Global Health Ingredients Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global health ingredients market has emerged as a result of the evolution of the triad of food, science, and public consciousness. It started with the idea of nutrition being no more than a source of energy, which was a long way from the scientific understanding that certain diets could even act as a form of disease prevention. One of the first products that would later characterize this industry was the introduction of vitamins and fortified foods in the early 1900s. Progress made in the bioactive compounds research enabled the production of more modern health-promoting ingredients, and so they set the stage for what the market would ultimately become.

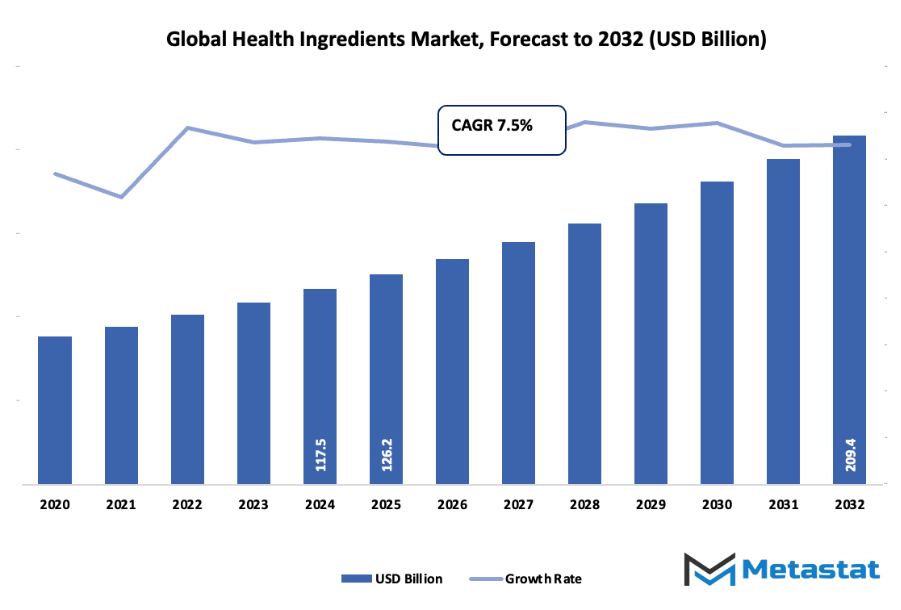

- The global health ingredients market is forecasted to be valued at around USD 126.2 Billion in 2025 and is projected to grow at a CAGR of roughly 7.5% through 2032, with a possibility of exceeding USD 209.4 Billion.

- Approximately 18.7% of the total market share is comprised of vitamins, which are responsible for the intense research activity, thus, driving and broadening their applications.

- The main factors that are responsible for market expansion are consumers’ increase in knowledge concerning health and wellness, and the rising popularity of functional foods and beverages.

- On the other hand, the market expansion into developing countries stands as a major opportunity.

- Market insight: Over the next ten years, there will be an exponential increase in the market worth, thereby revealing substantial growth potential.

By the end of the 1990s, a new direction was not only taken by the consumers but also the industry. On processed foods, there was no going back, and many people started to find and choose natural alternatives that did not just promise health benefits but actually delivered health value. This trend brought about the need for companies to use plant proteins, probiotics, omega-3 fatty acids, and prebiotics among other things in their products. At the same time, the acceptance of biomedicine in food and nutrition technologies made it easier for the producers to get the nutrients they wanted through less rigorous extraction methods while maintaining purity. The advent of personalized nutrition in 2010s further revolutionized the system by tying consumer data and ingredient innovation.

Regulatory frameworks were also of great significance. Governments in North America, Europe, and parts of Asia started to impose stricter standards for health claims and labeling which resulted in greater transparency and scientific validation respectively. The measures were not only in the interest of consumers but also helped in the production of ingredients that had adequate clinical research support. At the same time, the global trade networks made it possible for the manufacturers to get access to such raw materials as botanical extracts and marine-based nutrients and this opened up new ways for manufacturers to distinguish their products and reach diverse markets.

