Global Diagnostic Imaging Equipment Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

Will fast advances in AI-powered imaging push the global diagnostic imaging equipment market into a new segment in which early disorder detection turns into extra accurate than ever before, or will issues round records reliability gradual its adoption? As healthcare structures international shift closer to preventive and domestic-based care, ought to imaging technology become extra compact and reachable, or will excessive prices and complex rules limit their attain? With innovation accelerating across MRI, CT, and ultrasound, how will manufacturers navigate the developing strain to supply faster, more secure, and extra low-priced solutions at the same time as competing in a increasingly crowded market?

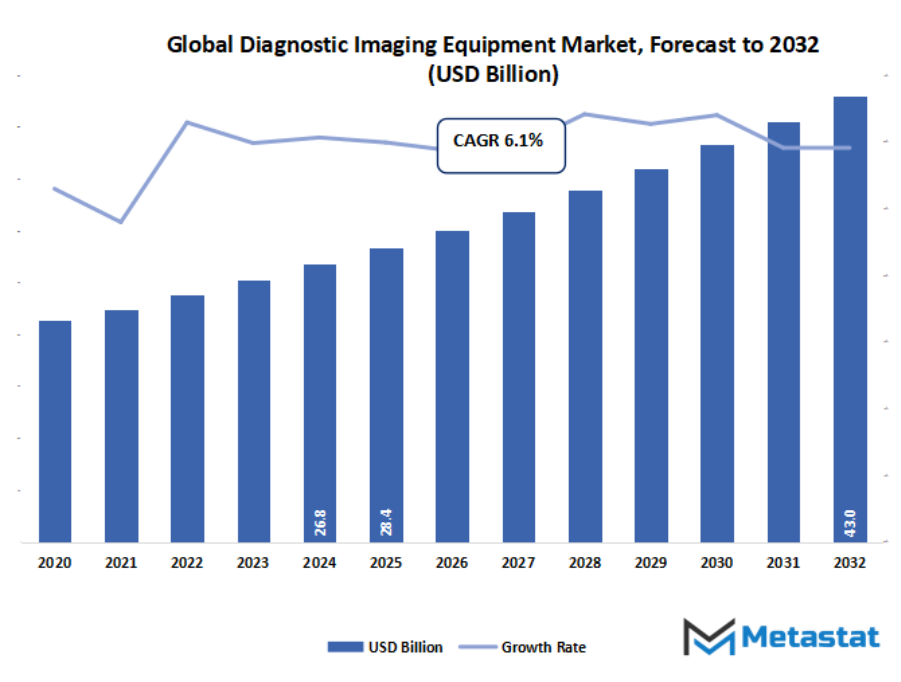

- The global diagnostic imaging equipment market valued at approximately USD 28.4 Billion in 2025, growing at a CAGR of around 6.1% through 2032, with potential to exceed USD 43 Billion.

- Ultrasound Systems account for nearly 19.0% market revenues, driving innovation and expanding applications through intense research.

- Key trends driving growth: Rising global prevalence of chronic diseases requiring early and accurate diagnosis., Technological advancements enhancing image resolution and diagnostic speed.

- Opportunities include Expansion into portable and point-of-care imaging for decentralized healthcare.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

The global diagnostic imaging equipment market will shape an enterprise transferring some distance past its present-day obstacles, opening a space wherein technology, scientific wishes, and human experience will converge in unexpected ways. As healthcare systems boost, the focus will shift from machines that definitely seize internal photos to structures with a purpose to feel styles, assume concerns, and manual practitioners with a degree of readability with the intention to experience nearly instinctive. The destiny will not be confined to better picture fine but will inspire new methods of deciphering what the ones pics monitor. Hospitals and clinics will want system in an effort to act as a companion, no longer merely a device, adapting to the condition of each affected person and providing insights to make choice-making less difficult and quicker.

This will broaden the industry's mission. Devices for imaging will form part of a much greater communication circle in which data will flow from a patient to equipment, from that equipment to digital platforms, and from these to medical teams in real time. Instead of working as stand-alone units, future systems will interface with larger networks that will facilitate early detection, remote assessments, and even more personal care. The direction will also ensure that designers, engineers, and healthcare providers think deeply about how machines will be applied in daily medical contexts.

