Global Drug Formulation Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global drug formulation market is going to be patient-centered with the innovations of precision, efficiency, and the like along its path. Over the course of the 20th century, the drug formulation industry was mostly linked to the scientists who were the first to change the production methods by delivering exact doses in the form of modern tablets instead of simple medicinal powders. Patients had no choice but to depend on pharmacists who would concoct the ingredients by hand, thus providing products of inconsistent quality, until such time that the change occurred. The gradual transition of drug formulation from an art to a scientific discipline was made possible by the increase in industrial production and the expertise of chemists to determine how different ingredients behaved in the body.

- The global drug formulation market is projected to reach around USD 1760.2 billion by the year 2025, with a CAGR of approximately 5.8% from 2025 to 2032, and the possibility of surpassing the mark of USD 2612.9 billion.

- Among them, tablets alone contributed to the largest market share of 31.5%, moreover, they are the basis opening up new applications and innovations via extensive research.

- Market growth is primarily driven by following trends: One trend is an increasing incidence of chronic diseases which in turn leads to a higher need for new drug formulations. The other one is the development of patient-oriented healthcare and targeted drug delivery systems.

- Referring to the current market situation, it can be said that the opportunity is there to a great extent, considering that the adoption of state-of-the-art drug delivery technologies, including nanocarriers and time-release formulations, is on the rise

- This insight reveals that beyond the coming decade, the market's value is expected to grow astronomically, thus, the opportunity to catch up with the significant growth is considerable.

The 1960s and 1970s were a period when the field of pharmaceutical chemistry made significant progress, which resulted in the introduction of controlled-release tablets. These drugs were gradually releasing their active ingredients, thus, the less frequent dosing of the patients and more of their comfort were the results. The regulatory authorities particularly in the USA and Europe, started to tighten their testing and quality standards to a greater extent during this period. The pharmaceutical companies shifted from merely discovery to how well they could come up with a stable and safe formulation as their criteria for being judged. Biotech again raised the bar by the end of the 90s. Before that, the biologic injectables needed very special delivery systems that would sometimes be made from living cells, thus protecting the very fragile molecules. Because old ways were insufficient, the pharmaceutical companies began pouring money into delivery science.

The market still reacts to changing expectations today. Patients will require treatments that blend in with their lifestyle such as oral alternatives to injections, or drugs with very mild side effects. Researchers will create carriers at the nano-scale that will take drugs to specific places in the body instead of just letting them move around the body without control. Digital tools, such as predictive software and machine learning, will enable scientists to understand how a drug behaves in the human body before it ever reaches the lab floor. The regulators will demand, and thus, the companies will choose the safest ingredients and the most transparent sourcing none-the-less the delivery method and the manufacturing procedure determined by the same company.

In the future, personalized medicine will play a pivotal role in the new drug formulation process. The different drugs may be developed to suit an individual’s personal genetic or metabolic make-up rather than coming up with a single version for all patients. The worldwide struggle of the forties was a factor which played a revolutionary role in this scenario. The mass-scale production of penicillin caused the drug to be subjected to the development of new techniques for its stabilization, long-distance traveling, and safe storage without compromising its potency. So, a new requirement was set up, the drug was to be reliable, transportable, and potent via controlled formulation.

Market Segments

The global drug formulation market is mainly classified based on Dosage Form, Routes of Administration, Indication, End User.

By Dosage Form is further segmented into:

- Tablets: The tablet as a dosage form facilitates a uniform and gradual release of the active substances to the patient through the solid structure. The effective dosage of the medication and its prolonged shelf life are advantages which the patients and the healthcare professionals appreciate most. The global Drug Formulation market is being increasingly pulled by the patients for the same reason of reliability and thus, the global drug formulation market proliferation will be dominated by the tablet segment.

- Capsules: This dosage form is similar to a pill that with a bitter powder inside it. The patients do not taste the bitterness with this method, and the precise dosage is supported. There is flexibility in filling methods: powders, granules, or liquids. The strong performance is the reason for the great adoption in many therapeutic areas and also the steady progress in pharmaceutical development.

- Injectable: This type of dosage form allows for a very prompt direct delivery of the medicine into the body and also the option of controlled administration by a professional healthcare provider draws many to it. The injection route is cleaner than other types of consumption thus the sterile production line guarantees the drug's quality. Rapid absorbance improves the need for the medication in clinics and hospitals, in particular, during emergencies. The strong demand is giving the drug manufacturers and medical facilities a solid return on investment.

