MARKET OVERVIEW

The Global Generator market is an integral part of the power and energy industry that displays an exceptional capability to adapt and innovate. This industry, along with navigating technological advancements and increased energy demand, has grown to become a base for intricate solutions to fulfill multiple applications. It will form a key source to ensure availability of energy in distant areas, for critical industries, and address issues created by surging energy needs.

At its core, the global generator market functions to provide backup power solutions during outages and, at the same time, work as a source of credible electricity in areas with no stable power infrastructure. It provides service to different fields- health care, construction, manufacturing, and data centers- wherein high energy is required to keep functions running uninterruptedly. This is truly an industry which is a balance of engineering accuracy with customer-centric innovations, constantly reforming themselves as needs change. Each portable and industrial-scale generator reflects a sophisticated design to meet specific challenges, including energy efficiency and environmental considerations.

The future of the Global Generator market would witness major revolutions. Innovations directed at procuring sustainable and clean energy sources would redefine its present course. Traditional generators dependent on fossil fuels have to yield to models incorporating cleaner energy technologies. Ultimately, the global focus on reducing carbon footprints will compel manufacturers to accommodate hybrid systems and alternative fuels, solutions that tally with environmental objectives.

The industry will extend its reach to the emerging economies where growing urbanization and industrialization will offer new opportunities. Such markets will demand customized products capable of operation in varied climates and terrains. Similarly, developed regions will look for advanced systems capable of integrating with existing power grids and renewable energy setups. Manufacturers' adaptability and versatility will determine their competitive edge.

Digitalization will change the Global Generator market in the next few years. Smart technologies will be incorporated into generator systems to improve monitoring, diagnostics, and operational efficiency. Remote management capabilities, with real-time data analysis, will empower users to optimize performance and reduce maintenance costs. These will not only increase reliability but also cater to the modern consumer's demand for more intelligent and efficient solutions.

Despite the positive trend, the market will also experience some challenges - fluctuating raw material prices and stringent environmental regulations. These factors will significantly influence design and manufacturing strategies and price to force the industry towards cost-effective yet compliant innovation. The industry will also have to face the increasing expectations of users who seek much more durable, easier to handle, and adaptable generator systems.

The global generator market will be a dynamic landscape against the need for meeting global energy challenges while embracing change through technological transformation. Success in the coming decades will depend on its ability to change and provide efficient, sustainable, and user-friendly solutions. With increasing demand for reliable energy solutions, this industry will play a greater role in supporting global progress and meeting the complex energy demands of a modern world.

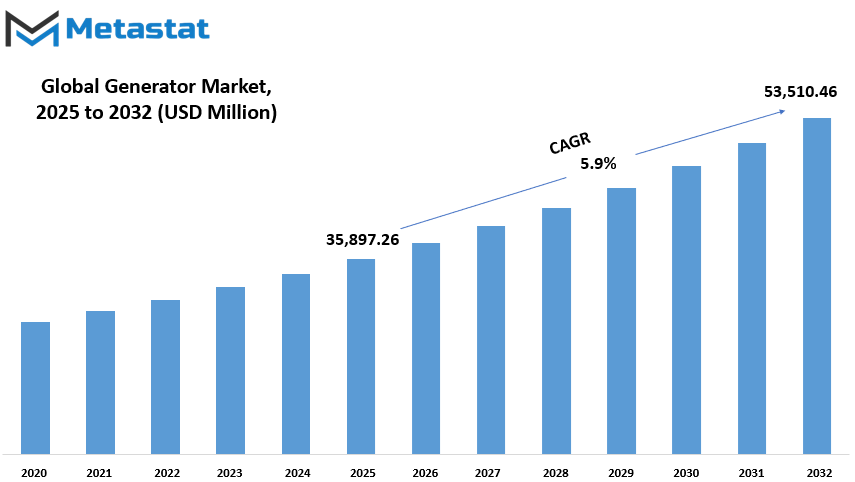

Global Generator market is estimated to reach $53,510.46 Million by 2032; growing at a CAGR of 5.9% from 2025 to 2032.

GROWTH FACTORS

The global generator market is gaining pace, and there are quite a few reasons for this. The most obvious reason is an increased demand for an uninterrupted power supply, mainly in emerging economies where frequent power outages bring about a break in daily life and business activities. In such regions, generators have become essential tools for ensuring reliable electricity. Additionally, industrial and commercial sectors are rapidly adopting generators to maintain operational continuity. Generators can be a reliable solution for businesses that require constant power for production, data management, and other critical functions.

