MARKET OVERVIEW

The global fumigation market, which belongs to the pest control and biosecurity industry, will be a prominent industry dealing with the protection of agricultural produce, commercial inventory, and structural structures against pests' damage. With the rising volume of international trade scale and complexity, fumigation services will play an ever-growing role to make certain that products in storage, shipping containers, and cargo do not become vectors for pests spreading geographically. The market will include services designed to prevent infestation by insects, rodents, termites, and other pest organisms using special chemical and non-chemical treatments. It will support numerous verticals including agriculture, warehousing, logistics, and food processing. In the coming years, the global fumigation market will make itself stronger in areas of intensive grain farming, export needs between countries, and rigorous safety standards. Market operators will rely on advanced application techniques that reduce exposure to danger and have limited environmental impact.

This market will not be limited to developing countries that experience pest pressure in crop yields but extend its worth in developed economies where there are enormous storage facilities and international import channels that call for regulated and preventative disinfection techniques. Besides, government regulatory compliance rules and quarantine procedures will continue to drive operational significance of fumigation services across boundaries. Residential and commercial spaces will also become more reliant on fumigation solutions to eliminate termites, cockroaches, and bed bugs—especially in cities where limited space and growing population densities make pest environments more attractive. The industry will not remain stagnant, as it will come to include more automated monitoring, automation, and data integration to improve planning and efficiency. Experts who give fumigation solutions will need to stay in step with environmental guidelines, secure chemical use, and tailored methods for various types of infestation.

The global fumigation market will also find applications in maritime and aerospace industries where import-export inspection and in-transit freight security measures demand bulk-scale fumigation operations. The market will also find specialized applications like the preservation of museum pieces, archival storage protection, and the safeguarding of high-value goods. Such niche segments will further drive the market's extent and create a diversified portfolio. As awareness regarding the risk of contamination and loss of product grows, demand for well-controlled and systematic fumigation processes will grow. Service providers will need to meet various national and international regulations, control safety risks, and ensure documented proof of treatment to develop trust across sectors. Technologies like gas sensors, studies of residual effects, and application audits will have a greater part to guarantee quality and consistency. With its vast service network, the global fumigation market will be a key support system for maintaining biosecurity and protecting economic interests globally. It will respond to industry-specific requirements, change with regulatory environments, and improve and adjust its operational range on a continuous basis to address future pest prevention and control needs.

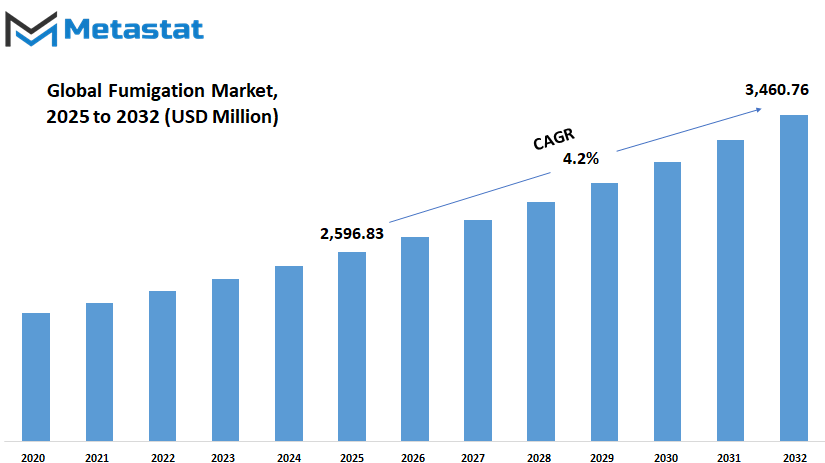

Global fumigation market is estimated to reach $3,460.76 Million by 2032; growing at a CAGR of 4.2% from 2025 to 2032.