- Sprays: The spray dosage form is the fastest way to get the medicine where it's needed; commonly, through the nasal or oral routes. Speed is one of the major benefits with this method, especially during situations like allergies or nasal congestion. The small-sized pack encourages the use of the product daily due to its easy carrying and storing. Health care providers value the range of dosing options that are made possible by this, thus the growth of the patient-friendly acceptance is accompanied by the steady increase in the market.

- Suspensions: Suspension dosage form holds active compounds within a liquid medium, supporting easier use among children or older adults. Gentle shaking mixes evenly before dosing. Healthcare professionals choose suspensions when solid dosage forms create swallowing challenges. Adjustable volume helps achieve personalized amounts for multiple age groups.

- Other: Other dosage forms include unique formats created for specific treatment needs. These formats address patient comfort, shelf stability, or advanced release patterns. Research teams continue shaping innovative methods to support better medication acceptance. Broad variation opens space for specialty products across many therapies.

By Routes of Administration the market is divided into:

- Oral: Oral administration is still the most common and accepted way of taking medications, as it only requires the patient to swallow the drug, which is a simple and convenient method of drug treatment. The availability of dosing in solid or liquid forms makes it possible to use different age groups more flexibly. The low cost of production is one of the factors that make it available in pharmacies all over the world. The ongoing progress in research and development is a factor that will encourage more product innovation in the global Drug Formulation market.

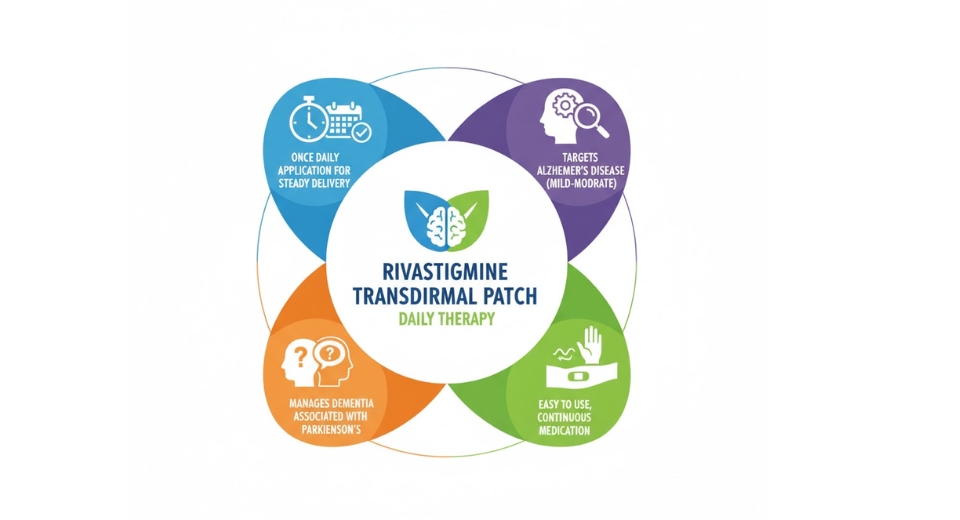

- Topical: Topical application places drug on skin or mucous membranes, providing localized pain relief. Creams, gels, and ointments are used to treat pain, inflammation, or various skin problems. The direct application restricts the drug's passage to other body systems, thus, reducing the risk of adverse effects. Patients consider the simple use as a part of their daily activities that comes with the benefits of the medication.

- Parenteral: Parenteral therapy gives the client medication through shot under the professional’s surveillance. The pathway is opened to the bloodstream hence speeding up the process of absorption. This method is used in emergency units and hospitals when quick action is required. A precise amount of medication is delivered to the organism and that is why it is applied in the treatment of serious diseases controlled by the dosages.

- Inhalations: Inhalation therapy takes treatment directly into the lungs via respiratory devices that control the patient’s breathing. The particles of medicine that are present in the form of a very fine mist or aerosol reach the lungs very quickly. The inhalation method is often the only approach in long-term management of chronic lung diseases. The small portable devices make it easier for those patients with breathing problems to use them daily.

- Other Routes of Administration: Other routes include specialized delivery methods developed for new therapeutic requirements. Each method supports precise placement of active compounds within selected body areas. Ongoing innovation shapes convenient approaches for unique patient needs, strengthening drug delivery progress within modern healthcare.

