MARKET OVERVIEW

The Global Green Hydrogen market will be a significant section of the renewable energy and sustainable fuels industry. It concerns hydrogen generation by means of solar, wind, and hydropower through a process called electrolysis, based on renewable energy sources. Conventional hydrogen generation methods are based on fossil fuels and hence allow carbon emissions; however, this method is free from such emissions, meeting the long-term decarbonization targets of numerous governments and energy-intensive sectors around the globe. As industries transmute from carbon-intensive energy inherently hydrogen needs with clean electricity available in abundance will fortify the Global Green Hydrogen market as a strategic solution.

Electrolysis is the main process predicted to characterize the whole market-it employs renewable electricity to split water into hydrogen and oxygen. Some marketing ploys will promote hydrogen as the great wonder good; however, this could be no more than a sound marketing trick! With the renewable involvement into the process, it now turns into an economic and environmental realization that could just be anybody's perception out there. In future in the Global Green-Hydrogen market, production sites located as near to the renewable generation areas as possible will minimize transmission losses and infrastructural needs, along with the promising development of decentralized hydrogen ecosystems-that reflect the needs of particular industrial clusters, export terminals, and grid storage in hydrogen.

The Global Green Hydrogen market will find numerous applications such as chemicals, transportation, steel, and long-duration energy storage. In particular, industries that experience some difficulties in employing direct electrification due to the very nature of their processes will look elsewhere for alternative inputs to green hydrogen. Steel producers, ammonia producers, and shipping companies will consider the capacity to retrofit operations to hydrogen-based solutions. This market will also create a dynamic for energy trades since those countries with plentiful renewable energies are prepared to invest in hydrogen for their domestic supply chains as well as export supply chains.

On the infrastructure planning side, Global Green Hydrogen would attain similar importance. The pipelines, liquefaction plants, storage systems, and specialized transport mechanisms will be the elements one will need to ensure hydrogen's seamless flow from production to end use. The regions with limited renewable capacity will import hydrogen, while the exporters will require long-term contracts and trading corridors, laying the foundations for fresh alliances and regional cooperation frameworks while radically reshaping the global energy landscape through shared technological standards and cross-border ventures.

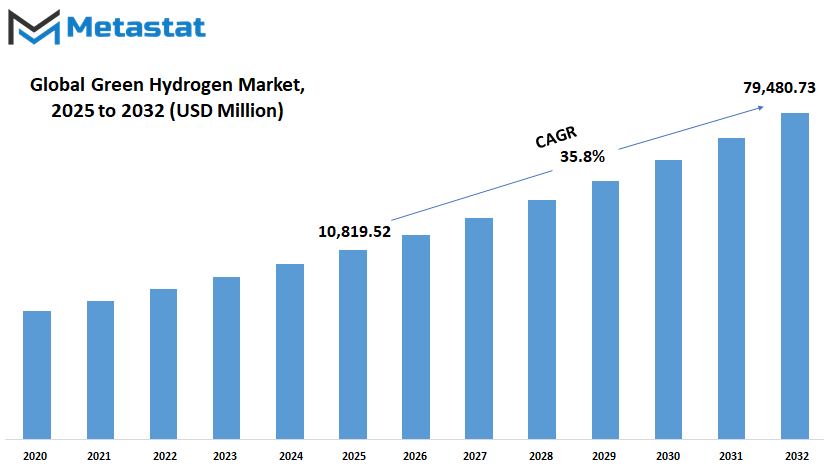

Global Green Hydrogen market is estimated to reach $79,480.73 Million by 2032; growing at a CAGR of 35.8% from 2025 to 2032.

GROWTH FACTORS

The Global Green Hydrogen market is gradually turning into a hot topic with the upcoming transition of the world to cleaner and sustainable sources of energy. Green Hydrogen, however, has emerged as one of the most attractive alternatives as countries want to reduce carbon emissions and decrease dependence on fossil-fuel energy. It is renewable based and so, compared to conventional hydrogen production using natural gas or coal, it is cleaner. With a greater focus on climate change and its complications, the call for clean energy takes too high a pitch and will probably maintain the same momentum in the future.

One of the major reasons behind the rising interest in green hydrogen is its promise to reduce harmful emissions. Various countries have developed new and ambitious climate goals, which can only be achieved through implementing cleaner fuels. Green hydrogen has a long potential to replace fossil fuels in most areas, be it power generation or heavy industries. And as the urgency for cleaner energy increases, the force will definitely be felt on this market with stronger support and broader acceptance across several sectors.

