers more choices that balance softness and strength, keeping polyester an important material within the global home textile market. - Cotton:

Cotton remains a preferred choice for softness, breathability, and comfort. Natural fibers encourage adoption in bedding, towels, and daily-use linens. Enhanced weaving methods and organic variants add further appeal, reinforcing cotton’s position as a dependable and familiar option for households and commercial establishments seeking trusted textile quality. - Silk:

Silk caters mainly to premium buyers seeking smooth texture, luxury appeal, and distinctive sheen. Strong demand arises from decorative uses and high-end bedding. Although cost remains higher, long-lasting elegance and natural temperature-regulating qualities support continual interest, giving silk a selective yet influential role in the market. - Wool:

Wool provides natural warmth, durability, and resilience, supporting usage in carpets, blankets, and specialty fabrics. Moisture-wicking properties and insulation benefits encourage adoption in colder regions. Continued focus on high-quality wool blends and sustainable sourcing contributes to steady preference among consumers seeking long-lasting, comfortable textile solutions. - Others:

Other materials include bamboo fibers, linen, jute, and various blends designed for strength, sustainability, and texture variety. These alternatives support consumer interest in eco-friendly and innovative fabrics for diverse home applications. Growing experimentation with mixed fibers expands product possibilities and encourages broader market diversification.

By Distribution Channel the market is further divided into:

- Offline:

Offline distribution retains strong presence due to physical product inspection, personalized assistance, and immediate purchase options. Retail stores, specialty outlets, and department chains support consumer trust through touch-and-feel evaluation. Attractive displays, seasonal collections, and direct guidance strengthen buying confidence within this traditional sales channel. - Online:

Online distribution grows rapidly, driven by ease of access, broad product variety, and competitive pricing. Digital platforms offer detailed descriptions, customer reviews, and swift delivery, enhancing convenience for buyers. Expanding e-commerce participation from established and emerging brands continues to boost overall market reach and purchasing flexibility.

By End User the global home textile market is divided as:

- Residential:

Residential demand remains strong as households prioritize comfort, style, and functionality in daily living spaces. Frequent updates in bedding, towels, and décor items support steady sales. Expanding urban housing and rising preference for coordinated interiors add momentum, making residential spaces a key driver of consumption. - Commercial:

Commercial demand comes from hotels, offices, healthcare facilities, and institutions requiring durable, high-performance textiles. Emphasis on hygiene, long-term use, and consistent design standards shapes selection. Bulk purchasing, standardized materials, and service-oriented requirements ensure commercial environments remain a vital part of overall market growth.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$140.3 Billion |

|

Market Size by 2032 |

$212.4 Billion |

|

Growth Rate from 2025 to 2032 |

6.1% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

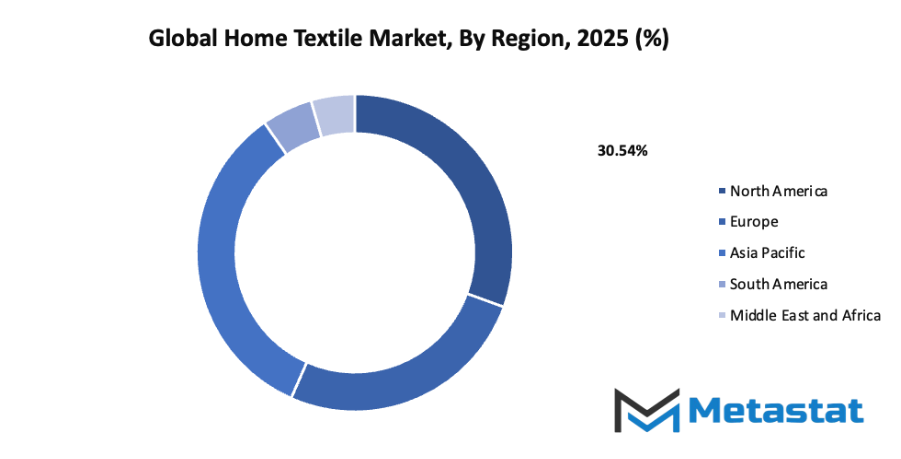

- Based on geography, the global home textile market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

Rising consumer demand for home décor and interior styling: Growing interest in fresh design options continues to guide buying decisions, with more attention placed on comfort, colour, and texture. The global home textile market gains steady support from changing lifestyle habits, frequent home upgrades, and stronger focus on creating welcoming living spaces influenced by modern design trends.

