MARKET OVERVIEW

The Global Dry Bulk Shipping market would remain an all-important part of international trade by facilitating the transport of raw materials and commodities like coal, grain, iron ore, and other bulk goods. Moving along, with the development of this sector, the rippling effects it generates will go further down the supply chain, impacting regional economies as well as global economic stability. The aforementioned realm will evolve owing to technological upgrades and shifting trade dynamics, shaping how goods are moved across oceans and borders.

Some of the focal characteristics of the Global Dry Bulk Shipping market are its flexibility towards demand. Shipping companies will modify their fleet and operations in line with demand-holding core industries like agriculture, construction, and energy. A combination of vessel design innovations that favor fuel efficiency and low environmental impact would allow the sector to comply with regulations and meet aspirations in sustainability.

Geopolitical change will also alter the global trade route structure by technological advancements. All of these influences will reverse the routes and intensity of bulk shipping operations, tying major shipping firms to update their market approaches and consider diversifying long-term investments in infrastructure. Port cities and logistics hubs will be adapted to these changing dynamics, thereby adding up to the growth of the Global Dry Bulk Shipping market.

Carbon foot printing in shipping seems to gain traction. The concerted march to reduce carbon footprints will characterize the market and balancing eco-friendliness in shipping in years to come. The governments will certainly begin to tighten up on pollution permits for carbon emissions, and then sustainable technology will flood industry. The drumbeat for green solutions will see alternative fuels, better hull designs, and digital tools for route optimization come mainstream, giving shipping operations a reduced environmental footprint.

Digital transformation in the Global Dry Bulk Shipping market will define operational strategy too. Adoption of big data, predictive analytics, and artificial intelligence will contribute immensely to the enhancement of decision-making processes. By using this data-driven approach, shipping companies would be able to predict patterns in demand, optimize loading of their cargoes, and review fleet operations in real-time. Processing vast amounts of data not only improves operational efficiency but also reduces operational costs, thus providing benefits across shipping companies and their clientele.

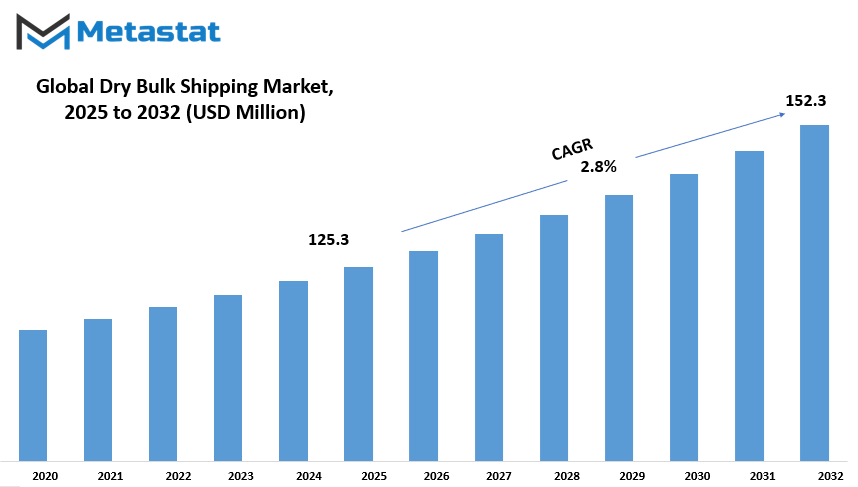

Global Dry Bulk Shipping market is estimated to reach $152.3 Million by 2032; growing at a CAGR of 2.8% from 2025 to 2032.

GROWTH FACTORS

The global dry bulk shipping market operates under a host of challenges-a lot of them come from fluctuating fuel prices coupled with regulatory pressure- but there are heavy drivers like the rising trend of global trade and industrialization. Moreover, this narrative would be incomplete without drifting into the newer opportunities, especially in the renewable energy sector and e-commerce, which mark areas of high growth potential for the sector.

