MARKET OVERVIEW

The Europe Protective Footwear market is a dynamic market in the safety and personal protection market. It lies at the core of the answer to the rising need for specialty footwear that will shield workers from numerous risk-bearing environments. With a top priority given to workers' safety by companies, the industry will react by using more advanced materials and technology to provide better protection and comfort.

The industry will be influenced by drivers like growing industrialization, strict safety regulations, and growing awareness of occupational risks. In the next few years, the Europe Protective Footwear market will see more utilization of innovative designs and application-specific functionality. Industry will focus on adopting new technologies such as smart sensors, antimicrobial treatment, and high-performance insulation systems in the products.

These technologies will not only enhance the protective features of safety footwear but also overall performance and comfort. Consequently, the market will grow to meet the demands of additional industries such as construction, manufacturing, oil and gas, and healthcare where safety of employees is a top priority. The regulatory environment will also determine the future of Europe Protective Footwear market.

Strict regulatory specifications from government agencies will compel producers to innovate and continually improve product lines in order to maintain compliance. Compliance rules will create the demand for footwear that is more resistant to chemicals and impacts, as well as having higher durability.

In particular, safety footwear in high-risk industries will become increasingly specialized, addressing many different job types, from heavy-duty use through to light office environments where generic foot protection could be called upon. Yet another trend that will shape the market's future is the increased focus on sustainability.

As issues affecting the environment receive more and more attention, more environmentally safe protective footwear solutions will be demanded. Manufacturers will, therefore, introduce products made from recycled or sustainable materials to target environmentally conscious companies and consumers.

This shift towards sustainability will not only be on the material used in producing footwear but also on the manufacturing process, which will be less energy-intensive and wasteful. The Europe Protective Footwear market will also witness a significant shift in consumer behavior.

Due to the expansion of e-commerce, customers will have greater access to an expanded range of protective footwear solutions. Companies and individual consumers will be able to compare, read reviews, and buy products online, further pressuring manufacturers into creating more personalized products with a more customized protective footwear strategy.

Further, as digital technologies become more integral to the shopping experience, virtual fitting software may be a reality, allowing customers to virtually try shoes on before purchasing them. The future of the Europe Protective Footwear market will be determined by an intersection between technological innovation, regulatory change, and shifting consumer requirements.

As industries place more emphasis on employee comfort and protection, more demand for quality protective footwear will be generated. The producers will continue to push the boundaries of functionality and design to meet the diverse demands of various industries. With all this innovation in the pipeline, the Europe Protective Footwear market will be a key component of ensuring the health and safety of workers across the continent.

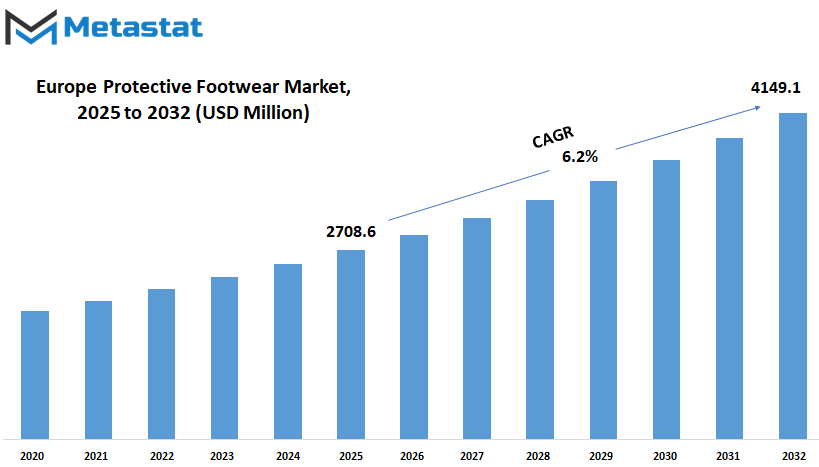

Europe Protective Footwear market is estimated to reach $4149.1 Million by 2032; growing at a CAGR of 6.2% from 2025 to 2032.

GROWTH FACTORS

The Europe protective footwear market is the direct result of many driving forces. However, the main driving force behind creating this market would be rising workplace safety regulations among different governments and regulatory bodies in Europe on enforcing stringent rules in protecting the workers on sectors such as construction, manufacturing, and logistics. Under this circumstance, the stricter standard rules make the companies refer using the protective shoes to comply with safety standards and keep the workers away from any risk. This made a constant market for shoes designed primarily to be injury protective in risky situations.

