MARKET OVERVIEW

The EU and APAC Maritime Satellite Communication market is seen as a highly vibrant one within the maritime universe, providing critical solutions to improve connectivity over the grand ocean regions. As a result of the increasing need for uninterrupted communications between the vessels, the ports, and the satellite networks, their strategic relevance has grown. It is a market with its seamless communication possibilities so that even miles away from the land-based communication networks, the vessels on the high seas remain connected. Although much is said about the technology of the market, the regulatory environment, and the service providers, the discussion really extends beyond what is conventionally spoken of.

Less talked about is how this field helps develop the security standards for data relating to maritime operations. As vessels continue to rely on satellite networks for navigation, cargo tracking, or crew communications, the security issues around these satellite systems will surface. The EU and APAC Maritime Satellite Communication market should look into signal interception, data breach threats, and unauthorized access to critical infrastructure. Adoption of newer encryptions and secured transport will set the tone for how data is going to be transmitted through ships at sea and consequently for the international maritime cybersecurity standards.

The market will also encourage the use of greener shipping. In Europe and Asia, since the environment is on top of the agenda of regulatory bodies, satellite communication networks will be used to monitor emissions, optimize fuel consumption, and facilitate real-time carbon footprint tracking. The integration of AI with satellite data will provide shipping companies with the intelligence to make good decisions working toward decarbonization. Moreover, satellite connectivity will become crucial in developing green shipping corridors in the future, ensuring that those new corridors will stand in line with the changing environmental regulation without hampering their operational efficiency.

Economically, another less-explored angle would be resolving these markets along remote coastal communities and small-scale enterprises in the maritime sector. Larger shipping corporations show obvious advantage from the satellite communication networks, whereas smaller fishing fleets and independent maritime operators have major affordability and access issues. Attention must be drawn towards developing and offering cheap satellite communication solutions, making advanced technology integration affordable for smaller players. Boosting access will help close the gap in digital divide between the large and smaller maritime economic sectors for growth across the maritime economic sector inclusively.

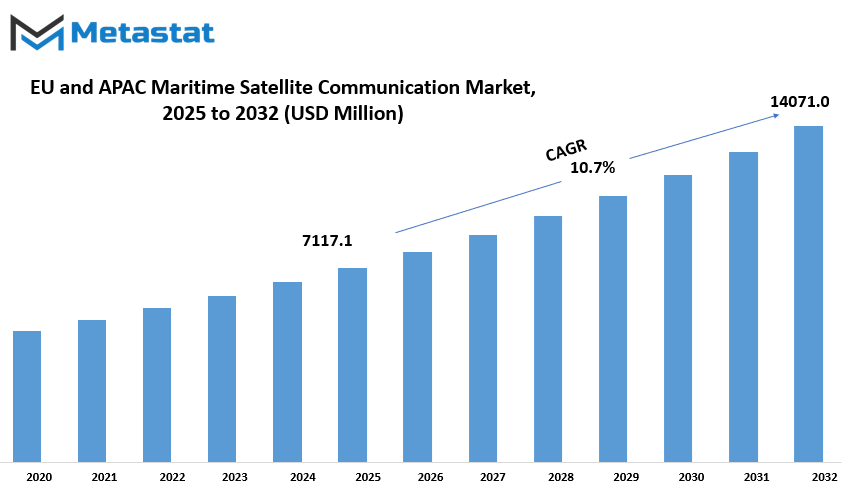

EU and APAC Maritime Satellite Communication market is estimated to reach $14071.0 Million by 2032; growing at a CAGR of 10.7% from 2025 to 2032.

GROWTH FACTORS

The EU and APAC Marine Satellite Communication Market is steadily gaining traction due to the increasing demand for uninterrupted and timely information access in Europe and Asia-Pacific. This has made the operations safer and more efficient with satellite communications, with greater dependence on digital technologies in shipping and offshore industries. Ships as well as offshore platforms and other marine objects have a continuous requirement of communication networks for navigation, weather monitoring, and remote management, resulting in the rising demand for advanced satellite solutions.

Another vital engine of growth for the market has been the development of offshore energy projects. The addition of oil rigs and wind farms and the proliferation of exploration activities in higher numbers in remote locations have necessitated the presence of reliable communication systems. Allowing operators to maintain consistent connectivity to these isolated areas where traditional networks do not reach, satellite networks provide valuable solutions. In this regard, therefore, one can safely say that services such as uninterrupted data transmission as well as the high efficiency of operations are now being made possible by satellite technologies for offshore industries.

