MARKET OVERVIEW

The Global Equestrian Apparel market, as an entity within the wider equine industry, stands as a niche yet vibrant sector focused entirely on the design and manufacturing of apparel for both the rider and the observer. As equestrianism developed from merely a pleasant pastime to one involving life styling, specialized clothing appeared to be in demand, thereby carving out this niche into an important one.

The equestrian apparel catalogue is vast, covering equipment requirements for riders ranging from fundamental needs in different disciplines (dressage, showjumping, and leisure riding). It consists of breeches, jackets, boots, and helmets, and it hopefully finds favor in both form and function-the tension of the previous and the present in the equestrian industry.

Recent changes in technology, market trends of consumers, and trend changes in style have greatly influenced the Global Equestrian Apparel market in the last two decades. The market today is flooded with traditional materials-wool and leather-but also modern fabrics, which are more performance-oriented, durable, and comfortable. Customization offered further options to allow riders to express individuality through designs and embellishments.

Globalization of equestrian sports, conversely, created enhanced requirement for specialized apparel demands, since outfits ought to endure varied climates and terrains. This has thus bolstered collaboration between renowned brands and equestrian athletes on product development for the very specific needs of competitive riders and recreational riders across the globe.

The boom in e-commerce has turned the look of the Global Equestrian Apparel market upside down, granting clientele immediate access to a spectrum of products from established brands to fledgling designers. This online convenience, cost-efficiency, and additional access for riders to peruse and buy goods tailored to their unique needs and preferences may be viewed as an added blessing in disguise.

The Global Equestrian Apparels are subject to threats such as changing prices of raw materials, government regulations, and competition from cheap imitations, yet they continue to thrive true to the spirit of equestrianism and perfectionism. The players are involved in constant innovation and adaptation through technological and sustainable efforts to improve product quality while streamlining operation processes so as to reduce environmental impact.

The Global Equestrian Apparel market, therefore, looking ahead, will undeniably shine on the backdrop of the growing popularity of equestrian sports, improved participation, and enhanced disposable incomes in the underdeveloped markets. Moving further, as the industry grows, stakeholders are advised to keep a watchful eye on welcoming changes and grabbing opportunities toward sustaining the growth and dynamism of this fast-evolving industry.

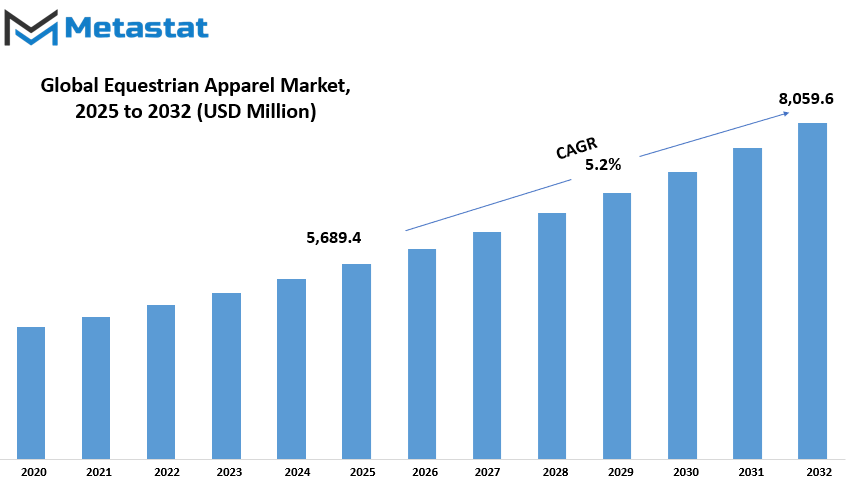

Global Equestrian Apparel market is estimated to reach $8,059.6 Million by 2032; growing at a CAGR of 5.2% from 2025 to 2032.

