Market Overview

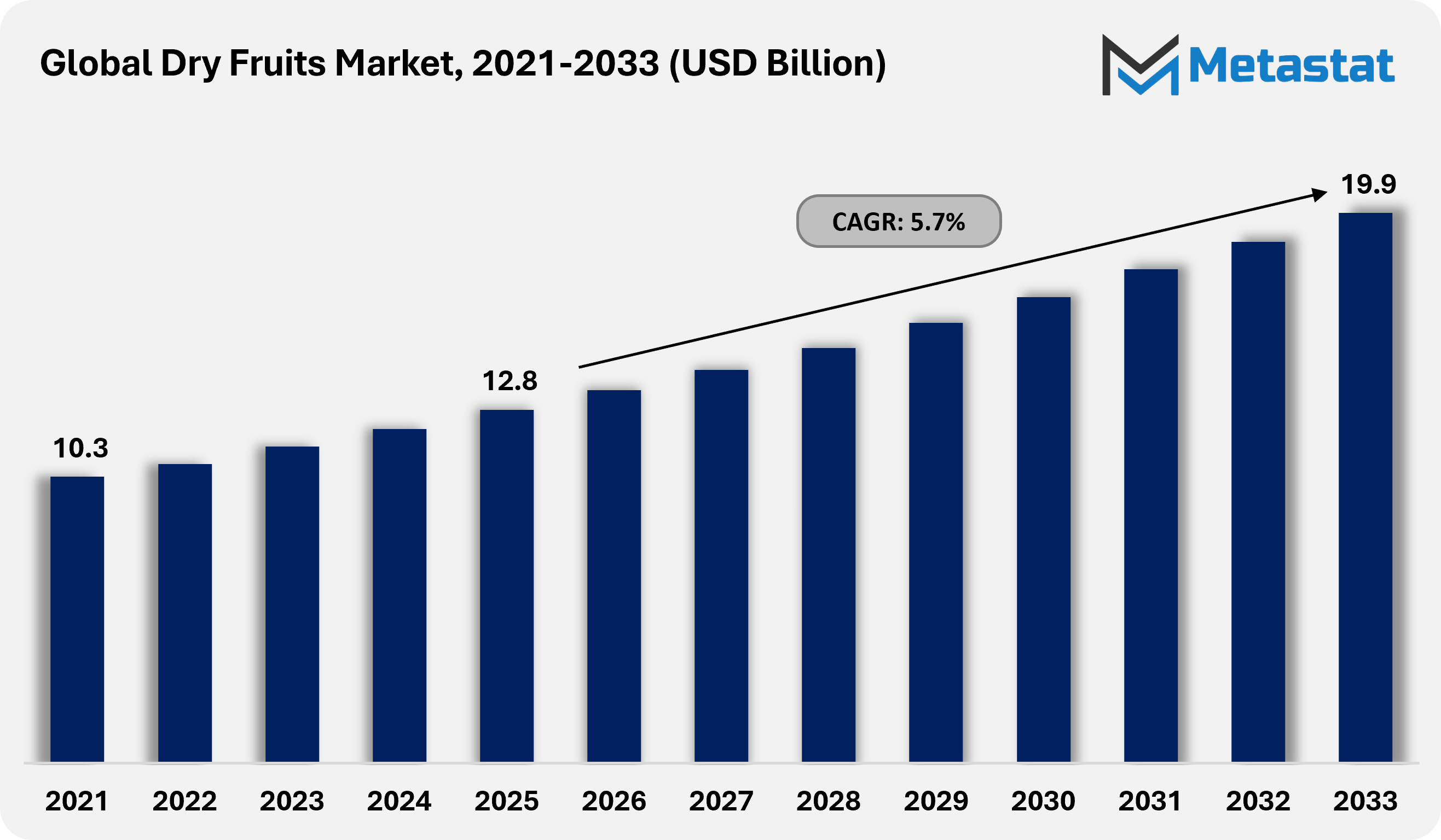

The global Dry Fruits market size was valued at USD 12.8 billion in 2025. The market is projected to grow from USD 13.5 billion in 2026 to USD 19.9 billion by 2033, exhibiting a CAGR of 5.7% during the forecast period.

