Global Dental Milling Machine Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

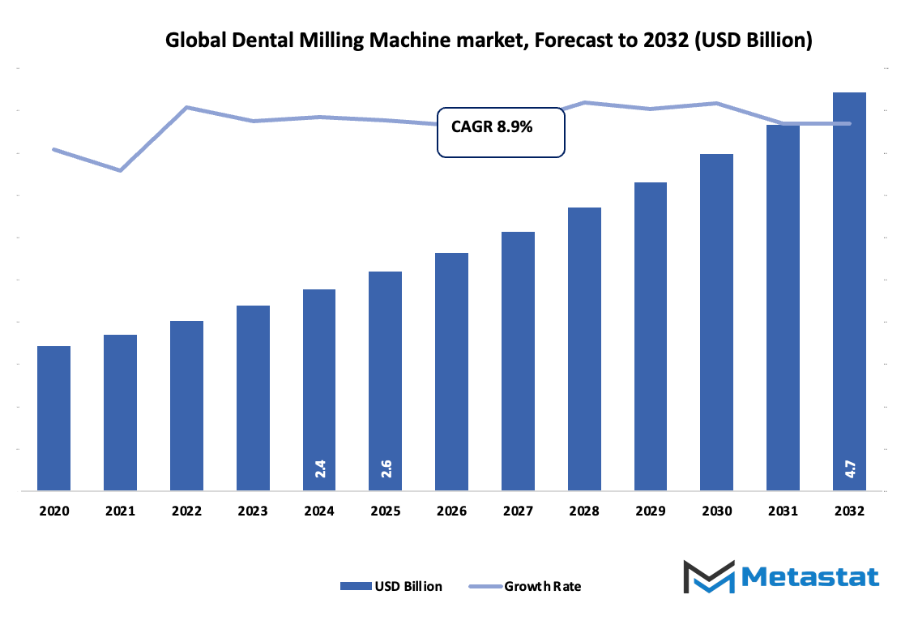

- The global dental milling machine market has been estimated at about USD 2.6 billion for the year 2025 and more than USD 4.7 billion due to about 8.9% CAGR from now to 2032.

- The wet milling technique will make up 47.1% of the market share in 2024 and will not only continue but also take the applications a step wider through intensive R&D, which leads to the technology’s pushing the boundaries of innovation.

- The main trends that have driven an increase in demand are: a persistent upward trend in cosmetic and restorative dentistry, digital dentistry, and CAD/CAM technologies becoming de facto in the world.

- The envisioned scenario: The rising demand for the technologies will be met by more chairside milling machines and 3D printing in the dental labs.

- Key Point: It is predicted that market demand will increase by three times over the next decade, which means it will be a favorable region for development.

Market Background & Overview

At first, the global dental milling machine market was but a small segment of chairside dentistry, it got transformed from user-operated systems of the late 1980s to digital solutions that would open up the next era of restorative therapy. The market matured from its inception with the hand-crafted quality of copied tooth dies and the quick-turnaround-first-to-branded-lab-batch-process demand at the existing and very hand-intensive dental labs. When the first CAD/CAM technology was introduced in clinics in the early 1990s, it was considered experimental by many practitioners. However, the promise of shorter turnaround times led to the gradual acceptance of the technology. The event that accelerated the adoption of CAD/CAM by dentists was the U.S. Food and Drug Administration's (FDA) clearance of the first chairside milling machines that were intended for commercial use, thus far more widespread clinical acceptance that could result.

As patients’ expectations change, the market will keep on taking their course, and one of the expectations will be restoration in a single visit. The American Dental Association’s reports indicated that in recent years more patients than ever before were interested in same-day treatment options, and this trend will lead clinics to buy the equipment that is able to make crowns, bridges, and custom components in a very short time. The dental laboratories are also experiencing the same change. The National Association of Dental Laboratories disclosed that the three-year period not only saw a volume increase of digital production but also a rise in zirconia-based restorative work that necessitates accurate milling was the reason for this increase.

Regulatory updates also influenced development. Government health agencies in Europe and Asia issued digital workflow guidelines that encouraged standardized production, which in turn led manufacturers to refine accuracy, noise reduction, and tool-life efficiency. As these standards continue to tighten, newer systems will adopt smarter calibration, closed-loop scanning, and more automated tool-change mechanisms.

Technological progress will remain central to the market’s future identity. High-speed spindles, hybrid wet-dry processing, and improved CAM algorithms will allow clinics and laboratories to handle complex geometries with minimal manual intervention. Meanwhile, data from public health authorities showing a rising global prevalence of tooth loss-driven by aging populations-suggests that demand for restorative solutions will continue to increase, sustaining investment in milling systems. From its early experimental phase to its current digital maturity, the market will keep expanding as dentistry leans further into precision-driven, patient-focused production.

Market Segmentation Analysis

The global dental milling machine market is mainly classified based on Type, Product Type, Axis Type, End-user.