Despite these trends, the market has its problems. Installation and operational costs are extremely high, thus inhibiting many small maritime operators from accessing such technologies. Setting up satellite communication systems can prove very capital-intensive, thus rendering it unaffordable to some companies. Moreover, regular maintenance and upgrading of systems call for recurring budgetary allocations, thus making it difficult for many organizations to adopt such systems. Another challenge to the market is the complexity of the regulatory framework and spectrum allocation policies. Each region has different regulations that would delay the establishment of the newest satellite networks and create uncertainty for service providers. These regulations would make it more difficult for companies to establish and provide consistent services to a wider market reaching across several regions.

But, despite these, there are new opportunities emerging in the domain of satellite communication in maritime. Technological advancements made satellites capable of enabling faster, more affordable ones. Some examples of inventions include low Earth orbit (LEO) satellites and improved signal processing techniques, both of which assist in reducing latency and increasing data speed transfer rates. Thus, a number of these developments open an even broader span of satellite communications available for maritime users. The developments in technology and the growing use of IoT and AI in this sphere deepen the transformation of the industry further. Improvements in decision-making, efficiency, and costs can, in addition, come by integrating technologies such as satellite communications with smart sensors or automated monitoring systems, along with the use of predictive analytics powered by AI. This can also optimize operations in the maritime industry.

MARKET SEGMENTATION

By Type

Whereas the EU and Asia-Pacific maritime satellite communication market are growing due to an increasing demand for reliable connectivity at sea, shipping companies, offshore operations, and naval forces depend on satellite technology to maintain seamless flow of information in the remote areas of the oceans. The advancement of technology means that satellite solutions have entered vessels predominantly for efficiency, safety, and crew welfare.

Satellite communications form an important component in maritime operations. Equally, they are service rendered to sustain navigation, weather updates, emergencies, and real-time information exchange. Due to the vast distances guards covered, ships often find these means of communication such as radio signals inadequate. It is in this vacuum that satellite technology comes in with continuous coverage and thus has been considered paramount in contemporary maritime activities. The digital economy is on the rise, with increased automation of shipping creating further requirement for robust satellite networks.

This market is being classified according to type; two dominant types triggering growth would be Mobile Satellite Services and Very Small Aperture Terminal. MSS, valued at $4684.1 million, provides crucial communication services with portable and reliable solutions. MSS systems support voice calls, messaging, and low-data applications specifically for emergency communications and basic operational needs. In contrast, VSAT technology provides high-speed broadband Internet link for data-guzzling applications such as real-time monitoring, remote diagnostics, and crew entertainment; hence, it is mostly supportive for commercial shipping and offshore industries that need a reliable and high-capacity Internet connection.

Governments and private firms are putting great money into designing satellite infrastructure for improving maritime communication, given the increasing rigidity for safety, growing concern regarding cybersecurity, and the need of ensuring strengthened fleet management. Current-day satellite systems are designed for synergistic interfacing with digital platforms allowing operators to track vessels, optimize routes and monitor fuel consumption, hence enabling regulatory compliance with cost-benefit and operational efficiency vis-a-vis international maritime regulation.

