Global Gastroenterology Products Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

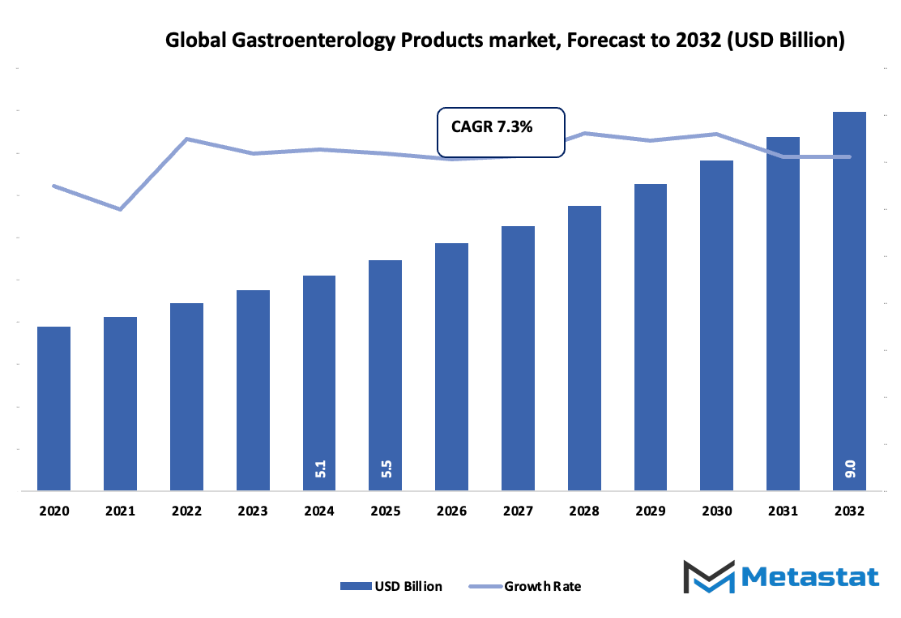

- The global gastroenterology products market is very promising as it is expected to rise to about USD 9 billion during the period between 2025 to 2032 at a CAGR of around 7.3%.

- By 2024, Endoscopy Devices is holding a significant part of the market with 41.7%, which is the result of a strong innovation and research to discover new applications.

- The primary factors contributing to the market growth are: the increasing occurrence of digestive illnesses due to poor diet, aging, and lifestyle changes, and the greater use of endoscopy, imaging, and less invasive methods in the treatment of GI disorders,

- The market will also benefit from: Rising requirement of AI-integrated endoscopy, capsule endoscopy, and digital diagnostics.

- Main point: The market is anticipated to gain huge value in the coming decade which will make it a prime area for investments.

Market Background & Overview

Over the years, the global gastroenterology products market, along with the industry, has been transformed from a small clinical niche to an extensive, innovation-driven field that is taking the shape of medical advancements and increasing digestive health awareness. The foundation of the industry can be traced back to the mid-20th century when doctors were first able to look inside the digestive system using flexible endoscopes without the need for open surgery. Such a single breakthrough opened a door to devices, diagnostics, and therapeutics that would continuously grow as hospitals sought safer and more accurate means for treating gastrointestinal disorders.

In the course of the 1970s and 1980s, health authorities and medical organizations were reporting drastic increases in the incidence of various diseases such as peptic ulcer disease, inflammatory bowel disease, and hepatitis. The World Health Organization, based on long-term statistics, indicated that by the early 1990s, digestive diseases were responsible for more than two billion deaths worldwide every year, thus emphasizing the need for improved and more screening purposes. During the time when these reports were being disseminated, manufacturers were accelerating the development of such modern endoscopic instruments, stent technology, biopsy tools, and eventually, minimally invasive surgical systems that would define our contemporary gastroenterology landscape.