This certainly seems to be the case, for, above all, there has been rapid global change, with myriad factors affecting dry bulk-shipping growth, challenges within the industry, and future opportunities. Therefore, all of these agents can be generally categorized into market drivers, constraints, and opportunities.

The growth in international trade volumes has remained one of the primary drivers of demand for dry bulk shipping services. Dependence on international trade means that with some bulk materials such as coal, grain, and iron ore, shipment would be required. With emerging economies and new trade partnerships, the volumes have increased further, and thus dry bulk shipping becomes an important element to satisfy the transportation demand for these developing markets. Industrialization and further development of infrastructure are other great contributors to the demand for raw materials and dry bulk shipping services. Metals and construction materials eventually become this expansion's life force.

However, a number of adversities clog the dry bulk shipping market, making it difficult for this segment to operate. These changes in fuel prices have a great impact on freight. While fuel prices increase, this would add enormous costs across the entire cargo transport sector rather than remaining favorable to a shipping line for competitive prices. Further, regulatory issues continue to add constraints in the industry. Citizens of the world should change and diversify how they ship to comply with demands of stricter rules like environmental regulations and emissions. This further narrows the operational flexibility available to them by adding cost for compliance to such standards.

But these voids are not totally empty for future growth in dry bulk shipping. One of the opportunities for growth would be the increase of renewable energy projects. When there's a reliance worldwide on the forms of energy to be sustainable, the demand for bulk raw materials like steel, copper, and those metals for constructing renewable energy infrastructure increases. This calls for enhanced opportunities in transport services for these materials across borders. Lastly, e-commerce growth has also seen an increasing need for shorter and faster shipping routes. E-commerce has increased consumer demand for shipping companies to try and find fast and reliable services using new routes and logistics solutions.

MARKET SEGMENTATION

By Cargo Type

A pretty significant section of international trade is the global dry bulk shipping market, which generally carries the bulk raw materials from one place to another. The primary defining parameter for the market is the category of cargo, which can be divided into various segments. Iron ore is the value amounting to $39.7 million, and this makes it one of the most significant commodities in dry bulk shipping, as it serves an essential purpose in steelmaking. This is being transported in mammoth volumes across the globe as well. Coal is another shortlisted major segment under cargo types, as it is directly linked with energy production and industries, thereby making it significant to the bulk shipping industry.

Grains lie among the most significant dry bulk shipping tonnages after iron ore and coal. They further include such agricultural products as wheat, rice, and corn, which are vital food sources for the world. Increased demand for these goods has increased the demand for shipping mobilization to reach them in world markets. Moreover, cement and fertilizers are key raw materials that have their relevance in construction and agriculture, respectively. Such shipping of materials is acknowledged to play a very important part in the global development and food production process.

Steel products aren't generally as heavy as the previously mentioned raw materials, yet they constitute a significant portion of the dry bulk shipping cargo. Steel is used in numerous industries from manufacturing to infrastructure; its transportation is vital for the economic grow. Finally, several other commodities, such as sugar, bauxite, and alumina, are all classified under "Others". Even though these are small in volume compared to the thousands of bulk metric tons, they indeed constitute a significant portion of what dry bulk vessels carry. An example is bauxite, which is an important source of aluminum, with varying applications-from that of automobiles to electronics.

It is quite apparent from the increasing numbers that dry bulk shipping will be an increasing industry segment as the global economy continues to prosper. Segmenting cargo types into categories like iron ore, coal, grains, cement, fertilizers, steel products, and other material shows the very nature of this sector. All of these cargo types have a corresponding important use in every industry across the width and breadth of the globe. Efficient transportation would guarantee such movements fast enough and safely so that these industries can grow and thrive along with the forever-increasing demands of the global population.