By Type is further segmented into:

- Wet Milling:

Wet milling supports smoother restoration shaping through steady coolant flow, allowing consistent handling of zirconia, glass ceramics, and similar materials. This approach helps control heat generation during cutting, which supports material stability and final restoration accuracy. Such performance helps strengthen production quality within the global dental milling machine market while supporting dependable day-to-day dental workflow needs. - Dry Milling:

Dry milling uses airflow instead of liquid coolant, supporting faster processing and simpler machine upkeep. This method suits materials such as wax and PMMA, helping maintain clean workspaces and reducing maintenance demands. The technique allows reliable output for numerous restorative needs, contributing to steady growth within the market and supporting efficient operational routines across dental settings.

By Product Type the market is divided into:

- In-office Milling Machine:

In-office milling machine use supports same-day restorative creation, reducing patient visits and strengthening treatment convenience. Chairside access to milling solutions also supports faster turnaround for crowns, bridges, and similar restorations. This approach enhances workflow control for dental teams while supporting broader adoption across the market through quicker service delivery and improved clinical responsiveness. - In-lab Milling Machine:

In-lab milling machine use supports high-volume production with strong material compatibility and advanced precision. Larger units offer broader cutting strength, allowing detailed fabrication for complex restorative needs. Dental laboratories benefit from steady output quality, dependable accuracy, and scalable production capacities, helping maintain strong demand patterns within the market and supporting diverse fabrication requirements.

By Axis Type the market is further divided into:

- 5-Axis:

5-axis systems support multi-angle cutting for detailed restoration shaping, enabling improved surface detail and reduced manual finishing. Broader movement range allows complex geometries to be completed in fewer steps. This capability helps laboratories and clinics achieve dependable accuracy and consistent material results, strengthening overall confidence in advanced milling technology within the market. - 4-Axis:

4-axis systems support reliable milling for routine restorative needs through rotational and horizontal movement. This structure provides balanced performance for commonly used dental materials, offering stable production without higher-cost machinery. Such systems fit facilities seeking solid accuracy with manageable investment demands, supporting continued adoption across the market for daily restorative workflows.

By End-user the global dental milling machine market is divided as:

- Dental Laboratories:

Dental laboratories rely on milling systems for crown, bridge, and implant component production, requiring dependable accuracy and uniform results. Broad material support and scalable output help laboratories manage large case volumes. Such advantages encourage ongoing equipment investment, strengthening overall demand patterns across the market through sustained restorative fabrication activity and growing case complexity. - Dental Clinics:

Dental clinics use milling systems to support chairside restoration creation, enabling quicker treatment completion and reduced waiting periods. Access to precise milling strengthens patient satisfaction and supports smoother clinical scheduling. Enhanced control over restorative quality also encourages broader adoption among clinics, supporting ongoing expansion of milling solutions across the market and routine care settings. - Others:

Other users include educational centers, research facilities, and specialty providers that require dependable milling accuracy for training, prototype development, or specialized restorative production. These environments value consistency, material flexibility, and stable performance. Such usage supports additional market growth by expanding adoption beyond standard clinical and laboratory settings, contributing to wider system utilization.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$2.6 Billion |

|

Market Size by 2032 |

$4.7 Billion |

|

Growth Rate from 2025 to 2032 |

8.9% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

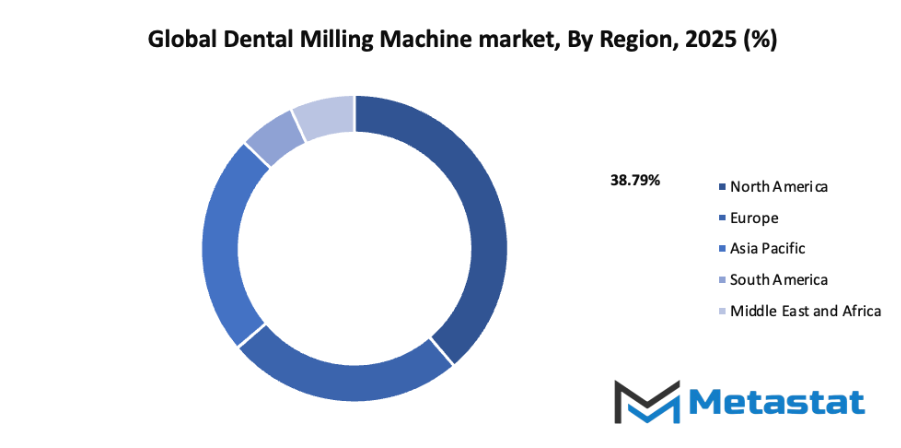

- Based on geography, the global dental milling machine market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Market Dynamics

Growth Drivers:

Rising demand for cosmetic and restorative dental procedures:

Strong interest in aesthetic care encourages wider use of advanced milling systems linked to the global dental milling machine market. Greater focus on natural-looking restorations encourages steady investment from dental centers, while broader patient expectations support consistent adoption of modern tools designed to improve accuracy, comfort, and long-term treatment quality.

