MARKET OVERVIEW

The Global Data Protection and Recovery Solutions market is a dynamic arena within the broader information technology industry. As the digital landscape continues to expand and businesses increasingly rely on data to drive their operations, the need for robust protection and recovery solutions becomes paramount. This market encompasses a range of products and services designed to safeguard data from loss, corruption, and unauthorized access, while also facilitating its timely restoration in the event of an incident.

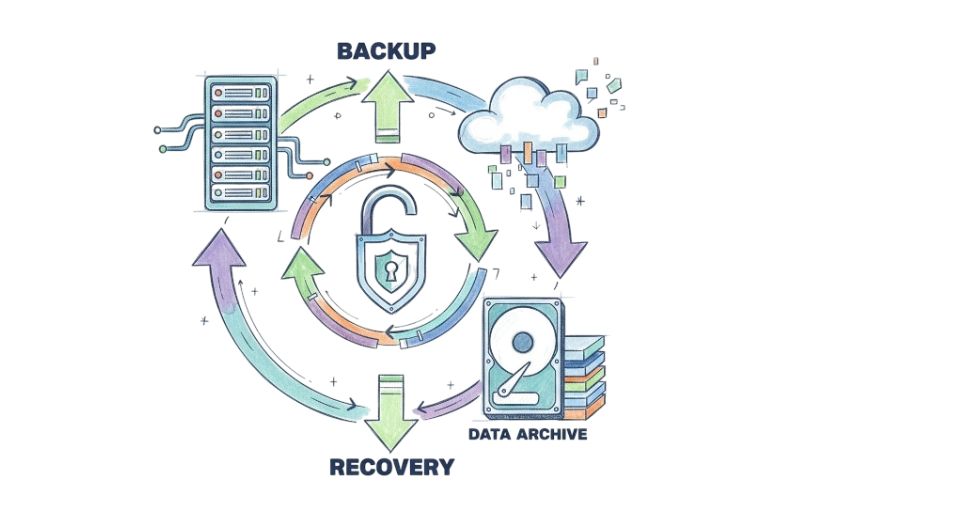

At its core, the Global Data Protection and Recovery Solutions market revolves around ensuring the integrity, availability, and confidentiality of critical information assets. This includes implementing measures such as data encryption, access controls, and backup procedures to mitigate the risks associated with cyber threats, system failures, and human error. Additionally, as organizations grapple with ever-changing regulatory requirements and compliance standards, there is a growing demand for solutions that offer comprehensive governance and auditing capabilities.

One of the key drivers shaping the future of this market is the proliferation of data across diverse environments, including on-premises infrastructure, cloud platforms, and edge devices. As businesses adopt hybrid and multi-cloud strategies to optimize performance and scalability, they are confronted with the challenge of securing data across disparate environments while ensuring seamless integration and interoperability. Consequently, there is a burgeoning need for data protection and recovery solutions that offer centralized management, unified visibility, and automated workflows to streamline operations and enhance resilience.

Moreover, the emergence of new technologies such as artificial intelligence and machine learning is poised to revolutionize the way organizations approach data protection and recovery. By harnessing the power of advanced analytics and predictive algorithms, these solutions can proactively identify and mitigate potential threats, anticipate data loss scenarios, and optimize resource allocation for optimal performance. Furthermore, as the volume and complexity of data continue to escalate, there is a growing emphasis on intelligent data management solutions that enable organizations to classify, prioritize, and optimize data storage and retention policies based on business value and risk.

In parallel, the Global Data Protection and Recovery Solutions market is witnessing a proliferation of innovative offerings tailored to specific industry verticals and use cases. Whether it's healthcare providers safeguarding sensitive patient data, financial institutions protecting transactional records, or manufacturing companies preserving intellectual property, there is a diverse array of solutions catering to unique regulatory, operational, and technological requirements. This trend towards specialization underscores the importance of customization and flexibility in addressing the evolving needs of different market segments.

Looking ahead, the Global Data Protection and Recovery Solutions market is poised for continued growth and innovation as organizations navigate the complexities of an increasingly data-centric world. By investing in robust, adaptive solutions that prioritize security, resilience, and agility, businesses can effectively safeguard their most valuable asset – their data – and capitalize on the opportunities of the digital age.

