MARKET OVERVIEW

The Global Feminine Care Tampons market, a critical segment within the feminine hygiene industry, represents a significant sector that caters to women's health and well-being. This market focuses on the production, distribution, and sales of tampons, a widely used feminine hygiene product designed to manage menstruation. The industry's scope encompasses various types of tampons, including regular, super, super plus, and organic options, each tailored to meet diverse consumer needs and preferences.

Understanding the dynamics of the Global Feminine Care Tampons market requires an exploration of its composition and the factors influencing its trajectory. The market includes a variety of players ranging from established multinational corporations to emerging startups. These companies invest heavily in research and development to innovate and improve tampon products, aiming to enhance comfort, safety, and environmental sustainability. Innovations in this market often focus on material composition, applicator design, and packaging, striving to address concerns related to health, convenience, and ecological impact.

The market's development is significantly shaped by shifting consumer preferences and awareness about menstrual health. Increasing educational initiatives and campaigns have empowered women to make informed choices about their menstrual products. As a result, there is a growing demand for tampons that are not only effective and comfortable but also eco-friendly and free from harmful chemicals. This consumer shift towards more sustainable and health-conscious options has led to a rise in organic and biodegradable tampon products, which are gaining traction in various regions around the world.

In addition to consumer preferences, regulatory frameworks and standards play a crucial role in shaping the Global Feminine Care Tampons market. Governments and health organizations in different countries establish guidelines to ensure the safety and efficacy of menstrual products. These regulations necessitate rigorous testing and quality control, prompting manufacturers to adhere to high standards. Compliance with these regulations is essential for market entry and sustainability, influencing the strategies of both existing companies and new entrants.

The distribution channels for tampons are diverse, ranging from traditional retail outlets such as supermarkets and pharmacies to online platforms. The rise of e-commerce has particularly transformed the landscape, offering consumers convenience and access to a wider range of products. Online platforms also provide a space for consumers to share reviews and experiences, further influencing purchasing decisions. This digital transformation is expected to continue driving changes in how tampons are marketed and sold globally.

Marketing strategies within the Global Feminine Care Tampons market have evolved to resonate with modern consumers. Brands are increasingly leveraging social media and influencer partnerships to reach a broader audience and create authentic connections with consumers. These marketing efforts often emphasize product benefits, user testimonials, and educational content about menstrual health, aiming to build trust and loyalty among consumers.

As the Global Feminine Care Tampons market moves forward, it will continue to adapt to the evolving needs and preferences of women worldwide. Technological advancements, increased awareness of menstrual health, and a growing emphasis on sustainability will likely drive further innovations in tampon products. Companies will need to remain agile and responsive to these changes, focusing on delivering products that meet the highest standards of quality, safety, and environmental responsibility.

The Global Feminine Care Tampons market is a dynamic and essential component of the feminine hygiene industry. It addresses a fundamental aspect of women's health, continually evolving to meet the changing demands and expectations of consumers. With ongoing advancements and a strong emphasis on sustainability and health, the future of this market holds significant potential for growth and innovation.

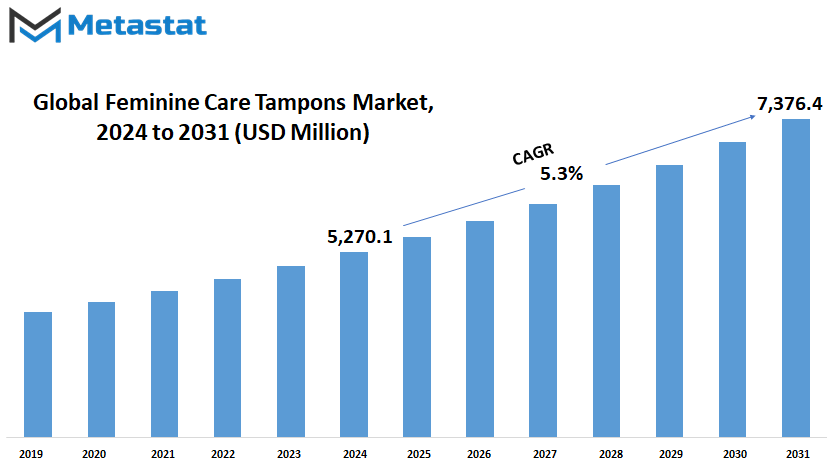

Global Feminine Care Tampons market is estimated to reach $7,376.4 Million by 2031; growing at a CAGR of 5.3% from 2024 to 2031.