Consumer expectations also changed. Patients that before had to bear long recovery times would now be increasingly looking for shorter hospital stays, less painful procedures, and earlier detection of gastrointestinal cancers. This will result in companies being compelled to produce devices with clearer imaging, smaller insertion diameters, and more automated features. Government entities, particularly in North America, Europe, and Japan, will persist in proclaiming new safety and cleanliness guidelines which will, in turn, dictate the design, packaging, and maintenance of the equipment.

A major milestone arrived when capsule endoscopy was approved for clinical use in the early 2000s. This technology, supported by research from gastrointestinal societies, allowed non-invasive imaging of the small bowel and opened a new segment of diagnostic tools. More recently, surgical robots and AI-supported imaging platforms have begun entering hospitals, backed by data from national health systems showing that early detection of colorectal cancer can raise survival rates above 90 percent when discovered in its initial stages.

From its early days of basic visualization tools to its current push toward automation, digital diagnostics, and patient-centered design, the market will continue evolving as digestive diseases rise, life expectancy increases, and health systems pursue more efficient interventions.

Market Segmentation Analysis

The global gastroenterology products market is mainly classified based on Product Type, Disease Indication, End-User.

By Product Type is further segmented into:

- Endoscopy Devices:

Endoscopy devices support detailed internal observation through flexible optical tools. Steady demand arises from rising digestive system concerns and increased screening practices. Broader use in early detection supports steady adoption across healthcare settings. These tools assist overall evaluation activity within the global gastroenterology products market while supporting safer and more accurate clinical decisions. - Laparoscopy Devices:

Laparoscopy devices allow minimally invasive procedures that lead to shorter recovery periods and reduced discomfort. Growing preference for targeted interventions encourages consistent demand. Enhanced visual guidance supports accurate treatment methods. Continuous improvement in design, lighting, and visualization strengthens overall acceptance across surgical facilities seeking efficient and patient-friendly gastrointestinal intervention methods. - GI Stents:

GI stents maintain open pathways within affected digestive channels, supporting smoother passage where blockages occur. Expanding use stems from higher incidence of obstructive conditions and broader acceptance of non-invasive supportive tools. Strong durability and easy placement encourage dependable application across varied clinical conditions requiring stable internal structural support. - Enteral Feeding Devices:

Enteral feeding devices provide essential nutritional access when regular intake becomes difficult. Stable demand connects to rising chronic illness levels and supportive post-operative requirements. Improved tube materials and placement systems offer safer nutrition delivery. Reliable function strengthens healthcare confidence and encourages wider adoption across digestive care programs. - Biopsy Devices:

Biopsy devices assist in accurate collection of internal tissue samples for diagnostic evaluation. Precision tools allow safer extraction with minimal disruption to surrounding structures. Growing emphasis on early disease identification encourages expanded use. Enhanced sample quality supports dependable laboratory assessment across a broad range of gastrointestinal conditions. - Hemostasis Devices:

Hemostasis devices assist in managing internal bleeding during gastrointestinal procedures. Effective control tools promote safer clinical outcomes and faster recovery. Advancement in mechanical and thermal methods increases reliability during interventions. Broader acceptance reflects rising procedure volumes requiring steady bleeding management support during diagnostic and therapeutic activities. - GI Imaging & Monitoring Systems:

GI imaging and monitoring systems provide clear internal visualization and continuous assessment during examinations. Enhanced resolution supports improved condition detection and treatment planning. Consistent upgrades in digital technology strengthen diagnostic confidence. Widespread use continues to rise as healthcare facilities prioritize precise evaluation for gastrointestinal conditions across varied patient groups. - Pharmaceuticals & Biologics:

Pharmaceuticals and biologics support symptom relief, disease control, and long-term management of gastrointestinal conditions. Broader therapeutic options address inflammation, acid imbalance, infection, and chronic disorders. Advancements in targeted biologic agents improve treatment effectiveness. Steady clinical acceptance reflects expanding research efforts focused on safer and more predictable digestive health solutions.