By Indication the market is further divided into:

- Infectious Diseases: Formulations for infectious diseases target bacterial, viral, or fungal pathogens. Treatment strategies aim for strong action with minimal side effects. Healthcare programs support vaccination and medication availability across community settings. Continued focus on resistance management maintains research and development activity within the global Drug Formulation market.

- Cancer: Cancer treatments rely on advanced formulations designed to deliver active agents near affected cells. Accurate dosing reduces harm to healthy tissue. Consistent research encourages new targeted medicines. Specialized delivery approaches support better response rates during therapy for different cancer stages.

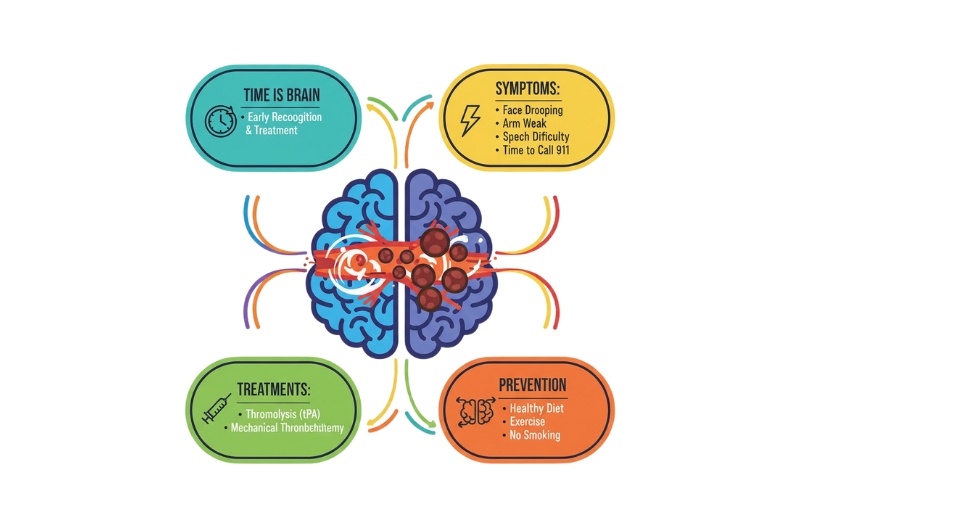

- Cardiovascular Diseases: Formulations for cardiovascular diseases aim to control blood pressure, stabilize cholesterol levels, and prevent clot formation. Daily management through reliable medication helps reduce complications. Healthcare systems maintain ongoing supply due to continual patient need.

- Diabetes: Diabetes treatments focus on blood sugar control using oral medications or injectable therapies. Stable dosing supports daily routine management. Educators encourage consistent monitoring to prevent long-term complications. Greater awareness prompts pharmaceutical expansion.

- Respiratory Diseases: Respiratory disease medication supports airflow improvement and inflammation reduction. Formulations include inhalers, sprays, and nebulizer solutions. Proper device training helps achieve steady relief. Growing awareness encourages more product variants for different age groups.

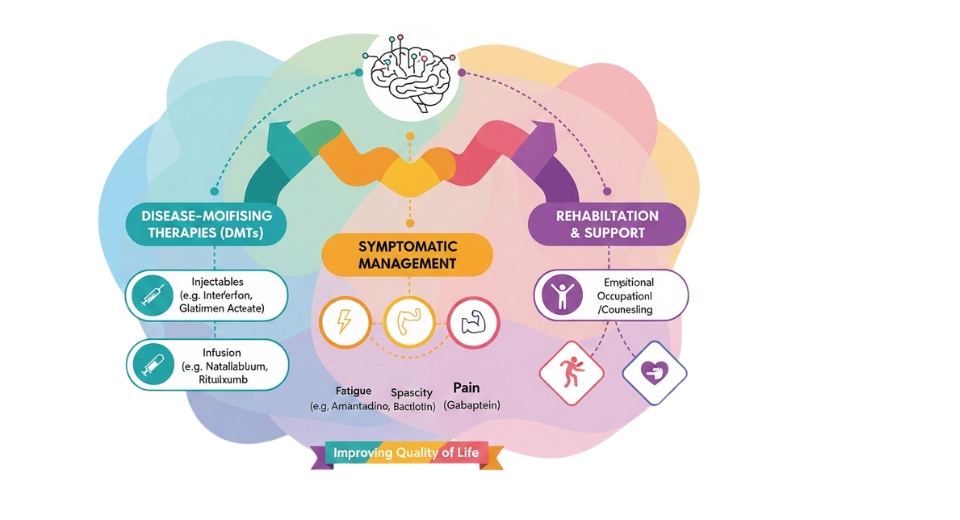

- Central Nervous System Disorders: Formulations for central nervous system disorders aim to support mood balance, seizure control, and cognitive function. Accurate release timing helps maintain stable response during daily activities. Research continues toward better symptom management.

