Global Green Packaging Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global green packaging market has slowly but surely emerged from a niche concept to a core one of the packaging industry's. It has thus, to a great extent, transformed how firms perceive their production, distribution, and sustainability practices. The primary driver behind this change was the concern for the environment, a concern that goes back to the late 1960s when consumers began expecting companies to adopt eco-friendly practices. The focus back then was on the functionality and cost-effectiveness of packaging, so the environment was hardly considered in the case of plastics and other non-degradable materials. However, with the growing concerns over waste management and pollution, companies soon turned their attention towards the development of recyclable and biodegradable substitutes that ultimately led to the global acceptance of and the breakthrough of the green packaging movement.

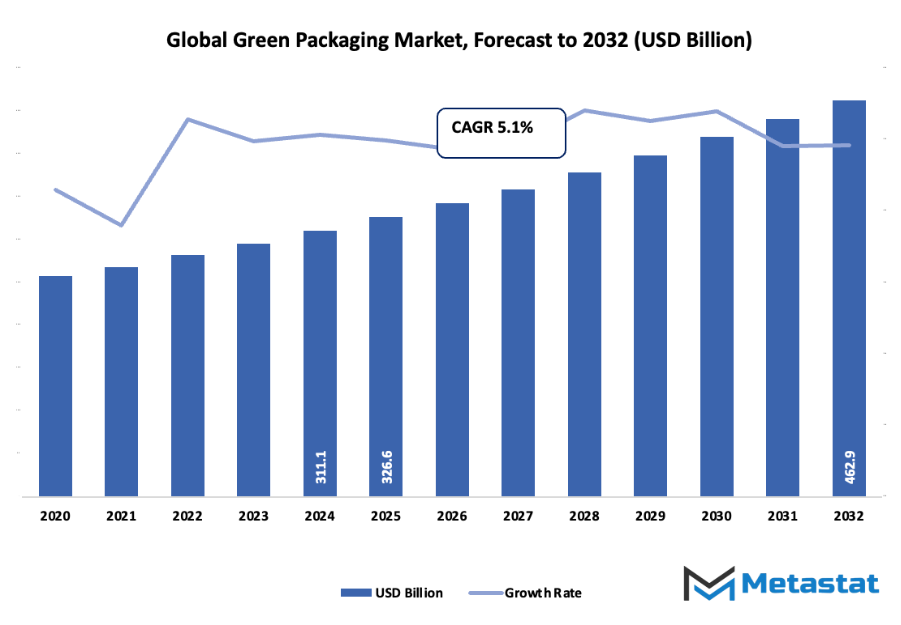

- The global green packaging market is expected to reach a valuation of about USD 326.6 billion by 2025, with a forecasted compound annual growth rate (CAGR) of approximately 5.1% during the period from 2025 to 2030, the market size might even surpass USD 462.9 billion.

- The packaging containing recycled content is estimated to have a market share of about 44.8% and will continue being the leading factor influencing the industry through the application of innovative technologies and by introducing new products.

- The main factors leading to increased sales: the increasing interest of customers in the eco-friendly products and their willingness to pay extra for them, the regulatory measures aimed at plastic and non-biodegradable materials that have been made stricter by the government.

- The growth of the market for compostable and biodegradable packaging solutions is an opportunity being highlighted.

- The analysis shows that the market is poised to experience exponential growth in value over the next decade, thereby indicating the existence of ample opportunities for the industry.

The entire process of the global green packaging market gaining momentum ran through a pretty rough phase until the early 2000s. Environmental regulations became stricter all over the world and that forced the industry to change the way they think about the whole cycle of packaging, starting from the materials used and how they are supplied, to how they are disposed of. The birth of biodegradable plastics, compostable films, and lightweight designs was a major turning point in packaging materials. The companies that were once using only plastics are now combining renewable resources such as paper, plant fibers, and starch-based polymers into their manufactured products. This transition has not only been demand-driven but also a competitive advantage for the companies as they are able to resonate with and attract consumers who are particular about the environment and are looking for brands that are responsible and innovative.

Gradually, the continuous technological advancement became the main force behind the whole green packaging market evolution. The change in the material science research resulted in the development of packaging with durability similar to traditional ones but with a significantly reduced carbon footprint. After that, smart packaging solutions capable of tracking lifecycle impacts will be coming in, the companies would then be able to ensure transparency and accountability. In the meantime, the customer scenario would be such that there would be a continuous shift towards products that are in line with environmental ethics which will act as a factor for both the new and old brands to employ circular design techniques.

Also, regulatory transformations have had a significant impact in defining the current status of the global green packaging market. Laws regarding extended producer responsibility, waste reduction mandates, and recycling infrastructure initiatives have helped in the formation of a framework that will continually have an impact on industry strategies. What started off as an industry response to environmental pressures has now turned into a business philosophy where sustainability is valued as highly as the performance of the product.

As awareness deepens and innovation advances, the global green packaging market will keep redefining the future of the packaging industry, merging ecological responsibility with commercial progress in ways that were once unimaginable.