Governments are showing their roles in promoting the making of the market in question. A lot of them have started funding renewable hydrogen projects while such investments have been made through policy support and incentives for easy acceptance of new technologies by companies. All these conditions would create the right setup for a flourishing green hydrogen economy and for large-scale application within the near future. As these initiatives carry on, market development will be possible going forward, attracting more investment.

However, challenges do remain. One of the biggest currently revolves around the fact that it remains costly to produce hydrogen greenly than through traditional methods: until that gap closes, the case for green hydrogen may never be strong enough in all areas. The necessary storage, transportation, and distribution infrastructure for green hydrogen has not been put in place. Without reliable systems in place, scaling up production and making it widely available will remain difficult.

However, the prospects for the future are quite optimistic. Researchers and companies are improving techniques in electrolysis-the method of generating hydrogen from electricity. While this progress continues, costs are likely to decline, thus making green hydrogen cheaper and more available. In the coming years, these changes will open up new prospects for the Global Green Hydrogen market and help it move toward broader adoption.

MARKET SEGMENTATION

By Technology

With countries all of the world producing shifts into different ways of life and abandoning completely fossil fuels-from mining to power generation uses and in the way they get involved with these technologies to make life easier-there is also a push for cleaner, more sustainable energy forms. The fact that the environment will continue to concern national governments, world bodies, and individuals over methods and sources of energy, and the fact that it will be a concern with traditional fuels, means that green hydrogen is slowly building up as an alternative. Such hydrogen is produced using renewable energy through electrolysis of water and emits no harmful pollutants, rendering it a cleaner option for energy generation, transportation, and industrial purposes. Increased demand for green hydrogen is expected because more and more countries would pledge continuously and positively to decrease their carbon footprints.

This is the anticipated growth in this market by technology in various ways available in electrolyzer types for hydrogen production. The Alkaline Electrolyzer as a type is most in use at present, appreciated at a milestone of USD 7,308.93 million in 2025. It has been around for some time and likes to be both reliable and cheaper to operate and takes a backseat to newer methods. The Polymer Electrolyte Membrane (PEM) Electrolyzer, which should amount to USD 2,856.02 million in 2025, has the reputation of rapid response and great efficiency. Thus, it fits renewable energies particularly well such as wind and solar, wherein power generation often does not take place on constant levels. There is also the SOEC Electrolyser, which made USD 654.56 million figures in terms of 2025. Currently in the developmental stage, this technology is using heat from other processes to increase its efficiency and is expected to gain popularity as per the advancements made in the near future.

Indeed, every one of these technologies will be significant in defining how the Global Green Hydrogen market will grow in the future. More funding and research will help boost performance and cut costs, making hydrogen affordable for more industries. Partnerships between governments and private companies will speed up the uptake of use for hydrogen technology as countries move toward achieving climate goals in the future. Transportation, especially long-distance shipping and heavy vehicles, would benefit cleaner energy sources, while industries like steel and chemical manufacturing would rely possibly on green hydrogen to replace traditional, fossil-based inputs.

However, the market will most likely not be dependent on a single technology but on every other method according to local energy sources, costs, and needs. Continuing progress and support ensure hydrogen green will be one of the keystones of the future global drive to make energy cleaner and sustainable.

By Application

The Global Green Hydrogen Market will be buoyed by several industries and governments focused on reducing carbon emission levels and alternatives for cleaner energy solutions. The fact that green hydrogen can strive to be a sustainable energy source is garnering attention from various sectors. One of the most interesting features of this market is its current application. These applications are set to not just influence market growth but will also help decide which industries stand to gain from the adoption of this clean fuel.

Power generation stands to witness the role of green hydrogen in cleaner energy systems. With an increase in electricity demand globally, there is a need for energy sources with minimal emissions. Green hydrogen produced from renewable sources such as wind or solar will meet this demand in cleaner ways. It can also be stored for use when solar or wind power is unavailable, thus engendering reliability within the energy grids. This characteristic of balancing supply and demand will arguably solidify its share in the future energy mix.

The transport sector will offer a strong impetus for the growth of the Global Green Hydrogen market. Green hydrogen will become an important fuel alternative, especially for long-distance-haul options and heavy-duty vehicles, as more and more countries push for cleaner options for public and private transport. Hydrogen refuels faster, offering extended ranges compared to electric batteries, making it practical for use in trucks, buses, and even trains. Further configuration of the technology and reduction in production costs will increase the number of transport companies adopting hydrogen systems.