- Autoimmune Diseases: Autoimmune disease medication works to limit harmful responses from the immune system. Treatments must balance symptom relief with safety. Advances in biologic drugs fuel growth for specialty formulations.

- Gastrointestinal Diseases: Gastrointestinal medications target stomach, intestine, and digestion challenges. Formulations offer acid control, improved digestion, or pain relief. Many products benefit from controlled release to protect sensitive active compounds during passage through digestive pathways.

- Other: Other indications cover therapeutic areas requiring unique medication solutions. Specialty products address smaller patient groups yet still demand precise performance. Pharmaceutical companies continue exploring multiple categories to support emerging healthcare needs.

By End User the global drug formulation market is divided as:

- Big Pharma: Large pharmaceutical organizations manage extensive research programs and global distribution networks. Strong funding supports advanced formulation development and rapid scale-up of manufacturing. Widespread market access strengthens visibility for new medications within the global Drug Formulation market.

- Small & Medium Size Pharma: Small and medium companies often focus on niche segments or regional demand. Flexibility allows faster decision-making during research projects. Partnerships with larger organizations enhance growth and distribution reach across healthcare markets.

- Biotech Companies: Biotech firms emphasize scientific innovation to discover new therapeutic methods. Unique research capability encourages breakthrough formulations for complex disorders. Collaboration with pharmaceutical manufacturers supports transition from laboratory development to commercial production.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1760.2 Billion |

|

Market Size by 2032 |

$2612.9 Billion |

|

Growth Rate from 2025 to 2032 |

5.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

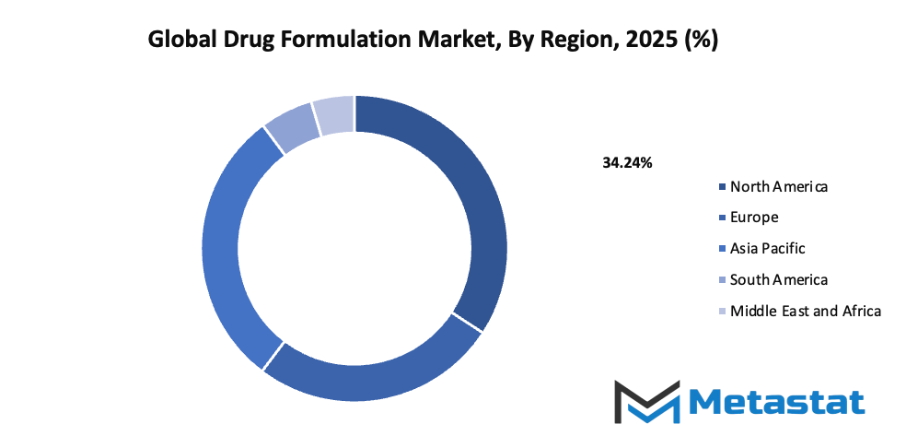

By Region:

- Based on geography, the global drug formulation market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Rising prevalence of chronic diseases increases demand for innovative drug formulations.: A growing number of individuals face long-term health conditions that require safer and more effective medicines. Healthcare systems encourage development of improved dosage forms that support steady therapeutic action and reduced side effects. Such progress strengthens investment and interest within the global drug formulation market, creating steady future growth potential.

- Growing focus on patient-centric and targeted drug delivery systems.: Modern therapies aim to match dosage and release speed with specific medical needs. Patient comfort and easier use encourage adoption of oral dissolving tablets, patches, and controlled-release capsules. Enhanced precision reduces unwanted reactions and supports stronger treatment outcomes, leading to wider acceptance across healthcare and research, worldwide demand continues upward.

Challenges and Opportunities

- High R&D and regulatory approval costs limit new formulation development.: Extensive laboratory testing, safety studies, and multi-phase trials require large budgets. Financial risk discourages small organizations from entering development programs. Slow progress delays access to improved therapies, reducing variety in available treatment options and lowering speed of scientific progress within pharmaceutical innovation, across research and market expansion efforts globally.

