MARKET OVERVIEW

The Global Forensic accounting market specializes fully in scrutiny, analysis, and interpretation of financial information for the purposes of law. Industry is essential, if not best ever possible, in the detection and prevention of financial fraud, embezzlement, and economic disputes in all sectors and denominators. With an ever-growing complexity of corporate transactions, increased transparency and awareness of the need for forensic accounting services is likely to put an increased demand on the market.

Forensic accountants typically use accounting knowledge and auditing, at times also considering investigative skills, to address legal issues. They significantly support litigation, insurance settlements for claims, and also act in investigations by government agencies about financial crimes. Assuring accuracy or truth in the financial records or identifying discrepancies between them gives forensic accountants access to and use of forged or illegal transactions. Their endeavors can take them to civil and criminal dimensions of operations within regulatory compliance and risk management, thus making their presence indispensable in maintaining financial integrity.

The coverage of the Global Forensic Accounting market comprised vast range of industries like banking, insurance, law enforcement, government agencies, and corporate enterprises. As a matter of fact, forensic accountants constantly need to acquire newer, advanced methods or modify the present ones to meet the threats that arise owing to sophistication in financial crimes. This flexibility will play the central role in the market dynamics relative to the law and financial arena.

Forensic advances in science are expected to influence the future of the Global Forensic Accounting market. This means, as said earlier, the fusion of data analytics and artificial intelligence with blockchain technology will eventually yield high levels of precision and reliability in financial investigation while giving forensic accountants an option to accumulate massive data sets on various kinds of transactions. Many of these tools will not only make forensic accountants capable of greater precision in aligning vast amounts of financial data in patterns but also detecting anomalies. This technology is evolving and will open further avenues of innovation in the industry, allowing forensic accountants to produce even more solid and credible evidence.

The Global Forensic Accounting market also has the regulatory environment as one of the factors shaping its growth. Compliance will become tighter and anti-fraud measures would inevitably increase globally which will create demands for forensic accounting services in many nations. Those companies that find the means to be compliant through the expertise of the forensic accountant will also be brought closer to mitigating the many financial misconduct risks.

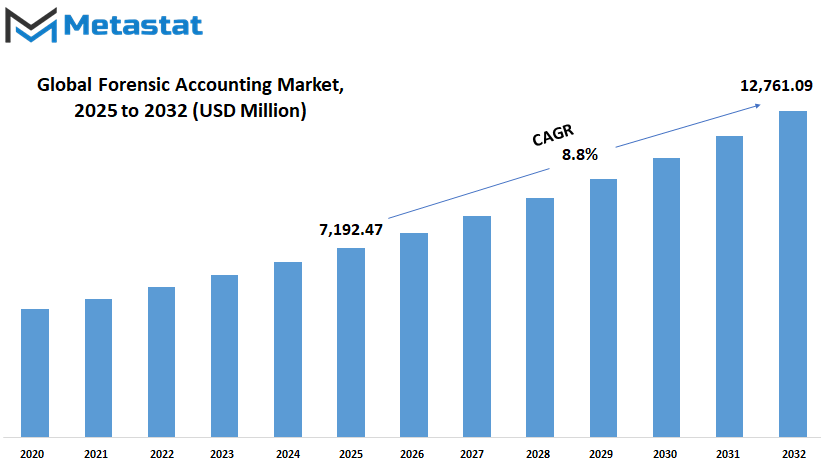

Global Forensic Accounting market is estimated to reach $12,761.09 Million by 2032; growing at a CAGR of 8.8% from 2025 to 2032.

GROWTH FACTORS

The Global Forensic Accounting market is expected to thrive mightily in the upcoming years based on a few factors including increased demand, technological advancement, and regulatory revisions all of which will boost the market. Given the escalating complexity in financial systems, it becomes even more critical to ensure compliance and specialized expertise in unearthing fraudulent activities. Forensic accounting that comes up with detailed financial investigations for detecting fraud, misrepresentation, and other irregularities is fast becoming a focal service among the businesses worldwide. Such rising importance makes such market vital to keep financial transparency and integrity across industries.