Green hydrogen will also be adopted in other sectors, namely industrial processes that are based upon fossil fuels. For example, it can displace natural gas in producing steel or chemicals. This transition will help reduce emissions within traditionally ecologically difficult industries. The knowledge and funding for research and development will play a key role in creating the conditions whereby green hydrogen can be recognized as a commonplace energy source for an even broader spectrum of uses.

So, looking to the future, it will not be a passing trend that will see the Global Green Hydrogen market emerge. Rather, it will be at the fore of how the world transitions into an energy paradigm that is cleaner and more dependable. Its applications in power generation, transport, and industry illustrate just how versatile and promising this energy source has been viewed in shaping the future.

By Distribution Channel

The Global Green Hydrogen market is likely to increase at a moderate pace, as clean energy solutions are becoming more and more important around the globe. Countries are beginning to concentrate more on reducing carbon emissions and moving away from fossil fuels. Green hydrogen is proving to be a very good alternative in this transition. It is an attractive option for long-term energy planning as hydrogen can generate energy with no harmful emissions. A key element toward supporting this market growth is its distribution mechanism. The speed and scale of green hydrogen adoption will depend on how it gets into the industries, power stations, and fueling stations.

Pipelines are expected to play an important role in distribution systems in the future. Pipelines offer specific controlled and steady flow rates that are crucial when supplying large-scale industries or urban centers. As demand increases, further pipeline networks will most likely be constructed or modified to carry green hydrogen. Countries already using natural gas pipelines might explore converting them for this cleaner option. It’s not only new projects; older infrastructure could also be upgraded, thereby saving time and resources along with supporting a cleaner transition. This will help to make green hydrogen available to areas where it is most needed.

Cargo-based delivery will continue to be crucial, especially in places where pipelines would not make much sense. In remote areas or through regions separated by great distance or water, shipping cargoes green hydrogen will afford flexibility. Ships, trucks, and perhaps trains could adapt to carry hydrogen in special containers. This method may not provide the flows possible through pipelines; however, it will afford countries or businesses the opportunity to determine exactly where and when it will be received. This could allow participation by smaller industries or developing regions in the greener shift without having to wait for permanent infrastructure.

Technologically advanced, both distribution routes will enhance efficiency and safety. New storage systems, stronger materials, and intelligent tracking devices will facilitate greater control over managing green hydrogen movement from the point of production to the users. Such advancement will therefore become an important arrow in furthering the growth of Global Green Hydrogen market and earning all the more confidence for this newly ushered energy. How green hydrogen is distributed in the forthcoming years will determine whether or not it becomes usable in various parts of the world and through that ultimately facilitate toward a cleaner and stable future in energy.

By End User

The Global Green Hydrogen market development is going to play a significant role in shaping clean energy systems across the world in the future. Because this world is still hunting for a better alternative to fossil fuels, green hydrogen is the most promising solution. It is produced from renewable sources like wind and solar energy, which means it is cleaner for industries that have used conventional energy methods. This way, while looking ahead, it will become a growing end user demanding green hydrogen from diverse sectors, each contributing its kind to this momentum.

In refining, the introduction of such green hydrogen will define the evolution into more sustainable operations. Typically, refineries have used hydrogen made from the natural gas process, which emits carbon into the atmosphere. But definitely, as companies turn to possible environmental reduction pathways, that practice would have to switch to using green hydrogen. Obviously, this would not occur all at the same time. Over time, it is expected to be part of the process, especially as environmental regulations become tighter.

The ammonia sector will be increasingly dependent on green hydrogen. Ammonia is one of the most used raw materials in fertilizers, which, at present, incurs additional costs in greenhouse gas emissions through its production process. With this green hydrogen, this process can become cleaner and therefore allow agriculture to reduce its overall footprint. With global food demand scales rising, there will remain a strong appetite for ammonia, making the shift to green hydrogen even more urgent.

Changing methanol production is another prospect. Methanol is a product of diverse uses, such as plastics and paints; it is produced by very energy-demanding manufacturing processes. Green hydrogen will contribute to reducing emissions while fulfilling industrial requirements as the old processes yield to this change. Green hydrogen will become not just an alternative but a necessity toward greener activities as companies progress with green practices.

The iron and steel industry are among the most significant carbon-emitting industries on this planet. The introduction of green hydrogen into the process will be a paradigm. Place it instead of coal or natural gas, and the result is a cleaner industry that's able to meet the future climate parameters. Certainly, this process will require time but adopting it would be made easier in time with its gaining popularity in newer technologies.