Growing awareness of occupational health and safety provisions is yet another major factor impacting the protective footwear market. Corporations and employees increasingly learn that they need personal protective equipment, and now they also want reliable and durable safety shoes. Nowadays, most of the companies are highly concerned with safety; safety in their workplaces at least includes equipping them with safety shoes meeting safety standards. Consequently, this has translated into a boom in demand protection shoes and boots that feature slip resistance puncture resistance, and impact resistance.

But there are also certain drawbacks in the market. One of them is production cost, which acts as a significant constraint in formulation of protective worn. Specialized materials, high technology, and quality control processes required to make the product safe make it more expensive. Such increased costs render protective footwear un-affordable by small enterprises or sectors with thin profit margins. On certain occasions, an enterprise may prefer less expensive alternatives that do not provide the high degree of protection, even at the cost of lowering its safety.

The other bane in the European market of protective footwear is the fierce competition. The entering of more companies in the market has started price wars among the companies. These are the activities of competition among companies, which are selling goods and capturing customers by offering the item at a lower price. While it is good for the customers, it has posed serious threat on manufacturers' profit margins and also for long-term sustainability of their businesses.

However, along with these problems, the market also holds potential opportunities. A developing promising trend is the increasing popularity of eco-friendly materials in the manufacture of protective footwear. As the consumers and companies push forward in their demands, companies are working on lowering the impacts of footwear production with recyclable, biodegradable, or less toxic materials. Such a trend gives new growth avenue as businesses and consumers look at more environmentally sustainable alternatives.

Increasing industries in Europe will also create demand for protective footwear. As constructions, manufacturing, and logistics industries grow, safety equipment, including protective footwear, will also grow. This opens the door for manufacturers to reach more possible customers to meet the rising demand for high-quality and protective shoes in different sectors in the region.

