Global Complete Blood Count Device Market- Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global complete blood count device market has been a long journey of innovations in clinical laboratory which finally ended up with the mid-20th century when hospitals still used manual cell counting methods that were very slow and inconsistent relying only on trained technicians. The introduction of hematology analyzers in research laboratories using electrical impedance to measure cell populations marked the beginning of automation in the field. Those very first devices changed the world’s expectations for speed and accuracy and their impact would last for decades. During the 70s late and 80s optical measurement, automated dilution systems, and integrated quality-control functions became core milestones driving manufacturers to develop instruments that would ultimately be used for high-volume diagnostic workflows in national health systems.

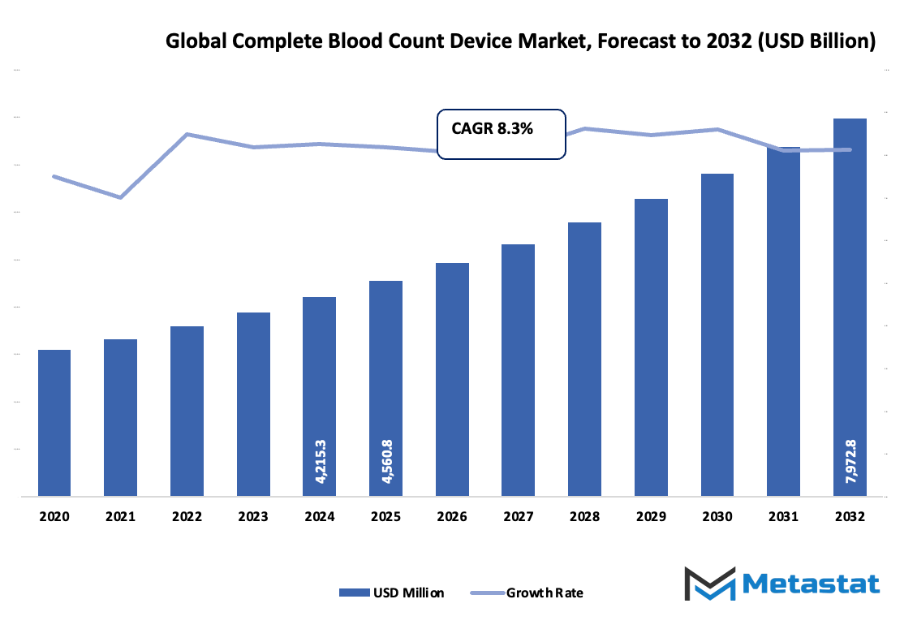

- The global complete blood count device market, which is very much the same as the global blood tests market, is valued at nearly USD 4560.8 million in 2025 with a growth rate of about 8.3% per year up to 2032 with a possibility of going beyond USD 7972.8 million.

- Nearly 42.6% of the market share is held by Automated Blood Count Analyzers while the rest of the markets are being developed through intense research thus driving innovation and expanding applications.

- One of the major factors contributing to the rapid growth is the rising adoption of automated hematology analyzers for quicker and more precise diagnostics that also include a growing prevalence of chronic diseases and infections which require routine blood analysis.

- Point-of-care CBC devices and portable CBC devices are among the primary sources of the opportunity.

- The core insight is that the market has been the growth area that would yield the greatest value in the coming decade thus it is regarded as the most significant area for further development.

The global demand for precise and automatic instruments in laboratories, as a result of the expansion of healthcare services and an increase in patient load, presented a challenge to the engineers. This situation, as i.e. the company's big point-of-care compact analyzers and the centralized lab's high-throughput systems, made their way through the bar. The transformation of the clinical practice led to regular blood tests being widely accepted as a key part of preventive medicine. Moreover, the companies were pushed to invest more in reliability, stability, and traceability of results as a result of Government regulations that imposed strict standards on the Performance of Medical Equipment, especially of devices in emergency and oncology.

The Current scenario of the market will be the outcome of a continuous quality improvement in microfluidics, reagent stability, and automated data validation. It is estimated from the publicly available health statistics of the government that more than 4 billion diagnostic blood tests are done every year in the national healthcare networks, and the blood count panels are among the most common procedures performed on the global scale. Professional societies of health care report that the lack of laboratory technicians has been a concern for over ten years, and thus the requirement for devices, that can execute uninterrupted cycles with very little manual involvement, has been heightened. On the other hand, the procurement data from the public hospitals reveal an unbroken uptrend in the demand for analyzers that work well with electronic medical record systems, indicating that the coming years will see clinical settings giving more importance to smooth data flow.