The global manufacturing of dry fruits continues to expand owing to consumer preference as nutritious snacks and long-lasting cooking components. The advancement in processing technologies, new applications in bakery products, confectioneries, breakfast cereals, and sweeteners is propelling the market acceptance. The traditional dried fruit production areas have started using modern sorting, grading, and packaging systems to enhance their operational efficiency and product quality owing to global market competition.

The worldwide dried fruit production reached 3,355,486 metric tons during 2023-24, which shows ongoing growth throughout both developed and developing countries. The main products in the industry include dates and dried grapes that generate 78% of all production is a key market driving force. Increase backing from the Middle East and North Africa and South Asia regions is the key driving factor of Dates segment which contributes to 42% of the production market share in 2024. These regions maintain high production through their suitable climate and expanding orchard areas. The supply contains dried grapes, which include raisins, sultanas, and currants that major production centers exist in Turkey, the United States, Iran, Chile, and India.

The sector receives its main production from these two key categories, which means any alteration in their harvest amounts will immediately affect worldwide pricing and international trade flows. Consumers have started using dried fruits in energy bars, functional foods, smoothies, and premium snack products owing to clean-label plant-based eating popularity. The growing global market demand requires producers and exporters to focus on quality control systems, traceability methods, and sustainable farming practices for maintaining their market position.

Global Dry Fruits Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

- Global Dry Fruits market valued at USD 12.8 billion in 2025, growing at a CAGR of around 5.7% through 2033, with potential to exceed USD 19.9 billion.

- North America holds 29.1% in 2025 with US leading the market share in 2026.

- Organic segment account for a market share of 34.7% in 2025, driving innovation and expanding applications through intense research.

- Key trends driving growth: Rising consumption of Healthy & Nutrient-Dense Snacks and growing use in Bakery, Confectionery, and Food Processing.

- Opportunities include the expansion of value-added and organic dry fruit products.

- Key Insight: The dry-fruits market is steadily advancing toward premium, organic, and value-added products as health-focused consumers drive demand for cleaner, nutrient-dense snacking and versatile food ingredients.

Market Dynamics

Growth Drivers:

Rising Preference for Healthy, Nutrient-Rich Snacks:

Consumers appreciate the natural fibres, vitamins, antioxidants, and sweetness incorporated in dry fruits which makes them a great option for daily snacking. Dry fruits have more social support, and the increased focus on immunity-building foods which makes them a great option for daily snacking. Busy urban lifestyles have also increased regular consumption. Dry-fruits have become more appealing owing to the factor that they are easier to carry around in convenient formats such as, ready-to-eat pouches, trail mixes, and single-serve snacks.

Increasing Use in Bakery, Confectionery, and Packaged Foods:

Reflective of both enhancing taste and nutrition, dry fruits have become a key ingredient of baked goods and a range of other products including, confectionery, cereals, dairy, and even in energy bars. Additionally, the long shelf life, compact packaging, and easy storage make dry fruits ideal for large food producers. The premiumization of baked goods and the rise of artisanal brands have also positively impacted the dry fruit usage, as these brands typically have a larger variety of dry fruits for flavor diversity and premiumization. With the increasing demand for convenience products, the demand for dried fruit in food products is expanding in the forecast period.

Restraints & Challenges

High Price Instability in Raw Materials:

Different sources attribute the price volatility of dry fruits such as weather, crops, and supply chains. Critical producing areas frequently encounter drought, heat waves, and water shortages, decreasing product yields like almonds, cashews, raisins, and dates. The complexity of pricing, unstable margin of trade, currency fluctuations, and price volatility might hamper the growth of dry fruits market.

Quality Concerns and Adulteration Risks:

Incorrect storage, poor drying, incorrect processing leads to mold or loss of nutrients within dry fruits. Some regions are notorious for adulteration, such as adding lower-grade products, artificial colorings, or sweeteners. These problems lead to a loss of consumer confidence, which drives the need for increased testing, certification, and control of such products. Countries that depend on imports of such products are also faced with issues and challenges of uneven standards from their suppliers. They factors are expected to hinder the market growth in the forecast period.