MARKET SEGMENTATION

By Type

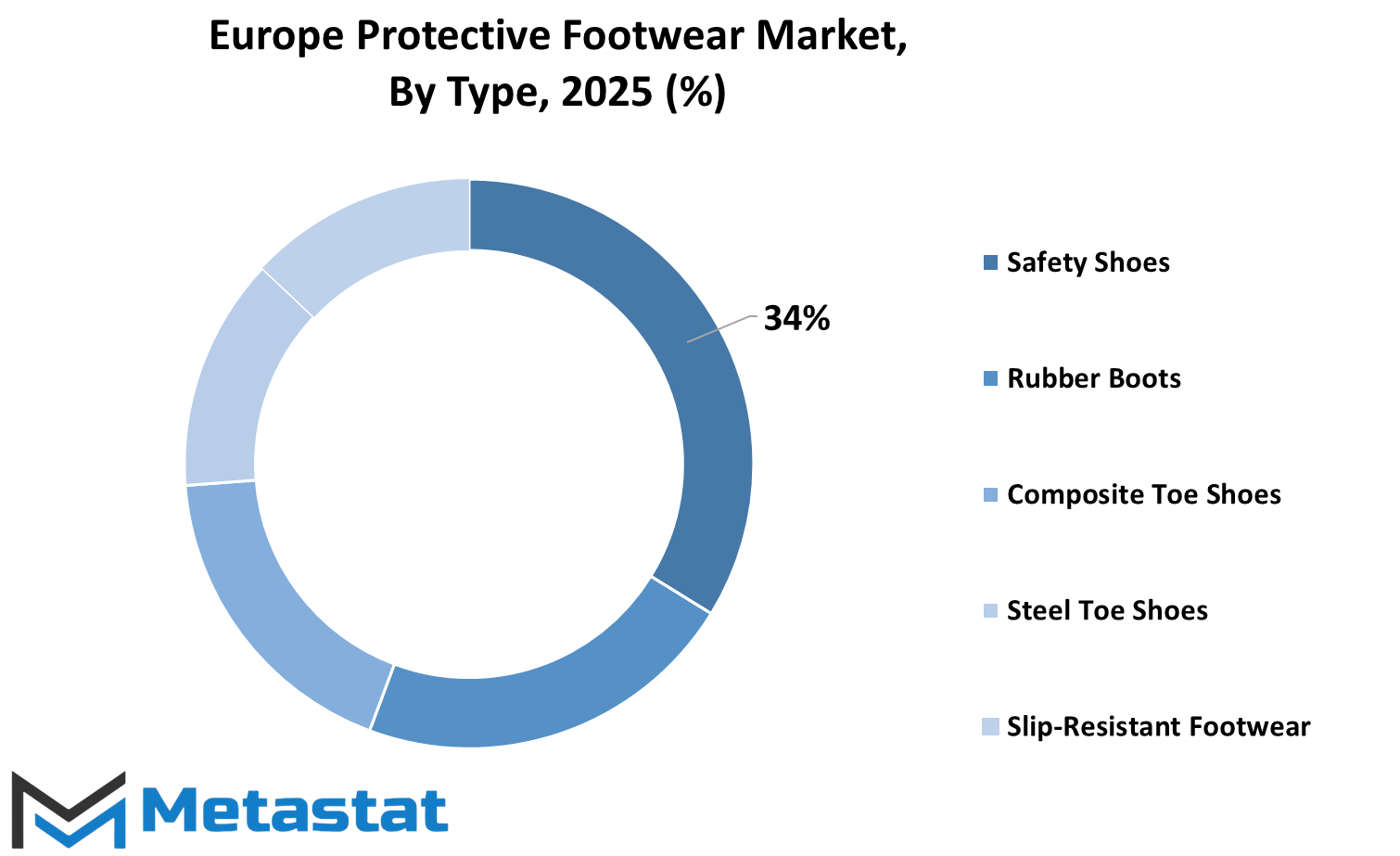

The Europe Protective Footwear Market is rapidly growing and diversifying, providing numerous alternatives for consumers requiring protection footwear. It is segmented in various categories, each addressing specific safety requirements. Safety shoes are an important group that serves to protect persons from workplace hazards. They are designed to provide maximum protection against impact, punctures, and electrical hazards.

The rubber boot segment accounts for another major part of safety shoes, one valued at $863.9 million. These rubber boots are well-respected in the industries in which workers are exposed to wet or other dangerous environments where protection and comfort are essential.

A famous segment is composite toe shoes, which have a lightweight composite material used at the toe section, giving an alternative to steel toe shoes. Composite toe shoes are gaining immense popularity since they can give away the same safety for the wearer and a less heavy option. The demand for such shoes is increasing across workers that value comfort along with safety.

Steel toe shoes, for the most part, have been a common choice within the protective footwear market. They are preferred among workers for protecting against heavy impact in areas where workers are exposed to falling objects or heavy machinery. Steel-toe shoes make for a durable option, and safety at the workplace can be assured reliably.

Slip-resistant shoes are another important category of the market. Workers from one or the other industries, especially ones falling within the proverbial 'slip and fall' category, mostly relish these shoes. These shoes have been traction enhanced to reduce any possibility of an accident happening. Slip-resistant shoe demand has risen with the growing significance of worker safety in such industries as construction, manufacturing, and food service.

There are other many types of protective shoes available in the market. There are specialized boots and shoes that have been specifically designed for a specific industry or environment with features such as waterproofing, insulation, or electrical hazard protection.

As a whole, the Europe Protective Footwear Market is expanding due to increasing concern for safety in most sectors. There are various categories of footwear present to make sure that employees are given the correct protection based on their needs, thereby further increasing safety and comfort in the workplace.

By End User

Some of the factors affecting the increasing demand for protective shoes in different industries have made a remarkable change in the market for Europe Protective Footwear. Such shoes are commonly made to protect all workers from their respective hazardous work environments. The market is, in fact, further narrowed into end-use sectors since protective footwear is consumed by different sectors with their specific diverse needs.

Manufacturing is a prominent end-user of protective footwear in Europe, where its workers usually work in factories and production plants, posing some risks resulting from heavy machinery and sharp objects, as well as electrical shocks. In relation to these dangers, protective footwear in this industry is made to ensure the durability as well as safety it promises in order to avoid injuries. Construction workers are subjected to numerous risks, including falling objects, uneven ground or terrain, and toxic chemicals, and therefore hard, dependable protective footwear is necessary for safe working on the construction site.

Likewise, the mine provides the own problematic challenges of protective footwear. The occupational environment of the miner is one that works underground such that emergencies arising in this section include falling, equipment malfunction, and exposure to toxic substances. Thus footwear for such particular purposes has to be highly durable against and resistant to such hazards. Employees in the oil and gas production sector usually face extreme conditions, including fire, chemicals, and heavy equipment on most occasions. These protective footwear are specifically built to withstand high temperatures, chemicals, and other dangerous elements for these operations.