Increasing fraud in finances is one of the prime growth factors. With the growing complexity of corporate structures, the nature of both white-collar crimes and fraud has become more advanced, manifesting itself more frequently but without being easily detected. For instance, a company may experience the increasing risk of embezzlement, money laundering, and fraudulent financial reporting. Most of the time, these activities lead to a large loss of money, and often, these events severely damage reputations. These are the primary reasons why companies have started looking for the services of forensic accounting to find, identify, and investigate or prevent fraudulent activities. The forensics accountant, however, creates a very strong evidence held up with proper documentation that is very useful to the courts.

Another element of growth in the market is the increasing emphasis on compliance with regulations. Governments and financial authorities worldwide are imposing stricter rules regarding finances to eliminate corruption and ensure transparency. With different regional businesses being multiprogressional, those are now becoming stringent to these changing rules to avoid litigation against the organization and still keep their good image in the markets. The forensic accounting services give the companies proper consultation on complicated legal environments where their financial practices are in the straight line with the law. This effect of increased attention on compliance is pushing even more organizations to adopt forensic accounting into practice and thus, increasing the demand in the market.

On the one hand, an enormous potential for growth; on the other hand, there exist some challenges that can eventually slow down the overall expansion of the market. One of the driving reasons that make forensic accounting services very accessible is their extraordinarily high rates, particularly against small and medium-sized enterprises. Financial investigations often require specialized skills and equipment, as well as considerable time, which culminates in high fees for expensive services. It is expected that the complicated and time-consuming nature of these investigations discourages firms from seeking out forensic accounting services until it is clearly unavoidable. Most of these important thorough financial analyses and rigorous legal documentation will take too long, thus delaying the case resolution.

However, promising emerging prospects lie in advanced technologies such as artificial intelligence and data analytics. Their use further enhances speed, efficiency, and accuracy in forensic investigation activities since tools of data analysis and pattern identification can be utilized to detect anomalies much more quickly than traditional means. As innovation advances, incorporation of AI-assisted tools will most likely continue to reduce costs and make the provision of forensic accounting services easy and even efficient. The anticipated impact of this technological progress will add future dimensions to the Global Forensic Accounting Market, thereby opening up new avenues for growth and development for the industry.

MARKET SEGMENTATION

By Service Type

The Global Forensic Accounting market is predicted growth in the coming years which will be propelled by the increasing demand for more transparency, accuracy, and accountability in financial practices. As necessary, companies and financial institutions expand their operations into new countries, the requirement for specialist forensic accounting services will continue to grow. This market is a key player as it reveals and solves financial discrepancies, whereby entities may assure that all practices are legit and that financial reports represent the true and fair value of operations. The increasing litigiousness with financial fraud, disputes, and regulatory pressures create the crucial question of forensic accounting in the financial environment.

Forensic accounting services have different subdivisions that perform a specific function of revealing and providing evidence for legal and business decision-making. Fraud detection, and investigation will remain a core market area for the foreseeable future. New sophisticated financial crimes would see companies ultimately turn to forensic accountants for the detection of illicit activities, tracing hidden assets, and prevention of fraudulent practices. The experts will combine their financial expertise and investigative skills to analyze transactions, identify abnormalities, and provide evidence for use before the courts.

Dispute resolution and litigation support are among the most popular forensic accounting services. As business environments become increasingly complicated, the disputes over financial issues become more common. Forensic accountants do great services in conflict resolution through analysis of financial data, expert opinions, and clear presentation of findings. Their contribution guarantees fair outcomes, whether in commercial disputes, in disagreement of partners, or in contractual issues.

The increased number of areas in which forensic accounting service provision will be in demand in future will include investigation in insurance claims. Insurance companies require correct evaluations of claims to childproof against fraud and also mitigate risks. Forensic accountants ascertain the legitimacy of claims through a review of financial records and relevant supporting documentations, assisting insurers in moving towards a wiser direction and avoiding unnecessary losses.

Digital forensics have gained eminence by becoming a major determining factor in the future of the Global Forensic Accounting market. The high level of digitization of financial information leads to increased incidences of cyber-related crimes. Digital forensic experts will be engaged in the examination of electronic records, evidence data breaches, and trace fraudulent activities by tracking digital transactions. This will be vital in ensuring data security while ascertaining the credibility and integrity of electronic financial information.