Opportunities

Rising Demand for Value-Added and Organic Dry Fruit Products:

Increased customer interest within flavored nuts, coated dried fruits, chopped fruit and nut mixes, freeze-dried fruits, dried fruit purees and pastes is a key opportunity within dry fruit market. The increasing popularity of organic dried fruit is driving demand for the products that are more likely to be chemical-free and grown sustainably. Gourmet blends, ready-to-cook ingredients, and premium packaging offer additional chances to create value-added products. The quick expansion of e-commerce, health-focused retail, and gifting has increased demand for premium, unique dried fruits.

Market Segmentation Analysis

The global Dry Fruits market is mainly classified based on Nature, Product Type, Application, and Distribution Channel.

By Nature, the market is further segmented into:

- Organic

Growing health-conscious consumers gravitate to organic dry fruits owing to pesticides, fertilizers, or chemicals free products. The organic sector of the dry fruit market is expanding at the fastest rate owing to the demand for sustainable products and increased specialized farming, certification, and processing methods. The organic market segment is expanding due to consumer demand for clean label and sustainably produced foods.

- Conventional

Conventional dry fruits are cultivated using standard practices in dry fruit agriculture, and as a result they are economically priced and abundantly available. The economically priced products, availability for everyday consumption, and ease bulk purchases will propel the conventional market segment within the dry fruits market.

By Product Type the market is divided into:

- Almonds

Almonds are a popular snack and key ingredient in bakery, confectionery, and health foods. Almonds are loved for their high protein, healthy fats, and versatility. They are a staple in both developed and emerging markets.

- Cashews

Cashews known for their creamy texture and rich flavor, cashews are widely used in snacks, sweets, sauces, desserts, and plant-based recipes. They also enjoy strong demand in international markets.

- Dried Figs

Dried Figs are rich in natural fiber and sugars. The dried figs are consumed directly or used in bakery and functional foods. They are especially popular in Middle Eastern and Mediterranean cuisines.

- Walnuts

Packed with omega 3 fatty acids, walnuts are usually added to baked goods, cereals, and savory dishes. Their nutritional benefits have driven higher consumption, particularly among health-conscious consumers.

- Table Dates

Table Dates eaten as a snack or used as natural sweeteners in smoothies, desserts, and energy bars. The table dates are also essential in traditional sweets and festive preparations, with strong demand in the Middle East, Africa, and South Asia.

- Dried Grapes

Dried Grapes are used in bakery items, cereals, trail mixes, and confectionery. Major producers include Turkey, the U.S., and India, supporting global supply.

- Dried Apricots

Dried Apricots are tangy-sweet and rich in vitamins and are enjoyed as snacks or used in bakery, salads, and desserts. Their popularity is rising in health-focused and gourmet food markets owing to the tangy-sweet flavour.

- Prunes

Prunes are known for their digestive health benefits. Prunes are incorporated into cereals, snacks, sauces, and desserts to enhance the fiber of the products. They are especially popular in Western markets for their natural laxative properties.

- Others (Dried Blueberries, Dried Oranges, etc)

The Others segment include specialty dried fruits cater to premium and gourmet markets such as dried blueberries, dried oranges, etc. Demand for exotic and unique flavors continues to grow within dry fruit market.

By Application the market is further divided into:

- Bakery

Dry fruits enhance breads, cakes, cookies, and pastries by adding flavor, texture, and nutrition. Industrial and artisanal bakeries use dry fruits extensively. The growth of packaged bakery products is boosting the dry fruits market for the bakery segment further.

- Confectioneries

Dry fruits improve taste, richness, and visual appeal for chocolates, candies, energy bars, and nougats. Premium brands rely on high-quality nuts and fruits for differentiation which will propel the market segment for the dry fruits market.

- Household Consumption

Dry fruits are enjoyed directly as snacks or used in cooking and traditional sweets. They are particularly popular during festivals, celebrations, and gifting seasons. Convenient packaging has helped increase household adoption which is a key driving factor for this segment.

- Others (Dairy and Ice Cream, Baby Food, etc)

The Others segment include dry fruits that are added to yogurts, ice creams, baby foods, and functional health products to enhance their taste, texture, and nutrition. Rising interest in health-conscious and infant nutrition products is a key driving force for this segment.

