MARKET OVERVIEW

The Global Wine and Spirits Yeasts market encapsulates a dynamic industry at the intersection of tradition, innovation, and discerning palates. Within this niche market, yeasts emerge as silent yet indispensable protagonists, influencing the very essence of wines and spirits worldwide.

Central to the domain of enology and distillation, wine and spirits yeasts dictate the flavor profile, aroma, and even the texture of the final product. Their role extends far beyond mere fermentation agents; they are the alchemists behind the transformation of grape musts into fine wines and grains into exquisite spirits. In essence, they are the invisible artisans shaping the sensory experiences cherished by connoisseurs and novices alike.

The industry's landscape is characterized by a rich tapestry of diversity, with a myriad of yeast strains tailored to specific varietals, production methods, and regional preferences. From the sun-drenched vineyards of Bordeaux to the misty distilleries of Scotland, each locale harbors its own unique microbial terroir, fostering a kaleidoscope of flavors waiting to be unlocked.

However, the Global Wine and Spirits Yeasts market is not impervious to the winds of change. In recent years, shifting consumer preferences towards artisanal, natural, and sustainable products have reverberated across the industry. This has propelled a renaissance in yeast research and development, with a renewed emphasis on indigenous strains, organic cultivation, and biotechnological innovations.

Moreover, globalization has catalyzed the cross-pollination of techniques and traditions, facilitating the exchange of knowledge and expertise among winemakers, distillers, and scientists worldwide. This interconnectedness has spurred a virtuous cycle of experimentation and collaboration, fueling the emergence of novel yeast strains capable of pushing the boundaries of flavor and complexity.

Yet, amidst the ceaseless flux of trends and technologies, the essence of the Global Wine and Spirits Yeasts market remains rooted in craftsmanship and heritage. Behind every bottle lies a narrative of

terroir, tradition, and tireless dedication, echoing the timeless pursuit of excellence that defines the industry.

As we navigate the ever-changing currents of taste and technique, one thing remains certain: the Global Wine and Spirits Yeasts market will continue to captivate our senses, tantalize our palates, and evoke the spirit of celebration and conviviality that transcends borders and generations. In this age-old alchemy of yeast and grape, innovation harmonizes with tradition, yielding a symphony of flavors that delight and inspire in equal measure.

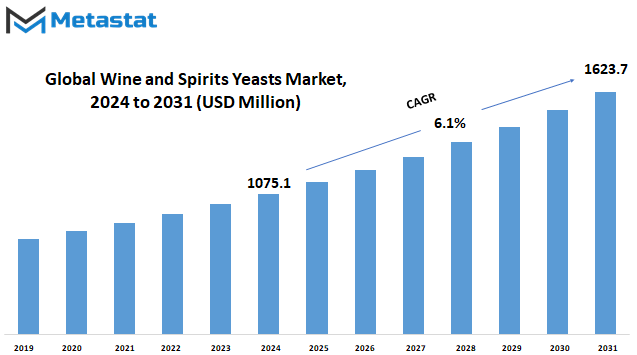

Global Wine and Spirits Yeasts market is estimated to reach $1623.7 Million by 2031; growing at a CAGR of 6.1% from 2024 to 2031.

GROWTH FACTORS

The Global Wine and Spirits Yeasts market is influenced by several factors driving its growth, while also facing challenges that need to be addressed. One of the primary drivers propelling this market forward is the increasing consumption of wine and spirits worldwide. This trend is fueled by the rise in disposable incomes and evolving lifestyle preferences, where people are increasingly opting for alcoholic beverages as a part of social gatherings or personal enjoyment.

Moreover, there's a noticeable surge in interest towards craft and artisanal alcoholic beverages. Consumers are showing a preference for unique flavor profiles, which has led to the adoption of specialized yeasts in the production process. These yeasts play a crucial role in imparting distinct characteristics to the final product, thereby catering to the diverse tastes of consumers.

However, alongside these drivers, the market encounters certain restraints. One significant challenge arises from the stringent regulations and compliance standards governing alcohol production across different regions. These regulations impose various restrictions on the production process, requiring manufacturers to adhere to specific guidelines to ensure product quality and safety.