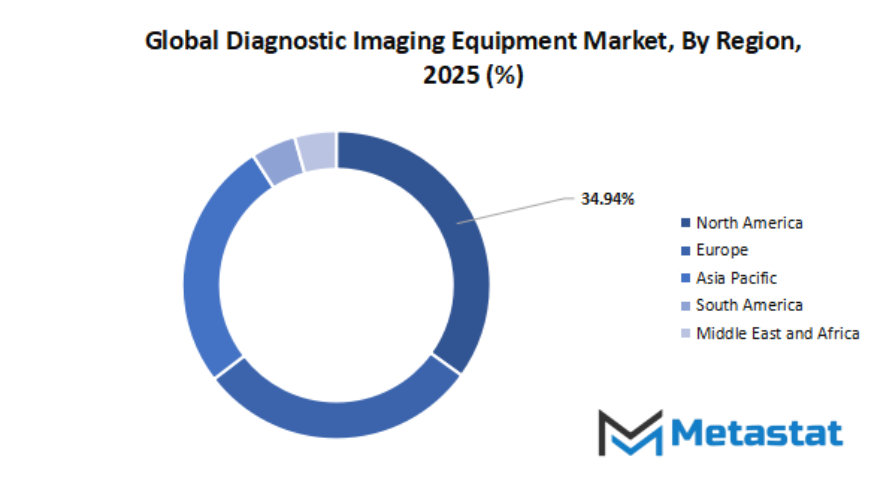

Geographic Dynamics

Based on geography, the global diagnostic imaging equipment market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

Market Segmentation Analysis

The global diagnostic imaging equipment market is mainly classified based on Modality, Portability, Application, End User.

By Modality is further segmented into:

- Ultrasound Systems

Ultrasound systems will continue in their development towards better clarity and real-time performance in the global diagnostic imaging equipment market. Advancements that support faster screenings shall enable detection of changes in organs, tissues, and blood flow with increased confidence by the medical teams using them. Integration with more digital platforms will further develop the overall diagnostic value in the settings of future healthcare.

- X-Ray Imaging Systems

X-ray imaging systems will move toward improved digital capture that reduces exposure levels while enhancing clarity. Continuous improvements will support safer use across a wide range of medical fields. More powerful features in image processing will enable hospitals and clinics to make faster decisions that will shape future diagnostic pathways and support better patient management in busy environments.

- Computed Tomography (CT) Scanners

Computed tomography scanners will have faster rotation speeds and sharper reconstruction methods. Expanding artificial intelligence support will help generate cleaner outputs, reducing the need for repeat scans. These will provide quicker assessments of injuries and internal conditions, enabling stronger clinical planning across emergency rooms, trauma centers, and advanced medical facilities.

- MRI Systems

MRI systems will trend toward wider bores, less noise, and stronger magnetic gradients; these will facilitate increased comfort and faster scan times. Improving software will sharpen the visualization of soft tissues, aiding medical teams in tracing subtle changes. In the future, the adoption of MRI will increase across those specialties that need deep structural insights without exposure to harmful radiation.

- Nuclear Imaging Systems

Next-generation detectors and refined tracer development will give nuclear imaging systems increased accuracy. Enhanced sensitivity will enable medical facilities to track metabolic activity with greater precision. A greater need for early disease detection will promote further research, leading to more compact designs and flexible scanning options for hospitals, diagnostic centers, and specialized medical programs.

- Mammography Systems

Mammography systems of the future will be using more advanced digital technologies to help detect early tissue changes with increased confidence. Tomosynthesis improvements will decrease the chances of oversight during a breast screening. Enhanced ergonomics and faster image availability will contribute to wide screening programs, enabling healthcare providers to strengthen preventative strategies in communities where awareness levels are increasing.

- Others

Other imaging solutions will be developed to focus on adaptability for specialized visualization in specific medical fields. Further development will emphasize speed, clarity, and lower operational burdens. As healthcare environments start to shift toward accurate and immediate results, the new formats of imaging will support wide testing demands and deliver more targeted diagnostic support to the diversified clinical teams.

By Portability the market is divided into:

- Fixed Systems

Fixed systems within diagnostic imaging will continue to support high-volume facilities requiring stable, high-capacity equipment. Stronger processing power and long-term durability will anchor these systems in major medical institutions. Expanded automation features will ease complicated workflows and enable hospitals to maintain accuracy while managing rising patient numbers and increasing diagnostic expectations.

- Mobile and Hand-held Systems

Mobile and hand-held systems will increasingly be adopted as medical teams seek versatile solutions for imaging. Compact designs will support bedside assessments, rural outreach, and emergency responses. Future developments will be directed at seamless data transfer and rapid deployment, enabling the medical facilities to expand imaging support well beyond the confines of traditional diagnostic rooms.

