MARKET OVERVIEW

The Equipment Breakdown Insurance Market, also known as machinery breakdown insurance or boiler and machinery insurance, is a specialized segment within the broader insurance industry that caters to the specific needs of businesses and industries reliant on various equipment and machinery to facilitate their operations. This type of insurance offers coverage against the sudden and unexpected breakdown of critical equipment, providing financial protection to policyholders when unforeseen technical failures threaten their productivity and profitability. To truly grasp the significance, importance, and necessity of the Equipment Breakdown Insurance Market, it's imperative to delve into the unique characteristics and the role it plays in the corporate landscape.

The Equipment Breakdown Insurance Market addresses a fundamental need for businesses across various sectors. In today's technologically advanced world, virtually every industry relies on machinery and equipment to drive efficiency, meet production goals, and deliver products or services to customers. From manufacturing facilities with complex machinery to data centers housing crucial servers, equipment breakdowns can cause substantial financial losses. This insurance, therefore, acts as a crucial safety net, ensuring that enterprises can quickly recover from these disruptions without bearing the full financial burden.

Moreover, the market's significance is magnified by the fact that traditional property insurance policies often exclude or provide limited coverage for equipment breakdowns. This gap in coverage leaves many businesses exposed to substantial risks, making Equipment Breakdown Insurance a vital component of a comprehensive risk management strategy.

The importance of this market extends further into the global economy. With businesses continually seeking ways to enhance productivity, reduce downtime, and stay competitive, the reliability of machinery and equipment is paramount. Equipment breakdowns not only result in direct repair or replacement costs but can also lead to indirect expenses, such as business interruption and loss of revenue. The Equipment Breakdown Insurance Market steps in to mitigate these economic consequences, ensuring the continued operation of businesses even in the face of technical setbacks.

This insurance market is not just a reactive solution; it also plays a proactive role in promoting preventative measures. Insurers, in collaboration with policyholders, often offer risk engineering services that assess and mitigate potential vulnerabilities in equipment and systems. By doing so, they contribute to reducing the likelihood of breakdowns, thus preventing disruptions that could have significant consequences for businesses.

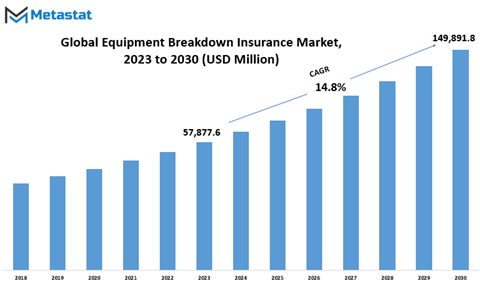

Global Equipment Breakdown Insurance market is estimated to reach $149,891.8 Million by 2030; growing at a CAGR of 14.8% from 2023 to 2030.

GROWTH FACTORS

The Global Equipment Breakdown Insurance Market has been witnessing significant growth due to several key driving factors. However, certain challenges might hamper the market's growth. On the other hand, there are opportunities that could prove lucrative for the market in the coming years.

The global market for equipment breakdown insurance has experienced substantial expansion in recent times. Several factors have contributed to this growth, making it a noteworthy industry in the broader landscape of insurance.

One of the primary drivers of this market's expansion is the increasing dependence of businesses on a wide range of equipment and machinery for their operations. In today's highly mechanized world, companies rely heavily on various equipment and machines to carry out their day-to-day activities. Whether it's manufacturing, construction, or technology, these industries require equipment that can be expensive to repair or replace in the event of a breakdown.

This need for equipment reliability and the high cost of repair or replacement has led to a surge in demand for equipment breakdown insurance. Businesses are seeking policies that can protect them from financial losses resulting from sudden equipment failures.

Additionally, the growing awareness among businesses about the risks associated with equipment breakdown has driven the demand for insurance products that can mitigate these risks. As a result, insurance companies have been actively developing and marketing equipment breakdown insurance policies to cater to this demand.

However, despite the promising growth prospects, the market faces certain challenges that might hinder its progress. For instance, the complexity of underwriting equipment breakdown insurance can pose difficulties for insurers. Assessing the risks associated with different types of equipment and their failure modes can be a complex task, which requires a deep understanding of the equipment's mechanics and the specific industry it serves.

Furthermore, the potential for fraudulent claims can be a significant concern for insurance providers. Detecting false claims and ensuring that the insurance policies are not being exploited can be a challenging task, and it requires a robust claims management process.

