Global Extra Neutral Alcohol (ENA) Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global extra neutral alcohol (ENA) market has its origins far back from the modern drinks counter. What was initially an ancient distillation process employed for medicine and ritual consumption slowly became a mass-scale process that would take root in manufacturing spirits, cosmetics, and even pharmaceuticals. The first grain and molasses distillers could not have dreamed that their clean, odorless liquid would one day be a worldwide commerce commodity, coveted both for its purity and versatility.

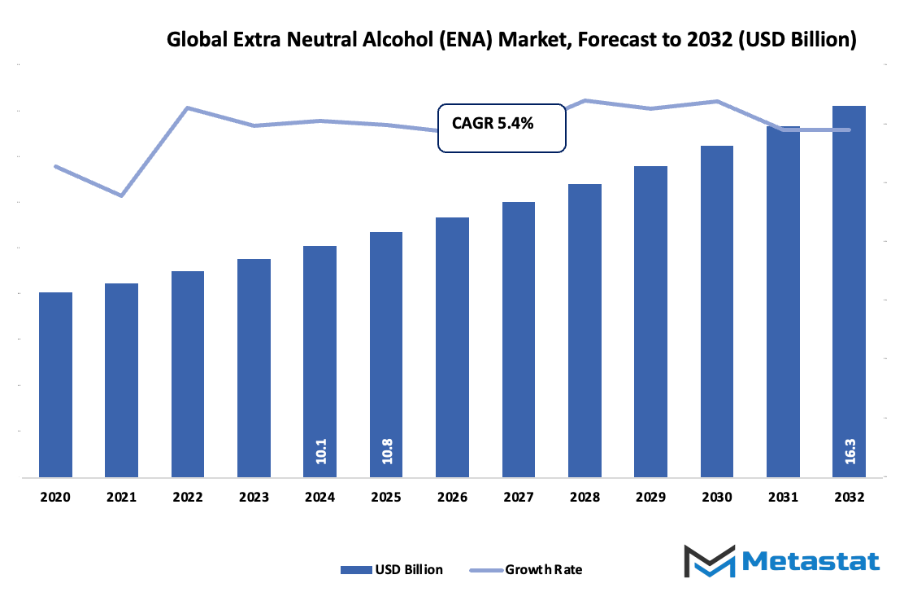

- Global extra neutral alcohol (ENA) market worth around USD 10.8 million in 2025, expanding at a CAGR of around 6.1% during 2032, with growth potential over USD 16.3 million.

- Sugarcane-Based account for nearly 77.9% market share, driving innovation and new applications through aggressive research.

- Key growth-spurring trends: Increasing worldwide consumption of alcoholic beverages and spirits, Increasing industrial and pharma applications of ethanol

- Opportunities are: Rising trend towards craft and premium spirits fueling high-end ENA application

- Key insight: The market is anticipated to grow exponentially in value over the next ten years, foretelling significant growth prospects.

- The origin of this market began during the colonial period, when distillation technology was exported and adapted between continents.

Increased production of sugar in the Caribbean and Asia caused by-products of molasses to form a foundation for the production of highly purified alcohol. Over time, new developments in rectification allowed producers to produce extra neutral alcohol with consistent quality, which marked it as distinct from low-grade spirits. The biggest turning point occurred in the twentieth century, when international standards for purity and safety were set, enabling mass cross-border commerce. Not only did these standards build customer confidence, they also enabled multinational brands of beverages and cosmetics to expand. Demand and technological innovation have shaped the course of the industry continuously. Demand shifted from regional small-batch production to industrialized production that could service multinationals. Subsequent technological improvements in continuous distillation and molecular filtration would redefine efficiency, resulting in more yield with less impurity. With each technological advance, operations grew in size, encouraging uniformity for what was initially a very variable product. Regulatory changes also marked occasions of great change within this industry. Stricter quality requirements, particularly in Europe and North America, forced manufacturers to invest in better facilities and test procedures. It would ultimately be adopted by rising economies, where increasing populations within cities began to influence demand for premium beverages and hygiene products.

