MARKET OVERVIEW

Europe's Automotive Dealer Management System (DMS) market plays a crucial role in streamlining and optimizing various operational facets, offering a comprehensive solution tailored to the specific demands of the European automotive industry. The Europe Automotive Dealer Management System (DMS) market is characterized by its adaptability to the diverse requirements of dealerships, ranging from inventory management and sales tracking to customer relationship management. As technology continues to advance, the DMS market in Europe has witnessed a paradigm shift, integrating sophisticated features and tools that enhance the efficiency of day-to-day operations.

One of the notable aspects of the European Automotive DMS market is its focus on providing seamless communication channels between different departments within a dealership. This ensures that information flows effortlessly, fostering collaboration and synergy among various teams. The ability to integrate data from sales, service, and finance departments into a unified platform is a key strength of the DMS market, facilitating a holistic approach to dealership management.

In response to the unique challenges posed by the European automotive landscape, DMS solutions in this market have evolved to offer robust analytics and reporting functionalities. Dealerships can now gain valuable insights into their performance, market trends, and customer preferences, enabling them to make informed decisions that drive business growth.

Furthermore, the Europe Automotive DMS market has witnessed a surge in cloud-based solutions, enabling dealerships to access critical data and functionalities remotely. This not only enhances the flexibility of operations but also addresses the growing need for mobility and accessibility in the modern business environment.

The integration of advanced technologies, such as artificial intelligence and machine learning, sets the European Automotive DMS market apart. These technologies empower dealerships to automate routine tasks, predict customer behavior, and optimize their overall business strategies. This tech-

driven approach aligns with the fast-paced nature of the automotive industry, helping dealers stay ahead of the curve.

The Europe Automotive Dealer Management System (DMS) market is a vibrant ecosystem that continues to evolve in response to the changing dynamics of the automotive industry. Its ability to offer tailored solutions, foster collaboration, provide insightful analytics, and embrace cutting-edge technologies positions it as an indispensable tool for dealerships navigating the complexities of the European automotive market.

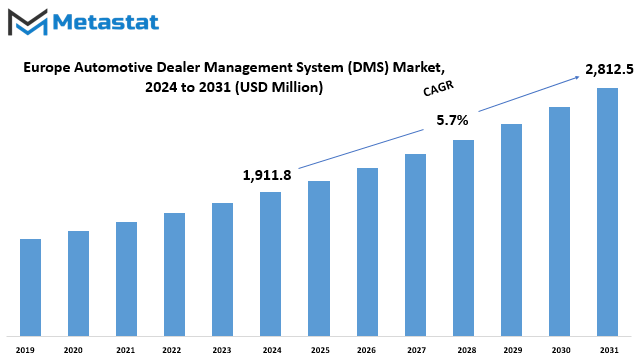

Europe Automotive Dealer Management System (DMS) market is estimated to reach $2,812.5 Million by 2031; growing at a CAGR of 5.7% from 2024 to 2031.

GROWTH FACTORS

In the European automotive industry, the Dealer Management System (DMS) market is shaped by several pivotal factors influencing its growth trajectory. Among these, two standout forces are Digital Transformation and Regulatory Compliance.

The advent of Digital Transformation has emerged as a significant catalyst propelling the market forward. In an era where technology is omnipresent, automotive dealerships are increasingly adopting digital tools and platforms to streamline their operations. This shift towards digitalization not only enhances efficiency but also opens up new avenues for improved customer engagement. As consumers become more digitally savvy, automotive dealers recognize the need to align their strategies with the evolving preferences of the market.

Simultaneously, Regulatory Compliance stands as another cornerstone in steering the direction of the European DMS market. The automotive industry operates within a framework of rules and

regulations that govern various aspects, from emissions standards to consumer protection. Compliance with these regulations is not merely a legal obligation but a crucial element in maintaining the industry's credibility and fostering trust among consumers. Dealerships that integrate robust DMS solutions, capable of ensuring compliance with the ever-evolving regulatory landscape, find themselves better positioned for sustainable growth.