Despite these challenges, the market is not without opportunities. In fact, the coming years hold promise for further growth. The increasing integration of technology in equipment and machinery is creating opportunities for insurance providers to develop innovative products. Sensor technology and the Internet of Things (IoT) enable real-time monitoring of equipment health, which can lead to more accurate risk assessment and pricing.

Moreover, as more businesses recognize the importance of risk management and disaster recovery planning, they are likely to seek comprehensive equipment breakdown insurance policies, which can create new revenue streams for insurers.

MARKET SEGMENTATION

By Product Type

The Global Equipment Breakdown Insurance market encompasses various product types. These product types play a vital role in the insurance industry, as they cater to the diverse needs of businesses and individuals. The market is dynamic and continuously evolving to meet the demands of an ever-changing world.

One of the significant product types within this market is Mechanical equipment. In 2021, the Mechanical segment recorded a value of 13,603.3 USD Million. This segment is crucial for businesses that rely on machinery and mechanical devices for their operations. Equipment breakdown insurance for mechanical components provides a safety net, ensuring that any unforeseen malfunctions or failures do not disrupt the workflow.

Following this, the Electrical equipment is another pivotal component of the Global Equipment Breakdown Insurance market. In 2021, the Electrical segment showed a value of 15,317.1 USD Million. Businesses and industries heavily depend on electrical systems for their operations, making this segment essential for risk management. Electrical equipment breakdown coverage ensures that electrical failures, which can lead to substantial losses, are adequately protected.

Next, the Computers & Communications equipment represents yet another vital part of this market. In 2021, the Computers & Communications segment had a value of 7,764.5 USD Million. In today's digital age, businesses rely on computers and communication systems for their day-to-day operations. These systems are prone to breakdowns, and having insurance coverage for them is imperative to maintain business continuity.

Moreover, the Air Conditioners & Refrigeration Systems are also included in the Global Equipment Breakdown Insurance market. In 2021, this segment was valued at 3,989.2 USD Million. These systems are essential for maintaining the proper functioning of various facilities, including industrial, commercial, and residential. Insurance for air conditioners and refrigeration systems ensures that unexpected breakdowns do not lead to discomfort and financial losses.

Further, the market caters to Boilers & Pressure Equipment. This segment had a value of 3,361.3 USD Million in 2021. Boilers and pressure equipment are crucial for various industries, such as manufacturing and energy production. The breakdown of such equipment can result in not only operational disruptions but also safety hazards. Insurance coverage for these components is essential for risk mitigation.

The Global Equipment Breakdown Insurance market is a dynamic and multifaceted domain, comprising various product types that are essential for businesses and individuals. These segments, including Mechanical, Electrical, Computers & Communications, Air Conditioners & Refrigeration Systems, and Boilers & Pressure Equipment, offer insurance solutions to mitigate the risks associated with equipment breakdowns. As technology advances and industries evolve, the importance of this market continues to grow, ensuring that businesses can operate smoothly even in the face of unexpected equipment failures

By Application

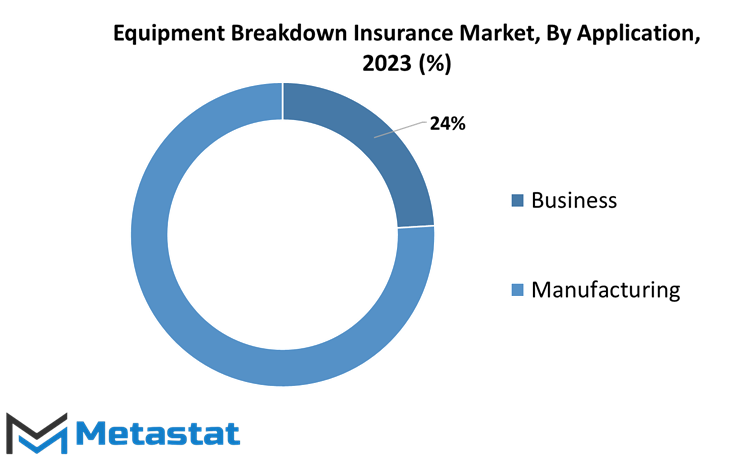

The global equipment breakdown insurance market can be broken down into different segments, with each segment having its own value. In 2021, the business segment of this market was valued at 10,517.4 USD million, while the manufacturing segment was valued at 33,518 USD million. The business segment, which likely covers insurance for various businesses and commercial enterprises, had a total value of 10,517.4 USD million in 2021. This signifies the importance of insurance coverage for businesses to protect against equipment breakdowns and related losses.

