Global Drilling Tools Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global drilling tools market has been the anchor of the oil and gas business since its inception in the late nineteenth century when crude extraction first started to take form employing basic mechanical drills. A labour-intensive, steam-powered enterprise in its infancy, it continued to develop over the twentieth century with the development of rotary drilling systems, one of the first technology advancements in the business. These initial decades laid the groundwork for a technologically more advanced and specialized marketplace that would come to redefine the availability of energy reserves globally.

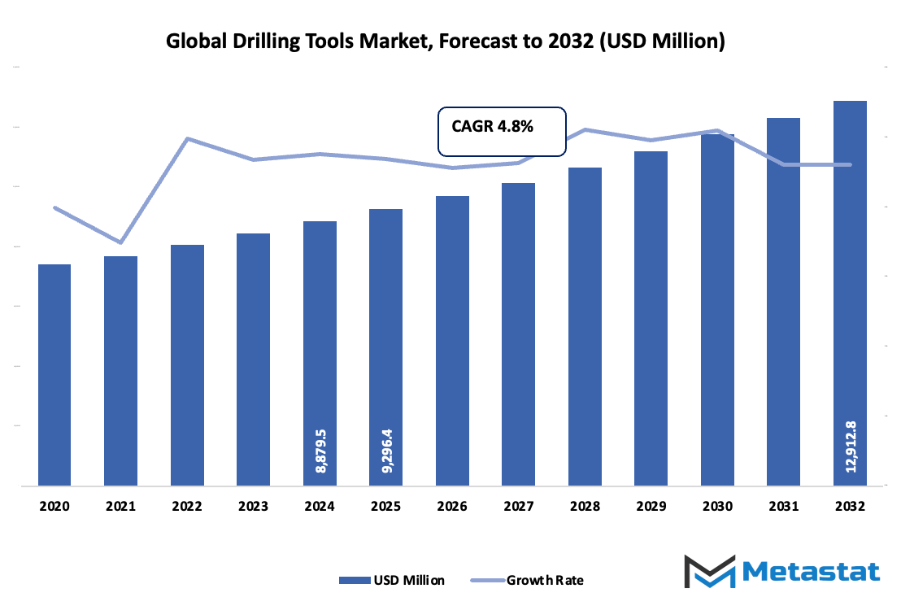

- Global drilling tools market worth approximately USD 9296.4 million in 2025, growing at an estimated CAGR of approximately 4.8% from 2032, likely to increase above USD 12912.8 million.

- Drill Bits hold nearly 26.8% market share, spearheading innovation and broadening applications through rigorous research.

- Major growth trends: Increasing global demand for oil and gas exploration and production, Technological advances improving drilling efficiency and precision

- Opportunities are: Expansion in unconventional resource exploration (shale gas, deepwater drilling, and geothermal energy)

- Key insight: The market will expand exponentially in terms of value within the next decade, emphasizing strong growth opportunities.

- By the mid-twentieth century, the market began to shift away from primitive mechanical designs as oil exploration penetrated deeper and more geologically complex formations.

The introduction of downhole tools and directional drilling integration created a new level of precision and efficiency. Offshore drilling once more hastened the transformation, requiring yet more robust and robust materials and design that can withstand extreme pressure and temperature extremes. Each step forward combined engineering skills with greater insight into subsurface conditions, transforming the industry into a high-technology part of energy production. Digitalization and data analytics started shaping the global drilling tools market in subsequent years. Real-time monitoring systems, automation, and predictive maintenance became inevitable, enabling companies to propel drilling performance while keeping environmental footprint to a minimum. As exploration became focused on non-traditional sources, adaptive tools were needed more than ever, giving rise to modular systems and intelligent Drilling Tools.

This was also a time of hardware advances but an overall shift in operating culture too. In the coming years, the industry will increasingly respond to shifting regulatory environments and environmental concerns. The incorporation of renewable-friendly processes and carbon-sensitive exploration will revolutionize tool design and application in drilling. New regions will invest more in enhanced infrastructure, supporting further technology development. From humble roots to a data-oriented and sustainability-driven future, the worldwide Drilling Tools sector will continue as an influential force in shaping technological and industrial energy exploration globally.

Market Segments

The global drilling tools market is mainly classified based on Type, Application, End-Use Industry, .

By Type is further segmented into:

- Drill Bits: Drill Bits have a colossal share in the worldwide market of Drilling Tools because they are indispensable in borehole formation. Drill Bits are pressure and temperature resistant, so they can drill hard surfaces successfully. The physical properties of the material and the cutting design have been relentlessly developed to be more efficient and durable when drilling.

- Drill Collars: Drill Collars serve the essential function of giving the necessary weight to the bit and stability during drilling. Drill Collars' thick-walled heavy design allows for proper control over the direction and angle of drilling. Expansion driven by growing oil and gas exploration demand has resulted in steady growth of this segment of the global drilling tools market.

- Drilling Jars: Drilling Jars are extremely crucial in avoiding stuck pipe conditions in drilling operations. They provide mechanical shock that assists in breaking the drill string free if it becomes stuck. Expanding exploration of deep and hard formations has increased the demand for high-quality Drilling Jars in the market.