The global complete blood count device market has been expanding ever since it first came into existence with manual cell counting and now with connected and increasingly automated systems. The market will keep on changing according to the demands of the clinical world, regulations, and technological breakthroughs.

Market Segments

The global complete blood count device market is mainly classified based on Device Type, Technology, End-User, Distribution Channel.

By Device Type is further segmented into:

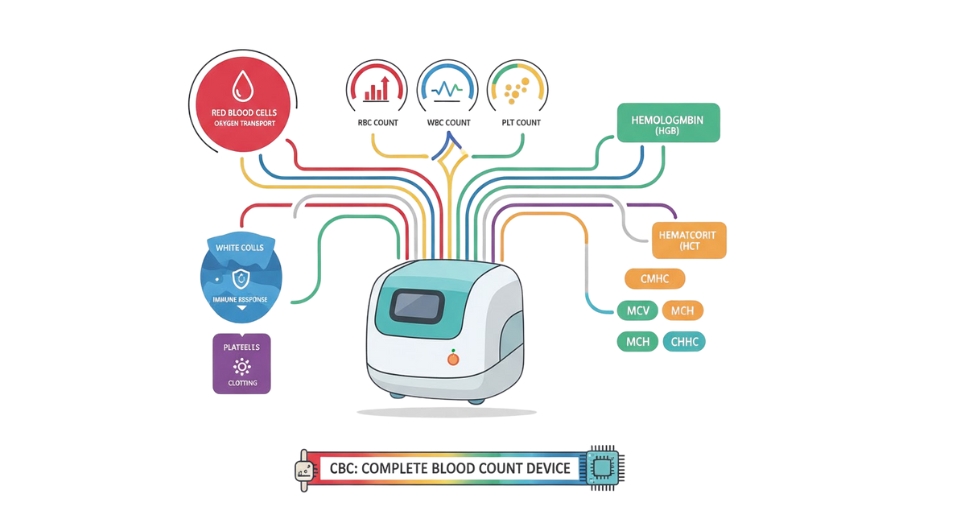

- Automated Blood Count Analyzers: Automated Blood Count Analyzers are the factors for the stable demand in the global market of Complete Blood Count Devices as they emphasize consistent performance, fast processing, and cutting down manual handling. Indication through these analyzers in the medical sector helps in the processing of many samples, boosting precision and the continuity of reliable workflows necessary for the routine checks required in the course of patient monitoring.

- Manual Blood Count Analyzers: Manual Blood Count Analyzers have not lost their importance as the main testing scenarios, budget constraints, and infrastructure limits dictate the buying decisions. The systems give the possibility of restricted evaluation of the samples and serve the medical institutions that practice the counting techniques. Such gadgets are still used in the smaller labs that have regular testing schedules and maintain their steady testing practices.

- Point-Of-Care Testing Devices: Point-Of-Care Testing Devices are the ones that provide fast results in the places where quick decisions are required. The systems make it possible to carry out rapid evaluations close to the patient areas which in turn helps the doctors to act without waiting for the processes in the central laboratory. The strong desire for quicker diagnosis keeps these devices in the spotlight for the medical institutions that need easy operation, portability, and efficient daily usage.

- Hematology Analyzers: Hematology Analyzers assist routine test needs across many centers that require dependable readings for blood-related conditions. These systems help laboratories maintain broader testing functions while reducing processing time. Steady adoption reflects the need for stable technology that supports continuous sample handling and dependable output for clinical decisions.

By Technology the market is divided into:

- Impedance Technology: Impedance Technology allows straightforward measurement of cell characteristics through electrical resistance changes. Many facilities rely on this method due to its reliability, manageable cost, and practical use in routine testing. Continued application supports consistent sample evaluation and plays a noticeable role in device selection across standard laboratory environments.

- Laser-Based Technology: Laser-Based Technology offers detailed readings that support more refined cell analysis in settings that require higher clarity. Facilities using this method gain improved detection of varied cell features, making the approach valuable for advanced hematology systems. Growing interest in stronger analytical performance keeps this method relevant for updated equipment.