By Distribution Channel the global Dry Fruits market is divided as:

- Supermarkets and Hypermarkets

Supermarkets & Hypermarkets offering a wide variety of packaged dry fruits from domestic and international brands, these stores attract consumers with competitive pricing, promotions, and easy access.

- Specialty Stores

Specialty Stores focused on premium, imported, and artisanal varieties, and appeal to consumers seeking high-quality or exotic products. Personalized service and curated selections are key impacting factors of this segment.

- Retail Grocery Stores

Retail grocery stores provide convenient pack sizes and everyday options, catering to regular consumers and bulk buyers in urban and semi-urban areas.

- Online

E-commerce platforms offer convenience, bulk packs, subscriptions, and access to a broad range of products. Online sales are growing rapidly due to digital adoption and delivery services. The growing e-commerce and easy of ordering will further fuel the market growth of online sales channel in dry fruits market.

- Others (Convenience Stores, Dry Fruit Marts, etc)

The Others segment covers small-format stores which provide quick access to popular dry fruits, especially in urban areas, and are important for impulse purchases.

By Region:

Based on geography, the global dry fruits market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

Asia Pacific Dry Fruits Market is set to expand at a CAGR of 5.7% within the forecast period, reaching a market size (TAM) of USD 6.1 billion by the end of 2033.

Growing consumer preference toward plant-based and nutritious snacks is a key market driver for North America dry fruits market. Due to their high protein and fiber content, as well as antioxidants, dry fruits such as almonds, cashews and raisins are beginning to display as traditional packaged snacks. Dry-fruit mix manufacturers are innovating to accommodate busy lifestyles of customers with their roasted and seasoned ready to eat dry-fruit mix recipes. These dry-fruit mixes are in high demand for premium gifts and healthy snacks, increasing market consumption and diversity, hence fueling the expansion dry fruits North America region.

The market for premium priced, certified, value-added packaging, organic, chemical-free and high-quality dry fruits is growing Asia Pacific region particularly in India, Japan, and China. The growing market in the Asia Pacific region has a high potential for premium priced dry fruit products. The growing processed food sector, confectionery brands, and industrial-scale bakeries in the Asia Pacific region are also increasing the opportunity for a bulk supply of dry fruits. This will also provide an opportunity for key player within Asia Pacific to innovate products for export markets.

The Middle East and North Africa remain key hubs for producing and consuming dates, raisins, and figs, while Europe has strong demand for imported almonds, walnuts, and prunes. Seasonal and cultural events like Ramadan, Christmas, and regional festivals drive peak consumption periods. Supply in these regions depends on local cultivation, trade flows, and import-export dynamics. Europe focuses on high-quality, certified, and processed dry-fruit products, while Africa’s market is gradually expanding due to urbanization and rising disposable incomes. Together, these regions balance strong production, premium consumption, and emerging growth opportunities.

Competitive Landscape & Strategic Insights

The dry-fruits industry is shaped by a mix of long-established global leaders, strong regional processors, fast-growing organic brands, and companies that specialize in high-value ingredients. The brands like Sun-Maid Growers, Sunsweet Growers, Del Monte Foods, Setton International Foods, and John B. Sanfilippo & Son (JBSS) continue to hold a strong position in the market, due to their extensive sourcing networks, long-standing grower relationships, and strong presence across supermarkets, club stores, and food-service channels. The key companies play a major role in setting benchmarks for quality, pricing, packaging, and innovation. Their well-developed brands and vertically integrated operations make them competitive in both retail and industrial ingredient markets.

The strong regional players, such as Sunbeam Foods, Mariani Nut Company, Traina, Bergin Fruit and Nut Company, and Dan-D Foods, add depth to the market by meeting the local demand and maintaining solid export capacities. In the Middle East, companies like AL FOAH and Agthia Group are central to the global supply of dates and date-based value-added products. In India and the wider Asia-Pacific region, brands such as Jabsons Foods, Paradise Kesar, and Ministry of Nuts are expanding through premium dry-fruit mixes, flavored offerings, and strong online distribution channels.