GROWTH FACTORS

The global fumigation market will continue growing over the next few years as people change the way they do agriculture and foreign trade. As farmers and businesses find it harder to deal with pests, particularly in stored commodities, there is a greater need for effective solutions. In agriculture, crops are perpetually under attack from pests that can destroy entire crops. To prevent such losses, fumigation has become the method of choice. It helps prevent pests from entering into crops in the field and stored crops in warehouses. With food safety as the top priority, fumigation is a sensible and speedy option for reducing spoilage and quality maintenance. Another main reason for the growth of the market is the sharp rise in international trade. With products traveling between nations and continents, the necessity increases to adhere to strict guidelines that guard against pest infestation.

Most nations now impose quarantine regulations whereby fumigation is mandatory before goods can enter or exit an area. This trend does not look likely to reverse anytime soon. It is indicative of how trade is becoming increasingly integrated and regulated. Firms must abide by these requirements, hence the demand for effective fumigation services. Irrespective of these growth factors, however, the global fumigation market also faces challenges. One of the main challenges is the manner in which chemical pesticides affect health and the environment. Misuse or overuse can bring about problems not just for the applicators themselves but for the surrounding land and air as well.

These controls make it harder for some companies to operate if they are not doing things in the proper procedures. Companies have to spend more money and time making their processes safe. But this challenge also has new possibilities. There is greater interest in developing safer, more environmentally friendly methods. Companies are now creating substitutes that do not harm individuals or the environment. These new options will likely find support from governments and consumers, who are becoming more aware of their impact on the environment. The trend towards greener solutions could change the practice of fumigation and bring new innovations. With the right stimulus, the global fumigation market can expect to expand into new markets by offering safe and efficient treatments that meet the demands of the future.

MARKET SEGMENTATION

By Type

The global fumigation market will keep expanding as effective pest control requirements become more significant in various industries. With increasing concerns on food safety, the environment, and global trade, fumigation has emerged as an important solution to safeguard stored commodities, agricultural products, and public health. The market will evolve with changing needs and newer challenges as technology and awareness advance.

Fumigation techniques by category have a number of variations, with each providing different benefits. Methyl Bromide Fumigation was universally applied because it acts very quickly, particularly for agricultural storage. Its potential to harm the environment could potentially see usage decline in the future. Phosphine Fumigation is seen as being safer for grain storage and remains the popular choice because of its efficiency and lesser toxicity to non-target living organisms. Sulfuryl Fluoride Fumigation applies primarily to structural fumigation and is likely to expand as the demand for improved pest control for urban and commercial structures increases. Carbon Dioxide Fumigation is a toxin-free process that is appealing to individuals looking for more natural alternatives, and demand might increase as concerns regarding chemical residues intensify.

Heat Treatment Fumigation provides yet another chemical-free alternative that is effective against insects without the aftereffects of toxic substances. Its application is expected to increase in sectors where product purity is a concern. Biological Fumigation, employing naturally occurring materials or organisms for pest control, will receive greater prominence as research progresses to enhance sustainable agriculture and safer ways of pest control. The global fumigation market will be subject to both pressure and opportunity. On the one hand, international trade continues to fuel the demand for effective pest control across borders. On the other hand, public pressure and regulation are encouraging companies to think green.

This will result in a move towards solutions that are not only effective but also safe for humans and the environment. Producers and service providers will have to emphasize flexibility, providing fumigation services that address both ancient requirements and contemporary expectations. Research, worker safety, and customer education will figure prominently in determining the future of the market. Increased awareness of the role of pest control in food security and healthy environment will prompt the global fumigation market towards more intelligent, cleaner, and more effective solutions that cater to multiple industries.

By Application

The global fumigation market is trending toward an era influenced by altered consumer behavior, tightened regulations, and heightened concerns regarding pest control and hygiene. With consumers becoming more health-conscious about food safety and the safeguarding of goods throughout the supply chain, fumigation services are emerging as an essential solution in many places. This market is influenced by both traditional uses and the growing demand from industries that did not heavily rely on such methods in the past. One of the biggest applications is in farm commodities. Producers and farmers are increasingly resorting to fumigation to shield crops from storage and transportation. With increasing worry regarding post-harvest losses, this process has become crucial in averting spoilage and infestation by insects. In the coming times, it won't be surprising if more producers start using new technology-based fumigation methods to achieve both export standards and consumer demands for clean and safe produce.