Factors such as bankruptcy and insolvency services will also galvanize forensic accounting. Entities in financial distress require rigorous assessments of their financial positions to navigate insolvency processes. Forensic accountants help identify the cause(s) of the financial failure, affirm the asset(s) and liabilities, and help in restructuring. Their expertise is central to achieving just and equitable outcomes in a less-than-favourable financial climate.

As the commerce and the financial institution evolve, the need for a comprehensive and reliable forensic accounting service will vastly multiply. This growth in the market is a reflection of the demand for expertise to investigate financial misconduct, to mediate disputes, and to affirm financial information.

By Application Area

The forensic accounting market is on the verge of booming in the next years owing to increased requirements for transparency and accuracy in financial matters. As the demand for specialized accounting services will also show more importance when businesses expand and financial transactions become more complex, forensic accounting becomes a huge part of many organizations as it brings up such discrepancies and ensures compliance with legal and regulatory standards. Forensic accounting will, therefore, soon become a must-have for every businesses, governments, and legal entities across the globe.

Detection of financial statement fraud is one of the prime application segments of the Global Forensic Accounting market. To showcase good financial results, companies try to manipulate their statements. The forensic accountant uses his expertise to find out the inconsistency, analyze the data, and give proof of fraudulent activity. They protect investors and other stakeholders from potential losses. Proper evidence and maintain trust in the financial reports. The future of this science is going to be mostly digital, just like the financial systems; forensic accountants will have to upgrade their tools and techniques according to the changing practice.

Another area where forensic accounting performs a major role is asset misappropriation. This type of fraud concerns the abuse or theft of some assets owned by a company. Certainly, this is one of the most common financial crimes. Forensic accountants would investigate suspicious activities, trace missing funds, and even help recover misappropriated assets. With advanced financial system adoption, the modes of asset misappropriation will probably get more sophisticated, making expert forensic accountants much sought after. Real-time capability in tracking and analyzing financial data will be critical in detecting and curbing these activities.

Corruption in foreign forensic investigations is becoming another area of concern in the Global Forensic Accounting Market. Bribery, embezzlement, and conflicts of interest are other common means by which corruption manifests in different geographies. They will analyze how the accountants of organizations might encourage misconduct and unethical practices to create evidence and transaction analysis. In this sense, with the increased growth of the global business networks, the incidence of cross-border corruption will grow as well, requiring forensic practitioners that are well versed with international settings regarding complex financial transactions. Thus, forensic accounting also will aid in promoting ethical business practices.

Intellectual property disputes pose yet another challenge in the international business arena. Companies invest considerable resources in developing their unique products, technologies, and content; therefore, it is essential to protect these assets. Forensic accountants evaluate the financial losses that occur as a result of intellectual property theft, assess damage, and appear in court as experts. Thus, the more the development of such innovations driving the world economy, there would be an increased need for sound financial analysis in intellectual property matters, making forensic accounting one of the important tools in protecting creative and technological investments.

Due to ever-increasing business reliance on digital platforms, cybercrime investigations are assuming ever-more prominence. Cybercriminals concentrate on financial information, leading to fraud, data breaches, and unauthorized transactions. Forensic accountants work with cybercrime specialists to follow digital footprints, analyze compromised data, and assess financial losses. With technology ever-changing, so will the nature of threats, which is why forensic accounting will protect the financial integrity of the given world in a digital context.

Next is detection of money laundering: another major area in forensic accounting. Criminal organizations, in concealing the source of their illicit money, often use very complicated transactional patterns. Forensic accountants discern the nature of suspicious activities, trace the money flows, and ensure compliance with anti-money laundering regulations. It is against the backdrop of the rapidly developing interconnectivity among financial systems that the increasing collaborations needed to combat money laundering will engender the sophistication of forensic accounts.

The Forensic Accounting market is poised to further evolve, grow, and adapt to continuously changing challenges and opportunities. As financial networks expand and criminal activities evolve, the input of forensic accountants will remain essential in maintaining financial integrity and ethics worldwide. Foreign fraud investigation corruption is yet another emerging topic of concern in the Global Forensic Accounting Market. Bribery, embezzlement, and conflict of interest are some of the common manifestations of corruption across various geographies. They will analyze how this accountants of organizations might encourage conspiring and unethical practices to create evidence and transaction analyses.

