Global Heat Resistant Labels Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The key trend was set in the 1990s when electronic components got smaller and smaller to the point that manufacturers had to use labels that could withstand the high temperatures of soldering. This was also the time when manufacturers of tech products wanted every single circuit board tagged accurately, so barcodes became the norm and engineers invented protective coatings that would last through the thermal cycles. Little by little, the printing techniques that are now common, such as thermal transfer printing, became available, making it possible to have very clear writing and also to keep track of the units for a long time in the production run.

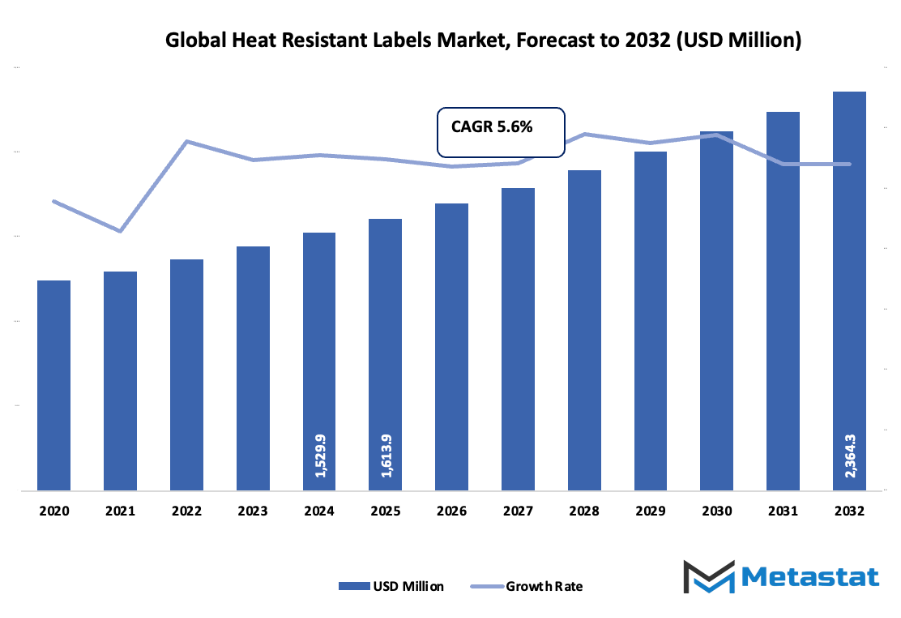

- The global heat resistant labels market is anticipated to be worth around USD 1613.9 million in 2025, registering a CAGR of about 5.6% throughout 2032 and possibly reaching over USD 2364.3 million.

- Coal Tar-based Polyester Labels is the dominant segment, holding around 35.3% of the market share, and driving innovations in the field with their extensive research and adoption of new technologies in the applications.

- Heat Resistant Packaging for Food Products is the most prominent demand in the market, and thus the Food Industry is one of the strongest drivers of growth alongside Automotive and Electronics Manufacturing Sectors.

- The market opening up for the industrial sector in emerging markets is one of the most significant opportunities from the above markets.

- Market has been interpreted as a thousand-fold increase over the next decade, thereby, pointing out the very large area for the growth prospect.

The decade of the 2000s marked a turning point when regulatory authorities made it compulsory to track food packaging, aerospace safety documentation, and electronic component handling. Labels gained new importance as "evangelist" and "overseer" of the product all at once. Permanent record maintenance dictated by the rules led to the masterful craftsmanship of material scientists who produced adhesives that could be applied to any material and also caustically resistant, friction resistant, and heat resistant during sterilization.

Consumerism was the main trendsetter from 2010 onwards. Consumers wanted to have transparency for everything they bought - they wanted to know even the most minor details like batch information, recycling status, safety measures, and authenticity verification. Brands then had to resort to labels that could withstand and still be readable after exposure to extreme temperatures, industrial cleaning, or very rigorous climates. Consequently, digital printing technology became more advanced which allowed for unique coding on every single item thus making it possible recalls, proof-of-origin tracking, and authentication against counterfeiting.