Other end users like transportation or power generation will also include the Global Green Hydrogen market growth. The eventual shift away from fossil fuels for such sectors will be enabled by green hydrogen. It will become a regular part of energy planning in many areas around the globe, as innovation continues, and production becomes even more affordable.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$10,819.52 million |

|

Market Size by 2032 |

$79,480.73 Million |

|

Growth Rate from 2025 to 2032 |

35.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

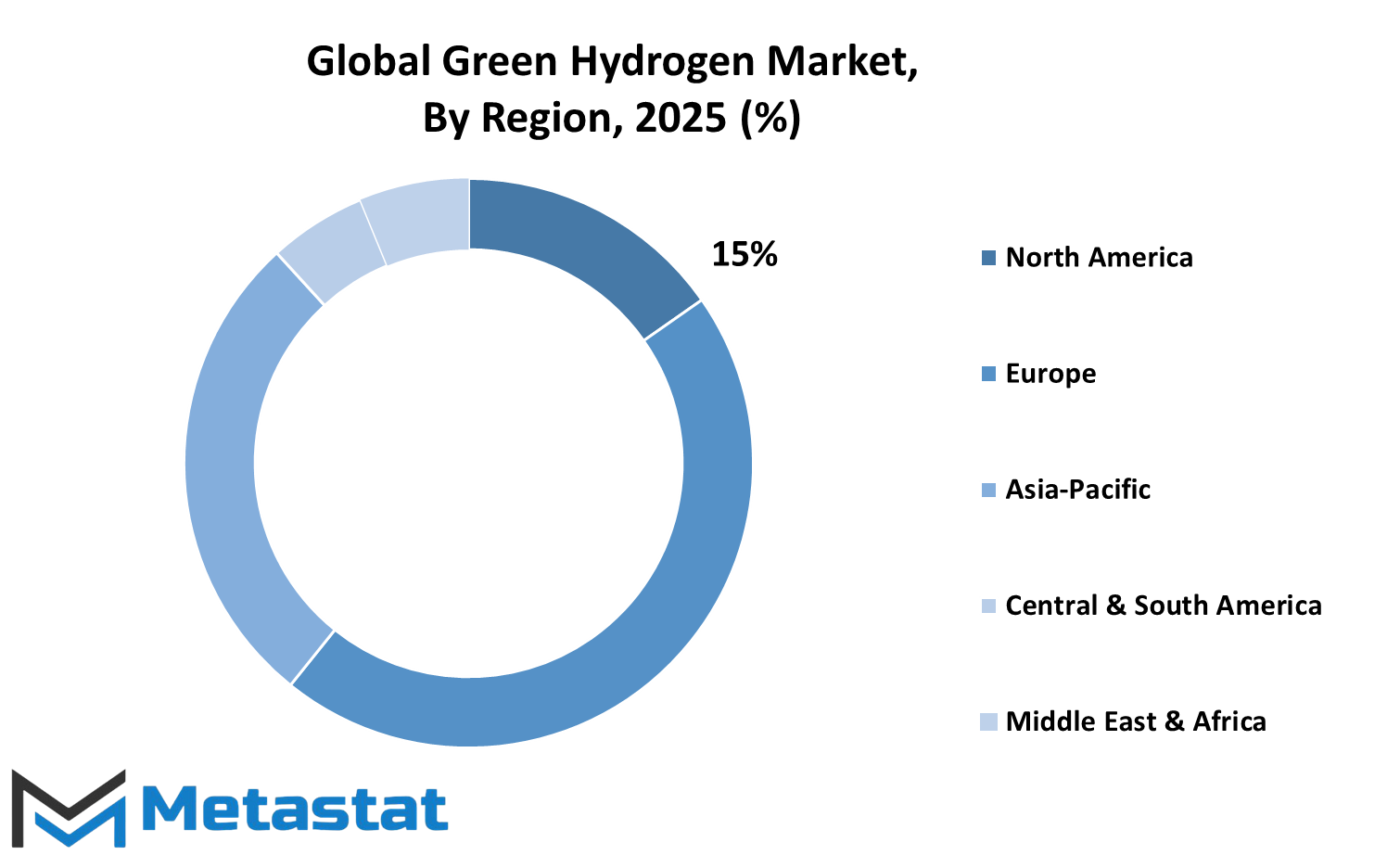

REGIONAL ANALYSIS

The future of the Global Green Hydrogen Market is finally shaped by cleaner energy goals and long-term solutions to climate challenges. While countries look for different means to reduce emissions and wean themselves from fossil fuels, green hydrogen is gaining serious attention as a strong alternate. Clean energy such as renewable electricity creates hydrogen, and the potential of hydrogen is not concentrated on one regional continent but is spread as continents possess different resources, strategies, and needs for energy. Geographically, however, the market seems to indicate how new parts of the world will shape the future in different, meaningful ways.