By Application the market is further divided into:

- Cardiology

Cardiology imaging applications will further develop into sharper cardiac scans with faster motion correction. Better visualization of blood vessels and heart structures allows for earlier identification of abnormalities. Enhanced workflows in imaging will further support treatment planning, tailored to the individual patient, and will make long-term monitoring stronger for various cardiac conditions in hospitals and specialized medical centers.

- Oncology

Oncology imaging applications will move toward more accurate identification of tumors in the earliest stages possible. Advanced contrast techniques and scanning algorithms will help medical teams track treatment responses more clearly. Future imaging enhancements will facilitate personalized care, enabling quicker decision-making at all levels in complex cancer management pathways across various treatment facilities.

- Neurology

Applications in neurology imaging will move toward the capture of subtler changes in brain structure and function. Stronger algorithms will assist in the early identification of neurological disorders. Greater detail in imaging will enable medical professionals to chart neural pathways more precisely, which better supports more accurate assessments related to chronic conditions, acute injuries, and complex neurodegenerative challenges.

- Orthopedics

Orthopedic applications stand to see improved visualization of bones, joints, and the soft tissues that surround structural elements. Improved clarity will allow the earlier detection of fractures, degeneration, and other alignment concerns. Future systems will facilitate speedier reviews, creating the possibility for health professionals to help lead in surgical planning, mapping physical therapy, and long-term musculoskeletal monitoring.

- Gastroenterology

Gastroenterology imaging applications will evolve to capture clearer views of digestive tract structures without invasive procedures. Future imaging platforms will highlight subtle changes in tissues, thereby supporting early recognition of various gastrointestinal disorders. Improved speed and clarity will strengthen decision-making across routine examinations, advanced screenings, and long-term digestive health management programs.

- Gynecology & Obstetrics

Gynecology and obstetrics applications will be strengthened by improved fetal monitoring, better detail of soft tissue, and reduced exposure techniques. Future systems will enable the early detection of developmental issues and reproductive health changes. Advancements will help medical practitioners seeking accurate diagnosis for maternal care in both routine and high-risk conditions.

- Other Applications

Other imaging applications will expand as medical teams explore new diagnostic requirements in emerging health concerns. The future design of equipment will have faster adjustments, more detail, and better compatibility with the digital ecosystem. This will enable broader clinical use, ensuring stronger diagnostic confidence in diverse healthcare environments.

By End User the global diagnostic imaging equipment market is divided as:

- Hospitals

Hospitals will remain the significant adopters for advanced systems in the global diagnostic imaging equipment market. Stronger infrastructure will accommodate large-size equipment; therefore, quick diagnosis will be possible for emergency, surgical, and even inpatient care. Future upgrades will further strengthen precision and workflow efficiency, helping hospitals to reliably manage the rising diagnostic loads.

- Diagnostic Imaging Centers

Diagnostic imaging facilities will prefer those systems that promote high volume and great detail. Ongoing upgrades will ensure competitive performance in support of increasing patient loads for speed. Expansions going forward will be focused on optimized scheduling, rapid reporting, and enhanced patient comfort, making these centers trusted diagnostic partners within a wide range of medical disciplines.

- Specialty Clinics

Specialty clinics will increasingly use targeted imaging systems for focused medical fields. These units will have compact designs, be faster in their processing, and will have technology suited to specific conditions. Increased accuracy will allow for more precise treatment decisions, thus assisting specialists to provide high-value care in orthopedics, oncology, neurology, cardiology, and other boutique areas of medicine.

- Other End Users

Other end users will include facilities that need flexible imaging support without complicated infrastructure. Equipment options in the near future will focus on mobility, digital connectivity, and ease of use. These systems will extend reliable diagnostic capability to community centers, small practices, and developing healthcare programs looking for dependable access to imaging.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$28.4 Billion |

|

Market Size by 2032 |

$43 Billion |

|

Growth Rate from 2025 to 2032 |

6.1% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

Competitive Landscape & Strategic Insights

Strong competition defines the Diagnostic Imaging Equipment market, with constant improvement and innovation shaping progress. Demand for accurate scans, faster results, and better patient care encourages leading companies to invest in new technology and strong global presence. Each organization focuses on solutions that support hospitals and clinics in delivering dependable diagnosis and care.