However, some challenges may impact the growth of the market. High installation and maintenance costs often make generators less accessible to small businesses, which may find it difficult to allocate the necessary budget for such investments. Another preference is increasing demand for renewable sources of energy such as sun and wind sources, which more and more have become considered green and environmentally sound substitutes for fossil generators. A change in that trend may thus be a risk to the prospects of growth.

There is still the prospect in this market, which comes from a growing interest for hybrid generator solutions, that include renewable energy but integrate with the traditional systems, an attractive solution as they enjoy all the merits of renewable sources with the comfort of the use of the more established traditional generator solutions, therefore satisfying business or consumers looking to become greener while maintaining efficacy in their electricity solutions. Thereby, these developments will fuel hybrid generators toward wider application prospects.

The global generator market is driven by a combination of push and pull factors. The increasing demand for uninterrupted power supply and the adoption of generators in industrial and commercial sectors is driving its growth. However, high costs and the shift towards renewable energy sources may somewhat deter growth. Nevertheless, hybrid generator solutions are a promising avenue, blending sustainability with reliability. These developments suggest that the future for the generator market will be quite dynamic, full of innovation and growth.

MARKET SEGMENTATION

By Type

Over the past few years, the market for generators globally has seen tremendous growth. The power outage period is also highly demanded as they are a need of all various industries and even households for getting electricity in emergencies. Among other types of generators, the demand for diesel generators is highest in the global generator market with an amount of $19,927.85 million. Diesel generators are highly preferred due to their strength, efficiency, and the ability to deliver high power output, thus becoming a choice for large applications like industrial operations and emergency backup systems.

Gas generators also occupy a considerable share of the market as a cleaner and, in most cases, cost-effective alternative to diesel. These generators are found particularly popular among the residential as well as commercial customers due to more environment and fuel-based priorities. The significance of renewable power in solar energy makes them sought after today throughout the world as renewable power and the sources become crucial considerations in its choice. More in its new infancy than similar models based upon diesel or other gaseous fuels, customers also value its nonpollutant nature which brings out more natural aspects for all.

Inverter generators bring an additional dimension of flexibility to the market. Known for their compact size and stability in producing electricity, they are suitable for sensitive electronics and portable use. This has made them a favorite for recreational activities and small-scale power needs. Each of the different types of generators caters to a different need and requirement that varies among consumers and industries.

The growth factors for this market are rapid urbanization, the process of industrialization, and the growth in extreme events leading to loss of power. The demand is ever increasing from the business communities and individuals toward an uninterrupted supply of power and has been helping to increase generator demand. Additionally, technological development contributes to its growth, especially through the work of manufacturers on fuel efficiency, emission standards, and a better overall product.

While the market for a generator presents a wide array of options, the specific type is chosen based on the power requirements, environmental considerations, and budget. This flexibility will ensure that generators remain basic tools for running energy management in diverse sites. Further evolutions and increased adoption will be expected in this market based on the continuing need for efficient and reliable power solutions.

By Power Rating

The global generator market plays an important role in meeting power demands in different industries. These devices, mainly designed to convert mechanical energy into electricity, have become imperative for guaranteed uninterrupted power supply in various contexts. Generators are of special importance in situations requiring a stable electricity supply. It includes issues related to power cuts or in remote locations or for infrastructure support.

The market for generators is classified as per the kilovolt amps ratings to relate the machine to the requirement set by users accordingly. Generators with a rating up to 100 kVA, in general, meet the demand at small scales including residential or low commercial scale; they are easy to use compact and less costlier machines good for users who look out for reliable economical power solutions. Generators rated from 100 kVA to 350 kVA are commonly used in businesses and medium-sized facilities. They can be used to supply power to small industries, construction sites, or a medium-sized commercial establishment. High-capacity machines are used in large-scale applications for generators with power ratings above 350 kVA. These machines are installed in industries, large commercial centers, and infrastructure projects where there is a need for a robust and continuous power supply.

Demand for generators varies based on such factors as power outages being experienced more regularly and the urgent need for having a backup system for power generation. In some areas, old-age electrical grids along with extreme climatic conditions give unpredictable power supplies, which call for businesses and households to look into generators as an alternative for power generation. In addition, the fast-pace urbanization and industrialization in most developing countries led to the demands for a dependable source of electricity for economic activities.

