MARKET OVERVIEW

The global cosmetics and personal care testing inspection and certification (TIC) market will transform as a vital pillar in guaranteeing safety and confidence in beauty and hygiene products across different regions. It will be a dynamic space where scientific requirements and client expectations interlink with regulatory demands. What will distinguish the sector will be its ability to keep up with changes in consumer behaviors like clean formulations, sustainable materials, and transparency while meeting formal requirements.

In the industry, the labs will be able to analyze new ingredients, be they botanical extracts or new preservatives, using sophisticated analytical tools that will detect even trace level impurities. At the same time, certification agencies will be able to verify compliance with future regulations, for instance, tighter allergen levels or microbiological levels. Brands will commission these services to affirm their formulations, strengthening consumer confidence in their products, whether they introduce themselves into developed markets or developing economies.

Test houses will adapt techniques to evaluate not only safety but performance, for example, skin compatibility or moisture retention. They will be geared to changing consumer demands such as cruelty-free or vegan status and whether products pass them. Inspection procedures, also, will be tailored to different supply chain configurations, from small-scale artisanal makers to worldwide contract makers. The laboratories and auditors will work very closely with the brand owners and the suppliers to track back ingredient origins, audit good manufacturing practices, and guarantee consistent quality. With sustainability increasingly defining production decisions, certification systems will feature audits for packaging recyclability, responsible sourcing, and lower energy consumption in manufacturing. Transparency labels certified by third parties will be adopted in the market, providing consumers with visible assurance. Testing procedures will adapt to non-conventional materials like bioplastics or compostable forms, testing their compatibility with product stability and safety.

Technological innovation will speed up capabilities: artificial intelligence-based analysis of data will predict potential risks before they happen, enabling labs to focus on new tests. Miniaturized assays and high-throughput screening will provide quicker turnaround times, facilitating speedier product development for brands while not compromising on vigilance. Video and data-sharing platform-based remote audit tools will enable facilities in remote parts of the world to be inspected without the need for prompt travel, expanding geographical reach.

Regulatory environments will increasingly harmonize globally, and the market will enable cross-border recognition of test results and certificates. This will reduce duplication for global brands and facilitate entry into new markets. Conversely, specialist services will develop for niche segments like microbiome safety testing or higher-end sunscreen efficacy tests suited to science-intensive niches. These will enable brands to substantiate exact claims and innovate responsibly.

Training and advisory services will become increasingly important. Sector-linked consultants will navigate customers through complex regulation across a number of jurisdictions, assisting them in anticipating standards that will emerge in the future. Such assistance will minimize expensive reformulations or recalls and will facilitate smoother product launches. Throughout, the industry will combine technical discipline with commercial flexibility.

It will maintain scientific integrity while meeting the needs of brands desiring differentiation. As consumer consciousness and scrutiny over personal care products continue to increase, the cosmetics & personal care TIC market globally will be a pillar that supports credibility, drives innovation, and inspires confident buying. In the end, it will become an indispensable ally in the pursuit of a safer, more responsible beauty industry.