Philips Healthcare continues strong activity in advanced systems that support early detection and efficient workflow. Siemens Healthcare builds technology aimed at high precision and reduced examination time. GE Healthcare remains known for broad product availability and support services. Canon Medical Systems Corporation and Toshiba Medical Systems Corporation focus on user-friendly design and reliable performance, supporting both large medical centers and smaller facilities. Hitachi Medical Corporation advances scanning systems that aim for clearer views of the human body. FUJIFILM Healthcare and Agfa Radiology Solutions work toward better image quality and digital integration within medical networks.

In addition, Hologic, Inc. drives progress in women’s health imaging, emphasizing breast cancer screening tools with strong accuracy. Samsung Medison strengthens ultrasound equipment development, supporting maternity and general care. Shimadzu Corporation maintains a respected position in X-ray systems and growing digital solutions. Carestream Health expands access to digital imaging, helping facilities manage records and scans more efficiently. Esaote S.p.A. brings specialized systems tailored for musculoskeletal and cardiovascular use. Shenzhen Mindray Bio-Medical Electronics Co., Ltd. rises as a key competitor with expanding reach and advanced digital technology.

Pricing strategies, service networks, and constant upgrades create major points of competition across all brands. Partnerships with hospitals, research centers, and technology companies support growth and strengthen product adoption. Clear focus on faster diagnosis, comfortable patient experience, and improved image clarity will guide future advancements. Strong rivalry encourages better tools for medical professionals and supports improved health outcomes worldwide, showing how vital this market remains in modern healthcare.

Market Risks & Opportunities

Restraints & Challenges:

Extremely high capital and maintenance costs for healthcare providers.

In the global diagnostic imaging equipment market, the excessive capital and upkeep fees will hold squeezing healthcare vendors because superior structures call for non-stop upgrading, specialised servicing, and skilled operators. Increasing financial burdens will decelerate the adoption of era for smaller centers, for that reason growing differences in diagnostic get right of entry to and decreasing the overall modernization pace in diverse areas.

Stringent regulatory approvals coupled with long product development cycles.

Complex regulatory approvals and long product development cycles would thus remain key growth inhibitors in the global diagnostic imaging equipment market due to the fact that manufacturers have to pass through difficult safety standards, extensive testing, and multi-stage validation procedures. Such demands increase launch timelines, enhance investments in research, and restrict the rapid entry of next-generation imaging technologies into highly competitive global healthcare settings.

Opportunities:

Expansion into portable and point-of-care imaging for decentralized healthcare.

The enlargement into transportable and factor-of-care imaging will open strong increase possibilities for the global diagnostic imaging equipment market, as compact structures help decentralized healthcare, faster prognosis, and higher emergency reaction. Further, extra mobility, less difficult controls, and extra accessibility will ensure wider diffusion in rural clinics, home-care programs, and cell clinical units, securing the destiny models of healthcare shipping.

Forecast & Future Outlook

- Short-Term (1-2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3-5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6-10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 28.4 Billion in 2025 to over USD 43 Billion by 2032. Diagnostic Imaging Equipment will maintain dominance but face growing competition from emerging formats.

Imaging technology will move beyond traditional hospital settings into community settings that could not previously access such advanced tools. Portable and adaptable devices will enable health workers to reach out to people who otherwise have to wait too long for proper diagnosis. Such progress will not only raise the level of care but also change the way the world looks at medical imaging. An increasingly connected, responsive industry will impact not only how society thinks about health but also make early insight and faster action a natural part of future healthcare journeys.

Report Coverage

This research report categorizes the Diagnostic Imaging Equipment market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Diagnostic Imaging Equipment market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Diagnostic Imaging Equipment market.

Diagnostic Imaging Equipment Market Key Segments:

By Modality

- Ultrasound Systems

- X-Ray Imaging Systems

- Computed Tomography (CT) Scanners

- MRI Systems

- Nuclear Imaging Systems

- Mammography Systems

- Other

By Portability

- Fixed Systems

- Mobile and Hand-held Systems

By Application

- Cardiology

- Oncology

- Neurology

- Orthopedics

- Gastroenterology

- Gynecology & Obstetrics

- Other Applications

By End User

- Hospitals

- Diagnostic Imaging Centers

- Specialty Clinics

- Other End Users

Key Global Diagnostic Imaging Equipment Industry Players

- Philips Healthcare

- Siemens Healthcare

- Shimadzu Corporation

- Esaote S.p.A

- GE Healthcare

- Samsung Medison

- Hitachi Medical Corporation

- Carestream Health

- Toshiba Medical Systems Corporation

- Hologic, Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383