By Disease Indication the market is divided into:

- Gastroesophageal Reflux Disease (GERD):

Gastroesophageal reflux disease treatment demand rises due to growing lifestyle-related factors and wider diagnostic awareness. Medication, monitoring, and supportive devices help reduce discomfort and prevent long-term tissue damage. Expanded treatment availability strengthens overall condition management within healthcare systems addressing frequent reflux episodes and related complications. - Colorectal Cancer (CRC):

Colorectal cancer management relies on early detection tools, improved imaging, and supportive therapeutic products. Rising screening participation encourages broader equipment use. Accurate diagnostic evaluation assists timely intervention and boosts survival rates. Continuous research supports development of refined therapeutic approaches that address tumor progression while minimizing treatment-related burden. - Inflammatory Bowel Diseases (IBD) - Crohn’s disease, ulcerative colitis:

IBD treatment activity grows due to increasing chronic inflammation cases requiring long-term care. Medication, biologics, and monitoring tools assist symptom control and complication prevention. Better understanding of disease patterns supports tailored therapy selection. Clinical focus centers on improving daily comfort and reducing flare-up frequency for sustained gastrointestinal stability. - Irritable Bowel Syndrome (IBS):

Irritable bowel syndrome solutions include dietary support, medication, and stress-management approaches. Broader recognition of symptom patterns encourages early consultation and structured care. Improved diagnostic awareness leads to better differentiation from other gastrointestinal issues. Focus remains on reducing discomfort, enhancing daily function, and supporting consistent symptom tracking across care settings. - Liver Disorders:

Liver disorder management requires reliable diagnostic imaging, laboratory evaluation, and supportive therapeutic agents. Broader occurrence of metabolic and viral conditions increases clinical attention. Early recognition supports prevention of advanced complications. Continuous improvement in treatment options encourages better long-term outcomes for patients presenting with diverse liver-related concerns. - Pancreatic Disorders:

Pancreatic disorder care involves accurate imaging, targeted medication, and supportive devices that assist digestive stabilization. Rising awareness of acute and chronic conditions encourages earlier evaluation. Better diagnostic clarity supports appropriate therapeutic planning. Healthcare systems continue expanding resources dedicated to managing inflammation, blockage, and enzyme imbalance affecting pancreatic function. - Biliary Diseases:

Biliary disease treatment includes imaging systems, stents, and therapeutic tools that address blockage or infection within bile pathways. Growing incidence of gallstone-related concerns increases reliance on precise diagnostic methods. Early intervention supports symptom relief and prevents severe complications. Expanded tool availability enhances treatment efficiency across clinical settings. - Gastric & Peptic Ulcers:

Gastric and peptic ulcer management depends on medication, diagnostic imaging, and supportive monitoring tools. Rising stress levels and infection rates contribute to consistent demand for evaluation and treatment. Accurate detection helps prevent bleeding and long-term tissue damage. Widespread therapeutic options support healing and reduce recurrence risk.

By End-User the market is further divided into:

- Hospitals & Clinics:

Hospitals and clinics represent major users of gastrointestinal diagnostic and treatment products due to broad patient intake and advanced facility capability. High procedure volume encourages steady equipment demand. Comprehensive service availability supports early detection, intervention, and follow-up care across diverse gastrointestinal conditions requiring structured clinical management. - Ambulatory Surgical Centers (ASCs):

Ambulatory surgical centers utilize compact, efficient gastrointestinal tools that support same-day procedures. Growing preference for shorter stays increases reliance on minimally invasive equipment. Streamlined workflows encourage adoption of modern visualization and treatment devices. Cost-effective operation supports wider access to gastrointestinal interventions outside traditional hospital environments. - Diagnostic Centers:

Diagnostic centers focus on imaging, sampling, and monitoring tools that support accurate evaluation of digestive health concerns. Increasing demand for early screening and preventive care strengthens equipment use. Efficient workflow design encourages high-quality assessments. These facilities play a key role in identifying conditions before advanced progression occurs. - Research & Academic Institutes:

