MARKET OVERVIEW

The Global Confectionery market and its industry reflect one of the most vibrant and diverse communities in all consumer goods. It denotes a variety of sweet products for different flavors, traditions, and preferences across regions. An industry continuously innovating and adapting to changing consumer demands, it varies from chocolate and sugar confectioneries to gum and specialty treats.

The Global Confectionery Market has the broadest range one can imagine from using the term indulgence. It is much more than mere confectionery: it is a major category in the food and beverage industry, linked to daily consumption and tied up with seasonal and festive occasions. From traditional candies to modern, health-aware options, the Global Confectionery market extends across well-established into growing economies, with each territory contributing its unique flavors and modes of production.

Future innovations in new product development will revolutionize this market further. Manufacturers will have to continue innovating and formulating in organic and plant-based varieties to meet varying dietary preferences now being observed in different population segments. Environmental sustainability finds packaging and processes of manufacture integrated in the future as a “must-have” concern for consumers. And enhanced efficiency and increased efficacy in production processes will be achieved with technology.

The distribution channels therefore would be very important to the expansion of the market. Growth would be seen from the fact that e-commerce and direct-to-consumer channels are providing new opportunities for growth while traditional retail spaces remain important. Strategic Partnerships would be critical to reaching a broad base of consumers within supermarkets, convenience stores, and specialized shops.

Above all, cultural diversity and regional preferences will drive product offerings. Compared to their adventurous taste experiences, consumers will have a greater appetite for premium and exotic products. In addition, seasonal and limited-time offerings will create anticipation and excitement in the market.

Branding and marketing strategies will have to be modified to meet the changing demands of the digital age. Social media influencers and platforms will create the perception and involvement of consumers with the brand. The art of storytelling will testify to the authenticity of the brands as well as their heritage, craftsmanship, and commitment to quality in winning consumer loyalty.

The Global Confectionery market, therefore, stands poised for a future defined by innovation, cultural exchange, and strategic extension. It will continue to play its role as a major player within the international food market and will adapt itself to continually emerging trends and consumption expectations. Its future success and permanence in the international arena will lie in balancing tradition and modernization within the evolving industry.

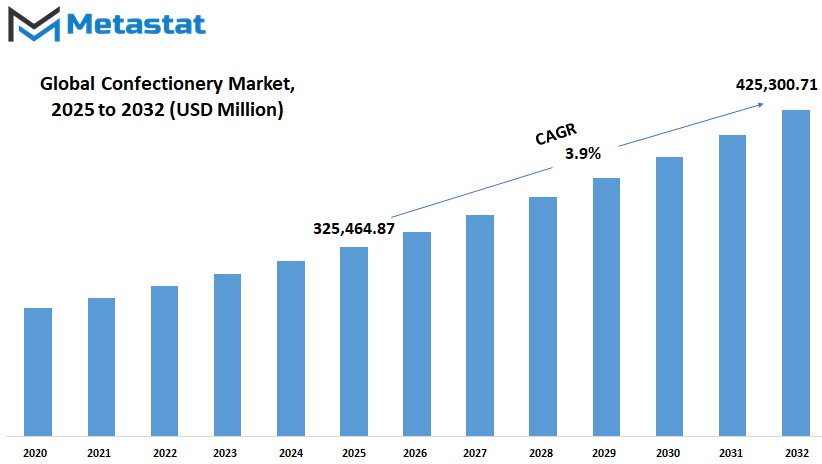

Global Confectionery market is estimated to reach $425,300.71 Million by 2032; growing at a CAGR of 3.9% from 2025 to 2032.

GROWTH FACTORS

Giant strides are to be made in the expansion of the global confectionery market in the coming years due to changes in consumerism and an evolving trend in the industry. Confectionery items would be gaining demand since people want to pamper or indulge themselves with sweetening the bitter everyday lives. From day to day dawns the sweet burst of chocolates and other sweets towards a relationship with comfort and hedonism.

The appetite for indulgence continues consumers just want more than just good taste; they want high-quality ingredients, original flavors, and products that speak to feelings-of-satisfaction-or in some cases-a sense of guilt. This shift in consumer behavior affects the future of the industry.

