Global Digital Denture Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global digital denture market, a sub-segment of the dental care space, will continue to revolutionize the way restorative dentistry works in the next few years. The evolution of digital equipment will not only shape the way dentures are manufactured and crafted but also change the patient experience altogether. With technology becoming a deeper part of the dental laboratory and clinic, the market will look beyond conventional ways that previously dominated denture production. This transformation will be marked by more accuracy, quicker turnaround, and more comfort for patients who desire personalized dental care.

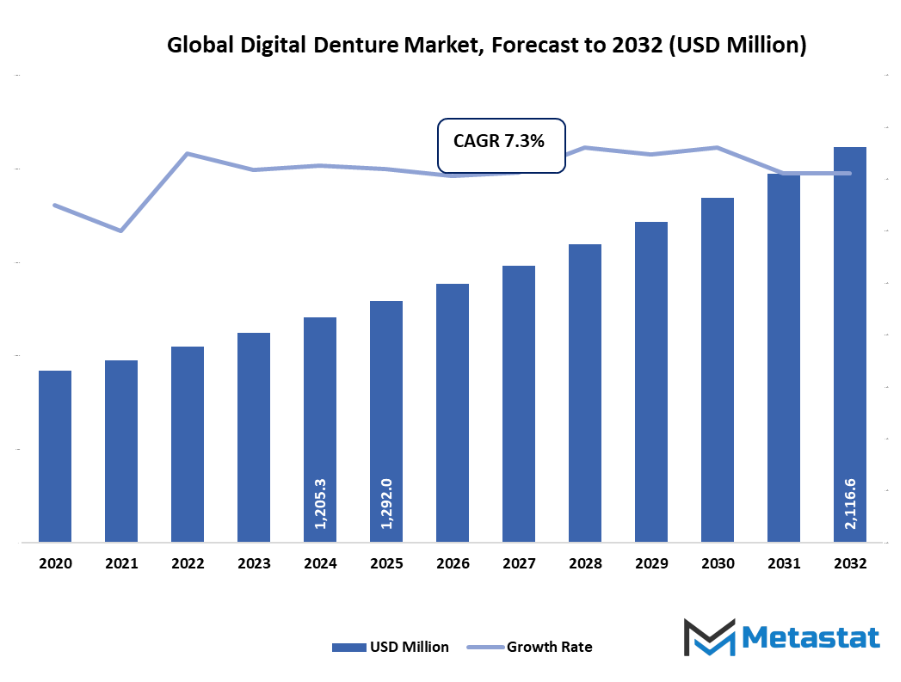

- Global digital denture market valued at approximately USD 1292 million in 2025, growing at a CAGR of around 7.3% through 2032, with potential to exceed USD 2116.6 million.

- Complete Denture account for nearly 64.6% market revenues, driving innovation and expanding applications through intense research.

- Key trends driving growth: Growing adoption of CAD/CAM and 3D printing technologies in dental prosthetics., Rising demand for customized and time-efficient dental restoration solutions.

- Opportunities include Advancements in digital materials and AI-driven design enhancing denture accuracy and aesthetics.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

What will the rapid integration of AI and 3D printing mean for precision and customization of digital dentures? Will the increasing adoption of digital workflows completely disrupt the current methodologies used in denture manufacturing? And as patients expect faster, more aesthetic alternatives, will the market be able to satisfy the balance between innovation and price?

What will really make the global digital denture market stand out in the future is its ability to close the gap between technology and human skill. Dentists and technicians will be working with digital processes that enable them to visualize, alter, and refine dentures prior to their physical manufacture. This innovation will cut out much of the trial and error that has traditionally been part of traditional methods. Furthermore, with digital impressions and 3D printing technology progressing, denture production will be more environmentally friendly, with less waste of materials and less discomfort for patients during procedures.

Market Segmentation Analysis

The global digital denture market is mainly classified based on Type, Tools, Material, End User.

By Type is further segmented into:

- Complete Denture

The global digital denture market will experience a rising demand for complete dentures as the elderly population increases and more people experience total tooth loss. Improved digital design and exact milling methods will enable the creation of a more comfortable fit, enhanced aesthetics, and faster production, improving patients' treatment outcomes globally.

- Partial Denture

In the global digital denture market, decreased reliance on full dentures in favor of partial dentures will be viable as patients continue to seek more affordable and less painful treatment options for tooth loss. Partial dentures will be produced with improved resiliency, weight, and aesthetics, thanks to digital impressions and CAD/CAM technology, resulting in more availability and customization by dentists.