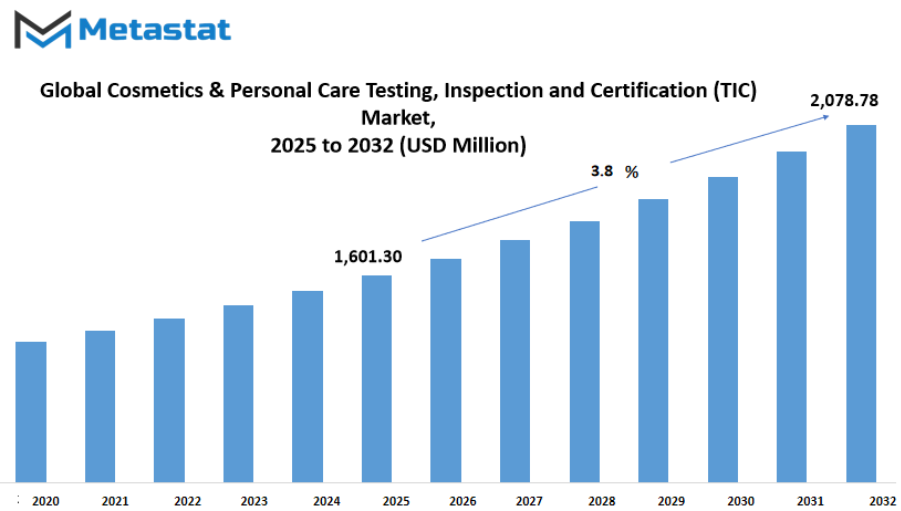

Global Cosmetics & Personal Care Testing, Inspection and Certification (TIC) market is estimated to reach $2,078.78 Million by 2032; growing at a CAGR of 3.8% from 2025 to 2032.

GROWTH FACTORS

The global cosmetics and personal care testing inspection and certification (TIC) market is expected to expand steadily as demand for quality and safe products continues to grow. More regulations in most regions will drive the need for stringent testing and inspection to ensure that all products meet safety and quality standards. As consumer anxiety for product safety grows and usage of organic and natural ingredients continues to rise, this will also propel the market, with companies looking to tested certification to guarantee confidence and transparency. Rapid innovation in cosmetic formulations will similarly propel demand for advanced testing solutions to meet new and advanced regulatory requirements.

Rising urbanization and a boom in disposable incomes will propel rising consumption of beauty and personal care products. With growing consumption, testing, inspection, and certification services will become vital for firms that wish to adhere to international standards.

Increased popularity of e-commerce portals will also create new opportunities for the market. As the online presence is greater, products now cross borders more often, and testing and certification become unavoidable in order to provide export and import compliance. But extreme operational costs and poor consistent regulations within regions may discourage the global cosmetics and personal care testing inspection and certification (TIC) market. Different countries have differing test procedures, which induce delays and additional costs for companies that are seeking certification for many markets. Lack of awareness in developing nations may also slow adoption since small-scale producers never value the benefits of quality assurance.

Online platforms for tracking and managing compliance processes will simplify the certification process for manufacturers, opening doors to growth and innovation. Trends for sustainability will also shape the future of the market, as companies increasingly switch to green packaging and clean formulations involving additional compliance tests. The Global Cosmetics & Personal Care Testing, Inspection and Certification (TIC) sector will continue to evolve as there is rising worldwide demand for safe, innovative, high-quality products. A consumer-aware, technology-oriented, and stringent standards-based future will make testing and certification an afterthought but also a key method of proving credibility and trust in a fiercely competitive market.

MARKET SEGMENTATION

By Service Type

A detailed look at the global cosmetics and personal care testing inspection and certification (TIC) market offers a glimpse into what lies ahead. The investigation of this market will focus on service types, with exploration into Testing Services, Inspection Services, and Certification Services. Each element will shape how safety, quality, and compliance evolve as innovation accelerates.

The exploration begins with Testing Services, a pillar that will continue to grow as demand for product safety increases. Cutting-edge methods such as noninvasive digital analysis and real-time monitoring will enhance the ability to detect harmful ingredients. Testing Services will ensure that formulations adhere to evolving regulatory requirements, even as novel substances and biodegradable formulations gain traction. Advances will reduce turnaround time, making it easier for brands to bring products to consumers responsibly.

Inspection Services will follow, ensuring that production lines and supply chains operate under higher standards. Inspections will expand beyond physical audits to include remote surveillance and predictive maintenance. Real-time data from Internet-of-Things devices and machine learning algorithms will make inspections more proactive. This shift will help identify anomalies before they become serious issues, ensuring continuous compliance and fostering trust between manufacturers and regulators.

Certification Services will play a vital role in confirming adherence to global standards. With tightening regulations, certification will become more rigorous and dynamic. Digital certificates stored on distributed ledgers will prevent tampering and simplify verification for stakeholders across continents. Markets will rely on certification not only for regulatory approval but also to signal commitment to safety and sustainability. Brands will leverage certification to demonstrate transparency, especially as consumers demand proofs of safety and environmental responsibility.