Now, the worldwide health ingredients market shows the impact of the past and present in the form of awareness, science, and accountability. By the stakeholders' needs and wants, the market will still be evolving towards the areas of transparent sourcing, environmentally friendly production, and clean-label authenticity. Technology will continue to play a major role in refining the methods of synthetic biology, fermentation, and precision extraction which will allow the unveiling of new ingredients and their scaling-up as well. This market will not only shift and change according to cultural values, scientific breakthroughs, and the need for health solutions that are harder to find but also grow from its humble beginnings that were still in the realms of basic nutrition science to the current status of being a complex global industry.

Market Segments

The global health ingredients market is mainly classified based on Type of Ingredient, Source, Function, Application.

By Type of Ingredient is further segmented into:

- Vitamins: The role of vitamins in energy support, immunity, and metabolism is vital. The global health ingredients market is heavily relying on the use of vitamins because of the consumer's inclination for fortifying foods and supplements that fill the gap in their diet. It is presumed that the demand for vitamin-based formulations will remain constant as the health maintenance trend continues to grow.

- Minerals: Minerals are a must for strong bones, nerves, and body fluids to function well. Their participation in the market is primarily for the purpose of added nutrition in the form of foods and drinks. Calcium, magnesium, zinc, and iron soloists among the most commonly used minerals as they help with the above-mentioned maintenance of the body and mitigation of deficiencies through diets.

- Probiotic: Probiotic ingredients are getting popularity for their role in maintaining digestive balance and supporting health. The market is observing an increase in the consumption of probiotic-rich foods and supplements, particularly for the purpose of gut health maintenance. The inclusion of these ingredients in dairy substitutes, snacks, and beverages is a reflection of the consumers’ demand for natural digestive aid.

- Prebiotics: Prebiotics serve as food for the good bacteria in the intestine. There is a strong and growing presence of prebiotic fibers in the market, which indeed is a reflection of their effectiveness in the process of digestion and nutrient absorption. Manufacturers of food are adding prebiotics in various forms for the purpose of supporting a healthy microbiome and providing long-term digestive comfort.

- Plant & fruit Extracts: The global market for Health Ingredients is enriched by the antioxidants, vitamins, and natural flavors that are derived from plant and fruit extracts. These extracts have made their way into various products on a large scale due to their clean-label appeal and health benefits perception. They are being developed into more extract-based functional ingredients by companies as an effect of the rising interest in plant-based nutrition.

- Enzymes: Nutrient absorption is aided by enzymes which breakdown food components. Enzymes are used in the production of dietary supplements and the processing of food within the global health ingredients market. They are considered essential ingredients in health-oriented formulations because they not only support digestion but also improve the texture and stability of products.

- Nutritional Lipids: Nutritional lipids which are a good source of omega-3 and omega-6 fatty acids are important for the functioning of the brain and heart. The market is characterized by a rising demand for these lipids owing to the increased awareness regarding both cardiovascular and cognitive health. These fats are used in dietary supplements and fortified foods to provide long-term wellness benefits.

- Others: Amino acids, fibers, and specialty compounds that support various health goals are among the other ingredients present in the market. Research has been continuous and will lead to the creation of new components that satisfy special dietary and functional requirements, thus enhancing the diversity and reach of the market.

By Source the market is divided into:

- Plant-based: The Health Ingredients market across the world is heavily leaning towards Plant-based sources because of the consumers' strong preference for natural and sustainable options. Health products are made using ingredients from fruits, vegetables, seeds, and herbs to a large extent. This trend is a part of the global shift towards cleaner, more environmentally friendly nutrition.

- Animal-based: Animal-based substances have a huge contribution towards the global health ingredients market as they provide collagen, proteins, and certain lipids, which are the essential nutrients. The use of these ingredients in the Health market supports the application areas of joint, bone, and skin health. The animal-derived ingredients, even with the rise in plant-based trends, continue to be in steady demand because they have been proven to be effective for certain health functions.

