MARKET OVERVIEW

The Global High-Voltage Power Transformer market stands as a pivotal feature of the electrical power industry, facilitating energy transmission over long distances efficiently. These transformers allow electricity to flow from generation plants to distribution networks without any gap, making them an essential part of modern infrastructure. Besides the classical uses, the industry will witness some good changes due to technological changes, development of newer regulation frameworks, and constant demand for reliable power supply. As the globe is now transforming in energy needs, the high-voltage power transformers, in the future, will have new applications that go beyond the conventional settings.

With the improvement in sustainable energy systems, the industry is likely to move towards newer materials and designs that significantly improve efficiency and minimize loss. The next generation of high-voltage power transformers will be envisaged, based on new insulation technologies and superconducting materials capable of dissipating far less energy and sustaining long life in service. In addition, the inclusion of digital monitoring systems will pave real-time diagnostics necessary for averting failure and optimizing performance along power grids. Such developments will deliver solutions for the current demand for electricity while addressing operational efficiency and environmental impact.

High-voltage power transformers, as energy consumption is getting higher worldwide, will essentially stand as an underlining of smart grid infrastructure. In order to support the transition toward intelligent networks, transformers must be equipped with automated controls capable of maintaining their stability during peak loading. AI and machine-learning algorithms will further sharpen predictive maintenance practices in order to minimize the incidence of unforeseen downtimes while improving overall asset management. Moreover, the widespread integration of renewable energy resources means that the transformer designs must be flexible enough to respond to variable loads and bidirectional energy flow to stabilize the grid as more decentralized power generation systems come online.

In addition to technical enhancements, there will be forces from continually changing regulatory regimes that are put into play for the future of the Global High-Voltage Power Transformer market. Governments and energy agencies worldwide will impose stringent standards of efficiency, which will compel manufacturers to concentrate on designs that cut down energy losses. Such standards would further spark innovative cooling methods and eco-efficient insulating fluids to mitigate environmental impact without compromising performance. Moreover, geopolitical trends would disrupt supply-chain dynamics, compelling manufacturers to start searching for alternatives in sourcing critical raw materials to maintain uninterrupted production capacity.

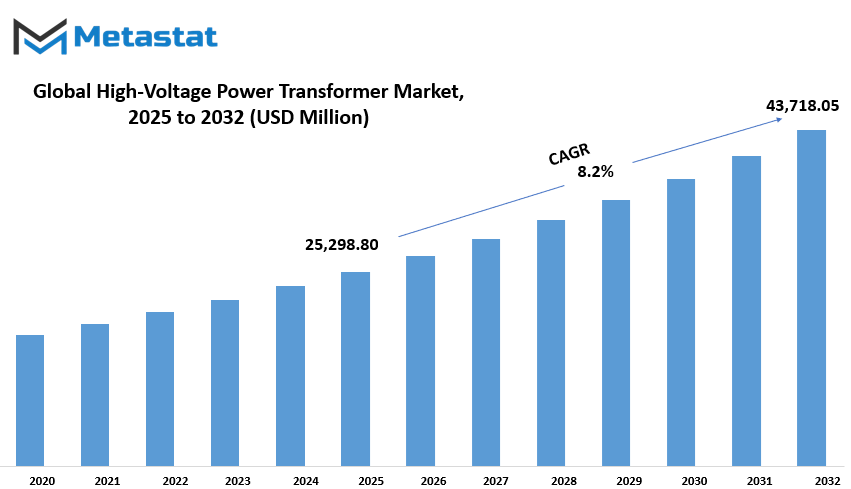

Global High-Voltage Power Transformer market is estimated to reach $43,718.05 Million by 2032; growing at a CAGR of 8.2% from 2025 to 2032.

GROWTH FACTORS

The Global High-Voltage Power Transformer market is one vitally necessary means of transmitting electricity across networks in a way that makes them economical. The power transformer market landscape is changing all over the world. The need to reliably distribute power and address infrastructure expansion is the most pressing factor influencing this change. When countries invest heavily in upgrading the electricity network, the demand for high-voltage power transformers shoots up. Such transformers play an important role in the long-distance transmission of electricity, which in turn helps keep the constant supply of power to industries, commercial players, and households. The countries are prioritizing power grid modernization, whereas advanced transformer technologies are gaining traction in being adopted widely to improve efficiency and minimize energy losses.