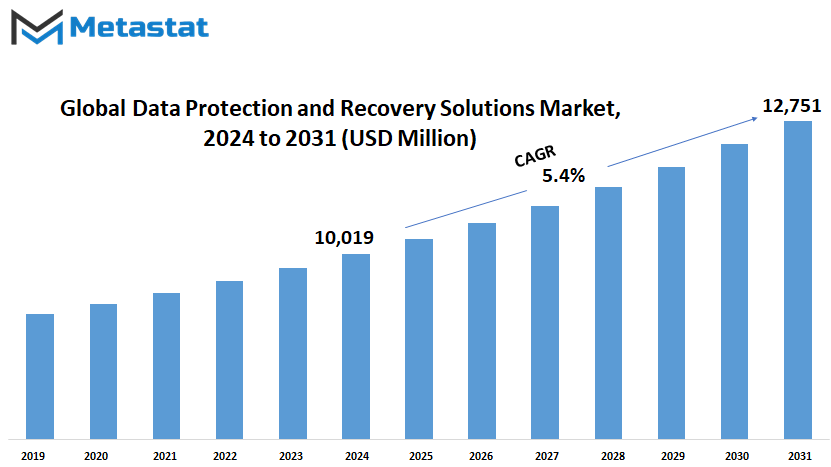

Global Data Protection and Recovery Solutions market is estimated to reach $12751 Million by 2031; growing at a CAGR of 5.4% from 2024 to 2031.

GROWTH FACTORS

In the vast landscape of the digital age, where data flows like a river through the networks of our world, the importance of safeguarding this invaluable resource cannot be overstated. The Global Data Protection and Recovery Solutions market stands as a bulwark against the rising tide of cyber threats and data breaches that threaten to undermine the integrity and security of our digital infrastructure.

In recent times, the proliferation of cyber threats has reached unprecedented levels, posing a grave risk to businesses, governments, and individuals alike. In response to this looming menace, organizations are increasingly turning to robust data protection measures to fortify their defenses and shield themselves from potential harm. This surge in demand for data protection solutions has been further fueled by stringent regulatory requirements, which compel organizations to implement comprehensive measures to safeguard sensitive information and ensure compliance with data protection laws.

However, amidst this backdrop of growing demand and heightened awareness, challenges abound that may impede the smooth sailing of the Data Protection and Recovery Solutions market. Foremost among these challenges are the high implementation costs associated with deploying comprehensive data protection solutions. For many organizations, especially small and medium-sized enterprises (SMEs), the financial burden of investing in state-of-the-art data protection technologies can be prohibitive, leading to hesitation and reluctance on their part.

Additionally, the landscape of data protection is characterized by a labyrinth of technologies, platforms, and methodologies, each with its own unique set of complexities and intricacies. Managing and integrating these diverse elements into a cohesive and effective data protection strategy can pose a significant challenge for organizations, requiring specialized expertise and resources that may not always be readily available.

Looking ahead, however, the horizon is not without promise. The growing demand for cloud-based data protection solutions heralds a new era of opportunity for the Data Protection and Recovery Solutions market. With their inherent scalability, flexibility, and cost-effectiveness, cloud-based solutions offer a compelling value proposition for organizations seeking to enhance their data protection capabilities without breaking the bank.

While the road ahead may be fraught with challenges, the prospects for the Global Data Protection and Recovery Solutions market remain bright. By navigating the turbulent waters of the digital landscape with foresight and innovation, organizations can chart a course towards a future where data is not just protected, but empowered to drive progress and prosperity for generations to come.

MARKET SEGMENTATION

By Solution

In the expansive landscape of technology, the Global Data Protection and Recovery Solutions market has emerged as a pivotal player in safeguarding the integrity and security of digital assets. This market encompasses various solutions aimed at protecting crucial data and ensuring its recovery in the event of unforeseen incidents or breaches.

One significant facet of this market is Email Protection, which saw a substantial revenue of 2750 million USD in 2017. With the increasing reliance on email communication in both personal and professional spheres, the need to shield these channels from cyber threats has become paramount. Email Protection solutions offer robust defenses against phishing attacks, malware infiltration, and unauthorized access, thereby fortifying the communication infrastructure of organizations and individuals alike.

Endpoint Data Protection is another vital segment within this market, accounting for a revenue of 1835 million USD in 2017. As computing devices proliferate and remote work becomes more prevalent, the endpoints where data resides are increasingly vulnerable to breaches and data loss. Endpoint Data Protection solutions serve as a bulwark against such risks by implementing encryption, access controls, and backup mechanisms to safeguard data stored on laptops, desktops, and mobile devices.

Application Recovery Management is an integral component of data protection strategies, with a revenue of 913.9 million USD in 2017. In the dynamic landscape of software applications, disruptions and downtime can have profound ramifications for businesses and end-users. Application Recovery Management solutions offer resilience against such disruptions by enabling swift recovery and restoration of critical applications, minimizing downtime and ensuring continuity of operations.

Cloud Platforms represent a burgeoning segment within the Global Data Protection and Recovery Solutions market, offering scalable and cost-effective options for data storage and protection. With the proliferation of cloud-based services and the adoption of hybrid IT environments, organizations are increasingly leveraging Cloud Platforms to augment their data protection strategies and mitigate risks associated with data loss and cyber threats.