By Vessel Type

The global dry bulk shipping market prominently features in world trade and transportation. It serves as a key instrument for the movement of bulk commodities. Examples would include coal, iron ore, grains, and all other essential materials in bulk. One of the major criteria for distinguishing this trade would be vessel types, each with specific functions and features enabling it to carry certain types of cargo. The major vessel types in the dry bulk shipping trade are Capesize, Panamax, Supramax, and Handysize.

The Capesize vessels that are the largest in this category are explicitly constructed for the long-distance transportation of bulk commodities, mainly coal and iron ore. These carriers are too big to go through the Panama Canal and therefore are forced to take longer routes around either Africa via the Cape of Good Hope or Cape Horn. Their very large dimensions make them ideal for heavy volumes loading over lengthy distances, typically from key mining areas into nearby industrial centers.

Following this would be Panamax vessels which are smaller than Capesize vessels but still quite large to carry other hefty amounts of cargo. Thus, these vessels are usually designed in an in-between situation that is set in a particular given size range fitting through the Panama Canal that forms a significant consideration by every shipping company that wishes to reduce its time and costs in transit. Panamax vessels mostly carry such bulk commodities as grain and coal and are therefore put to use regionally, where access to shipping lanes calls for more flexible options.

Meanwhile, the Supramax vessels are a step smaller than Panamax and handle various bulk products, including agricultural products, coals, and steels. These vessels equate between size and versatility, and hence they are highly desired for large shipments as well as small regional transport. Supramax vessels operate in regions whose ports are available to their size, allowing them access to larger hinterlands.

By far, Handysize vessels are the smallest in the dry bulk category. Handysize vessels have high versatility and a very good haven-Masters that enable this category of ships to reach ports that larger vessels cannot. Typically Handle vessels load lighter cargo, which implies that they normally engage in comparatively short distances on major trades list. They are widely applied for the transport of non-grain agricultural products, fertilizers, and those lighter bulk items not requiring the services of bigger ships. Handysize acts as the backbone for regional trade and shorter trades due to their flexibility, which is complemented by efficiency.

The aforementioned classification of the global dry bulk shipping market is thus characterized among these vessel types in addressing divergent needs of trade around the globe. Each vessel type plays a relevant role in furthering the seamless flow of goods from one part of the globe to another. By being knowledgeable regarding their capabilities, shipping companies are able to hone and fine-tune their operations so as to provide the most effective transportation solution for goods of any nature.

By Application

The global dry bulk shipping market forms an essential part of the transportation industry by performing an indispensable role with respect to bulk movement over the oceans by sea. Throughout the years, actions of various parameters included developments of industries that demand dry bulk commodities at various stages in production. Dry bulk shipping is significant in global supply chains and varies according to the range of patterns that change with economic activity and trade relationships. Indeed, the sheer size of the market is such that there are many submarkets which cater to quite different types of cargo.

Among them, the market is further classified into applications and further divided into various industries. The broad categories under which various applications are classified include mining, agriculture, construction, industrial manufacturing, and a number of other smaller sectors. Individual applications may all have distinct requirements and applications in dry bulk shipping, thus impacting the overall demand in the market.

Mining is one of those activities using dry bulk shipping. Under this sector, transport of bulk raw materials like coal, ores, minerals would be very significant in the industries around the world because these are used for energy generation, construction, and production processes in various stages of manufacturing. Similarly, dry bulk shipping is crucial in agriculture for commodity movements like crops especial grains, cereals, and other bulk agricultural products. These shipments greatly experience the steady supply of food and raw materials throughout the world, catering to both domestic needs and external trade.

The construction industry contributes heavily to the demand for dry bulk shipping. This industry also uses sand, cement, and other bulk materials, all requiring efficient and reliable shipping methods to meet construction schedules and project needs. It will be appreciated that the industrial manufacturing sector exists within a continuum of differing production activities and each of these would hinge on dry bulk shipping for the transportation of raw materials and intermediate goods in the production of finished products.

Lastly, other smaller sectors that also constitute a part of dry bulk shipping include chemicals, fertilizers, and other specialized areas. Though not as big as the sectors mentioned earlier, these sectors are certainly drivers of the overall market demand.