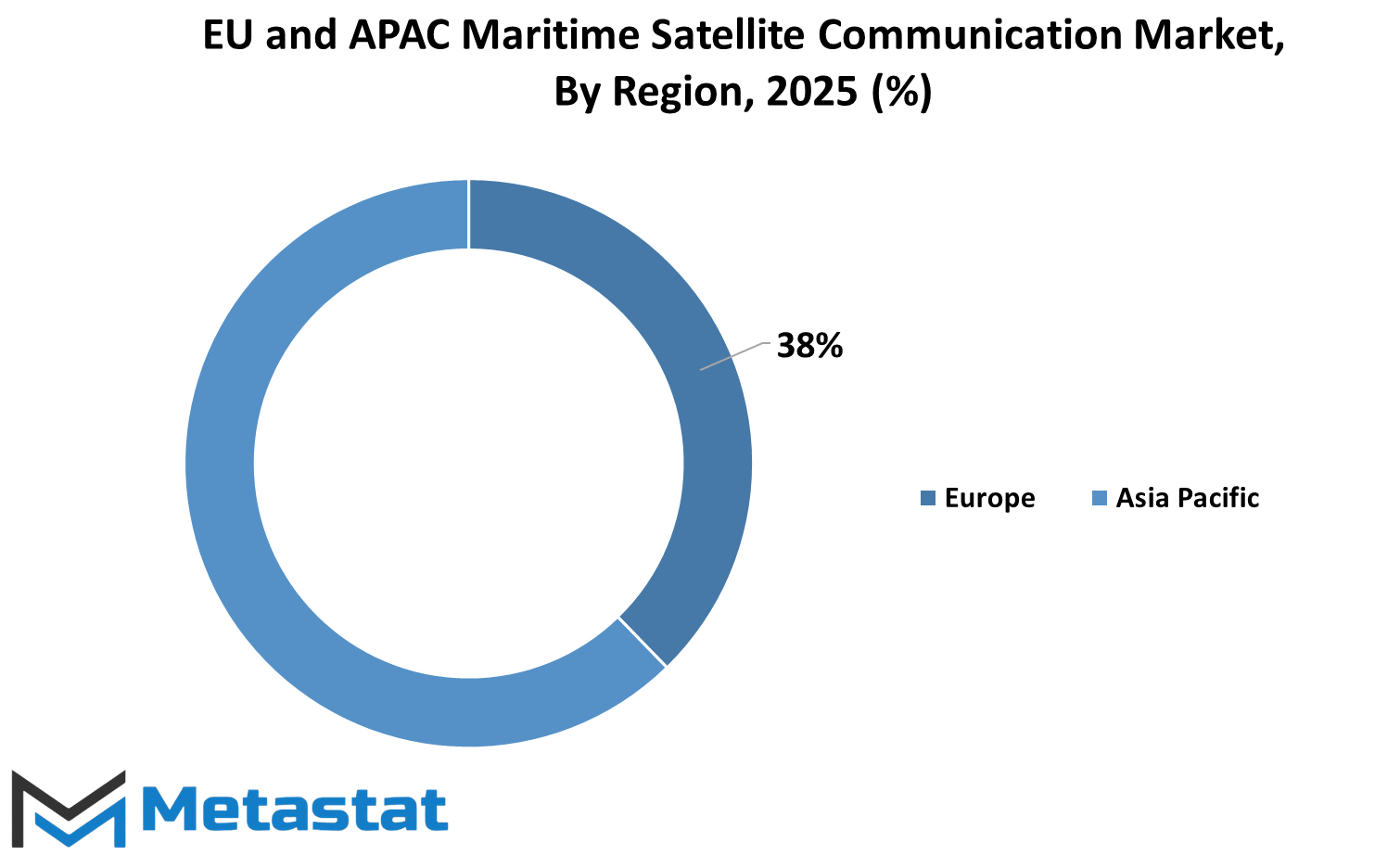

The EU and APAC regions have different factors influencing their market differentiations. In Europe, environmental regulations and technology adoption determine satellite communication uptake. Emissions reduction and energy efficiency improvements drive satellite monitoring systems' adoption as smart solutions for shipping companies working within the European setup. Meanwhile, APAC, with some of the busiest shipping lanes worldwide, is fast-growing in trade activities. With increased traffic over the oceans, the call for communication solutions is getting louder for satellite services to take off.

By End-User Vertical

The maritime satellite communication market in the EU and APAC has continued to prosper owing to the increasing dependence of industries on modern digital solutions, which are putting more advanced satellite technologies in use by maritime operators to facilitate connectivity at sea. The market can be segmented end-user-wise into merchant vessels that include cargo ships, tankers, container ships, and bulk carriers. Offshore rigs and support vessels also have a significant part to play in this segment by providing the vital satellite coverage needed in operations.

They also use satellite communications for navigation, the entertainment of passengers, and efficient operation in passenger fleets that include cruise ships and ferries. As this demand for leisure travel continues to grow, the factor that comes with it is the urgent requirement for stable internet connectivity aboard yachts, allowing passengers to stay connected while on journey. Fishing vessels, although small, also make use of satellites for their operations, hence improving their coordination, navigation, and weather forecasting to ensure their safety and efficiency.