Market Segments

The global green packaging market is mainly classified based on Packaging Type, Application, , .

By Packaging Type is further segmented into:

- Recycled Content Packaging: Recycled content packaging utilizes materials that have already undergone processing and repurposing for new packaging production. This method not only decreases waste but also saves the environment by conserving the earth's resources. It encourages the circular use of materials and reduces the need for virgin resources making it both cost-efficient and environmentally friendly to manufacturers.

- Reusable Packaging: Reusable packaging is engineered for multiple usages without sacrificing strength or quality. It not only helps in reducing packaging waste but also in curtailing the use of single-use materials. This kind of packaging has become popular owing to its durability, long-term cost savings and contribution to cutting down pollution and landfill accumulation of wastes.

- Degradable Packaging: Degradable packaging consists of materials that get converted to compost through natural breakdown over time with the help of microorganisms, moisture, and heat in the proper environment. It aids in waste reduction by leaving little or no harmful residue behind. This kind of packaging is extremely popular among industries as it helps reduce plastic waste and associated problems of clean-up, thus, it is considered a vital part of the sustainable packaging solution.

By Application the market is divided into:

- Food & Beverages: The food and beverages sector embraces green packaging not only to preserve the product freshness but also to minimize the impact on the environment. It comprises of biodegradable containers, bottles that can be recycled, and wrappers made from eco-friendly materials. The ever-increasing consumer wants in terms of food sustainability and the rising government regulations are the main reasons for the eco-safe packaging options to continue widening the use in this sector.

- Personal Care: The personal care industry considers the sustainable packaging use as the main focus on recyclable and refillable containers. The plastic waste is thus reduced, and the brand reputation is supported by the eco-conscious customers’ attraction. The companies are thus presenting their products in a good way through the use of aesthetic value, durability, and environmental responsibility in the packaging.

- Healthcare: Green packaging is gradually the choice of the healthcare industry for its hospitals, medical devices, and supplies. It brings safety and hygiene along with less environmental impact. Traditional plastics are being substituted by recyclables and biodegradable materials and thus supporting hospitals and manufacturers in achieving their sustainability targets without depriving the product of its protection and sterility.

- Others: The green packaging trend is likewise affirming by other industries such as electronics, household products, and industrial goods. The aim is mainly on the reduction of waste, optimization of material use, and enhancement of recyclability. The activities strengthen the industries in terms of regulatory compliance, brand image and they are also contributors to the global sustainability and resource conservation objectives.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$326.6 Billion |

|

Market Size by 2032 |

$462.9 Billion |

|

Growth Rate from 2025 to 2032 |

5.1% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

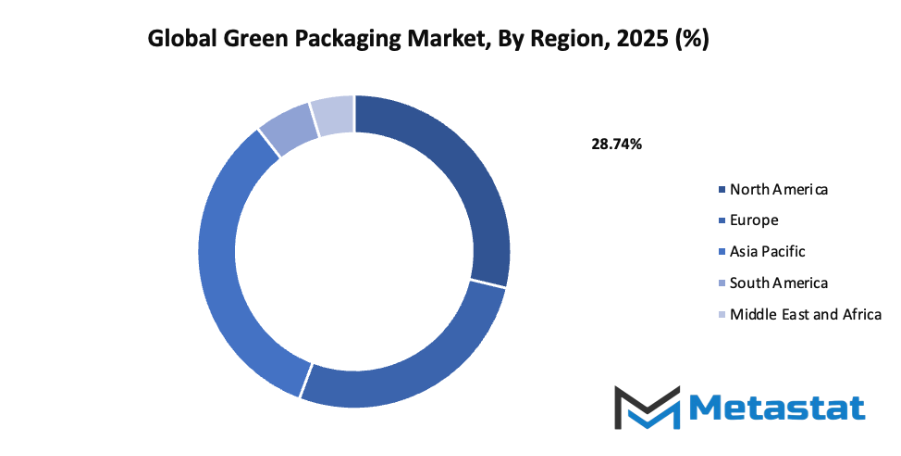

By Region:

- Based on geography, the global green packaging market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Growing consumer demand for eco-friendly and sustainable products: The global green packaging market is gaining strong momentum as consumers increasingly prefer products that are environmentally friendly. Awareness about the harmful effects of plastic waste and pollution encourages the use of sustainable packaging materials. Many companies now focus on adopting recyclable, reusable, and biodegradable packaging options to attract environmentally conscious buyers. This shift in consumer behaviour pushes manufacturers to develop packaging that reduces waste, conserves resources, and supports a cleaner environment. Businesses adopting such practices are also enhancing their brand image, leading to long-term customer loyalty and market growth.

- Stringent government regulations on plastic and non-biodegradable packaging: The global green packaging market is being strongly influenced by government actions that aim to reduce plastic use and promote sustainability. Many countries have imposed strict bans or limits on single-use plastics and introduced policies encouraging eco-friendly alternatives. These regulations push industries to switch to biodegradable and compostable materials that align with environmental standards. Companies complying with such rules benefit from tax incentives, improved market reputation, and better consumer trust. These initiatives help control pollution, minimize landfill waste, and support the global transition toward sustainable packaging practices.