Looking forward to the global cosmetics and personal care testing inspection and certification (TIC) market will transform. Testing Services, with faster and more sensitive tools, will enable safe innovation. Inspection Services will become smarter, moving from periodic audits to continuous oversight. Certification Services will evolve into dynamic, digital badges of compliance that boost credibility in a global marketplace.

A human-centered perspective sees the market responding to consumer expectations and regulatory shifts while harnessing technology. The future of the global cosmetics and personal care testing inspection and certification (TIC) market will highlight how service types evolve, reinforcing a commitment to safe, reliable, and transparent personal care products. The market will not only support innovation but also uphold the responsibility to protect consumers and the environment

By Product Type

The future will bring remarkable strides in how testing, inspection and certification shape quality and safety in cosmetic and personal care products. The global cosmetics and personal care testing inspection and certification (TIC) market will expand into new frontiers by product type. Testing of hair care items will use advanced sensors that predict formula stability before full-scale trials begin. Treatment of skin and body products will rely on eco-friendly micro-lab tools that run simulations on ingredients to ensure no harmful reactions occur. Bath product evaluation will benefit from handheld devices that instantly analyze pH balance and ingredient purity at production sites. Testing designed for kid and baby safe products will focus on ultra-sensitive assays that detect trace allergens in a fraction of current time. Evaluation of OTC & cosmeceuticals will incorporate AI-augmented microscopes that spot microscopic contaminants with precision. Other categories will adopt remote audit tools that monitor facility compliance through secure video feeds and smart reporting.

This evolution means processes will become faster, cleaner, and more transparent. Real-time data will feed dashboards where factory managers and testing labs receive updates on every batch, reducing delays and ensuring only compliant products go forward. Inspection by robots will occur in high-speed packaging lines, flagging anomalies without slowing output. Certification agencies will verify standards using blockchain-backed records that cannot be tampered with, so every certificate will hold irrefutable traceability.

Expect global demand for these innovations to grow, especially where regulations tighten and consumers demand safer products. Companies offering fast, accurate testing for hair care, skin and body, bath, baby-safe, OTC & cosmeceuticals, and other types will lead in trust and reputation. Suppliers will invest in portable testing kits and virtual audits, shrinking the gap between lab and market. In less regulated regions, mobile labs will travel to small makers, bringing certification access to remote areas that otherwise lack testing infrastructure.

Future workflow will look like this: a formulation is entered into a digital interface, smart tests for every relevant product type run automatically, results appear almost instantly, and compliance certificates issue without manual review. Speed, safety, and confidence in product quality will increase across the global cosmetics and personal care testing inspection and certification (TIC) market. Companies that embrace these tools will not only stay ahead but will also bring safer products to people faster than ever before.

By Sourcing Type

The global cosmetics and personal care testing inspection and certification (TIC) market holds a vital place in ensuring safety and quality. Looking ahead, this market will move toward more advanced approaches that shape how products are tested, inspected and certified in future settings. The future will show how global cosmetics and personal care testing inspection and certification (TIC) market will tap data driven methods, real-time monitoring and smart sensing to raise standards for safety and performance.

Across the global cosmetics and personal care testing inspection and certification (TIC) market, two main sourcing types will appear: Outsourced and In-house. Outsourced testing will benefit from networks of specialized labs offering wide technical knowledge and equipment without needing each company to maintain costly facilities. That will free resources to focus on core efforts such as product design, marketing and distribution. On the other hand, In-house testing will let companies adapt quickly to new trends, tailor test protocols and manage sensitive data control. That will suit firms wanting direct control over quality checks and proprietary ingredient evaluation.

Future will bring blended approaches in the global cosmetics and personal care testing inspection and certification (TIC) market where Outsourced and In-house methods work together. For example, initial screening may happen within company walls to monitor new product formulations rapidly, then complex or regulated tests might move to external labs with certifications recognized across regions. That will create flexibility without losing rigor. Emerging tools such as predictive analytics powered by machine learning will allow earlier detection of potential risk, saving time and helping steer resources toward critical areas. Smart sensors embedded in production lines will feed constant data across systems, triggering alerts when unusual results appear. That keeps quality high while reducing delays.