GROWTH FACTORS

Various factors such as sports culture, lifestyle choices, and the rising realization of safety and style have all contributed to the steady growth pattern of the Global Equestrian Apparel Market. The growth of equestrian sports is one such large influencing factor since equestrian sports have become trendy. From work to leisure, with people's increasing involvement in riding, so has the increase in demand for riding apparel such as helmets, riding boots, jackets, and breeches. These items not only serve as fashion statements; they are essential to performance and protection. Nowadays, one sees an increase in rider awareness regarding the need for wearing good tack that does not only prevent injuries but enhances the riding experience. So, of course, as more people take up riding as a sport, the greater the demand for good quality apparel for equestrian purposes.

Furthermore, the growth in disposable income across markets is another major catalyst propelling this market. Purchase for high-end equestrian gear is now an increased possibility because the price is now of little if moderate constraint. Premium equestrian clothing, mostly fabricated from high-tech material giving comfort, safety, and performance, is increasingly in vogue. This in turn has influenced the consumer behavior towards a more innovative approach from the brands to upgrade their products, thereby establishing a competitive yet flourishing market.

Where there is an opening for new advances, for example, in ultra-modern technology, there also lie obstacles in the way of market opportunities. The primary market-holding difference is considered to be the expense incurred by equestrian apparel, generally high. This provision of gear is costly on account of the materials used and the amount of workmanship involved, making it hard for the $200 Rule-type casual or beginner rider who was hoping to enter the sport. Groups are relatively few; many consider it too costly and will not ride at all, inhibiting the possible growth from this group. Then, of course, equestrian sports are pretty seasonal. The demand for riding gear usually comes and goes, depending on the season, resulting in occasional spikes in revenue for these businesses, which can affect their stability.

Nevertheless, alongside the disadvantages hanging over the market are some strong opportunities expected to take the lead and drive future growth. Top of the list is the growing fame of online shopping. With the availability of digital platforms, the equestrian apparel buyers around the world can access the products and make their purchases even in the areas with limited or no physical stores. This ease of accessibility is bound to widen the reach of the market. Another opportunity gradually drifting in is the movement toward sustainable materials. More and more consumers are on the lookout for green alternatives, and those brands that practice ethical production might actually earn themselves a loyal customer base that will give them a competitive edge over others.

MARKET SEGMENTATION

By Apparel Types

In fact, the equestrian apparel market is gaining momentum as a result of horse riding sport, in reality, becoming more and more popular or joined into leisure activities where people would like to participate. The very same increase in the consumption of horse riding apparel goes hand in hand with the increase in horse riders. These garments are made in a stylistic manner so as to provide comfort, safety, and performance while riding. Such increase in the household size has also been matched by an increase in the numbers spent on horse riding uniforms. These are garments fashioned into style so that it brings comfort, safety, and better performance whilst in riding. Apparel-wise, some categories stand out amongst several others, popular for their uses.

The show shirt category is an important product in the equestrian apparel market valued at $687.0 million. These are typically worn for competitions, and the purpose is to be neat-looking while comfortable for the rider. Polo shirts and tops are valued as well and are popular for casual riding. They generally feature breathable fabric and a loose fit that offers a fantastic option for training or just riding for pleasure.

Show jackets are required for all formal functions and competitions. They keep to dressmaker conceptions of the trimmest cut possible, while intelligently constructed to allow full movement. Breeches or riding pants are obligatory articles of attire in any rider's closet. These are fitted pant-trousers tailored to limit chafing and ensure grip while seated on the saddle. Tights are also in vogue, especially among the young, having the advantage of being lightweight and stretchy, providing a more comfortable wear compared to breeches.

Helmets are one of the very important pieces of gear in riding. Helmets are necessary for keeping the rider safe, and they are made with safety standards in mind. Belts, socks, and hats might be a little thing, but they help complete the outfit. The belt helps the overall look and maintains the breeches in place, whilst the proper socks assist the rider in comfort and prevent blisters. Hats are an accessory used mainly to protect the rider from the sun when riding outdoors.