Expansion in retail and e-commerce channels is one of the major drivers for growth in the industry. Traditional brick-and-mortar stores continue to be popular, but online shopping has exploded recently, and this has propelled global opportunities for the candy market. It is now easier for the consumer to enjoy home delivery and browse a plethora of goods from different brands around the world. Online platforms then recommend choices depending on what other people buy during the season, further facilitating discovering new confectionery products for the consumer. All this increases the market reach and its appeal for consumers.

Besides these determinants, there are a few hindrances to the expected growth of the market. Rising health consciousness and stringent sugar regulations determine the matter-of-consumption behavior of consumers and make manufacturers think twice about the offerings in their products. As the number of health-conscious beings grows, so does the demand for low-sugar and healthier products. Besides that, governments all over the world undertake initiatives focused on reducing sugar usage across populations.

This puts greater pressure on confectionery manufacturers to rethink their strategies. Another challenge was that cost fluctuation of raw materials also represents an additional barrier. The prices of core ingredients, such as cocoa, sugar, and dairy, can be very unpredictable because of changing environmental circumstances, supply chain issues, and international economy shifts. These changes would influence production costs and profit margins, which in turn creates ambiguity for the manufacturers.

Keeping in mind, though, these hurdles bring out innovation and new opportunities. Sugar-free and functional products in confectionery are believed to define the future of this market. Today, consumers are gravitating more toward confectionery that not only satiates their sweet tooth but also serves to maintain their health. Products with added vitamins, minerals, and natural ingredients are gaining popularity. Sugar-free products, which were once regarded as niche products, are now entering the mainstream as companies focus on creating healthier alternatives without compromising on taste. The strong innovation wave this drives should attract more customers and energize further growth in the marketplace.

As the global confectionery market will continue to change, the balance between indulgence and health consciousness will determine its future. The industry must adapt in the face of changing consumer tastes, explore new distribution channels, and embrace innovative product development to be successful in the long run.

MARKET SEGMENTATION

By Product Type

The worldwide candy and sweet market is expected to significantly grow in coming years because of the changeable tastes of consumers and innovative developments in products. That is why the search in most parts of the world is still for these indulgent treats and comforting snacks. This broad market consists of chocolate confectionery, sugar confectionery, gums and jellies, caramel and toffees, mints and lozenges, hard candy, and chewing gum. Each of these categories offers unique tastes and textures appropriate to different flavors and preferences. Growing varieties in this market do not include changes in trends but depend more on how these manufacturers change and respond.

The global confectionery market is increasingly being propelled along with demand for high-end and innovating products. These days, more consumers are becoming health conscious in demanding high-quality ingredients along with unique and healthier flavors. As a result, companies invest in the very innovation that caters to these preferences by coming up with sugar-free, organic, and vegan alternatives. Though it remains among the most popular segments, chocolate confectionery is known for rich taste and versatility. Sugar confectionery that includes gummies and jellies will keep clients coming with their fancy shapes and colors. Caramel and toffees create a moment of nostalgia while mints and lozenges provide refreshing yet functional properties.

Even in terms of technology and creativity, all innovations mark the future of the global confectionery market. Brands are now trying sustainable packaging solutions to suit the demand for such products in the market. At the same time, digital marketing and e-commerce make it possible for manufacturers to reach an even wider audience. There are several personalized types of products like individualized chocolates or specially curated assortments of candies being favored by people looking out for something unique and memorable in gifts.

Another section of flavor profiling is where this skyrocketing demand will be experienced in the market. From incredible fruity gummies to spices found in chocolate bars, the yearning for new tastes is pushing brands away from walls. Limited-edition items and seasonal offerings help maintain market excitement and curiosity among consumers. Functional confectionery would further include products fortified with vitamins, minerals, or any other ingredients claimed to boost health, as awareness about health increases.

The future is bright for the global confectionery market, with changing consumer expectations leading to innovativeness in product development. With tradition entangled in innovation, there will always be something new to discover; hence, the market between producers and consumers promises to be very dynamic and appealing. The candy industry would remain a crucial part of the global food industry as manufacturers adjusted and explored new opportunities.

By Ingredient Type

With shifting consumer tastes, innovation in the confectionary sector, and new food trends, the global confectionary market is expected to grow and change in the forecast years. The taste changes are accompanied by new demands for diverse flavors; thus, great upheavals are most likely to be seen in this market. The variability of ingredients in a confectionary product is another major factor driving this growth. The market is segmented on the basis of ingredients into sugar-based products, cocoa-based products, and dairy products. Each one of these is vital in determining the future of the confectionery sector.