Innovations in testing techniques such as tissue models or computer simulations also will raise confidence in safety assessments while reducing reliance on traditional animal-based tests. Digital platforms will streamline certification workflows, offering faster document exchange and real-time status tracking. That will push the global cosmetics and personal care testing inspection and certification (TIC) market into greater efficiency and transparency. Stronger collaboration between regulators, lab providers and cosmetic makers will help shape clearer guidelines that keep safety at the forefront of progress. Future horizon promises a global cosmetics and personal care testing inspection and certification (TIC) market that balances speed, accuracy and trust, using both Outsourced and In-house knowledge to meet tomorrow’s needs.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1,601.30 million |

|

Market Size by 2032 |

$2,078.78 Million |

|

Growth Rate from 2025 to 2032 |

3.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

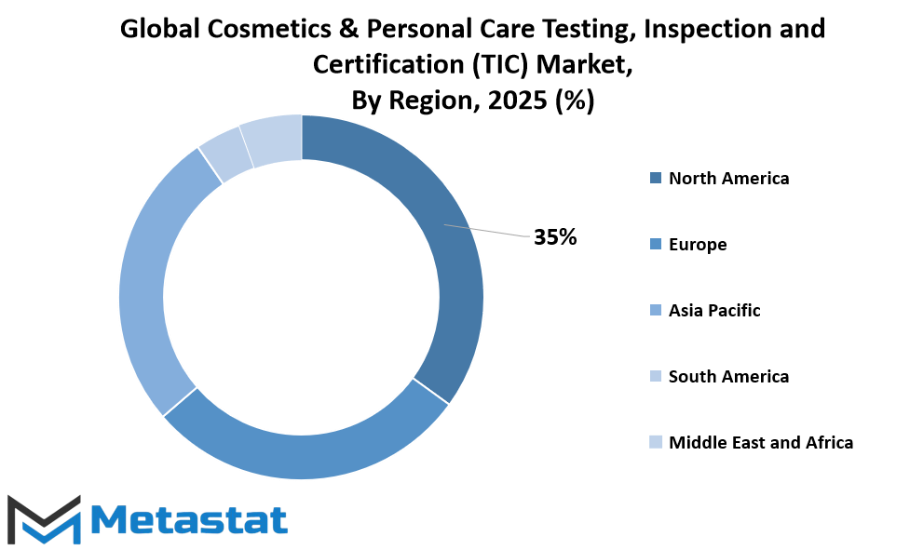

REGIONAL ANALYSIS

The global cosmetics and personal care testing inspection and certification (TIC) market is shaping the future of product safety, quality, and compliance across every major region. With rising consumer awareness and stricter regulatory standards, this market will continue to expand as companies seek trusted testing and certification processes to maintain credibility and meet evolving demands. Advancements in biotechnology, digital testing platforms, and automated inspection systems will further push the industry toward faster and more reliable solutions that meet both regulatory requirements and consumer expectations.

In North America, steady growth will be driven by advanced testing facilities in the U.S., Canada, and Mexico, where increasing demand for safe and sustainable personal care products will require constant innovation in testing methods. Companies in this region will adopt cutting-edge technologies to ensure accuracy and efficiency, allowing products to reach the market more quickly while maintaining safety standards.

Europe will maintain a strong position as regulatory frameworks in the UK, Germany, France, Italy, and other countries push for higher quality standards. The push for clean beauty and eco-friendly formulations will drive the need for comprehensive testing, ensuring that every product aligns with environmental and safety guidelines. Advanced laboratories and digital inspection systems will play a major role in meeting these requirements while supporting faster certification timelines.

Asia-Pacific will witness the fastest expansion due to rapid urbanization and rising consumer spending in countries such as India, China, Japan, and South Korea. This growth will be supported by high demand for innovative personal care products and the adoption of smart testing technologies that improve efficiency. Investments in AI-powered inspection and certification systems will enhance reliability, creating opportunities for global partnerships and technological collaborations in this region.