Healthcare, too, has its share of protective footwear, particularly for the many professionals working in hospitals, clinics and laboratories. Medical personnel work with threats like slippery floors, sharp objects, and biological exposure. Footwear in the healthcare sector should combine safety and comfort to allow healthcare professionals to concentrate on their duties without safety concerns bothering them. Agriculture and food processing share similar requirements as the need for protecting employees from contaminants, slippery surfaces, and long hours standing or walking would suggest.

There are protective shoes for transporting and logistics for professionals working through transport vehicles, delivery services, and warehouses. With repeated heavy lifts, uneven ground, and continuous movement from one place to another within warehouses, these workers are exposed to these occupational risks. Hence protective footwear should attain the right balance in construction between support and durability.

There's good demand for protective footwear in other sectors - retail or service industries - and it has grown with products boasting features tailored to particular consumer needs such as slip resistance, comfort, and many others. All in all, every one of these mentioned industries ends up benefiting from specialized footwear to answer the unique safety needs therein, resulting in an ever-growing market for protective footwear within Europe.

By Distribution Channel

Distribution channels form the backbone of growth in the protective footwear market across Europe. Direct sales, distribution sales, online sales, and specialized retail are these distribution channels. In reaching the customers and providing them with protective and safety footwear, the channels have their exclusive role.

Direct sales are one of the main forms of distribution for protective footwear products across Europe. This method essentially eliminates the need for the mediator, whereby the manufacturers market their products directly to the end-user. The manufacturers develop a very good rapport with their customers due to the direct interaction with them, giving more personalized services that strengthen customer loyalty to the brand. Eventually, an effective direct sales program gives the manufacturer a better understanding of their customers regarding needs and preferences, thus allowing the manufacturer to adjust to accommodate.

In distributor sales, the intermediate channel is made up of distributors operated by third parties between a manufacturer and the end-user consumer. Distributors usually have established networks and establish contacts with various retail outlets and businesses, making them an efficient means of targeting a wider customer base. They increase the reach of the protective footwear market by delivering products to various regions and industries that may be inaccessible by the direct sales route.

In the last few years, online retail has seen a mad growth. Because of the convenience of shopping for their protective footwear sitting at home, consumers now increasingly resort to online buying. E-commerce websites provide a wide array of options for their customers to choose from, thus allowing price comparison, reviews, and other useful decision-making. Online retail is a boon for manufacturers to address an enlarged global market from beyond local or regional strengths.

Specialty stores sell various safety and protective products. These stores service a customer base in need of protective footwear for such industries as construction, manufacturing, and agriculture. Specialty stores provide a selection of footwear tailored for professions working in dangerous environments. They further do assist in offering expert opinions on the right choice of the product according to the customers' requirements.

In conclusion, the European protective footwear market is broadening its horizons due to various distribution channels, all with their respective benefits. While some channels may focus on direct sales, others work through distributors; there are even some with online engagement, or going to specialty stores. All of these strive to ensure that protective footwear gets into the right hands with efficiency and effectiveness.

By Material Type

In Europe, protective footwear is categorized primarily on the basis of types, which are further subclassified based on the materials out of which they are manufactured. The materials more often than not used for protective footwear are leather, rubber, and plastic. The types are meant for different working conditions and have special features to enhance the safety and comfort of whoever uses them.

It stands to reason that leather is favoured by most industries for its durability and resistance to wear and tear. To elaborate, leather possesses natural abrasion resistance far superior to any other material and is resistant to sharp objects, chemicals, and even hard impacts. Hence, it has found favour in industries like construction, manufacturing, and mining, where the footprint of a worker is created every now and then by exposure to hazardous conditions. Leather safety boots have also been appreciated for their ability to mold and therefore hold their shape much better in order to accommodate the feet over long hours of work.

Rubber footwear is also one of the most widely used materials for the manufacture of protective footwear. It is water-challenging and yet has an incredible amount of grip. The rubber boots are most popular in industries where activities are carried out under wet conditions, i.e., farming, fishery, and chemical industries. The material also resists chemicals and oil, ideal for use by workers operating in hazardous environments. Rubber footwear would thus be lightweight flexible and have good insulation hence all the features considered, it forms an enforcing shoe for workers that need to move a lot while working under harsh conditions.