- Microbial-based: The use of probiotics and enzymes, which are microbial-based ingredients, is an essential segment of the market. Microbial-based ingredients are fermentation-derived and play major roles in digestion, immunity, and metabolism. These ingredients are being increasingly seen as functional and efficient, and hence, suitable for a variety of dietary formulations.

- Others (Synthetic): Synthetic sources provide consistent quality and stability in ingredient production. Within the global health ingredients market, synthetic vitamins and minerals are used where natural sources are limited or unstable. Their controlled formulation ensures product uniformity and meets regulatory standards for nutritional supplementation.

By Function the market is further divided into:

- Weight Management: The global health ingredients market is increasingly incorporating components that promote weight management. The use of fibers, proteins, and herbal extracts helps to control the amount of calories absorbed by the body and at the same time stimulates the feeling of fullness. The growing worry about obesity and health issues caused by lifestyles are the main reasons for the increasing popularity of these products in the wellness food and dietary supplement categories.

- Immunity Enhancement: The ingredients that support immunity are still the most important ones in the market. Vitamins, minerals, and herbal extracts are some of the most important sources that help fortify the human body’s defense mechanisms. Health concerns being raised more often and preventive care becoming more desirable are constantly fueling this category of products.

- Gut Health Management: Probiotics and prebiotics, which are gut health ingredients, are top on the list of the most demanded products in the market. They are responsible for the reduction of digestive problems and the preservation of a healthy intestinal flora. One of the main reasons for the increased market size is the fact that consumers link improved gut health with better overall wellness

- Joint Health Management: market has joint health formulations containing collagen, glucosamine, and certain minerals among others. Mobility is supported, and there is a reduction of joint pain especially in the case of senior citizens. The rising number of older people and the trend of active lifestyles are the factors that lead to the continuous demand for this segment.

- Heart/Cardiovascular Health Management: Ingredients like omega-3 fatty acids, antioxidants, and plant sterols are among the main contributors to the market related to heart health. These substances are a great help in keeping cholesterol levels balanced and in the heart's proper functioning. The increase in the heart disease preventive measures awareness among consumers has made them accept such ingredients more readily.

- Eye health Management: The main ingredients for eye health are lutein, zeaxanthin, and vitamins. The global market for Health Ingredients is gradually recognizing these compounds’ growing applications in the manufacture of supplements and fortified foods. The high usage of digital devices and age-related eyesight problems are the prime reasons for the growth of this segment.

- Brain Health Management: Nutrients that are meant to help with cognition and memory make up a significant share of the market. Among the most common are omega-3 fatty acids, specific vitamins, and extracts from plants. These ingredients have become popular among adults who are looking for mental sharpness and have a long-lasting brain support.

- Other: Other functional ingredients treat different health aspects in the global health ingredients market such as general wellness, bone, and skin health. The creative formulation has made it possible for these ingredients to tackle several health issues at the same time and thus deliver comprehensive nutritional support to a wide range of consumer groups.

By Application the global health ingredients market is divided as:

- Functional Foods: Functional foods represent a major segment in the global health ingredients market. They combine everyday nutrition with added health benefits, appealing to consumers seeking convenient wellness solutions. Fortified cereals, snacks, and dairy alternatives continue to lead this category with consistent market growth.

- Functional Beverages: Functional beverages in the market include energy drinks, vitamin-infused waters, and probiotic drinks. These beverages deliver health benefits while maintaining taste and convenience. Growing consumer preference for hydration with added value supports expansion in this category.

- Dietary Supplements: Dietary supplements hold a strong position in the market. Capsules, powders, and tablets provide concentrated nutrients for specific health needs. Increased fitness awareness and personalized nutrition trends continue to support demand for these products.

- Animal Feed: Health ingredients are increasingly used in animal feed to improve livestock nutrition and immunity. The market benefits from the growing focus on animal welfare and food quality. Enriched feed formulations contribute to healthier and more productive livestock.