The global heat resistant labels market today is on a very diverse floor far beyond manufacturing activities. It also takes care of aerospace safety logs, medical sterilization tracking as well as smart supply chain systems. The future innovations are going to be driven by the use of more eco-friendly adhesives, recycled films, and labels that consumers as well as machines can immediately scan for data. The transformation of identification strips from very simple beginnings into the core of traceability, safety, and product trust has turned out to be a major accomplishment.

Market Segments

The global heat resistant labels market is mainly classified based on Type, Printing Technology, Application, End-Use Industry.

By Type is further segmented into:

- Polyester Labels: The material for polyester labels provides very effective resistance against heat, moisture, and mechanical stress. The surface of the label enable nice printing and it also does not change during long production. Manufacturers pick this kind of material for industries where the product must be visible under high temperatures during storage or shipment, thus giving the consistency of performance in tough handling situations.

- Polyimide Labels: Polyimide label material can resist very high temperatures during soldering and component production. The very strong surface structure does not change and it retains clear printed data even during tough processing stages. Electronics makers go for this label type for circuit boards and micro-components because the reliable information needs to be visible even after extreme thermal contact.

- Vinyl Labels: Vinyl label material is very flexible especially when it comes to applying on curved or uneven surfaces. The chemical resistance and moderate heat put together forms a reliable identification during cleaning, sorting, and packaging activities. The surface of vinyl labels is such that ink adheres very well, thus whenever the manufacturing teams and quality inspectors are in the daily production movement, the printed labels are still visible.

- Aluminum Labels: Aluminum label material can endure high temperatures and physical contact when machines are working. The rigid metallic surface covers the printed information and thus prevents it from getting damaged by abrasion and corrosion. Manufacturing industries put aluminum labels on the machines and the structures where long-lasting durability and good visibility during safety inspections or maintenance works are needed.

- Others: Additional heat-resistant label options include materials designed for niche projects requiring unique surface bonding, color durability, or chemical resistance. These solutions support specific production needs across different sectors where standard materials cannot meet temperature or environmental demands, ensuring continuous data visibility during intense operational conditions.

By Printing Technology the market is divided into:

- Direct Thermal Printing: In the direct thermal printing process a heated print head makes direct contact with a specially coated label and chars the surface to form the image without using ribbons or ink. This method is suitable for temporary marking, as the thermal effect must be very short. The practice is generally accepted in the case of high-availability identification, since it has the advantage of being less costly.

- Thermal Transfer Printing: In thermal transfer printing a thin film-like ribbon with the desired color is placed on the label surface and pressed. The heat of the print head melts the pigment, which is transferred to the label. The text and graphic elements created in this manner are durable and easily readable. The printing method is most often used in manufacturing to mark components, track them throughout the whole process and keep documentation up-to-date.

- Laser Printing: Laser printing produces black and white as well as color prints of very high quality with extreme detail, thus the barcode's reliability in terms of readability even when scanning is assured. The method is ideal for large batch printing such as those in the areas of warehousing or preparing products for sale. This is because the toner adheres strongly to materials that resist heat, so the text on the label is still readable even after being subjected to the packaging line and heavy-duty machinery.

- Inkjet Printing: In inkjet printing controlled droplets of ink are sprayed onto the label surface, thus giving a lot of freedom in terms of color coding and irregular layouts. This process is a good fit for businesses that offer custom printing in short runs. When used together with a special heat-resistant substrate, the printed surface remains legible under the moderate heat of up to 55C found in packing or sorting lines.

By Application the market is further divided into:

- Product Identification: Heat-resistant labels help manufacturers to provide permanent product information for instance batch codes, production dates, and compliance marks. The sturdy surface guarantees to have the message very clearly seen even amid the transportation, storage, or assembly. The power of adhesion will not let the data go during the heat exposure; thus the production manager will be helped by it confirming the correct lodgment of components and finished goods.

- Barcoding and Tracking: By using barcode labeling, logistics accuracy is improved and handling efficiency is increased. The durable heat-resistant material acts as a shield for the critical tracking numbers through all the challenges of machinery contact or temperature stress. The warehouses and production area adopt these labels to track the flow from assembly lines to distribution centers thereby enabling them not only to manage their inventory accurately but also to fulfill orders promptly.