GROWTH FACTORS

The global feminine care tampons market is poised for significant growth in the future. This surge in demand is driven by several key factors. One of the primary drivers is the increasing awareness of women's health and hygiene. As more information becomes available about the importance of menstrual health, women are becoming more informed and proactive about their choices in menstrual products. This heightened awareness leads to a greater demand for tampons, which are valued for their effectiveness and comfort.

Additionally, changing lifestyles and a growing preference for convenience play a significant role in the adoption of tampons. Modern lifestyles often require products that are easy to use and provide reliable performance. Tampons offer a convenient solution for menstrual management, fitting seamlessly into the busy schedules of many women. This convenience factor is a major contributor to the rising popularity of tampons.

However, the market also faces challenges that could hinder its growth. Concerns about the safety and potential health risks associated with certain ingredients in tampons can be a barrier. Women are increasingly cautious about the products they use, and any doubts about safety can impact their purchasing decisions. Ensuring the safety and transparency of tampon ingredients is essential to maintaining consumer trust and market growth.

Cultural taboos and stigma surrounding menstruation in some regions also pose a challenge. In certain areas, menstruation remains a taboo topic, limiting the acceptance and accessibility of tampons. Overcoming these cultural barriers requires ongoing education and awareness campaigns to normalize discussions about menstrual health and promote the benefits of tampons.

Despite these challenges, the development of eco-friendly and biodegradable tampons presents a significant opportunity for market expansion. As environmental concerns become more prominent, consumers are looking for sustainable alternatives in all aspects of their lives, including menstrual care. Eco-friendly tampons can attract environmentally conscious consumers, expanding the market share and fostering growth.

In the coming years, the feminine care tampon market is expected to continue its upward trajectory. By addressing safety concerns, promoting cultural acceptance, and embracing sustainability, the market can unlock new growth opportunities. The focus on women's health and convenience, coupled with the development of innovative and eco-friendly products, will likely drive the market forward. This evolving landscape presents a promising future for the feminine care tampon market, catering to the needs of a more informed, busy, and environmentally conscious consumer base.

MARKET SEGMENTATION

By Nature

The Global Feminine Care Tampons market, segmented by Nature into Scented and Unscented varieties, signifies a growing trend towards catering to diverse consumer preferences. This segmentation reflects the industry's recognition of the importance of offering options that align with individual needs and sensitivities.

Scented tampons, infused with fragrances, aim to provide users with a heightened sense of freshness and comfort during menstruation. These products often appeal to individuals who prefer a subtly scented experience, believing it enhances their overall sense of cleanliness and well-being. However, it's crucial to note that while scented tampons offer added fragrance, they may not be suitable for everyone, as some individuals may have sensitivities or allergies to certain perfumes or ingredients.

On the other hand, Unscented tampons cater to those who prioritize simplicity and minimalism in their feminine care routine. These products forgo added fragrances, appealing to consumers who prefer a more natural and fragrance-free experience. Unscented tampons are often favored by individuals with sensitive skin or allergies, as they minimize the risk of irritation or adverse reactions.

By Pack Size

In the expansive landscape of consumer goods, the Global Feminine Care Tampons market stands as a vital component. Within this market, the differentiation lies not only in the product itself but also in the pack sizes offered to consumers. These pack sizes, categorized as Less Than 10, 10 to 30, 31 to 50, and 50 & Above, play a crucial role in meeting the diverse needs and preferences of consumers worldwide.

In understanding the significance of pack sizes within the Feminine Care Tampons market, it becomes evident that they serve as a practical solution to address varying consumer demands. With options ranging from smaller packs to larger ones, consumers are provided with the flexibility to choose according to their individual usage patterns, budget constraints, and storage preferences. For instance, individuals with lighter menstrual flows or those seeking portability may opt for packs containing fewer tampons, such as those categorized as Less Than 10. Conversely, individuals with heavier flows or those who prefer to purchase in bulk may gravitate towards larger pack sizes like 50 & Above.

Moreover, the segmentation of the market based on pack sizes reflects a forward-looking approach adopted by manufacturers and retailers to cater to the evolving needs of consumers. As consumer behaviors and preferences continue to evolve, the ability to offer a diverse range of pack sizes ensures that brands remain competitive and responsive to market dynamics. This adaptability is crucial in sustaining consumer interest and loyalty amidst a constantly changing landscape.

