MARKET OVERVIEW

In logistics and transportation industry, the Global Dangerous Goods Logistics Market stands as a critical and specialized segment. This sector plays a vital role in the safe and efficient handling, storage, and transportation of goods that pose a risk to health, safety, and the environment. The complexity of managing dangerous goods necessitates a unique set of logistics solutions that go beyond the conventional supply chain.

The Global Dangerous Goods Logistics Market encompasses a spectrum of hazardous materials, ranging from flammable liquids and gases to toxic substances. Unlike the routine logistics operations, the transportation of dangerous goods demands meticulous planning, adherence to stringent regulations, and the implementation of advanced technologies to ensure the integrity of the supply chain.

One of the key challenges in the Global Dangerous Goods Logistics Market is the need for specialized packaging and labeling to comply with international standards and regulations. Ensuring that these materials are handled with the utmost care from the point of origin to the final destination is paramount. Any lapse in the logistics process can have severe consequences, not only for the businesses involved but also for public safety and the environment.

Moreover, the Global Dangerous Goods Logistics Market is continually evolving in response to changes in regulations, advancements in packaging technologies, and the emergence of new hazardous materials. Companies operating in this market must stay abreast of these developments to adapt their strategies and ensure compliance with the latest safety standards.

In addition to regulatory compliance, risk management is a crucial aspect of the Global Dangerous Goods Logistics Market. Companies must implement robust risk assessment and mitigation strategies to safeguard against potential incidents during transportation and handling. This involves investing in training programs for personnel, utilizing state-of-the-art tracking and monitoring systems, and fostering collaboration with regulatory bodies to stay ahead of emerging risks.

The importance of the Global Dangerous Goods Logistics Market extends beyond its immediate stakeholders to impact industries that rely on the transportation of hazardous materials, such as chemical manufacturing, pharmaceuticals, and energy. Any disruption in the logistics chain for dangerous goods can have far-reaching consequences, making it imperative for all involved parties to prioritize safety and compliance.

The Global Dangerous Goods Logistics Market plays a critical role in ensuring the secure and efficient movement of materials that pose inherent risks. The challenges posed by the transportation of dangerous goods require a specialized approach that goes beyond traditional logistics practices. As industries continue to innovate and introduce new hazardous materials, the Global Dangerous Goods Logistics Market will remain a dynamic and indispensable component of the global supply chain.

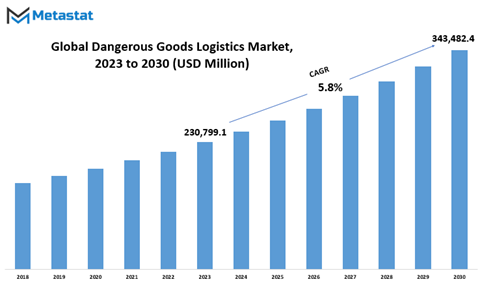

Global Dangerous Goods Logistics market is estimated to reach $343,482.4 Million by 2030; growing at a CAGR of 5.8% from 2023 to 2030.

GROWTH FACTORS

The Dangerous Goods Logistics Market is influenced by a variety of factors. One prominent driver is the rising demand for transporting hazardous materials, a consequence of growth in industries like chemicals, oil & gas, and mining. These sectors rely on the movement of dangerous goods to support their operations, driving the demand for specialized logistics services.

Another significant driver is the presence of stringent regulations governing the safe transportation of dangerous goods. Governments and regulatory bodies have imposed strict guidelines to ensure the secure handling and transport of hazardous materials. This not only safeguards the environment and public safety but also compels businesses to seek reliable logistics partners who can navigate these regulations effectively.

However, alongside these drivers, there are also constraints that shape the Dangerous Goods Logistics Market. High costs associated with the transportation of dangerous goods can be a significant deterrent. Ensuring compliance with safety regulations, packaging, and insurance requirements can significantly increase the overall transportation expenses.