By Tools the market is divided into:

- Equipment

In the global digital denture market, dental equipment including 3D printing machines, milling devices, and scanners will play a major role in transforming dental restoration workflows. The equipment will produce higher precision and speed, minimize manual labor, and support the ability of laboratories and clinics to make dentures more quickly, with less waste and to a higher consistent quality.

- Software

Software in the market will proceed to evolve, incorporating artificial intelligence and cloud-based platforms to make design processes more efficient. Digital design software will facilitate dentists to simulate results, make instant adjustments to models, and share information between platforms, ensuring easy collaboration and enhanced patient satisfaction.

By Material the market is further divided into:

- Resins

The market will witness widespread application of resins because of their durability, biocompatibility, and versatility in design. In-depth research and development will render resin dentures tougher against wear and staining, resulting in longer-lasting outcomes and better comfort for patients in developed as well as emerging markets.

- Plastics

Plastics will remain a cost-effective and versatile material option in the global digital denture market. Advances in top-quality dental plastics will enhance structural quality and surface finish, resulting in dentures with greater natural appearance and comfort. These plastics will prove particularly useful for cost-conscious practices with requirements for quality at reduced manufacturing costs.

By End User the global digital denture market is divided as:

- Dental Hospitals

Dental hospitals will still hold a power position for the global digital denture market where digital prosthetics are concerned due to their superior facilities and technologies. As the public intelligence related to digital prosthetics and the resultant process improves, this will likely allow more dental hospitals to increase digital lab capabilities and produce dentures for their patients in a more expedient fashion with superior accuracy for complex dental cases.

- Dental Clinics

Dental clinics will become robust players in the global digital denture market when portable and cost-effective digital solutions become increasingly available. The clinics will deliver patient-specific denture solutions directly to patients, minimizing turnaround time and satisfaction with same-day or next-day prosthetic delivery options.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1292 Million |

|

Market Size by 2032 |

$2116.6 Million |

|

Growth Rate from 2025 to 2032 |

7.3% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

Geographic Dynamics

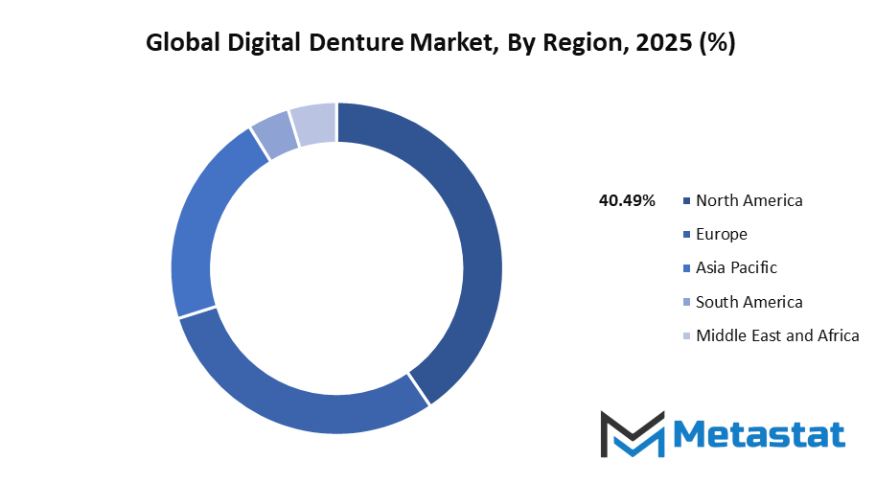

Based on geography, the global digital denture market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

Competitive Landscape & Strategic Insights

The global digital denture market from Metastat Insight identifies the trend toward precision and efficiency in contemporary dental care. Across the industry, international leaders and regional innovators are establishing how dentures are designed, manufactured, and fitted. Digital technology is making many of the traditional ways irrelevant and design, manufacture, and fit will be delivered considerably faster and more accurately by dentists and technicians. Increased use of 3D printing and computer-aided design has decreased human error, improved patient comfort, and sped the treatment process. This introduction of digital technology is increasing interest maybe by patients and practitioners looking for convenience, quality, and security in oral care.

The industry comprises a broad range of companies that have established the trajectory of innovation. AVADENT, 3Shape, Amann Girrbach AG, Asiga, CARIMA Co., Ltd., DENTCA, Inc., and Dentsply Sirona are some major brands that are recognized for their sophisticated digital platforms and research-driven products. These companies have been working towards creating systems by which dental professionals can transition from manual impressions to digital workflows without any hiccups. They have been instrumental in making people aware of the precision and longevity of digital dentures that are increasingly substituting traditional methods in clinics and laboratories.