However, amidst these driving factors, challenges loom on the horizon. Integration Challenges and High Costs pose as potential impediments to the seamless evolution of the DMS market. The integration of new digital systems with existing infrastructures can be a complex process, demanding careful navigation to avoid disruptions. Simultaneously, the financial aspect comes into play, with the initial costs of implementing advanced DMS solutions being a point of concern for many automotive dealers. Striking a balance between technological advancement and fiscal prudence becomes imperative in such scenarios.

Looking forward, amidst these challenges, there exists a promising avenue for market growth – Personalized Customer Experience. As the automotive landscape continues to transform, the significance of personalized interactions with customers becomes increasingly apparent. Tailoring services and communications to meet individual preferences not only enhances customer satisfaction but also fosters brand loyalty. Dealerships that leverage DMS solutions to create a personalized customer experience are likely to unlock lucrative opportunities in the years to come.

The Europe Automotive Dealer Management System market is a dynamic arena shaped by the interplay of Digital Transformation, Regulatory Compliance, Integration Challenges, and Cost Considerations. While obstacles exist, the potential for growth lies in the ability of dealerships to embrace digitalization, navigate regulatory complexities, and prioritize personalized customer experiences. As the wheels of progress continue to turn, the DMS market stands at the intersection of technological innovation and market demand, poised for further evolution and transformation.

MARKET SEGMENTATION

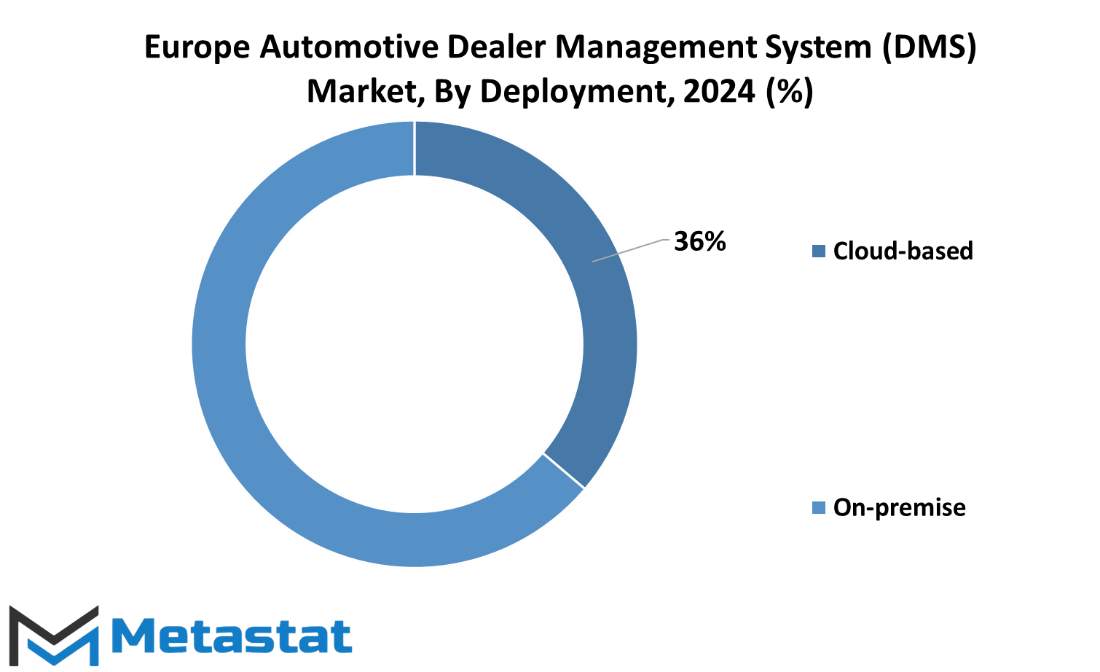

By Deployment

In the European automotive industry, the Dealer Management System (DMS) market is categorized based on deployment, with two main segments being Cloud-based and On premise solutions.