- Personal Care and Cosmetics: The inclusion of bioactive ingredients in personal care products has grown within the market. Collagen, vitamins, and plant extracts support skin health and rejuvenation. Consumers favour products offering both beauty and wellness benefits, driving growth in this sector.

- Others: Other applications in the global health ingredients market include pharmaceuticals and specialty nutrition products. These applications expand the use of health-promoting ingredients beyond traditional food and beverage categories, offering broader health solutions to meet diverse consumer needs.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$126.2 Billion |

|

Market Size by 2032 |

$209.4 Billion |

|

Growth Rate from 2025 to 2032 |

7.5% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

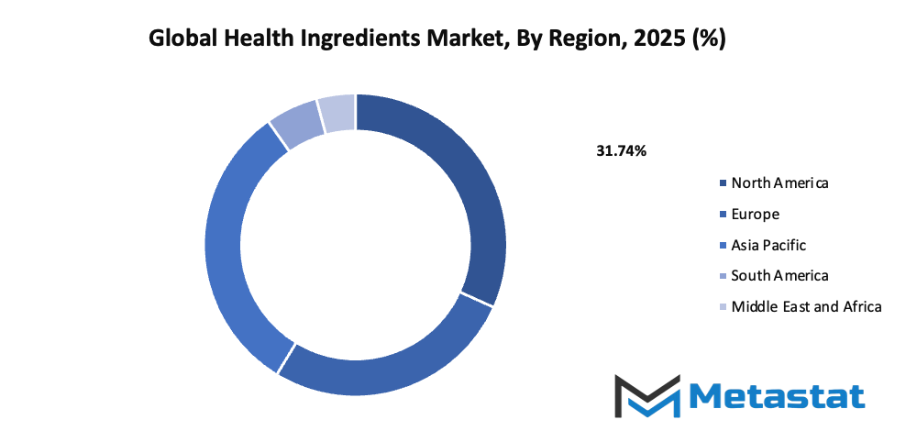

- Based on geography, the global health ingredients market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Increasing Consumer Awareness About Health and Wellness: The rise in lifestyle-related illnesses has made people more conscious of health and nutrition. The global health ingredients market benefits as consumers look for products with clear health advantages. Natural supplements, vitamins, and plant-based ingredients are preferred, pushing companies to develop offerings that align with these changing consumer choices.

- Growing Demand for Functional Foods and Beverages: The market is experiencing growth because of higher demand for functional foods and beverages that support immunity, digestion, and energy. Modern consumers prefer convenient, ready-to-consume products that provide nutritional value. This demand encourages manufacturers to use advanced ingredient formulations that enhance both taste and health benefits.

Challenges and Opportunities

- Stringent Regulations and Compliance Challenges: The global health ingredients market is affected by complex international safety and labeling rules. These regulations are necessary to protect consumers but often slow down product launches. Meeting varying standards across regions increases production time and expenses, making compliance one of the toughest barriers for market participants.

- High Costs Associated with Research and Development: Continuous innovation is vital in the market, but research and development require heavy investment. Developing safe, effective, and stable ingredients demands advanced testing and technology. Smaller companies struggle with these expenses, while larger ones focus on balancing cost with the need for continuous product improvement.

Opportunities

- Expansion into Emerging Markets: Emerging economies present major growth potential for the global health ingredients market. Rising incomes and awareness about health benefits encourage demand for fortified foods and dietary supplements. Companies that enter these regions with affordable and locally suited products can build long-term presence and expand global competitiveness effectively.

Competitive Landscape & Strategic Insights

The global health ingredients market is still on an upward trajectory caused by the prioritization of wellness and preventive nutrition. It has been affected by the changes in lifestyle, the increasing knowledge of healthy eating's advantages, and the demand for natural and functional ingredients that are on the rise. The transition from supplements to products that enhance immunity, digestion, and vitality overall encourages the manufacturers to come up with new and eco-friendly ingredient solutions. The food and beverage firms are reformulating their products to include vitamins, minerals, probiotics, plant-based proteins, and other health-promoting ingredients that are attractive to consumers who are conscious of their health.