Research and academic institutes support product development, clinical studies, and training activities that influence future gastrointestinal care standards. Access to advanced equipment enables experimentation with emerging technologies. Continuous study expands understanding of disease patterns and treatment responses. These institutions help shape innovation and guide best-practice adoption. - Home Healthcare:

Home healthcare services use portable feeding devices, monitoring tools, and medication support systems that assist patients outside clinical settings. Rising preference for comfort-focused care encourages broader use of easy-to-operate products. Consistent guidance from trained professionals ensures safe application. Increased demand reflects growing emphasis on convenient digestive health management.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$5.5 Billion |

|

Market Size by 2032 |

$9 Billion |

|

Growth Rate from 2025 to 2032 |

7.3% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

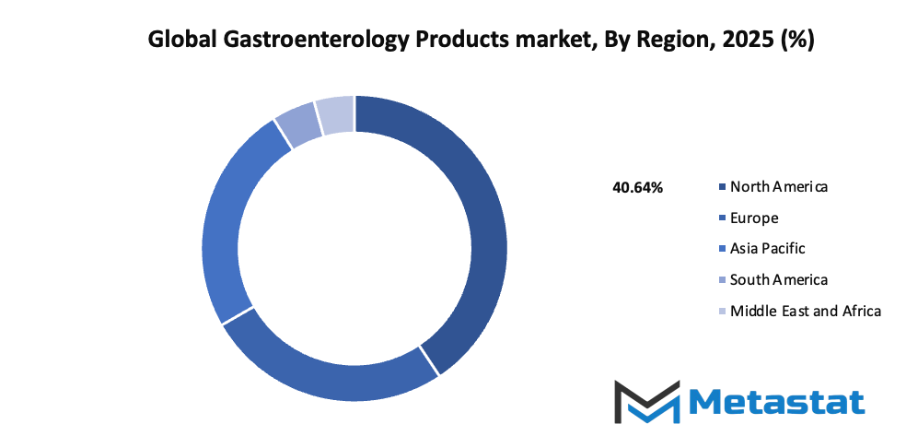

By Region:

- Based on geography, the global gastroenterology products market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Market Dynamics

Growth Drivers:

Rising prevalence of digestive disorders linked to diet, aging, and lifestyle changes:

Growing cases of digestive disorders connected to poor diet patterns, older population expansion, and lifestyle shifts are raising attention toward improved care methods. Stronger awareness and better screening approaches are encouraging healthcare facilities to support broader access to solutions offered within the global gastroenterology products market, leading to steady progress in overall demand.

Increasing adoption of endoscopy, imaging and minimally invasive devices in GI care:

Greater acceptance of endoscopic tools, imaging systems, and minimally invasive devices is supporting safer and faster diagnosis. Hospitals and clinics are steadily turning toward technologies that reduce recovery time and enhance comfort, allowing more consistent usage of modern GI tools and encouraging wider trust in advanced diagnostic and treatment options.

Restraints & Challenges:

High cost of advanced GI equipment and procedural risks limiting adoption in some regions:

Expensive equipment and the chance of complications create barriers for several regions with limited budgets. Healthcare centers facing financial pressure often delay upgrades to advanced GI tools, leading to slower modernization. This situation restricts broader usage and reduces opportunities for reliable access to high-quality diagnostic systems in underserved locations.

Limited reimbursement and training for specialized GI procedures in emerging markets:

Restricted reimbursement support and insufficient training programs reduce access to specialized GI procedures in developing locations. Hospitals with limited funding struggle to maintain skilled staff, causing slower adoption of updated technologies. This gap affects patient access to timely diagnosis and delays expansion of refined GI tools across these healthcare systems.