Moreover, there is a limited availability of specialized equipment and trained personnel. Handling and transporting dangerous goods require specific knowledge, skills, and equipment. The shortage of these resources can create logistical challenges and limit the capacity of service providers.

MARKET SEGMENTATION

By Business Type

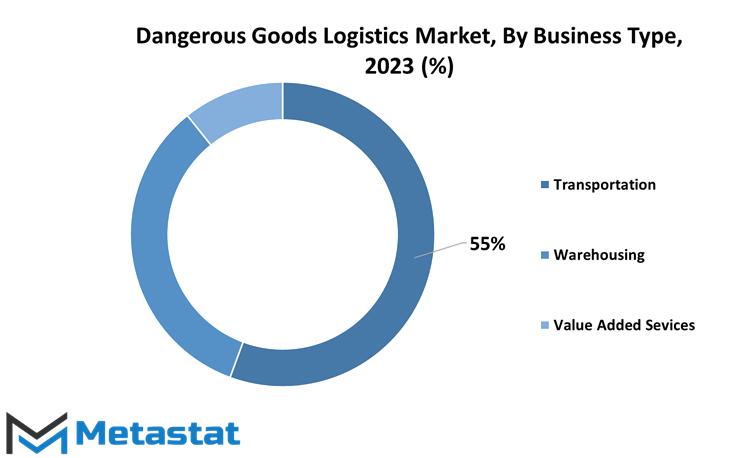

The Dangerous Goods Logistics Market encompasses various facets that together constitute a critical component of the global supply chain. Among these aspects, the segmentation by business type plays a pivotal role. It comprises Transportation, Warehousing, and Value Added Services, each contributing uniquely to the dynamics of the market.

Transportation, as an integral part of the Dangerous Goods Logistics Market, held a substantial value of 121,669.8 USD Million in 2022. This segment is the lifeline of industry, responsible for the safe and efficient movement of dangerous goods from one point to another. The significance of proper transportation cannot be overstated, as any lapse in this aspect could lead to severe consequences.

In parallel, the Warehousing segment, valued at 73,352.9 USD Million in 2022, adds another layer of importance. Warehouses dedicated to handling dangerous goods must adhere to stringent safety and security standards. They act as essential repositories, ensuring that these goods are stored in a manner that minimizes risk and complies with regulations. The significance of warehousing extends to the safe storage of goods awaiting transportation and delivery.

The Value Added Services, which had a valuation of 23,495.7 USD Million in 2022. These services bring an extra dimension to the dangerous goods logistics market. They encompass a range of activities such as labeling, packaging, documentation, and compliance management. Value Added Services are crucial for maintaining the integrity and safety of the goods throughout their journey, making them an indispensable part of the overall process.

In essence, these three segments of business types, namely Transportation, Warehousing, and Value Added Services, coalesce to ensure the effective and secure management of dangerous goods within the logistics industry. Their individual contributions are interlinked, forming a seamless operation that upholds safety and compliance in the ever-challenging landscape of dangerous goods logistics.

By Operation

The Dangerous Goods Logistics Market, a dynamic and crucial sector, encompasses diverse modes of operation to meet the needs of various industries. It's an intricate web where safety and efficiency are paramount, and these operations play a vital role.

The Seaways segment, valued at 37205.7 USD Million in 2022, is a key player in the dangerous goods logistics market. It facilitates the transportation of hazardous materials across oceans and seas. With strict regulations and safety measures in place, seaways transportation ensures that goods reach their destination securely, especially for industries like chemicals and oil.

On the other hand, Roadways, valued at 100119.7 USD Million in 2022, are the workhorses of the logistics market. They handle a significant portion of dangerous goods transportation, ensuring that products like flammable chemicals or explosives reach their destinations efficiently. Roadway transportation is critical for shorter distances and areas with limited access to other modes.

Railways, valued at 42943.8 USD Million in 2022, provide a reliable and cost-effective means of transporting dangerous goods. Rail transport is preferred for its ability to move bulk quantities safely, making it a favored choice for industries dealing with hazardous materials like petroleum or toxic chemicals.