Additionally, the market faces fluctuations in the availability of raw materials, which directly impact yeast production costs and supply chain stability. The reliance on certain raw materials makes the industry vulnerable to disruptions caused by factors such as weather conditions or geopolitical tensions, leading to uncertainty in the market.

Despite these challenges, there exist opportunities for growth within the Global Wine and Spirits Yeasts market. One promising avenue is the expansion into emerging markets with burgeoning alcoholic beverage sectors. These markets offer untapped potential for yeast producers, providing them with opportunities to establish a presence and capitalize on the growing demand for wine and spirits.

The Global Wine and Spirits Yeasts market is characterized by a dynamic interplay of drivers, restraints, and opportunities. By navigating these factors effectively, stakeholders can position themselves to thrive in this evolving landscape, catering to the diverse needs and preferences of consumers worldwide.

MARKET SEGMENTATION

By Type

The global market for wine and spirits yeasts encompasses various types, each playing a crucial role in the fermentation process. These yeasts are essential in transforming sugars into alcohol, contributing to the flavor and quality of the final product. The market is categorized into different segments based on yeast types, including Saccharomyces Cerevisiae, Saccharomyces Bayanus, Non-Saccharomyces Yeast, and Hybrid Yeasts.

Saccharomyces Cerevisiae, one of the primary types of yeasts used in winemaking and brewing, held a significant share of the market. In 2023, it was valued at 499 USD million. Known for its ability to efficiently convert sugars into alcohol and carbon dioxide, Saccharomyces Cerevisiae plays a fundamental role in the fermentation process, contributing to the aroma and flavor profile of the final product.

Another notable segment is Saccharomyces Bayanus, valued at 248.8 USD million in 2023. Saccharomyces Bayanus is commonly used in winemaking and is appreciated for its ability to ferment at lower temperatures, making it suitable for certain wine styles and regions where temperature control is essential.

Non-Saccharomyces Yeasts, valued at 185 USD million in 2023, represent a diverse group of yeasts apart from the Saccharomyces genus. These yeasts contribute unique characteristics to the fermentation process, such as enhanced aroma complexity and acidity modulation, thereby adding depth and complexity to the final product.

Hybrid Yeasts, another segment in the market, offer a combination of traits from different yeast species. These hybrids are engineered to exhibit specific fermentation characteristics, such as improved ethanol tolerance or aroma production, tailored to meet the demands of winemakers and distillers.

The global wine and spirits yeasts market continues to witness growth and innovation, driven by factors such as evolving consumer preferences, technological advancements, and a growing demand for premium and artisanal products. With an increasing emphasis on sustainability and environmental responsibility, there is a rising interest in utilizing yeasts that reduce the need for chemical additives and promote eco-friendly practices in fermentation.

The diversity of yeasts available in the market underscores their significance in the production of wine and spirits. Each yeast type brings its own unique attributes, contributing to the complexity and character of the final product. As the market continues to evolve, the demand for innovative yeast strains and sustainable practices is expected to drive further growth and development in the industry.