Growth in urbanization and increasing disposable incomes: Expanding urban centers bring higher housing development, leading to wider demand for quality furnishings. Rising income levels allow broader spending on updated textiles, encouraging better material choices and frequent replacements. Strong market participation emerges as households seek improved comfort, durability, and style across different living environments.

Challenges

Fluctuating raw material prices, especially cotton and synthetic fibers: Constant changes in fiber costs create planning difficulties for producers, affecting production budgets and retail pricing. Unstable supply conditions add pressure on sourcing decisions, pushing manufacturers toward careful cost management while maintaining consistent product quality across multiple categories within the global home textile market structure.

Intense competition from low-cost manufacturers: Expanding production bases in cost-focused regions place strong pressure on pricing and differentiation. Competitive conditions encourage stronger branding, unique textures, and improved durability. Manufacturers respond with enhanced quality standards, faster delivery systems, and broader design ranges to maintain stable customer interest in a crowded marketplace.

Opportunities

Increasing adoption of sustainable and eco-friendly textile materials: Growing awareness of environmental responsibility encourages wider use of organic fibers, recycled blends, and low-impact dyes. Sustainable options attract support from environmentally mindful buyers, allowing producers to build stronger value perceptions while aligning with global sustainability goals across multiple home furnishing categories.

Competitive Landscape & Strategic Insights

The global home textile market shows a broad mix of established international leaders and rising regional competitors, creating steady movement within production, branding, and distribution. Major organizations such as Welspun Group, Trident Group, Springs Global, New Sega Home Textiles, Ralph Lauren Corporation, IKEA Systems B.V., Marvic Textiles, Industria Innovations, Honsun Home Textile Co., LTD, Hunan Mendale Hometextile Company Ltd., West Point Home, Mohawk Home, Milliken, Himatsingka, Al Haseeb Textiles, MZ Global Trading, Textilepages, Sutlej Textiles and Industries Ltd., Allcost, Luren, and Sunvim Group Co., Ltd. hold significant ground in global trade and continue to push production standards forward.

Market progress depends on consistent attention to design, material quality, and supply chain strength. Strong demand for comfortable and durable household fabrics supports steady growth for leading organizations, while fresh entrants often focus on specialized styles or flexible service models. Each organization works toward stronger recognition through careful selection of fabrics, careful finishing methods, and dependable delivery networks. Growing attention to environmental responsibility also shapes strategic direction, encouraging broader use of recycled fibers, reduced energy consumption, and safer manufacturing processes.

Wider access to digital platforms supports smoother communication between producers, distributors, and buyers. Faster sharing of product details encourages clearer expectations and shorter response times. Many organizations also rely on steady research to understand buying behaviour across different regions, helping each group shape collections that match current preferences.

Market size is forecast to rise from USD 140.3 Billion in 2025 to over USD 212.4 Billion by 2032. Home Textile will maintain dominance but face growing competition from emerging formats.

Competition encourages steady improvement across quality, comfort, and long-term value. Established groups continue to protect long-held reputations through dependable production methods, while regional suppliers build recognition through flexible pricing and quick adjustments to market shifts. As more households place greater value on both comfort and style, steady demand supports ongoing expansion for numerous organizations listed within the global home textile market. Continuous progress across materials, patterns, and production methods strengthens overall market direction and supports consistent interest from buyers seeking reliable and appealing household textiles.

Report Coverage

This research report categorizes the global home textile market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global home textile market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global home textile market.

Home Textile Market Key Segments:

By Product Type

- Bedroom Linen

- Bathroom Linen

- Carpets and Floor Coverings

- Kitchen Linen

- Curtains and Drapes

By Material

- Polyester

- Cotton

- Silk

- Wool

- Others

By Distribution Channel

- Offline

- Online

By End User

- Residential

- Commercial

Key Global Home Textile Industry Players

- Welspun Group

- Trident Group

- Springs Global

- New Sega Home Textiles

- Ralph Lauren Corporation

- IKEA Systems B.V.

- Marvic Textiles

- Industria Innovations

- Honsun Home Textile Co.,LTD

- Hunan Mendale Hometextile Company Ltd.

- West Point Home

- Mohawk Home

- Milliken

- Himatsingka

- Al Haseeb Textiles

- MZ Global Trading

- Textilepages

- Sutlej Textiles and Industries Ltd.

- Allcost

- Luren

- Sunvim Group Co., Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383