On the other hand, the manufacturing segment, which is focused on the insurance needs of manufacturing industries, had a significantly higher value of 33,518 USD million in 2021. This indicates the vital role of equipment breakdown insurance in the manufacturing sector, where the cost of equipment and machinery is often high, and any breakdown can result in substantial financial losses.

These values highlight the significance of equipment breakdown insurance across different sectors of the economy. The figures clearly demonstrate the financial investments made by businesses and manufacturers in securing their operations against unforeseen equipment failures. Such insurance coverage plays a crucial role in ensuring the smooth functioning of businesses and manufacturing operations by providing a safety net for unexpected breakdowns.

REGIONAL ANALYSIS

The geographical distribution of the equipment breakdown insurance market is widespread, encompassing both developed and developing regions. Owing to factors such as economic growth, rapid industrialization, and an increase in construction and manufacturing activities, there has been a surge in demand for this insurance product.

North America remains a dominant force in the global market mainly due to its well-established infrastructure and extensive manufacturing facilities. The presence of numerous leading insurance companies also contributes to the region's strong market position. Europe follows closely behind as another significant player with countries like Germany, France, and the United Kingdom driving demand.

Meanwhile, the expanding market in the Asia-Pacific region demonstrates impressive potential for future growth. Rising investments in infrastructure development projects and increasing awareness about risk management amongst businesses in countries like China and India have fueled market expansion. Additionally, government policies promoting the adoption of such insurance products have catalyzed growth in this region.

In contrast, regions such as Latin America and Africa exhibit relatively slower growth compared to other markets. However, there is still notable progress in these areas due to economic developments and increasing adoption of technological advancements by industries.

The global equipment breakdown insurance market continues to flourish across diverse geographical regions. It plays a crucial role in safeguarding businesses against unforeseen events that can cause costly damage to essential machinery and other vital assets. The steady expansion of this market reflects its importance in modern industry as businesses recognize the need for adequate risk management

COMPETITIVE PLAYERS

In today's competitive world, the need for insurance policies to protect one's valuable assets and investments is more crucial than ever. One such important policy is Equipment Breakdown Insurance, which caters to businesses and individuals' needs. This form of insurance covers the unexpected breakdown of essential equipment which can lead to severe financial implications or a loss in productivity.

Many key players have emerged in the global Equipment Breakdown Insurance market, and it is essential to be aware of these major contributors to make informed decisions when choosing an insurance provider. One such significant player is Allianz SE, a multinational company providing various financial services including insurance products. With a presence in over 70 countries worldwide, Allianz SE has built a reputation for offering comprehensive coverage and personalized solutions to its clients.

Another prominent competitor in this industry is the Allstate Corporation. Known primarily for its auto insurance products, Allstate has also expanded into other forms of coverage, including equipment breakdown protection. Offering a wide range of policies to cater to different requirements and budgets, Allstate has become a sought-after choice for many who are seeking reliable equipment breakdown insurance solutions.

These prominent names in the Equipment Breakdown Insurance market are continually striving to improve their offerings while maintaining customer satisfaction as their top priority. By staying updated on recent developments and advancements in technology within this industry, clients can ensure that they select an appropriate insurance provider that meets their specific needs. Furthermore, understanding the significance and nuances associated with equipment breakdown insurance will help individuals and businesses alike make well-informed decisions when it comes to safeguarding their valuable assets for long-term success and stability.

Equipment Breakdown Insurance Market Key Segments:

By Product Type

- Mechanical

- Electrical

- Computers & Communications

- Air Conditioners & Refrigeration Systems

- Boilers & Pressure Equipment

By Application

- Business

- Manufacturing

Key Global Equipment Breakdown Insurance Industry Players

- Allianz SE

- Allstate Corporation

- Aviva plc

- Westfield

- Axis Bank Limited

- Nationwide Mutual Insurance Company

- CNA Financial Corporation

- Liberty Mutual Insurance Company

- Arch Capital Group Ltd

- FM Global

- AXA XL

- Great American Insurance Group

- Travelers

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252