By End-User

ing professional integrity will grow in both corporate settings and privately held businesses. This will require the development of forensic accountancy practice and research to determine the challenges and opportunities that different regions provide. However, the most important factor expected to boost the growth of the Global Forensic Accounting market is the effortlessly diverse end-user pool.

The corporate sector relies on forensic accounting for fraud detection, prevention of mismanagement, and financial irregularities. As companies grow, they engage in a much larger volume of transactions and increase the risk of internal and external fraud. However, with the introduction of forensic accounting, a blueprint exists to ensure that operations would be safeguarded by providing clear insights into the legality and compliance of financial activities within the organization. Forensic accounting will, in all likelihood, be incorporated into the pure corporate financial structure as part of the broader risk management efforts and strategies of corporations going forward.

A very important aspect of the Global Forensic Accounting market is government agency involvement. The agencies have demonstrated in the past their reliance on forensic accounting with respect to the tracking of public funds, investigations of corrupt practices, and regulation on the usage of public money. Moreover, as many governments increasingly tighten their scope against all financial crimes, putting stringent regulations against financial crimes, so also will the need for specialized services in forensic accounting multiply. This will serve to increase public trust as well as help in establishing agriculture systems that are fair and transparent.

Another important segment that forensic accounting would benefit is law firms. Disputes regarding finances end up in courts, where expert opinion is required for proper, clear, and accurate evidence. Thus, forensic accountants may relate with legal teams in fraud, embezzlement, and contract disputes matters. Law firms are likely to get deeper into collaboration with forensic accountants in years to come, as more cases of this nature are brought to court because of complicated financial data.

Forensic accounting finds application in insurance firms and financial institutions for fraud detection and claims management. Insurance fraud is still one of today's biggest issues, and forensic accountants validate the claims for the companies and save them from losses. Forensic accounting becomes quite universal among financial institutions, including banks and investment firms; it would be used for transaction monitoring, compliance, and money-laundering prevention. As time passes and new techniques come into being, these associated industries will be getting more and more dependent on forensic knowledge in order to save themselves from damage in assets reputation.

Although the conglomerate countries are neither as financially complex as the big corporations, SMEs have realized the value of forensic accounting, as these small but emerging businesses can also be defrauded or financially mismanaged. This is possibly what will encourage these businesses to begin putting more money into forensic accounting services as they grow, to safeguard their interests while building a more sustained future in business.

Thus, we see that in the future, the Global Forensic Accounting market will go on evolving because of the definite need for accurate financial oversight and fraud prevention. With more and more industries recognizing the importance of forensic accounting, the call for its role will increase in maintenance of finance.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$7,192.47V million |