The advancements in technology also play a significant role in shaping the generator market. Modern generators are more efficient, environmentally friendly, and have added features that improve performance and usability. From portable generators for recreational use to large industrial units, these innovations meet the diverse needs of consumers while addressing environmental concerns.

As the need for reliable power goes up, a generator market remains crucial in all ways to alleviate some of these issues. Providing different solutions, including generators to specific power requirements, assures continuity, productivity, and convenience in numerous applications.

By Application

The global generator market has grown rapidly in the last few years due to increasing demand across various applications. Generators are crucial in providing power for diverse needs, whether as a backup during outages, for regular use in primary systems, or for continuous energy in demanding environments. By application, the market is divided into three key categories: standby power, prime power, and continuous power. Each serves a unique purpose, reflecting the growing reliance on generators in both residential and commercial sectors. Standby power is crucial in ensuring uninterrupted electricity during outages, particularly in areas prone to power instability.

Hospitals, data centers, and other critical facilities rely on these systems to maintain operations without disruptions. The importance of standby generators becomes even more vital with the increasing frequency of extreme weather and natural calamities, causing long hours of grid failure in many regions. Standby generators are there to spring into action immediately in case the main power supply is cut off. The prime power, however, is for situations where generators become the exclusive source of electricity. This is a common application in rural setups or remote locations away from centralized power supplies.

Construction sites, mining sites, and rural areas often rely on prime power generators in order to have regular energies for all the respective pursuits. The need for prime power generators goes directly with economic development since infrastructure and industrial development normally demand reliable power sources in remote locations. Continuous power is essential in any industry that requires constant energy to operate. Continuous power systems are designed to be on standby and prime power but are capable of running continuously for a long time without shutdown.

These are suitable for large-scale operations, manufacturing plants, and industrial processes. Generators provide stable power supply and do not cause costly shutdowns; instead, they maintain productivity. The increasing demand for such products has influenced the technology for generators to make them more efficient, produce lesser emissions, and be friendly with renewable sources. Modern generators, designed to achieve increased fuel efficiency and noise reduction, are thus very attractive to ecologically concerned customers and business persons. As the global market expands, generators continue to play a very important role in supporting energy needs. The applications of standby, prime, and continuous power highlight the versatility and importance of generators in addressing the challenges of modern energy demands, ensuring reliability across a range of environments.

By End User

The applications of the global generator market vary widely across the different end-users, including residential, commercial, and industrial. Each of these segments plays a vital role in driving demand for generators, reflecting the unique energy needs and challenges faced by users in these categories.

In the residential sector, generators are mainly sought after for backup power solutions. These appliances provide homes with uninterrupted electricity supplies, especially in times of power failures or unstable supplies. Rising occurrences of severe climatic events and the widespread use of electronics in homes further explain the rise in the usage of generators at home. Portable generators are one of the favorites for their affordable and easy operation. They allow people to maintain minimal energy levels at home when they need them the most during emergencies.

Commercial users are offices, shops, hospitals, and schools that require a power supply to keep everything running, prevent damage to vital equipment, and ensure the occupants' safety and comfort. As an example, hospitals use the generators to preserve life-saving apparatuses during electricity outages and data centers not to lose massive amounts of cash or data, which may eventually be lost irretrievably because of the interrupted power supply. Often in this industry, reliability and a long period of performance mean advanced and durable generators are selected.

The industrial industry is the greatest market for these generators since, for instance, manufacturing plants require much energy at construction sites as well as during mining operations; this often occurs with facilities that sit in remote or circumstances where access to the grid might be limited. Industrial generators are built to handle high workloads and provide energy solutions tailored to large-scale operations. They are indispensable for maintaining productivity and minimizing downtime, making them a critical investment for industries seeking to meet stringent operational deadlines and cost efficiency.