By Application

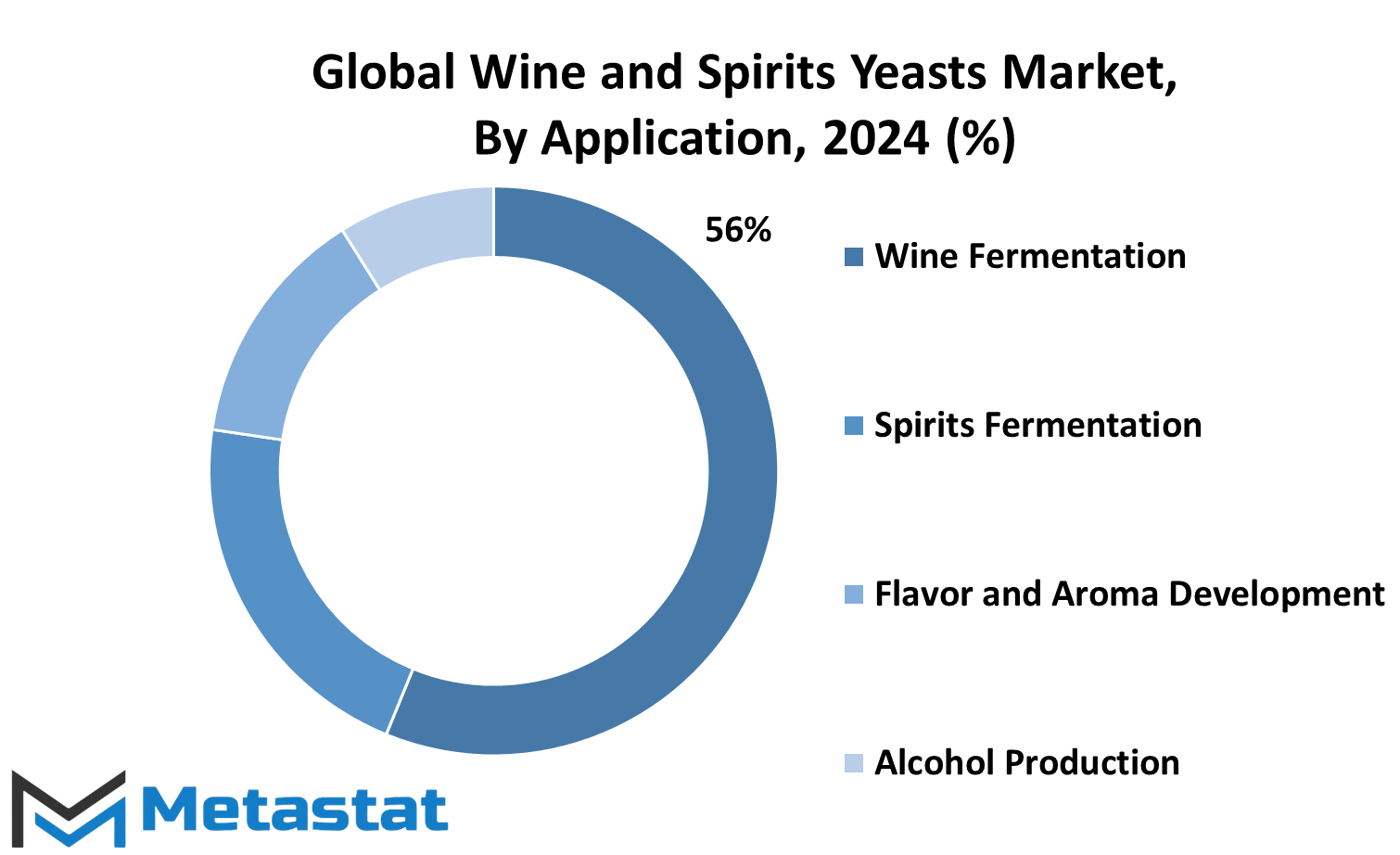

The global market for wine and spirits yeasts encompasses various applications, including wine fermentation, spirits fermentation, flavor and aroma development, and alcohol production. These diverse applications highlight the crucial role that yeasts play in the production of alcoholic beverages.

In wine fermentation, yeasts are essential for converting sugars into alcohol through the process of fermentation. This transformation is central to winemaking, as it contributes to the characteristic flavors and alcohol content of different wine varieties. Yeasts are carefully selected based on their ability to ferment specific types of sugars and their impact on the final flavor profile of the wine.

Similarly, in spirits fermentation, yeasts are utilized to ferment sugars derived from grains, fruits, or other raw materials to produce alcoholic spirits such as whiskey, vodka, and rum. The choice of yeast strain can significantly influence the fermentation process and the sensory attributes of the final spirit product. Distillers often employ specific yeast strains to achieve desired flavors, aromas, and alcohol content in their spirits.