- Flow Cytometry: Flow Cytometry supports detailed measurement of cell properties using controlled light-based detection. This method offers strong analytical capability, allowing laboratories to study multiple cell aspects quickly. The approach remains important for centers that need deeper evaluation tools and dependable measurement of complex samples during routine or focused testing.

- Microscopy: Microscopy continues to support direct sample observation where visual assessment is needed for confirmation or detailed inspection. Many laboratories maintain this method as a foundational tool for checking abnormalities and verifying automated results. Continued use reflects the need for clear, hands-on viewing in targeted diagnostic situations.

By End-User the market is further divided into:

- Hospitals and Clinics: Hospitals and Clinics rely on blood count devices to support everyday diagnostic needs. Regular patient flow requires systems that deliver steady output and manageable operation. These settings depend on reliable testing solutions that help guide treatment decisions, making consistent access to these devices essential for daily medical practice.

- Diagnostic Laboratories: Diagnostic Laboratories manage significant test volumes and require devices that support accuracy, speed, and continual operation. These facilities depend on advanced systems that help maintain workflow efficiency while providing dependable results. Strong demand stems from ongoing testing requirements that sustain routine and specialized assessments across broad sample groups.

- Blood Banks and Transfusion Centers: Blood Banks and Transfusion Centers use these devices to ensure safe handling of donor samples and confirm suitability before distribution. Consistent testing supports quality control and helps maintain safe practices during collection and transfusion processes. Dependable equipment remains essential for managing stored units and protecting recipients.

- Other: Other settings include educational centers, small clinics, and research units that rely on suitable devices for varied testing needs. These environments often seek adaptable systems that support training, study activities, or occasional assessments. Broader use continues due to the versatility required across different operational purposes beyond primary clinical care.

By Distribution Channel the global complete blood count device market is divided as:

- Online: Online channels support flexible access to device information, pricing, and supply options. Many buyers use digital platforms to compare features and make convenient purchase decisions. This pathway helps widen product availability and supports easier procurement for centers seeking efficient ordering processes without traditional in-person transactions.

- Offline: Offline channels remain important for facilities needing guided purchasing, direct demonstrations, or structured support from distributors. Physical outlets and professional representatives assist buyers during selection and installation. Continued use of this method reflects the value of in-person assurance when choosing equipment for essential diagnostic functions.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$4560.8 Million |

|

Market Size by 2032 |

$7972.8 Million |

|

Growth Rate from 2025 to 2032 |

8.3% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

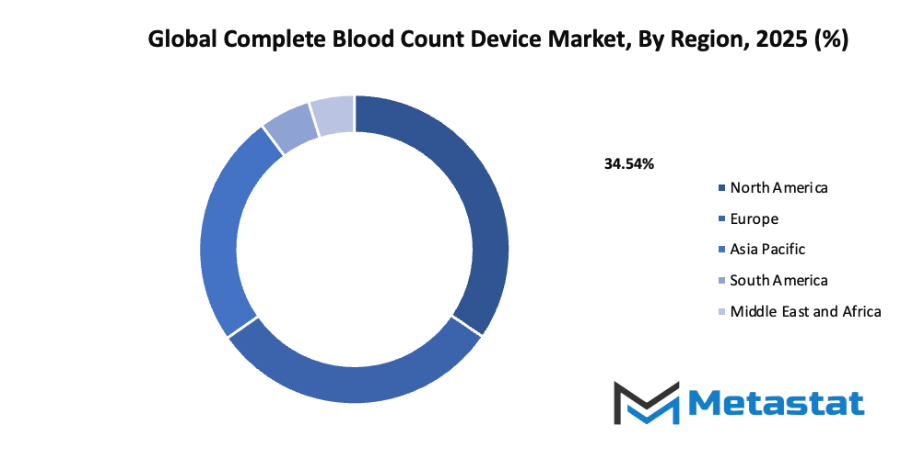

- Based on geography, the global complete blood count device market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Growing prevalence of chronic diseases and infections requiring routine blood analysis: Rising cases of long-term disorders and frequent infections create stronger demand for regular diagnostic checks. Many healthcare centres rely on Complete Blood Count results to track patient conditions, leading to wider use of advanced tools across the global complete blood count device market supporting broader adoption and steady expansion.