The sustained injection of funds in the power infrastructure establishments is one of the core driving forces for this market. The strengthening of electricity networks, especially in developing economies where urbanization and industrialization are at their peak, is one area where both governments and the private sector players are actively pouring resources. In addition, the current global trend of moving from conventional to renewable energy sources further propels the demand for high-voltage power transformers. An easy integration of the grid with wind and solar energy projects will be key in balancing power supply levels that keep fluctuating. High-voltage transformers ensure seamless transfer of energy collected from renewable generation into the grid to maintain reliability and stability.

Certain obstacles could impede market growth. The initial installation and maintenance cost, which remains high, is a pertinent concern for utility providers and industries. These types of transformers require huge capital investment, thus restricting the large-scale application for small companies and developing nations. Supply chain interruptions that affect the availability of essential raw materials like copper and steel are another challenge. One can imagine how supply chain issues with these materials can lead to the subsequent delays in manufacturing and installation, hence curtailing the expansion of the market.

Despite these drawbacks, opportunities still abound for the Global High-Voltage Power Transformer market. The advent of smart grid technology has transformed power distribution systems into Highly Efficient and Reliable Systems. Digital transformers, which have solid monitoring and automation features, are increasingly being adopted. The advantages of these innovations include increased operational efficiency and reduced probability of system failures. Therefore, while existing energy technologies will develop and continue to shape the energy sector, the entry of smart transformers will open opportunities for further growth. Demand for intelligent energy management solutions can grow, making high-voltage power transformers the mainstay in today's electricity networks.

MARKET SEGMENTATION

By Power Rating

The high-voltage transformers are built to handle high voltage levels of electricity to ensure they transfer energy from generation sources to end users conveniently. Though the market is likely to growth driven by improvements to grid infrastructure, industrialization, and a greater need for reliable energy distribution, the demand for electricity continues to increase. Thus, the significance of high-voltage transformers will only increase as countries continue upgrading their power grids.

Power rating is one of the major differences that matter with these transformers, and the market is further characterized into categories based on rating capacity. Substantial in terms of share is the Small Power Transformers (SPT) with a rating of ≤ 60 MVA, worth $8,762.24 million. These transformers are used in urban distribution networks to deliver electricity efficiently to residential areas and commercial spaces. Large Power Transformers (LPT), however, have a rating of over 60 MVA, fulfilling not only industrial applications but also keeping transmission over long distances. Gas efficiency and stability upkeep are their fundamental contributions to power grids.

In addition, the increasing demand for high voltage transformers is mostly because of the stress on renewables' integration. The increased use of solar and wind resources will result in incapacity for effective linkages. High-voltage transformers are useful for linking the sources directly into the grid for a clear and continuous flow of energy. Strengthening of power infrastructure due to urbanization and industrialization in these growing economies will further drive growth in demand.

Technological advancements have paved the way for more efficient and improved transformers, which further brings down the cost of maintenance and improves performance overall. Now smart grid technologies and digital monitoring systems have significantly influenced the improvement of the effectiveness of energy transmission, thereby enhancing even further transformer operability to flexibly provide electricity energy under the ever-changing requirements. In addition, regulatory policies limiting the effects of carbon footprints, require increased efficiency in energy use, and adoption of greener alternatives, continue to direct the mission of the industry.

The Global High-Voltage Power Transformer market is therefore transformed as demand for reliable and flexible energy distribution continues to grow. Both companies invest heavily in the research and development of more efficient, more durable, and better-optimized-for-today's networks transformers.

By Cooling Type

Power transformers provide a backbone for power grids in stepping up and stepping down voltage levels necessary for effective power transmission and distribution, making the Global High-Voltage Power Transformer market indispensable for stabilizing and efficient electricity distribution. These power transformers are, however, mainly used to give a smooth transition to an electric network that connects the generation source to the utilization point. Generally speaking, their applications cover substations, industrial installations, and renewable energy plants.

The cooling scheme is one of the most significant aspects of these transformers ensuring optimal working conditions and maximum life. The classification of power transformers into dry-type transformers and oil-immersed transformers is based on their cooling medium. Heat dissipation in a dry-type transformer takes place in the air or through some other environmentally safe insulation system. They are preferred in indoor applications and sites where little fire hazards are concerned. Low maintenance paired with high efficiency has ensured that dry-type transformers are favored for application in commercial buildings, underground substations, and renewable energy projects.