|

Market Size by 2032 |

$12,761.09 Million |

|

Growth Rate from 2025 to 2032 |

5.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

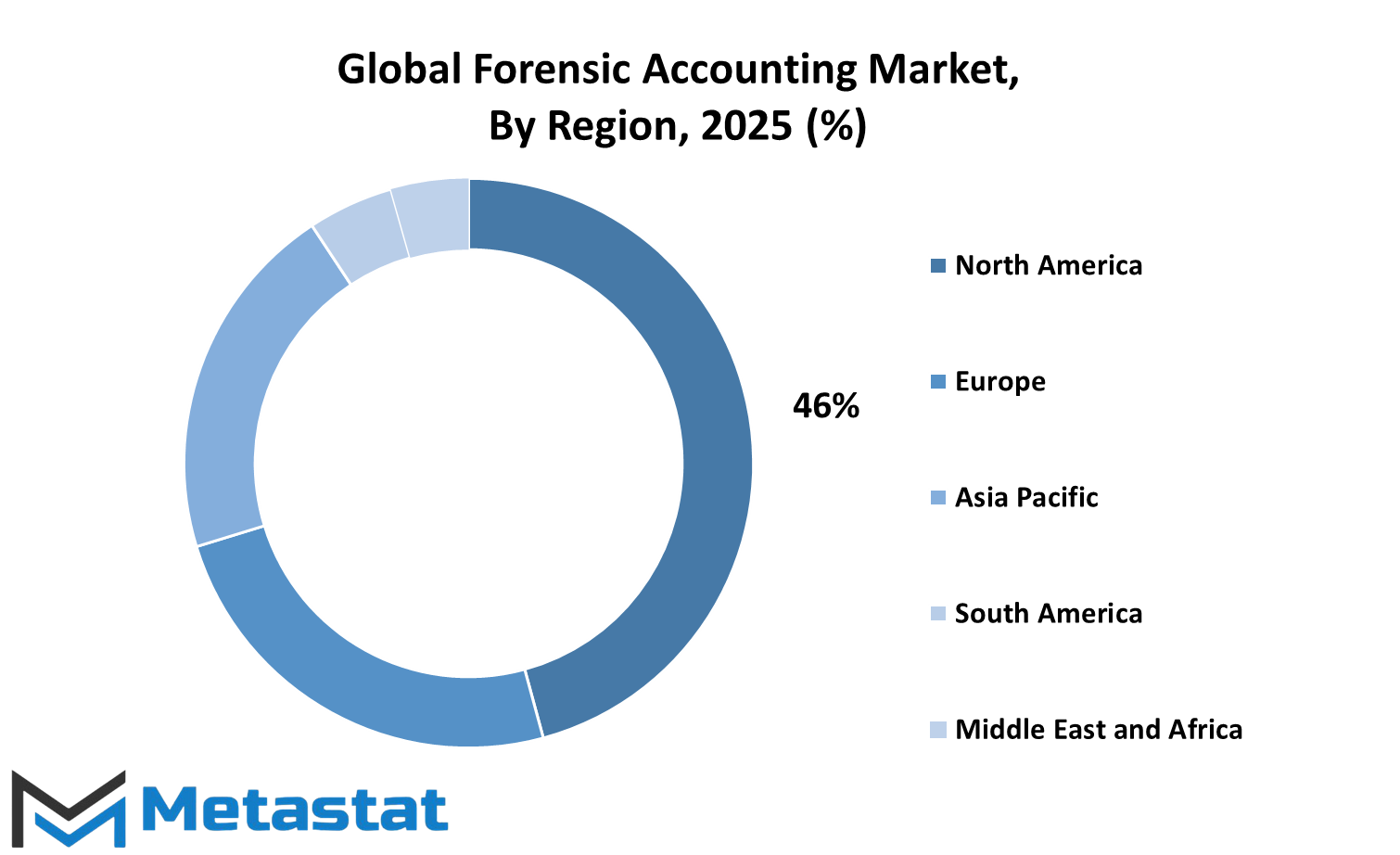

REGIONAL ANALYSIS

The global forensic accounting market is amid significant growth supported by a rise in demand for financial integrity and containment of economic crimes. Prevention of fraud, corruption, and misstatements is high on the agenda for all businesses and governments, for which forensic accounting is a tool of necessity. The development of this market will be determined by regional dynamics, each providing unique opportunities and challenges. How different parts of the world set about adopting and developing forensic accounting services will determine the future of this sector.

The North American region will witness high growth in the global forensic accounting market due to advanced regulatory frameworks and increasing incidents of financial crimes. The US will most probably remain among the leaders owing to its established financial system and stringent compliance requirements. The contribution from Canada and Mexico is likely to increase with the growing awareness and acceptance of forensic accounting services responding to increasing economic activities and the need for transparency in such activities.

The role of Europe in the international forensic accounting will be equally significant with countries such as the UK, Germany, France, and Italy being known for their well laid-up financial systems and stern regulations. While the services of forensic accountants will be in greater demand since financial crimes are poised to become advanced, the same pattern will develop in the remaining part of Europe, resulting from cross-border trade and a dire necessity for detailed financial investigations to maintain trust and stability.

The Asia-Pacific region will be a bigger player in the expected future growth of the global forensic accounting market. In rapidly developing economies like India and China, there is an increase in demand for financial scrutiny and fraud prevention. Already developed countries like Japan and South Korea are likely to increase the demand for advanced forensic accounting practices. The rest of the Asia-Pacific region has an opportunity to see its emerging markets harbor growth in forensic needs as its financial ecosystems continue to develop.