All the other items available in the market include gloves, vests, and base layers for the convenience and performance of a rider. This is a continuing evolution of the market as riders become more conscious of what they wear and why it matters. The focus continues to be on creating quality and tiny mouthfuls. Each article of clothing stands for its own purpose, allowing riders to enjoy their time in the saddle with confidence.

By Consumer Group

Just like the past years, the global equestrian apparel industry has continued to grow with the rise of interest in horse riding as a sport and as a leisure activity. From Increased participation in horse riding activities, there is a greater need for clothing which stresses comfort, safety, and style. Equestrian clothing is therefore seen to serve both aesthetic and functional purposes. Riding apparel would include things like riding boots, helmet, breeches, jackets, and gloves designed with the rider in mind-whether the rider is training, competing, or social riding. Further segmentation covers men, women, and children, based on their particular tastes and requirements.

For men, practicality and durability are often such factors of preference. Men tend to look for outfits designed to withstand rigorous use while providing fit, protection, and comfort. Brands catering to this demographic emphasize durability in their choice of materials and timeless styling. On the contrary, women's equestrian apparel allows for a brimming pallet of color and design and is fit-wise more diverse. Women typically appreciate clothing that offers equal doses of performance and style, so many brands have collections dedicated to this end. The increasing participation of women in equestrianism has gradually shifted focus toward this segment, thus bringing more design options and innovations.

Safety and comfort are the foremost concerns with children. Since young riders are still learning and developing their skills, their clothing should allow for movement while giving them protection. Children-specific equestrian gear companies tend to use soft materials and design for ease of use. Parents are more likely to spend money on a quality product that keeps their child safe while riding.

Other factors, apart from consumer preferences, driving the market include disposable income increase, equestrian sports awareness, and outdoor activity promotion. Increasingly, riding is seen as good exercise and a pleasurable activity needing complementing gear. The influences of social networking and fashion trends have also been crucial, especially when it comes to captivating a younger audience. These consumers want well-functioning products and also want to look good on or off the field.

Therefore, with each new generation, the demand for more stylish, comfortable, and safe apparel will continue to grow as people of all ages take part in equestrian activities. In time, this will prompt brands to expand their collections in order to meet the needs of their respective consumers.

By Distribution Channel

The equestrian apparel market has been growing steadily over the years due mainly to increased interest in riding, for sport and leisure alike. North America and Europe have seen people from all walks of life involved in equestrian sports, thus giving a sustained demand for quality riding apparel. This market is meant to include all clothing items a rider might wear-like jackets, breeches, helmets, boots, gloves-to ride comfortably, safely, and stylishly. Function and fashion blend into one, and that is probably why more and more target consumers are investing in these types of clothing, which brands are answering with an introduction of more innovative line collections and better designs to suit the changing preferences.

Essentially, one of the areas that will shape the future of this market is the tendency of the distribution channel. It is the course through which the product reaches the consumer that is fundamental to his or her buying decision. The market can be further divided into such segments as: E-commerce Websites, Company-owned Websites, Specialty Stores, Hypermarkets & Departmental Stores, and Others. Customers can browse riding apparel without actually stepping into a shop, coming to see the glory of E-commerce websites. Most of the time they entertain customers with a wide range of choices along with in-detail size guides and customer reviews, which help more in a smarter way of decisions.

Some other channels might include local retailers or pop-up stores at equestrian events. These can give a rider an easy, quick way to grab what he or she needs on the spot. Each of these channels has its own advantages and disadvantages, and many brands nowadays use a combination of them to get to different types of consumers. Because consumer habits are changing with technology altering shopping patterns, the way equestrian apparel sells will surely continue to evolve. The constant factor, however, will be the need for quality, comfort, and accessibility for the equipment that hold up this sport, which is quite different yet very passionate toward keeping.