Cloud-based deployment refers to the utilization of online servers to host the DMS software. This allows dealerships to access and manage their data through the internet, offering flexibility and convenience. With Cloud-based DMS, automotive dealers can streamline their operations, accessing information from various locations without being tied to a specific physical location. It promotes efficient collaboration among different dealership departments, enhancing overall productivity.

On the other hand, On-premise deployment involves installing and running the DMS software on local servers within the dealership premises. This traditional approach provides a sense of control over data security and customization, as the system is managed in-house. However, it may lack the accessibility and flexibility that the Cloud-based counterpart offers.

Choosing between Cloud-based and On-premise deployment depends on the specific needs and preferences of automotive dealers. Cloud-based solutions are favored for their accessibility, scalability, and reduced infrastructure costs. They allow dealerships to stay current with updates and innovations without the burden of managing their own servers.

Conversely, On-premise solutions are selected by those prioritizing control and customization, often due to specific security or compliance requirements. While they may demand more upfront investment in hardware and maintenance, On-premise DMS options provide a localized approach to data management.

The Europe Automotive Dealer Management System market, when viewed through the lens of deployment, presents a choice between the convenience of Cloud-based solutions and the control of On-premise systems. Each option has its own set of advantages and considerations, and dealerships must weigh these factors based on their unique requirements to make an informed decision that aligns with their business goals.

By Application

The Europe Automotive Dealer Management System (DMS) market is characterized by its diverse applications, each playing a crucial role in the overall efficiency of the automotive dealership ecosystem. One of the key components within this market is Customer relationship Management (CRM). In 2022, the CRM segment held a significant value of 444.3 USD Million, underscoring its pivotal role in fostering and maintaining strong connections between dealerships and their customers.

Another integral aspect of the DMS market is Dealer Tracking, which boasted a value of 381.3 USD Million in 2022. Dealer Tracking serves as a vital tool for monitoring and optimizing dealership operations, ensuring a streamlined and effective management system. This segment’s substantial value highlights the industry’s recognition of the importance of tracking and analyzing dealer activities for enhanced performance.

Inventory Management is another noteworthy component of the DMS market, valued at 323 USD Million in 2022. Efficient inventory management is critical for automotive dealerships to maintain optimal stock levels, minimize excess inventory, and maximize profitability. The significant valuation of the Inventory Management segment reflects its essential role in the overall functionality of the automotive dealer system.

The Finance segment, valued at 211.3 USD Million in 2022, underscores the financial dimension of the DMS market. Financial management is a critical aspect for dealerships, encompassing tasks such as budgeting, financial reporting, and ensuring compliance with regulatory requirements. The noteworthy value assigned to the Finance segment emphasizes the industry’s acknowledgment of the financial intricacies involved in automotive dealership operations.

Sales, with a value of 203.3 USD Million in 2022, represents another crucial facet of the DMS market. This segment encapsulates the processes and tools involved in managing and optimizing sales operations within the automotive dealership framework. The substantial valuation of the Sales segment underscores its significance in driving revenue and ensuring the overall success of the dealership.

The Others segment, valued at 159.3 USD Million in 2022, encompasses various additional functionalities within the DMS market. While not explicitly categorized into the aforementioned segments, the diverse set of services covered under the Others category adds to the comprehensive nature of the Automotive Dealer Management System.

The Europe Automotive Dealer Management System (DMS) market comprises distinct segments, each contributing uniquely to the efficient functioning of automotive dealerships. The significant values associated with Customer Relationship Management, Dealer Tracking, Inventory Management, Finance, Sales, and Others emphasize the multifaceted nature of the DMS market and its integral role in supporting the dynamic automotive industry.

REGIONAL ANALYSIS

In the analysis of the Europe Automotive Dealer Management System (DMS) market, a closer look at the regional landscape reveals key players in the field. Europe, as a collective entity, encompasses significant automotive markets such as the United Kingdom (UK), Germany, France, Italy, and the Rest of Europe.