Much of the strengthening impact will be affected by South American growth potential, as increased economic development causes the need for financial oversight to grow louder. Brazil and Argentina, the two largest economies in South America, will probably drive the movement. With foreign investments coming in, the rest of South America is expected to follow suit in the call for financial accountability.

The Middle East and Africa are likely to witness similar market growth on account of increasing measures to ensure good financial governance. There will be increased awareness in the forensic accounting service sector in the Gulf Cooperation Council (GCC) states, well known for pursuing economic diversification. While Egypt and South Africa will play major roles, the remaining part will gradually incline toward recognizing the value of financial transparency.

COMPETITIVE PLAYERS

At the forefront of transformation and expansion in the Global Forensic Accounting market will be witnessed in the years to come. As businesses become globalized in their operational scope and more complex in design, the need for forensic accounting services will continue to expand. This field serves a very important function in discovering and preventing financial wrongdoing, ensuring accountability, and lending its hand to the legal processes. With the ever-increasing global economic activity, an ever-increasing demand will exist for these professionals to investigate financial discrepancies and generate credible reports.

While the Global Forensic Accounting market will feature renowned companies competing with one another on account of their diverse capabilities and strengths, the companies most noticed for their operations nowadays are Deloitte, PricewaterhouseCoopers Forensic Service, KPMG Forensics, and EY Forensic & Integrity Services. With their broad geographical presence and wide spectrum of services, these firms set the benchmark across the institutional spectrum. These firms are known for conducting complex financial investigations, where results are integrated with fraud detection, risk assessment procedures, and dispute resolution mechanisms. All these firms carry key reputations and experience to shape the future of forensic accounting.

Apart from these major firms, Forensic Risk Alliance (FRA), MDD Forensic Accountants, and BDO USA LLP are complementary in the sense that they channel specialized knowledge and customized approaches into the industry. Their specialized services help clients in confronting legal and regulatory hurdles while sustaining accuracy and accountability. Innovative methodologies and hands-on investigation skills are also the attributes of Grant Thornton LLP, AlixPartners, and FTI Consulting, who have made their mark as well in the field. Navigant Consulting and RSM Global reinforce the sector by providing strategic advice and comprehensive investigations aligned with international standards.

In the years to come, there is likely to be healthy competition inducing a high level of technological and methodological advancements across the sector. Slowly but steadily, the use of artificial intelligence, data analytics, and digital tools will become prevalent in speeding up and adding precision to financial investigations. Such innovations will empower forensic accountants to identify anomalies in a timely fashion and provide greater insight into financial data. Consequently, the clients will derive a resolve faster and findings that are easy to trust.

As the Forensic And Accounting Global Market expands, there will be increased emphasis on collaboration and sharing of knowledge among important players. Staying ahead will require continuous learning and the capacity to respond to changes, especially as financial crimes evolve. A collaborative approach and a sharing of expertise among such firms will enhance their strategy against fraud and financial dishonesty. If this continues and is furthered by technological developments, then it can become the very basis for a resilient and efficient forensic accounting industry.

Forensic Accounting Market Key Segments:

By Service Type

- Fraud Detection and Investigation

- Dispute Resolution

- Litigation Support

- Insurance Claims Investigation

- Digital Forensics

- Bankruptcy and Insolvency

By Application Area

- Financial Statement Fraud

- Asset Misappropriation

- Corruption Investigations

- Intellectual Property Disputes

- Cybercrime Investigations

- Money Laundering Detection

By End-User

- Corporate Enterprises

- Government Agencies

- Law Firms

- Insurance Companies

- Financial Institutions

- SMEs

Key Global Forensic Accounting Industry Players

- Deloitte

- PwC Forensic Services

- KPMG Forensic

- EY Forensic & Integrity Services

- Forensic Risk Alliance (FRA)

- MDD Forensic Accountants

- BDO USA LLP

- Grant Thornton LLP

- AlixPartners

- FTI Consulting

- Navigant Consulting

- RSM Global

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252