Of course, specialty stores carry a very strong part in the market. They might even have limited-collection top-of-the-line items and provide personal assistance that is especially beneficial for the newbies or those whose shopping for specific items end. Hypermarkets and departmental stores make horse-riding apparel matching other everyday items available and convenient for customers. Admittedly, such convenience doesn't come with the same kind of know-how specialist shops have, but they are mostly patronized by the casual rider or by parents shopping for kids.

Other channels could include local retail outlets; pop-up stores at equestrian events, which could provide quick and easy approaches for riding enthusiasts to grab what they need on-site, have not been left out. Each of these channels has its own pros and cons, and many brands are now combining them to make their presence felt by different types of customers. Changing consumer habits, along with the technological changes in how shoppers tend to shop, will keep changing the scene for selling equestrian clothing. What stays constant will be the need for gear quality, comfort, and accessibility in this peculiar but passionate sport.

By Price Category

The Global Equestrian Apparel Market has the pricewise three main segments of Low, Medium, and High or Premium. The varying categories reflect the different product requirements brought forth by the range of needs and budgets worldwide. The Low segment normally includes inexpensive apparel for beginners, casual riders, or anyone who rides merely as a hobby. These products often tend to basic comfort and safety features without added embellishments in looks or performance. However, while affordable, many brands assure durability and basic functionality in this segment to ensure that they can withstand regular use.

The Middle range offers compliance with quality and affordability. This category sells to riders who want more than just the basics at prices that don't reach the top tier. Medium-rich apparel often incorporates good-quality fabrics, better fits, and worthwhile features such as moisture control, more flexibility, and breathability. This segment accommodates an extensive cross-section of riders, from amateur competitors to those who ride for training or recreation more often. Many reputable brands within this price range provide a vast assortment that allows riders to dress with style while remaining comfortable and performance oriented.

At the ultimate level is the High or Premium category for the professional rider, competitors, and deeply devoted professionals in this field. It includes products made from ultra-premium materials with an emphasis on performance, style, and precision. Premium equestrian apparel is also prepared with the most advanced technology in fabrics and fit, along with unique designs that reflect both function and fashion. These offer products that impact a rider's performance while ensuring extreme durability and a fashionable expression in which the appearance fits the bill of formal competitions.

Demand in each category is owed to various factors, such as income levels, purpose of riding, and regional market trends. With the increased number of up-and-coming equestrian sports and awareness regarding the importance of riding with the right gear, every price segment finds its share and place in the equestrian apparel market. The global equestrian apparel market will provide all sorts of options to suit any riders, whether they be new, intermediate, or even those training at the highest levels. Innovation is taking place within all categories of equestrian apparel, thus enabling riders across all levels to find a suitable product to meet their needs and budgets along with comfort and safety.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$5,689.4 million |