Today, the global extra neutral alcohol (ENA) market is a reflection of centuries of growth. From necessity to its current status as an industry building block, its fate will be shaped forever by innovation, lifestyle changes of consumers, and the eternal desire for balance between tradition and technology.

Market Segments

The global extra neutral alcohol (ENA) market is mainly classified based on Raw Material, Purity, Application, .

By Raw Material is further segmented into:

- Sugarcane-Based: Sugarcane-based ENA will continue to be relevant because of plentiful raw material availability and the fact that it is renewable. Future production methods will enhance yield and lower energy consumption. Greater government encouragement towards sustainable processes will render this segment more competitive internationally, meeting industrial and beverage industry needs effectively.

- Fruit Based: Fruit-based ENA will grow through the demand for premium products and specialty alcoholic beverage applications. New technologies for extraction will enhance efficiency and purity. Demand for fruit-derived ingredients for the beverage, cosmetics, and personal care industries will give this segment a boost in the next couple of years.

- Others: Raw materials from other sources will gain significance as the market seeks diversity and sustainability. Alternative feedstocks like grains, agricultural residues, and synthetic sources will form the drivers of future growth. Focus on low-cost and environmentally sound production processes will make this segment a major contributor to the global ENA supply chain.

By Purity the market is divided into:

- 95%-98%: ENA of 95%-98% purity will enjoy consistent demand for general industry and beverage use. Enhanced production efficiency and cost optimization will maintain this segment competitive. Its expansion will also rely on developing countries with expanding industries, where pure alcohol is required at an affordable cost.

- 98%-99%: The 98%-99% pure segment will see growth in pharmaceuticals, personal care items, and specialty industrial applications. New technologies will improve purification processes, contributing to consistent quality. Worldwide supply chains will rely more heavily on the segment to meet regulations and customer requirements for higher-purity materials.

- Above 99%: ENA above 99% purity will become significant in high-end applications where exceptionally high quality is needed. Improvements in purification and manufacturing technology will bring this segment into reach. Growth will be driven by demand from the pharmaceutical, cosmetic, and high-end beverage segments, as regulatory requirements and product performance demands rise across the world.

By Application the market is further divided into:

- Potable Alcohol: Potable alcohol will remain a major application of ENA as global consumption patterns evolve. New production techniques and sustainable sourcing will enhance supply. Rising preference for premium and clean-label products will drive the market toward higher-quality ENA for beverages and related sectors.

- Pharmaceuticals: The pharmaceutical sector will increasingly rely on ENA for production of medicines and disinfectants. Growing healthcare demands and stricter regulations will require consistent supply of high-purity alcohol. Technological improvements will ensure quality control and cost efficiency, making this application a leading growth driver.

- Flavors & Fragrances: ENA will be essential for the flavors and fragrances industry due to its role in extraction and formulation. Future trends will focus on natural and sustainable solutions, with higher-purity alcohol enabling more refined and concentrated products. Global demand for fragrances and flavorings will push this segment forward.

- Cosmetics & Personal Care: The cosmetics and personal care industry will increasingly adopt ENA for premium products and formulations. Rising awareness of safety and quality standards will require high-purity alcohol. Innovative applications in skincare, perfumes, and personal hygiene will continue to expand the market for ENA.

- Others: Other applications of ENA will grow in industrial and specialty uses, including biofuels, chemicals, and cleaning agents. Technological advancements and sustainability initiatives will support expansion in non-traditional areas. Emerging sectors will provide opportunities for ENA to serve new functions and meet diverse global needs.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$10.8 Billion |