To conclude, the global dry bulk shipping market is driven by many applications influencing demand for bulk transport in their own way. Mining, agriculture, construction, and industrial manufacturing present the main sectors of the market, and these, in turn, depend heavily on dry bulk shipping to facilitate the transport of various raw materials of importance. As industries continue to evolve globally, the demand for dry bulk shipping will always be synonymously tied to the supply chain.

By End-User

The dry bulk shipping market worldwide impacts the transportation of vital goods, such as coal, iron ore, and grains, and other bulk commodities across the continents. It forms a lifeline within the global supply chain by establishing connectivity between producers and consumers in various industries. The dry bulk shipping market basically comprises two classes of end users- exporters and importers. Importers and exporters jointly play an enormous role in the dynamics of dry bulk shipping, and the consequences of their activities are felt in international trade.

Exporters may be defined as those countries or companies which export raw materials or bulk goods to other countries. They usually include large producers of commodities, such as coal, iron ore, etc., highly needed in industries all over the world. For example, Australia and Brazil are leading exporters of iron ore, while export of grains is dominated by the USA and Russia. Exporters, therefore, demand dry bulk shipping mainly for the movement of large quantities of such goods in a timely manner to the global market. The efficiency of this process hinges upon shipping companies that provide such work in large bulk carriers such that the exports reach their destinations quickly and economically.

The term importers refer to countries or firms that require bulk commodities for their industries but under-produce them. Importing customarily entails large-scale industrialized nations or some emerging economies that need resources for manufacturing, energy production, and construction under grown-sized commercial category dry bulk commodities like coal, iron ore. China and India, for instance, are large-scale importers of coal and iron ore to feed their proliferated economies. Therefore, importers demand dry bulk shipping to ensure that those resources are available to catalyze their economic growth and sustain their industrial activities.

Both exporters and importers are important to the global dry bulk shipping market's functioning. Their requirements and their demands shape the movement of the goods while determining the routes that must be taken and the capacity of the vessels required to satisfy the needs of global trade. The dry bulk shipping market continuously shifts with the changes in trade patterns and with the evolving global economy, therefore ensuring that goods are supplied where and when they are needed. That relationship between exporters and importers is of prime importance, and an efficient sector in its working supplies the world's industries with the resources needed to prosper.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$125.3 million |