|

Market Size by 2032 |

$8,059.6 Million |

|

Growth Rate from 2025 to 2032 |

5.2% |

|

Base Year |

2024 |

|

Regions Covered |

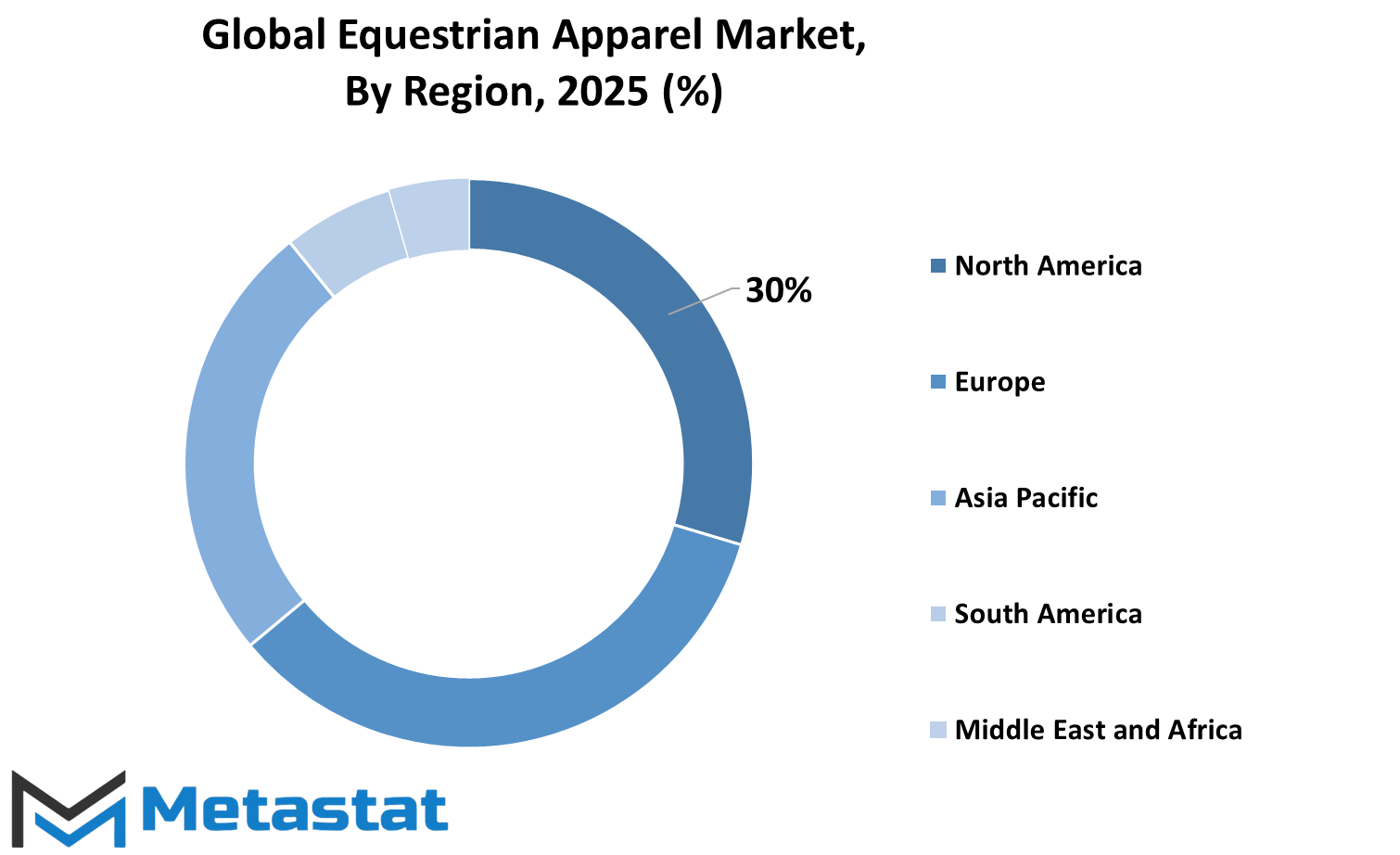

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The world is richly divided into North America, South America, Asia Pacific, the Middle East, Africa, and Europe, and so is the global equestrian apparel market. All these continents possess countries with varying different sections contributing towards the growth and demand of this market. North America involves three countries: the United States, Canada, and Mexico. The activities of individuals from these countries promote the demand for riding clothes and gear. The United States has a very big contribution in this regard as equestrian events are quite popular and several professional as well as amateur riders exist there. Canada and Mexico also show steady growth in this area with additional ever-increasing interest and growing horse riding communities.

For Europe, the market includes places like the United Kingdom, Germany, France, Italy, and the Rest of Europe. The region has a long horse riding culture that still remains popular with various ages. The existence of famous brands, a long-lasting bond with traditional practices in riding, and, finally, the horse riding competitions help preserve the demand for superior quality products in the form of attire and gear. Functionality and fashion are in high demand by this region's populace, so the brands go for innovation designs backed by strong raw materials.