The market reacts to the development of technology, the changing dietary habits, and the impact of research on the relationship between nutrition and health. The companies are dedicating a lot of money and resources into R&D with the aim of producing ingredients that will satisfy nutritional requirements and palates of consumers at the same time. Trends towards clean-labels and the demand for sourcing transparency are also increasingly becoming the main driving forces behind the production and marketing strategies. The preference for the use of natural sources instead of synthetic additives has motivated the manufacturers to embrace environmentally-friendly and ethical practices that not only improve product quality and consumer trust but also enhance brand reputation.

The Health Ingredients sector is dominated by players like BASF SE, DuPont de Nemours, Inc., Royal DSM N.V., Archer Daniels Midland Company, Kerry Group, Ingredion Incorporated, Cargill, Incorporated, Tate & Lyle PLC, Associated British Foods PLC, Givaudan SA, Ajinomoto Co., Inc., Arla Foods, Roquette Frères, Frutarom Health (IFF), Corbion N.V., Lonza Group AG, Omega Protein Corporation, Kemin Industries, Inc., and Nature’s Sunshine Products, Inc. These companies not only lead the change over the market by their innovation, acquisition, and collaboration but also set the high standards of quality for the ingredients that they produce. Besides that, they also take care of the things like sustainability, and regulatory compliance, and are aiming for consumer satisfaction.

The trend for plant-based and fortified products will not cease since consumers are on the lookout for medicines that offer long-term benefits. Hence, Global Health Ingredient market producers are investing in functional ingredients that augment nutritional value, not at the expense of flavor or texture. This has paved the way for the advanced formulation of dairy substitutes, nutritional supplements, and fortified snacks. Improved extraction, and fermentation technologies are the main factors behind the breakthrough in the bioactive compound production, which is not only cost-effective but also quality-wise good.

The growing recognition of the dietary factor in chronic disease prevention has also contributed to the advancing of the market. Nutrient-dense foods recommended by the government and health organizations worldwide are driving the demand even more. Veganism and flexitarianism are also leading the companies to look for new protein sources and natural sweeteners in order to please a larger customer base. The continuous improvement of the supply chain along with global partnerships has made these ingredients easily available to manufacturers in different regions.

In short, the global health ingredients market would always be on the rise as health-conscious consumers look for better nutrition and companies' innovations to their expectations. The constant investment in technologies, sustainability, and product quality will guarantee the market leaders not only to retain the competitive advantage but also to play an important role in the healthiness of the world population.

Report Coverage

This research report categorizes the global health ingredients market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global health ingredients market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global health ingredients market.

Health Ingredients Market Key Segments:

By Type of Ingredient

- Vitamins

- Minerals

- Probiotic

- Prebiotics

- Plant & fruit Extracts

- Enzymes

- Nutritional Lipids

- Others

By Source

- Plant-based

- Animal-based

- Microbial-based

- Others (Synthetic)

By Function

- Weight Management

- Immunity Enhancement

- Gut Health Management

- Joint Health Management

- Heart/Cardiovascular Health Management

- Eye health Management

- Brain Health Management

- Other

By Application

- Functional Foods

- Functional Beverages

- Dietary Supplements

- Animal Feed

- Personal Care and Cosmetics

- Others

Key Global Health Ingredients Industry Players

- BASF SE

- DuPont de Nemours, Inc.

- Royal DSM N.V.

- Archer Daniels Midland Company

- Kerry Group

- Ingredion Incorporated

- Cargill, Incorporated

- Tate & Lyle PLC

- Associated British Foods PLC

- Givaudan SA

- Ajinomoto Co., Inc.

- Arla Foods

- Roquette Frères

- Frutarom Health (IFF)

- Corbion N.V.

- Lonza Group AG

- Omega Protein Corporation

- Kemin Industries, Inc.

- Nature’s Sunshine Products, Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252