- Asset Management: Heat-resistant labels are an essential part of the long-term identification of machinery, tools, and equipment. The maintenance teams are aided by permanent markings in their inspections, calibration schedules, and ownership records. The robust surface acts as a barrier against fading caused by washing or heating, thus cutting down replacement and providing uninterrupted access to crucial asset data throughout the service life.

- Safety and Warning Labels: Labels of safety supply hazard notices at the proximity of hot surfaces, moving parts, and restricted zones. A heat-resistant construction offers still clearer messages even when the equipment has been running for a long time. Text visibility is very supportive of the safe conduct in daily production areas thus the accidents are reduced and the regulatory compliance is ensured during the inspections.

- Others: Additional applications include instructional labeling, temporary location markings, and tracking of parts across testing lines. Specialized material options support diverse temperature demands, reducing label failure during harsh production tasks. The continued visibility of printed information promotes accurate decision-making and efficient workflow completion.

By End-Use Industry the global heat resistant labels market is divided as:

- Automotive: Automotive production requires labels on engine compartments, exhaust areas, and under-hood components where high temperature exposure is constant. Strong label adhesion and clarity allow workers to confirm part numbers and service details during manufacturing and maintenance. Reliable identification supports quality control across assembly stages.

- Electronics: Electronics producers apply heat-resistant labels to circuit boards and internal components during soldering and testing. The label surface protects barcodes and serial data from smudging or distortion. Clear identification ensures accurate tracking of parts during assembly, inspection, and distribution toward final device integration.

- Aerospace: Aerospace facilities place strong emphasis on durable labeling for components exposed to extreme temperature variation. Accurate data on parts supports maintenance logs, inspection cycles, and regulatory compliance. High-strength labels ensure readable information during flight-related testing, storage, and long operational lifespan.

- Food & Beverage: Food and beverage processing environments involve steam, heat sealing, and rapid temperature changes. Heat-resistant labels support clear tracking of product batches and expiration data. The strong label surface remains readable during cooking, chilling, or pasteurization, helping staff monitor safety and freshness across processing steps.

- Healthcare: Healthcare settings require heat-resistant labels for sterilization cycles, high-temperature cleaning, and secure patient or sample identification. Durable printing maintains legibility during exposure to autoclave systems. Clear data supports accurate tracking of instruments, laboratory samples, and medication packaging.

- Chemicals: Chemical producers need labels that withstand high temperatures along with spills, splashes, and harsh cleaning agents. Durable heat-resistant labels support regulatory documentation and safe storage. Strong adhesion ensures continuous visibility during handling, mixing, or transportation within production centers.

- Others: Additional sectors use heat-resistant labels for inspection tags, outdoor machinery, and industrial packaging. The durable material ensures that printed data remains visible during extreme temperature shifts and heavy handling. Reliable labeling assists teams with organization, documentation, and long-term monitoring of stored or active components.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1613.9 Million |

|

Market Size by 2032 |

$2364.3 Million |

|

Growth Rate from 2025 to 2032 |

5.6% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

- Based on geography, the global heat resistant labels market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Increasing Demand for Heat-Resistant Packaging in Food Industry:

Rising focus on food safety encourages packaging that prevents label distortion during high-temperature processes such as pasteurization and sterilization. Many food producers require labels that remain readable through heat exposure, moisture, and storage changes. This increasing requirement supports steady growth for the global heat resistant labels market, creating consistent commercial interest. - Growth of Automotive and Electronics Manufacturing Sectors:

Automotive and electronics production frequently involves harsh conditions, including high heat from engines, machinery, and circuit components. Clear and durable labeling supports safety checks and efficient tracking during assembly, testing, and distribution. Rapid manufacturing expansion across multiple regions generates consistent demand for long-lasting labels designed to handle elevated temperature environments.

Challenges and Opportunities

- Technological Limitations in Achieving High-Temperature Resistance:

Creating labels that withstand extreme temperatures without fading or peeling requires advanced materials and specialized adhesives. Research and development efforts demand significant investment, slowing adoption for certain applications. Without consistent breakthroughs in manufacturing materials, some industrial users remain cautious, particularly when long-term durability under severe heat exposure is required. - Cost Sensitivity among Small and Medium Enterprises (SMEs):

High-performance label materials often command a premium price, which challenges smaller businesses with strict budgeting strategies. These companies frequently compare costs between standard labels and heat-resistant options, leading to slower purchasing decisions. Price concerns reduce adoption speed and create hesitation during long-term procurement planning.