Challenges and Opportunities

- Higher production cost compared to conventional packaging: One of the main challenges in the global green packaging market is the relatively higher production cost of sustainable materials. Biodegradable and recyclable options often require advanced technologies and specific raw materials, increasing manufacturing expenses. Many small and medium enterprises find it difficult to compete with traditional packaging prices. This cost difference sometimes limits large-scale adoption, especially in developing regions. However, as technology improves and production scales up, the cost gap is expected to narrow, making eco-friendly packaging more affordable and widely accepted in various industries.

- Limited availability of sustainable raw materials in some regions: The global green packaging market faces supply challenges due to uneven access to eco-friendly raw materials across different regions. In some areas, the infrastructure for collecting, processing, and recycling sustainable materials is still developing. This shortage affects production capacity and slows the adoption of green packaging solutions. Importing these materials often increases costs and delays supply chains. Expanding local sources and investing in recycling facilities can address this issue over time, allowing for better material availability and consistent production of sustainable packaging products.

Opportunities

- Rising adoption of innovative biodegradable and compostable packaging solutions: The global green packaging market offers strong opportunities through innovation in biodegradable and compostable materials. Businesses are increasingly investing in research and development to create packaging that naturally decomposes without harming the environment. These new solutions cater to the growing preference for sustainable lifestyles and meet global environmental goals. Advancements in material science are also improving product quality, durability, and affordability. As consumer and industrial demand continues to grow, the use of such innovative packaging options is set to expand further, opening new paths for sustainable growth and profitability.

Competitive Landscape & Strategic Insights

The global green packaging market has been growing steadily over the past few years, driven by increasing awareness of environmental issues and the demand for sustainable solutions. Governments, consumers, and manufacturers are placing greater emphasis on eco-friendly materials and recycling practices to reduce pollution and waste. This collective effort has encouraged companies to invest in packaging solutions that minimize environmental impact while maintaining product quality and safety. The movement toward sustainable packaging reflects a shift in priorities within the business world, where protecting the planet has become an important part of long-term success.

Within this market, several key companies play a major role in shaping industry standards and innovation. The industry is a mix of both international industry leaders and emerging regional competitors. Important competitors include Amcor, Tetra Pak, Crown Holdings Incorporated, DuPont, Evergreen Packaging LLC, DS Smith, Ball Corporation, Smurfit Kappa, Mondi Group, Ardagh Group SA, Sealed Air Corporation, Constantia Flexibles, Greif, Inc., and Nampak in the global green packaging market. These companies are recognized for developing packaging that meets both environmental and performance needs. Many of them focus on recyclable, biodegradable, and reusable materials to reduce carbon footprints and resource waste.

Technological advancements have also contributed to the progress of sustainable packaging. Companies are working to replace conventional plastics with bio-based materials and to create lighter packaging that uses fewer raw materials without compromising durability. Digital printing and smart labeling are being adopted to improve supply chain transparency and traceability, helping consumers understand how products are made and packaged. Such developments support the goal of creating a circular economy, where materials are reused or recycled instead of discarded.

Consumer behavior has become another major factor influencing the direction of the global green packaging market. As people grow more conscious of the environmental effects of their purchases, they increasingly prefer brands that demonstrate responsible production methods. This shift in consumer expectations encourages businesses to rethink their packaging strategies and adopt eco-friendly alternatives. Retailers and producers that respond quickly to these preferences often gain a competitive advantage and build stronger customer trust.

Government regulations also play a crucial part in shaping the future of sustainable packaging. Many countries are enforcing stricter rules on plastic usage, waste management, and recycling targets. These policies encourage companies to redesign packaging and invest in materials that meet environmental standards. Compliance not only avoids penalties but also enhances brand reputation among environmentally aware customers.

Market size is forecast to rise from USD 326.6 billion in 2025 to over USD 462.9 billion by 2032. Green Packaging will maintain dominance but face growing competition from emerging formats.

The global green packaging market continues to expand as innovation, regulation, and consumer demand align toward a common goal. With ongoing research and investment, more efficient and affordable solutions are expected to emerge. The combined efforts of leading manufacturers and new entrants are likely to push the market forward, setting new benchmarks for sustainability and performance. As awareness grows and technology advances, the market will keep evolving toward a cleaner and more responsible packaging future.

Report Coverage

This research report categorizes the global green packaging market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global green packaging market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global green packaging market.

Green Packaging Market Key Segments:

By Packaging Type

- Recycled Content Packaging

- Reusable Packaging

- Degradable Packaging

By Application

- Food & Beverages

- Personal Care

- Healthcare

- Others

Key Global Green Packaging Industry Players

- Amcor

- Tetra Pak

- Crown Holdings Incorporated

- DuPont

- Evergreen Packaging LLC

- DS Smith

- Ball Corporation

- Smurfit Kappa

- Mondi Group

- Ardagh Group SA

- Sealed Air Corporation

- Constantia Flexibles

- Greif, Inc.

- Nampak

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383