|

Market Size by 2032 |

$152.3 Million |

|

Growth Rate from 2025 to 2032 |

2.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

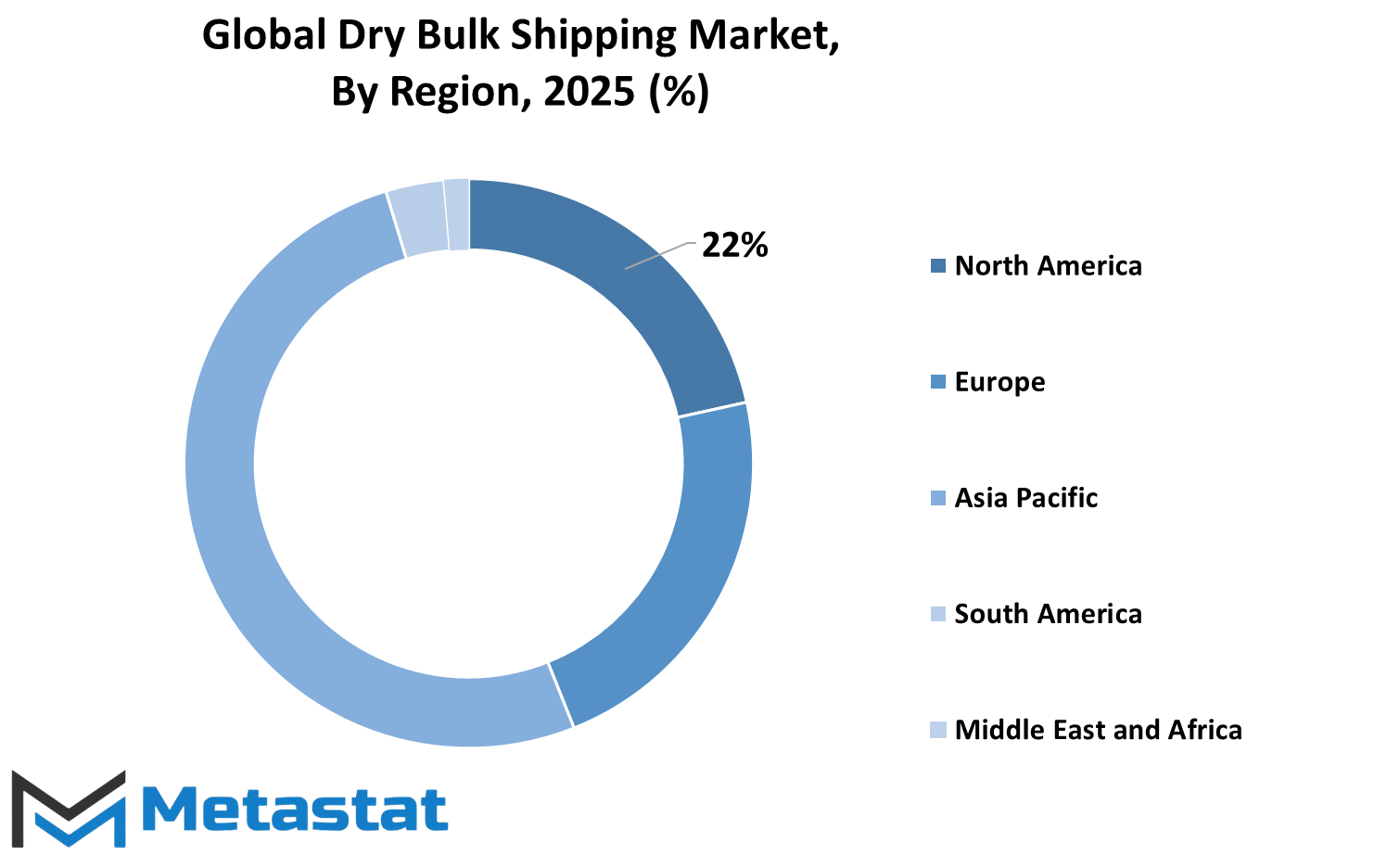

They are aggregating into the market for global dry bulk shipping; every regional market is important for an overall picture. For example: North America, Europe, Asia-Pacific, South America, and the Middle East & Africa are the main regions that contribute to and from the dry bulk shipping market. Within each of these regions, all countries and geographical regions are important for all aspects of market growth.

The market within North America can be subdivided into three major countries: United States, Canada, and Mexico. Each of these countries has distinct shipping needs that have to do with its respective infrastructures and have therefore influenced market dynamics differently. The U.S. becomes the largest player in the region because of its extensive port systems and shipping routes. Being positioned in the Arctic, Canada plays a strategic role but fairly connects with international trade. Mexico adds further importance to the region due to its proximity to major trading markets like the U.S.

The other major area − Europe − consists of countries namely United Kingdom, Germany, France, Italy, and Rest of Europe. The U.K. has been a maritime power for ages and has ports that can handle a large volume of trade. Germany boosts the market with its solid industrial base and stature in global trade. France and Italy also feature in the European dry bulk shipping portfolio, thanks to their major ports and shipping lines. The Rest of Europe collects the balance of the smaller-but-no-less-important countries contributing to the market.

Asia-Pacific is another highly viral region in the global dry bulk shipping market. It consists of countries such as India, China, Japan, South Korea, and Rest- Asia-Pacific. China and Japan are two of the world leaders in the shipping business because their economies are very big and their heavy trading activities are manifested in global shipping. Therefore, India and South Korea are important for these countries with their growing demands for bulk shipping services. Meanwhile, the Rest of Asia-Pacific includes a medley of countries within the continent, which are increasingly becoming important in the marketplace.