In contrast, oil-immersed transformers cool the transformer and control temperature by insulating oil. They are most common in large power transference networks for their superior capacity and ability to take higher loads. The oil acts as insulation and coolant, maintaining stability and efficiency of operations. These transformers may require occasional maintenance services, but due to their capacity to work under severe stress conditions, they are regarded as strategic assets for industrial plants, transmission substations, and grid infrastructure.

With technological advances, manufacturers are currently concerned with energy-efficient and environmentally friendly solutions. The urgency created by the transition into renewable energy sources has driven an even higher demand for transformers that can blend in with wind and solar power systems. Also, changes in insulation materials and smart monitoring systems help enhance the reliability and operational efficiency of transformers. Governments and regulatory bodies also form a significant market influence through stringent efficiency standards and the promotion of sustainable energy practices.

The lifestyle of transformers will be growing with thorough demand as the evolutionary phase of power continues. The extension of electricity networks and the transmutation to more environmentally suitable sources will, thereby, continue stepping up the pace of transformer technology evolution. The benefit will be for companies engaged heavily in R&D on this count, as there will be an escalating demand for efficient and durable solutions for power transmission. Therefore, the Global High-Voltage Power Transformer market will experience unbroken growth and innovation, with a view towards improved sustainability and better grid resilience in years to come.

By Application

With stable and efficient electricity being provided from generation to consumption for all kinds of use, the global high-voltage power transformer market serves as one of the keys to that process. These power transformers step up voltages so that electricity can be transmitted over long distances with negligible losses. With increasing demand for electricity, then, on these transformers have begun to rely as a backbone of their operation industries and utilities. This market has largely been segmented based upon the application, which consists of three important segments: commercial, industrial, and utility.

In the commercial segment, the high-voltage power transformer is utilized to ensure a reliable power supply for businesses in general, office buildings, malls, etc.; these establishments obviously require uninterrupted power supply that should keep their operations going smoothly, aided by artificial lighting, heating, and cooling, and equipment considered unnecessary." By the same token, disruptions arising from substations that either operate poorly or upon which short-term disturbances may occur could severely affect production efficiency and thus cause monetary losses.

The industrial sector requires high-voltage power transformers mainly to satisfy the large consumption of electrical energy by manufacturing plants, production facilities, and processing units. The factories and industrial operations utilize complex machinery that requires a steady and very secure high-power source. Fluctuation of voltages hence can Cause damage to the machinery and can also delay production and cost even more for maintenance. This advanced transformer technology integration, therefore, offers industries added efficiency, little downtime, and sustainably optimized holistic energy.

One of the largest consumers of high-voltage power transformers-the utility sector-provides more reliable generation, transmission, and distribution of electricity. They step up or step-down voltage in power plants, substations, and grid networks in such a way that the electricity efficiently and safely reaches its consumers. With renewable energy integration ramping up, utilities are upgrading their transformers to accommodate solar, wind, and hydroelectricity generation. The modernization plans include those to improve grid stability, enhance energy efficiency, and minimize transmission losses away from the renewables-an endeavor that will further solidify the credibility of this power sector.

Change is the only constant, which thereby Effects Even After fully Adapting These Listed-there Will Still be An Increased Demand for High-Voltage Power Transformers. Transformer insulation materials, new cooling arrangements, and smart grid integration are the core of modernization. Present market trends for energy-efficient solution development and eco-friendly operation ensure steady market growth.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$25,298.80 million |