The global generator market continues to grow, driven by the varied needs of these end users and advancements in generator technologies. Across segments, increased awareness for sustainability and further development of an eco-friendly variant also impacts their choices. There may be difference in requirements of the specific version, but importance of a proper power supply goes hand in hand. This results in generators acting as a key for fulfilling energy supply needs in various residential, commercial, and industrial sectors.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$35,897.26 million |

|

Market Size by 2032 |

$53,510.46 Million |

|

Growth Rate from 2024 to 2031 |

5.9% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

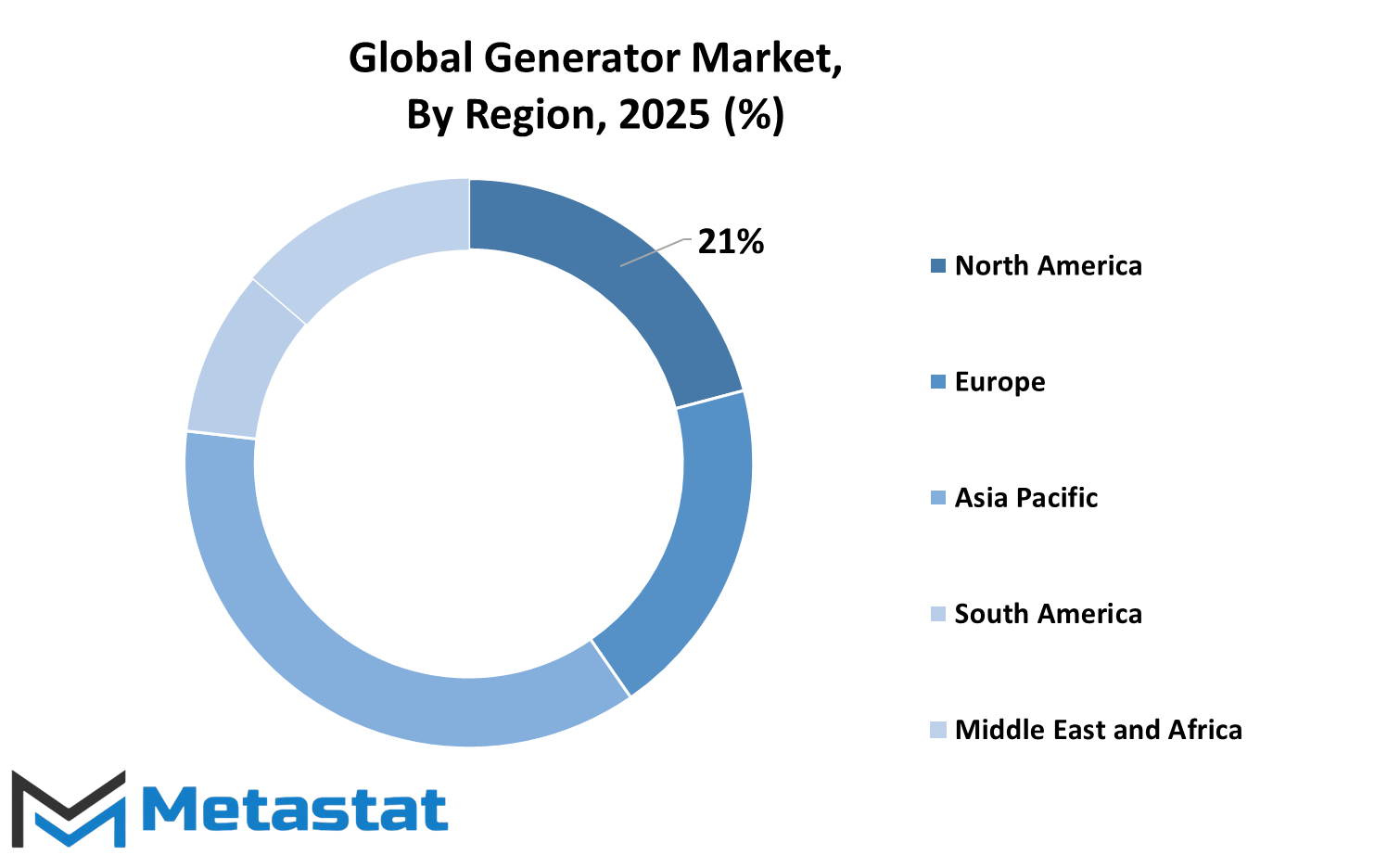

The global generator market is a highly important industry in support of multiple applications across all sectors. Power backup solutions are on the rise, industrial developments are happening at a faster rate, and increasing reliance on electricity for daily needs are factors pushing the growth. The global market is segmented based on geographical areas: North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Each area has different features that help develop the market's overall dynamics.