Furthermore, the significance of pack sizes extends beyond mere convenience and choice. It also underscores the importance of sustainability and environmental consciousness within the Feminine Care Tampons market. By offering smaller pack sizes, manufacturers can promote responsible consumption habits and reduce unnecessary waste. Conversely, larger pack sizes can contribute to economies of scale and potentially reduce the overall environmental footprint associated with production and distribution

By Price Range

The Global Feminine Care Tampons market is experiencing significant growth and diversification. This expansion is evident in the segmentation of the market by price range, which is categorized into Economy, Mid-range, and Premium segments. This segmentation allows for a more nuanced understanding of consumer preferences and purchasing behavior.

The Economy segment encompasses tampons that are priced affordably, making them accessible to a broader demographic of consumers. These tampons often cater to individuals who prioritize cost-effectiveness without compromising on quality. With the increasing awareness of menstrual hygiene and the importance of access to affordable products, the Economy segment is expected to witness steady growth in the coming years.

In contrast, the Mid-range segment offers tampons that strike a balance between affordability and quality. These products may feature additional benefits such as enhanced comfort or sustainability features, appealing to consumers seeking value beyond just the price point. As consumers become more discerning about the products they use, the Mid-range segment is projected to see continued expansion as well.

The Premium segment represents the highest tier of feminine care tampons, characterized by their superior quality and often higher price point. These tampons may feature advanced technology, premium materials, or innovative design elements aimed at providing an unparalleled user experience. While the Premium segment may cater to a niche market of discerning consumers willing to invest in top-of-the-line products, it is nonetheless a significant contributor to the overall market revenue.

As the global market for feminine care tampons continues to evolve, each price segment will play a distinct role in shaping consumer preferences and market dynamics. While the Economy segment ensures accessibility and affordability for a wide range of consumers, the Mid-range segment offers value-added features to meet the needs of increasingly sophisticated consumers. Meanwhile, the Premium segment caters to those seeking the ultimate in quality and luxury.

By Distribution Channel

The global market for feminine care tampons is expanding, with a significant division in distribution channels between online and offline platforms.

In recent years, the global market for feminine care tampons has experienced substantial growth. This growth can be attributed to various factors such as increasing awareness about feminine hygiene, rising disposable incomes, and changing lifestyles. As a result, the demand for feminine care tampons has surged across the globe.

One of the significant aspects shaping the global feminine care tampons market is the distribution channels through which these products are made available to consumers. Broadly categorized, these channels are divided into two main categories: online and offline.

The online distribution channel has emerged as a prominent force in the feminine care tampons market. With the proliferation of e-commerce platforms and the increasing preference for online shopping, more consumers are opting to purchase feminine care tampons online. The convenience of browsing and purchasing products from the comfort of one's home, coupled with the availability of a wide range of options, has fueled the growth of online sales in this market. Additionally, online retailers often offer discounts and promotional offers, further incentivizing consumers to buy feminine care tampons online.

On the other hand, the offline distribution channel remains a significant contributor to the global feminine care tampons market. Brick-and-mortar stores, supermarkets, pharmacies, and convenience stores continue to play a crucial role in making these products accessible to consumers. While online shopping offers convenience, offline channels provide immediate access to feminine care tampons, allowing consumers to purchase them quickly and easily. Moreover, for some consumers, particularly in rural or remote areas, offline stores may be the only viable option for purchasing feminine care tampons.