|

Market Size by 2032 |

$43,718.05 Million |

|

Growth Rate from 2025 to 2032 |

8.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

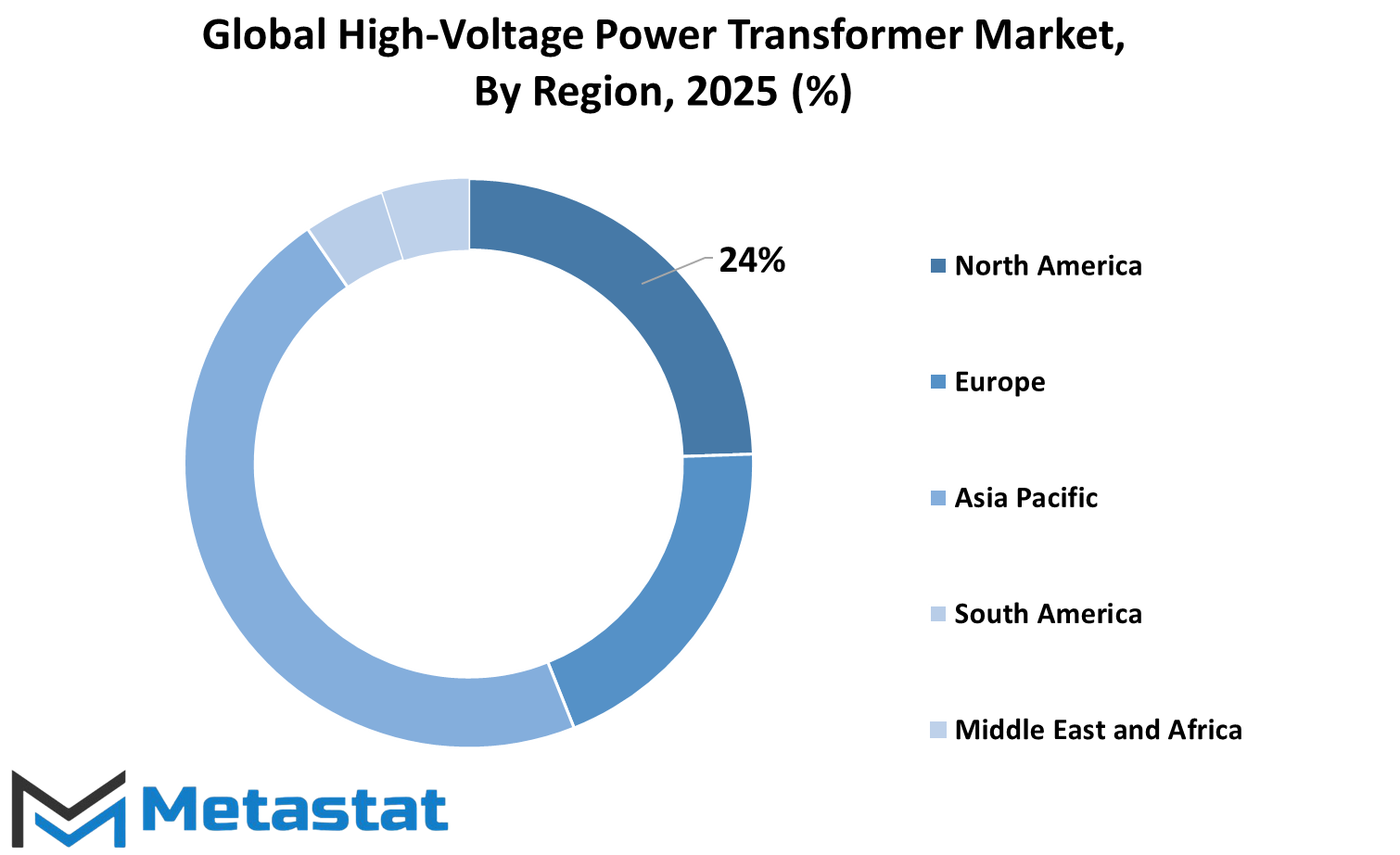

Global High-Voltage Electricity Transformer Market: A Complex Multinational Regional Demand Influences Power Transformer. It is segmented based on geography to North America, South America, Europe, Asia-Pacific, and Middle East & Africa. Each geographic region has its own set of dynamics for summer and the final market adoption.

This region consists of the US, Canada and Mexico. As such, the area has to take advantage of advanced electrical grids and the increasing use of modernization grid application that this growing area in itself possesses. The role of the US becomes even more vital in this regard because the country ultimately aims towards pulling itself onto a track of 100% renewable energy integration within the area. The market is also held up as can be borne out by the contributions from other countries such as Canada and Mexico, where they are also growing their power distribution networks towards the impending increased energy needs.

This region can include the UK, Germany, France, and Italy, The Rest of Europe. It is a well-known region with a well-established electrical infrastructure and strong emphasis on sustainability. The counties across Europe are currently focusing on the upgrade of existing transmission systems while reducing energy losses and further integrating/resorting high renewable sources such as wind and solar power. These initiatives would escalate the overall requirement of reliable high-voltage power transformers.