- Drilling Motors: Drilling Motors are a critical feature of providing rotational energy to the drill bit in direction and horizontal drilling. They provide better control, more penetration rates, and reduced wear and tear on other equipment. Increased use of advanced motor technologies has provided significant contributions towards the overall demand of the market.

- Drilling Tubulars: Drilling Tubulars such as drill pipes and casings are essential for connecting surface tools with the drill bit. Drilling Tubulars provide unobstructed flow of drilling fluid and wellbore stability. Rising exploration activity and the demand for tougher, corrosion-resistant materials have driven the use of Drilling Tubulars in the market.

- Drill Swivels: Drill Swivels enable the rotary system to operate smoothly by linking the rotating drill string and fixed equipment. They enable drilling fluid transfer and minimize torsional stress on equipment. Rising offshore and onshore drilling have fueled steady growth of Drill Swivels in the market.

- Other: Some of the other tools utilized in the global drilling tools market are copperhead stabilizers, reamers, and subs that enhance safe and effective drilling. These elements manage vibration, enhance hole cleaning, and assist in alignment. More utilization of automation and bespoke designs is further enhancing performance in most of the drilling applications across the world.

By Application the market is divided into:

- Onshore: Onshore drilling applications dominate the global drilling tools market due to lower operational costs and easier accessibility to resources. Expanding exploration in shale and conventional fields has created steady demand for durable and efficient tools. Continuous investments in onshore oil, gas, and mineral extraction projects contribute to this segment’s strong growth.

- Offshore: Offshore drilling activities have increased significantly, driven by the discovery of new underwater reserves. The global drilling tools market benefits from technological innovations that allow operations in deep and ultra-deep waters. Demand for high-strength and corrosion-resistant tools continues to grow as offshore projects expand across various regions.

By End-Use Industry the market is further divided into:

- Oil & Gas: The oil & gas sector is the leading end-user of the global drilling tools market. The constant search for new reserves and the development of unconventional sources require advanced drilling technologies. Continuous modernization of equipment helps improve safety, precision, and productivity in both upstream and downstream operations.

- Mining: Mining activities rely heavily on efficient Drilling Tools for exploration and extraction of minerals. The market supports mining operations by providing tools that can handle tough geological conditions. With growing demand for metals and minerals, investment in durable and high-performance Drilling Tools continues to rise.

- Construction: The construction industry uses Drilling Tools for foundation work, tunneling, and infrastructure development. Growing urbanization and the expansion of transportation networks have boosted demand within this segment of the market. Continuous improvements in tool design have enhanced accuracy, stability, and speed in construction-related drilling projects.

- Manufacturing: Manufacturing industries require precise Drilling Tools for producing components and machinery used in multiple sectors. The market supports this demand through advanced tools that ensure accuracy and efficiency in production processes. Increasing automation and focus on quality improvement are driving steady adoption across manufacturing units.

- Other: Other industries, including geothermal and environmental exploration, also contribute to the growth of the global drilling tools market. These sectors use Drilling Tools for soil testing, water well creation, and resource assessment. Expanding renewable energy projects and environmental studies are expected to further increase demand in the coming years.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$9296.4 Million |

|

Market Size by 2032 |

$12912.8 Million |

|

Growth Rate from 2025 to 2032 |

4.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

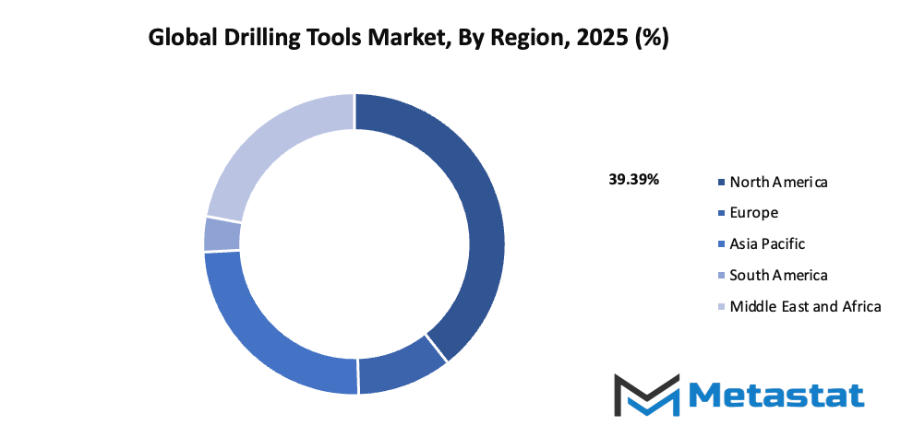

By Region:

- Based on geography, the global drilling tools market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Increasing global demand for oil and gas exploration and production: The global drilling tools market will continue to expand due to the growing need for oil and gas across various industries. Rising energy consumption, industrial growth, and urbanization in developing nations will increase exploration and production activities. This rise in demand will push companies to invest in advanced Drilling Tools to enhance output and meet global energy requirements efficiently.