Food storage warehouses will also witness increased utilization of fumigation. Since food items are bulk stored and for longer durations, the chances of pest infestation are higher. Fumigation aids in maintaining quality and shelf life, thus proving beneficial to suppliers and retailers. Future advancements in gas monitoring and application technology could result in improved safety and efficiency of fumigation in these units.

Wood packaging and shipping containers offer another site where fumigation is increasingly necessary. Shipping containers and wood packaging materials can carry insects across borders, potentially transferring invasive species. With the further expansion of trade, international regulations will tighten, and shipping containers and wood packaging materials will have to be treated more often and intensively. Developments may include cleaner fumigants or automated systems in the future to limit exposure and boost productivity.

In transportation and logistics, the application of fumigation is slowly gaining traction. Goods in transit, vehicles, and warehouses are susceptible to pest threats. As this industry aims for safer and smoother deliveries, fumigation services will be more fully incorporated into day-to-day operations.

Industrial plants, houses, and office buildings are now looking at fumigation as more than an occasional treatment. It is now incorporated into regular maintenance practices. The future could hold smarter, sensor-driven pest control systems, with data used to schedule treatments to the exact moment, minimizing the use of chemicals but effectively controlling the pests. The global fumigation market will go on evolving and expanding, driven by shifting needs, improved technology, and an increasing need for safety in various sectors of modern society.

By End User

The global fumigation market is expected to witness sustainable growth in the future since demand for pest control continues to increase in most industries. As industries and populations expand, demand for clean and safer environments increases in importance. Fumigation, a method applied to eliminate pests as well as unwanted microorganisms, contributes in a major way to enable this goal. It will not just be helping in managing health and hygiene but also industries that are reliant on hygienic shipping and storage habits. From food security to protecting products during transit, the need for effective fumigation services will be even more needed. Based on application, the global fumigation market serves a number of segments that are each set to grow in demand. Produce from farms will continue to need protection from insects both in storage and during transport.

With countries competing to reduce food loss and improve food security, fumigation will become a commonplace operation in food processing agriculture. Food storage godowns charged with holding large volumes of edible products will similarly rely more on these services as well. Ensuring pest-free storage will maintain food quality and safety until it is consumed by the customers. Shipping containers and wooden packaging materials will remain at the heart of international trade, and fumigation will be critical in meeting import and export laws. Since the trade volume keeps going up between borders, the prevention of pests from infesting areas to areas is the most critical. Transport and logistics networks will also help drive this market. Sanitized and pest-free transport does not only mean compliance but also maintaining the integrity of products when in transit.

In business settings, fumigation will play an essential role in maintaining production areas. Factories and large buildings need to avoid infestations that can slow down operations or even damage equipment. Domestic and commercial houses and buildings, however, will continue to utilize fumigation to create tidier living and working environments. Increasing urbanization means the need to control pests in urban areas will only become more urgent. In the future, the global fumigation market will respond to tighter regulations, mounting health concerns, and the need for long-term protection in key markets. The focus will be on safer, more effective treatments with sure results. As these sectors grow, fumigation will continue to be essential in protecting people, products, and infrastructure.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$2,596.83 million |

|

Market Size by 2032 |

$3,460.76 Million |

|

Growth Rate from 2025 to 2032 |

4.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

With the world progressing, one can notice a change in how various sectors tackle safety, hygiene, and protecting the environment. Of these, the global fumigation market is still making waves because of its increasing role in agriculture and also in commercial environments. With the need for clean, rodent-free environments becoming increasingly widespread, the demand for efficient fumigation techniques will also be on the rise. Individuals from different industries are increasingly recognizing the issues created by pests—not only for crops, but also in storage facilities, warehouses, and homes. This increased awareness will be a major influence in determining the future of fumigation services. In the years to come, one of the most powerful forces driving this market is the global demand to safeguard food supplies.