Increasing adoption of digital dentistry and CAD/CAM technologies:

Digital workflows offer faster turnaround, reliable precision, and predictable outcomes, encouraging steady movement toward automated production systems. CAD/CAM use supports smoother cooperation between dental labs and clinical facilities, allowing efficient creation of crowns, bridges, and similar solutions. Growing dependence on digital tools encourages stronger confidence in milling equipment across many care environments.

Restraints & Challenges:

High equipment cost and maintenance requirements for small dental clinics:

Advanced milling units demand significant investment, creating financial pressure for smaller practices. Regular upkeep, software updates, and component replacement add further expense, reducing overall accessibility for facilities with limited budgets. Cost barriers slow wider adoption, limiting modernization efforts in locations seeking advanced production capability while managing strict operational spending limits.

Lack of trained professionals in digital dental manufacturing:

Specialized training remains essential for reliable system performance, yet many regions report limited availability of skilled operators. Insufficient familiarity with software, scanning tools, and milling workflows often leads to slower output, frequent errors, and inconsistent restoration quality. Limited training access restricts broader technological expansion within dental production environments.

Opportunities:

Growing use of chairside milling machines and 3D printing integration in dental labs:

Chairside systems support same-day restorations, allowing faster service and stronger patient satisfaction. Blending milling with 3D printing expands design freedom, encourages material innovation, and reduces turnaround in laboratory settings. Combined technologies create smoother production paths, supporting flexible fabrication options for a wide range of restorative and cosmetic treatment needs.

Competitive Landscape & Strategic Insights

The global dental milling machine market shows steady growth as demand for advanced digital solutions continues across dental laboratories and clinics. The sector features a mix of long-established international producers and rising regional groups, creating a competitive setting that encourages new methods, higher accuracy, and dependable performance. Strong emphasis on precision, durability, and workflow efficiency shapes purchasing decisions, leading to consistent interest in both premium and mid-range systems.

Major participants influence development trends through constant product updates and strong support networks. Dentsply Sirona provides broad product lines that support digital workflows from scanning to milling. Amann Girrbach AG presents versatile systems suitable for a wide range of materials. Planmeca Oy strengthens market reach through steady innovation supported by long experience in digital dentistry. Additional pressure comes from vhf camfacture AG, Ivoclar (Ivoclar Vivadent AG), DGSHAPE Corp. (Roland DG Group), imes-icore GmbH, DATRON AG, Zirkonzahn GmbH, Dental Machine (Tecno-Gaz / Dental Machine), Yenadent Ltd., UP3D (Shenzhen Up3D Technology Co., Ltd.), B&D Dental Technologies (Origin), Tecno-Gaz S.p.A. (Dental Machine / Tecno-Gaz), and Renishaw plc. Continuous rivalry among such groups encourages advancements that support smoother workflows, cleaner results, and stronger reliability across varied production settings.

Steady demand for restorative solutions, growth in cosmetic procedures, and expansion of digital dentistry support a positive outlook for the global dental milling machine market. Rising attention toward predictable outcomes also raises expectations for automated systems that reduce manual steps and support consistent restoration quality. Strong training programs and service partnerships add further momentum, encouraging wider adoption across both large laboratories and smaller practices. As more regions shift toward digital production, the market shows clear potential for additional expansion supported by ongoing technological progress and dependable service models.

Forecast & Future Outlook

- Short-Term (1-2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3-5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6-10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 2.6 billion in 2025 to over USD 4.7 billion by 2032. Dental Milling Machine will maintain dominance but face growing competition from emerging formats.

Report Coverage

This research report categorizes the global dental milling machine market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global dental milling machine market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global dental milling machine market.

Dental Milling Machine Market Key Segments:

By Type

- Wet Milling

- Dry Milling

By Product Type

- In-office Milling Machine

- In-lab Milling Machine

By Axis Type

- 5-Axis

- 4-Axis

By End-user

- Dental Laboratories

- Dental Clinics

- Others

Key Global Dental Milling Machine Industry Players

- Dentsply Sirona

- Amann Girrbach AG

- Planmeca Oy

- vhf camfacture AG

- Ivoclar (Ivoclar Vivadent AG)

- DGSHAPE Corp. (Roland DG Group)

- imes-icore GmbH

- DATRON AG

- Zirkonzahn GmbH

- Dental Machine (Tecno-Gaz / Dental Machine)

- Yenadent Ltd.

- UP3D (Shenzhen Up3D Technology Co., Ltd.)

- B&D Dental Technologies (Origin)

- Tecno-Gaz S.p.A. (Dental Machine / Tecno-Gaz)

- Renishaw plc

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252