- Stringent regulatory compliance slows market entry for novel drugs.: Detailed documentation, strict testing rules, and continuous safety monitoring extend approval timelines. Every revision adds more review cycles, raising project expense and delaying launch plans. Longer timelines reduce competitive strength for newer therapies and limit availability of improved treatment methods, across global markets and research driven development paths worldwide annually.

Opportunities

- Increasing adoption of advanced drug delivery technologies such as nanocarriers and sustained-release formulations.: Technology allows precise transport of active ingredients to targeted sites, supporting better treatment performance. Reduced dosing frequency raises comfort and encourages adherence. Strong interest from research groups and investors stimulates partnerships, expanding future product pipelines for advanced therapies, across multiple healthcare segments and scientific development areas worldwide driving steady growth.

Competitive Landscape & Strategic Insights

The global drug formulation market represents a dynamic and competitive market that includes both long-established multinational corporations and fast-growing regional players. Major participants such as AbbVie Inc., Allergan plc, Amgen Inc., AstraZeneca plc, Bayer AG, Biocon Limited, Boehringer Ingelheim GmbH, Bristol-Myers Squibb Company, Dr. Reddy’s Laboratories Ltd., Eli Lilly and Company, Gilead Sciences Inc., GlaxoSmithKline plc, Johnson & Johnson, Merck & Co. Inc., Mylan N.V., Novartis AG, Pfizer Inc., Roche Holding AG, Sanofi S.A., Sun Pharmaceutical Industries Ltd., Takeda Pharmaceutical Company Limited, and Teva Pharmaceutical Industries Ltd. continue to shape the direction of the sector through innovation and strategic expansion.

Strong research and development efforts drive growth in the market as companies work to create new formulations that improve drug effectiveness, safety, and patient experience. The focus remains on optimizing dosage forms, enhancing drug delivery systems, and extending product life cycles through reformulation. Continuous investment in technology supports advancements that make drug manufacturing more efficient and accessible across different markets. Strategic collaborations, mergers, and acquisitions among key players also help strengthen global reach and diversify product portfolios.

Rising healthcare awareness, expanding access to medical treatment, and the growing need for effective chronic disease management contribute to increasing demand. Emerging economies provide significant opportunities due to developing healthcare infrastructure and supportive government policies. The competition among leading and regional manufacturers promotes continuous improvement in quality, pricing, and production methods. Innovation in formulation science ensures that modern treatments meet evolving therapeutic needs while maintaining cost efficiency and regulatory compliance.

Market size is forecast to rise from USD 1760.2 billion in 2025 to over USD 2612.9 billion by 2032. Drug Formulation will maintain dominance but face growing competition from emerging formats.

The industry’s progress relies on scientific advancement, strategic partnerships, and an understanding of patient requirements. Continuous efforts toward research, affordability, and accessibility will ensure sustained development and competitiveness in the global drug formulation market.

Report Coverage

This research report categorizes the global drug formulation market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global drug formulation market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global drug formulation market.

Drug Formulation Market Key Segments:

By Dosage Form

- Tablets

- Capsules

- Injectable

- Sprays

- Suspensions

- Other

By Routes of Administration

- Oral

- Topical

- Parenteral

- Inhalations

- Other Routes of Administration

By Indication

- Infectious Diseases

- Cancer

- Cardiovascular Diseases

- Diabetes

- Respiratory Diseases

- Central Nervous System Disorders

- Autoimmune Diseases

- Gastrointestinal Diseases

- Other

By End User

- Big Pharma

- Small & Medium Size Pharma

- Biotech Companies

Key Global Drug Formulation Industry Players

- AbbVie Inc.

- Allergan plc

- Amgen Inc.

- AstraZeneca plc

- Bayer AG

- Biocon Limited

- Boehringer Ingelheim GmbH

- Bristol-Myers Squibb Company

- Dr. Reddy’s Laboratories Ltd.

- Eli Lilly and Company

- Gilead Sciences, Inc.

- GlaxoSmithKline plc

- Johnson & Johnson

- Merck & Co., Inc.

- Mylan N.V.

- Novartis AG

- Pfizer Inc.

- Roche Holding AG

- Sanofi S.A.

- Sun Pharmaceutical Industries Ltd.

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceutical Industries Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252