In addition to these key segments, the market encompasses a spectrum of other solutions tailored to specific needs and use cases. As technological advancements continue to reshape the digital landscape, the Global Data Protection and Recovery Solutions market will play a pivotal role in safeguarding the integrity, confidentiality, and availability of data in an increasingly interconnected and data-driven world.

By Deployment

In today's fast-paced digital landscape, the Global Data Protection and Recovery Solutions market is witnessing significant growth and development. As businesses increasingly rely on digital data to drive their operations, the need for robust data protection and recovery solutions becomes paramount.

The market for data protection and recovery solutions is divided into two main deployment options: Cloud and On-premise. Both options offer unique advantages and cater to different business needs and preferences.

Cloud deployment is gaining traction due to its scalability, flexibility, and cost-effectiveness. With cloud-based solutions, businesses can leverage the power of remote servers to store and protect their data. This eliminates the need for costly hardware investments and allows for easy scalability as businesses grow.

On the other hand, On-premise deployment offers greater control and customization over data protection and recovery processes. Businesses that prioritize data security and compliance often prefer On-premise solutions as they can maintain full control over their data storage and management infrastructure.

By Enterprise Size

One key aspect of the market is its segmentation by enterprise size. Companies come in various sizes, ranging from large enterprises with vast resources and extensive infrastructure to small and medium-sized enterprises (SMEs) operating on a more modest scale. Each of these segments has unique needs and challenges when it comes to data protection and recovery.

Large enterprises, with their extensive operations and complex IT environments, require sophisticated solutions capable of handling large volumes of data across multiple locations. These solutions must be scalable, adaptable, and capable of integrating seamlessly with existing systems and processes. Additionally, large enterprises often have stringent regulatory requirements and compliance standards to meet, further necessitating robust data protection measures.

On the other hand, SMEs may lack the resources and expertise of their larger counterparts but still face similar risks when it comes to data loss and downtime. For these companies, affordability and ease of use are critical factors when selecting data protection and recovery solutions. They require solutions that are cost-effective, simple to deploy and manage, and provide reliable protection against common threats such as hardware failure, human error, and cyberattacks.

The Global Data Protection and Recovery Solutions market recognizes these differences in needs and preferences across different enterprise sizes. By segmenting the market into categories such as Large Enterprise and SMEs, vendors can tailor their offerings to better meet the specific requirements of each customer segment. This segmentation enables businesses of all sizes to find solutions that align with their budgets, technical capabilities, and risk profiles.

By End-use

In the vast landscape of technology, one crucial aspect that demands attention is data protection and recovery solutions. As we march forward into the future, the significance of safeguarding sensitive information against threats and ensuring its retrieval in case of mishaps will only amplify.

The Global Data Protection and Recovery Solutions market is a multifaceted arena, segmented by various end-users. These end-users include sectors such as BFSI, Energy & Utilities, Government, Healthcare, Manufacturing, Retail, and Others. Each sector has its unique set of challenges and requirements when it comes to data protection and recovery.

For instance, in the BFSI sector, the paramount concern is securing financial transactions and customer data from cyber-attacks and breaches. With the rise of digital banking and online transactions, the need for robust data protection measures becomes indispensable. Similarly, the healthcare sector deals with sensitive patient information that must be safeguarded to ensure patient privacy and compliance with regulations like HIPAA.

In the space of Energy & Utilities, data protection plays a critical role in ensuring the integrity and reliability of energy supply systems. Government agencies, on the other hand, handle vast amounts of sensitive data pertaining to national security and public services. Hence, their data protection needs revolve around safeguarding classified information and ensuring continuity of essential services.

Manufacturing industries rely heavily on data-driven processes for production and supply chain management. Data protection solutions are essential to prevent disruptions in operations and safeguard intellectual property rights. Retail sectors, with the proliferation of e-commerce, face challenges related to securing customer data and maintaining trust in online transactions.

The Other category encompasses a diverse range of industries, each with its specific data protection and recovery needs. These may include sectors such as education, transportation, and telecommunications, among others.

As technology continues to advance, the complexity and volume of data generated will only increase. Consequently, the demand for innovative data protection and recovery solutions will continue to grow across various industries. Companies will need to invest in cutting-edge technologies such as artificial intelligence, machine learning, and blockchain to stay ahead of evolving threats and ensure the safety and integrity of their data.

The Global Data Protection and Recovery Solutions market is a dynamic landscape shaped by the unique needs and challenges of different industries. With data becoming an invaluable asset in the digital age, investing in robust data protection measures will be essential for organizations to thrive in the future.