South America includes Brazil, Argentina, and the Rest of South America. Under the shipping and mainly bulk commodities heading, Brazil is of great importance to the continent. Agricultural exports from Argentina have also made their impact on the regional shipping market. Meanwhile, other countries under the "Rest of South America" will also be contributing at an appreciable extent in terms of dry bulk shipping.

The Middle East and Africa are further classified into GCC countries, Egypt, South Africa, and Rest of Middle East. The GCC countries like Saudi Arabia and the UAE play here as the major countries in terms of oil exports. Egypt is also another major gateway for global trade because of its Suez Canal. South Africa strengthens further the market through its mining and agricultural exports.

COMPETITIVE PLAYERS

The global dry bulk shipping market is essentially an artery of international trade, providing shipment coordination for assorted bulk goods such as coal, iron ore, grains, and raw materials. The successful operation of this market links suppliers and consumers all around the world, with a consistent flow of essentials. Dozens of companies are linked with dry bulk shipping, with a few major players taking on the more formative role of the industry and its development.

China COSCO Shipping Corporation Limited occupies a premier position among the prominent companies in the dry bulk shipping sector; it is indeed one of the largest shipping companies of all time. It has a strong presence in the dry bulk as well as in the container shipping segment. Yet another major player is Star Bulk Carriers Corp., a company that operates a fleet of large vessels that help match the supply for bulk commodity transport. Golden Ocean Group Ltd. is another prominent player operating in a wide scope of services, prominently dry bulk.

Key competitors include Oldendorff Carriers GmbH & Co. KG, using the global reach of its network to provide efficient services in the mining and energy industries. Pacific Basin Shipping Limited focuses on bulk commodity transportation and is known for operational flexibility. Diana Shipping Inc. has emerged as a giant with reliable dry bulk shipping services worldwide.

Genco Shipping & Trading Limited has a huge fleet and operations in many markets and thus assists in developing the dry bulk sector. Safe Bulkers, Inc., another prominent player, has invested in dry bulk shipping in several regions. Bahri, the National Shipping Company of Saudi Arabia, thus secured its place in the industry and became a key player in the bulk transportation business.

One of the major players in this regard would be Navios Maritime Partners L.P. An active player in the marketplace, it manages a large fleet while emphasizing efficient bulk materials transportation. Pangaea Logistics Solutions Ltd. is making its way across the dry bulk shipping world by providing transportation solutions for many industries. Western Bulk Management AS rounds up the players as it takes pride in its reputed operating ability and enormous experience in dry bulk shipping.

These companies, among many others, prop up the global dry bulk shipping market, ensuring timely and efficient delivery of goods. Competition among players remains strong, with each trying to better its own offering to fulfill the increasingly demanding requirements of bulk commodity transportation.

Dry Bulk Shipping Market Key Segments:

By Cargo Type

- Iron Ore

- Coal

- Grains

- Cement

- Fertilizers

- Steel Products

- Others (Sugar, Bauxite, Alumina, etc.)

By Vessel Type

- Capesize

- Panamax

- Supramax

- Handysize

By Application

- Mining

- Agriculture

- Construction

- Industrial Manufacturing

- Others

By End-User

- Exporters

- Importers

Key Global Dry Bulk Shipping Industry Players

- China COSCO Shipping Corporation Limited

- Star Bulk Carriers Corp.

- Golden Ocean Group Ltd.

- Oldendorff Carriers GmbH & Co. KG

- Pacific Basin Shipping Limited

- Diana Shipping Inc.

- Genco Shipping & Trading Limited

- Safe Bulkers, Inc.

- Bahri (National Shipping Company of Saudi Arabia)

- Navios Maritime Partners L.P.

- Pangaea Logistics Solutions Ltd.

- Western Bulk Management AS

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252