In the realm of air transport, the Airways segment, valued at 20408.1 USD Million in 2022, plays a vital role in the logistics market. It caters to urgent deliveries of dangerous goods, such as medical supplies, and offers a swift and secure mode of transportation, ensuring that time-sensitive materials reach their destinations promptly.

Moreover, the Storage and Services segment, valued at 17841.1 USD Million in 2022, is an integral part of the dangerous goods logistics market. It involves the warehousing, handling, and management of hazardous materials. Storage and service providers ensure compliance with safety regulations and offer solutions to effectively store and handle these goods.

The Dangerous Goods Logistics Market is a dynamic and diverse industry that relies on multiple modes of operation to transport hazardous materials safely and efficiently. These segments, whether by seaways, roadways, railways, airways, or through storage and services, collectively form a vital part of this intricate web, ensuring that dangerous goods reach their destinations without compromising safety or efficiency.

By Product

The Dangerous Goods Logistics Market, concerning product segmentation, features distinct categories that encompass a wide range of potentially hazardous materials. These categories are the Flammable, Explosive, Radioactive, Bio-hazardous, and Others segments. Each of these segments presents unique challenges and opportunities within the market.

The Flammable segment, valued at 85524.3 USD Million in 2022, comprises materials that have the potential to ignite and sustain a fire under specific conditions. These goods demand special care in handling, storage, and transportation to mitigate the risks associated with their combustible nature.

Further, the Explosive segment, valued at 51816.4 USD Million in 2022, encompasses materials that can undergo rapid combustion, often with the release of a significant amount of energy. Ensuring the safe transport and handling of explosives is crucial to prevent accidents and safeguard lives and property.

The Radioactive segment, valued at 33364.7 USD Million in 2022, includes materials that emit ionizing radiation. Proper logistics for radioactive substances are vital to prevent exposure and protect both the environment and human health.

The Bio-hazardous segment, valued at 29700.9 USD Million in 2022, involves materials that pose a threat to living organisms, including humans. Effective logistics in this category are crucial to minimize the risk of contamination and the potential spread of diseases.

The Others segment, valued at 18112.1 USD Million in 2022, encompasses a broad spectrum of dangerous goods that do not fall squarely into the previous categories. This category may include corrosive materials, oxidizers, and other substances with unique handling requirements.

The diversity in the Dangerous Goods Logistics Market, as illustrated by these product segments, underscores the importance of tailored logistics solutions for each category. Safety, regulatory compliance, and the prevention of accidents and environmental harm remain top priorities in this intricate and critical sector.

By Application

The global Dangerous Goods Logistics market presents a dynamic landscape, influenced by a diverse range of applications. This market's vitality is evidenced by its segmentation into several key application areas, each with distinct characteristics and demands.

One significant application within the Dangerous Goods Logistics market is the Industrial sector. In 2022, the Industrial segment displayed a substantial value of 104,004.2 USD Million. This sector encompasses the transportation and management of hazardous materials and substances vital to industrial processes. It involves intricate logistics solutions to ensure the safe handling, storage, and distribution of these dangerous goods, which are integral to the functioning of various industrial operations.

Another crucial application area is Healthcare, with a market value of 53,932 USD Million in 2022. The Healthcare segment specializes in the transportation of hazardous medical materials and pharmaceuticals. These goods demand a meticulous approach to logistics to guarantee their safe and secure delivery, considering the critical nature of healthcare supplies.

The Agriculture sector, valued at 33,165.9 USD Million in 2022, represents yet another facet of the Dangerous Goods Logistics market. This application involves the transport of dangerous materials used in agricultural activities. These materials, which include fertilizers and pesticides, necessitate precise logistics to mitigate potential risks to both people and the environment.