Along with these industry leaders, duerrdental, Formlabs Dental, Global Dental Solutions, Ivoclar Vivadent, lake3D, Medit, Merz Dental GmbH, and Midmark Corporation are reinforcing global presence through digital denture solutions. Their activities are focused on enhancing scanning equipment, materials, and production technologies. With the launch of affordable and easy-to-use systems, they have brought digital dentistry to the reach of small clinics and local markets, ensuring that innovation is not a prerogative of high-end centers only.

In addition to this, various new entrants, including Neoss AG, NextDent, Overjet, Perceptive and PDS Health, Stratasys, VITA Zahnfabrik, and ZimVie, are greatly expanding the possibilities for digital dentures. They are focused on providing AI-powered diagnostics, 3D imaging, and customized patient data that allow dentures to be made more efficiently with improved predictability and accuracy. As this technology continues to develop, patients can expect dentures that look and feel more natural while providing the dental clinician with tools that increase efficiency and productivity.

In short, the global digital denture market will continue to transform the practice of dentistry around the world. With both traditional and newly established companies working together with the common goal of improving patient outcomes, the industry will observe an even more aggressive adoption of advancements in digital technology. This will not only change the patient experience, but it will create new standards for efficiency, accuracy, and sustainability in restorative dentistry.

Market Risks & Opportunities

Restraints & Challenges:

Steep initial cost of digital equipment and software integration. The huge investment for sophisticated digital equipment and specialized software will be a constraint for the global digital denture market. Most dental clinics and labs will not be able to budget for implementing new digital systems, particularly in areas that are financially constrained. This constraint will retard the rate of technological assimilation and deter smaller offices from coming into the global digital denture market. With the advancement of the market, cost-cutting measures and low-cost digital options will be critical in order to bring about wider penetration and similar access in both developed and emerging economies.

Limited technical skills and training among dentists. The global digital denture market will be severely challenged by the lack of trained professionals who are well-equipped to use digital design software and production machines. Most dental professionals will still depend on conventional fabrication techniques owing to low exposure to new technology. This gap in skill will decrease efficiency and raise production faults, affecting overall patient satisfaction. In the future, cooperative programs between manufacturers, schools, and dental organizations will transcend this barrier by providing structured training modules and certificate programs. These efforts will enhance digital workflow confidence and ensure professional acceptability.

Opportunities:

Innovations in digital materials and AI-based design improving denture accuracy and aesthetics. The global digital denture market will have tremendous growth through advancements in digital materials and the incorporation of AI-based design systems. These developments will provide for greater accuracy in fitting and natural looks, minimizing human error and increasing patient comfort. Artificial intelligence is going to change the design process, generating dentures that recreate morphology and gum contours to a higher level of detail than ever before. Additionally, advances in high-performance resin and polymer development will create products with increased longevity, leading to more identifiable digital dentures and a higher desire from patient and clinician perspectives. Moving forward, ongoing research and technological advances will elevate dental breakthroughs onto a global stage of innovation in dental restoration.

Forecast & Future Outlook

- Short-Term (1–2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3–5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6–10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 1292 million in 2025 to over USD 2116.6 million by 2032. Digital Denture will maintain dominance but face growing competition from emerging formats.

Aside from manufacturing efficiency, the global digital denture market is expected to bring about a new level of cooperation among dental professionals. The integration of software, the utilization of cloud-based design platforms, and artificial intelligence will allow laboratories and clinics to communicate and transfer information with greater ease, and quality of care to improve. Over time, this ingenuity will produce better outcomes and restorations that will sustain for a greater length of time. The future of this profession will not be about generating better dentures, it will be about transforming the dental environment to produce more customized, accessible, advanced care, illustrating a paradigm shift for dental professionals and patients' experience with restorative dentistry.

Report Coverage

This research report categorizes the global digital denture market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global digital denture market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global digital denture market.

Digital Denture Market Key Segments:

By Type

- Complete Denture

- Partial Denture

By Tools

- Equipment

- Software

By Material

- Resins

- Plastics

By End User

- Dental Hospitals

- Dental Clinics

Key Global Digital Denture Industry Players

- AVADENT

- 3Shape

- Amann Girrbach AG

- Asiga.

- CARIMA Co., Ltd.

- DENTCA, Inc.

- Dentsply Sirona.

- duerrdental

- Formlabs Dental

- Global Dental Solutions

- Ivoclar Vivadent

- lake3D

- Medit

- Merz Dental GmbH

- Midmark Corporation.

- Neoss AG

- NextDent

- Overjet

- Perceptive and PDS Health

- Stratasys

- VITA Zahnfabrik.

- ZimVie

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252