- Technological advancements improving drilling efficiency and precision: Continuous innovation in drilling technologies will support the market by improving accuracy, reducing downtime, and minimizing operational costs. The use of automation, real-time data monitoring, and advanced materials will help enhance drilling performance. These improvements will enable faster operations, better resource management, and reduced environmental impact, ensuring higher productivity and safety.

Challenges and Opportunities

- High initial investment and maintenance costs: The market faces cost-related challenges as advanced tools and equipment require significant initial investment. Maintenance, repair, and replacement also add to operational expenses. Smaller companies often struggle with these financial demands, which can limit adoption rates and slow down technological upgrades across the sector.

- Environmental and regulatory constraints on drilling operations: Strict environmental regulations and sustainability concerns will continue to impact the market. Governments and international bodies are enforcing laws to minimize the ecological footprint of drilling activities. Compliance with these regulations often requires additional investments in cleaner technologies, increasing operational costs but encouraging the use of safer, more sustainable methods.

Opportunities

- Expansion in unconventional resource exploration (shale gas, deepwater drilling, and geothermal energy): The market will benefit from growing exploration in unconventional energy sources such as shale gas, deepwater reserves, and geothermal projects. These areas offer new avenues for growth as energy companies look beyond traditional oil and gas fields. With the support of advanced drilling technologies, such expansion will open long-term opportunities and strengthen energy security worldwide.

Competitive Landscape & Strategic Insights

The global drilling tools market is expected to experience major growth as technology continues to shape industrial processes and energy exploration. The industry is a mix of both international industry leaders and emerging regional competitors. This balance of established corporations and innovative newcomers is likely to define the future direction of the market. Companies such as Schlumberger Limited, Halliburton Company, Baker Hughes, National Oilwell Varco, Weatherford International, Nabors, Sandvik AB, Caterpillar Inc., Epiroc AB, Helmerich & Payne, Samtectools, KGR Industries, Sugino Corp., Torquato Drilling Accessories, Varel International Energy Services, ARCH Cutting Tools, Bit Brokers International Ltd., Drilling Tools International, Rubicon Oilfield International Holdings, L.P, and BICO Drilling Tools, Inc. are among the most significant competitors driving global advancements.

As technology continues to progress, the market will focus more on precision, efficiency, and environmental responsibility. Advanced materials, automation, and data-driven decision-making are expected to reshape how drilling operations are conducted. Companies will invest heavily in developing tools that reduce downtime, extend equipment life, and minimize environmental risks. The shift toward sustainable practices will encourage new designs that use less energy while maintaining high performance.

The competition between international leaders and regional manufacturers will encourage constant innovation. Established corporations with vast resources will continue to refine large-scale production and enhance global supply chains. Meanwhile, smaller and emerging firms will push creative designs, niche solutions, and customized services tailored to local needs. This dynamic will create a market where efficiency and adaptability are equally important for success.

In the future, digital technology will become a core component of drilling operations. Predictive analytics, artificial intelligence, and remote monitoring will make equipment more responsive and reliable. Real-time data collection will allow operators to identify issues before they cause delays or failures. This development will help reduce costs, improve safety, and support more sustainable production.

The market will also benefit from the growing demand for energy and natural resources. As countries expand industrial and infrastructure projects, exploration and extraction activities will increase. This will drive the need for durable and advanced drilling equipment. Research and development will remain at the center of progress, with companies working to balance performance with environmental considerations.

In the coming years, partnerships, mergers, and collaborations will likely shape the competitive landscape. Global leaders may work with regional companies to share technology, enhance distribution networks, and enter new markets. These alliances will help strengthen product quality and availability, ensuring that innovations reach a wider customer base.

Market size is forecast to rise from USD 9296.4 million in 2025 to over USD 12912.8 million by 2032. Drilling Tools will maintain dominance but face growing competition from emerging formats.

Overall, the global drilling tools market is entering a period of transformation driven by technology, sustainability, and competition. Continuous improvement in design, automation, and environmental safety will define future growth. The cooperation and rivalry between international leaders and emerging players will lead to a stronger, more efficient, and forward-looking industry.

Report Coverage

This research report categorizes the global drilling tools market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global drilling tools market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global drilling tools market.

Drilling Tools Market Key Segments:

By Type

- Drill Bits

- Drill Collars

- Drilling Jars

- Drilling Motors

- Drilling Tubulars

- Drill Swivels

- Other

By Application

- Onshore

- Offshore

By End-Use Industry

- Oil & Gas

- Mining

- Construction

- Manufacturing

- Other

Key Global Drilling Tools Industry Players

- Schlumberger Limited

- Halliburton Company

- Baker Hughes

- National Oilwell Varco

- Weatherford International

- Nabors

- Sandvik AB

- Caterpillar Inc.

- Epiroc AB

- Helmerich & Payne

- Samtectools

- KGR Industries

- Sugino Corp.

- Torquato Drilling Accessories

- Varel International Energy Services

- ARCH Cutting Tools

- Bit Brokers International Ltd.

- Drilling Tools International

- Rubicon Oilfield International Holdings, L.P

- BICO Drilling Tools, Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383