REGIONAL ANALYSIS

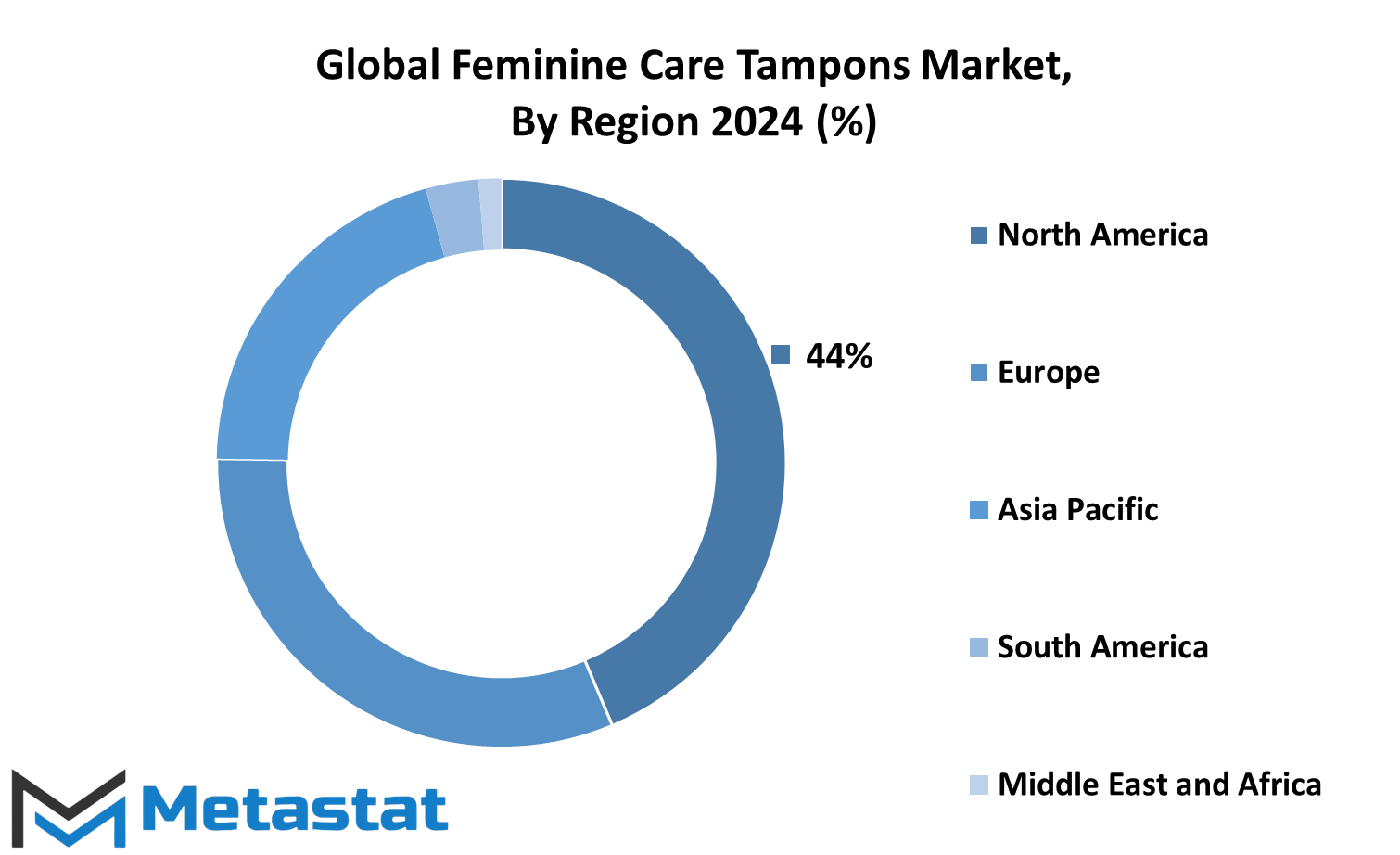

The global Feminine Care Tampons market is poised for significant growth, driven by increasing awareness about feminine hygiene and a growing population of women in need of these products. Analyzing the market by regions, each area presents unique opportunities and challenges that will shape the future landscape of this industry.

North America, a prominent market for feminine care products, includes the United States, Canada, and Mexico. In this region, high standards of living and greater awareness about health and hygiene contribute to a steady demand for tampons. The U.S., being the largest market, drives regional growth due to its well-established healthcare infrastructure and the presence of major market players. Canada's market is also strong, supported by similar economic conditions and consumer behavior, while Mexico shows potential for growth as urbanization and awareness continue to rise.

Europe, encompassing the UK, Germany, France, Italy, and other countries, also holds a significant share of the market. The region benefits from high disposable incomes and advanced distribution networks, which make tampons readily accessible to a large segment of the population. The UK and Germany are particularly strong markets due to their progressive attitudes towards feminine hygiene and widespread acceptance of tampons. France and Italy follow closely, with increasing adoption rates driven by growing health consciousness among women.