This region includes India, China, Japan, South Korea, and the rest of Asia-Pacific. The rapid speed of urbanization and industrialization in this region has caused a demand for electricity transmission assets. High energy consumption in the population is a constant force for the most populous countries in the world, China and India, to invest continuously in power grids. Furthermore, Japan and South Korea are known for advanced technologies importing smart grids, thereby enhancing the growth of the market.

South America contains Brazil, Argentina, and other countries in the rest of South America. High-voltage power transformer demand in this continent is majorly driven by expanding energy networks and increasing electricity consumption over time. Brazil requires transformers to enhance electricity distribution efficiency due to large renewable hydropower resources. Economy growth will be supported in Argentina and many other countries as they invest their efforts toward building energy infrastructures.

The possible countries in the Middle East & Africa may be the GCC Countries, Egypt, South Africa, and the rest of the region. The Middle East is focused on high-capacity transformers to cater to all commercial and industrial key activities when talking about energy projects on a large scale. Africa still has relatively low access to electrification, and increasing infrastructure development will help reject it later. Investments made towards renewable energies and grid modernization will add to the demand for high-voltage power transformers in this region.

COMPETITIVE PLAYERS

The Global High-Voltage Power Transformers Market is a vital market in the power transmission of electricity over long distances. The emerging industries and growing urbanization create a continual need for reliable power. High-voltage power transformers help in the major energy infrastructures control of voltage levels to minimize losses during transmission. They figure prominently in utility use, manufacturing, and renewable energy sources, wherein an uninterrupted supply of electricity becomes imperative for continuity of operations.

Jointly, several critical stakeholders are involved in market shaping to catalyse technology advancement as well as capacity development. Such players in this industry include Telawne Power Equipments Private Limited, Siemens Energy, General Electric, Toshiba Energy Systems & Solutions Corporation, and Mitsubishi Electric Corporation. These are the major companies that have facilities in transformer-manufacturing technology applicable for manufacturing transformers that necessarily must have high efficiency, durability, and allow keeping conforming with international energy standards. Besides these, there are several other contributors, including HYOSUNG HEAVY INDUSTRIES, Hitachi Energy, Hyundai Electric & Energy Systems, and Transformers and Rectifiers (India) Ltd. These increasingly progressive manufacturers are implementing strategies, which include creating new design and development programs for digital monitoring systems and also using environmentally friendly insulation materials to enhance the performance of the transformers.

Alongside these well-established brands are some key regional manufacturers like Ningbo IRONCUBE Works International Co., LTD., A B C TRANSFORMERS (P) LTD, Fuji Electric, and Vijay Power. Their endeavors are directed toward placing their input in support of the increasing demand for transformers in developing markets where infrastructure expansion requires solutions that are efficient and cost-effective. Wilson Power Solutions, JiangSu HuaPeng Transformer Co., Ltd., ARTECHE, BTW, Kirloskar Electric Company, Elta Transformers Ltd, and BEST Transformer are also important players influencing market dynamics at present. These companies are concentrating on customized transformer solutions for specialized applications on industry lines.

The holy grail of high-voltage power transformers is being substantially upgraded in accordance with renewable energy principles. Investments in new insulation systems, integration into smart grids, and design for high-efficiency operation are being put to work to meet sustainability targets. With the world turning towards cleaner energy, transformers will continue to act as a stabilizing force within power networks. A ceaseless supply of transformers that are efficient, durable, and high performance will thereby be provided by the collaboration of both industry leaders and emerging players that support the growing energy need of modern society.

High-Voltage Power Transformer Market Key Segments:

By Power Rating

- SPT (≤ 60 MVA)

- LPT (> 60 MVA)

By Cooling Type

- Dry Type

- Oil Immersed

By Application

- Commercial

- Industrial

- Utility

Key Global High-Voltage Power Transformer Industry Players

- Telawne Power Equipments Private Limited

- Siemens Energy

- General Electric

- Toshiba Energy Systems & Solutions Corporation

- Mitsubishi Electric Corporation

- HYOSUNG HEAVY INDUSTRIES

- Hitachi Energy

- Hyundai Electric & Energy Systems

- Transformers and Rectifiers (India) Ltd.

- Ningbo IRONCUBE Works International co., LTD.

- A B C TRANSFORMERS (P) LTD

- Fuji Electric

- Vijay Power

- Wilson Power Solutions

- JiangSu HuaPeng Transformer Co., Ltd.

- ARTECHE

- BTW

- Kirloskar Electric Company

- Elta Transformers Ltd

- BEST Transformer

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383