Real-time data transfer, remote monitoring, safety enhancement, are the major factors that drive satellite technology in maritime use. Given the advances in broadband technology, ships can now access ca-high-speed internet, even in the remotest parts of the ocean. This works out well for both commercial and leisure, as it improves the welfare of the crew and optimizes operational efficiency, notwithstanding their locations. To comply with safety standards and environmental regulations, some maritime operators are now investing in satellite solutions mainly due to law regulations asking for safety compliance.

One of the greatest constraints for the market is related to the high acquisition costs of satellite communication systems. The installation and maintenance costs are indeed quite large for the smaller operator. Continuous advancement in technology, however, is expected to reduce costs, thus making such solutions viable for a wider base of maritime users. To further ease access to these services, some service providers have also introduced flexible pricing models to enable businesses to choose their plans according to operational needs.

As competition among market players heightens to present ever more efficient and economical satellite communication solutions, several key trends have continued to underpin innovation. Providers still strive to innovate coverage, minimize latency, and provide tailored services that meet various maritime customer's needs. Partnerships between satellite operators and maritime companies are also becoming more integrated, as they assure seamless integration of the technologies into the existing infrastructures.

By Service

The expansion of this maritime satellite communication market within EU and APAC indicates an increasing reliance of industries on advanced technologies for seamless connectivity. Maritime satellite communication plays a key role for vessels in being connected at all times to facilitate safe and efficient operations. Increased demand for reliable communication has brought focus among the players toward improving the services offered to cater to the industry's changing requirements.

By service, we can further divide the market into tracking and monitoring, voice, video, and data. Tracking and monitoring services enable vessels to receive real-time location updates, allowing for better route planning and cargo security. These services find application in fleet monitoring, cargo tracking, and compliance with maritime regulations. Voice remains a critical service to be used for essentially crew welfare, emergency responses, and operational coordination. Even in the midst of the most remote waters, satellite voice has delivered reliable, clear conversations, connecting maritime professionals from every corner.

Video services have gained momentum in remote inspections, training sessions, and real-time surveillance to increase operational efficiency and comply with standards of safety. Rapid technological advancement has supported this rise in demand, allowing for HD video streaming in adverse maritime conditions.

A feature that has become an essential footprint for modern maritime operations is data. Data service enables easy, safe, and timely movement of ships from weather forecasting to navigational assistance. With increasing automation and digitalization, vessel will require continuous data interchange for system monitoring and predictive maintenance. To maintain the escalating demand for connectivity, companies are now geared toward providing high-speed and secure data solutions.

As maritime industries increasingly embrace digital transformation, satellite communication providers are thus focusing on lesser latency, greater bandwidth, and better overall service quality. Increased demand for these services within the EU and APAC regions can also be attributed to regulatory requirements, the growing scale of maritime trade, and advancements in satellite technology. Governments and private organizations have begun working collaboratively on innovating solutions so that seamless communication is guaranteed for ships, ports, and offshore platforms.

The future of maritime satellite communication appears bright, as companies are developing next-generation technologies to provide better connectivity in the most distant oceanic areas. With the march of the automated and smart shipping world, satellite communication will assume even more critical importance. Innovations in satellite technology will be required continuously to cater to the demands of modern maritime operations and ensure efficiency, safety, and seamless connectivity in the years to come.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$7117.1 million |

|

Market Size by 2032 |

$14071.0 Million |

|

Growth Rate from 2025 to 2032 |

10.7% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

With unfettered demand for seaworthy connectivity, the fast-growing EU and APAC maritime satellite communication market is in full swing. There are flourishing maritime hubs where crystal-accurate communication has become indispensable for safety, navigation, and operational efficiency. For smooth functioning and compliance with regulatory requirements, ships, offshore platforms, and coastal stations need uninterrupted connectivity. Also, high-speed data services made available through satellites can ensure vessel connectivity even in the farthest stretches of the water.

Real-time data is becoming increasingly valuable for navigation, weather forecasting, and emergency response. Due to unpredictable ocean conditions, vessels must really either receive accurate data for timely decision-making or face loss. Satellite communications allow route monitoring, hazard avoidance, and shedding operational efficiencies. While maritime safety norms have been in place for years, regulatory authorities are tightening them up, thus pressing companies to invest in such differentiating communication solutions.