Plastic footwear comprise types that are made from materials such as PVC and polyurethane. These have more economic considerations and flexible offerings in the protective foot wear market. PVC footwear is found to be milder, resistant to many chemical reactions and quite easy to clean; hence it would be recommended for use by workers who would be in such industries as food processing, health care, and sanitation among others.

Polyurethane, however, would have more durability and better shock absorption for any conditions where workers would have to be standing for long periods or have to handle heavy loads. Plastic footwear will make the necessary provisions of protection while being less costly when compared to either leather or rubber.

All of these material types cater to a specific need in the protective footwear market of Europe. Certainly this means durable yet comfortable leather, waters resistance with chemicals protection rubbers and finally, affordable and versatile plastics. This healthy enhancing tendency is still on demand for protective footwear because of evolving industries where the need for the safety of workers becomes more and more crucial. Investment by companies in protective solutions will therefore continue to hasten market expansion because their most valuable assets at work are their employees whom they strive to safeguard.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$2708.6 million |

|

Market Size by 2032 |

$4149.1 Million |

|

Growth Rate from 2024 to 2031 |

6.2% |

|

Base Year |

2024 |

COMPETITIVE PLAYERS

The production and marketing of footwear have presently entered a flush of industrial growth and demand with regards to safety in disparate fields, such as construction, manufacturing, and healthcare, in Europe. Protective footwear protects workers from injuries inflicted on their feet in hazardous areas; thus, given the increase in awareness about workplace safety, the market for such products has risen along with the growing adoption of strict safety regulations by European countries.

Key players in the industry of protective footwear really catalyze the developing market. Well-known names in this category include Dunlop Protective Footwear, Bata Industrials, Uvex Safety Group, Honeywell International Inc., Cofra S.r.l., Dr. Martens plc, ELTEN GmbH, Sievin Jalkine Oy, ATLAS The Shoe Company, HAIX Group, Jallatte Shoes, U-POWER Group S.P.A., Panter Safety Footwear, and Bellota. These companies focus their research, development, and manufacture of protective footwear to ensure the highest safety, durability, and comfort standards for workers.

As a market leader, Dunlop Protective Footwear is well respected as a producer of high-quality, long-lasting products for harsh environments and has a loyal customer base throughout Europe. The second market leader is Bata Industrials, which has a large inventory of protective footwear for various industries like construction and logistics. Uvex Safety Group believes in the matching of innovation and comfort, providing comfort and modern safety-standard footwear.

Honeywell International Inc., which is known for its technological innovations in workplace safety, sees protective footwear as its lead product category. Cofra S.r.l. and Dr. Martens plc have also participated through focused design of casual but safety footwear with an appeal to workers from diverse industries. ELTEN GmbH and Sievin Jalkine Oy mostly develop products that consider the safety and comfort of the people who wear them; mainly professionals who really need something they can work in for long hours.

Other companies in the industry include ATLAS The Shoe Company, HAIX Group, Jallatte Shoes, U-POWER Group S.P.A., Panter Safety Footwear, Bellota. Such companies are actively engaged in research and development and the manufacture of protective footwear; those companies are thus ensuring the highest safety, durability, and comfort standards for workers.

Such healthy competition among the key players ensures continuous improvement in product quality that ultimately offers commendable protective footwear to the workers in Europe. As the protective standard keeps changing, these companies would continue to provide better and more comfortable shoes and footwear solutions.

Europe Protective Footwear Market Key Segments:

By Type

- Safety Shoes

- Rubber Boots

- Composite Toe Shoes

- Steel Toe Shoes

- Slip-Resistant Footwear

- Others

By End User

- Manufacturing

- Construction

- Mining

- Oil & Gas

- Healthcare

- Agriculture

- Food Processing

- Logistics & Transportation

- Others

By Distribution Channel

- Direct Sales

- Distributor Sales

- Online Retail

- Specialty Stores

By Material Type

- Leather Footwear

- Rubber Footwear

- Plastic Footwear (PVC, Polyurethane, etc.)

Key Europe Protective Footwear Industry Players

- Dunlop Protective Footwear

- Bata Industrials

- Uvex Safety Group

- Honeywell International Inc.

- Cofra S.r.l.

- Dr. Martens plc

- ELTEN GmbH

- Sievin Jalkine Oy

- ATLAS The Shoe Company

- HAIX Group

- Jallatte Shoes

- U-POWER Group S.P.A.

- Panter Safety Footwear

- Bellota

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252