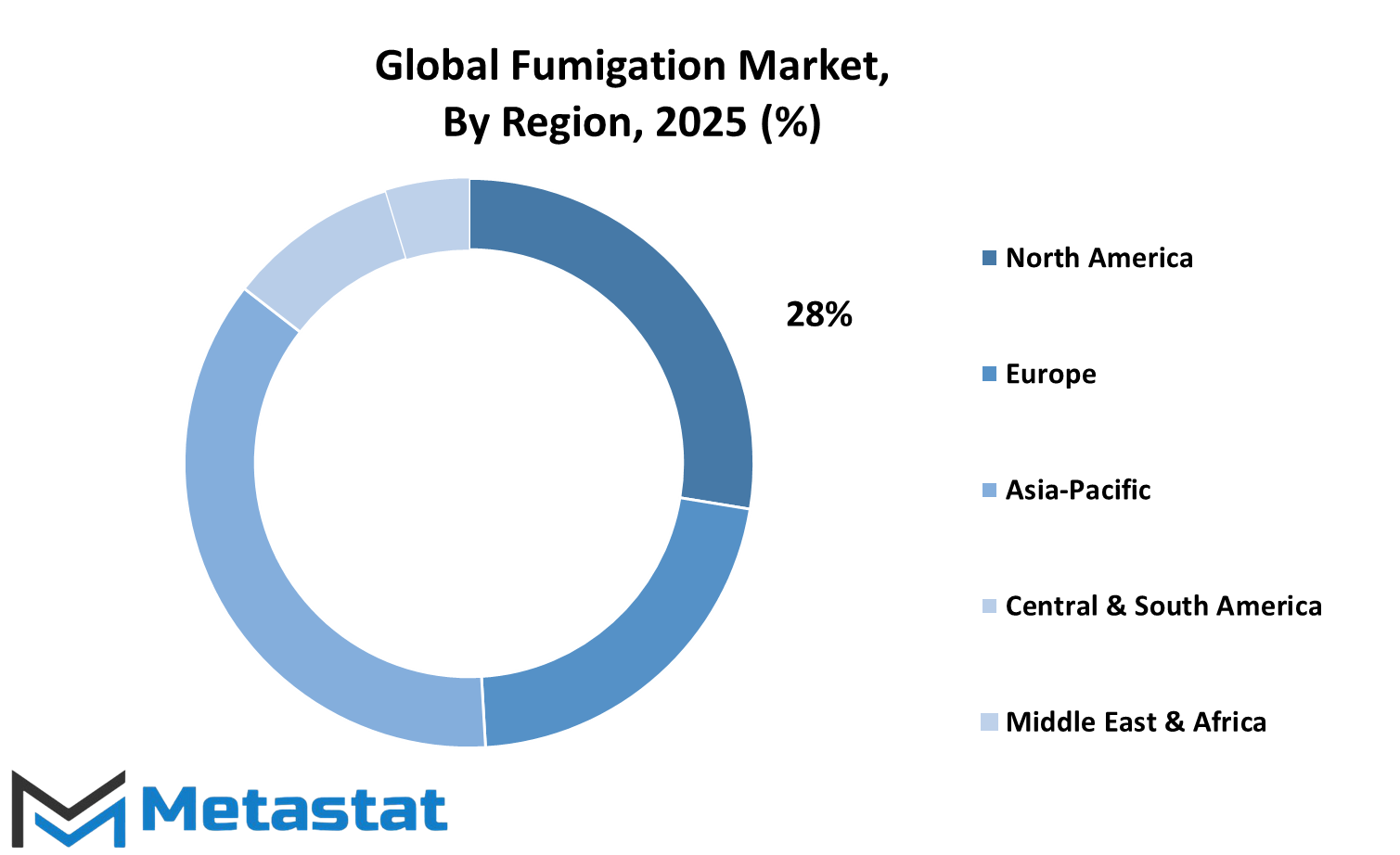

As food security rises higher on the agenda, waste caused by pests will be reduced more strictly. It will not only require fumigation solutions to be effective but also to be less harmful to humans and the environment. Technology advancements will probably introduce new, more efficient products using less toxic chemicals, or even natural substitutes, to make the industry more sustainable. As far as location-based expansion is concerned, the global fumigation market displays various patterns on various continents. In North America and particularly in the U.S., tight regulations and a strong agricultural sector keep the demand driving.