Sugar-based products for centuries have formed the core of the international confectionery market. Products such as confectionery candies, gummies, and hard sweets continue to attract consumers of all ages. As the sugar-based traditional treats are favored by consumers, it has started to take roots to favor healthier alternatives in food. Consumers today are more concerned about the amount of sugar they consume, and this has compelled companies to look more seriously at natural sweeteners and reduced-sugar formulations.

Going forward, it is reasonable to expect a broader assortment of sugar-based confections that balance indulgent enjoyment with health benefits. These may include products infused with vitamins, minerals, and plant-based ingredients to satisfy the demand for guilt-free enjoyment.

Cocoa-based products, the foremost examples of which are chocolate bars, truffles, and coated snacks, hold a significant share in the market of confectionary products. The everlasting popularity of chocolate is largely due to its rich flavor and versatility. In the upcoming years, due to this very reason, the market for global confectionery is likely to see innovations poured into this sector.

Alongside these trends, with the rise of concern for ethical sourcing and sustainability, more brands are likely to start using fair trade cocoa with eco-friendly production methods. Demand for premium and artisanal chocolates may increase as consumers seek unique flavors and high-quality ingredients. Innovations such as plant-based and dairy-free chocolates are expected to gain popularity as trends toward veganism and health consciousness emerge.

Dairy-based products form another important segment of the global confectionery market. Items such as milk-based toffees, caramels, and creamy chocolates are traditional favorites with their rich texture and taste. Looking ahead, with lactose-free or plant-based lifestyles becoming more popular, there may be increased use of dairy alternatives. Products based on almond, oat, and coconut milk, in particular, are gaining popularity, and this trend is likely to continue. At the same time, traditional dairy-based confections will continue to evolve, with manufacturers experimenting with innovative flavors and nutritional enhancements.

From here onward, these ingredient categories will determine the growth and direction of the global confectionery market. Given the ever-evolving consumer expectations, the market will innovatively address health trends and sustainability-related issues, thereby providing a plethora of fun-offering products.

By Distribution Channel

Despite being a dynamic environment, the confectionery market is expected to grow because of changing consumer tastes, innovative product developments, and changing shopping habits. As consumers continue to indulge in comfort-seeking sweets, demand for chocolates, candies, and other confectionery products will remain. The different distribution channels sway consumer choice, thereby spurring on the market. Be it supermarkets and hypermarkets, or online retailing, all will motivate the purchase of these products and all three will undergo transformation in the near future.

To date, supermarkets and hypermarkets are happy partners in the distribution of confectionery products. These vast retail spaces provide choice; the consumers can browse many different brands and flavors at one stop. The concept of a supermarket attracts people because they can find everything in one place. In the future, the shopping experience in supermarkets and hypermarkets would be strengthened through stimulating in-store product displays and promotional offers, personalized recommendations, and possibly the advent of digital applications that integrate devices like smart shopping carts or interactive shelves to enable customers to discover products meaningfully.

On the other hand, convenience stores provide quick access to favorite snacks. Their smaller size and strategically located outlets are more suitable for impulse purchases. Certainly, the future looks bright for convenience stores, since consumer lives seem to be getting busier, thereby creating increased demand for these watering holes. Most likely, in the coming times, convenience stores will diversify their offering to healthier and varied forms of confectionery. They might be adopting additional facilities, such as self-check-out and digital payment systems, for faster and hassle-free shopping.

E-commerce is completely revolutionizing the buying and selling of confectionery products. E-commerce not only delivers at-home but also allows browsing through a wide range of products without stepping out. With the increasing dominance of online shopping, brands are presumed to invest in enhancing their digital presence through user-friendly websites and mobile applications. More personalized recommendations may come based on browsing and purchase history with subscription services starting to deliver treats at regular intervals. Also, packaging that ensures safe and fresh delivery will gain importance.

As consumer expectations change and technology evolves, the global confectionery market will keep changing and growing. By their very nature, each of these distribution channels possesses unique strengths, and their evolution will dictate how products will be consumed and enjoyed. With so much opportunity for transformation ahead, this promises immense potential for both businesses and consumers, thereby keeping the love for confectionery alive well into the future.