Moreover, yeasts play a crucial role in flavor and aroma development during the fermentation process. Certain yeast strains produce various compounds, including esters, aldehydes, and higher alcohols, which contribute to the complex flavor profiles and aromas found in wines and spirits. The interaction between yeast metabolism and other fermentation factors, such as temperature and nutrient availability, influences the formation of these compounds, ultimately shaping the sensory characteristics of the end product.

Additionally, yeasts contribute to alcohol production by metabolizing sugars into ethanol and carbon dioxide during fermentation. The ability of yeast strains to efficiently ferment sugars and tolerate high alcohol concentrations is essential for achieving desired alcohol yields in the production of wines and spirits. Yeast selection and fermentation conditions are carefully optimized to maximize alcohol production while maintaining product quality and consistency.

Overall, the global market for wine and spirits yeasts is characterized by its diverse applications in fermentation, flavor and aroma development, and alcohol production. Yeasts play a fundamental role in shaping the sensory attributes and alcohol content of wines and spirits, making them indispensable to the alcoholic beverage industry. As consumer preferences and production techniques continue to evolve, the demand for specialized yeast strains tailored to specific applications is expected to grow, driving further innovation in the market.

By End User

The Global Wine and Spirits Yeasts market is a significant player in the beverage industry, catering to various end users. These end users include Wineries, Distilleries, Craft Breweries, and Home Brewers. Each segment contributes differently to the market, reflecting distinct preferences and demands.

Wineries, for instance, represent a substantial portion of the market, valued at 608.8 USD Million in 2023. These establishments focus primarily on wine production, utilizing yeasts for fermentation to achieve desired flavors and characteristics in their wines. The demand for wine yeasts remains high due to the continuous production and consumption of wine worldwide.

Similarly, Distilleries constitute another vital sector within the market, with a value of 268.4 USD Million in 2023. Distilleries engage in the production of distilled spirits such as whiskey, vodka, rum, and gin. Yeasts play a crucial role in the fermentation process, converting sugars into alcohol and contributing to the distinctive taste profiles of various spirits.

Craft Breweries also make their mark in the market, valued at 115.4 USD Million in 2023. These breweries focus on producing small batches of beer with unique flavors and styles, often experimenting with different yeast strains to create diverse beer profiles. Yeasts are integral to the brewing process, affecting the aroma, flavor, and overall quality of the beer produced.

Additionally, Home Brewers constitute a noteworthy segment within the market. While smaller in scale compared to commercial establishments, home brewers contribute to the demand for yeast products, valued at an estimated figure in 2023. Home brewing enthusiasts experiment with various ingredients and techniques to craft personalized beers, ciders, and wines, relying on yeasts to ferment their creations.

Overall, the Global Wine and Spirits Yeasts market caters to a diverse range of end users, each with its specific requirements and preferences. Wineries, Distilleries, Craft Breweries, and Home Brewers all rely on yeast products to ferment sugars and produce alcoholic beverages with distinct flavors and characteristics. As consumer tastes continue to evolve, the demand for yeast products is expected to persist, driving further growth and innovation within the market.

REGIONAL ANALYSIS

The global market for Wine and Spirits Yeasts is segmented by geography into North America, Europe, Asia-Pacific, and other regions. This division is crucial for understanding market dynamics and trends, as different regions often have unique preferences, regulations, and consumption patterns.

North America, comprising the United States and Canada primarily, holds a significant share in the global Wine and Spirits Yeasts market. The region is known for its diverse consumer base and robust wine and spirits industry. Factors such as increasing disposable income, evolving consumer tastes, and a growing preference for premium alcoholic beverages contribute to the market's growth in this region.

Europe, including countries like France, Italy, Spain, and Germany, is another key player in the global Wine and Spirits Yeasts market. With a rich history and tradition in winemaking and distillation, Europe is a major producer and consumer of wine and spirits globally. The region's well-established vineyards, wineries, and distilleries, coupled with a strong culture of wine and spirits appreciation, drive market demand. Additionally, initiatives promoting sustainable practices and organic production further boost market growth in Europe.