Canada and Mexico follow with the same requirements, particularly in export-oriented agriculture. Europe also has a significant role to play with the UK, Germany, France, and Italy having a keen interest in new pest control techniques that are both efficient and environmentally friendly. This trend will continue to be consistent as regulations continue to tighten. The Asia-Pacific region is particularly noted as a region for future expansion. With nations such as India, China, Japan, and South Korea experiencing fast population growth and urbanization, pressure on food supply chains is intense. This will probably result in increased use of fumigation methods in agriculture and storage.

South America, particularly Brazil and Argentina, boasts a huge agricultural base that relies heavily on crop protection for export. Lastly, the Middle East & African region, composed of regions such as the GCC nations, Egypt, and South Africa, is experiencing steady growth in fumigation services primarily owing to expanding infrastructure and trade. All in all, the future of the global fumigation market will lie in how effectively it adjusts to evolving needs, technology, and environmental issues.

COMPETITIVE PLAYERS

The global fumigation market will keep on rising steadily as the demand for food security, storage protection, and safety environments increases in various regions of the world. With the rapid urbanization and international trade, the demand for pest control services that can ensure safety standards will only intensify. Fumigation, which assists in the elimination of pests from warehouses, farm fields, and shipping, plays a critical role in the quality of products. The expansion of trade routes and transportation means, particularly via ports and border stations, further underlines the need for efficient fumigation services. That is why increasing numbers of companies are getting into the business and enhancing services. In the future, technological advancements will revolutionize the way fumigation is carried out.

Additional companies will be applying automation, green chemicals, and enhanced safety measures. These are being done not just to conform to the local norms but also to earn world-wide confidence. Among the market competitors influencing the direction of this industry are popular names that have established themselves for quality and reliability. Intertek Group plc, SGS Group, and Bureau Veritas are prominent for their attention to inspection and certification services. They infuse scientific know-how in the sector and advance the standards. Other players like Termirite Pest Control Services, Rentokil Initial plc, and Entech are practical, grounded solutions, delivering specialized fumigation for domestic use, commercial establishments, and agriculture. Their service efficiency and reliability have put them in the focus of customer trust.

South Fumigation Professionals Inc., Techno Pest Control Phils, and Cat's Eye King International Inc. have also become significant with their concentration on local requirements with compliance to international safety standards. The mix of local concentration and international compliance allows their services to be more efficient and universally accepted. The industry will also witness the emergence of players such as Pest Assassins Pest Control and Termite Specialist, Mc Ace Service Provider Inc., and Tercopex Pest Management Services. These organizations are enhancing their equipment, training, and safety procedures to keep up with the industry's escalating standards. Bio-Tech Environmental Services Phils., Inc. provides additional value by introducing eco-friendly practices, which will gain prominence with increasing environmental regulations. With the global fumigation market growing, these competitive companies will keep investing in intelligent solutions. Their contribution will define the future of pest control services by increasing the standard for safety, quality, and innovation without sacrificing accessibility or efficiency.

Fumigation Market Key Segments:

By Type

- Methyl Bromide Fumigation

- Phosphine Fumigation

- Sulfuryl Fluoride Fumigation

- Carbon Dioxide Fumigation

- Heat Treatment Fumigation

- Biological Fumigation

By Application

- Agricultural Commodities

- Food Storage Warehouses

- Shipping Containers

- Wood Packaging Materials

- Logistics and Transportation

- Industrial Facilities

- Residential and Commercial Buildings

By End User

- Agriculture Sector

- Food & Beverage Industry

- Logistics & Warehousing

- Import/Export Companies

- Manufacturing Plants

- Pest Control Service Providers

Key Global Fumigation Industry Players

- Intertek Group plc

- SGS Group

- Bureau Veritas

- Termirite Pest Control Services

- Rentokil Initial plc

- Entech

- South Fumigation Professionals Inc.

- Techno Pest Control Phils

- Cat’s Eye King International Inc.

- Pest Assassins Pest Control and Termite Specialist

- Mc Ace Service Provider Inc.

- Tercopex Pest management Services

- Bio-Tech Environmental Services Phils., Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383