Opportunities:

Growing demand for AI-enabled endoscopy, capsule endoscopy and digital diagnostics:

Demand for AI-guided endoscopy, capsule-based screening, and digital diagnostic methods is increasing as healthcare facilities seek safer, faster, and more precise evaluations. Rising interest in automated detection tools and remote monitoring solutions is opening pathways for innovation, shaping stronger interest in modern GI technologies and supporting long-term market growth.

Competitive Landscape & Strategic Insights

The global gastroenterology products market features a wide group of established corporations and rising regional players working toward stronger positions through steady product development and broader distribution. Demand for advanced tools and devices encourages constant progress from manufacturers, leading to a setting where long-standing brands and newer companies compete through quality, safety, and dependable performance. Strong research programs, careful regulatory planning, and consistent cooperation with healthcare facilities shape most strategies in this market.

Major corporations such as Olympus Corporation, Medtronic plc, Boston Scientific Corporation, Johnson & Johnson (Ethicon), FUJIFILM Holdings Corporation, CONMED Corporation, Stryker Corporation, Pentax Medical (HOYA Group), B. Braun Melsungen AG, Cardinal Health Inc., Smith & Nephew plc, KARL STORZ SE & Co. KG, Alvimedica, EndoChoice Holdings Inc., and ERBE Elektromedizin GmbH maintain strong influence through long histories, wide portfolios, and global networks. Steady updates to diagnostic tools, therapeutic systems, and supporting equipment help each company strengthen market presence. Many organizations work closely with hospitals to understand daily challenges faced by medical teams, encouraging improvements in device safety, durability, and ease of use.

Regional competitors continue to gain attention through targeted product lines designed for local needs, often offering flexible pricing and faster support services. Strong relationships with healthcare providers allow smaller companies to adjust quickly to changing preferences, helping expand access to gastrointestinal care across developing areas.

Growing attention toward minimally invasive procedures encourages a broader range of devices, guiding companies toward lighter designs, clearer imaging, and better patient comfort. Investment in training programs for healthcare professionals also supports safer procedures and stronger confidence in advanced equipment. As demand for reliable gastroenterology solutions rises, cooperation between manufacturers and medical centers becomes more important, supporting consistent progress across diagnostic and therapeutic segments.

Overall, the market reflects active movement from major corporations and regional manufacturers working toward dependable solutions for gastrointestinal care, with strong focus on product quality, clinical value, and long-term support for healthcare systems worldwide.

Forecast & Future Outlook

- Short-Term (1-2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3-5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6-10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 5.5 billion in 2025 to over USD 9 billion by 2032. Gastroenterology Products will maintain dominance but face growing competition from emerging formats.

Report Coverage

This research report categorizes the global gastroenterology products market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global gastroenterology products market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global gastroenterology products market.

Gastroenterology Products Market Key Segments:

By Product Type

- Endoscopy Devices

- Laparoscopy Devices

- GI Stents

- Enteral Feeding Devices

- Biopsy Devices

- Hemostasis Devices

- GI Imaging & Monitoring Systems

- Pharmaceuticals & Biologics

By Disease Indication

- Gastroesophageal Reflux Disease (GERD)

- Colorectal Cancer (CRC)

- Inflammatory Bowel Diseases (IBD) - Crohn’s disease, ulcerative colitis

- Irritable Bowel Syndrome (IBS)

- Liver Disorders

- Pancreatic Disorders

- Biliary Diseases

- Gastric & Peptic Ulcers

By End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Centers

- Research & Academic Institutes

- Home Healthcare

Key Global Gastroenterology Products Industry Players

- Olympus Corporation

- Medtronic plc

- Boston Scientific Corporation

- Johnson & Johnson (Ethicon)

- FUJIFILM Holdings Corporation

- CONMED Corporation

- Stryker Corporation

- Pentax Medical (HOYA Group)

- B. Braun Melsungen AG

- Cardinal Health Inc.

- Smith & Nephew plc

- KARL STORZ SE & Co. KG

- Alvimedica

- EndoChoice Holdings Inc.

- ERBE Elektromedizin GmbH

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252