REGIONAL ANALYSIS

The global market for Data Protection and Recovery Solutions is segmented based on geographical regions. These regions include North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Each of these regions is further divided into specific countries or areas.

North America encompasses the United States, Canada, and Mexico. Europe is comprised of the United Kingdom, Germany, France, Italy, and other European countries. In Asia-Pacific, the key countries are India, China, Japan, South Korea, and other parts of the region. South America includes Brazil, Argentina, and other South American countries. Lastly, the Middle East & Africa region covers GCC Countries, Egypt, South Africa, and other parts of the Middle East & Africa.

This segmentation provides a comprehensive overview of the market's reach and distribution across different parts of the world. It allows businesses to understand the regional dynamics and tailor their strategies accordingly. For instance, companies operating in North America may need to consider the specific regulations and preferences of consumers in the United States, Canada, and Mexico, while those targeting the European market would focus on the diverse landscape of the UK, Germany, France, Italy, and other European countries.

Similarly, businesses looking to expand into the Asia-Pacific region would need to navigate the distinct markets of India, China, Japan, South Korea, and other countries in the area. Understanding the unique characteristics of each region is crucial for successful market penetration and growth.

Moreover, this geographical segmentation enables stakeholders to identify emerging opportunities and challenges in different parts of the world. For example, while North America and Europe may have well-established markets for data protection and recovery solutions, the Asia-Pacific region could offer significant growth potential due to its large population, rapid technological advancements, and increasing awareness about data security.

The global Data Protection and Recovery Solutions market is divided into distinct geographical regions, each with its own set of countries or areas. This segmentation facilitates a deeper understanding of regional dynamics, allowing businesses to tailor their strategies and capitalize on emerging opportunities worldwide.

COMPETITIVE PLAYERS

The Global Data Protection and Recovery Solutions market sees the participation of several prominent players. These companies, including Commvault, EMC Corporation, Hewlett-Packard Enterprise, IBM Corporation, Acronis, Veritas Technologies LLC, Veeam Software AG, Seagate Technology LLC, Unitrend, Arcserve (USA) LLC, Oracle, NetApp, CA Technologies, Symantec, McAfee, and Norton, are vital actors in this industry.

Each of these firms brings its unique strengths and capabilities to the table, contributing to the dynamic landscape of data protection and recovery solutions. Commvault, for instance, is known for its comprehensive data management and backup solutions, catering to a wide range of businesses and industries. On the other hand, EMC Corporation, now a part of Dell Technologies, boasts a long-standing reputation for its storage and data protection offerings.

Hewlett-Packard Enterprise (HPE) is another significant player in this field, leveraging its expertise in hardware and software solutions to provide robust data protection solutions to its clients. IBM Corporation, with its extensive portfolio of IT services and solutions, offers a suite of data protection and recovery products designed to meet the evolving needs of modern businesses.

Acronis, a global leader in cyber protection, focuses on delivering innovative solutions that combine data backup, disaster recovery, and cybersecurity capabilities. Veritas Technologies LLC, with its long history in data management and protection, continues to innovate with solutions tailored for hybrid and multi-cloud environments.

Veeam Software AG specializes in backup, replication, and data recovery for virtualized environments, while Seagate Technology LLC provides hardware-based data protection solutions, including storage devices and backup solutions. Unitrend and Arcserve (USA) LLC offer comprehensive backup and disaster recovery solutions for businesses of all sizes, ensuring data resilience and continuity.

Oracle and NetApp, both renowned for their storage and data management solutions, bring their expertise to the data protection arena, providing reliable backup and recovery options for enterprises. CA Technologies, Symantec, McAfee, and Norton, each with their own unique offerings, round out the competitive landscape, offering a diverse range of data protection solutions to address various cybersecurity challenges.

In this highly competitive market, innovation and adaptability will continue to be key drivers of success. As technology evolves and data volumes grow, companies will need to stay ahead of the curve, anticipating and addressing emerging threats and challenges in the realm of data protection and recovery.

Data Protection and Recovery Solutions Market Key Segments:

By Solution

- Email Protection

- Endpoint Data Protection

- Application Recovery Management

- Cloud Platforms

- Others

By Deployment

- Cloud

- On-premise

By Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

By End-use

- BFSI

- Energy & Utilities

- Government

- Healthcare

- Manufacturing

- Retail

- Others

Key Global Data Protection and Recovery Solutions Industry Players

- Commvault

- EMC Corporation

- Hewlett-Packard Enterprise

- IBM Corporation

- Acronis

- Veritas Technologies LLC

- Veeam Software AG

- Seagate Technology LLC

- Unitrend

- Arcserve (USA) LLC

- Oracle

- NetApp

- CA Technologies

- Symantec

- McAfee

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252