|

Market Size by 2032 |

$16.3 Billion |

|

Growth Rate from 2025 to 2032 |

6.1% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

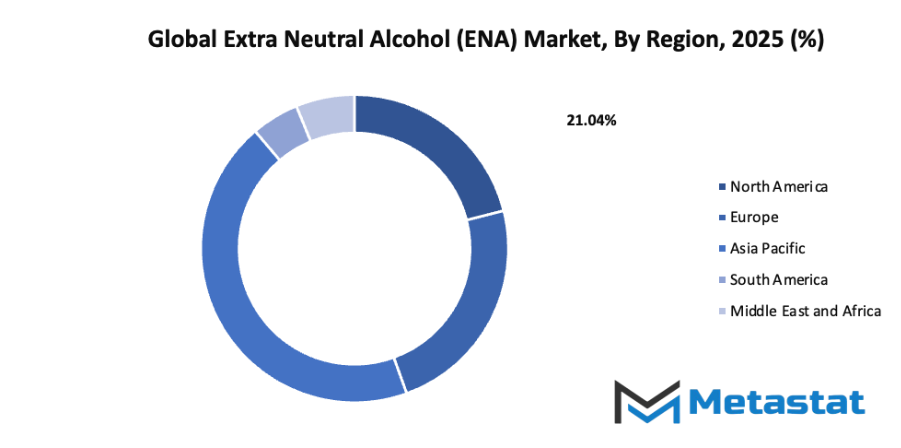

By Region:

- Based on geography, the global extra neutral alcohol (ENA) market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Rising demand for alcoholic beverages and spirits globally: The rising demand for alcoholic beverages and spirits globally will push the global extra neutral alcohol (ENA) market forward. Growing bars, restaurants, and nightlife culture, combined with international exposure to premium alcoholic products, will create a strong need for consistent and high-quality ENA supplies for manufacturers.

- Increasing industrial and pharmaceutical applications of ethanol: Ethanol derived from ENA will see wider industrial and pharmaceutical use. Its applications in sanitizers, personal care products, and chemical intermediates will increase. Pharmaceutical companies will adopt ENA for solvent purposes and medicinal formulations, making it an essential ingredient across multiple sectors. This trend will positively influence market growth.

Challenges and Opportunities

- Strict government regulations and excise duties: Stringent government regulations and excise duties will challenge the global extra neutral alcohol (ENA) market. Compliance with legal frameworks, taxation policies, and safety standards will require significant investment from producers. These factors may limit profit margins and slow down market expansion if not managed strategically.

- Volatility in raw material (molasses, grains) prices: Price volatility of raw materials such as molasses and grains will impact the global extra neutral alcohol (ENA) market. Supply shortages, climatic conditions, and demand fluctuations can lead to unpredictable production costs. Market players must develop flexible sourcing strategies to stabilize supply chains and minimize financial risks.

Opportunities

- Growing trend of craft and premium spirits encouraging high-quality ENA usage: The growing trend of craft and premium spirits will directly impact the global extra neutral alcohol (ENA) market. Consumers are seeking unique flavors and refined quality, prompting producers to use superior ENA. This shift will create a sustainable demand for high-grade alcohol in both domestic and international markets.

Competitive Landscape & Strategic Insights

The global extra neutral alcohol (ENA) market reflects both strength and complexity, driven by the contributions of large international corporations and fast-growing regional players. The industry is a mix of both international industry leaders and emerging regional competitors, creating a competitive environment that is steadily moving toward transformation. Important competitors include Illovo Sugar Limited, NCP Alcohols (Pty) Ltd, USA Distillers LLC, Agro Chemical and Food Company Limited, Sasol Solvents (Pty) Ltd, Mumias Sugar Company Limited, Swift Chemicals Ltd, Tag Solvent Products Pvt Ltd, Enterprise Ethanol (Pty) Ltd, BCL Industries Ltd, Radico Khaitan Limited, TEREOS PARTICIPATIONS, Kakira Sugar, Cargill, Incorporated, NSL Sugar, Tandlianwala Sugar Mills Ltd., Gulshan Polyols Ltd., Associated British Foods plc, Dhampur Bio Organics Limited, Pioneer Industries Private Limited, IFB Agro Industries Limited, Radical Bio Organics Limited, PRO Industries Pte Ltd, New Phaltan, Baramati Agro, and Vitthal Corporation Ltd. Each of these organizations contributes to the development of supply chains, production methods, and distribution networks that will define future growth.