Public and private investment along with government policies will strongly propel green hydrogen in North America. The countries, USA and Canada, have in one way laid the groundwork for hydrogen infrastructure, and they will continue to grow as industries seek cleaner fuels. Though Mexico is still building up, it is likely to catch up sooner or later as renewable energy projects grow. The focus will be created around the whole region in developing and enhancing green hydrogen with its renewable power capacities, more so in areas such as transportation and heavy industry.

Europe would assume a pre-eminent position with regard to developing global policies and spreading hydrogen into a wide range of applications. Countries such as Germany and the UK are gaining traction into early efforts. Interest has historically built from these two nations in green hydrogen as they envision it within their clean-energy future. Investments in renewable electricity and electrolysis technologies will underlie this development. Nations, France and Italy, among others, are also moving through the building of links between energy producers and large users. The common vision will forge ahead to position Europe as leading the green hydrogen market in production and use.

Activity is also expected to increase the most in Asia-Pacific. While countries like China, India, Japan, and South Korea try to reduce pollution, they also have very high energy demands. So, local green hydrogen will be developed for local and export purposes. This region has very strong manufacturing capabilities, as well as access to solar and wind resources, and will become one of the suppliers of green hydrogen, on a global scale.

Gradually, with time, South America will develop its green hydrogen market. Brazil and Argentina have strong potential with renewable energy strengths, and these factors should drive these countries towards international partnerships. In the Middle East and Africa, ongoing undertakings to reduce dependencies on oil and gas will tie green hydrogen into the mix. Countries like the UAE, Egypt, and South Africa are likely to play significant roles, especially in exporting green hydrogen to other parts of the world.

COMPETITIVE PLAYERS

The Global Green Hydrogen market is fast emerging as a critical player in the evolution of clean energy. As the world moves toward low-emission options, green hydrogen-based firms are exploring ways to influence that pathway. These players are investing not only in new technologies but also in mass production methods that will enable hydrogen to be easily made available and economically viable. In the coming years, green hydrogen is expected to feature heavily in plans to lower carbon footprints in various sectors, particularly in transportation, manufacturing, and power generation.

Within this space, various companies are taking bold initiatives to stay ahead. Siemens Energy AG and Linde PLC are capitalizing on their long history with industrial systems to advance hydrogen-based solutions. They are developing massive projects on integrating green hydrogen into regular use, especially in places where traditional energy sources are being systematically phased out. Partners will continue to be sought, and processes enhanced by these companies to sustain cleaner energy production.

Others are companies like Toshiba Energy Systems & Solutions Corporation and Air Liquide, who are working to set up robust systems capable of supporting hydrogen production at very large scales. Their vision is to make green hydrogen a serious option, that is equal to any other economic energy source, but also for its efficiency and adaptability. An investment in infrastructure with a global footprint would most likely augment their ability to supply.

Smaller but well on-their-way-up-Green Hydrogen Systems and Nel ASA are putting their weight into the future of this market. The companies are bringing in new features and designs that, together with portable and easy-to-use equipment, are allowing smaller producers access to the market. Being well-supported by governments and with a greater focus on sustainability, these companies are bound to secure more headlines, giving themselves a more stable foothold.

Meanwhile, other companies - Plug Power Inc., ITM Power, and Engie Impact - are focused on working towards solutions that encompass more than just production. Their view is on the entire hydrogen supply chain, addressing everything from storage to delivery. This holistic approach will become very relevant as industries come in looking for simple-to-use hydrogen solutions. With more economies embracing clean energy, competition will only heat up down the line in the Global Green Hydrogen market. These players will not only contrive the market but also steer the future of energy production and consumption across the globe.

Green Hydrogen Market Key Segments:

By Technology

- Alkaline Electrolyzer

- Polymer Electrolyte Membrane (PEM) Electrolyzer

- SOEC Electrolyzer

By Application

- Power Generation

- Transport

- Others

By Distribution Channel

- Pipeline

- Cargo

By End User

- Refining

- Ammonia

- Methanol

- Iron & Steel

- Others

Key Global Green Hydrogen Industry Players

- Siemens Energy AG

- Linde PLC

- Toshiba Energy Systems & Solutions Corporation

- Air Liquide

- Nel ASA

- Air Products and Chemicals Inc.

- Green Hydrogen Systems

- H&R Olwerke Schindler GmbH

- Engie Impact

- Uniper SE

- ITM Power

- Messer Group GMBH

- Plug Power Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252