- Rising adoption of automated hematology analyzers for faster and more accurate diagnostics: Automated systems support quicker sample processing, reduce manual errors, and help medical teams gain dependable results. Many healthcare facilities choose automated analyzers to manage large testing volumes, improve workflow, and support timely clinical decisions, encouraging broader acceptance across laboratories of different sizes.

Challenges and Opportunities

- High cost of advanced CBC analyzers and maintenance: Modern analyzers require significant financial investment, along with ongoing service expenses. Smaller medical centres often struggle to allocate sufficient resources, limiting access to high-end devices. Budget restrictions slow upgraded equipment adoption, creating uneven availability of advanced diagnostic solutions across various healthcare settings.

- Lack of skilled laboratory professionals in developing regions: Many locations face limited training resources and insufficient numbers of qualified laboratory workers. Restricted expertise reduces testing accuracy and slows sample processing in numerous facilities. Limited access to proper training programs further affects the reliability of diagnostic services and constrains wider technology adoption.

Opportunities

- Increasing demand for portable and point-of-care CBC devices for decentralized testing: Growing interest in compact diagnostic tools supports wider testing access in rural clinics, emergency units, and community programs. Portable solutions enable faster decision-making near patient locations, support early detection, and ease pressure on central laboratories, creating new growth potential for manufacturers focused on accessible hematology technologies.

Competitive Landscape & Strategic Insights

A broad mix of global leaders and rising regional players shapes the current global complete blood count device market. Constant product development, steady regulatory attention, and growing clinical demand have encouraged strong competition among established corporations and smaller innovators. Abbott Laboratories, Agilent Technologies, BD, Bio-Rad Laboratories, BioMérieux, Danaher Corporation, Horiba, PerkinElmer, PixCell Medical Technologies, Roche Diagnostics, Siemens Healthineers, and Thermo Fisher stand out as key forces in this space. Each organization contributes a distinct approach to diagnostic technology, fostering steady advancement across laboratories, clinics, and testing facilities.

A wide range of product strategies supports market growth, including enhancements in automation, point-of-care performance, digital integration, and reliability. Stronger analytical features and faster testing capacity have boosted adoption across both large medical centers and smaller healthcare settings. Broader access to high-quality testing has encouraged greater attention to preventive care, encouraging further investment from major companies. Regional manufacturers continue to gain attention as well, offering cost-focused solutions designed for growing healthcare networks across developing areas.

Ongoing demand for accurate blood analysis drives continuous improvement in device durability, data handling, and maintenance efficiency. Strong competition encourages consistent upgrades in hardware design and software support, allowing healthcare professionals to rely on more stable and user-friendly tools. Advances in automated sampling and simplified workflows have reduced operating time for many facilities, leading to smoother daily routines and improved resource management.

Market size is forecast to rise from USD 4560.8 million in 2025 to over USD 7972.8 million by 2032. Complete Blood Count Device will maintain dominance but face growing competition from emerging formats.

Large corporations within the market often concentrate on advanced platforms with expanded diagnostic menus, while emerging competitors highlight compact designs and affordability. This balance strengthens global availability and helps healthcare providers choose devices that match local needs, budget limits, and patient volumes. Steady attention to quality, speed, and accessibility supports a healthier competitive landscape and promotes more dependable testing for medical communities around the world.

Report Coverage

This research report categorizes the global complete blood count device market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global complete blood count device market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global complete blood count device market.

Complete Blood Count Device Market Key Segments:

By Device Type

- Automated Blood Count Analyzers

- Manual Blood Count Analyzers

- Point-Of-Care Testing Devices

- Hematology Analyzers

By Technology

- Impedance Technology

- Laser-Based Technology

- Flow Cytometry

- Microscopy

By End-User

- Hospitals and Clinics

- Diagnostic Laboratories

- Blood Banks and Transfusion Centers

- Other

By Distribution Channel

- Online

- Offline

Key Global Complete Blood Count Device Industry Players

- Abbott Laboratories

- Agilent Technologies

- BD

- Bio-Rad Laboratories

- BioMérieux

- Danaher Corporation

- Horiba

- PerkinElmer

- PixCell Medical Technologies

- Roche Diagnostics (Roche)

- Siemens Healthineers

- Thermo Fisher

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252