Opportunities

- Expansion into Emerging Markets with Growing Industrial Activities:

Countries experiencing rapid industrial development present significant sales potential for heat-resistant labeling solutions. Increased manufacturing activity in sectors such as food processing, electronics, and automotive production encourages new adoption. Greater investment in organized manufacturing and better regulatory compliance builds strong opportunities for suppliers offering durable labeling materials designed for demanding production environments.

Competitive Landscape & Strategic Insights

Competition within the global heat resistant labels market shows strong activity from large multinational corporations along with newer regional groups. The industry includes recognized leaders such as Avery Dennison Corporation, Metalcraft Inc., Brady Corporation, UPM-Kymmene Oyj, Sheenum Graphics, CCL Industries Inc., DuraMark Technologies Inc., Tesa SE, YS Tech CO., LTD., IndustriTAG by GA International, Lintec Corporation, SATO Holdings Corporation, CILS International, Crown Labels, AA Labels, Label-Aid Systems, Camcode, Shamrock Labels, PLASTOCHEM INDIA PVT. LTD., and Labelmaster. Every company seeks strong performance during high heat applications and dependable adhesion during harsh industrial processes. Demand from manufacturing, automotive production, and electronics encourages regular product improvement and wider material choice.

Strong brand recognition from multinational corporations supports significant sales power. Avery Dennison Corporation and CCL Industries Inc. maintain extensive global networks along with long-term partnerships. Brady Corporation and Metalcraft Inc. focus on accuracy in tracking and industrial control. Regional competitors such as PLASTOCHEM INDIA PVT. LTD., Shamrock Labels, AA Labels, and Crown Labels support growth within domestic markets by offering flexible order quantities and rapid delivery. Established corporations guide overall standards, while regional groups encourage broader access and cost-friendly options.

Many end-use sectors require steady reliability. Automotive plants depend on strong label adhesion during painting or metal treatment. Electronics production demands clear legibility during soldering or high heat processing. Safety standards in every sector require readable data display, and every company aims to deliver solutions aligned with industry rules.

Market size is forecast to rise from USD 1613.9 million in 2025 to over USD 2364.3 million by 2032. Heat Resistant Labels will maintain dominance but face growing competition from emerging formats.

Pricing, supply chain strength, and material innovation guide purchasing decisions. Companies using strong research spending gain faster progress in new coatings and adhesive materials. Regional groups drive price competition, while international leaders concentrate on durability and consistent performance. Frequent collaboration among material suppliers and printing technology partners encourages further advancement.

Report Coverage

This research report categorizes the global heat resistant labels market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global heat resistant labels market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global heat resistant labels market.

Heat Resistant Labels Market Key Segments:

By Type

- Polyester Labels

- Polyimide Labels

- Vinyl Labels

- Aluminum Labels

- Others

By Printing Technology

- Direct Thermal Printing

- Thermal Transfer Printing

- Laser Printing

- Inkjet Printing

By Application

- Product Identification

- Barcoding and Tracking

- Asset Management

- Safety and Warning Labels

- Others

By End-Use Industry

- Automotive

- Electronics

- Aerospace

- Food & Beverage

- Healthcare

- Chemicals

- Others

Key Global Heat Resistant Labels Industry Players

- Avery Dennison Corporation

- Metalcraft Inc.

- Brady Corporation

- UPM-Kymmene Oyj

- Sheenum Graphics

- CCL Industries Inc.

- DuraMark Technologies Inc.

- Tesa SE

- YS tech CO., LTD.

- IndustriTAG by GA International

- Lintec Corporation

- SATO Holdings Corporation

- CILS International

- Crown Labels

- AA Labels

- Label-Aid Systems

- Camcode

- Shamrock Labels

- PLASTOCHEM INDIA PVT. LTD.

- Labelmaster

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252