In the Asia-Pacific region, the market is expanding rapidly, driven by populous countries like India, China, Japan, and South Korea. These nations are witnessing a shift in consumer preferences towards more convenient and sanitary options like tampons. In India and China, where traditional practices are slowly giving way to modern hygiene solutions, the market is set to grow significantly. Japan and South Korea, with their high literacy rates and awareness, already show a strong acceptance of tampons, which will continue to drive market growth.

South America, including Brazil and Argentina, presents a growing market for tampons. As economic conditions improve and women become more educated about hygiene practices, the demand for tampons is expected to rise. Brazil, being the largest economy in the region, leads in market potential, with Argentina following suit as awareness campaigns and accessibility improve.

The Middle East & Africa region, categorized into GCC Countries, Egypt, South Africa, and other areas, shows a diverse range of market dynamics. In GCC countries, economic prosperity and increasing western influence are contributing to the adoption of tampons. South Africa, with its relatively higher economic status compared to other African nations, shows promising growth. In Egypt and the rest of the region, improving education and healthcare access will likely drive market expansion as women become more aware of modern feminine hygiene products.

Overall, the global Feminine Care Tampons market is set to grow as awareness and accessibility improve across regions. Each area offers unique growth opportunities, influenced by economic conditions, cultural practices, and levels of awareness. As these factors evolve, the market will continue to expand, providing better feminine hygiene solutions to women worldwide.

COMPETITIVE PLAYERS

The global market for feminine care tampons is poised for significant growth in the coming years, driven by increasing awareness of menstrual health and hygiene. This market is not only expanding due to the rising demand for convenient and reliable menstrual products but also because of the innovative strides taken by key industry players. Companies such as Procter & Gamble, Playtex, Kimberly-Clark, Johnson & Johnson, and Unicharm are at the forefront of this growth, continually enhancing their product lines to meet the evolving needs of consumers.

Procter & Gamble, a major player in this sector, continues to innovate with its well-known brands, ensuring high-quality and safe products for users. Similarly, Playtex and Kimberly-Clark are expanding their reach through extensive research and development, aiming to offer superior comfort and protection. Johnson & Johnson, a household name, leverages its extensive expertise in healthcare to create tampons that prioritize both safety and efficacy.

Unicharm, Natracare, and Libra are other significant contributors, each bringing unique strengths to the market. Unicharm, with its strong presence in Asia, combines advanced technology with user-friendly designs. Natracare, known for its organic and eco-friendly products, caters to the growing segment of environmentally conscious consumers. Libra, a prominent brand in Australia, focuses on providing high-quality products that cater to the specific needs of women in the region.

The competition is further intensified by companies like Lil-lets, MOXIE, and SCA, which continuously strive to improve their product offerings. Lil-lets, with its commitment to understanding women's needs, offers a range of tampons designed for different menstrual flows. MOXIE, known for its stylish and practical packaging, appeals to a younger demographic. SCA, a global hygiene and health company, uses its extensive resources to innovate and expand its product portfolio.

Bella Hygiene Products Pvt. Ltd., Bodywise Ltd, and Essity AB are also key players, each contributing to the market's dynamism. Bella Hygiene Products and Bodywise Ltd focus on providing high-quality and affordable options, while Essity AB leverages its extensive global network to reach a broad audience.

First Quality Enterprises Inc., Ontex Group NV, and TZMO SA add to the competitive landscape with their emphasis on quality and innovation. First Quality Enterprises Inc. is known for its rigorous quality control processes, while Ontex Group NV and TZMO SA continually invest in new technologies to enhance their product offerings.

As these companies continue to innovate and expand, the global feminine care tampons market will likely see sustained growth. The future holds promising advancements in product design and materials, aimed at providing even greater comfort, safety, and environmental sustainability. This growth will not only benefit consumers but also foster healthy competition among the leading players, driving further advancements in the industry.

Feminine Care Tampons Market Key Segments:

By Nature

- Scented

- Unscented

By Pack Size

- Less Than 10

- 10 to 30

- 31 to 50

- 50 & Above

By Price Range

- Economy

- Mid-range

- Premium

By Distribution Channel

- Online

- Offline

Key Global Feminine Care Tampons Industry Players

- Procter & Gamble

- Playtex

- Kimberly-Clark

- Johnson & Johnson

- Unicharm

- Natracare

- Libra

- Lil-lets

- MOXIE

- SCA

- Bella Hygiene Products Pvt. Ltd.

- Bodywise Ltd

- Essity AB

- First Quality Enterprises Inc.

- Ontex Group NV

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383