On the innovation front, ingredient specialists including Döhler, European Freeze Dry, Chaucer, Ceres Organics, and Naturz Organics are driving the growth of freeze-dried products, organic-certified ingredients, and clean-label inclusions used by bakeries, confectioners, dairy processors, and nutraceutical companies. Their technical expertise gives them a competitive edge in supplying high-margin, ready-to-use ingredients for industrial applications.

Moreover, a growing cluster of organic and ethically focused brands such as Organic Gyaan, Farmley, Naturz Organics, Kiantama Ltd, and Ceres Organics is gaining traction among premium consumers who value certified sourcing, transparency, and sustainability. Private-label and bulk-focused suppliers like Red River Foods Inc, Royal Nut Company, and Zieler & Co. continue to support retailers and food manufacturers looking for consistent quality at competitive prices.

Forecast & Future Outlook

Market size is forecast to rise from USD 12.8 billion in 2025 to over USD 19.9 billion by 2033.

Future growth in the dry-fruits market will be fueled by the global shift toward healthier, nutrient-rich snacking and the rising use of dried fruits across bakery, confectionery, dairy, and plant-based food categories. As organic farming expands, the cleaner and efficient processing technologies will become mainstream and the demand for high-quality, chemical-free products will continue to rise. Innovations such as freeze-dried varieties, flavored mixes, and ready-to-use blends are also helping brands to reach new consumer segments.

Improved cold-chain infrastructure, better grading practices, and stronger quality-control standards will play a key role in increasing product reliability and availability, particularly in fast-growing emerging markets. E-commerce platforms will further boost accessibility by offering wider product choices and convenient delivery options.

Key Global Dry Fruits Industry Players

- Sunbeam Foods

- AL FOAH

- Dan-D Foods Ltd.

- Whitworths

- Bergin Fruit and Nut Company

- angas park

- RED RIVER FOODS INC

- Geobres

- Mariani Nut Company

- Kiantama Ltd

- Sun-Maid Growers

- Sunsweet Growers

- Traina

- Jabsons Foods Pvt Ltd

- Chaucer

- European Freeze Dry

- Del Monte Foods

- Ceres Organics

- Naturz Organics

- Organic Gyaan

- Paradise Kesar

- Döhler

- ZIELER & CO.

- Farmley

- Croc’Ella

- Setton International Foods, Inc.

- JOHN B. SANFILIPPO & SON, INC.

- ROYAL NUT COMPANY

- AgthiaGroup

- Ministry Of Nuts

Report Coverage

This research report categorizes the Dry Fruits market based on key segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Dry Fruits market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market.

The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Dry Fruits market.

|

Report Attributes |

Details |

|

Study Period |

2021-2033 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2033 |

|

Historical Period |

2021-2025 |

|

Growth Rate |

CAGR 5.7% from 2026 to 2033 |

|

Revenue Unit |

USD Billion |

|

Sales Volume Unit |

Kilotons |

|

Segmentation |

By Nature, Product Type, Application, Distribution Channel, and Region |

|

By Nature |

Organic |

|

Conventional |

|

|

By Product Type |

Almonds |

|

Cashews |

|

|

Dried Figs |

|

|

Walnuts |

|

|

Table Dates |

|

|

Dried Grapes |

|

|

Dried Apricots |

|

|

Prunes |

|

|

Others (Dried Blueberries, Dried Oranges, etc) |

|

|

By Application |

Bakery |

|

Confectioneries |

|

|

Household Consumption |

|

|

Others (Dairy and Ice Cream, Baby Food, etc) |

|

|

By Distribution Channel |

Supermarkets and Hypermarkets |

|

Specialty Stores |

|

|

Retail Grocery Stores |

|

|

Online |

|

|

Others (Convenience Stores, Dry Fruit Marts, etc) |

|

|

By Region |

North America (By Nature, Product Type, Application, Distribution Channel, and Country) |

|

|

|

|

|

|

|

Europe (By Nature, Product Type, Application, Distribution Channel, and Country) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asia Pacific (By Nature, Product Type, Application, Distribution Channel, and Country) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

South America (By Nature, Product Type, Application, Distribution Channel, and Country) |

|

|

|

|

|

|

|

|

Middle East and Africa (By Nature, Product Type, Application, Distribution Channel, and Country) |

|

|

|

|

|

|

|

|

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383