In addition, the most significant region is Asia-Pacific, including countries such as India, China, Japan, and South Korea, and the Rest of Asia-Pacific. While some are emerging markets for equestrian activity, they are taking the steps to enhance the sport's popularity. Horse riding schools and clubs have sprouted considerably in China and India. This increased method of exposure is gradually increasing the demand for appropriate clothing and accessories. This growth also is contributed to by Japan and South Korea, with organized sporting events and consistent consumer demand.

There are Brazil and Argentina driving the South American market, with the Rest of South America contributing at a smaller scale. These countries have shown strong equestrian traditions and riding by people into sports as well as hobbies. This maintains a steady need for comfortable, reliable apparel.

The Middle East and Africa have GCC Countries, Egypt, South Africa, and the Rest of Middle East & Africa. Among the regions, the Middle East has shown a great deal of interest in luxury horse riding apparel, while South Africa is consistently driving the sport by means of events and clubs. However, even though differing by region, such differences in the craving for a product keep the global market busy.

COMPETITIVE PLAYERS

In recent years, the worldwide demand for equestrian apparel has consistently exhibited growth due to renewed enthusiasm for horseback riding as a sport and leisure activity. The proper riding gear has slowly gained traction, as equestrian sports have become popular among an increasing number of people across the globe. Riders want comfort and safety but also a sense of style and performance. Hence, many companies were forced by consumer expectations into designing quality apparel that is durable and fashionable for amateurs and professionals alike. The changing lifestyle and awareness about the use of protective equipment while riding enhances variability in playing a role in the market.

Most importantly, the increase in disposable income in many regions has enabled more people to afford luxuries such as horse riding. Thus, demand for well-constructed apparel goes up. Product innovation is an emphasis here too. Several brands design improvements in textile technology, targeting breathability, flexibility, and protective properties. Some products are even made from sustainable materials to meet rising demand for eco-friendly fashion. Together with functionality, today many riders care about the looks of what they wear, thus riding gear deemed stylish is in greater demand than ever.

While the market is full of competition, it has an equally potent force from some of the key players. These include Animo S.R.L., LeMieux Ltd., Samshield, Equestrian Stockholm, Equiline S.r.l., Ariat International Inc., Cavallo GmbH&Co.KG, Charles Owen, HKM Sports Equipment GmbH, Kingsland Equestrian, Cavalleria Toscana, Ladyhall Ltd.(Equetech), Mountain Horse, WeatherBeeta, PS of Sweden, Tredstep Ireland, FITS Riding Ltd. and Kerrits Equestrian Apparel. These companies address the market need for quality, comfort, and modern design to satisfy the expectations of riders around the globe. They make an additional investment in R&D activities to forge ahead and introduce safe and good-looking products.

Online shopping facilitates the market further, as people can find and purchase the equipment they need while staying at home virtually. With access to many more styles, sizes, and brands, consumers have plenty to choose from to suit themselves. With more and more individuals taking on horse riding and able-to-aim-for companies coming up with ever-better and attractive products forward, continued growth is expected for this market.

Equestrian Apparel Market Key Segments:

By Apparel Types

- Show Shirts

- Polo Shirts & Tops

- Show Jackets

- Breeches/Riding Pants

- Tights

- Helmets

- Belts

- Socks

- Hats

- Others

By Consumer Group

- Men

- Women

- Children

By Distribution Channel

- E-commerce Websites

- Company-owned Websites

- Specialty Stores

- Hypermarkets & Departmental Stores

- Others

By Price Category

- Low

- Medium

- High/Premium

Key Global Equestrian Apparel Industry Players

- Animo S.R.L.

- LeMieux Ltd.

- Samshield

- Equestrian Stockholm

- Equiline S.r.l

- Ariat International, Inc.

- Cavallo GmbH & Co. KG

- Charles Owen

- HKM Sports Equipment GmbH

- Kingsland Equestrian

- Cavalleria Toscana

- Ladyhall Ltd. (Equetech)

- Mountain Horse

- WeatherBeeta

- PS of Sweden

- Tredstep Ireland

- FITS Riding Ltd.

- Kerrits Equestrian Apparel

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383