An increased uptake of digital solutions in maritime operations is yet another strong factor propelling the market growth. From automated ship management systems to realtime cargo monitoring, satellite communications have a great impact on the efficiency of maritime operations. Companies want affordable communication networks that can operate reliably for the seamless operation and assurance of minimized delays. Demand for high-bandwidth services has been increasing, particularly in the incorporation of IoT technology into maritime solutions.

In Europe, both state and private stakeholders are investing in satellite networks to improve maritime security and logistics. The vital ports and long shipping routes of this region demand a robust communication infrastructure. There is also an impetus to adopt satellite technology for smart shipping on the heels of carbon emission reductions.

Fast-growing trade activities and economic development are the driving forces for the growth of these maritime industries in the Asia Pacific region. China, Japan, and South Korea have dominion over satellite-based communication systems. Enormous coasts and a plethora of shipping lanes give need for reliable communications to keep up pace with increasing maritime traffic in the region. A large number of fishing fleets, cargo ships, and offshore energy projects are implementing satellite connectivity for boosting efficiency and safety.

Technological changes keep on sunsetting and bringing in new opportunities in the maritime satellite communication market of the EU and APAC and, therefore, affect the communication consistency. These companies look for highly costeffective solutions.

COMPETITIVE PLAYERS

The EU and APAC maritime satellite communication market have escalated due to increasing demand for reliable connectivity on the oceans. Digitalization requires uninterrupted internet access for shipping companies, offshore operations, and naval forces. Several demands drive this facility: real-time navigation, weather monitoring, and crew welfare. With the vast territorial waters that ships navigate, established communication systems have become inadequate for achieving uninterrupted connectivity; hence satellite communication is the best alternative in these cases.

Many companies increasingly influence this industry with advanced satellite communication solutions. Besides the aforementioned companies, other key players are SpaceX (Starlink Maritime), Inmarsat Global Limited, Marlink SA, KVH Industries Inc., SpeedCast International Limited, NSSL Global Limited, Cobham Satcom, and Iridium Communications Inc. These companies provide services that support high-speed internet, voice communication, and data transmission, ensuring that vessels stay connected no matter where they are.

Adoption of high-throughput satellites (HTS) is one of the most important factors that attracts movement beyond shores and thus, pressurizes growing satellite communication service provisions. Its services include wider bandwidth and higher speed for improved transfer of data. This becomes even more critical in the commercial shipping environment, where data is dealt with in real time to maximize operational efficiency and security, thus allowing autonomous navigation systems. Moreover, enhanced connectivity allows better working conditions for seafarers that support connection with their families and entertaining options for long sea voyages.

The regulations assure their fair share in the continental polyphony- The EU and APAC authorities have promulgated guidelines to allow safe and efficient maritime operations. Everywhere, governments support the enhancement of communication facilities for maritime safety or environmental monitoring, leading to investments in satellite technology, as better communication systems assist with accident prevention, tracking of vessel movements, and launching prompt emergency responses.

The rivalry among key players is another driving force for accelerating innovations for market growth. Endowed to develop surely more cost-effective solutions, with better coverage, speed, and lower latency, companies are seeking bent on these missions. With such international solicitations coming from the LEO satellites-its connections with the satellites running faster and with more reliability than that offered by its dear counterpart, the traditional geostationary satellites-LEO has come to change the world. The development of satellite deployment in low earth orbit by other companies, like SpaceX, will mean major assistance to the maritime sector with connectivity.

EU and APAC Maritime Satellite Communication Market Key Segments:

By Type

- Mobile Satellite Services (MSS)

- Very Small Aperture Terminal (VSAT)

By End-User Vertical

- Merchant (Cargo, Tanker, Container, Bulk Carrier etc)

- Offshore Rigs and Support Vessels

- Passenger Fleet (Cruise, Ferry)

- Leisure (Yachts)

- Finishing Vessels

By Service

- Tracking and Monitoring

- Voice

- Video

- Data

Key EU and APAC Maritime Satellite Communication Industry Players

- SpaceX (Starlink Maritime)

- Inmarsat Global Limited

- Marlink SA

- KVH Industries Inc.

- SpeedCast International Limited

- NSSL Global Limited

- Cobham Satcom

- Iridium Communications Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252