The generator market in North America is further bifurcated into the United States, Canada, and Mexico. These countries have a high demand for generators, as frequent power outages due to natural disasters and a need for a constant power supply in industrial and commercial sectors. The U.S. leads this segment, and Canada and Mexico also contribute significantly because of their focus on improving infrastructure and ensuring energy reliability.

Europe includes the UK, Germany, France, Italy, and the Rest of Europe. The region is experiencing growth in the generator market as a result of the advancement of technology, smart grids, and an increase in the use of renewable energy sources. Industrialized countries such as Germany and France lead the demand, while the Rest of Europe is investing in new power infrastructure as it ages.

Asia-Pacific is an emerging segment in the global generator market. Countries like India, China, Japan, South Korea, and Rest of Asia-Pacific are growing at a rapid pace. Rapid industrialization, urbanization, and the increasing need for reliable power sources are driving the demand for generators. Surging demand has been seen mainly in China and India, respectively, due to large infrastructure projects and growth in population.

The market in South America comprises Brazil, Argentina, and the Rest of South America. The market in this region is driven by economic development, increased investments in energy infrastructure, and the need to address frequent power outages. Brazil is the leader in this segment, followed by Argentina and other countries.

GCC Countries, Egypt, South Africa and the Rest of Middle East & Africa make up the Middle East & Africa region. The driving forces here behind demand are generally the oil & gas industry; rapid urbanisation and need for reliable electricity supplies in remote parts of the economy. The bulk of these arise from the Gulf Cooperation Council region, with impetus given there by infrastructure investments and energy related projects. Overall, the global generator market's geographical segmentation highlights its diverse and expanding nature, driven by unique regional demands and developments.

COMPETITIVE PLAYERS

It supports a wide variety of industries and homes with electricity during power outage or in far-flung places, ensuring consistent electricity supply. This market is continually gaining ground due to rising energy needs, urbanization, and necessity of backup in times of disaster or emergency situations. Generators now serve as backup in critical operational establishments-from medical institutions to factories-and are imperative in maintaining smooth running operations at these places.

The key players in this industry have become household names because of their reliability, innovation, and ability to meet diverse customer needs. Companies such as Caterpillar Inc., Cummins Inc., Kohler Co., Generac Power Systems, Inc., and Atlas Copco AB are the leaders in this industry with their wide variety of generators suited for different applications. MTU Onsite Energy, a subsidiary of Rolls-Royce plc, Mitsubishi Heavy Industries, Ltd., and Honda Motor Co., Ltd., brings decades of experience and cutting-edge technology to the market, offering solutions that meet specific demands. Other companies, including Wärtsilä Corporation and Siemens AG, concentrate on major power generation projects. This ensures that the equipment used is efficient as well as environmentally friendly. Other companies like Doosan Corporation (Bobcat) and Aggreko Plc emphasize portable and rental generator options, which have proven valuable for temporary power requirements. Kirloskar Oil Engines Limited has also gained prominence, especially in emerging markets, for providing cost-effective and durable solutions.

The competition among these companies has spurred innovation, resulting in quieter, more fuel-efficient, and eco-friendly models. The shift towards renewable energy sources has also influenced the generator industry, with many manufacturers exploring hybrid models that combine traditional fuel engines with renewable energy systems. This approach aligns with global efforts to reduce carbon emissions while maintaining reliable power options.

With growing concerns for energy security and climate change in the world, the generator market is an essential component of the energy sector. Such developments and diversity reflect the efforts of industry leaders in trying to meet both traditional and modern power needs. From small residential backup systems to large industrial applications, the generator market has adapted and continues to thrive because of technological progress and a commitment to powering the world effectively.

Generator Market Key Segments:

By Type

- Diesel Generators

- Gas Generators

- Solar Generators

- Inverter Generators

By Power Rating

- Below 100 kVA

- 100–350 kVA

- Above 350 kVA

By Application

- Standby Power

- Prime Power

- Continuous Power

By End User

- Residential

- Commercial

- Industrial

Key Global Generator Industry Players

- Caterpillar Inc.

- Cummins Inc.

- Kohler Co.

- Generac Power Systems, Inc.

- Atlas Copco AB

- MTU Onsite Energy (Rolls-Royce plc)

- Mitsubishi Heavy Industries, Ltd.

- Honda Motor Co., Ltd.

- Wärtsilä Corporation

- Siemens AG

- Doosan Corporation (Bobcat)

- Aggreko Plc

- Kirloskar Oil Engines Limited

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252