The Asia-Pacific region, encompassing countries such as China, Japan, India, and Australia, is witnessing rapid growth in the Wine and Spirits Yeasts market. Changing lifestyles, increasing urbanization, and a burgeoning middle class are driving the demand for premium alcoholic beverages in this region. Moreover, rising disposable incomes and a growing interest in wine and spirits among millennials contribute to market expansion. In particular, countries like China are emerging as key players in the global market, with a growing number of consumers embracing Western drinking habits and preferences.

Other regions, including Latin America, the Middle East, and Africa, also contribute to the global Wine and Spirits Yeasts market, albeit to a lesser extent. Factors such as changing consumer demographics, government policies, and economic developments influence market dynamics in these regions.

The global Wine and Spirits Yeasts market is shaped by regional variations in consumer behavior, industry practices, and regulatory frameworks. Understanding these regional nuances is essential for businesses operating in the market to devise effective strategies and capitalize on growth opportunities. As the market continues to evolve, monitoring regional trends and adapting to changing dynamics will be key to sustaining success in the wine and spirits industry.

COMPETITIVE PLAYERS

The Global Wine and Spirits Yeasts market is an arena where various companies compete to provide yeasts for the production of wine and spirits. These yeasts play a crucial role in the fermentation process, which is essential for transforming sugars into alcohol. Among the key players in this industry are Lallemand Inc., Lesaffre Group (Fermentis Division), Angel Yeast Co., Ltd., Chr. Hansen Holding A/S, AB Biotek, Wyeast Laboratories, Inc., DSM N.V., AEB Group S.p.A., Oenobrands SAS, and Anchor Oenology.

These companies bring their expertise and products to meet the demands of wineries and distilleries worldwide. Lallemand Inc. is known for its range of yeast strains tailored for specific wine and spirits styles. Similarly, Lesaffre Group, through its Fermentis Division, offers a diverse portfolio of yeast products to suit different fermentation needs.

Angel Yeast Co., Ltd., another major player, provides yeast solutions not only for alcoholic beverage production but also for various other industries. Chr. Hansen Holding A/S is renowned for its innovative approach to yeast development, focusing on enhancing flavor profiles and fermentation efficiency.

AB Biotek is recognized for its advanced research and development in yeast strains, ensuring high quality and reliable products for winemakers and distillers. Wyeast Laboratories, Inc. is known for its commitment to providing fresh and pure yeast cultures to the brewing and distilling communities.

DSM N.V. brings its expertise in fermentation science to the wine and spirits industry, offering a range of yeast products backed by extensive research and development. AEB Group S.p.A. specializes in providing complete solutions for winemaking, including yeasts tailored to specific grape varieties and regions.

Oenobrands SAS focuses on developing yeast strains that contribute to the complexity and character of wines and spirits. Lastly, Anchor Oenology offers a range of yeast products and technical support to help wineries and distilleries achieve their desired outcomes.

In this competitive landscape, each player strives to differentiate itself through product innovation, quality, and customer service. Continuous research and development efforts drive advancements in yeast technology, enabling winemakers and distillers to produce beverages of exceptional quality and distinctiveness.

Overall, the presence of these key players in the Global Wine and Spirits Yeasts market highlights the importance of yeast in the production process and the commitment of companies to meet the evolving needs of the industry.

Wine and Spirits Yeasts Market Key Segments:

By Type

- Saccharomyces Cerevisiae

- Saccharomyces Bayanus

- Non-Saccharomyces Yeast

- Hybrid Yeasts

By Application

- Wine Fermentation

- Spirits Fermentation

- Flavor and Aroma Development

- Alcohol Production

By End User

- Wineries

- Distilleries

- Craft Breweries

- Home Brewers

Key Global Wine and Spirits Yeasts Industry Players

- Lallemand Inc.

- Lesaffre Group (Fermentis Division)

- Angel Yeast Co., Ltd.

- Chr. Hansen Holding A/S

- AB Biotek

- Wyeast Laboratories, Inc.

- DSM N.V.

- AEB Group S.p.A.

- Oenobrands SAS

- Anchor Oenology

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252