Furthermore, the Dangerous Goods Logistics market extends its reach into various other domains, collectively referred to as "Others." These applications cover a diverse range of sectors, including automotive, chemicals, and more. The logistics requirements for these diverse applications are as multifaceted as the industries themselves, reflecting the wide spectrum of dangerous goods transported.

The global Dangerous Goods Logistics market operates in multiple application areas, each with distinct logistics challenges and specificities. These sectors, including Industrial, Healthcare, Agriculture, and Others, highlight the intricate and varied nature of this market, where the safe handling and transportation of hazardous materials are paramount.

REGIONAL ANALYSIS

The global Dangerous Goods Logistics market, based on geography, is segmented into North America, Europe, Asia-Pacific, and the rest of the world. These geographical divisions play a crucial role in shaping the dynamics of this market. In North America, the Dangerous Goods Logistics market is driven by stringent regulations and a strong focus on safety. The United States and Canada, in particular, have well-established frameworks for handling and transporting dangerous goods. This region boasts a mature logistics infrastructure, which is essential for the safe and efficient movement of hazardous materials.

Moving over to Europe, the market here is heavily influenced by the European Agreement concerning the International Carriage of Dangerous Goods by Road (ADR). European countries have harmonized regulations for the transport of dangerous goods by road, ensuring a standardized approach. This region places a significant emphasis on environmental sustainability and safety measures, which has a direct impact on logistics practices.

In Asia-Pacific, the market for Dangerous Goods Logistics is propelled by the rapid industrialization and economic growth in countries like China and India. As industries expand, the demand for the transportation of hazardous materials increases. However, this region also faces unique challenges, including varying regulations across countries and the need for substantial investments in logistics infrastructure to ensure safety.

The rest of the world, comprising regions in South America, Africa, and the Middle East, exhibits diverse dynamics. In some areas, the market is nascent, with the need for stringent regulations and infrastructure development. In others, it is driven by specific industries, such as mining or oil and gas, which require specialized logistics for handling dangerous goods.

COMPETITIVE PLAYERS

The Dangerous Goods Logistics market is a complex landscape where various players are engaged in the movement and handling of hazardous materials. One of the key players in this sector is Agility Logistics. Agility Logistics is a prominent company that specializes in providing logistics solutions for dangerous goods. They have a strong global presence and a wealth of experience in managing the transportation and storage of hazardous materials.

Another significant player in the Dangerous Goods Logistics market is Bolloré Logistics. Bolloré Logistics is a well-established name in the logistics industry and has a dedicated division for handling dangerous goods. They offer a range of services, including the safe transport and storage of hazardous materials. Their expertise in compliance with regulations and safety measures makes them a trusted choice for businesses dealing with dangerous goods.

These key players play a crucial role in ensuring the safe and efficient handling of dangerous goods. They have the necessary expertise and resources to navigate the complexities and challenges of this specialized sector. Businesses that deal with hazardous materials rely on these players to meet regulatory requirements and maintain the integrity of their supply chains. The Dangerous Goods Logistics market continues to evolve, and the presence of such key players is vital for maintaining safety standards and ensuring the smooth movement of dangerous goods.

Dangerous Goods Logistics Market Key Segments:

By Business Type

- Transportation

- Warehousing

- Value Added Services

By Operation

- Seaways

- Roadways

- Railways

- Airways

- Storage and Services

By Product

- Flammable

- Explosive

- Radioactive

- Bio-hazardous

- Others

By Application

- Industrial

- Healthcare

- Agriculture

- Others

Key Global Dangerous Goods Logistics Industry Players

- Agility Logistics

- Bolloré Logistics

- CEVA Logistics

- CMA CGM Group

- DB Schenker

- DGD Transport

- Deutsche Post DHL Group

- DSV A/S

- Expeditors International of Washington, Inc.

- FedEx Corporation

- GEODIS

- Hellmann Worldwide Logistics SE & Co. KG

- Kuehne + Nagel International AG

- Rhenus Logistics

- Sinotrans Limited

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252