By End-User

The future of the confectionery industry expects considerable change, with shifting consumer preferences, new technologies, and changes in business processes among these drivers. While tastes are broadening and the demand for creative new products is ever-increasing, the industry is likely to respond in creativity and efficiency. With its many end-users, each of whom contributes in unique ways to its growth, the future of this market is greatly shaped by such an assortment of entities.

Retail consumers remain primary elements within the global confectionery market. Their needs and wants constitute the basis for most advances and changes in the industry. As people become increasingly interested in healthier alternatives, natural ingredients, and sustainable practices, manufacturers will be likely to provide these very things.

In increasing numbers, consumers are demanding special experiences, such as the opportunity to customize their confectionery products’ flavors and packaging, thus compelling manufacturers to seriously consider variability and flexibility. As online shopping continues to increase, so will the expectation for convenience and easy and fast access to confectionery products.

Food service providers play a key role in the development of the global confectionery market. Any restaurant, café, or fast-food chain will understand that confectionaries give flavor to any menu, attracting more customers to it. With competition becoming fiercer in the industry, differentiation by these providers will probably involve the incorporation of novel dessert selections and exotic flavor combinations. Seasonal and limited-time offers can thus be expected to gain momentum and excite consumers to circle back.

Confectionery manufacturers are the backbone of the industry as they are the ones who transform raw materials into finished confectionery items, thereby catering to individual consumers as well as businesses. In the near future, these firms will invest heavily in R&D in search of newer approaches and ingredients to meet changing tastes. With the growing public perception of sustainability, eco-friendly packaging and a more significant commitment to sustainable practices will bound to grow. Automation, along with advanced technology, might drill down production with pace and greater efficiency where it actually matters, considered product quality.

Bakeries and patisseries lend artisan value to the global confectionery market by emphasizing fresh-made products for customers desiring quality and craftsmanship. Hence, with the growing demand for distinctive and premium goods, brick-and-mortar facilities are expected to play around with numerous flavors, designs, and healthier options. Working with local suppliers and using organic or sustainably sourced ingredients may become increasingly common and present their products with added prestige.

Hospitality and catering services contribute significantly to the market’s growth. Hotels, event planners, and catering companies procure large volumes of high-quality confectionery products for special occasions and daily service. In the future, these businesses may prioritize customization and presentation by offering visually striking and memorable desserts designed for specific events and themes. Demand for exquisite and high-end confectionery products will likely increase as these businesses strive to enhance the guest experience.

These diverse end-users collectively shape the future of the global confectionery industry. The changing preferences and demands of these end-users will lead the industry to greater innovation, sustainability, and quality, ensuring the continued growth and relevance of the industry for the coming years.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$325,464.87 million |