South America, led by Brazil and Argentina, will see gradual progress as awareness of product safety and quality rises among consumers. The region will benefit from strategic alliances with global testing providers, bringing advanced solutions that support regulatory compliance and boost market growth.

The Middle East & Africa will experience steady development, with GCC countries, Egypt, and South Africa driving demand for high-quality testing services. Increasing investment in the beauty and personal care sector, paired with a shift toward sustainable and safe product formulations, will create significant opportunities for advanced certification systems in the future.

With innovation shaping every stage of testing and inspection, the global cosmetics and personal care testing inspection and certification (TIC) market will remain a critical component of the beauty and personal care industry. Growing demand for safety, sustainability, and efficiency will ensure consistent progress, making the sector a vital driver of global quality assurance in the years ahead.

COMPETITIVE PLAYERS

The global cosmetics and personal care testing inspection and certification (TIC) market will continue to expand as demand for product safety, quality, and regulatory compliance grows worldwide. Continuous innovation in beauty and personal care products will create more opportunities for reliable testing and certification services. Stringent safety standards set by governments and international organizations will further push brands to rely on trusted providers, ensuring consumer confidence and compliance with diverse regional regulations.

Strong competition will shape the future of this industry, as leading players aim to enhance their testing capabilities and expand their global reach. Companies such as SGS, Intertek Group PLC, Bureau Veritas, Eurofins Scientific, TÜV SÜD, UL Solutions, ALS Limited, NSF International, Waters Corporation, CIRS Group, Cosmax, Dermaclaim Lab S.L., ACT Lab, and Shriram Food & Pharma Research Centre will play a key role in driving innovation and maintaining high industry standards. These organizations will not only focus on laboratory excellence but will also invest in advanced digital tools, such as automated systems and AI-driven analytics, to improve accuracy and reduce testing timelines.

Growing awareness of clean beauty, sustainability, and ethical sourcing will continue to influence this market. Certification of products that meet eco-friendly or cruelty-free standards will be in higher demand, and competitive players will adapt by offering specialized services to match these consumer expectations. For instance, laboratories will refine their processes to assess safety without compromising environmental or ethical values, a shift that will set new benchmarks for the industry.

Strategic partnerships, acquisitions, and technological advancements will shape the way these companies operate. Collaboration between TIC service providers and cosmetics manufacturers will help streamline testing processes, making them faster and more cost-efficient. The integration of digital platforms will allow real-time monitoring of testing progress and quicker delivery of certifications, which will be essential as companies work to launch products at a rapid pace in a highly competitive environment.

The global cosmetics and personal care testing inspection and certification (TIC) market will also see strong growth in emerging economies, where rising disposable income and an increasing focus on personal care are fueling the expansion of local and international brands. Key players will strengthen their presence in these regions by establishing state-of-the-art facilities and offering localized services that meet both global standards and regional regulatory requirements.

Future growth will be defined by adaptability and innovation. Companies that prioritize efficiency, transparency, and sustainability will lead the market, while those that fail to evolve will struggle to keep up with rapidly shifting industry needs.

Cosmetics & Personal Care Testing, Inspection and Certification (TIC) Market Key Segments:

By Service Type

- Testing Services

- Inspection Services

- Certification Services

By Product Type

- Hair Care

- Skin & Body Products

- Bath Products

- Kid & Baby Safe

- OTC & Cosmeceuticals

- Others

By Sourcing Type

- Outsourced

- In-house

Key Global Cosmetics & Personal Care Testing, Inspection and Certification (TIC) Industry Players

- SGS

- Intertek Group PLC

- Bureau Veritas

- Eurofins Scientific

- TÜV SÜD

- UL Solutions

- ALS Limited

- NSF International

- Waters Corporation

- CIRS Group

- Cosmax

- Dermaclaim Lab S.L.

- ACT Lab

- Shriram Food & Pharma Research Centre

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252