The increasing demand for ENA, used widely in beverages, pharmaceuticals, cosmetics, and industrial applications, suggests a market that will not remain static. Future growth will depend heavily on innovation in processing, sustainability practices, and the ability to meet strict quality standards across industries. Global players bring with them advanced technologies, research capacities, and strong export channels. At the same time, regional competitors are pushing forward with localized expertise, cost advantages, and flexible supply capabilities. This combination ensures that no single company will hold dominance for long, as constant adaptation will shape the market balance.

Sustainability will be a defining factor in the years ahead. Many companies are expected to increase investments in renewable raw materials and energy-efficient production facilities. Consumers and regulatory bodies are placing greater pressure on industries to lower carbon footprints, and ENA producers will need to align with these expectations. Organizations that successfully integrate clean technologies and circular economy models will strengthen their competitiveness not just in pricing but in reputation as well.

Technological advancement will also play a central role. Automation in distillation plants, improvements in fermentation processes, and digital monitoring of quality will allow companies to improve efficiency and reduce waste. With the growing importance of data-driven decisions, producers of ENA will increasingly rely on artificial intelligence and predictive analytics to anticipate shifts in demand, manage risks, and streamline logistics. Those that embrace such tools will gain an advantage in a market where delays or inefficiencies can quickly erode market share.

From a global perspective, the diversity of competitors ensures that different regions will bring their own strengths to the table. African producers are focusing on agricultural integration and building capacity for exports. Asian players are expanding aggressively, fueled by the growing consumption of alcohol-based products in developing economies. European and North American companies continue to lead in research, compliance, and international distribution. This broad spread of expertise means the ENA market will continue to expand beyond traditional boundaries, offering opportunities for collaboration, joint ventures, and cross-border partnerships.

Market size is forecast to rise from USD 10.8 Billion in 2025 to over USD 16.3 Billion by 2032. Extra Neutral Alcohol (ENA) will maintain dominance but face growing competition from emerging formats.

Looking forward, the ENA market will not only be defined by who produces the most, but by who produces with foresight. Companies that invest in future-ready facilities, anticipate shifts in consumer behavior, and maintain flexible strategies will be the ones to thrive. The coming years will likely see greater consolidation, with mergers and acquisitions creating stronger entities capable of competing on a larger scale. However, the space for regional enterprises will remain, especially for those that deliver niche solutions or maintain a strong local connection.

Report Coverage

This research report categorizes the global extra neutral alcohol (ENA) market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global extra neutral alcohol (ENA) market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global extra neutral alcohol (ENA) market.

Extra Neutral Alcohol (ENA) Market Key Segments:

By Raw Material

- Sugarcane-Based

- Fruit Based

- Others

By Purity

- 95%-98%

- 98%-99%

- More than 99%

By Application

- Potable Alcohol

- Pharmaceuticals

- Flavors & Fragrances

- Cosmetics & Personal Care

- Others

Key Global Extra Neutral Alcohol (ENA) Industry Players

- Illovo Sugar Limited

- NCP Alcohols (Pty) Ltd

- USA Distillers LLC

- Agro Chemical and Food Company Limited

- Sasol Solvents (Pty) Ltd

- Mumias Sugar Company Limited

- Swift Chemicals Ltd

- Tag Solvent Products Pvt Ltd

- Enterprise Ethanol (Pty) Ltd

- BCL Industries Ltd

- Radico Khaitan Limited

- TEREOS PARTICIPATIONS

- Kakira Sugar

- Cargill, Incorporated

- NSL Sugar

- Tandlianwala Sugar Mills Ltd.

- Gulshan Polyols Ltd.

- Associated British Foods plc

- Dhampur Bio Organics Limited

- Pioneer Industries Private Limited

- IFB Agro Industries Limited

- Radical Bio Organics Limited

- PRO Industries Pte Ltd

- New Phaltan

- Baramati Agro

- Vitthal Corporation Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252