|

Market Size by 2032 |

$425,300.71 Million |

|

Growth Rate from 2025 to 2032 |

3.9% |

|

Base Year |

2024 |

|

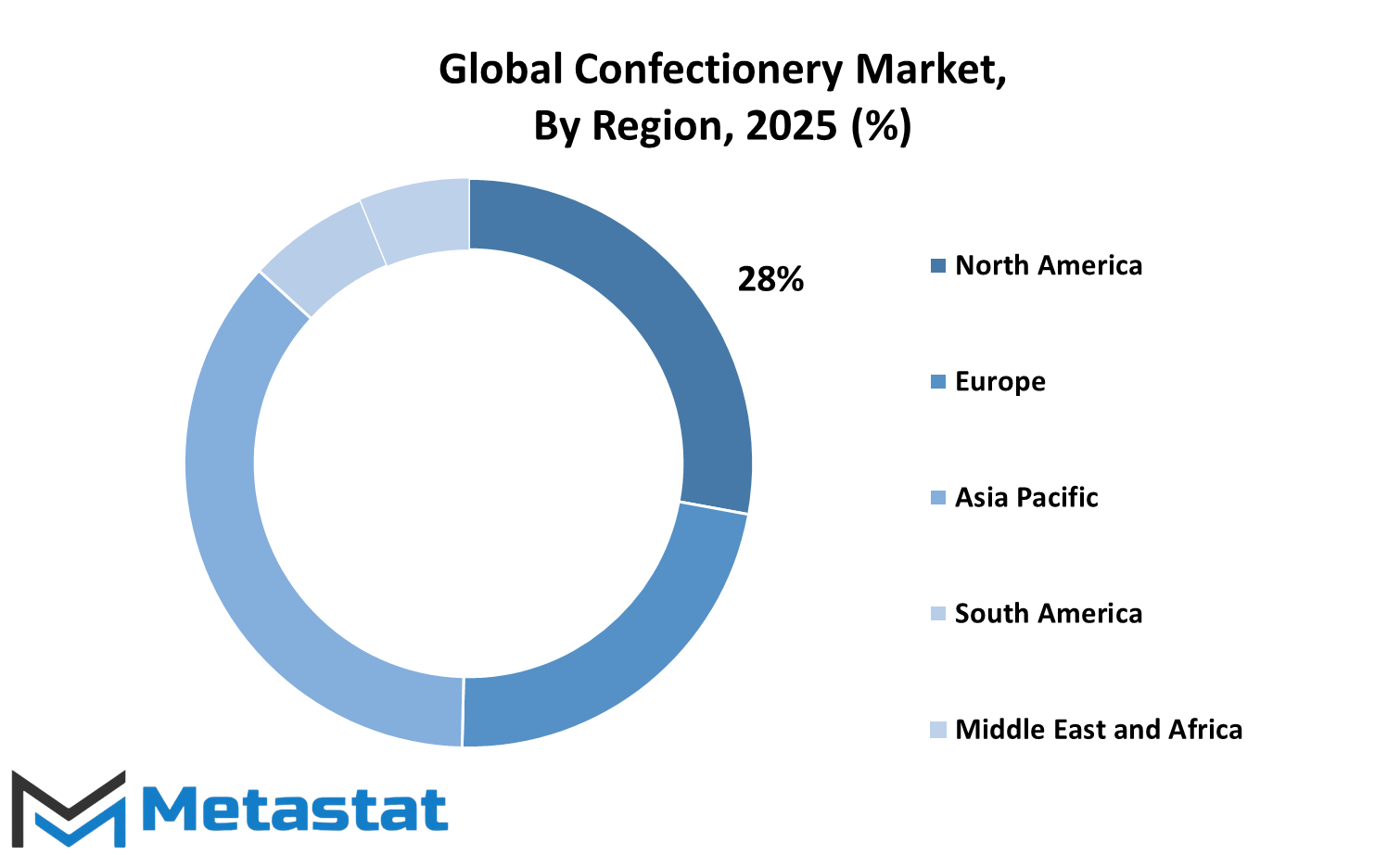

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

Globally distributed, the confectionery market has several regions, all adding to the planets unique development and growth. This industry is bound to see dramatic shifts in the near future due to evolving consumer tastes and economies. Different regions around the globe display unique characteristics, which will have been molded by culture, economic strength, and lifestyle trends. With a regional focus, analysis becomes significant to envisaging the market's future.

North America stands out as one of the most established and influential players in the confectionery global market. The three countries treat the confectionery market with strong demand: the USA, Canada, and Mexico. The factors are high disposable income and changing taste patterns. In this regard, the USA stands first because of a modern retail environment and continuous product innovation. The consumers in this area are health-conscious, demanding premium products, and all this pushes manufacturers to use organic, low-sugar, and sustainably sourced ingredients. This trend will be accelerated, and the companies may invest more in healthy products without any issues in taste and indulgence.

Next is Europe, with a very long historical relationship with the craft and quality of confectionery. The UK, Germany, France, and Italy have long been associated with the good and bad candy from either old-fashioned or innovative recipes alike. European consumers appreciate authentic and premium products, providing artisan and luxury confectionery with high amounts of demand. Concern for sustainability and ethical sourcing are factors affecting their choices. The future will demand even higher amounts of green packaging and fair-trade ingredients in that region, indicating increased social and ecological responsibility awareness.

Asia-Pacific is rapidly establishing itself as an important driver of the global confectionery market. Urbanization and changing consumer lifestyles fuel the rise of demand in this market in countries including India, China, Japan, and South Korea. The more incomes climb and Western confidence expands, the more Asia, particularly India, looks towards its local confectionery brands and appreciating global standards. The outlook for this region is positive, with innovation responding to regional tastes and preferences likely to become a strategy for global brands strengthening its regional foothold.