Beginning with the United Kingdom, it stands out as a noteworthy player in the European DMS market. The automotive industry in the UK has a robust presence, contributing significantly to the overall economy. Dealerships in the UK leverage DMS solutions to streamline their operations, manage inventory, and enhance customer interactions.

Moving on to Germany, another powerhouse in the European automotive scene, the market for Dealer Management Systems is vibrant. German dealers recognize the importance of efficient management tools, and DMS adoption is a prevalent trend. The focus here is not just on optimizing internal processes but also on delivering a seamless experience to customers.

France, too, plays a significant role in the European DMS landscape. French automotive dealerships recognize the need for sophisticated management systems to stay competitive. The integration of DMS solutions aids in inventory management, sales tracking, and customer relationship management.

Italy, with its rich automotive heritage, is a distinctive market for DMS. Italian dealerships embrace these systems to enhance efficiency and meet the demands of a dynamic automotive market. The emphasis is on staying agile and responsive to market trends.

The Rest of Europe, comprising various countries with their unique automotive landscapes, contributes to the overall diversity of the European DMS market. Each nation brings its own set of challenges and opportunities, shaping the adoption of Dealer Management Systems.

The Europe Automotive Dealer Management System market is a tapestry woven with the distinctive threads of the UK, Germany, France, Italy, and the Rest of Europe. Each region adds its unique flavor to the overarching narrative of DMS adoption in the European automotive landscape. The emphasis across these regions is on leveraging technology to enhance operational efficiency, streamline processes, and ultimately provide a more seamless experience for both dealers and customers.

COMPETITIVE PLAYERS

The European market for Automotive Dealer Management Systems (DMS) boasts key players in the industry, with PBS Systems and Information Systems Ltd. standing out among them. These companies play a crucial role in the realm of Automotive DMS, contributing significantly to the growth and efficiency of automotive dealerships.

PBS Systems, a prominent player, brings its expertise to the table, offering solutions that streamline various aspects of dealership management. From inventory tracking to customer relationship management, PBS Systems addresses the diverse needs of automotive dealers. Their commitment to delivering user-friendly interfaces and reliable support has solidified their position in the market.

Similarly, Information Systems Ltd. is another noteworthy contender in the European Automotive DMS sector. This company specializes in providing comprehensive DMS solutions tailored to meet the specific demands of the automotive industry. With a focus on innovation and adaptability, Information Systems Ltd. ensures that dealers have access to cutting-edge tools for managing their operations efficiently.

Both PBS Systems and Information Systems Ltd. recognize the dynamic nature of the Automotive DMS industry. As technology continues to advance, these key players continually update their offerings to stay ahead of the curve. This commitment to staying current with industry trends enables automotive dealers to rely on them for state-of-the-art solutions.

The presence of PBS Systems and Information Systems Ltd. significantly contributes to the vitality of the European Automotive DMS market. Their dedication to providing effective and up-to-date solutions reflects the ever-changing landscape of the automotive industry. As key players, they not only enhance the operational efficiency of dealerships but also contribute to the overall growth and success of the Automotive DMS sector in Europe.

Automotive Dealer Management System (DMS) Market Key Segments: By Deployment

- Cloud-based

- On-premise

By Application

- Customer Relationship Management

- Dealer Tracking

- Inventory Management

- Finance

- Sales

- Others

Key Europe Automotive Dealer Management System (DMS) Industry Players

- PBS Systems

- Information Systems Ltd.

- BiT Dealership Software, Inc.

- Blue Skies Business Solutions Inc.

- CDK Europe LLC.

- DealerSocket

- Dealertrack Inc.

- Integrated Dealer Systems (IDS)

- Pinewood Technologies PLC

- The Reynolds and Reynolds Company

- XAPT Corporation

- vAuto Inc.

- OpusVL

- Keyloop Canada Ltd

- Pagodalabs

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252