South America offers a rich variety of flavors and cultural influences. Brazil and Argentina specifically are interactive when it comes to confectionery: blending local ingredients and techniques with international trends. The region's emerging middle class, along with increasing exposure to international confectionery products, suggests a slow, evolving acceptance of diversity. Looking ahead, experimentation with flavor and format appears unavoidable in a region where its adventurous consumers will respond positively.

This region presents a unique and developing segment of the global confectionery market. Demand is increasing in Egypt, South Africa, and the Gulf countries due to the rising youth population demanding international brands. This market is poised to expand as economic development continues, with opportunities for both premium and midrange product lines catering to a variety of consumer needs.

All of these unique attributes generate varied futures for the confectionery global marketplace providing avenues for growth, innovation, and adaptation. As these regions evolve, their importance in the above-mentioned global trends will only increase, making the industry even more dynamic and diverse.

COMPETITIVE PLAYERS

The global confectionery market is expected to grow and transform significantly in the years to come, driven by changing consumer preferences, technological advancements, and innovation from leading companies. With evolving tastes and the demand for more diverse and healthier options, competition among major players in the industry is set to become even more intense. Companies like Mars, Inc., Mondelez International, Nestlé S.A., and Ferrero SpA have long established themselves as leaders, known for their wide range of popular products and strong global presence. Their ability to adapt to shifting trends and meet consumer expectations will play a crucial role in shaping the market’s future.

Innovation will be a key factor in this evolving landscape. Companies like The Hershey Company and Barry Callebaut AG are already investing heavily in research and development to introduce new flavors, unique textures, and products that cater to health-conscious customers. As demand for sugar-free, organic, and plant-based confectionery rises, these companies will likely continue expanding their portfolios to meet these needs. Sustainability will also remain a priority, with efforts focused on ethical sourcing of ingredients like cocoa and reducing environmental impact.

The competition will not just be about traditional products. Brands like General Mills, Inc., and Meiji Holdings Co., Ltd. are likely to explore the fusion of snacks and sweets, creating innovative offerings that blur the lines between confectionery and health food. Companies like Haribo GmbH & Co. KG and Perfetti Van Melle, known for their iconic gummies and candies, will need to stay ahead by introducing creative flavors and packaging that appeal to both younger consumers and nostalgic adults.

Luxury and premium confectionery will also continue gaining traction. Brands like Lindt & Sprüngli AG, Ghirardelli Chocolate Company, and Sugarfina Inc. have set high standards with their focus on quality, unique ingredients, and sophisticated presentation. As disposable incomes rise in various regions, demand for high-end products is expected to grow, pushing these companies to maintain their edge through exceptional craftsmanship and innovation.

At the same time, companies like ITC Limited, Cargill, Inc., and Tate & Lyle PLC will likely focus on supplying high-quality ingredients and developing partnerships that support the industry’s expansion. Meanwhile, established names like Lotte Confectionery Co., Ltd., Clif Bar & Company, Brach’s Confections, Inc., and Spangler Candy Company will continue striving for market share through distinctive branding and product development.

As the global confectionery market evolves, competitive players will face increasing pressure to innovate, stay adaptable, and meet the demands of a more informed and health-conscious audience. Their success will depend on balancing tradition and creativity while embracing sustainability and ethical practices, shaping a future rich with possibilities and flavor.

Confectionery Market Key Segments:

By Product Type

- Chocolate Confectionery

- Sugar Confectionery

- Gums & Jellies

- Caramel & Toffees

- Mints & Lozenges

- Hard Candy

- Chewing Gums

By Ingredient Type

- Sugar-based Products

- Cocoa-based Products

- Dairy-based Products

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retail

By End-User

- Retail Consumers

- Food Service Providers

- Confectionery Manufacturers

- Bakeries & Patisseries

- Hospitality & Catering

Key Global Confectionery Industry Players

- Mars, Inc.

- Mondelez International

- Nestlé S.A.

- Ferrero SpA

- The Hershey Company

- Barry Callebaut AG

- General Mills, Inc.

- Meiji Holdings Co., Ltd.

- Haribo GmbH & Co. KG

- Perfetti Van Melle

- Lindt & Sprüngli AG

- ITC Limited

- Cargill, Inc.

- Tate & Lyle PLC

- Ghirardelli Chocolate Company

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252